0001080319

false

0001080319

2023-07-17

2023-07-17

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report: July 17, 2023

(Date of earliest event reported)

ELYS GAME TECHNOLOGY, CORP.

(Exact name of registrant

as specified in its charter)

| Delaware |

001-39170 |

33-0823179 |

|

(State or other jurisdiction

of incorporation) |

(Commission

File Number) |

(IRS Employer

Identification No.) |

130 Adelaide Street West, Suite 701

Toronto, Ontario M5H 2K4, Canada

(Address of principal executive offices)

1-561-838-3325

(Registrant’s telephone number, including area

code)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading

Symbol(s) |

Name of each exchange

on which registered |

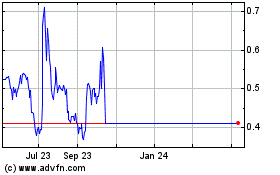

| Common stock, par value $0.0001 per share |

ELYS |

The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an

emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On July 11, 2023 (the "Closing Date"), Elys

Game Technology, Corp. (the "Company") closed a private placement offering of up to 3,000 units and entered into a Subscription

Agreement (the "Agreement") with a group of accredited investors (the "Investors"), which Investors included Gold

Street Capital Corp., which is a company owned by Gilda Pia Ciavarella, a related party and spouse of the Company’s Executive Chairman,

Michele Ciavarella, and Braydon Capital Corp. a company owned by Claudio Ciavarella, a related party and brother of the Company’s

Executive Chairman, Michele Ciavarella. The amount received from Braydon Capital, included the conversion of the promissory note advanced

by Braydon Capital of $360,000 and accrued interest up to the closing date. Each Unit sold to the Investors were sold at a per unit price

of $1,000 and were comprised of (i) a 12% convertible debenture in the principal amount of $1,000 (the “Debentures”), and

(ii) warrants to purchase shares of the Company’s common stock (the “Warrants”). The purpose of the private placement

is to provide working capital for general corporate purposes in advance of launching the Company’s online channel and mobile app

product for U.S. and Canadian markets.

The Investors purchased a total of 2,876 units and

the Company issued Debentures for the total principal amount of $2,876,000 (the "Principal Amount") to the Investors and warrants

to purchase 6,951,905 shares of common stock of the Company.

The Debentures mature three years from their date

of issuance and bear interest at a rate of 12% per annum compounded annually and payable on the maturity date. Each Debenture is convertible,

at the option of the holder, at any time, into such number of shares of common stock of the Company equal to the principal amount of the

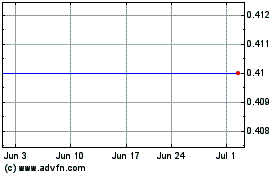

Debentures plus all accrued and unpaid interest at a price equal to $0.40 per share by each of the Investors, except that Debentures issued

to Gold Street are exercisable at the Nasdaq consolidated closing bid price (calculated to the nearest one-hundredth of one cent) of the

Company common stock on the Nasdaq stock market on the Closing Date, or $0.42 per share, subject to adjustment as provided in the Debenture,

at any time up to the Maturity Date. The Debentures are initially convertible into 6,951,905 shares of common stock, subject to anti-dilution

adjustment as provided in the Debentures. The holder is guaranteed to receive a minimum of five months of interest in the event of an

early repayment (“Redemption”) by the Company.

In addition, the Company may accelerate this right

of conversion on at least ten (10) business days prior written notice to the Holder if there is an effective Registration Statement registering,

or a current prospectus available for, the resale of the common shares issuable on the conversion and (i) the closing price of the Company’s

common shares exceeds two hundred (200%) per cent of the Conversion Price for five (5) trading days in a thirty (30) day period or (ii)

the Company wishes to redeem or pre-pay the Debentures prior to the Maturity Date.

If at any time that the common shares issuable to

the Investors on conversion of the Debentures in whole or in part would be free trading without resale restrictions or statutory hold

periods, the Debentures are redeemable by the Company at any time or times prior to the Maturity Date on not less than ten (10) Business

Days prior written notice from the Company to the Investor of the proposed date of Redemption (the “Redemption Date”), without

bonus or penalty, provided, however, that prior to the Redemption Date, the Investors have the right to convert the whole or any part

of the principal and accrued and unpaid interest of the Debentures into common shares of the Company.

The Warrants are exercisable at an exercise price

equal to $0.40 per share by each of the Investors, except that Warrants issued to Gold Street are exercisable at the Nasdaq consolidated

closing bid price (calculated to the nearest one-hundredth of one cent) of the Company common stock on the Nasdaq stock market on the

Closing Date, or $0.42 per share, subject to adjustment as provided in the Warrant and expire three years after the issuance date. Each

Warrant is exercisable on a cashless basis in the event that there is not an effective registration statement registering the shares underlying

the Warrant at the time of exercise.

The Company may accelerate the right to exercise the

Warrants on at least ten (10) business days prior written notice to the Holder if there is an effective Registration Statement registering,

or a current prospectus available for, the resale of the common shares issuable on exercise of the Warrants and the closing price of the

Company’s common shares exceeds two hundred (200%) per cent of the Exercise Price for five (5) trading days in a thirty (30) day

period.

The Warrants and Debentures provide that if the Company

issues or sells common stock of securities convertible or exercisable into common stock for a price lower than the exercise price of conversion

price that the exercise price and conversion price will be reduced to such price, subject to a floor price of $0.35 and subject to certain

exempt issuances set forth in the Debentures and Warrants.

The number of shares of common stock that may be

issued upon conversion of the Debentures and exercise of the Warrants is subject to an Exchange Cap (as defined in the Debenture and

Warrant) unless shareholder approval to exceed the Exchange Cap is approved. The parties agree to amend the Debentures and Warrants as

necessary in order to comply with the requirements of the Nasdaq Capital Markets.

The Debentures are secured by a senior security interest

in all of the assets of Elys Game Technology, Corp. pursuant to a Security Agreement. The Company’s primary assets consist of certain

business operations and licenses in multiple jurisdictions, trademarks and other intellectual property, betting technology and products

as further described in the Company’s annual report on Form 10-K filed with the SEC on April 17, 2023. Following an event of default

under the Debentures, the Investors will have all available rights under the Security Agreement and applicable law to enforce their rights

as secured creditors, including to sell, assign, transfer, pledge, encumber or otherwise dispose of the secured assets, and to exercise

any other available rights and remedies upon the occurrence of an event of default as described in the Debentures.

The Debentures can be declared due and payable upon

an “Event of Default.” As more fully described in the Purchase Agreement, each of the following, among other things, constitutes

an “Event of Default” under the Debentures:

| |

(a) |

default in the payment of any principal or interest on the Debentures as and when the same shall become due and payable, and continuance of such default for a period of five (5) Business Days after the date on which written notice of such failure, requiring the Company to remedy the same, shall have been given by the Holder; |

| |

(b) |

the institution of bankruptcy or insolvency proceedings against the Company, or the institution of proceedings seeking reorganization or winding-up of the Company or any other bankruptcy, insolvency or analogous laws, or the issuing of sequestration or process of execution against the Company or any substantial part of its property, or the appointment of a receiver or manager of the Company or of any substantial part of its property, and, in each case, the continuance of any such proceedings unstayed, undischarged and in effect for a period of fifteen (15) days from the date thereof; |

| |

(c) |

or the institution by the Company of proceedings to be adjudicated bankrupt or insolvent, or the consent by it to the institution of bankruptcy or insolvency proceedings against it, or the filing by it, or the passing of a resolution authorizing the filing by it, of a petition or answer or consent seeking reorganization or relief under bankruptcy laws or any other bankruptcy, insolvency or analogous laws, or the consent by it to the filing of any such petition or to the appointment of a receiver of the Company or of any substantial part of its property, or the making by it of a general assignment for the benefit of creditors, or the Company’s admitting in writing its inability to pay its debts generally as they become due or taking corporate action in furtherance of any of the aforesaid purposes. |

The Company paid no finders fees in connection with

the subscriptions.

