false

0001169445

0001169445

2024-02-29

2024-02-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): February 29, 2024

COMPUTER PROGRAMS AND SYSTEMS, INC.

(Exact Name of Registrant as Specified in Charter)

|

Delaware

|

000-49796

|

74-3032373

|

|

(State of Incorporation)

|

(Commission File Number)

|

(IRS Employer

Identification No.)

|

54 St. Emanuel Street, Mobile, Alabama 36602

(Address of Principal Executive Offices, including Zip Code)

(251) 639-8100

(Registrant’s telephone number, including area code)

N/A

(Former Name or Former Address, if Changed Since Last Report)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, par value $.001 per share

|

CPSI

|

The NASDAQ Stock Market LLC

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On February 29, 2024, Computer Programs and Systems, Inc. (the “Company”) entered into a Fourth Amendment (the “Fourth Amendment”) to the Amended and Restated Credit Agreement, dated as of June 16, 2020 (as amended, the “Credit Agreement”), by and among the Company; certain subsidiaries of the Company, as guarantors (collectively, the “Subsidiary Guarantors”); Regions Bank, as administrative agent and collateral agent (the “Administrative Agent”); and various other lenders. Capitalized terms used but not defined herein shall have the meanings ascribed to them in the Credit Agreement.

The Fourth Amendment modified the term “Consolidated EBITDA” to provide that the additional following amounts will be added back to Consolidated Net Income: (i) costs and expenses related to the voluntary early retirement program during the fiscal year ending December 31, 2023; and (ii) fees, costs and expenses in categories identified to the Administrative Agent to the extent incurred during the fiscal year ending December 31, 2024, in an aggregate amount not to exceed $7,250,000. Additionally, the modified definition of “Consolidated EBITDA” limits the amount of pro forma “run rate” cost savings, operating expense reductions and synergies (collectively, “Savings”) related to the Viewgol Acquisition that can be added back to Consolidated Net Income to an aggregate amount not to exceed $6,600,000; however, Savings related to the Viewgol Acquisition are not subject to the cap of 15% of Consolidated EBITDA that otherwise applies to Savings related to Permitted Acquisitions, restructurings or cost savings initiatives.

Finally, the Consolidated Fixed Charge Coverage Ratio covenant was decreased from 1.25:1.00 to 1.15:1.00 for each fiscal quarter ending March 31, 2024 through and including December 31, 2024. As of December 31, 2023, the Company was not in compliance with the Consolidated Fixed Charge Coverage Ratio required by the Credit Agreement, and the Fourth Amendment provides for a one-time waiver of this failure as an event of default.

The Company’s obligations under the Credit Agreement continue to be secured pursuant to the Amended and Restated Pledge and Security Agreement, dated as of June 16, 2020, by and among the parties identified as Obligors therein and Regions Bank, as collateral agent, on a first priority basis by a security interest in substantially all of the tangible and intangible personal assets (subject to certain exceptions) of the Company and the Subsidiary Guarantors, including certain registered intellectual property and the capital stock of certain of the Company’s direct and indirect subsidiaries. The Company’s obligations under the Credit Agreement also continue to be guaranteed by the Subsidiary Guarantors.

The foregoing description of the Fourth Amendment does not purport to be complete and is qualified in its entirety by reference to the full text of the Fourth Amendment, a copy of which is filed herewith as Exhibit 10.1 and incorporated herein by reference. A copy of the Fourth Amendment has been included as an exhibit to provide investors with information regarding its terms. It is not intended to provide any other factual information about the Company or any of its subsidiaries or affiliates. The representations, warranties and covenants contained in the Fourth Amendment were made only for purposes of such agreement and as of the specific date of such agreement; were made solely for the benefit of the parties to such agreement; may be subject to limitations agreed upon by the contracting parties, including being qualified by information in confidential disclosures; may not have been intended to be statements of fact, but rather, as a method of allocating contractual risk and governing the contractual rights and relationships between the parties to such agreement; and may be subject to standards of materiality applicable to contracting parties that differ from those applicable to investors. Investors should not rely on the representations, warranties and covenants or any descriptions thereof as characterizations of the actual state of facts or condition of the Company or any of its subsidiaries or affiliates. Moreover, information concerning the subject matter of the representations, warranties and covenants may change after the date of the Fourth Amendment, which subsequent information may or may not be fully reflected in the Company’s public disclosures.

Item 2.02 Results of Operations and Financial Condition.

