UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the month of July 2023

Commission File Number 001-40375

E-Home Household Service Holdings Limited

(Translation of registrant’s name into English)

E-Home, 18/F, East Tower, Building B,

Dongbai Center, Yangqiao Road,

Gulou District, Fuzhou City 350001,

People’s Republic of China

(Address of principal executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form 40-F

☐

INFORMATION CONTAINED IN THIS FORM 6-K REPORT

This current report on Form 6-K is being filed

to disclose the home country rule exemption of E-Home Household Service Holdings Limited (“we”, “our”, “us”

or the “Company”) that it intends to disclose in its annual report on Form 20-F for the fiscal year ended June 30, 2023.

As a company incorporated in the Cayman Islands

that is listed on Nasdaq Capital Market (“Nasdaq”), the Company is subject to Nasdaq corporate governance listing standards.

Under Nasdaq rules, a foreign private issuer may, in general, follow its home country corporate governance practices in lieu of some of

the Nasdaq corporate governance requirements. Pursuant to the home country rule exemption set forth under Nasdaq Listing Rule 5615(a)(3)(A),

which provides (with certain exceptions not relevant to the conclusions expressed herein) that a Foreign Private Issuer may follow its

home country practice in lieu of the requirements of the Nasdaq Marketplace Rule 5600 Series, we elected to be exempt from the requirements

as follows:

| |

(i) |

Nasdaq Marketplace Rule 5620(a) which provides that (with certain exceptions not relevant to the conclusions expressed herein) each company listing common stock or voting preferred stock, and their equivalents, shall hold an annual meeting of shareholders no later than one year after the end of the company’s fiscal year-end; and |

| |

(ii) |

Nasdaq Marketplace Rule 5635(a) which sets forth the circumstances under which shareholder approval is required prior to an issuance of securities of the Company in connection with the acquisition of the stock or assets of another company; and |

| |

(iii) |

Nasdaq Marketplace Rule 5635(c) which sets forth the circumstances under which shareholder approval is required prior to an issuance of securities of the Company in connection with equity-based compensation of officers, directors, employees or consultants; and |

| |

(iv) |

Nasdaq Marketplace Rule 5635(d) which sets forth the circumstances under which shareholder approval is required prior to an issuance of securities, other than in a public offering, equal to 20% or more of the voting power outstanding at a price less than the lower of: (i) the Nasdaq Official Closing Price (as reflected on Nasdaq.com) immediately preceding the signing of the binding agreement; or (ii) the average Nasdaq Official Closing Price of the common stock (as reflected on Nasdaq.com) for the five trading days immediately preceding the signing of the binding agreement. |

Conyers Dill & Pearman,

our Cayman Islands counsel, has provided a letter to the Nasdaq Stock Market certifying that under Cayman Islands law, we are not required

to comply with above-mentioned requirements.

Except for the foregoing,

there is no significant difference between our corporate governance practices and what the Nasdaq requires of domestic U.S. companies.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: July 20, 2023

| |

E-Home Household Service Holdings Limited |

| |

|

| |

By: |

/s/ Wenshan Xie |

| |

Name: |

Wenshan Xie |

| |

Title: |

Chief Executive Officer |

3

Exhibit 99.1

| CONYERS DILL & PEARMAN

29th Floor

One Exchange Square

8 Connaught Place

Central

Hong Kong

T +852 2524 7106 | F +852 2845 9268

conyers.com

|

Matter No.: 833814 / 109228816

852 2842 9530

Richard.Hall@conyers.com

19 July 2023

The Nasdaq Stock Market, Inc.

Listing Qualifications

9600 Blackwell Road

Fifth Floor

Rockville, MD 20850

United States of America

Dear Sir / Madam,

Re: E-HOME HOUSEHOLD SERVICE HOLDINGS LIMITED (the “Company”)

We have

acted as special Cayman Islands legal counsel to the Company in connection with the following by the Company of certain corporate governance

practices in the absence of any established or normal practice in the Cayman Islands (“Home Country Practice”)

and in lieu of certain requirements of the Nasdaq Marketplace Rule 5600 Series as set out in the schedule (the “NASDAQ Listing

Rules”).

For the purposes of giving this opinion, we have

reviewed

| 1.1. | a copy of the Memorandum and Articles of Association of the Company, each certified by the Secretary of

the Company on 19 July 2023; and |

| 1.2. | such other documents and made such enquiries as to questions of law as we have deemed necessary in order

to render the opinion set forth below. |

We have assumed:

| 2.1. | the genuineness and authenticity of all signatures and the conformity to the originals of all copies (whether

or not certified) examined by us and the authenticity and completeness of the originals from which such copies were taken; |

| 2.2. | the accuracy and completeness of all factual representations made in the documents reviewed by us; |

| 2.3. | that there is no provision of the law of any jurisdiction, other than the Cayman Islands, which would

have any implication in relation to the opinions expressed herein; and |

| 2.4. | that following Home Country Practice in such circumstances will comply with the NASDAQ Listing Rules. |

| 3.1. | We have made no investigation of and express no opinion in relation to the laws of any jurisdiction other

than the Cayman Islands. This opinion is to be governed by and construed in accordance with the laws of the Cayman Islands and is limited

to and is given on the basis of the current law and practice in the Cayman Islands. This opinion is issued solely for your benefit and

use in connection with the matter described herein and is not to be relied upon by any other person, firm or entity or in respect of any

other matter. |

On the basis of and subject to the foregoing,

we are of the opinion that the Company’s Home Country Practice relating to corporate governance set forth above is not prohibited

by Cayman Islands law.