The foregoing descriptions of the Subscription Agreement,

Debenture, Warrant and Security Agreement are qualified in their entirety by reference to the full text of the forms of Subscription Agreement,

Debenture, Warrant and Security Agreement copies of each of which are attached hereto as Exhibits 10.1, 10.2, 10.3 and 10.4, respectively.

Item 2.03 - Creation of Direct Financial Obligation

The information set forth under Item 1.01 of this

Current Report on Form 8-K is incorporated herein by reference.

Item 3.02 - Unregistered Sales of Equity Securities

The information set forth under Item 1.01 of this

Current Report on Form 8-K is incorporated herein by reference.

The Debentures and Warrants were issued pursuant to

an exemption from registration under Section 4(a)(2) of the Securities Act of 1933, as amended and Rule 506 of Regulation D promulgated

thereunder (the "Securities Act") and therefore are not registered under the Securities Act or the securities laws of any state

of the United States. The transaction does not involve a public offering. The investors are each an "accredited investor" and

each investor has access to information about us and their investment.

| |

Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits.

The following exhibits are filed with this Current

Report on Form 8-K.

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: July 17, 2023 |

ELYS GAME TECHNOLOGY, CORP. |

| |

|

| |

By: |

|

/s/ Michele Ciavarella |

| |

Name: |

|

Michele Ciavarella |

| |

Title: |

|

Executive Chairman |

SUBSCRIPTION AGREEMENT

(United States Dollar)

TO: ELYS GAME TECHNOLOGY, CORP.

RE: PURCHASE OF UNITS OF ELYS GAME TECHNOLOGY,

CORP.

Subject to the terms and conditions contained in this

subscription agreement, including the terms and conditions set forth in Schedule “A” hereto, the undersigned (the “Purchaser

”), hereby irrevocably subscribes for and agrees to purchase the number of units (the “Units ” or the

“ Purchased Securities ”) of ELYS GAME TECHNOLOGY, CORP. (the “ Corporation ”)

as set forth below at a purchase price of US$1,000 per Unit (the “Purchase Price ”).

|

_____________________________________

( Name of Purchaser – please print)

By: __________________________________

( Authorized Signature )

_____________________________________

( Please print name of individual whose signature

appears above if different than the name of the Purchaser printed above.)

_____________________________________

( Subscriber’s Address )

______________________________________

( Telephone Number )

______________________________________

( Fax Number)

______________________________________

( Email Address )

Register the Purchased Securities as set forth below:

____________________________________

( Name )

____________________________________

( Account reference, if applicable )

____________________________________

( Address )

____________________________________

|

|

Number of Units:_________________________

Aggregate Purchase Price: US$_____________

If the Purchaser is signing as finder for a principal

and the Purchaser is not a trust company or a portfolio manager, in either case, purchasing as trustee or finder for accounts fully managed

by it, complete the following:

_______________________________________

( Name of Principal )

___________________________________

( Principal’s Address )

Deliver the Purchased Securities as set forth below:

____________________________________

( Name )

____________________________________

( Account reference, if applicable )

____________________________________

( Contact Name )

____________________________________

( Address )

____________________________________

( Telephone Number )

|

SUBSCRIPTION AGREEMENT

(United States Dollar)

(Cont’d)

The Purchased Securities represent ________ Units

offered by the Corporation (the “ Offering ”) to initially close on or about ________, 2023 or such other date

mutually agreed between the Purchaser and the Corporation (the “ Closing Date ”). The maximum Offering will

result in gross proceeds to the Corporation of up to US$________________. The Corporation may, at its discretion, elect to complete the

Offering for proceeds of less than or more than US$________________ or less than or more than ______ Units and in one or more separate

closings on a rolling basis.

Each Unit is comprised of (i) a Secured Debenture

of the Corporation in a principal amount of US$1,000 with a term of three (3) years from the date of issuance (the “ Maturity

Date ”) and bearing interest at the rate of twelve (12%) percent per annum (the “ Debenture ”),

and (ii) _____ common share purchase warrants of the Corporation [for the purchase of a number of shares of the Corporation’s Common

Stock equal to the purchase price per Unit divided by the initial Conversion Price (as defined below) of the Debentures] (the “

Warrants ”).

Subject to the Exchange Cap, if applicable, as set

out in Schedule B, the whole or any part of the principal amount of the Debenture plus any accrued and unpaid interest may be convertible

at the option of the Debenture holder into common shares of the Corporation at a price equal to $____ per share or the Nasdaq consolidated

closing bid price (calculated to the nearest one-hundredth of one cent) of the Corporation common stock on the Nasdaq stock market on

the Closing Date, subject to adjustment as provided in the Debenture, at any time up to the Maturity Date (the “ Conversion

Price ”) provided that the Corporation may accelerate this right of conversion on at least ten (10) business days prior

written notice to the Holder if there is an effective Registration Statement registering, or a current prospectus available for, the resale

of the common shares issuable on the conversion and (i) the closing price of the Corporation’s common shares exceeds two hundred

(200%) per cent of the Conversion Price for five (5) trading days in a thirty (30) day period or (ii) the Corporation wishes to redeem

or pre-pay the Debentures prior to the Maturity Date.

Subject to the Exchange Cap, if applicable, as set

out in Schedule C, each one Warrant will entitle the holder to acquire one (1) common share of the Corporation within sixty (60) months

from the Closing Date and each Warrant will have an exercise price equal to $____ per share or the Nasdaq consolidated closing bid price

(calculated to the nearest one-hundredth of one cent) of the Corporation common stock on the Nasdaq stock market on the Closing Date,

subject to adjustment as provided in the Warrant Certificate (the “ Exercise Price ”) and each Warrant may be

exercised either by a cash payment of the Exercise Price or by a cashless exercise on the terms set out in the Warrant Certificate. The

Corporation may accelerate the right to exercise the Warrants on at least ten (10) business days prior written notice to the Holder if

there is an effective Registration Statement registering, or a current prospectus available for, the resale of the common shares issuable

on exercise of the Warrants and the closing price of the Corporation’s common shares exceeds two hundred (200%) per cent of the

Exercise Price for five (5) trading days in a thirty (30) day period.

The Terms and Conditions of Subscription for Units

is attached hereto as SCHEDULE “A”, the form of the Debenture is attached hereto as SCHEDULE “B”,

the form of Warrant Certificate is attached hereto as SCHEDULE “C” and the Accredited Investor Certificate is attached

hereto as SCHEDULE “D” for U.S. Subscribers and SCHEDULE “E” for Canadian Subscribers. All dollar

amounts referred to in this agreement are in United States Dollars unless otherwise noted.

ACCEPTANCE: The Corporation hereby (i) accepts

the above subscription subject to the terms and conditions contained in this subscription agreement; and (ii) agrees that the Purchaser

shall be entitled to rely on such representations and warranties of the Corporation contained in the subscription agreement.

ELYS GAME TECHNOLOGY, CORP.