On February 29, 2024, CPSI issued a press release announcing financial information for its fiscal fourth quarter and full year ended December 31, 2023. The press release is attached as Exhibit 99.1 to this Form 8-K and is furnished to, but not filed with, the Commission.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

The following exhibits are filed herewith:

|

Exhibit Number

|

Description

|

|

10.1

|

Fourth Amendment, dated as of February 29, 2024, to the Amended and Restated Credit Agreement, dated as of June 16, 2020, by and among Computer Programs and Systems, Inc., certain of its subsidiaries, as guarantors, certain lenders named therein, and Regions Bank, as administrative agent and collateral agent.

|

|

99.1

|

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

COMPUTER PROGRAMS AND SYSTEMS, INC. |

| |

|

| |

|

| Date: February 29, 2024 |

By: |

/s/ Christopher L. Fowler |

|

| |

Christopher L. Fowler

President and Chief Executive Officer

|

Exhibit 10.1

FOURTH AMENDMENT TO CREDIT AGREEMENT

THIS FOURTH AMENDMENT TO CREDIT AGREEMENT (this “Amendment”) dated as of February 29, 2024 (the “Fourth Amendment Effective Date”) to the Credit Agreement referenced below is by and among COMPUTER PROGRAMS AND SYSTEMS, INC., a Delaware corporation (the “Borrower”), the Guarantors identified on the signature pages hereto, the Lenders identified on the signature pages hereto (the “Lenders”), and REGIONS BANK, as Administrative Agent (the “Administrative Agent”).

W I T N E S S E T H :

WHEREAS, credit facilities have been extended to the Borrower pursuant to the Amended and Restated Credit Agreement, dated as of June 16, 2020 (as amended, restated, extended, supplemented or otherwise modified in writing from time to time, the “Credit Agreement”), among the Borrower, the Guarantors identified therein, the Lenders identified therein, and Regions Bank, as Administrative Agent and Collateral Agent;

WHEREAS, the Borrower has requested certain modifications to the Credit Agreement; and

WHEREAS, the Required Lenders have agreed to such modifications to the Credit Agreement on the terms and conditions set forth herein;

NOW, THEREFORE, in consideration of the premises and the mutual covenants contained herein and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

1. Defined Terms. Capitalized terms used herein but not otherwise defined herein shall have the meanings provided to such terms in the Credit Agreement.

2. Amendments to Credit Agreement.

2.1 The definition of Consolidated EBITDA in Section 1.1 of the Credit Agreement is amended and restated in its entirety to read as follows:

“Consolidated EBITDA” means, for any period, for the Borrower and its Subsidiaries on a consolidated basis, an amount equal to Consolidated Net Income for such period plus the following to the extent deducted in calculating such Consolidated Net Income: (a) Consolidated Interest Charges for such period, (b) the provision for federal, state, local and foreign income taxes payable by the Borrower and its Subsidiaries for such period, (c) depreciation and amortization expense for such period, (d) non-cash compensation expense and other non-cash expenses or charges arising from the granting of stock options, stock appreciation rights or similar arrangements, (e) other non-cash charges and losses (excluding any such non-cash charges or losses to the extent (i) there were cash charges with respect to such charges and losses in past accounting periods, (ii) there is a reasonable expectation that there will be cash charges with respect to such charges and losses in future accounting periods or (iii) such charges or losses relate to the write-down of current assets), (f) any fees and related out-of-pocket expenses incurred as a result of the closing of the First Amendment to this Agreement in an aggregate amount not to exceed $1,000,000 provided that such fees and expenses are incurred no later than 60 days after the First Amendment Effective Date, (g) any expenses with respect to liability or casualty events or business interruption to the extent reimbursed or advanced to the Borrower or any Subsidiary during such period by third party insurance, (h) for any period of four fiscal quarters ending on or after the Closing Date, fees and out-of-pocket expenses incurred in such period in connection with any Permitted Acquisition in an amount not to exceed 10% of the aggregate consideration of such Permitted Acquisition including, for the avoidance of doubt, the reasonably expected value of all earn-out consideration; provided, that the aggregate amount of fees and out-of-pocket expenses added back pursuant to this clause (h) for all anticipated Permitted Acquisitions which are not consummated in such period shall not exceed the greater of $7,000,000 and 10% of Consolidated EBITDA, (i) pro forma “run rate” cost savings, operating expense reductions and synergies (in each case, net of amounts actually realized) related to: (A) the Viewgol Acquisition and fees and expenses related thereto, in an aggregate amount not to exceed $6,600,000 and (B) each other Permitted Acquisitions, restructurings, cost savings initiatives and other initiatives and any fees, costs or expenses related to the implementation of the foregoing, in each case, that are reasonably identifiable and projected by the Borrower to result from actions that have been taken within 12 months after the relevant transaction, (j) fees and expenses related to any Equity Transaction, the incurrence of any Indebtedness permitted to be incurred hereunder or amendments to the Credit Documents (in each case whether or not consummated), (k) losses resulting from any Asset Sales or Involuntary Disposition, (l) costs and expenses related to the investigation by the SEC during the fiscal year ending December 31, 2023, in an aggregate amount not to exceed $1,250,000, (m) costs and expenses related to the voluntary early retirement program during the fiscal year ending December 31, 2023 and (n) fees, costs and expenses identified on the Disclosure Schedule to Fourth Amendment delivered to the Administrative Agent to the extent incurred during the fiscal year ending December 31, 2024 in an amount not to exceed the maximum amount for such category on such schedule and not exceeding $7,250,000; provided that the aggregate amount added back pursuant to clauses (i)(B) and (j) shall not exceed 15% of Consolidated EBITDA (determined prior to giving effect to such adjustments); minus the following to the extent included in calculating such Consolidated Net Income: (x) interest income, (y) non-cash gains (excluding any such non-cash gains to the extent (1) there were cash gains with respect to such gains in past accounting periods or (2) there is a reasonable expectation that there will be cash gains with respect to such gains in future accounting periods) and (z) gains resulting from Asset Sales or Involuntary Dispositions.

