0000854775false00008547752024-01-312024-01-310000854775exch:XNAS2024-01-312024-01-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

________________________________________

FORM 8-K

________________________________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

January 31, 2024

Date of report (date of earliest event reported)

_________________________________________

Digi International Inc.

(Exact name of registrant as specified in its charter)

_________________________________________

| | | | | | | | | | | | | | |

| Delaware | | 1-34033 | | 41-1532464 |

| (State of Incorporation) | | (Commission file number) | | (I.R.S. Employer Identification No.) |

| |

| 9350 Excelsior Blvd. | | Suite 700 | | |

| Hopkins | | Minnesota | | 55343 |

| (Address of principal executive offices) | | (Zip Code) |

(952) 912-3444

(Registrant’s telephone number, including area code)

________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common Stock, par value $.01 per share | | DGII | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 2.02 | Results of Operations and Financial Condition. |

On January 31, 2024, Digi International Inc. (“Digi”) issued a press release regarding Digi’s financial results for its first fiscal quarter ended December 31, 2023. A copy of Digi’s press release is attached hereto as Exhibit 99.1.

The information contained in this Current Report shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

| | | | | | | | | | | | | | |

| | | | |

| No. | | Exhibit | | Manner of Filing |

| 99.1 | | | | | Furnished Electronically |

| 104 | | | The cover page from the Current Report on Form 8-K formatted in Inline XBRL | | Filed Electronically |

SIGNATURES

Pursuant to the requirements of the Securities and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned duly authorized.

Date: January 31, 2024

| | | | | | | | | | | |

| | | |

| DIGI INTERNATIONAL INC. |

| | |

| By: | | /s/ James J. Loch |

| | | James J. Loch |

| | | Senior Vice President, Chief Financial Officer and Treasurer |

| | |

| Digi International Reports First Fiscal Quarter 2024 Results |

| Revenue of $106M, Record End of Quarter ARR of $108M |

| ARR Surpasses Quarterly Revenue for First Time |

| Cash Flow From Operations was $19 Million |

(Minneapolis, MN, January 31, 2024) - Digi International® Inc. (Nasdaq: DGII), a leading global provider of business and mission critical Internet of Things ("IoT") products, services and solutions, today announced its financial results for its first fiscal quarter ended December 31, 2023.

First Fiscal Quarter 2024 Results Compared to First Fiscal Quarter 2023 Results

•Revenue was $106 million, a decrease of 3%.

•Gross profit margin was 57.6%, an increase of 130 basis points.

•Net loss per diluted share was $0.08, driven by the $0.26 impact of the term B debt issuance cost write off, compared to net income per diluted share of $0.16.

•Adjusted net income per diluted share was $0.48, flat year over year.

•Adjusted EBITDA was $23 million, flat year over year.

•Annualized Recurring Revenue (ARR) was $108 million at quarter end, an increase of 13%.

Reconciliations of GAAP and non-GAAP financial measures appear at the end of this release.

"Double digit ARR growth propelled Digi to reach a milestone of ARR exceeding quarterly revenue for the first time," said Ron Konezny, President and Chief Executive Officer. "Lowered inventory levels combined with a reduction in debt significantly improved our balance sheet. We are committed to achieving $200 million of ARR and $200 million of adjusted EBITDA within the next five years."

Additional Financial Highlights

•We retired the term loan existing under our prior credit facility in the first quarter of fiscal 2024, incurring a one-time expense of $10 million for the write-off of debt issuance costs. In addition, we made payments towards our new revolving credit facility, reducing our gross outstanding debt to $196 million at quarter end and debt net of cash and cash equivalents to $163 million.

•We had $5.7 million of interest expense in the first quarter of fiscal 2024, compared to $6.0 million a year ago. The decrease was driven by reduction of our effective interest rate and decreased debt outstanding.

•Cash flow from operations was $19 million in the first quarter of fiscal 2024, compared to $3 million a year ago, driven primarily by year over year changes in inventory.

