SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D/A

Under the Securities Exchange Act of 1934

(Amendment No. 1)*

comScore, Inc.

(Name of Issuer)

Common Stock, par value $0.001 per share

(Title of Class of Securities)

20564W105

(CUSIP Number)

Renee L. Wilm, Esq.

Chief Legal Officer

Liberty Broadband Corporation

12300 Liberty Boulevard

Englewood, Colorado 80112

(720) 875-5700

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

July 24, 2024

(Date of Event Which Requires

Filing of this Statement)

If the filing person has previously

filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because

of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box ¨

* The remainder of this cover

page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities,

and for any subsequent amendment containing information which would alter the disclosures provided in a prior cover page.

The information required in

the remainder of this cover page shall not be deemed to be “filed” for the purpose of section 18 of the Securities Exchange

Act of 1934 (“Act”), or otherwise subject to the liabilities of that section of the Act but shall be subject to all other

provisions of the Act (however, see the Notes).

| 1. |

Names

of Reporting Persons.

Liberty

Broadband Corporation |

| |

|

| 2. |

Check the Appropriate

Box if a Member of a Group (See Instructions) |

| |

|

| |

(a) |

o |

| |

|

|

| |

(b) |

x (1) |

| |

|

| 3. |

SEC

Use Only |

| |

|

| 4. |

Source

of Funds (See Instructions)

WC, OO |

| |

|

| 5. |

Check

if Disclosure of Legal Proceedings Is Required Pursuant to Item 2(d) or 2(e) o |

| |

|

| 6. |

Citizenship

or Place of Organization

Delaware |

| |

|

Number

of

Shares

Beneficially

Owned by

Each

Reporting

Person With: |

7. |

Sole

Voting Power

Common Stock: 1,603,578 (2)

(3) |

| |

|

| 8. |

Shared

Voting Power

Common

Stock: 0 |

| |

|

| 9. |

Sole

Dispositive Power

Common

Stock: 1,603,578 (2) (3) |

| |

|

| 10. |

Shared

Dispositive Power

Common

Stock: 0 |

| |

|

| 11. |

Aggregate

Amount Beneficially Owned by Each Reporting Person

Common

Stock: 1,603,578 (2) (3) |

| |

|

| 12. |

Check if the

Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) x

(4) |

| |

|

| |

|

| 13. |

Percent

of Class Represented by Amount in Row (11)

Common

Stock: 24.9% (5) |

| |

|

| 14. |

Type

of Reporting Person (See Instructions)

CO |

| (1) | On

May 16, 2023, in connection with the purchase by Liberty Broadband Corporation (the “Reporting

Person”) of 27,509,203 shares of comScore, Inc.'s (the “Issuer”)

Series B Convertible Preferred Stock, par value $0.001 per share (the “Series B

Preferred Stock”), from Qurate Retail, Inc. (“Qurate”) (the

“Transaction”), Qurate assigned its rights and obligations under the Stockholders

Agreement, dated as of March 10, 2021 (the “SHA”), by and among the Issuer,

Qurate, Charter Communications Holding Company, LLC (“Charter”) and Pine

Investor, LLC (“Pine” and, together with the Reporting Person and Charter,

referred to herein collectively as the “Purchasers”) to the Reporting

Person. The SHA contains provisions relating to the transfer, ownership and voting of the

Issuer’s securities by the Reporting Person. The Reporting Person expressly disclaims

the existence of any membership in a group with the Issuer or the other Purchasers. The SHA

was amended and restated on July 24, 2024. See Item 6 of the Schedule 13D/A. |

| (2) | Subject to certain restrictions

contained in the SHA. See Item 6 of the Schedule 13D/A. |

| (3) | Includes

31,928,301 shares of Series B Preferred Stock convertible, at any time at the option of the

holder, into 1,603,578 shares of the Issuer’s common stock, par value $0.001 per share

(the “Common Stock”). Subject to certain anti-dilution adjustments and

customary provisions related to partial dividend periods, the Series B Preferred Stock is

convertible at the option of the holders at any time into a number of shares of Common Stock

equal to the Conversion Rate (as defined in the Certificate of Designations for the Series

B Preferred Stock), which was originally one-to-one, but was approximately 0.050 as of July

24, 2024. The Conversion Rate will continue to adjust to the extent there are additional

accrued but unpaid dividends. |

| (4) | Excludes

shares beneficially owned by the executive officers and directors of the Reporting Person.

See Item 5 of the Schedule 13D/A. |

| (5) | Calculated

based on (i) the 4,833,820 shares of Common Stock outstanding as of May 6, 2024, as reported

in the Issuer’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2024,

filed with the Securities and Exchange Commission on May 10, 2024, and (ii) the 1,603,578

shares of Common Stock currently underlying the Series B Preferred Stock, pursuant to Rule

13d-3 of the Securities Exchange Act of 1934. |

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 13D/A

(Amendment No. 1)

Statement of

LIBERTY BROADBAND CORPORATION

Pursuant to Section 13(d) of

the Securities Exchange Act of 1934

in respect of

COMSCORE, INC.

Item 1. Security and Issuer.