2.2 Section 8.8(b) of the Credit Agreement is amended and restated in its entirety to read as follows:

(b) Consolidated Fixed Charge Coverage Ratio. Permit the Consolidated Fixed Charge Coverage Ratio as of the end of any Fiscal Quarter of the Borrower specified below to be less than the ratio set forth in the table below corresponding to such fiscal quarter.

|

Fiscal Quarter End

|

Minimum Fixed Charge Coverage Ratio

|

|

June 30, 2022 through and including December 31, 2023

|

1.25 to 1.0

|

|

March 31, 2024 through and including December 31, 2024

|

1.15 to 1.0

|

|

March 31, 2025 and each fiscal quarter ending thereafter

|

1.25 to 1.0

|

3. Waiver. The Required Lenders hereby waive any Event of Default resulting from the Borrower not being in compliance with Section 8.8(b) as of December 31, 2023; provided, that the Borrower is in compliance with such section after giving effect to this Amendment. The foregoing waiver is a one-time waiver and applies only to this specific instance and shall not relieve the Borrower of its obligation to comply with Section 8.8(b) of the Credit Agreement after the date hereof. For the avoidance of doubt, the Borrower shall calculate Section 8.8(b) of the Credit Agreement in the Compliance Certificate delivered pursuant to Section 7.1(c) of the Credit Agreement for the fiscal quarter ending December 31, 2023 giving effect to this Amendment.

4. Conditions Precedent. This Amendment shall become effective upon satisfaction of the following conditions precedent:

(a) receipt by the Administrative Agent of copies of this Amendment duly executed by the Borrower, the Guarantors, the Required Lenders, the Issuing Bank, and the Swingline Lender; and

(b) receipt by the Administrative Agent of all reasonable fees and expenses required to be paid on or before the Fourth Amendment Effective Date, including the reasonable out-of-pocket fees and expenses of counsel for the Administrative Agent.

5. Amendment is a “Credit Document”. This Amendment is a Credit Document and all references to a “Credit Document” in the Credit Agreement and the other Credit Documents (including, without limitation, all such references in the representations and warranties in the Credit Agreement and the other Credit Documents) shall be deemed to include this Amendment.

6. Representations and Warranties; No Default. Each Credit Party represents and warrants to the Administrative Agent that, on and as of the date hereof, immediately after giving effect to this Amendment, (a) the representations and warranties contained in Section 6 of the Credit Agreement and in the other Credit Documents are true and correct in all material respects (except to the extent such representation or warranty is already qualified by materiality in which case such representation and warranty is true and correct in all respects) on and as the date hereof, except to the extent such representations and warranties relate to an earlier date, in which case they are true and correct in all material respects (except to the extent such representation or warranty is already qualified by materiality in which case such representation and warranty is true and correct in all respects) as of such earlier date, and (b) no event has occurred and is continuing which constitutes an Event of Default or a Default.