Date: _______ __, 2023

Per:________________________________

Michele Ciavarella, Executive Chairman

SCHEDULE “A”

TERMS AND CONDITIONS OF

SUBSCRIPTION FOR UNITS OF

ELYS GAME TECHNOLOGY, CORP.

| |

1. |

Description of Secured Debentures |

The secured debenture that forms a part of the Purchased

Securities (the “ Debenture ” ) shall be governed by provisions of the form of Debenture which is annexed hereto

as Schedule “B”. The Debentures yield interest at the rate of twelve (12%) percent per annum compounded annually and payable

on maturity of the Debentures. The Debentures mature three (3) years from the date of issue provided that the Corporation may, on ten

(10) business days prior written notice to the holder redeem or prepay all or any part of the Debenture prior to maturity without notice

or penalty, except that the Debenture is not redeemable by the Corporation for a period of six (6) months from the commencement date.

The Debentures are secured obligations of the Corporation and shall rank pari-passu with all other senior secured obligations of the Corporation

and senior to all unsecured obligations of the Corporation irrespective of the date of issue of such debentures or the date on which such

obligations were incurred by the Corporation. Subject to the Exchange Cap, if applicable, as set out in Schedule B, the principal amount

of the Debenture plus any accrued and unpaid interest shall be convertible in whole or in part at the option of the holder at a price

equal to $____ per share or the Nasdaq consolidated closing bid price (calculated to the nearest one-hundredth of one cent) of the Corporation

common stock on the Nasdaq stock market on the Closing Date, subject to adjustment as provided in the Debenture, at any time up to the

Maturity Date as more specifically set out in the Debenture (the “ Conversion Price ”) provided that the Corporation

may accelerate this right of conversion on at least ten (10) business days prior written notice to the holder if there is an effective

Registration Statement registering, or a current prospectus available for, the resale of the common shares issuable on the conversion

and (i) the closing price of the Corporation’s common stock exceeds two hundred (200% ) per cent of the Conversion Price for five

(5) trading days in a thirty (30) day period or (ii) the Corporation wishes to redeem or pre-pay the Debentures prior to the Maturity

Date.

| |

2. |

Description of Warrants |

The warrants that form part of the Purchased Securities

(the “ Warrants ”) shall be governed by the provisions of warrant certificates (the “ Warrant Certificates

”) of the Corporation, the form of which is annexed hereto as Schedule “C”. Subject to adjustment as provided in the

Warrant Certificates, each Warrant shall entitle the holder thereof to acquire one common share of the Corporation at any time from the

date of issuance until on or before 5:00 p.m. (New York time) on the date that is sixty (60) months from the Closing Date (the “

Warrant Shares ”). Subject to the Exchange Cap, if applicable, as set out in Schedule C, each one Warrant will have

an exercise price equal to $____ per share or the Nasdaq consolidated closing bid price (calculated to the nearest one-hundredth of one

cent) of the Corporation common stock on the Nasdaq stock market on the Closing Date, subject to adjustment as provided in the Warrant

Certificates (the “ Exercise Price ”) and each Warrant may be exercised either by a cash payment of the Exercise

Price or by a cashless exercise on the terms set out in the Warrant Certificate if and only if there is no effective Registration Statement

after six months from the Closing Date. The Warrant exercise may be accelerated by the Corporation if the closing price of the Corporation’s

common stock exceeds 200% of the Exercise Price for five (5) trading days in a 30 day period at any time up to the expiration date as

more specifically set out in the Warrant Certificate and there is an effective Registration Statement registering, or a current prospectus

available for, the resale of the Warrant Shares.

| |

3. |

Description of the Restricted Common Shares; Obligation to Remove Legend |

Neither the Debentures nor the Warrants nor any of

the shares of common stock underlying the Debentures or the Warrants (the “ Subscription Shares ”) have been

registered under the United States Securities Act of 1933, as amended (the " US Securities Act "), or any U.S.

state securities laws, and, unless so registered, none may be offered or sold, directly or indirectly, in the United States or to U.S.

persons (as defined herein) except pursuant to an effective registration statement under the US Securities Act, or pursuant to an available

exemption from, or in a transaction not subject to, the registration requirements of the US Securities Act and in each case only in accordance

with applicable state securities laws, or an opinion of counsel satisfactory to the corporation that such registration or qualification

is not required.

Upon the request of the Purchaser from time to time,

the Corporation shall be responsible (at its cost) for promptly supplying to Corporation’s transfer agent and the Purchaser a customary

legal opinion letter of its counsel (the “Legal Counsel Opinion”) to the effect that the resale of the Subscription Shares

by the Purchaser or its affiliates, successors and assigns is exempt from the registration requirements of the US Securities Act pursuant

to Rule 144 (provided the requirements of Rule 144 are satisfied and provided the Subscription Shares are not then registered under the

Securities Act for resale pursuant to an effective registration statement). Should Corporation’s legal counsel fail for any reason

to issue the Legal Counsel Opinion, a Purchaser may (at Corporation’s cost not to exceed $500) secure another legal counsel to

issue the Legal Counsel Opinion, and Corporation will instruct its transfer agent to accept such opinion. The Corporation shall not impede

the removal by its stock transfer agent of the restricted legend from any common stock certificate upon receipt by the transfer agent

of a Rule 144 Opinion Letter. CORPORATION HEREBY AGREES THAT IT MAY NEVER TAKE THE POSITION THAT IT IS A “SHELL CORPORATION”

IN CONNECTION WITH ITS OBLIGATIONS UNDER THIS AGREEMENT OR OTHERWISE UNLESS THE CORPORATION HAS SOUGHT THE ADVICE OF ITS COUNSEL AND

ITS COUNSEL HAS INDICATED THAT IT MUST TAKE SUCH POSITION AS A MATTER OF APPLICABLE LAW.

The Corporation agrees that until all the Subscription

Shares have been sold under a Registration Statement (as defined below) or pursuant to Rule 144 or other available exemption from US Securities

Act registration requirements, it shall use its reasonable commercial efforts to keep current in filing all reports, statements and other

materials required to be filed with the SEC to permit the Purchasers to sell the Subscription Shares under Rule 144.

4. Registration

Rights. The Corporation hereby grants the following registration rights to the Purchaser.

(a) Registration

Statement. The Corporation shall file with the Securities and Exchange Commission (the “SEC”) not later

than sixty (60) days after the date of this Agreement a registration statement on an appropriate form (the “Registration Statement”)

covering the resale of the Subscription Shares issuable upon conversion of the Debenture and the exercise of the Warrants and shall use

its commercially reasonable efforts to cause the Registration Statement to be declared effective within one hundred fifty (150) days following

the date hereof. Notwithstanding anything to the contrary herein, at any time, the Corporation may delay the disclosure of material, non-public

information concerning the Corporation the disclosure of which at the time is not, in the good faith opinion of the Board of Directors

of the Corporation, in the best interest of the Corporation and otherwise required (a “Grace Period”); provided,

that the Corporation shall promptly: (i) notify the Purchasers in writing of the existence of material, non-public information giving

rise to a Grace Period (provided that in each notice the Corporation will not disclose the content of such material, non-public information

to the Purchasers) and the date on which the Grace Period will begin, and (ii) use commercially reasonable efforts to resolve any issue

that makes disclosure of the material, non-public information not in the best interests of the Corporation.

