As filed with the Securities and Exchange Commission on September 21, 2023

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

Tender Offer Statement under Section 14(d)(1) or 13(e)(1)

of the Securities Exchange Act of 1934

(Amendment No. 2)

DIRECT DIGITAL HOLDINGS, INC.

(Name of Subject Company (Issuer))

DIRECT DIGITAL HOLDINGS, INC. (Offeror)

(Names of Filing Persons (Identifying Status as Offeror, Issuer or Other Person))

Warrants exercisable for Class A Common Stock at an exercise price of $5.50 per share

(Title of Class of Securities)

25461T113

(CUSIP Number of Class of Securities)

Mark Walker

Chief Executive Officer

Direct Digital Holdings, Inc.

1177 West Loop S,

Suite 1310

Houston, TX 77027

(832) 402-1051

(Name, Address, and Telephone Numbers of Person Authorized to Receive Notices and Communications on Behalf of Filing Persons)

With copies to:

Stephen E. Older, Esq.

Andrew J. Terjesen, Esq.

McGuireWoods LLP

1251 Avenue of the Americas 20th Floor

New York, NY 10020

Tel: (212) 548-2100

Check the box if the filing relates solely to preliminary communications before the commencement of a tender offer. ☐

Check the appropriate boxes below to designate any transactions to which the statement relates:

☐

third-party tender offer subject to Rule 14d-1.

☒

issuer tender offer subject to Rule 13e-4.

☒

going-private transaction subject to Rule 13e-3.

☐

amendment to Schedule 13D under Rule 13d-2.

Check the following box if the filing is a final amendment reporting the results of the tender offer: ☐

If applicable, check the appropriate box(es) below to designate the appropriate rule provision relied upon:

☐

Rule 13e-4(i) (Cross-Border Issuer Tender Offer)

☐

Rule 14d-1(d) (Cross-Border Third-Party Tender Offer)

SCHEDULE TO

This Amendment No. 2 (“Amendment No. 2”) amends and supplements the combined Tender Offer Statement and Rule 13e-3 Transaction Statement on Schedule TO (“Schedule TO”) originally filed by Direct Digital Holdings, Inc., a Delaware corporation (“Direct Digital” or the “Company”) on August 29, 2023, as amended on September 14, 2023. This Amendment No, 2 relates to the tender offer by the Company to purchase for cash any and all of its outstanding Warrants (as defined in the Offer to Purchase (defined below)) at a price of $1.20 per Warrant, without interest (the “Offer Purchase Price”). The Company’s offer is being made upon the terms and subject to the conditions set forth in the Second Amended and Restated Offer to Purchase and Consent Solicitation dated September 21, 2023 (as amended or supplemented from time to time, the “Offer to Purchase”), a copy of which is attached to this Schedule TO as Exhibit (a)(1)(A), and in the related Letter of Transmittal and Consent (as amended and supplemented from time to time), which is incorporated by reference into this Schedule TO as Exhibit (a)(1)(B) (which together, as amended or supplemented from time to time, constitute the “Offer”).

Concurrently with the Offer, the Company is also soliciting consents from holders of its outstanding Warrants to amend the Warrant Agent Agreement, dated as of February 15, 2022, by and between the Company and Equiniti Trust Company, LLC (formerly American Stock Transfer & Trust Company, LLC) (the “Warrant Agreement”), which governs all of the Company’s Warrants, to permit the Company to redeem each outstanding Warrant for $0.35 in cash, without interest (the “Redemption Price”), which Redemption Price is approximately 71% less than the Offer Purchase Price.

Only those items amended are reported in this Amendment No. 2. Except as amended hereby to the extent specifically provided herein, the information contained in the Schedule TO, the Offer to Purchase, and the other exhibits to the Schedule TO remains unchanged and are hereby expressly incorporated into this Amendment No. 2 by reference. This Amendment No. 2 should be read with the Schedule TO and the Offer to Purchase.

This Schedule TO is intended to satisfy the reporting requirements of Rules 13e-3 and 13e-4 under the Exchange Act.

Items 1 through 11 and 13.

Items 1 through 11 and 13 of the Schedule TO, to the extent such Items incorporate by reference the information contained in the Second Amended and Restated Offer to Purchase and Consent Solicitation, are hereby amended and supplemented by adding the following text thereto:

“On September 21, 2023, the Company extended the expiration date of the Offer. The Offer was previously scheduled to expire at one minute after 11:59 PM, Eastern Time, on September 26, 2023. The expiration date of the Offer has been extended until one minute after 11:59 PM, Eastern Time on September 28, 2023, unless further extended or terminated. Equiniti Trust Company, LLC, the depositary for the Offer, has indicated that as of September 21, 2023, 95 Warrants had been validly tendered and not validly withdrawn from the Offer, representing 0.003% of all outstanding Warrants.”

On September 21, 2023, the Company issued a press release announcing the extension of the expiration date for the Offer. The full text of the press release is attached as Exhibit (a)(5)(iii) to the Schedule TO and is incorporated herein by reference.

Amendments to the Second Amended and Restated Offer to Purchase and Consent Solicitation, Letter of Transmittal and Consent and Other Exhibits to the Schedule TO

All references to “one minute after 11:59 PM, Eastern Time, on September 26, 2023” set forth in the Second Amended and Restated Offer to Purchase and Consent Solicitation (Exhibit (a)(1)(A)), Letter of Transmittal and Consent (Exhibit (a)(1)(B)), Notice of Guaranteed Delivery (Exhibit (a)(1)(C)), Letter to Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees (Exhibit (a)(1)(D)), and Letter to Clients for use by Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees (Exhibit (a)(1)(E)) are hereby amended and replaced with “one minute after 11:59 PM, Eastern Time, on September 28, 2023”.

The Offer to Purchase was also amended to include summary financial information for the Company and correct some typographical errors.

The Second Amended and Restated Offer to Purchase and Consent Solicitation, which includes the above extension to the expiration date of the Offer is attached to the Schedule TO as Exhibit (a)(1)(A).

Item 12. Exhibits.

| |

Exhibit

Number

|

|

|

Description

|

|

| |

(a)(1)(A)

|

|

|

Second Amended and Restated Offer to Purchase and Consent Solicitation, dated September 21, 2023.

|

|

| |

(a)(1)(B)*

|

|

|

Letter of Transmittal and Consent (including Guidelines of the Internal Revenue Service for Certification of Taxpayer Identification Number on Form W-9).

|

|

| |

(a)(1)(C)*

|

|

|

Form of Notice of Guaranteed Delivery.

|

|

| |

(a)(1)(D)*

|

|

|

Form of Letter to Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees, dated August 29, 2023.

|

|

| |

(a)(1)(E)*

|

|

|

Form of Letter to Clients for use by Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees, dated August 29, 2023.

|

|

| |

(a)(2) – (4)

|

|

|

Not Applicable

|

|

| |

(a)(5)(i)*

|

|

|

Press Release, dated August 29, 2023, announcing cash tender offer for Direct Digital Holdings, Inc. warrants.

|

|

| |

(a)(5)(ii)*

|

|

|

Summary Advertisement, dated August 29, 2023, announcing cash tender offer for Direct Digital Holdings, Inc. warrants.

|

|

| |

(a)(5)(iii)

|

|

|

Press Release, dated September 21, 2023, announcing extension of the Expiration Date of the cash tender offer for Direct Digital Holdings, Inc. warrants

|

|

| |

(b)(1)

|

|

|

Term Loan and Security Agreement, dated as of December 3, 2021, by and among Direct Digital Holdings, LLC, as borrower, Orange142, LLC, Huddled Masses LLC, Colossus Media, LLC, and Universal Standards for Digital Marketing, LLC, as guarantors, Lafayette Square Loan Servicing, LLC, as administrative agent, and the various financial institutions signatory to the Term Loan and Security Agreement as lenders (incorporated by reference to Exhibit 10.6 to Direct Digital Holdings, Inc.’s Registration Statement on Form S-1 (File No. 333-261059) filed November 15, 2021).