7. Reaffirmation of Obligations. Each Credit Party (a) acknowledges and consents to all of the terms and conditions of this Amendment, (b) affirms all of its obligations under the Credit Documents and (c) agrees that this Amendment and all documents, agreements and instruments executed in connection with this Amendment do not operate to reduce or discharge such Credit Party’s obligations under the Credit Documents.

8. Reaffirmation of Security Interests. Each Credit Party (a) affirms that each of the Liens granted in or pursuant to the Credit Documents are valid and subsisting (excluding all Liens on Real Estate Assets which have been released by the Collateral Agent) and (b) agrees that this Amendment and all documents, agreements and instruments executed in connection with this Amendment do not in any manner impair or otherwise adversely affect any of the Liens granted in or pursuant to the Credit Documents.

9. No Other Changes. Except as modified hereby, all of the terms and provisions of the Credit Documents shall remain in full force and effect.

10. Counterparts/Facsimile. This Amendment may be executed in counterparts (and by different parties hereto in different counterparts), each of which shall constitute an original, but all of which when taken together shall constitute a single contract. Delivery of an executed counterpart of a signature page of this Amendment by telecopy or other electronic imaging means (e.g. “pdf” or “tif” format) shall be effective as delivery of a manually executed counterpart of this Amendment.

11. Governing Law. This Amendment shall be deemed to be a contract made under, and for all purposes shall be construed in accordance with, the laws of the State of New York.

[signature pages follow]

IN WITNESS WHEREOF, the parties hereto have caused this Amendment to be duly executed as of the date first written above.

| BORROWER: |

COMPUTER PROGRAMS AND SYSTEMS, INC.,

|

| |

a Delaware corporation |

| |

|

| |

|

| |

By: |

/s/ Christopher L. Fowler |

| |

Name: |

Christopher L. Fowler |

| |

Title: |

President and Chief Executive Officer |

| |

|

| GUARANTORS: |

TRUBRIDGE, LLC, |

| |

a Delaware limited liability company |

| |

|

| |

By: Computer Programs and Systems, Inc.

Its: Managing Member

|

| |

|

| |

|

By: |

/s/ Christopher L. Fowler |

| |

|

Name: |

Christopher L. Fowler |

| |

|

Title: |

President and Chief Executive Officer |

| |

|

| |

EVIDENT, LLC,

a Delaware limited liability company

|

| |

|

| |

By: Computer Programs and Systems, Inc.,

Its: Managing Member

|

| |

|

| |

|

By: |

/s/ Christopher L. Fowler |

| |

|

Name: |

Christopher L. Fowler |

| |

|

Title: |

President and Chief Executive Officer |

| |

|

| |

HEALTHLAND HOLDING INC.,

a Delaware corporation

|

| |

|

| |

By: |

/s/ Christopher L. Fowler |

| |

Name: |

Christopher L. Fowler |

| |

Title: |

President and Chief Executive Officer |

| |

|

| |

HEALTHLAND INC.,

a Minnesota corporation

|

| |

|

| |

By: |

/s/ Christopher L. Fowler |

| |

Name: |

Christopher L. Fowler |

| |

Title: |

President and Chief Executive Officer |

COMPUTER PROGRAMS AND SYSTEMS, INC.

FOURTH AMENDMENT TO CREDIT AGREEMENT

| |

RYCAN TECHNOLOGIES, INC.,

a Minnesota corporation

|

| |

|

| |

By: |

/s/ Christopher L. Fowler |

| |

Name: |

Christopher L. Fowler |

| |

Title: |

President and Chief Executive Officer |

| |

|

| |

INETXPERTS, CORP.,

a Maryland corporation

|

| |

|

| |

By: |

/s/ Christopher L. Fowler |

| |

Name: |

Christopher L. Fowler |

| |

Title: |

Chief Executive Officer |

| |

|

| |

TRUCODE LLC,

a Virginia limited liability company

|

| |

|

| |

By: |

/s/ Christopher L. Fowler |

| |

Name: |

Christopher L. Fowler |

| |

Title: |

Chief Executive Officer |

| |

|

| |

HEALTHCARE RESOURCE GROUP, INC.,

a Washington corporation

|

| |

|

| |

By: |

/s/ Christopher L. Fowler |

| |

Name: |

Christopher L. Fowler |

| |

Title: |

Chief Executive Officer |

COMPUTER PROGRAMS AND SYSTEMS, INC.