Liberty Broadband

Corporation, a Delaware corporation (the “Reporting Person”), is filing this Statement on Schedule 13D/A with respect

to shares of the common stock, par value $0.001 per share (the “Common Stock”), of comScore, Inc., a Delaware corporation

(the “Issuer”). The statement on Schedule 13D originally filed with the Securities and Exchange Commission (“SEC”)

by the Reporting Person on May 23, 2023 is hereby amended and supplemented to include the information set forth herein. This amended

statement on Schedule 13D/A constitutes Amendment No. 1 to the Schedule 13D (this “Amendment” and, together with the

Schedule 13D, this “Statement”). Capitalized terms used but not defined herein have the meanings given to such terms

in the Schedule 13D. Except as set forth herein, the Schedule 13D is unmodified.

Item 2. Identity and Background.

(a) – (c)

The principal

business address of the Reporting Person is 12300 Liberty Boulevard, Englewood, Colorado 80112. The Reporting Person is a Delaware corporation

and is primarily comprised of GCI Holdings, LLC, a wholly owned subsidiary, and an investment in Charter Communications, Inc.

(d)

– (f)

Schedule 1 attached

to this Statement and incorporated herein by reference, provides the required information with respect to each executive officer and

director, as applicable, of the Reporting Person (the “Schedule 1 Persons”). Each of such executive officers and directors

is a citizen of the United States.

During the last

five years, neither the Reporting Person nor any of the Schedule 1 Persons (to the knowledge of the Reporting Person) has been convicted

in a criminal proceeding (excluding traffic violations or similar misdemeanors) or been a party to a civil proceeding of a judicial or

administrative body of competent jurisdiction resulting in a judgment, decree or final order enjoining future violations of, or prohibiting

or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws.

Item 3. Source and Amount of Funds.

The information contained in Item 4 of this Statement is

incorporated by reference herein.

Item 4. Purpose of Transaction

The information

contained in Item 4 of the Schedule 13D is hereby amended to delete the last paragraph thereof and supplemented to include the following

information:

On July 24, 2024,

the Issuer issued 4,419,098 additional shares of Series B Convertible Preferred Stock, par value $0.001 (the “Series B Preferred

Stock”) to the Reporting Person in exchange for cancellation of the Company’s obligation to pay accrued dividends totaling

approximately $10.9 million to the Reporting Person for annual dividend periods ended in 2023 and 2024. As of the issuance date, the

additional shares of Series B Preferred Stock were convertible into 220,954 shares of Common Stock. The additional shares of Series B

Preferred Stock have the same terms and conditions as the Series B Preferred Stock previously held by the Reporting Person.

In connection

with the issuance, the Issuer and the holders of Series B Preferred Stock entered into an amendment to the SHA between the parties (the

“Amended and Restated SHA”). Among other things, the Amended and Restated SHA (i) reduced the $100.0 million special

dividend threshold set forth in the SHA by an amount equal to the liquidation preference of the additional Series B Preferred Stock (approximately

$32.8 million) and (ii) clarified that the provisions of the SHA relevant to the Series B Preferred Stock also apply to the newly issued

shares of Series B Preferred Stock.

The foregoing

summary of the Amended and Restated SHA does not purport to be complete and is subject to, and is qualified in its entirety by, the full

text of the Amended and Restated SHA, which is attached as Exhibit 7(a) hereto and is incorporated herein by reference.

The shares of

Common Stock beneficially owned by the Reporting Person and described in this Statement are being held by the Reporting Person for investment

purposes.

Other than as

set forth in this Amendment, the Reporting Person does not have any present plans or proposals which relate to or would result in: (i) any

acquisition by any person of additional securities of the Issuer, or any disposition of securities of the Issuer; (ii) any extraordinary

corporate transaction, such as a merger, reorganization or liquidation, involving the Issuer or any of its subsidiaries; (iii) any

sale or transfer of a material amount of assets of the Issuer or any of its subsidiaries; (iv) any change in the board or management

of the Issuer, including any plans or proposals to change the number or term of directors or to fill any vacancies on the board; (v) any

material change in the present capitalization or dividend policy of the Issuer; (vi) any other material change in the Issuer’s

business or corporate structure; (vii) any change in the Issuer’s charter or bylaws or other actions which may impede the

acquisition of control of the Issuer by any person; (viii) any delisting from a national securities exchange or any loss of authorization

for quotation in an inter-dealer quotation system of a registered national securities association of a class of securities of the Issuer;

(ix) any termination of registration pursuant to Section 12(g)(4) of the Securities Exchange Act of 1934, as amended (the

“Exchange Act”), of a class of equity securities of the Issuer; or (x) any action similar to any of those enumerated

above.

Notwithstanding

the foregoing, the Reporting Person may determine to change his intentions with respect to the Issuer at any time in the future and may,

for example, elect (i) to acquire additional securities of the Issuer in open market or privately negotiated transactions or (ii) to

dispose of all or a portion of the Reporting Person’s holdings of securities of the Issuer. In reaching any determination as to

his future course of action, the Reporting Person will take into consideration various factors, such as the Issuer’s business and

prospects, other developments concerning the Issuer, other business opportunities available to the Reporting Person, tax and estate planning

considerations, liquidity needs and general economic and stock market conditions, including, but not limited to, the market prices of

the securities.