(b) Registration

Procedures. In connection with the Registration Statement, the Corporation will:

(i) Prepare

and file with the SEC such amendments and supplements to the Registration Statement and the prospectus used in connection therewith as

may be necessary to keep such Registration Statement effective with respect to the Purchasers until all the Subscription Shares owned

by such Purchasers may be resold without restriction under the Securities Act; and

(ii) Immediately

notify the Purchasers when the prospectus included in the Registration Statement is required to be delivered under the US Securities Act,

of the happening of any event of which the Corporation has knowledge as a result of which the prospectus contained in such Registration

Statement, as then in effect, includes an untrue statement of a material fact or omits to state a material fact required to be stated

therein or necessary to make the statements therein not misleading in light of the circumstances then existing. If the Corporation notifies

the Purchasers to suspend the use of any prospectus until the requisite changes to such prospectus have been made, then the Purchasers

shall suspend use of such prospectus. In such event, the Corporation will use its commercially reasonable efforts to update such prospectus

as promptly as is practicable.

(c) Provision

of Documents etc. In connection with the Registration Statement, the Purchasers will furnish to the Corporation in writing such information,

selling stockholder questionnaires and representation letters with respect to itself and the proposed distribution by it as reasonably

shall be necessary in order to assure compliance with federal and applicable state securities laws. The Corporation may require the Purchaser,

upon five business days’ notice, to furnish to the Corporation a certified statement as to, among other things, the number of Subscription

Shares and the number of other shares of the Corporation’s Common Stock beneficially owned by such Purchaser and the person that

has voting and dispositive control over such shares. The Purchasers covenant and agree that each such Purchaser will comply with the prospectus

delivery requirements of the Securities Act, if applicable, in connection with sales of Subscription Shares pursuant to the Registration

Statement.

(d) Expenses.

All expenses incurred by the Corporation in complying with this article, including, without limitation, all registration and filing fees,

printing expenses, fees and disbursements of counsel and independent public accountants for the Corporation, fees of transfer agents and

registrars are called “Registration Expenses.” All underwriting discounts and selling commissions applicable

to the sale of the Subscription Shares, including any fees and disbursements of any counsel to the Purchaser, are called “Selling

Expenses.” The Corporation will pay all Registration Expenses in connection with the Registration Statement. Selling Expenses

in connection with the Registration Statement shall be borne by the applicable Purchaser.

(e) Indemnification

and Contribution.

(i) The

Corporation will, to the extent permitted by law, indemnify and hold harmless each Purchaser, and, as applicable, each officer of each

Purchaser, each director of each Purchaser, and each other person, if any, who controls each Purchaser within the meaning of the US Securities

Act, against any losses, claims, damages or liabilities, joint or several, to which such Purchaser or such other person (a “controlling

person”) may become subject under the Securities Act or otherwise, insofar as such losses, claims, damages or liabilities

(or actions in respect thereof) (“Claims”) arise out of or are based upon any untrue statement or alleged untrue

statement of any material fact contained in the Registration Statement at the time of its effectiveness, any preliminary prospectus or

final prospectus contained therein, or any amendment or supplement thereof, or arise out of or are based upon the omission or alleged

omission to state therein a material fact required to be stated therein or necessary to make the statements therein not misleading in

light of the circumstances when made, and will, subject to the limitations herein, reimburse such Purchaser and each such controlling

person for any legal or other

expenses reasonably incurred by them in connection with investigating or defending any such Claim; provided,

however, that the Corporation shall not be liable to a Purchaser to the extent that any Claim arises out of or is based upon an untrue

statement or alleged untrue statement or omission or alleged omission made in conformity with information furnished by such Purchaser

or any such controlling person in writing specifically for use in the Registration Statement or related prospectus, as amended or supplemented.

(ii) The

Purchaser will, to the extent permitted by law, indemnify and hold harmless the Corporation, and each person, if any, who controls the

Corporation within the meaning of the US Securities Act, each underwriter, each officer of the Corporation who signs the Registration

Statement and each director of the Corporation against all Claims to which the Corporation or such officer, director, underwriter or controlling

person may become subject under the Securities Act or otherwise, insofar as such Claims arise out of or are based upon any untrue statement

or alleged untrue statement of any material fact contained in the Registration Statement, any preliminary prospectus or final prospectus

contained therein, or any amendment or supplement thereof, or the omission or alleged omission to state therein a material fact required

to be stated therein or necessary to make the statements therein not misleading, and will reimburse the Corporation and each such officer,

director, underwriter and controlling person for any legal or other expenses reasonably incurred by them in connection with investigating

or defending any such loss, claim, damage, liability or action, provided, however, that such Purchaser will be liable hereunder in any

such case if and only to the extent that any such Claim arises out of or is based upon an untrue statement or alleged untrue statement

or omission or alleged omission made in reliance upon and in conformity with information pertaining to such Purchaser, as such, furnished

in writing to the Corporation by such Purchaser specifically for use in the Registration Statement or related prospectus, as amended or

supplemented.

(iii) Promptly

after receipt by an indemnified party hereunder of notice of the commencement of any action, such indemnified party shall, if a claim

in respect thereof is to be made against the indemnifying party hereunder, notify the indemnifying party in writing thereof, but the omission

so to notify the indemnifying party shall not relieve it from any liability which it may have to such indemnified party other than under

this section and shall only relieve it from any liability which it may have to such indemnified party under this section except and only

if and to the extent the indemnifying party is materially prejudiced by such omission. In case any such action shall be brought against

any indemnified party and it shall notify the indemnifying party of the commencement thereof, the indemnifying party shall be entitled

to participate in and, to the extent it shall wish, to assume and undertake the defense thereof with counsel satisfactory to such indemnified

party, and, after notice from the indemnifying party to such indemnified party of its election so to assume and undertake the defense

thereof, the indemnifying party shall not be liable to such indemnified party under this section for any legal expenses subsequently incurred

by such indemnified party in connection with the defense thereof other than reasonable costs of investigation and of liaison with counsel

so selected; provided, however, that, if the defendants in any such action include both the indemnified party and the indemnifying party

and the indemnified party shall have reasonably concluded that there may be reasonable defenses available to it which are different from

or additional to those available to the indemnifying party or if the interests of the indemnified party reasonably may be deemed to conflict

with the interests of the indemnifying party, the indemnified parties, as a group, shall have the right to select one separate counsel

and to assume such legal defenses and otherwise to participate in the defense of such action, with the reasonable expenses and fees of

such separate counsel and other expenses related to such participation to be reimbursed by the indemnifying party as incurred. The indemnifying

party shall not be liable for any settlement of any such proceeding affected without its written consent, which consent shall not be unreasonably

withheld.

(iv) In

order to provide for just and equitable contribution in the event of joint liability under the US Securities Act in any case in which

either (i) a Purchaser, or any controlling person of a Purchaser, makes a claim for indemnification pursuant to this section but it is

judicially determined (by the entry of a final judgment or decree by a court of competent jurisdiction and the expiration of time to appeal

or the denial of the last right of appeal) that such indemnification may not be enforced in such case notwithstanding the fact that this

section provides for indemnification in such case, or (ii) contribution under the US Securities Act may be required on the part of a Purchaser

or controlling person of a Purchaser in circumstances for which indemnification is not provided under this section, then, and in each

such case, the Corporation and such Purchaser will contribute to the aggregate losses, claims, damages or liabilities to which they may

be subject (after contribution from others) in a manner that reflects, as near as practicable, the economic effect of the foregoing provisions

of this section. Notwithstanding the foregoing, no person or entity guilty of fraudulent misrepresentation (within the meaning of Section

10(f) of the US Securities Act) will be entitled to contribution from any person or entity who was not guilty of such fraudulent misrepresentation.

(f) Delivery

of Unlegended Shares.