FOURTH AMENDMENT TO CREDIT AGREEMENT

| ADMINISTRATIVE AGENT |

|

| AND COLLATERAL AGENT: |

REGIONS BANK |

| |

|

| |

By: |

/s/ George Hunter |

| |

Name: |

George Hunter |

| |

Title: |

Vice President |

COMPUTER PROGRAMS AND SYSTEMS, INC.

FOURTH AMENDMENT TO CREDIT AGREEMENT

| LENDERS: |

REGIONS BANK, |

| |

as a Lender, the Issuing Bank and the Swingline Lender |

| |

|

| |

By: |

/s/ George Hunter |

| |

Name: |

George Hunter |

| |

Title: |

Vice President |

COMPUTER PROGRAMS AND SYSTEMS, INC.

FOURTH AMENDMENT TO CREDIT AGREEMENT

| |

PNC BANK, NATIONAL ASSOCIATION |

| |

|

| |

By: |

/s/ Raj Nambiar |

| |

Name: |

Raj Nambiar |

| |

Title: |

Sr. Vice President |

COMPUTER PROGRAMS AND SYSTEMS, INC.

FOURTH AMENDMENT TO CREDIT AGREEMENT

| |

HANCOCK WHITNEY BANK |

| |

|

| |

By: |

/s/ Angela Dunn |

| |

Name: |

Angela Dunn |

| |

Title: |

SVP |

COMPUTER PROGRAMS AND SYSTEMS, INC.

FOURTH AMENDMENT TO CREDIT AGREEMENT

| |

TRUSTMARK NATIONAL BANK |

| |

|

| |

By: |

/s/ Robert F. Diehl, Jr. |

| |

Name: |

Robert F. Diehl, Jr. |

| |

Title: |

Executive Vice President |

COMPUTER PROGRAMS AND SYSTEMS, INC.

FOURTH AMENDMENT TO CREDIT AGREEMENT

| |

SYNOVUS BANK |

| |

|

| |

By: |

/s/ Custis Proctor |

| |

Name: |

Custis Proctor |

| |

Title: |

Corporate Banker |

COMPUTER PROGRAMS AND SYSTEMS, INC.

FOURTH AMENDMENT TO CREDIT AGREEMENT

| |

BANK OF AMERICA, N.A. |

| |

|

| |

By: |

/s/ H. Hope Walker |

| |

Name: |

H. Hope Walker |

| |

Title: |

Senior Vice President |

COMPUTER PROGRAMS AND SYSTEMS, INC.

FOURTH AMENDMENT TO CREDIT AGREEMENT

| |

BRYANT BANK |

| |

|

| |

By: |

/s/ Gregory E. Strachan |

| |

Name: |

Gregory E. Strachan |

| |

Title: |

President - Baldwin County |

COMPUTER PROGRAMS AND SYSTEMS, INC.

FOURTH AMENDMENT TO CREDIT AGREEMENT

Exhibit 99.1

CONTACT

Tracey Schroeder

Chief Marketing Officer

Tracey.schroeder@cpsi.com

(251) 639-8100

CPSI ANNOUNCES FOURTH QUARTER AND FULL YEAR 2023 RESULTS

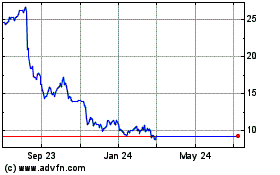

MOBILE, ALA. (February 29, 2024) – CPSI (NASDAQ: CPSI), a healthcare solutions company, today announced results for the fourth quarter and year ended December 31, 2023.

Fourth Quarter 2023 Financial Overview

All comparisons are to the fourth quarter ended December 31, 2022, unless otherwise noted.

| |

●

|

Bookings of $26.0 million compared to $24.7 million

|

| |

●

|

Total revenue of $85.9 million compared to $83.2 million

|

| |

●

|

Revenue Cycle Management (RCM) revenue of $51.0 million compared to $45.7 million

|

| |

o

|

RCM revenue represented 60.7% of CPSI’s total recurring revenue and 59.3% of CPSI’s total revenue

|

| |

●

|

GAAP loss per diluted share of $(2.92) and non-GAAP earnings per diluted share of $0.36

|

| |

●

|

Adjusted EBITDA of $12.0 million compared to $13.2 million

|

Full Year 2023 Financial Overview

All comparisons are to the year ended December 31, 2022, unless otherwise noted.