|

|

| |

(b)(2)

|

|

|

First Amendment to Term Loan and Security Agreement, dated as of February 3, 2022, by and among Direct Digital Holdings, LLC, as borrower, Colossus Media, LLC, Huddled Masses LLC, Orange142, LLC, and Universal Standards for Digital Marketing, LLC, as guarantors, Lafayette Square Loan Servicing, LLC as administrative agent, and the various financial institutions signatory to the Term Loan and Security Agreement as lenders (incorporated by reference to Exhibit 10.16 to Direct Digital Holdings, Inc.’s Annual Report on Form 10-K filed March 31, 2022).

|

|

| |

(b)(3)

|

|

|

Second Amendment and Joinder to Term Loan and Security Agreement, dated effective as of July 28, 2022, by and among Direct Digital Holdings, LLC, as borrower, Colossus Media, LLC, Huddled Masses LLC, Orange142, LLC, Universal Standards for Digital Marketing, LLC and Direct Digital Holdings, Inc., as guarantors, Lafayette Square Loan Servicing, LLC as administrative agent, and the various financial institutions signatory to the Term Loan and Security Agreement as lenders (incorporated by reference to Exhibit 10.1 to Direct Digital Holdings, Inc.’s Quarterly Report on Form 10-Q filed November 14, 2022).

|

|

| |

(b)(4)

|

|

|

Early Opt-in Election, dated June 1, 2023, by and among Direct Digital Holdings, Inc., Direct Digital Holdings, LLC, Huddled Masses LLC, Colossus Media, LLC, Orange142, LLC, Lafayette Square Loan Servicing, LLC and Lafayette Square USA, Inc. ((incorporated by reference to Exhibit 10.1 to Direct Digital Holdings, Inc.’s Current Report on Form 8-K filed June 6, 2023).

|

|

| |

(c)

|

|

|

Not Applicable

|

|

| |

(d)(1)

|

|

|

Warrant Agreement, dated February 15, 2022, between Direct Digital Holdings, Inc. and Equiniti Trust Company, LLC (formerly American Stock Transfer & Trust Company, LLC), as warrant agent (incorporated by reference to Exhibit 4.3 to Direct Digital Holdings, Inc.’s Current Report on Form 8-K filed February 16, 2022).

|

|

| |

Exhibit

Number

|

|

|

Description

|

|

| |

(d)(2)

|

|

|

Not Applicable

|

|

| |

(f)

|

|

|

Not Applicable

|

|

| |

(g)

|

|

|

Not Applicable

|

|

| |

(h)

|

|

|

Not Applicable

|

|

| |

107*

|

|

|

|

|

*

Previously filed.

Item 12(b). Exhibits.

Filing Fee Exhibit

SIGNATURES

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: September 21, 2023

Direct Digital Holdings, Inc.

/s/ Mark Walker

Name: Mark Walker

Title:

Chairman, Chief Executive Officer and Director

Exhibit (a)(1)(A)

SECOND AMENDED AND RESTATED OFFER TO PURCHASE

BY

DIRECT DIGITAL HOLDINGS, INC.

OF

ANY AND ALL OF ITS WARRANTS TO PURCHASE SHARES OF CLASS A COMMON STOCK

AT A PURCHASE PRICE OF $1.20 IN CASH PER WARRANT

AND

CONSENT SOLICITATION

| |

|

THE OFFER PERIOD AND YOUR RIGHT TO WITHDRAW WARRANTS THAT YOU TENDER WILL EXPIRE AT ONE MINUTE AFTER 11:59 P.M., EASTERN TIME, ON SEPTEMBER 28, 2023, UNLESS THE OFFER PERIOD IS EXTENDED. THE COMPANY MAY EXTEND THE OFFER PERIOD AT ANY TIME.

|

|

|

Direct Digital Holdings, Inc., a Delaware corporation (the “Company,” “we,” “us,” or “our”), hereby offers to purchase any and all of its outstanding warrants described below at a purchase price of $1.20 in cash, without interest (the “Offer Purchase Price”), for each outstanding warrant tendered. The “Offer Period” is the period commencing on August 29, 2023 and ending one minute after 11:59 p.m., Eastern Time, on September 28, 2023, or such later date to which the Company may extend the Offer (the “Expiration Date”). The offer is made upon the terms and conditions in this Second Amended and Restated Offer to Purchase (“Offer Letter”) and the related Letter of Transmittal and Consent (together with the Offer Letter, as each may be amended or supplemented from time to time, the “Offer”).

Warrants eligible to be tendered pursuant to the Offer are 3,217,800 publicly traded warrants to purchase shares of our Class A common stock, par value $0.001 (“Class A common stock”), which were publicly issued and sold as part of units of the Company, in connection with the initial public offering of the Company’s securities on February 15, 2022 (the “DIRECT IPO”), which entitle such warrant holders to purchase one share of our Class A common stock at an exercise price of $5.50, subject to adjustments (the “Warrants”).

The Offer is subject to the satisfaction (or, to the extent permitted, waiver) of the conditions described in “The Offer and Consent Solicitation, Section 10: Conditions; Termination; Waivers, Extensions; Amendments”, beginning on page 23, including that there has been validly tendered in accordance with the terms of the Offer, and not withdrawn prior to 5:00 p.m., New York City time, on the Expiration Date, 50.1% or more of the outstanding Warrants (the “Minimum Tender Condition”).

Concurrently with the Offer, we also are soliciting consents (the “Consent Solicitation”) from holders of the Warrants to amend the Warrant Agreement, dated as of February 15, 2022 (the “Warrant Agreement”), by and between the Company and Equiniti Trust Company, LLC (formerly American Stock Transfer & Trust Company, LLC) (the “Transfer Agent” or “Depositary”), which governs all of the Warrants (the “Warrant Amendment”), to permit the Company to redeem each outstanding Warrant for $0.35 in cash, without interest (the “Redemption Price”), which Redemption Price is approximately 71% less than the Offer Purchase Price. Pursuant to the terms of the Warrant Agreement, the consent of holders of at least 50.1% of the outstanding Warrants is required to approve the Warrant Amendment as it relates to the Warrants. Although we intend to redeem all remaining outstanding Warrants if the Warrant Amendment is approved, we would not be required to effect such a redemption and may defer doing so until it is most advantageous to us. For a valid tender, consent must be given for all Warrants tendered. Accordingly, consents will be deemed to be delivered for all Warrants tendered on or before the Expiration Date for the Offer and Consent Solicitation.

If the Warrants are registered in your name, the execution and delivery of the Letter of Transmittal and Consent will constitute your consent to the Warrant Amendment and will also authorize and direct the

Depositary to execute and deliver a written consent to the Warrant Amendment on your behalf with respect to all Warrants that you tender. Custodial entities that are participants in The Depository Trust Company (“DTC”) may tender their Warrants through the Automatic Tender Option Program (“ATOP”) maintained by DTC, by which the custodial entity and the beneficial owner on whose behalf the custodial entity is acting agree to be bound by the Letter of Transmittal and Consent and which constitutes their consent to the Warrant Amendment and also authorizes and directs the Depositary to execute and deliver a written consent to the Warrant Amendment on their behalf with respect to all Warrants thereby tendered. You must deliver your consent to the proposed Warrant Amendment in order to participate in the Offer.

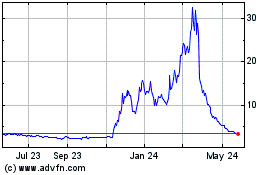

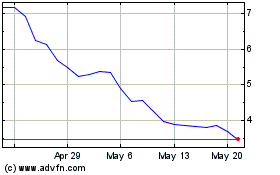

Our Warrants are listed on The Nasdaq Stock Market LLC (“Nasdaq”) under the symbol “DRCTW”. On September 20, 2023, the last reported sale price on Nasdaq for the Warrants was $1.17. As of September 21, 2023, 3,217,800 Warrants were outstanding. Warrant holders should obtain current market quotations for the Warrants before deciding whether to tender their Warrants pursuant to the Offer.

The Offer permits holders of Warrants to tender any and all Warrants in exchange for the Offer Purchase Price for each Warrant tendered. A holder may tender as few or as many Warrants as the holder elects. Holders are also entitled to exercise their Warrants during the Offer Period in accordance with the terms of the Warrants.

If you elect to tender Warrants in response to the Offer and Consent Solicitation, please follow the instructions in this Offer Letter and the related documents, including the Letter of Transmittal and Consent. If you wish to exercise your Warrants in accordance with their terms, please follow the instructions for exercise included in the Warrants.