(i) Within

three business days (such business day, the “Unlegended Shares Delivery Date”) after the business day on which

the Corporation has received (i) a notice that Subscription Shares have been sold either pursuant to, and in compliance with, the Registration

Statement or Rule 144 under the US Securities Act (“Rule 144”) and (ii) in the case of sales under Rule 144,

customary representation letters of a Purchaser and a Purchaser’s broker regarding compliance with the requirements of Rule 144,

the Corporation at its expense, (A) shall deliver the Subscription Shares so sold without any restrictive legends relating to the US Securities

Act (the “Unlegended Shares”); and (B) shall cause the transmission of the certificates representing the Unlegended

Shares together with a legended certificate representing the balance of the unsold Subscription Shares, if any, to the Purchaser at the

address specified in the notice of sale, via express courier, by electronic transfer or otherwise on or before the Unlegended Shares Delivery

Date. Transfer fees shall be the responsibility of the Purchaser.

(ii) In

lieu of delivering physical certificates representing the Unlegended Shares, if the Corporation’s transfer agent is participating

in the Depository Trust Company (“DTC”) Fast Automated Securities Transfer program, upon request of a Purchaser,

so long as the certificates therefor do not bear a legend and the Purchaser is not obligated to return such certificate for the placement

of a legend thereon, the Corporation shall use its best efforts to cause its transfer agent to electronically transmit the Unlegended

Shares by crediting the account of Purchaser’s broker with DTC through its Deposit/Withdrawal at Custodian system. Such delivery

must be made on or before the Unlegended Shares Delivery Date but is subject to the cooperation of the Purchaser’s broker (the so-called

DTC participant).

(iii) The

Purchaser agrees that the removal of the restrictive legend from certificates representing the Subscription Shares as set forth in this

section is predicated upon the Corporation’s reliance that the Purchaser will sell any Subscription Shares pursuant to either the

registration requirements of the US Securities Act, including any applicable prospectus delivery requirements, or an exemption therefrom.

| |

5. |

Acknowledgments re: Hold Periods and Resale Restrictions |

The Purchaser on its own behalf and (if applicable)

on behalf of others for whom it is contracting hereunder, understands and acknowledges the following:

| |

(a) |

The Debentures, Warrants and Subscription Shares (collectively, the “ Purchased Securities ”) are subject to statutory holding periods or resale restrictions. |

| |

(b) |

The Purchaser, and (if applicable) others on whose behalf the Purchaser is contracting hereunder, have been advised to consult their own legal advisers in connection with any applicable statutory hold periods and resale restrictions relating to the Purchased Securities and no representation has been made respecting applicable statutory hold periods or resale restrictions relating to such securities; |

| |

(c) |

The Certificates representing the Purchased Securities may be endorsed with a legend setting out resale restrictions under applicable securities legislation; |

| |

(d) |

The Purchaser, and (if applicable) others on whose behalf the Purchaser is contracting hereunder, are solely responsible (and the Corporation is not in any way responsible) for compliance with applicable hold periods and resale restrictions, including without limitation the filing of any documentation and, if applicable, the payment of any fees with any applicable securities regulatory authority, and the Purchaser, and (if applicable) others on whose behalf the Purchaser is contracting hereunder, are aware that the Purchaser, and (if applicable) such others, may not be able to resell the Purchased Securities, except in accordance with limited exceptions under applicable securities legislation and regulatory policies and the Purchaser and, if applicable, others on whose behalf the Purchaser is contracting hereunder, will not sell, resell or otherwise transfer the Purchased Securities, except in compliance with applicable laws; and |

| |

(e) |

No market currently exists for the Debentures or the Warrants and although a market currently exists for the Subscription Shares no liquid market may exist for the Subscription Shares in the future. |

Unless other arrangements are agreed by the Corporation,

the following must be delivered to you or your broker, not later than 5:00 p.m. (New York time) on the day immediately preceding the Closing

Date:

| |

(a) |

One signed copy of this subscription agreement with the relevant “accredited investor” certification completed in Schedule “D” or Schedule “E”, as applicable to U.S. and Canadian Subscribers respectively; |

| |

(b) |

The aggregate Purchase Price payable for the Purchased Securities by way of a certified check or bank draft payable to the Corporation or your broker; and |

| |

(c) |

Such other documents as may be required pursuant to terms of this subscription agreement. |

This subscription is subject to acceptance by the

Corporation, as described below. A Debenture and a Warrant Certificate endorsed by the Corporation representing part of the Purchased

Securities will be available for delivery to the Purchaser, on the Closing Date against payment of the aggregate Purchase Price for the

Purchased Securities and a certificate representing part of the Purchased Securities will be available for delivery to the Purchaser approximately

fifteen (15) days after the Closing Date.

| |

8. |

Acceptance Subscription |

This subscription may be accepted in whole only and

the right is reserved to the Corporation to refuse to accept any subscription. Confirmation of acceptance or rejection of this subscription

will be forwarded to the Purchaser promptly after the acceptance or rejection of this subscription by the Corporation. If this subscription

is rejected, the Purchaser understands that any certified check, bank draft, wire transfer or other method of payment delivered by the

Purchaser to the broker or the Corporation c/o the law firm of Beard Winter LLP, representing the Purchase Price will be promptly returned

to the Purchaser without interest or deduction.

| |

9. |

Acknowledgments re: Prospectus Exemptions, etc. |

The Purchaser acknowledges and agrees, on its own

behalf and (if applicable) on behalf of others for whom the Purchaser is contracting hereunder, that the sale of the Purchased Securities

to the Purchaser, or (if applicable) to such others, is conditional upon, among other things, such sale being exempt from the requirement

to file a registration statement or deliver a prospectus in respect of such sale or upon the issuance of such rulings, orders, consents

or approvals as may be required to permit such sale without complying with the requirement to file a registration statement or deliver

a prospectus.

The Purchaser also acknowledges and agrees, on its

own behalf and (if applicable) on behalf of others for whom it is contracting hereunder, that: (i) the Purchaser, and (if applicable)

such others have not received, requested or been provided with, nor have any need to receive, a prospectus, offering memorandum, sales

or advertising literature or similar disclosure document relating to the Offering and/or the business and affairs of the Corporation and

that the decision to enter into this subscription agreement and purchase the Purchased Securities has not been based upon any verbal or

written representation as to fact or otherwise made by or on behalf of the Corporation or any officer, director, employee or agent of

the Corporation and that such decision is based entirely upon the form of Debenture attached as Schedule “B” and the form

of Warrant Certificate attached as Schedule “C” to this subscription agreement and information set out in this subscription

agreement, (ii) there has not been any advertisement of the Purchased Securities in printed public media, radio, television or telecommunications,

including electronic display such as the Internet; and (iii) Beard Winter LLP is acting as counsel to the Corporation and is not acting

as counsel to the Purchasers of Purchased Securities. The Purchaser acknowledges that the Corporation may be required by law to provide

applicable securities regulatory authorities with a list setting forth the identities of the beneficial purchasers of the Purchased Securities

and the Purchaser agrees to use its best efforts to comply with such laws, if required.