| |

●

|

Bookings of $85.1 million compared to $89.4 million

|

| |

●

|

Total revenue of $339.4 million compared to $326.6 million

|

| |

●

|

Revenue Cycle Management (RCM) revenue of $193.9 million compared to $179.9 million

|

| |

o

|

RCM revenue represented 58.9% of CPSI’s total recurring revenue and 57.1% of CPSI’s total revenue

|

| |

●

|

GAAP loss per diluted share of $(3.15) and non-GAAP earnings per diluted share of $1.79

|

| |

●

|

Adjusted EBITDA of $47.6 million compared to $55.9 million

|

“Despite the challenges we faced in 2023, we were able to finish out the year with a strong fourth quarter in terms of revenue performance, and we kicked off 2024 with the exciting news announcing our imminent rebrand to TruBridge,” said Chris Fowler, chief executive officer of CPSI. “Unifying our identity under this brand reflects our transformation as an organization that is leveraging its strengths and expertise to deliver a more cohesive and comprehensive suite of solutions to our customers.

“We believe that the investments we made to enhance our business over the past few quarters will provide us with a strong foundation from which to grow. We see a significant opportunity ahead to improve the financial health of our community hospital partners, and we are confident that our recent acquisition of Viewgol has only strengthened our position in the market. We look forward to seizing this opportunity and making further progress throughout 2024.”

-MORE-

CPSI Announces Fourth Quarter and Full Year 2023 Results

Page 2

February 29, 2024

First Quarter 2024 Financial Outlook

For the first quarter 2024, the Company is providing an initial outlook of:

| |

●

|

Revenue in the range of $82 million to $84 million

|

| |

●

|

Adjusted EBITDA of $8.5 million to $9.5 million

|

2024 Financial Outlook1

For the full year 2024, the Company is providing an initial outlook of:

| |

●

|

Revenue in the range of $340 million to $350 million

|

| |

●

|

Adjusted EBITDA of $45 million to $50 million

|

Conference Call Information

CPSI will hold a live webcast to discuss fourth quarter and full year 2023 results today, Thursday, February 29, 2024, at 3:30 p.m. Central time/4:30 p.m. Eastern time. A 30-day online replay will be available approximately one hour following the conclusion of the live webcast. To listen to the live webcast or access the replay, visit the Company’s website, www.cpsi.com.