If you tender Warrants, you may withdraw your tendered Warrants at any time before the Expiration Date and retain them on their current terms or amended terms if the Warrant Amendment is approved, by following the instructions in this Offer Letter. If you withdraw the tender of your Warrants, your consent to the Warrant Amendment will be withdrawn as a result.

See “The Offer and Consent Solicitation, Section 11. Forward-Looking Statements; Risk Factors” for a discussion of information that you should consider before tendering Warrants in the Offer.

The Offer and Consent Solicitation commenced on August 29, 2023 and will end on the Expiration Date.

A detailed discussion of the Offer and Consent Solicitation is contained in this Offer Letter. We may amend or terminate the Offer and Consent Solicitation at any time with requisite notice, as further described in this Offer Letter. Holders of Warrants are strongly encouraged to read this entire package of materials, and the publicly filed information about the Company referenced herein, as well as any supplemental disclosure regarding the Offer and Consent Solicitation before making a decision regarding the Offer and Consent Solicitation.

THE COMPANY’S BOARD OF DIRECTORS HAS APPROVED THE OFFER AND CONSENT SOLICITATION. HOWEVER, NONE OF THE COMPANY, ITS DIRECTORS, OFFICERS OR EMPLOYEES, NOR THE DEPOSITARY FOR THE OFFER, D.F. KING & CO., INC., THE INFORMATION AGENT FOR THE OFFER (THE “INFORMATION AGENT”), OR STIFEL, NICOLAUS & COMPANY, INCORPORATED, THE COMPANY’S DEALER MANAGER FOR THE OFFER (THE “DEALER MANAGER”), MAKES ANY RECOMMENDATION AS TO WHETHER YOU SHOULD TENDER WARRANTS OR CONSENT TO THE WARRANT AMENDMENT. EACH HOLDER OF A WARRANT MUST MAKE HIS, HER OR ITS OWN DECISION AS TO WHETHER TO TENDER SOME OR ALL OF HIS, HER OR ITS WARRANTS AND CONSENT TO THE WARRANT AMENDMENT.

Neither the U.S. Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of the Offer or passed upon the merits or fairness of the Offer or the accuracy or adequacy of the disclosure in this Offer Letter or the Letter of Transmittal and Consent. Any representation to the contrary is a criminal offense.

The Dealer Manager for the Offer and Consent Solicitation is:

Stifel

787 Seventh Avenue, 12th Floor

New York, New York 10019

Attention: Stifel Syndicate Desk

Email: BaltimoreEqtySynd@stifel.com

Offer to Purchase and Consent Solicitation dated September 21, 2023

IMPORTANT PROCEDURES

If you want to tender some or all of your Warrants, you must do one of the following before the Expiration Date:

•

if your Warrants are registered in the name of a broker, dealer, commercial bank, trust company or other nominee, contact the nominee and have the nominee tender your Warrants for you, which typically can be done electronically;

•

if you hold Warrant certificates in your own name, complete and sign the Letter of Transmittal and Consent according to its instructions, and deliver the Letter of Transmittal and Consent, together with any required signature guarantee, the certificates for your Warrants and any other documents required by the Letter of Transmittal and Consent, to the Depositary; or

•

if you are an institution participating in DTC, called the “book-entry transfer facility” in this Offer Letter, tender your Warrants according to the procedure for book-entry transfer described under “The Offer and Consent Solicitation, Section 2. Procedure for Tendering Warrants.”

If you want to tender your Warrants, but:

•

your certificates for the Warrants are not immediately available or cannot be delivered to the Depositary;

•

you cannot comply with the procedure for book-entry transfer; or

•

your other required documents cannot be delivered to the Depositary before the expiration of the Offer,

then you can still tender your Warrants if you comply with the guaranteed delivery procedure described under “The Offer and Consent Solicitation, Section 2. Procedure for Tendering Warrants.”

TO TENDER YOUR WARRANTS, YOU MUST CAREFULLY FOLLOW THE PROCEDURES DESCRIBED IN THIS OFFER LETTER, THE LETTER OF TRANSMITTAL AND CONSENT AND THE OTHER DOCUMENTS DISCUSSED HEREIN RELATED TO THE OFFER.

WARRANTS NOT TENDERED FOR PURCHASE WILL EXPIRE IN ACCORDANCE WITH THEIR TERMS ON FEBRUARY 15, 2027, AT 11:59 P.M. EASTERN TIME OR EARLIER UPON REDEMPTION, AND OTHERWISE REMAIN SUBJECT TO THEIR ORIGINAL TERMS, UNLESS THE WARRANT AMENDMENT IS APPROVED BY AT LEAST 50.1% OF THE HOLDERS OF THE WARRANTS AS IT RELATES TO THE APPLICABILITY OF THE WARRANT AMENDMENT TO THE WARRANTS.

THE OFFER RELATES TO THE WARRANTS THAT WERE PUBLICLY ISSUED IN CONNECTION WITH THE DIRECT IPO, WHICH TRADE ON NASDAQ UNDER THE SYMBOL “DRCTW.” ANY AND ALL OUTSTANDING WARRANTS ARE ELIGIBLE TO BE TENDERED PURSUANT TO THE OFFER. AS OF SEPTEMBER 21, 2023, THERE WERE 3,217,800 WARRANTS OUTSTANDING.

THE COMPANY RESERVES THE RIGHT TO EXERCISE ITS ABILITY TO REDEEM THE WARRANTS IF AND WHEN IT IS PERMITTED TO DO SO PURSUANT TO THE TERMS OF THE WARRANTS.

If you have any questions or need assistance, you should contact D.F. King & Co., Inc., the Information Agent for the Offer. You may request additional copies of this Offer Letter, the Letter of Transmittal and Consent or the Notice of Guaranteed Delivery from the Information Agent. The Information Agent may be reached at:

D.F. King & Co., Inc.

48 Wall Street

New York, New York 10005

Investors Call (Toll-Free): (866) 796-1290

Banks and Brokers Call: (212) 269-5550

By Email: drct@dfking.com

The address of the Depositary is:

Equiniti Trust Company, LLC

6201 15th Avenue

Brooklyn, NY 11219

Phone: (877) 248-6417

TABLE OF CONTENTS

| |

|

|

Page

|

|

|

|

|

|

|

|

1 |

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

|

9 |

|

|

|

|

|

|

|

|

9 |

|

|

|

|

|

|

|

|

11 |

|

|

|

|

|

|

|

|

15 |

|

|

|

|

|

|

|

|

15 |

|

|

|

|

|

|

|

|

16 |

|

|

|

|

|

|

|

|

19 |

|

|

|

|

|

|

|

|

20 |

|

|

|

|

|

|

|

|

20 |

|

|

|

|

|

|

|

|

20 |

|

|

|

|

|

|

|

|

21 |

|

|

|

|

|

|

|

|

25 |

|

|

|

|

|

|

|

|

25 |

|

|

|

|

|

|

|

|

26 |

|

|

|

|

|

|

|

|

27 |

|

|

|

|

|

|

|

|

30 |

|

|

|

|

|

|

|

|

30

|

|

|

We are not making the Offer to, and will not accept any tendered Warrants from, holders of Warrants in any jurisdiction where it would be illegal to do so. However, we may, at our discretion, take any actions necessary for us to make the Offer to holders of Warrants in any such jurisdiction.

You should rely only on the information contained in this Offer Letter and in the Letter of Transmittal and Consent or to which we have referred you. We have not authorized anyone to provide you with information or to make any representation in connection with the Offer other than those contained in this Offer Letter or in the Letter of Transmittal and Consent. If anyone makes any recommendation or gives any information or representation regarding the Offer and Consent Solicitation, you should not rely upon that recommendation, information or representation as having been authorized by us, our board of directors, the Depositary, the Information Agent, or the Dealer Manager. You should not assume that the information provided in this Offer Letter is accurate as of any date other than the date as of which it is shown, or if no date is otherwise indicated, the date of this Offer Letter.