The Purchaser, on its own behalf and (if applicable

on behalf of others for whom the Purchaser is contracting hereunder, understands and acknowledges that: (i) the Purchased Securities have

not been nor will be registered under the United States Securities Act of 1933, as amended (the “ US Securities Act

”) nor any applicable state securities laws and may not be offered or sold or re-offered or resold, directly or indirectly, in the

United States or to any United States person (as defined in Regulation S under the U.S. Securities Act, a “ U.S. Person

”), unless such securities have been registered under the U.S. Securities Act, and any applicable state securities laws, or are

otherwise exempt from such registration; and (ii) certificates representing the Purchased Securities may bear a legend to such effect.

| |

10. |

Conditions to Closing |

The Purchaser acknowledges and agrees that as the

Offering will not be qualified by a prospectus, the Offering is subject to the condition that the Purchaser, or (if applicable) others

for whom the Purchaser is contracting hereunder, execute and return to the Corporation, as applicable, all relevant documentation required

by applicable securities legislation, regulations, rules and policies.

| |

11. |

Representations, Warranties and Covenants of the Purchaser |

The Purchaser, on its own behalf and (if applicable)

on behalf of others for whom the Purchaser is contracting hereunder, represent, warrant and covenant to and with the Corporation (and

acknowledges that the Corporation, and its counsel are relying thereon) as follows:

| |

(a) |

Jurisdiction of Residence – the Purchaser, or (if applicable) any beneficial purchaser for whom the Purchaser is contracting hereunder, is resident in the jurisdiction set forth on the first page of this agreement and the purchase by and sale to the Purchaser, or any such beneficial purchaser, of the Purchased Securities is being made in accordance with the applicable securities legislation of such jurisdiction; |

| |

(b) |

Prospectus Exempt Purchase –if the Purchaser or (if applicable) any beneficial purchaser for whom the Purchaser is contracting hereunder, is resident in a state of the United States of America or Canada, or is otherwise subject to the securities laws of any US state, the Purchaser, on its own behalf and (if applicable) on behalf of any such beneficial purchaser makes the representations, warranties and covenants set out in Schedule “D” or Schedule “E”, to this subscription agreement, as applicable, with the Corporation and the Purchaser, and (if applicable) any such beneficial purchaser, may avail itself of one or more of the categories of prospectus exempt purchasers listed in Schedule “D” or Schedule “E” as applicable; |

| |

(c) |

Agent Purchasing for Principal(s) – if the Purchaser is acting as agent for one or more beneficial purchasers: (i) each such beneficial purchaser is purchasing as principal for its own account and not for the benefit of any other person; and (ii) each such principal can, and does, make the representations, warranties and covenants set out herein as are applicable to such principal by virtue of its jurisdiction of residence or by virtue of it being subject to the applicable securities legislation of such jurisdiction, and (if applicable) any beneficial purchaser for whom the Purchaser is contracting hereunder, acknowledges that such schedule forms part of and is incorporated into this subscription agreement; |

| |

(d) |

Capacity – (i) if the Purchaser, or (if applicable) any beneficial purchaser for whom the Purchaser is contracting hereunder, is an individual, the Purchaser, or such beneficial purchaser, as the case may be, has attained the age of majority and is legally competent to execute this subscription agreement and to perform all actions required pursuant hereto; (ii) if the Purchaser, or any beneficial purchaser for whom the Purchaser is acting, is a corporation, partnership, unincorporated association or other entity, the Purchaser, or such beneficial purchaser, as the case may be, has the legal capacity and competence to enter into and be bound by this subscription agreement and to take all actions required pursuant thereto and the Purchaser further certifies that all necessary approvals of directors, shareholders or otherwise have been given and obtained; |

| |

(e) |

Authority – (i) if the Purchaser is acting as agent for one or more beneficial purchasers, the Purchaser is duly authorized to execute and deliver this subscription agreement and all other necessary documentation in connection with such subscription on behalf of each such principal and this subscription agreement has been duly authorized, executed and delivered by the Purchaser on behalf of each such principal; and (ii) the entering into of this subscription agreement and the completion of the transactions contemplated herein will not result in the violation of any of the terms and provisions of any law applicable to, or the constating documents of, the Purchaser or of any beneficial purchaser for whom the Purchaser is acting or of any agreement, written or oral, to which the Purchaser or any beneficial purchaser for whom the Purchaser is acting is a party or by which the Purchaser or such beneficial purchaser is bound; |

| |

(f) |

Enforceability – this subscription agreement has been duly and validly authorized, executed and delivered by the Purchaser (on its own behalf and, if applicable, on behalf of any beneficial purchaser) and, upon acceptance by the Corporation this subscription agreement will constitute a legal, valid and binding contract of the Purchaser, or (if applicable) any beneficial purchaser for whom the Purchaser is acting, enforceable against the Purchaser, or (if applicable) any such beneficial purchasers, in accordance with its terms; |

| |

(g) |

Purpose – If the purchaser is not an individual, the Purchaser has not been created solely or primarily to use exemptions from the registration and prospectus exemptions under applicable securities legislation and has a pre-existing purpose other than to use such exemptions; |

| |

(h) |

No Representation re: Resale, Refund, Future Price or Listing – no person has made any written or oral representation to us: |

(i) That any person will resell or repurchase the Purchased Securities;

(ii) That any person will refund the Purchaser Price other than

as may be provided in this subscription agreement; or

(iii) Relating to the future price or value of the Purchased

Securities;

| |

(i) |

Investment Experience – the Purchaser, or (if applicable) any beneficial purchaser for whom the Purchaser is contracting hereunder, has knowledge and experience with respect to investments of this type and the Purchaser, or (if applicable) any such beneficial purchaser, is capable of evaluating the merits and risks thereof and obtaining competent independent business, legal and tax advice regarding this investment; |

| |

(j) |

Proceeds of Crime - The funds representing the subscription amount which will be advanced by the Purchaser, or (if applicable) any beneficial purchaser for whom the Purchaser is contracting hereunder, to the Corporation hereunder will not represent proceeds of crime for the purposes of the Proceeds of Crime (Money Laundering) Act (Canada) or any laws relating to money laundering in the United States or any other jurisdiction (collectively, the " PCMLA ") and the Purchaser, or (if applicable) any beneficial purchaser for whom the Purchaser is contracting hereunder, acknowledges that the Corporation may in the future be required by law to disclose the Purchaser's, or (if applicable) any beneficial purchaser for whom the Purchaser is contracting hereunder, name and other information relating to this Subscription Agreement and the Purchaser's, or (if applicable) any beneficial purchaser for whom the Purchaser is contracting hereunder, subscription hereunder, on a confidential basis, pursuant to the PCMLA. To the best of its knowledge (a) no portion of the subscription amount to be provided by the Purchaser, or (if applicable) any beneficial purchaser for whom the Purchaser is contracting hereunder, (i) has been or will be derived from or related to any activity that is deemed criminal under the law of Canada, the United States, or any other jurisdiction, or (ii) is tendered on behalf of a person or entity who has not been identified to the Purchaser, or (if applicable) any beneficial purchaser for whom the Purchaser is contracting hereunder. The Purchaser, or (if applicable) any beneficial purchaser for whom the Purchaser is contracting hereunder, shall promptly notify the Corporation if the Purchaser, or (if applicable) any beneficial purchaser for whom the Purchaser is contracting hereunder, discovers that any of such representations ceases to be true, and to provide the Corporation with appropriate information in connection therewith; and |

| |

(k) |

Additional Filings - The Purchaser, or (if applicable) any beneficial purchaser for whom the Purchaser is contracting hereunder, shall execute, deliver, file and otherwise assist the Corporation with filing all documentation required by the applicable securities laws and any other applicable securities legislation to which the Purchaser, or (if applicable) any beneficial purchaser for whom the Purchaser is contracting hereunder, may be subject, within the time limits prescribed to permit the subscription for and issuance of, the Units and thereafter for any subsequent exchange thereof. |