•Net inventory ended the quarter at $68 million, compared to $74 million at September 30, 2023. This represents a $13 million reduction from the balance a year ago, reflecting continued efforts to manage inventory levels.

| | | | | | | | | | | | | | |

| | | | |

| Digi International Reports First Fiscal Quarter 2024 Results |

Segment Results

IoT Product & Services

The segment's first fiscal quarter 2024 revenue of $82 million decreased 3% from the same period in the prior fiscal year. This decrease was driven by decreases in sales volume in Console Server and Cellular products, partially offset by growth in OEM products. ARR as of the end of the first fiscal quarter was $23 million, an increase of 64% from the prior fiscal year. This increase primarily was due to growth in the subscription base for Console Server services, complemented by growth in other business lines. Gross profit margin decreased 110 basis points to 53.5% of revenue for the first fiscal quarter of 2024, driven primarily by decreased volume in Console Server, partially offset by increased volume and higher margin mix in OEM. Operating income was $10 million, a decrease of 18%, primarily due to the decrease in revenue.

IoT Solutions

The segment's first fiscal quarter 2024 revenue of $24 million decreased 4% from the same period in the prior fiscal year. This decrease was a result of decreased sales of Ventus offerings, partially offset by volume growth in SmartSense. ARR as of the end of the first fiscal quarter was $85 million, an increase of 4% from the prior fiscal year primarily driven by growth in SmartSense. Increased revenue and expanding margins in SmartSense drove a 950 basis points gross margin increase to 71.6% in the first fiscal quarter of 2024. Operating income was $1.8 million, compared to an operating loss of $0.7 million a year ago.

Capital Allocation Strategy

We intend to continue to deleverage the company while managing inventory appropriately as our supply chain continues to normalize. Our inventory position remains elevated, but we believe this investment will deliver working capital benefits for Digi in future quarters.

Acquisitions remain a top capital priority for Digi. We will be disciplined in our approach and act when we believe an opportunity is appropriate to execute in the context of prevailing market conditions. We are evolving and monitoring our acquisition pipeline, and we intend to focus more on scale and ARR.

Second Fiscal Quarter 2024 and Full-Year 2024 Guidance

Digi remains steadfast in achieving our new long term strategic goals of doubling ARR and Adjusted EBITDA to $200 million within the next five years. Digi’s resilient execution in a large and growing Industrial Internet of Things market has stayed consistent. Our outlook for fiscal 2024 remains unchanged, with our ARR and Adjusted EBITDA growing 5% and our revenue projects to be flat year over year.

For the second fiscal quarter, revenues are estimated to be $105 million to $109 million. Adjusted EBITDA is estimated to be between $22.5 million and $24.5 million. Adjusted net income per share is anticipated to be between $0.45 and $0.49 per diluted share, assuming a weighted average diluted share count of 37.7 million shares.

We provide guidance or longer-term targets for Adjusted net income per share as well as Adjusted EBITDA targets on a non-GAAP basis. We do not reconcile these items to their most similar U.S. GAAP measure as it is difficult to predict without unreasonable efforts numerous items that include but are not limited to the impact of foreign exchange translation, restructuring, interest and certain tax related events. Given the uncertainty, any of these items could have a significant impact on U.S. GAAP results.

First Fiscal Quarter 2024 Conference Call Details

As announced on January 19, 2024, Digi will discuss its first fiscal quarter results on a conference call on Thursday, February 1, 2024 at 10:00 a.m. ET (9:00 a.m. CT). The call will be hosted by Ron Konezny, President and Chief Executive Officer and Jamie Loch, Chief Financial Officer.

Participants may register for the conference call at: https://register.vevent.com/register/BI5fa5a3d6e5ca4856948123f5f6ddf85e. Once registration is completed, participants will be provided a dial-in number and passcode to access the call. All participants are asked to dial-in 15 minutes prior to the start time.

Participants may access a live webcast of the conference call through the investor relations section of Digi’s website, https://digi.gcs-web.com/ or the hosting website at: https://edge.media-server.com/mmc/p/tn9spd4c/.

A replay will be available within approximately two hours after the completion of the call for approximately one year. You may access the replay via webcast through the investor relations section of Digi’s website.

A copy of this earnings release can be accessed through the financial releases page of the investor relations section of Digi's website at www.digi.com.

For more news and information on us, please visit www.digi.com/aboutus/investorrelations.

| | | | | | | | | | | | | | |

| | | | |

| Digi International Reports First Fiscal Quarter 2024 Results |

About Digi International

Digi International (Nasdaq: DGII) is a leading global provider of IoT connectivity products, services and solutions. We help our customers create next-generation connected products and deploy and manage critical communications infrastructures in demanding environments with high levels of security and reliability. Founded in 1985, we’ve helped our customers connect over 100 million things and growing. For more information, visit Digi's website at www.digi.com.