We have no contract, arrangement or understanding relating to the payment of, and will not, directly or indirectly, pay, any commission or other remuneration to any broker, dealer, salesperson, agent or any other person, including the Dealer Manager, for soliciting tenders in the Offer. In addition, none of the Depositary, the Information Agent, the Dealer Manager or any broker, dealer, salesperson, agent or any other person is engaged or authorized to express any statement, opinion, recommendation or judgment with respect to the relative merits and risks of the Offer and Consent Solicitation. Our officers, directors and regular employees may solicit tenders from holders of the Warrants and will answer inquiries concerning the terms of the Offer and Consent Solicitation, but they will not receive additional compensation for soliciting tenders or answering any such inquiries.

SUMMARY TERM SHEET

Unless otherwise stated in this Offer Letter, references to “we,” “our,” “us,” or the “Company” refer to Direct Digital Holdings, Inc. This summary term sheet highlights important information regarding the Offer. To understand the Offer fully and for a more complete description of the terms of the Offer, you should carefully read this entire Offer Letter and the related Letter of Transmittal and Consent that constitute the Offer. We have included references to the sections of this Offer Letter where you will find a more complete description of the topics addressed in this summary term sheet.

| |

The Company

|

|

|

Direct Digital Holdings, Inc., a Delaware corporation. Our principal executive offices are located at 1177 W Loop S., Suite 1310, Houston, Texas 77027. Our telephone number is (832) 402-1051.

|

|

| |

The Warrants

|

|

|

As of September 21, 2023, the Company had 3,217,800 Warrants outstanding. Each Warrant is exercisable for one share of our Class A common stock, par value $0.001 per share, at an exercise price of $5.50. By their terms, the Warrants will expire on February 15, 2027, at 11:59 p.m. Eastern Time, unless sooner exercised or redeemed by the Company in accordance with the terms of the Warrants. The Offer relates to the Warrants that were sold as part of the units issued in connection with the DIRECT IPO, which trade on Nasdaq under the symbol “DRCTW.” Any and all outstanding Warrants are eligible to be tendered pursuant to the Offer.

|

|

| |

Market Price of the Warrants

|

|

|

The Warrants are listed on Nasdaq under the symbol “DRCTW”. On September 20, 2023, the last reported sale price on Nasdaq for the Warrants was $1.17.

|

|

| |

The Offer

|

|

|

The Offer is to permit holders of Warrants to tender any and all outstanding Warrants for a purchase price of $1.20 in cash, without interest, for each Warrant tendered. A holder may tender as few or as many Warrants as the holder elects.

|

|

| |

|

|

|

See “The Offer and Consent Solicitation, Section 1. General Terms.”

|

|

| |

The Consent Solicitation

|

|

|

In order to tender the Warrants in the Offer, holders of the Warrants are required to consent (by executing the Letter of Transmittal and Consent or requesting that their broker or nominee consent on their behalf) to an amendment to the Warrant Agreement governing the Warrants as set forth in the Warrant Amendment attached as Annex A. If approved by at least 50.1% of the holders of the Warrants, the Warrant Amendment would permit, as it relates, respectively, to the Warrants, the Company to redeem each Warrant as applicable that is outstanding upon the closing of the Offer for $0.35 in cash, without interest, which is approximately 71% less than the Offer Purchase Price. Although we intend to redeem all remaining outstanding Warrants if the Warrant Amendment is approved, we would not be required to effect such a redemption and may defer doing so until it is most advantageous to us.

|

|

| |

|

|

|

See “The Offer and Consent Solicitation, Section 1. General Terms.”

|

|

| |

Fairness of the Transaction

|

|

|

On September 12, 2023, our Board of Directors approved the Transaction as fair and in the best interest of the Company and the unaffiliated holders of the Warrants.

See “Special Factors, Section 2. Fairness of the Transaction.”

|

|

| |

U.S. Federal Income Tax Consequences of the Offer and Warrant Amendment

|

|

|

The exchange of Warrants for cash pursuant to the Offer will be a taxable sale of the Warrants for U.S. federal income tax purposes. A U.S. Holder will recognize gain or loss in an amount equal to the difference between the amount of cash received and the U.S. Holder’s adjusted tax basis in the Warrants.

|

|

| |

|

|

|

Although the issue is not free from doubt, if the Warrant Amendment is approved, we intend to treat all Warrants that are not exchanged for cash pursuant to the Offer as having been exchanged for “new” Warrants pursuant to the Warrant Amendment, and we intend to treat such deemed exchange as a “recapitalization” within the meaning of Section 368(a)(1)(E) of the Code, pursuant to which (i) the U.S. Holder should not recognize any gain or loss on the deemed exchange of Warrants for “new” Warrants, (ii) the U.S. Holder’s aggregate tax basis in the “new” Warrants deemed to be received should equal its aggregate tax basis in its existing Warrants deemed surrendered, and (iii) the U.S. Holder’s holding period for the “new” Warrants deemed to be received should include its holding period for the Warrants deemed surrendered.

|

|

| |

|

|

|

See “Special Factors, Section 5. Material U.S. Federal Income Tax Consequences.”

|

|

| |

Reasons for the Transaction

|

|

|

The Offer is being made to all holders of Warrants. The purpose of the Offer and Consent Solicitation (including any subsequent redemption of untendered Warrants) is to reduce the number of shares of Class A common stock that would become outstanding upon the exercise of Warrants, thus providing investors and potential investors with greater certainty as to the Company’s capital structure.

|

|

| |

|

|

|

See “Special Factors, Section 1. Purpose of the Transaction.”

|

|

| |

Expiration Date of Offer

|

|

|

One minute after 11:59 pm, Eastern Time, on September 28, 2023, or such later date to which we may extend the Offer. All Warrants and related paperwork must be received by the Depositary by this time, as instructed herein.

|

|

| |

|

|

|

See “The Offer and Consent Solicitation, Section 10. Conditions; Termination; Waivers; Extensions; Amendments.”

|

|

| |

Withdrawal Rights

|

|

|

If you tender your Warrants and change your mind, you may withdraw your tendered Warrants at any time until the Expiration Date.

|

|

| |

|

|

|

See “The Offer and Consent Solicitation, Section 3. Withdrawal Rights.”

|

|

| |

Participation by Executive Officers and Directors

|

|

|

To our knowledge, with the exception of 27,259 Warrants held by Mark Walker, and 71,124 Warrants held by Keith Smith, none

|

|

| |

|

|

|

of our directors or executive officers beneficially own Warrants. Mark Walker and Keith Smith may tender their Warrants in the Offer and consent to the Warrant Amendment as it relates to the Warrants.

|

|

| |

|

|

|

See “Special Factors, Section 4. Interests of Directors and Executive Officers.”

|

|

| |

Conditions of the Offer

|

|

|

We will not accept for payment, purchase or pay for any Warrants tendered, and may terminate or amend the Offer or may postpone the acceptance for payment of, or the purchase of and the payment for the Warrants tendered, subject to the rules under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), if:

•

the Minimum Tender Condition has not been satisfied; or

•

there has been instituted, threatened in writing or is pending any action, suit or proceeding by any government or governmental, regulatory or administrative agency or instrumentality, or by any other person, before any court, authority or other tribunal that, in our reasonable judgment, would or would be reasonably likely to prohibit, prevent, restrict or delay consummation of the Offer or materially impair the contemplated benefits to us of the Offer, or that is, or is reasonably likely to be, materially adverse to our business, operations, properties, condition, assets, liabilities or prospects; or

•

any order, statute, rule, regulation, executive order, stay, decree, judgment or injunction has been proposed, enacted, entered, issued, promulgated, enforced or deemed applicable by any court or governmental, regulatory or administrative agency or instrumentality that, in our reasonable judgment, would or would be reasonably likely to prohibit, prevent, restrict or delay consummation of the Offer or materially impair the contemplated benefits to us of the Offer, or that is, or is reasonably likely to be, materially adverse to our business, operations, properties, condition, assets, liabilities or prospects; or

•

in our reasonable judgment, there shall have occurred or be reasonably likely to occur, any material adverse change to our business, operations, properties, condition, assets, liabilities, or prospects.

|

|

| |

|

|

|

The foregoing conditions are solely for our benefit, and we may assert one or more of the conditions regardless of the circumstances giving rise to any such conditions, provided that, in no event shall the action or inaction of the Company or any of its affiliates be permitted to trigger any of such conditions. We may also, in our sole and absolute discretion, waive these conditions in whole or in part, subject to the potential requirement to disseminate additional information and extend the Offer, or terminate the Offer if these conditions are not satisfied prior to the Expiration Date.