The Purchaser acknowledges that the representations,

warranties and covenants made by the Purchaser in this Subscription Agreement are made by the Purchaser with the intent that they may

be relied upon by the Corporation and its counsel to, among other things, determine the eligibility of the Purchaser, or (if applicable)

the eligibility of others on whose behalf the Purchaser is contracting hereunder, to purchase the Purchased Securities under relevant

securities legislation including, without limitation, the availability of exemptions from the registration and prospectus requirements

of applicable securities legislation in connection with the issuance of the Purchased Securities to the Purchaser. The Purchaser further

agrees that by accepting the Purchased Securities on the Closing Date the Purchaser shall be representing and warranting that such representations,

warranties and covenants are true as at the Closing Date, with the same force and effect as if they had been made by the Purchaser on

such date. The Purchaser undertakes to immediately notify the Corporation of any change in any statement or other information relating

to the Purchaser or others on whose behalf the Purchaser is contracting set forth herein that takes place prior to Closing.

| |

12. |

Representations, Warranties and Covenants of the Corporation |

The Corporation hereby represents, warrants and covenants

to the Purchaser (and/or to any others on whose behalf the Purchaser is contracting hereunder), that as of the date of this Subscription

Agreement and as of the Closing Date:

| |

(b) |

The Corporation is a valid and subsisting corporation duly incorporated and in good standing under the laws of its jurisdiction of incorporation; |

| |

(c) |

The Corporation will reserve and set aside a sufficient number of authorized and unissued Common Shares of the Corporation to issue to the Purchaser the Common Shares issuable in connection with the exercise of the Warrants and such Common Shares will, when issued and delivered upon such exercise, be duly and validly issued as fully paid and non-assessable shares of the Corporation; |

| |

(d) |

This Subscription Agreement and the Offering have been duly authorized by all necessary corporate action on the part of the Corporation and constitute valid obligations of the Corporation legally binding upon it and enforceable in accordance with its terms; |

| |

(e) |

The Corporation has all requisite corporate power and authority to carry on its business as now and proposed to be carried on and to own, lease and operate its material properties, business and assets, or the interests therein; |

| |

(f) |

The Corporation is not a party to any actions, suits or proceedings which could have a material adverse effect on the assets, liabilities, financial condition, business, capital or prospects of the Corporation and, to the best of the Corporation’s knowledge, no such actions, suits or proceedings are pending or threatened; |

| |

|

|

| |

(g) |

The Purchased Securities, upon issuance in accordance

with the terms of this Agreement and the instruments representing such Purchased Securities for the consideration provided for herein

and therein, shall be duly authorized and validly issued, fully paid and nonassessable.

|

| |

(h) |

The execution, delivery and performance by the Corporation of each of this Agreement, the Debenture and the Warrant (collectively, the “Transaction Documents”) to be executed by the Corporation and the consummation of the transactions contemplated thereby (i) are within the power of the Corporation and (ii) have been duly authorized by all necessary actions on the part of the Corporation. |

| |

|

|

| |

(i) |

Each of the Transaction Documents executed, or to be executed, by the Corporation has been, or will be, duly executed and delivered by the Corporation and constitutes, or will constitute, a legal, valid and binding obligation of the Corporation, enforceable against the Corporation in accordance with its terms, except as limited by bankruptcy, insolvency or other laws of general application relating to or affecting the enforcement of creditors’ rights generally and general principles of equity. |

| |

13. |

Acknowledgment and Waiver |

The Purchaser, on its own behalf and/or on behalf

of others for whom the Purchaser is contracting hereunder, has acknowledged that the decision to purchase the Purchased Securities was

made solely on the basis of publicly available information. Accordingly, the decision to acquire the Purchased Securities has also been

made on the basis of currently available public information.

This Subscription Agreement, including without limitation

the representations, warranties and covenants contained herein, shall survive and continue in full force and effect and be binding upon

the Corporation and the undersigned for a period of three (3) years from the Closing Date notwithstanding the completion of the purchase

of the Purchased Securities.

The Corporation’s obligations hereunder shall

be secured pursuant to the Security Agreement annexed to Schedule B as Exhibit “B1”.

This Subscription Agreement shall be governed by and

construed in accordance with the laws of the State of Delaware. The Purchaser, on its own behalf and (if applicable) on behalf of others

for whom the Purchaser is contracting hereunder, hereby irrevocably attorn to the jurisdiction of the courts of the State of Delaware

with respect to any matters arising out of this agreement.

All costs and expenses incurred by the Purchaser (including

any fees and disbursements of any counsel retained by the Purchaser) relating to its purchase of the Purchased Securities shall be borne

by the Purchaser.

This Subscription Agreement is not transferable or

assignable, in whole or in part, by the Purchaser or (if applicable) by others on whose behalf the Purchaser is contracting hereunder.

| |

19. |

Entire Agreement and Headings |

This Subscription Agreement (including the schedules

hereto), contains the entire agreement of the parties hereto relating to the subject matter hereof and there are no representations, covenants

or other agreements relating to the subject matter hereof except as stated or referred to herein. This agreement may only be amended or

modified in any respect by written instrument only. The headings contained herein are for convenience only and shall not affect the meanings

or interpretation hereof.

The parties hereto confirm their express wish that

this agreement and all documents and agreements directly or indirectly relating thereto be drawn up in the English language

Time shall be of the essence of this Subscription

Agreement.

Unless otherwise specified, all dollar amounts referred

to in this Subscription Agreement are in United States Dollars.

| |

23. |

Counterparts and Facsimile Deliveries |

This Subscription Agreement may be executed in one

or more counterparts, each of which counterparts when executed shall constitute an original and all of which counterparts so executed

shall constitute one and the same instrument. The Corporation shall be entitled to rely on delivery of a facsimile copy of this Subscription

Agreement, including the completed schedules attached hereto, and acceptance by the Corporation of any such facsimile copy shall be legally

effective to create a valid and binding agreement between the parties hereto in accordance with the terms hereof.

| |

24. |

Consent to Collection and Use of Personal Information |

The Purchaser acknowledges that this subscription

agreement requires the Purchaser to provide certain personal information to the Corporation (“ Personal Information

”). Such information is being collected by the Corporation for the purposes of completing the proposed issuance of the Units, which

includes, without limitation, determining the Purchaser’s eligibility to purchase the Units under applicable securities laws, preparing

and registering certificates representing the Underlying Securities and completing filings required by the securities commissions, and/or

other securities regulatory authorities. The Purchaser agrees that the Purchaser’s Personal Information may be disclosed by the

Corporation to: (a) securities commissions and/or other securities regulatory authorities, (b) the Corporation’s registrar and transfer

agent, and (c) any of the other parties involved in this subscription, including legal counsel, and may be included in record books in

connection with this subscription. In the case of such information is being collected indirectly by them for the purpose of the administration

and enforcement of the applicable securities laws and the Purchaser authorizes the indirect collection of such information by them.

Purchase of Debentures pursuant to this Offering should

only be made after consulting with independent and qualified sources of investment and tax advice. Investment in the Debentures at this

time is speculative due to the stage of the Corporation’s development. An investment in Debentures is appropriate only for Subscribers

who are prepared to invest money for three (3) years and who have the capacity to absorb a loss of some or all of their investment. Subscribers

must rely on the management of the Corporation. Any investment in the Corporation at this stage involves a high degree of risk. The following

additional risk factors are inherent in an investment in the Debentures:

1. Redemptions:

There can be no assurance that if additional funding is required by the Corporation to redeem any or all of the Debentures on maturity,

that such financing will be available on terms satisfactory to the Corporation, or at all. If the Corporation does not have sufficient

funds on hand to redeem any or all of the Debentures and its assets do not mature or cannot be sold quickly enough, it will not be able

to redeem any or all of the Debentures on maturity.