| | | | | | | | | | | | | | |

| | | | |

| Digi International Reports First Fiscal Quarter 2024 Results |

Forward-Looking Statements

This press release contains forward-looking statements that are based on management’s current expectations and assumptions. These statements often can be identified by the use of forward-looking terminology such as "anticipate," "assume," "believe," "continue," "estimate," "expect," "intend," "may," "plan," "potential," "project," "should," "target," or "will" or the negative thereof or other variations thereon or similar terminology. Among other items, these statements relate to expectations of the business environment in which Digi operates, projections of future performance, inventory levels, perceived marketplace opportunities, interest expense and statements regarding our mission and vision. Such statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions. Among others, these include risks related to ongoing and varying inflationary and deflationary pressures around the world and the monetary policies of governments globally as well as present concerns about a potential recession, the ability of companies like us to operate a global business in such conditions as well as negative effects on product demand and the financial solvency of customers and suppliers in such conditions, risks related to ongoing supply chain challenges that continue to impact businesses globally, risks related to cybersecurity, risks arising from the present wars in Ukraine and the Middle East, the highly competitive market in which our company operates, rapid changes in technologies that may displace products sold by us, declining prices of networking products, our reliance on distributors and other third parties to sell our products, the potential for significant purchase orders to be canceled or changed, delays in product development efforts, uncertainty in user acceptance of our products, the ability to integrate our products and services with those of other parties in a commercially accepted manner, potential liabilities that can arise if any of our products have design or manufacturing defects, our ability to integrate and realize the expected benefits of acquisitions, our ability to defend or settle satisfactorily any litigation, the impact of natural disasters and other events beyond our control that could negatively impact our supply chain and customers, potential unintended consequences associated with restructuring, reorganizations or other similar business initiatives that may impact our ability to retain important employees or otherwise impact our operations in unintended and adverse ways, and changes in our level of revenue or profitability which can fluctuate for many reasons beyond our control. These and other risks, uncertainties and assumptions identified from time to time in our filings with the United States Securities and Exchange Commission, including without limitation, those set forth in Item 1A, Risk Factors, of our Annual Report on Form 10-K for the year ended September 30, 2023, subsequent filings on Form 10-Q and other filings, could cause our actual results to differ materially from those expressed in any forward-looking statements made by us or on our behalf. Many of such factors are beyond our ability to control or predict. These forward-looking statements speak only as of the date for which they are made. We disclaim any intent or obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

| | | | | | | | | | | | | | |

| | | | |

| Digi International Reports First Fiscal Quarter 2024 Results |

Presentation of Non-GAAP Financial Measures

This release includes adjusted net income, adjusted net income per diluted share and Adjusted EBITDA, each of which is a non-GAAP measure.

We understand that there are material limitations on the use of non-GAAP measures. Non-GAAP measures are not substitutes for GAAP measures, such as net income, for the purpose of analyzing financial performance. The disclosure of these measures does not reflect all charges and gains that were actually recognized by Digi. These non-GAAP measures are not in accordance with, or an alternative for measures prepared in accordance with, generally accepted accounting principles and may be different from non-GAAP measures used by other companies or presented by us in prior reports. In addition, these non-GAAP measures are not based on any comprehensive set of accounting rules or principles. We believe that non-GAAP measures have limitations in that they do not reflect all of the amounts associated with our results of operations as determined in accordance with GAAP. We believe these measures should only be used to evaluate our results of operations in conjunction with the corresponding GAAP measures. Additionally, Adjusted EBITDA does not reflect our cash expenditures, the cash requirements for the replacement of depreciated and amortized assets, or changes in or cash requirements for our working capital needs.

We believe that providing historical and adjusted net income and adjusted net income per diluted share, respectively, exclusive of such items as reversals of tax reserves, discrete tax benefits, restructuring charges and reversals, intangible amortization, stock-based compensation, other non-operating income/expense, changes in fair value of contingent consideration, acquisition-related expenses and interest expense related to acquisitions permits investors to compare results with prior periods that did not include these items. Management uses the aforementioned non-GAAP measures to monitor and evaluate ongoing operating results and trends and to gain an understanding of our comparative operating performance. In addition, certain of our stockholders have expressed an interest in seeing financial performance measures exclusive of the impact of these matters, which while important, are not central to the core operations of our business. Management believes that Adjusted EBITDA, defined as EBITDA adjusted for stock-based compensation expense, acquisition-related expenses, restructuring charges and reversals, and changes in fair value of contingent consideration is useful to investors to evaluate our core operating results and financial performance because it excludes items that are significant non-cash or non-recurring items reflected in the Condensed Consolidated Statements of Operations. We believe that the presentation of Adjusted EBITDA as a percentage of revenue is useful because it provides a reliable and consistent approach to measuring our performance from year to year and in assessing our performance against that of other companies. We believe this information helps compare operating results and corporate performance exclusive of the impact of our capital structure and the method by which assets were acquired.