|

|

| |

|

|

|

See “The Offer and Consent Solicitation, Section 10. Conditions; Termination; Waivers; Extensions; Amendments.”

|

|

| |

Board of Directors’ Recommendation

|

|

|

Our board of directors has approved the Offer and Consent Solicitation. However, none of the Company, its directors, officers or employees, nor the Depositary, the Information Agent or the Dealer Manager makes any recommendation as to whether holders of Warrants should tender their Warrants and consent to the Warrant Amendment. Holders of Warrants must make their own decision as to whether to tender some or all of their Warrants and consent to the Warrant Amendment.

|

|

| |

|

|

|

See “The Offer and Consent Solicitation, Section 1.C. General Terms-Board Approval of the Offer; No Recommendation; Holder’s Own Decision.”

|

|

| |

How to Tender Warrants

|

|

|

To tender your Warrants, you must complete the actions described herein under “The Offer and Consent Solicitation, Section 2. Procedure for Tendering Warrants” before the Offer expires.

|

|

| |

Questions or Assistance

|

|

|

Please direct questions or requests for assistance, or for additional copies of this Offer Letter, Letter of Transmittal and Consent or other materials to the Information Agent. The contact information for the Information Agent is located on the back cover of this Offer Letter.

|

|

SPECIAL FACTORS

1. PURPOSE OF THE TRANSACTION

The Offer is being made to all holders of Warrants. The purpose of the Offer and Consent Solicitation (including any subsequent redemption of the untendered Warrants) is to reduce the number of shares of Class A common stock that would become outstanding upon the exercise of the Warrants. The Company’s board of directors believes that by allowing holders of Warrants to tender one Warrant for the Offer Purchase Price, the Company can potentially reduce the substantial number of shares of Class A common stock that would be issuable upon exercise of the Warrants, thus reducing the potential dilutive impact of the Warrants, thereby providing investors and potential investors with greater certainty as to the Company’s capital structure. The Warrants acquired pursuant to the tender will be retired and cancelled. The Offer is not made pursuant to a plan to periodically increase any securityholder’s proportionate interest in the assets or earnings and profits of the Company.

The Consent Solicitation is being made in order to provide the Company with a mechanism for redeeming Warrants that are not tendered in the Offer as the Company’s board of directors believe this would enhance the benefits of the Offer.

The board of directors believes that the Offer and the Consent Solicitation should be undertaken at this time because they believe the Class A common stock had been underperforming because of the Warrants.

2. FAIRNESS OF THE TRANSACTION

On August 28, 2023, the board of directors approved the commencement of the Offer and Consent Solicitation. On September 12, 2023, our board of directors approved the Offer and the Consent Solicitation (including a subsequent redemption of the untendered Warrants) as fair and in the best interests of the Company and the unaffiliated holders of the Warrants. The board of directors evaluated information assembled and provided by the Company’s management in reaching its determination.

The board of director’s determination regarding the fairness of the transaction is required under Item 1014(a) of Regulation M-A and is not to be understood as an acknowledgment or admission by the board of directors that they have a fiduciary duty to any holders of the Warrants. As has been settled under Delaware law, directors do not have fiduciary duties to warrant holders. Instead, the warrant holder relationship is a contractual relationship. However, as this transaction would be deemed a Rule 13e-3 transaction since a successful tender offer and consent solicitation followed by a redemption of the remaining untendered warrants would have a reasonable likelihood of causing the warrants to be delisted, this Offer Letter is required by the Commission to address whether the board of directors has a reasonable belief regarding the fairness of the transaction to unaffiliated Warrant holders.

Factors Considered

The board of directors took into account a number of factors, including the following material factors, in support of its determination that the Transaction is fair and in the best interest of the Company and the unaffiliated holders of the Warrants:

•

The offer price of $1.20 was based on price discovery efforts conducted by the Company to determine indicative levels of interest for a redemption.

•

The offer price of $1.20 per Warrant constituting (1) an 84% premium over the last reported sale price of the Warrants on Nasdaq of $0.6534 on August 28, 2023, the day before the Offer was launched, (2) a 93% premium over the 30-day volume weighted average price of the Warrants on Nasdaq before the Offer was launched ($0.6208) and (3) a 100% premium over the 60-day volume weighted average price of the Warrants on Nasdaq before the Offer was launched ($0.6000).

•

The fact that the Warrants have a median price from their issuance until immediately prior to commencement of the Offer of approximately $0.55 per Warrant and an average price of $0.52 cents per Warrant.

•

The challenges the Warrants pose to analysts conducting valuation modeling of the Company, which may often result in improper valuations by analysts and cause an adverse effect on the price of the Company’s Class A common stock.

•

The Warrants may be seen as having undesirable accounting and valuation consequences because warrants represent marked-to-market derivative liabilities with non-cash changes in fair value recognized each quarter in net income.

•

The likelihood that the Offer would be consummated and a substantial majority of the warrant holders would tender at the Offer Purchase Price.

•

The fact that the Offer is a voluntary transaction in which holders of the Warrants may or may not choose to participate (although holders who elect to not participate face the possibility of being redeemed at $0.35 per Warrant).

•

The limited trading market for the Warrants, including limited liquidity and trading volume. The average daily volume of the Warrants has been approximately 9,132 warrants since the DIRECT IPO. More recently, prior to the Commencement of the Offer, the 30-day average volume of the Warrants was 347 warrants per day and the 60-day average volume was 836 warrants per day. The Offer also provides unaffiliated holders of the Warrants with an opportunity to obtain liquidity with respect to the Warrants without potential disruption to the Warrant market price, given the limited trading volume of the Warrants and the usual transaction costs associated with market sales, including brokerage fees and commissions.

•

The adverse effect on the value of the common stock of companies with warrants issued during, and outstanding following, an initial public offering (such as is the case with the Company) due to the negative perception associated with the existence of an artificial cap on the value of the Company’s common shares, such cap being equivalent to the redemption price of the warrants.

In evaluating the fairness of the Offer and the Consent Solicitation (including any subsequent redemption of the untendered Warrants), the key factors considered in particular were the premium over the market price at the time of launch, the historical market prices and volume of the Warrants and the challenge that the outstanding Warrants posed for analyst valuations, as discussed in detail above. Going concern value and liquidation value were not utilized for purposes of evaluating the fairness of the Offer, given management’s view that these are not metrics which investors utilize in pricing warrants generally or the Warrants specifically. The Company did not separately consider net book value of the Warrants as a metric, but the book value of the Warrants on the Company’s books is equal to their market price which was used as a metric. Purchase prices paid by the Company for the Warrants were not considered because the Company has not purchased its own Warrants since the consummation of the Company’s initial public offering. Finally, the Company is not aware of any firm offers being made by any unaffiliated person during the past two years for (A) the merger or consolidation of the Company with or into another company, or vice versa; (B) the sale or other transfer of all or any substantial part of the assets of the Company; or (C) a purchase of the Company’s securities that would enable the holder to exercise control over the Company.

Our board of directors did not entertain any alternative transactions as a factor in its evaluation of the fairness of the Offer and Consent Solicitation. The board of directors did discuss conducting an exchange offer for the Warrants (in lieu of a cash tender offer) but decided not to pursue this alternative because the Company understands that Warrant holders on average prefer receiving cash so they can exit their position and because the additional dilutive effects of an exchange offer would undermine the main purpose of the Offer and Consent Solicitation (including any subsequent redemption of untendered Warrants) to improve existing stockholder value. Our board of directors has elected to offer a premium to the market value of the Warrants as the board of directors believes the premium offer price will maximize participation in the Offer. Given our view that the Warrants are significantly dilutive to current common stockholder ownership interests, the advantages of maximizing the Offer participation are viewed to outweigh the higher costs of offering a premium to the market value of the Warrants.

