Textron, Elbit, AAR, and Triumph Added to the SPADE Defense Index(TM)

December 27 2007 - 12:09PM

Marketwired

WASHINGTON, DC (AMEX: DXS). Effective December 31, 2007, Textron

(NYSE: TXT), Elbit Systems (NASDAQ: ESLT), AAR Corporation (NYSE:

AIR), and Triumph Group (NYSE: TGI) were added to the index. EDO

and United Industrial exited the index during the quarter as

acquisitions of both companies, by ITT and Textron respectively,

were completed. The SPADE Defense Index serves as a benchmark for

the value that the markets ascribe to companies involved with

defense, homeland security, and space, and forms the basis for the

PowerShares Aerospace & Defense Portfolio ETF (AMEX: PPA).

-- Textron Inc.: manufactures military helicopters and their recent

acquisition of United Industrial gives them access to the unmanned aerial

vehicle (UAV) market. Overall, the firm generates approximately 35% of its

revenues from defense. An additional 35% is generated from its Cessna

aircraft business line, which is increasingly being used for homeland

security reconnaissance.

-- Elbit Systems: specializes in defense electronic and electro-optic

systems including C4ISR systems for unmanned vehicles for defense and

homeland security applications. Its operations include systems and products

for military aircraft and helicopters, land vehicles, military

communications, UAVs, electro-optic and countermeasures, and homeland

security and C4I.

-- AAR Corporation: provides products and services to the aviation,

aerospace, and defense industries worldwide including the maintenance,

repair, and overhaul of aircraft systems. Other divisions are involved

with cargo loading and handling systems for military aircraft and

helicopters, and advanced composite structures. The addition of AAR

provides exposure to a growing MRO market associated with the rising age of

military aircraft and an expanding commercial aviation market. More than a

third of revenues are derived from its defense operations with the balance

from commercial aerospace.

-- Triumph Group: engages in the design, manufacture, repair, overhaul,

and distribution of aircraft components worldwide. This company also

provides exposure to the MRO market. One-third of the company's revenues

are derived from military contracts.

"The SPADE Defense Index aims to cover the broad diversity of

activities that is representative of companies involved with

defense, homeland security, and space -- including industrial firms

that manufacture aircraft, tanks, ships, and missiles and those

involved with current and next generation systems related to

network centric warfare and information technology; intelligence,

surveillance, and reconnaissance; satellites; border security; and

defense systems that protect the lives of our servicemen and

servicewomen," said Scott Sacknoff, SPADE Defense Index

manager.

"Companies are required to meet a variety of eligibility

criteria including market valuation, liquidity, and listing on a

major U.S. exchange. The addition of these firms provides the Index

with added diversification in defense growth areas such as unmanned

aerial vehicles, persistent surveillance, electro-optics, as well

as operations and technical services."

The SPADE Defense Index has outperformed the S&P500 for

eight consecutive years, with a year-to-date gain of 24.4%, nearly

20% better than the widely-followed broad market index.

Add to Digg Bookmark with del.icio.us Add to Newsvine

For more information: www.spadeindex.com (202) 349-3917

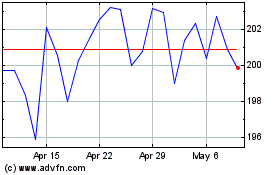

Elbit Systems (NASDAQ:ESLT)

Historical Stock Chart

From Jun 2024 to Jul 2024

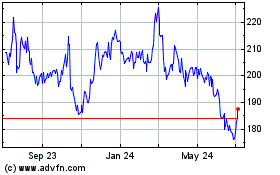

Elbit Systems (NASDAQ:ESLT)

Historical Stock Chart

From Jul 2023 to Jul 2024