Yours faithfully,

/s/ Conyers Dill & Pearman

Conyers Dill & Pearman

Schedule

5620. Meetings of

Shareholders

(a) Each Company listing

common stock or voting preferred stock, and their equivalents, shall hold an annual meeting of Shareholders no later than one year after

the end of the Company’s fiscal year-end, unless such Company is a limited partnership that meets the requirements of Rule 5615(a)(4)(D).

5635. Shareholder

Approval

(a) Acquisition

of Stock or Assets of Another Company

Shareholder approval

is required prior to the issuance of securities in connection with the acquisition of the stock or assets of another company if:

(1) where, due to the

present or potential issuance of common stock, including shares issued pursuant to an earn-out provision or similar type of provision,

or securities convertible into or exercisable for common stock, other than a public offering for cash:

(A) the common

stock has or will have upon issuance voting power equal to or in excess of 20% of the voting power outstanding before the issuance of

stock or securities convertible into or exercisable for common stock; or

(B) the number

of shares of common stock to be issued is or will be equal to or in excess of 20% of the number of shares of common stock outstanding

before the issuance of the stock or securities; or

(2) any director, officer

or Substantial Shareholder (as defined by Rule 5635(e)(3)) of the Company has a 5% or greater interest (or such persons collectively have

a 10% or greater interest), directly or indirectly, in the Company or assets to be acquired or in the consideration to be paid in the

transaction or series of related transactions and the present or potential issuance of common stock, or securities convertible into or

exercisable for common stock, could result in an increase in outstanding common shares or voting power of 5% or more; or

(c) Equity Compensation

Shareholder approval

is required prior to the issuance of securities when a stock option or purchase plan is to be established or materially amended or other

equity compensation arrangement made or materially amended, pursuant to which stock may be acquired by officers, directors, employees,

or consultants, except for:

(1) warrants

or rights issued generally to all security holders of the Company or stock purchase plans available on equal terms to all security holders

of the Company (such as a typical dividend reinvestment plan);

(2) tax qualified,

non-discriminatory employee benefit plans (e.g., plans that meet the requirements of Section 401(a) or 423 of the Internal Revenue Code)

or parallel nonqualified plans, provided such plans are approved by the Company’s independent compensation committee or a majority of

the Company’s Independent Directors; or plans that merely provide a convenient way to purchase shares on the open market or from the Company

at Market Value;

(3) plans or

arrangements relating to an acquisition or merger as permitted under IM-5635-1; or

(4) issuances

to a person not previously an employee or director of the Company, or following a bona fide period of non-employment, as an inducement

material to the individual’s entering into employment with the Company, provided such issuances are approved by either the Company’s independent

compensation committee or a majority of the Company’s Independent Directors. Promptly following an issuance of any employment inducement

grant in reliance on this exception, a Company must disclose in a press release the material terms of the grant, including the recipient(s)

of the grant and the number of shares involved.

(d) Transactions

other than Public Offerings

(1) For purposes of this

Rule 5635(d):

(A)

“Minimum Price” means a price that is the lower of: (i) the Nasdaq Official Closing Price (as reflected on Nasdaq.com) immediately

preceding the signing of the binding agreement; or (ii) the average Nasdaq Official Closing Price of the common stock (as reflected on

Nasdaq.com) for the five trading days immediately preceding the signing of the binding agreement.

(B)

“20% Issuance” means a transaction, other than a public offering as defined in IM-5635-3, involving the sale, issuance or potential

issuance by the Company of common stock (or securities convertible into or exercisable for common stock), which alone or together with

sales by officers, directors or Substantial Shareholders of the Company, equals 20% or more of the common stock or 20% or more of the

voting power outstanding before the issuance.

(2) Shareholder

approval is required prior to a 20% Issuance at a price that is less than the Minimum Price.

conyers.com | 4

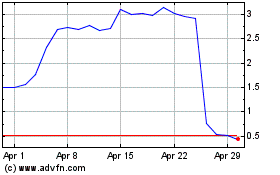

E Home Household Service (NASDAQ:EJH)

Historical Stock Chart

From Apr 2024 to May 2024

E Home Household Service (NASDAQ:EJH)

Historical Stock Chart

From May 2023 to May 2024