Fairness for Unaffiliated Holders Who Tender or Do Not Tender

For unaffiliated Warrant holders who tender their Warrants in the Offer, we believe the Offer is fair because these holders will receive $1.20 per Warrant, which is a premium to the market price on the day of

launch of the Offer ($0.6534 per Warrant) and to the 30-day and 60-day volume weighted average price of the Warrants ($0.6208 and $0.6000, respectively). Given the illiquid market for the Warrants and the difficulty of finding buyers for large quantities of the Warrants, the Offer provides liquidity to the unaffiliated holders who might otherwise have difficulty selling their Warrants into the market with limited trading. In addition, the Company’s Class A common stock closed above the $5.50 strike price on only five trading days since the DIRECT IPO and this for 99.8% of the life of the Warrants so far have been out-of-the -money.

A countervailing consideration was that unaffiliated holders of the Warrants who failed or chose not to validly tender their Warrants before the Expiration Date could end up being redeemed at the lower redemption price of $0.35, which is a 71% discount off of the Offer Purchase Price. However, the high likelihood that a substantial majority of the warrant holders would tender due to the premium provided by the Offer Purchase Price was also considered.

In approving the Offer and Consent Solicitation, based on analysis assembled and prepared by management, our board of directors weighed the costs and risks, including the costs associated with the Offer and Consent Solicitation, the risks of not completing the Offer and Consent Solicitation, and the potential adverse impact of the Offer and Consent Solicitation on the trading market for untendered Warrants. Our board of directors determined that the benefits of the Offer and Consent Solicitation and the outweighed these costs and risks based on the factors described above.

The majority of directors who are not employees of the Company did not retain an unaffiliated representative to act solely on behalf of the unaffiliated Warrant holders for purposes of negotiating the terms of the Offer and Consent Solicitation (including any subsequent redemption of untendered Warrants), since they did not have a fiduciary duty to the unaffiliated Warrant holders.

Alternatives Considered

With respect to consideration of alternative transactions, the Company did briefly consider conducting an exchange offer for the Warrants (or a combined offer of cash and stock). However, the Company decided not to pursue this alternative because the board of directors believed that most holders of the Warrants would want cash to exit their position and because the additional dilutive effects of an exchange offer would undermine the main purpose of the Offer to improve existing stockholder value. An exchange offer would also be more expensive and take longer to complete than a cash tender offer for the Company because preparing the Form S-4 would be more expensive and would also require the Company’s auditor to deliver a comfort letter to the dealer manager which would entail substantial additional work and expense. The Company also understands that Warrant holders on average prefer receiving cash, and therefore regarded a cash tender offer to have a greater percentage of Warrant holder participation. The determining factors in choosing a cash tender offer, rather than an exchange offer, were the ability to complete the transaction more quickly, the ability to complete the transaction with less expense, the chances of maximizing Warrant holder participation (and consequently maximize the benefits of the Offer to the Company) and the fact that it would not have a dilutive effect on existing stockholders.

Premium Price

Our board of directors, based on the recommendation of management, has approved an Offer which includes a premium to the market value of the Warrants as the board of directors believes the premium offer price will maximize participation in the Offer. As discussed above, the premium was determined based upon the input received from the Company’s price discovery efforts and a consideration of current and historical market prices. Given our view that the Warrants are significantly dilutive to current common stockholder ownership interests, the advantages of maximizing the Offer participation are viewed to outweigh the higher costs of offering a premium to the market value of the Warrants.

No Third Party Reports, Opinions or Presentations

We did not retain any independent representative or consultant to render a fairness opinion or to provide any fairness analysis in connection with the Offer and the Consent Solicitation as we did not think the expense of such an opinion or analysis was necessary given that the board of directors does not have a fiduciary duty to the Warrant holders and that this was not an instance where there would be a change of

control. Additionally, we did not obtain any appraisals or valuations in connection with the determination of the Offer consideration, other than the price discovery efforts discussed above. The board of directors concluded that the Offer and Consent Solicitation (including a subsequent redemption of any untendered Warrants) is fair and in the best interests of the Company and the unaffiliated Warrant holders based on the board of directors’ and management’s own analysis, in light of the factors described above. However, the Company consulted with the Dealer Manager with respect to the structure of the Offer and pricing of the Offer. The Dealer Manager did not provide any reports, presentations, opinions, valuations or appraisals with respect to the Offer.

In addition, no outside party prepared a report or made a presentation to management or the Board of Directors that is materially related to the Offer or the Consent Solicitation, including with respect to the fairness of the consideration offered to unaffiliated Warrant holders or the fairness of the Offer and the Consent Solicitation (including a subsequent redemption of any untendered Warrants).

Weighing of Factors

In view of the wide variety of factors considered in connection with its evaluation of the Offer and Consent Solicitation (including a subsequent redemption of the untendered Warrants), our board of directors has found it impractical to, and therefore has not, quantified or otherwise attempted to assign relative weights to the specific factors considered in reaching a decision to approve the Offer and the Consent Solicitation. However, as stated above, key factors considered were the premium over the market price represented by the Offer Purchase Price, the historical market prices of the Warrants and the current issues for accurate valuation of the Class A common stock by analysts.

Recusal by Insiders

Mr. Mark Walker, our Chief Executive Officer and Chairman of our board of directors, who currently beneficially owns 27,259 Warrants, or less than 1.0% of the outstanding Warrants, and Mr. Keith Smith, our President and a member of our board of directors, who currently beneficially owns 71,124 Warrants, or approximately 2.2% of the outstanding Warrants, recused themselves from the vote approving the Offer. Mr. Walker and Mr. Smith informed the board of directors that they intended to participate in the Offer at the price approved by the disinterested directors. Each of our non-employee directors, who were all “disinterested directors” under Delaware law for purposes of the approval of the Offer and the Consent Solicitation and comprise a majority of our board of directors, has approved the Offer.

No Warrant holder Approval

The Offer does not require the approval of our Warrant holders; however, the Consent Solicitation (concurrently with the Offer, we are also soliciting the Consent Solicitation from holders of the Warrants to amend the Warrant Agreement to permit the Company to redeem each outstanding Warrant not tendered in the Offer for $0.35 in cash, which is 71% less than the Offer Purchase Price) requires the consent of holders of at least 50.1% of the outstanding Warrants to approve the Warrant Amendment. Despite the fact that the Offer is not structured to require the approval of our Warrant holders, we believe that the Offer is fair to the unaffiliated Warrant holders with respect to the price offered. We base these beliefs on the unanimous approval of the Offer by all of our non-employee directors and on the following factors:

•

all Warrant holders are offered the same consideration per Warrant;

•

Warrant holders are offered a premium to the market price of the Warrants;

•

Warrant holders are provided with full disclosure of the terms and conditions of the Offer; and

•

Warrant holders are afforded sufficient time to consider the Offer.

All Warrant holders are being notified of the Offer and the implications of the Offer on their holdings, and all Warrant holders are afforded sufficient time to consider the Offer. See “Special Factors, Section 3. Effects of the Transaction on the Market for the Warrants” for a detailed discussion of potential consequences that may result from remaining a holder of the Warrants.

3. EFFECTS OF THE TRANSACTION ON THE MARKET FOR THE WARRANTS

Consummation of the Offer

The Warrants are currently traded on Nasdaq. The Warrants acquired pursuant to the Offer will be retired and cancelled. Consequently, our purchase and subsequent cancellation of the Warrants tendered in the Offer will reduce the number of the Warrants that might otherwise be traded publicly and may reduce the number of holders of the Warrants. There can be no assurance that holders of the Warrants will be able to find willing buyers for their securities after the Offer.

Warrant Amendment

Pursuant to the terms of the Offer and Consent Solicitation, if we obtain the approval of the Warrant Amendment by holders of at least 50.1% of the Public Warrants, we will have the right to redeem the remaining Warrants untendered in the Offer. In case we redeem the remaining Warrants untendered in the Offer, the Nasdaq listing of the Warrants will be terminated and we would seek to terminate the registration of the Warrants pursuant to Sections 12(b), 12(g) and 15(d) of the Exchange Act. However, whether or not the Offer is consummated and any non-tendered Warrants are redeemed, the Company’s Class A common stock will remain listed on the Nasdaq Capital Market and registered with the SEC pursuant to Section 12(b) of the Exchange Act and we will remain an SEC registrant.