About CPSI

CPSI has over four decades of experience in connecting providers, patients and communities with innovative solutions that support both the clinical and financial side of healthcare delivery. We provide business, consulting, and managed information technology (IT) services, including our industry leading HFMA Peer Reviewed® suite of revenue cycle management (RCM) offerings, to help streamline day-to-day revenue functions, enhance productivity, and support the financial health of healthcare organizations. Our patient engagement solutions provide patients and providers with the critical information and tools they need to share existing clinical data and analytics that support value-based care, improve outcomes, and increase patient satisfaction. We support efficient patient care across an expansive base of community hospitals with electronic health record (EHR) product offerings that successfully integrate data between care settings. We make healthcare accessible through data-driven insights that support informed decisions and deliver workflow efficiencies, while keeping patients at the center of care. We are a healthcare solutions company. We clear the way for care. For more information, please visit www.cpsi.com.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified generally by the use of forward-looking terminology and words such as “expects,” “anticipates,” “estimates,” “believes,” “predicts,” “intends,” “plans,” “potential,” “may,” “continue,” “should,” “will” and words of comparable meaning. Without limiting the generality of the preceding statement, all statements in this press release relating to the Company’s future financial and operational results are forward-looking statements. We caution investors that any such forward‑looking statements are only predictions and are not guarantees of future performance. Certain risks, uncertainties and other factors may cause actual results to differ materially from those projected in the forward‑looking statements. Such factors may include: a public health crisis, such as the COVID-19 pandemic, and related economic disruptions; saturation of our target market and hospital consolidations; unfavorable economic or market conditions that may cause a decline in spending for information technology and services; significant legislative and regulatory uncertainty in the healthcare industry; exposure to liability for failure to comply with regulatory requirements; transition to a subscription-based recurring revenue model and modernization of our technology; competition with companies that have greater financial, technical and marketing resources than we have; potential future acquisitions that may be expensive, time consuming, and subject to other inherent risks; our ability to attract and retain qualified client service and support personnel; disruption from periodic restructuring of our sales force; potential inability to properly manage growth in new markets we may enter; exposure to numerous and often conflicting laws, regulations, policies, standards or other requirements through our international business activities; potential litigation against us; our reliance on an international workforce which exposes us to various business disruptions; potential failure to develop new products or enhance current products that keep pace with market demands; failure of our products to function properly resulting in claims for medical and other losses; breaches of security and viruses in our systems resulting in customer claims against us and harm to our reputation; failure to maintain customer satisfaction through new product releases free of undetected errors or problems; failure to convince customers to migrate to current or future releases of our products; failure to maintain our margins and service rates; increase in the percentage of total revenues represented by service revenues, which have lower gross margins; exposure to liability in the event we provide inaccurate claims data to payors; exposure to liability claims arising out of the licensing of our software and provision of services; dependence on licenses of rights, products and services from third parties; misappropriation of our intellectual property rights and potential intellectual property claims and litigation against us; interruptions in our power supply and/or telecommunications capabilities, including those caused by natural disaster; potential inability to secure additional financing on favorable terms to meet our future capital needs; our substantial indebtedness, and our ability to incur additional indebtedness in the future; pressures on cash flow to service our outstanding debt; restrictive terms of our credit agreement on our current and future operations; changes in and interpretations of financial accounting matters that govern the measurement of our performance; significant charges to earnings if our goodwill or intangible assets become impaired; fluctuations in quarterly financial performance due to, among other factors, timing of customer installations; volatility in our stock price; failure to maintain effective internal control over financial reporting; lack of employment or non-competition agreement with most of our key personnel; inherent limitations in our internal control over financial reporting; vulnerability to significant damage from natural disasters; market risks related to interest rate changes; potential material adverse effects due to macroeconomic conditions, including bank failures or changes in related regulation; and other risk factors described from time to time in our public releases and reports filed with the Securities and Exchange Commission, including, but not limited to, our most recent Annual Report on Form 10-K and our Quarterly Report on Form 10-Q for the quarter ended September 30, 2023. We also caution investors that the forward-looking information described herein represents our outlook only as of this date, and we undertake no obligation to update or revise any forward-looking statements to reflect events or developments after the date of this press release.

1 Excluding revenues, the Company does not provide guidance on a GAAP basis as certain items that impact Adjusted EBITDA or non-GAAP net income such as severance and other nonrecurring charges, which may be significant, are outside the Company’s control and/or cannot be reasonably predicted. Please see the “Explanation of Non-GAAP Financial Measures” at the end of this press release for detailed information on calculating non-GAAP measures. For a reconciliation of other non-GAAP financial measures, see the non-GAAP financial reconciliation tables in this release.

-MORE-

CPSI Announces Fourth Quarter and Full Year 2023 Results

Page 3

February 29, 2024

Computer Programs and Systems, Inc.

Condensed Consolidated Statements of Income

(In '000s, except per share data)

(Unaudited)

| |

|

Three Months Ended December 31,

|

|

|

Twelve Months Ended December 31,

|

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

|

Revenues

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RCM

|

|

$ |

50,956 |

|

|

$ |

45,670 |

|

|

$ |

193,929 |

|

|

$ |

179,870 |

|

|

EHR

|

|

|

33,412 |

|

|

|

35,968 |

|

|

|

138,063 |

|

|

|

139,823 |

|

|

Patient engagement

|

|

|

1,500 |

|

|

|

1,586 |

|

|

|

7,443 |

|

|

|

6,955 |

|

|

Total revenues

|

|

|

85,868 |

|

|

|

83,224 |

|

|

|

339,435 |

|

|

|

326,648 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Costs of revenue (exclusive of amortization and depreciation)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RCM

|

|

|

28,731 |

|

|

|

25,956 |

|

|

|

110,192 |

|

|

|

97,024 |

|

|

EHR

|

|

|

14,153 |

|

|

|

17,497 |

|

|

|

62,048 |

|

|

|

65,661 |

|

|

Patient engagement

|

|

|

810 |

|

|

|

1,061 |

|

|

|

3,628 |

|

|

|

3,856 |

|

|

Total costs of revenue (exclusive of amortization and depreciation)