| | | | | | | | | | | | | | |

| | | | |

| Digi International Reports First Fiscal Quarter 2024 Results |

Investor Contact:

| | | | | | | | |

| Rob Bennett | | |

| Investor Relations | | |

| Digi International | | |

| 952-912-3524 | | |

| Email: rob.bennett@digi.com | | |

| | |

| | | | | | | | | | | | | | |

| | | | |

| Digi International Reports First Fiscal Quarter 2024 Results |

Digi International Inc.

Condensed Consolidated Statements of Operations

(In thousands, except per share amounts)

(Unaudited)

| | | | | | | | | | | | | | | |

| | Three months ended December 31, | | |

| | 2023 | | 2022 | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Revenue | $ | 106,089 | | | $ | 109,306 | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Cost of sales | 44,989 | | | 47,785 | | | | | |

| Gross profit | 61,100 | | | 61,521 | | | | | |

| Operating expenses: | | | | | | | |

| Sales and marketing | 19,647 | | | 19,106 | | | | | |

| Research and development | 14,633 | | | 14,094 | | | | | |

| General and administrative | 14,687 | | | 16,358 | | | | | |

| | | | | | | |

| Operating expenses | 48,967 | | | 49,558 | | | | | |

| Operating income | 12,133 | | | 11,963 | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Other expense, net | (15,409) | | | (5,954) | | | | | |

| (Loss) income before income taxes | (3,276) | | | 6,009 | | | | | |

| Income tax (benefit) provision | (222) | | | 230 | | | | | |

| | | | | | | |

| | | | | | | |

| Net (loss) income | $ | (3,054) | | | $ | 5,779 | | | | | |

| | | | | | | |

| Net (loss) income per common share: | | | | | | | |

| | | | | | | |

| | | | | | | |

| Basic | $ | (0.08) | | | $ | 0.16 | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Diluted | $ | (0.08) | | | $ | 0.16 | | | | | |

| Weighted average common shares: | | | | | | | |

| Basic | 36,129 | | | 35,608 | | | | | |

| Diluted | 36,129 | | | 36,859 | | | | | |

| | | | | | | | | | | | | | |

| | | | |

| Digi International Reports First Fiscal Quarter 2024 Results |

Digi International Inc.

Condensed Consolidated Balance Sheets

(In thousands)

(Unaudited)

| | | | | | | | | | | |

| December 31,

2023 | | September 30,

2023 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 31,548 | | | $ | 31,693 | |

| | | |

| Accounts receivable, net | 61,441 | | | 55,997 | |

| Inventories | 67,590 | | | 74,396 | |

| | | |

| | | |

| Other current assets | 4,799 | | | 4,112 | |

| | | |

| Total current assets | 165,378 | | | 166,198 | |

| Non-current assets | 663,284 | | | 669,333 | |

| Total assets | $ | 828,662 | | | $ | 835,531 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current liabilities: | | | |

| Current portion of long-term debt | $ | — | | | $ | 15,523 | |

| Accounts payable | 16,679 | | | 17,148 | |

| Other current liabilities | 53,766 | | | 53,307 | |

| Total current liabilities | 70,445 | | | 85,978 | |

| Long-term debt | 194,684 | | | 188,051 | |

| Other non-current liabilities | 21,458 | | | 21,014 | |

| Non-current liabilities | 216,142 | | | 209,065 | |

| Total liabilities | 286,587 | | | 295,043 | |

| Total stockholders’ equity | 542,075 | | | 540,488 | |

| Total liabilities and stockholders’ equity | $ | 828,662 | | | $ | 835,531 | |

Digi International Inc.