2. No

Covenants: The covenants in the Debenture are limited and are not designed to protect the holders of Debentures in the event

of a material adverse change in the Corporation’s financial condition, results of operations, or if the Corporation is not successful

in effecting its business plan or finding an investor who will invest in the Corporation and whom the Corporation may use to repay the

Debentures. The Debentures provide for the payment of interest only at maturity and investors in the Debentures will not have the benefit

of amortized principal payments or any sinking fund payments by the Corporation. Further, there is no interest reserve, and as such, the

Corporation is not setting aside in a separate fund the capital to make such interest payments, which may result in its inability to make

such payments.

3. Tax

Consequences: The tax consequences associated with an investment in the Debentures may be subject to changes in federal and state

tax laws. There can be no assurance that the tax laws will not be changed in a manner that will adversely affect tax consequences to Subscribers

holding or disposing of the Debentures.

4. No

Right to Vote: Debenture holders will have no right to vote on matters relating to the Corporation. Exclusive authority and responsibility

for managing the Corporation rests with management of the Corporation and those persons, consultants and advisors retained by management

on behalf of the Corporation. Accordingly, Subscribers should appreciate that they will be relying on the good faith, experience, expertise

and ability of the directors and officers of the Corporation and other parties for the success of the business of the Corporation.

5. Bankruptcy.

Holders of Debentures may lose a substantial amount or all of their investment in the Debentures if the Corporation files for bankruptcy.

If the Corporation is unable to meet its payment obligations under the Debentures or for other financial obligations the Corporation has

or may have, the Corporation may seek protection from its creditors under the Federal bankruptcy code. A bankruptcy will have the effect

of stopping all collection actions while the Corporation or a bankruptcy trustee, under court supervision, arranges either a plan of repayment

or a sale of assets designed to pay off the creditors. A bankruptcy repayment plan or asset sale may not be on terms acceptable to Purchasers

or upon terms that are adequate to repay all or a substantial portion of the Debentures.

6. Limited

History: The Corporation has limited operational history. Accordingly, there is limited information available to a Subscriber upon

which to base an evaluation of the Corporation and its business and prospects. The Corporation is in the early stages of its business

and therefore is subject to the risks associated with early-stage companies, including uncertainty of revenues, markets and profitability,

the need to raise additional funding, the evolving and unpredictable nature of the Corporation’s business and the ability to identify,

attract and retain qualified personnel. There can be no assurance that the Corporation will be successful in doing what it is required

to do to overcome these risks. No assurance can be given that the Corporation’s business activities will be successful.

7. Illiquid

Investment: An investment in the Debenture of the Corporation is an illiquid investment. There is currently no public market through

which the Debenture of the Corporation may be resold.

8. No

Deposit Insurance: The Debentures are not insured against loss through the Canada Deposit Insurance Corporation, Federal Deposit Insurance

Corporation or any other insurance company or program.

9. No

Independent Counsel: No independent counsel has been retained on behalf of the Subscribers; and no independent counsel has conducted

any due diligence and reviewed the structure and the documentation of the Offering on their behalf to assess potential issues and risks

for Debenture Holders.

10. Competitive

Industry: The regulated gaming industry in Italy and the U.S. in which the Corporation primarily operates is, and will continue to

be, very competitive. There is no assurance that the Corporation will be able to continue to compete successfully or that the level of

competition and pressure on pricing will not affect its margins.

11. General

Market Risk: The Corporation and its affiliates may be adversely affected by a general deterioration in economic conditions or a deterioration

affecting specific industries, products or geographies: A recession or downturn in the economy or the deterioration in the economic conditions

affecting specific industries, geographic locations and/or products could make it difficult for the Corporation and its affiliates to

originate new business and maintain existing business.

12. Liquidity

Risk: If the Corporation requires new capital, it may need to raise additional funds. If it is unable to raise such capital, it would

need to curtail its growth and its business, and its ability to service or redeem Debentures could be adversely impacted.

13. Private

Placement Risk: Investing in private placements like this Offering involve significant risks not present in investments in public

offerings. Securities sold through private placements are typically not publicly traded and, therefore, are less liquid. Additionally,

investors may receive restricted securities that may be subject to holding period requirements. Companies seeking private placement investments

tend to be in earlier stages of development and have not yet been fully tested in the public marketplace. Investing in private placements

requires high risk tolerance, low liquidity concerns, and long-term commitments. Investors must be able to afford to lose their entire

investment. Investment products are not FDIC insured, may lose value, and there is no bank guarantee.

14. Other

Material Risks: In addition, a Subscriber should refer to the section entitled “Risk Factors” in the most recent

Annual Report of the Corporation on Form 10-K filed by the Corporation with the U.S. Securities and Exchange Commission and each quarterly

report on Form 10-Q or other report or filing filed thereafter by the Corporation, which are available www.sec.gov/archives/edgar/data.

SCHEDULE “D”

U.S. SUBCRIBERS

CONFIRMATION OF APPLICABLE PORTION OF ACCREDITED

INVESTOR DEFINITION

NOTE: THE INVESTOR MUST INITIAL BESIDE THE APPLICABLE PORTION OF

THE DEFINITION BELOW.

ELYS GAME TECHNOLOGY, CORP.

(The “Corporation”)

The purpose of this Statement is to obtain information

relating to whether or not you are an accredited investor as defined in Securities and Exchange Regulation D as well as your knowledge

and experience in financial and business matters and to your ability to bear the economic risks of an investment in the Corporation.

As used in Regulation D, the following terms shall

have the meaning indicated:

a. Accredited investor. Accredited investor shall

mean any person who comes within any of the following categories, or who the issuer reasonably believes comes within any of the following

categories, at the time of the sale of the securities to that person:

1. Any bank as defined in section 3(a)(2) of the Act,

or any savings and loan association or other institution as defined in section 3(a)(5)(A) of the Act whether acting in its individual

or fiduciary capacity; any broker or dealer registered pursuant to section 15 of the Securities Exchange Act of 1934; any insurance company

as defined in section 2(13) of the Act; any investment company registered under the Investment Corporation Act of 1940 or a business development

company as defined in section 2(a)(48) of that Act; any Small Business Investment Corporation licensed by the U.S. Small Business Administration

under section 301(c) or (d) of the Small Business Investment Act of 1958; any plan established and maintained by a state, its political

subdivisions, or any agency or instrumentality of a state or its political subdivisions, for the benefit of its employees, if such plan

has total assets in excess of $5,000,000; any employee benefit plan within the meaning of the Employee Retirement Income Security Act

of 1974 if the investment decision is made by a plan fiduciary, as defined in section 3(21) of such act, which is either a bank, savings

and loan association, insurance company, or registered investment adviser, or if the employee benefit plan has total assets in excess

of $5,000,000 or, if a self-directed plan, with investment decisions made solely by persons that are accredited investors;

2. Any private business development company as defined

in section 202(a)22 of the Investment Advisers Act of 1940;

3. Any organization described in section 501(c)3 of

the Internal Revenue Code, corporation, Massachusetts or similar business trust, or partnership, not formed for the specific purpose of

acquiring the securities offered, with total assets in excess of $5,000,000;

4. Any director, executive officer, or general partner

of the issuer of the securities being offered or sold, or any director, executive officer, or general partner of a general partner of

that issuer;

5. Any natural person whose individual net worth,