Although we intend to redeem all remaining outstanding Warrants if the Warrant Amendment is approved, we would not be required to effect such a redemption and may defer doing so until it is most advantageous to us. Also see “Forward-Looking Statements; Risk Factors — The Warrant Amendment, if approved by the requisite holders of the Warrants, will allow us to redeem all outstanding Warrants for cash”, “Forward-Looking Statements; Risk Factors — There is no guarantee that your decision whether to tender your Warrants in the Offer will put you in a better future economic position,” and “Forward-Looking Statements; Risk Factors — The liquidity of the Warrants that are not tendered may be reduced”.

THE COMPANY’S BOARD OF DIRECTORS HAS APPROVED THE OFFER AND CONSENT SOLICITATION. HOWEVER, NONE OF THE COMPANY, ITS DIRECTORS, OFFICERS OR EMPLOYEES, NOR THE DEPOSITARY, THE INFORMATION AGENT OR THE DEALER MANAGER, MAKES ANY RECOMMENDATION AS TO WHETHER A WARRANT HOLDER SHOULD TENDER ANY WARRANTS AND CONSENT TO THE WARRANT AMENDMENT. EACH HOLDER OF A WARRANT MUST MAKE HIS, HER OR ITS OWN DECISION AS TO WHETHER TO TENDER SOME OR ALL OF HIS, HER OR ITS WARRANTS AND CONSENT TO THE WARRANT AMENDMENT.

4. INTERESTS OF DIRECTORS AND EXECUTIVE OFFICERS

The names of the executive officers and directors of the Company are set forth below. The business address for each such person is: c/o Direct Digital Holdings, Inc. 1177 West Loop S, Suite 1310, Houston, Texas 77027, and the telephone number for each such person is (832) 402-1051.

|

Name

|

|

|

Position

|

|

|

Mark Walker

|

|

|

Chief Executive Officer and Chairman of the Board

|

|

|

Anu Pillai

|

|

|

Chief Technology Officer

|

|

|

Diana P. Diaz

|

|

|

Interim Chief Financial Officer

|

|

|

Maria Vilchez Lowrey

|

|

|

Chief Growth Officer

|

|

|

Keith Smith

|

|

|

Director

|

|

|

Richard Cohen

|

|

|

Director

|

|

|

Antoinette Leatherberry

|

|

|

Director

|

|

|

Mistelle Locke

|

|

|

Director

|

|

As of September 21, 2023, 3,217,800 Warrants were outstanding.

To our knowledge, with the exception of 27,259 Warrants held by Mark Walker, and 71,124 Warrants held by Keith Smith, none of our directors or executive officers beneficially own Warrants. Mark Walker and Keith Smith may tender their Warrants in the Offer and consent to the Warrant Amendment as it relates to the Warrants. The Company does not beneficially own any Warrants.

Except as set forth below, we have not and, to the best of our knowledge, none of our current directors, executive officers or any person holding a controlling interest in us has, engaged in any transactions involving the Warrants during the 60-day period prior to the date of this Offer Letter.

NONE OF THE COMPANY OR ANY OF ITS DIRECTORS, OFFICERS OR EMPLOYEES, OR THE DEPOSITARY, THE INFORMATION AGENT OR THE DEALER MANAGER MAKES ANY RECOMMENDATION AS TO WHETHER ANY HOLDER SHOULD TENDER ANY WARRANTS AND CONSENT TO THE WARRANT AMENDMENT. EACH HOLDER OF A WARRANT MUST MAKE HIS, HER OR ITS OWN DECISION AS TO WHETHER TO TENDER SOME OR ALL OF HIS, HER OR ITS WARRANTS AND CONSENT TO THE WARRANT AMENDMENT.

The following table sets forth information regarding the beneficial ownership of our Class A common stock and Class B common stock, as of September 21, 2023 by:

i.

each of our directors and executive officers;

ii.

all directors and executive officers as a group; and

iii.

each person who is known to us to own beneficially more than 5% of our Class A common stock or Class B common stock.

Beneficial ownership is determined according to the rules of the SEC, which generally provide that a person has beneficial ownership of a security if he, she or it possesses sole or shared voting or investment power over that security, including options and warrants that are currently exercisable or exercisable within 60 days. In computing the number of shares of common stock beneficially owned by a person and the percentage ownership, we deemed outstanding shares of our common stock subject to options and warrants held by that person that are currently exercisable or exercisable within 60 days. We did not deem these shares outstanding, however, for the purpose of computing the percentage ownership of any other person.

The percentage ownership of common stock is based on 2,991,792 shares of Class A common stock and 11,278,000 shares of Class B common stock outstanding as of September 21, 2023.

Unless otherwise indicated and subject to applicable community property laws, we believe that all persons named in the table have sole voting and investment power with respect to all shares of our Class A common stock beneficially owned by them.

| |

|

|

Shares of Class A

Common

Stock Beneficially

Owned

|

|

|

Shares of Class B

Stock

Beneficially Owned

|

|

|

Total Voting Power

Beneficially Owned

|

|

|

Name of Beneficial Owner

|

|

|

No.

|

|

|

Percent

|

|

|

No.

|

|

|

Percent

|

|

|

No.

|

|

|

Percent

|

|

|

5% Stockholders

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Direct Digital Management, LLC(1)

|

|

|

|

|

— |

|

|

|

|

|

—% |

|

|

|

|

|

11,278,000 |

|

|

|

|

|

100% |

|

|

|

|

|

11,278,000 |

|

|

|

|

|

79.6% |

|

|

|

Named Executive Officers and Directors

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mark Walker(2), Chairman, Chief Executive Officer and director

|

|

|

|

|

62,915(3) |

|

|

|

|

|

2.0% |

|

|

|

|

|

5,689,000 |

|

|

|

|

|

50.4% |

|

|

|

|

|

5,751,915 |

|

|

|

|

|

40.0% |

|

|

|

Keith Smith(2), President and director

|

|

|

|

|

146,780(4) |

|

|

|

|

|

4.6% |

|

|

|

|

|

5,589,000 |

|

|

|

|

|

49.6% |

|

|

|

|

|

5,735,780 |

|

|

|

|

|

39.7% |

|

|

|

Diana Diaz, Interim Chief Financial Officer

|

|

|

|

|

— |

|

|

|

|

|

*% |

|

|

|

|

|

— |

|

|

|

|

|

*% |

|

|

|

|

|

— |

|

|

|

|

|

*% |

|

|

|

Anu Pillai(5), Chief Technology Officer

|

|

|

|

|

10,610 |

|

|

|

|

|

*% |

|

|

|

|

|

— |

|

|

|

|

|

*% |

|

|

|

|

|

10,610 |

|

|

|

|

|

*% |

|

|

|

Maria Vichez Lowrey(6)

|

|

|

|

|

6,642 |

|

|

|

|

|

*% |

|

|

|

|

|

— |

|

|

|

|

|

*% |

|

|

|

|

|

6,642 |

|

|

|

|

|

*% |

|

|

|

Richard Cohen, director

|

|

|

|

|

16,296 |

|

|

|

|

|

*% |

|

|

|

|

|

— |

|

|

|

|

|

*% |

|

|

|

|

|

16,296 |

|

|

|

|

|

*% |

|

|

|

Antoinette R. Leatherberry, director

|

|

|

|

|

16,296 |

|

|

|

|

|

*% |

|

|

|

|

|

— |

|

|

|

|

|

*% |

|

|

|

|

|

16,296 |

|

|

|

|

|

*% |

|

|

|

Mistelle Locke, director

|

|

|

|

|

— |

|

|

|

|

|

*% |

|

|

|

|

|

— |

|

|

|

|

|

*% |

|

|

|

|

|

— |

|

|

|

|

|

*% |

|

|

|

All executive officers and directors as a group (8 persons)(7)

|

|

|

|

|

259,539 |

|

|

|

|

|

8.5% |

|

|

|

|

|

11,278,000 |

|

|

|

|

|

100% |

|

|

|

|

|

11,537,539 |

|

|

|

|

|

79.6% |

|

|

*

Less than 1%.

(1)

Direct Digital Management, LLC is a holding company in which Mark Walker, our Chairman and Chief Executive Officer, and Keith Smith, our President, each indirectly hold a 50% economic and voting interest. AJN Energy & Transport Ventures, LLC and SKW Financial LLC each own 50% of the equity interests in Direct Digital Management, LLC. Mr. Walker and his wife share voting and dispositive power with respect to the shares of Class B common stock held by AJN Energy & Transport Ventures, LLC. Mr. Smith and his wife share voting and dispositive power with respect to the shares of Class B common stock held by SKW Financial LLC.