Condensed Consolidated Statements of Cash Flows

(In thousands)

(Unaudited)

| | | | | | | | | | | |

| | Three months ended December 31, |

| | 2023 | | 2022 |

| Net cash provided by operating activities | $ | 18,672 | | | $ | 2,680 | |

| Net cash used in investing activities | (292) | | | (963) | |

| Net cash used in financing activities | (20,376) | | | (5,896) | |

| Effect of exchange rate changes on cash and cash equivalents | 1,851 | | | 228 | |

| Net decrease in cash and cash equivalents | (145) | | | (3,951) | |

| Cash and cash equivalents, beginning of period | 31,693 | | | 34,900 | |

| Cash and cash equivalents, end of period | $ | 31,548 | | | $ | 30,949 | |

| | | | | | | | | | | | | | |

| | | | |

| Digi International Reports First Fiscal Quarter 2024 Results |

Non-GAAP Financial Measures

TABLE 1

Reconciliation of Net (Loss) Income to Adjusted EBITDA

(In thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended December 31, | | |

| 2023 | | 2022 | | | | |

| | | % of total

revenue | | | | % of total

revenue | | | | | | | | |

| Total revenue | $ | 106,089 | | | 100.0 | % | | $ | 109,306 | | | 100.0 | % | | | | | | | | |

| | | | | | | | | | | | | | | |

| Net (loss) income | $ | (3,054) | | | | | $ | 5,779 | | | | | | | | | | | |

| Interest expense, net | 5,661 | | | | | 5,971 | | | | | | | | | | | |

| Debt issuance cost write off | 9,722 | | | | | — | | | | | | | | | | | |

| Income tax (benefit) provision | (222) | | | | | 230 | | | | | | | | | | | |

| Depreciation and amortization | 8,051 | | | | | 8,112 | | | | | | | | | | | |

| Stock-based compensation expense | 3,106 | | | | | 2,868 | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Restructuring charge | 103 | | | | | 23 | | | | | | | | | | | |

| Acquisition expense | (61) | | | | | 381 | | | | | | | | | | | |

| Adjusted EBITDA | $ | 23,306 | | | 22.0 | % | | $ | 23,364 | | | 21.4 | % | | | | | | | | |

TABLE 2

Reconciliation of Net Income and Net Income per Diluted Share to

Adjusted Net Income and Adjusted Net Income per Diluted Share

(In thousands, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended December 31, | | |

| 2023 | | 2022 | | | | |

| Net (loss) income and net (loss) income per diluted share | $ | (3,054) | | | $ | (0.08) | | | $ | 5,779 | | | $ | 0.16 | | | | | | | | | |

| Amortization | 6,238 | | | 0.17 | | | 6,463 | | | 0.18 | | | | | | | | | |

| Stock-based compensation expense | 3,106 | | | 0.08 | | | 2,868 | | | 0.08 | | | | | | | | | |

| Other non-operating expense (income) | 26 | | | — | | | (17) | | | — | | | | | | | | | |

| Acquisition expense | (61) | | | — | | | 381 | | | 0.01 | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Restructuring charge | 103 | | | — | | | 23 | | | — | | | | | | | | | |

| Interest expense, net | 5,661 | | | 0.15 | | | 5,971 | | | 0.16 | | | | | | | | | |

| Debt issuance cost write off | 9,722 | | | 0.26 | | | — | | | — | | | | | | | | | |

Tax effect from the above adjustments (1) | (3,913) | | | (0.11) | | | (4,869) | | | (0.14) | | | | | | | | | |

Discrete tax (benefits) expenses (2) | (182) | | | — | | | 1,192 | | | 0.03 | | | | | | | | | |

Adjusted net income and adjusted net income per diluted share (3) | $ | 17,646 | | | $ | 0.48 | | | $ | 17,791 | | | $ | 0.48 | | | | | | | | | |

| Diluted weighted average common shares | | | 36,715 | | | | 36,859 | | | | | | | | |

(1)The tax effect from the above adjustments assumes an estimated effective tax rate of 18.0% for fiscal 2024 and 2023 based on adjusted net income.

(2)For the three and twelve months ended December 31, 2023 and 2022 discrete tax (benefits) expenses primarily are a result of changes in excess tax benefits recognized on stock compensation.

(3)Adjusted net income per diluted share may not add due to the use of rounded numbers.

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

dei_EntityListingsExchangeAxis=exch_XNAS |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

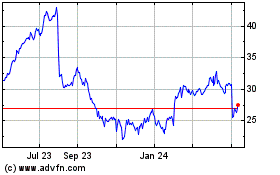

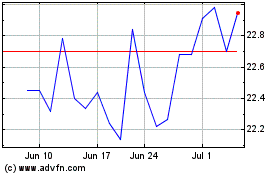

Digi (NASDAQ:DGII)

Historical Stock Chart

From Apr 2024 to May 2024

Digi (NASDAQ:DGII)

Historical Stock Chart

From May 2023 to May 2024