Item 5. Interest in Securities of

the Issuer.

| (a) | The

Reporting Person is the beneficial owner of 1,603,578 shares of Common Stock as a result

of its ownership of 31,928,301 shares of Series B Preferred Stock that are convertible, at

any time at the option of the holder, into the underlying shares of Common Stock. The 1,603,578

shares of Common Stock constitute approximately 24.9% of the outstanding shares of Common

Stock, calculated based on (i) the 4,833,820 shares of Common Stock outstanding as of May

6, 2024, as reported in the Issuer’s Quarterly Report on Form 10-Q for the quarter

ended March 31, 2024, filed with the Securities and Exchange Commission on May 10, 2024,

and (ii) the 1,603,578 shares of Common Stock underlying the Series B Preferred Stock held

by the Reporting Person, pursuant to Rule 13d-3 of the Exchange Act. As of the date hereof,

Mr. Brian J. Wendling (“Mr. Wendling”), Chief Accounting Officer and Principal

Financial Officer of the Reporting Person and a director of the Issuer, beneficially owns

(i) 17,268 shares of Common Stock subject to vested, deferred stock units that are scheduled

to be settled on the earlier of Mr. Wendling’s separation from service or a change

in control of the Issuer, of which 8,415 vested on June 12, 2024, and (ii) 4,500 shares of

Common Stock held directly. |

| (b) | The

Reporting Person has the sole power to vote or to direct the voting of and the sole power

to dispose or direct the disposition of the 1,603,578 shares of Common Stock beneficially

owned by it, subject to the restrictions described in Item 6 of this Statement. |

| (c) | Other

than as disclosed in this Statement, no transactions were effected by the Reporting Person,

or, to the knowledge of the Reporting Person, any Schedule 1 Person, with respect to the

Common Stock during the 60 days preceding the date hereof. |

Item 6. Contracts, Arrangements,

Understandings or Relationships With Respect to Securities of the Issues.

The information set forth in Item 4 is incorporated herein

by reference.

Item 7. Material to Be Filed

as Exhibits.

7(a) Amended

and Restated Stockholders Agreement, dated as of July 24, 2024, by and among comScore, Inc., Charter Communications Holding Company,

LLC, Liberty Broadband Corporation and Pine Investor, LLC (incorporated by reference to Exhibit 10.4 to comScore, Inc.’s Current

Report on Form 8-K (File No. 001-33520), filed with the Securities and Exchange Commission on July 25, 2024).

SIGNATURE

After reasonable inquiry

and to the best of my knowledge and belief, I certify that the information set forth in this Statement is true, complete and correct.

| Dated: July 26, 2024 |

LIBERTY BROADBAND CORPORATION |

| |

|

| |

By: |

/s/ Craig Troyer |

| |

|

Name: |

Craig Troyer |

| |

|

Title: |

Senior Vice President and Assistant Secretary |

[Signature Page to Liberty

Broadband. Amendment No. 1 to Schedule 13D with respect to comScore, Inc.]

SCHEDULE 1

DIRECTORS AND EXECUTIVE OFFICERS

OF

LIBERTY BROADBAND CORPORATION

The name and present principal

occupation of each director and executive officer of Liberty Broadband Corporation is set forth below. The business address for each

person listed below is c/o Liberty Broadband Corporation, 12300 Liberty Boulevard, Englewood, Colorado 80112. All executive officers

and directors listed are United States citizens.

Name

and

Business

Address

(if applicable) |

|

Principal

Occupation and Principal Business

(if applicable) |

| |

|

|

| John

C. Malone |

|

Chairman

of the Board of Liberty Broadband Corporation |

| |

|

|

Gregory B. Maffei |

|

President,

Chief Executive Officer and Director of Liberty Broadband Corporation |

| |

|

|

| Gregg

L. Engles |

|

Director

of Liberty Broadband Corporation |

| |

|

|

| Julie

D. Frist |

|

Director

of Liberty Broadband Corporation |

| |

|

|

| Richard

R. Green |

|

Director

of Liberty Broadband Corporation |

| |

|

|

Sue Ann R. Hamilton |

|

Director

of Liberty Broadband Corporation |

| |

|

|

| J. David

Wargo |

|

Director

of Liberty Broadband Corporation |

| |

|

|

| John

E. Welsh III |

|

Director

of Liberty Broadband Corporation |

| |

|

|

| Brian

J. Wendling |

|

Chief

Accounting Officer and Principal Financial Officer of Liberty Broadband Corporation |

| |

|

|

| Renee

L. Wilm |

|

Chief

Legal Officer and Chief Administrative Officer of Liberty Broadband Corporation |

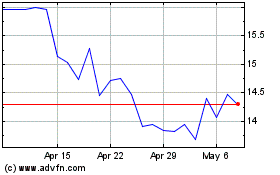

comScore (NASDAQ:SCOR)

Historical Stock Chart

From Dec 2024 to Jan 2025

comScore (NASDAQ:SCOR)

Historical Stock Chart

From Jan 2024 to Jan 2025