(2)

Consists of the shares owned by Direct Digital Management, LLC. Each of Messrs. Walker and Smith indirectly hold a 50% economic and voting interest in Direct Digital Management, LLC. AJN Energy & Transport Ventures, LLC and SKW Financial LLC each own 50% of the equity interests in Direct Digital Management, LLC. Mr. Walker and his wife share voting and dispositive power with respect to the shares of Class B common stock held by AJN Energy & Transport Ventures, LLC. Mr. Smith and his wife share voting and dispositive power with respect to the shares of Class B common stock held by SKW Financial LLC.

(3)

Includes 27,259 shares of Class A common stock underlying warrants exercisable within 60 days of the Determination Date and 20,300 options to purchase Class A common stock.

(4)

Includes (a) 71,124 shares of Class A common stock underlying warrants exercisable within 60 days of the Determination Date, (b) 40,000 shares of Class A common stock held directly by SKW Financial LLC. Mr. Smith is owner of SKW Financial LLC, and shares voting and dispositive power with his wife over securities held by such entity; as such, Mr. Smith may be deemed to have beneficial ownership of the securities held directly by SKW Financial LLC and (c) 20,300 options to purchase Class A common stock.

(5)

Includes 6,216 options to purchase Class A common stock.

(6)

Includes 3,899 options to purchase Class A common stock.

(7)

Includes each of our directors and all five of our executive officers.

5.

MATERIAL U.S. FEDERAL INCOME TAX CONSEQUENCES

The following is a summary of certain material U.S. federal income tax consequences to U.S. Holders and Non-U.S. Holders (each as defined below) of (i) the exchange of Warrants for cash pursuant to the Offer, and (ii) the adoption of the Warrant Amendment if it is approved.

For purposes of this discussion, a “U.S. Holder” is a beneficial owner of Warrants that is for U.S. federal income tax purposes:

•

an individual citizen or resident of the United States;

•

a corporation (or other entity treated as a corporation) that is created or organized in or under the laws of the United States, any state thereof or the District of Columbia;

•

an estate whose income is subject to U.S. federal income taxation regardless of its source; or

•

a trust if (i) a U.S. court can exercise primary supervision over the trust’s administration and one or more “United States persons” within the meaning of Section 7701(a)(30) of the Internal Revenue Code of 1986, as amended (the “Code”) are authorized to control all substantial decisions of the trust, or (ii) it has a valid election in effect under applicable U.S. Treasury regulations to be treated as a United States person.

For purposes of this discussion, a “Non-U.S. Holder” is a beneficial owner of Warrants that is not a U.S. Holder and is not an entity or arrangement treated as a partnership or other pass-through entity for U.S. federal income tax purposes.

This discussion is based on the Code, final, temporary and proposed Treasury regulations promulgated thereunder, administrative rulings and pronouncements and judicial decisions, all as in effect as of the date hereof. These authorities are subject to change or differing interpretations, possibly on a retroactive basis. There is no assurance that a change in law (including, but not limited to, proposed legislation) will not significantly alter the tax considerations described in this discussion.

This discussion does not address all aspects of U.S. federal income taxation that may be relevant to any particular holder based on such holder’s individual circumstances. In particular, this discussion considers only holders that own Warrants as capital assets within the meaning of Section 1221 of the Code (generally, property held for investment), and does not address the alternative minimum tax or the Medicare tax on certain investment income. In addition, this discussion does not address the U.S. federal income tax consequences to holders that are subject to special rules, including:

•

financial institutions or financial services entities;

•

broker, dealers or traders in securities;

•

persons that use the mark-to-market method of accounting for U.S. federal income tax purposes;

•

tax-exempt entities;

•

governments or agencies or instrumentalities thereof;

•

insurance companies;

•

regulated investment companies or mutual funds;

•

real estate investment trusts;

•

former citizens or former long-term residents of the United States;

•

“controlled foreign corporations” or “passive foreign investment companies”;

•

persons that actually or constructively own 5 percent or more of our shares;

•

persons that acquired our Warrants in connection with employee share incentive plans or otherwise as compensation;

•

persons that hold Warrants as part of a straddle, constructive sale, hedging, conversion or other integrated transaction; or

•

U.S. Holders whose functional currency is not the U.S. dollar.

This discussion does not address any tax laws other than U.S. federal income tax laws, such as U.S. federal gift or estate tax laws or state, local or non-U.S. tax laws or, except as discussed herein, any tax reporting obligations of a holder of the Warrants. Additionally, this discussion does not consider the tax

treatment of partnerships (including entities or arrangements treated as partnerships for U.S. federal income tax purposes) or other pass-through entities for U.S. federal income tax purposes or persons who hold the Warrants through such entities. If a partnership (or other entity or arrangement treated as a partnership for U.S. federal income tax purposes) is the beneficial owner of the Warrants, the U.S. federal income tax treatment of a partner in the partnership generally will depend on the status of the partner and the activities of the partnership. If you are a partnership or a partner of a partnership holding the Warrants, you are urged to consult your own tax advisor regarding the tax consequences of the Offer and the adoption of the Warrant Amendment.

We have not sought, and will not seek, a ruling from the IRS as to any U.S. federal income tax consequence described herein. The IRS may disagree with the descriptions herein, and its determination may be upheld by a court. Moreover, there can be no assurance that future legislation, regulations, administrative rulings or court decisions will not adversely affect the accuracy of the statements in this discussion.

THIS DISCUSSION IS ONLY A SUMMARY OF CERTAIN MATERIAL U.S. FEDERAL INCOME TAX CONSEQUENCES OF THE OFFER AND THE ADOPTION OF THE WARRANT AMENDMENT TO U.S. HOLDERS AND NON-U.S. HOLDERS OF OUR WARRANTS. EACH HOLDER OF WARRANTS IS URGED TO CONSULT HIS, HER OR ITS OWN TAX ADVISOR WITH RESPECT TO THE PARTICULAR TAX CONSEQUENCES TO SUCH HOLDER OF THE OFFER AND THE ADOPTION OF THE WARRANT AMENDMENT, INCLUDING THE APPLICABILITY AND EFFECT OF ANY STATE, LOCAL, AND NON-U.S. TAX LAWS, AS WELL AS U.S. FEDERAL TAX LAWS AND ANY APPLICABLE TAX TREATIES.

U.S. Holders

Exchange of Warrants for Cash Pursuant to the Offer

The exchange of Warrants for cash pursuant to the Offer will be a taxable sale of the Warrants for U.S. federal income tax purposes. A U.S. Holder will recognize capital gain or loss in an amount equal to the difference between the amount of cash received and the U.S. Holder’s adjusted tax basis in the Warrants. Any such capital gain or loss will be long-term capital gain or loss if the U.S. Holder’s holding period for the Warrants exceeds one year. A U.S. Holder must calculate gain or loss separately for each block of Warrants exchanged pursuant to the Offer (generally, Warrants acquired at the same cost in a single transaction). Long-term capital gain recognized by a non-corporate U.S. Holder may be eligible for reduced rates of tax. The deduction of capital losses is subject to limitations.

Warrant Amendment

Although the issue is not free from doubt, if the Warrant Amendment is approved, we intend to treat all Warrants that are not exchanged for cash pursuant to the Offer as having been exchanged for “new” Warrants pursuant to the Warrant Amendment, and we intend to treat such deemed exchange as a “recapitalization” within the meaning of Section 368(a)(1)(E) of the Code, pursuant to which (i) the U.S. Holder should not recognize any gain or loss on the deemed exchange of Warrants for “new” Warrants, (ii) the U.S. Holder’s aggregate tax basis in the “new” Warrants deemed to be received should equal its aggregate tax basis in its existing Warrants deemed surrendered, and (iii) the U.S. Holder’s holding period for the “new” Warrants deemed to be received should include its holding period for the Warrants deemed surrendered. Special tax basis and holding period rules apply to a U.S. Holder that acquired different blocks of Warrants at different prices or at different times. U.S. Holders should consult their tax advisors as to the applicability of these special rules to their particular circumstances.