|

|

|

43,694 |

|

|

|

44,514 |

|

|

|

175,868 |

|

|

|

166,541 |

|

|

Product development

|

|

|

10,347 |

|

|

|

9,001 |

|

|

|

37,246 |

|

|

|

31,898 |

|

|

Sales and marketing

|

|

|

6,143 |

|

|

|

4,553 |

|

|

|

28,049 |

|

|

|

27,131 |

|

|

General and administrative

|

|

|

21,682 |

|

|

|

14,650 |

|

|

|

76,153 |

|

|

|

54,965 |

|

|

Amortization

|

|

|

6,974 |

|

|

|

5,687 |

|

|

|

24,522 |

|

|

|

20,887 |

|

|

Depreciation

|

|

|

554 |

|

|

|

553 |

|

|

|

1,946 |

|

|

|

2,443 |

|

|

Impairment of goodwill

|

|

|

35,913 |

|

|

|

- |

|

|

|

35,913 |

|

|

|

- |

|

|

Impairment of trademark intangibles

|

|

|

2,342 |

|

|

|

- |

|

|

|

2,342 |

|

|

|

- |

|

|

Total expenses

|

|

|

127,649 |

|

|

|

78,958 |

|

|

|

382,039 |

|

|

|

303,865 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income (loss)

|

|

|

(41,781 |

) |

|

|

4,266 |

|

|

|

(42,604 |

) |

|

|

22,783 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expense):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income

|

|

|

176 |

|

|

|

264 |

|

|

|

745 |

|

|

|

1,178 |

|

|

Gain (loss) on contingent consideration

|

|

|

- |

|

|

|

(427 |

) |

|

|

- |

|

|

|

565 |

|

|

Loss on extinguishment of debt

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(125 |

) |

|

Interest expense

|

|

|

(4,116 |

) |

|

|

(2,276 |

) |

|

|

(12,521 |

) |

|

|

(6,320 |

) |

|

Total other income (expense)

|

|

|

(3,940 |

) |

|

|

(2,439 |

) |

|

|

(11,776 |

) |

|

|

(4,702 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) before taxes

|

|

|

(45,721 |

) |

|

|

1,827 |

|

|

|

(54,380 |

) |

|

|

18,081 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision (benefit) for income taxes

|

|

|

(3,247 |

) |

|

|

(690 |

) |

|

|

(8,591 |

) |

|

|

2,214 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) (1)

|

|

$ |

(42,474 |

) |

|

$ |

2,517 |

|

|

$ |

(45,789 |

) |

|

$ |

15,867 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) per common share—basic

|

|

$ |

(2.92 |

) |

|

$ |

0.17 |

|

|

$ |

(3.15 |

) |

|

$ |

1.08 |

|

|

Net income (loss) per common share—diluted

|

|

$ |

(2.92 |

) |

|

$ |

0.17 |

|

|

$ |

(3.15 |

) |

|

$ |

1.08 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding used in per common share computations:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

14,205 |

|

|

|

14,210 |

|

|

|

14,187 |

|

|

|

14,356 |

|

|

Diluted

|

|

|

14,205 |

|

|

|

14,210 |

|

|

|

14,187 |

|

|

|

14,356 |

|

(1) In connection with the Company’s disposition of AHT in January 2024 and other factors, management is finalizing certain line items in the financial statements included herein, primarily related to the amount of goodwill impairment. Any change to the amount of goodwill impairment set forth in this earnings release (and the corresponding impact on related line items) is not expected to be material. The final amount of goodwill impairment and the amounts of impacted line items for fiscal year 2023 will be reflected in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023. Any change to the amounts for the fourth quarter of 2023 will be provided on the Investor Relations portion of the Company’s website.

-MORE-

CPSI Announces Fourth Quarter and Full Year 2023 Results

Page 4

February 29, 2024

Computer Programs and Systems, Inc.

Condensed Consolidated Balance Sheets

(In '000s, except per share data)

| |

|

December 31,

2023

(unaudited)

|

|

|

Dec. 31, 2022

|

|

|

Assets

|

|

|

|

|

|

|

|

|

|

Current assets

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

3,848 |

|

|

$ |

6,951 |

|

|

Accounts receivable, net of allowance for expected credit losses of $3,631 and $2,854, respectively

|

|

|

59,723 |

|

|

|

51,311 |

|

|

Financing receivables, current portion (net of allowance for expected credit losses of $319 and $223, respectively)

|

|

|

3,997 |

|

|

|

4,474 |

|

|

Inventories

|

|

|

475 |

|

|

|

784 |

|

|

Prepaid income taxes

|

|

|

1,628 |

|

|

|

701 |

|

|

Prepaid expenses and other

|

|

|

15,807 |

|

|

|

10,338 |

|

|

Assets of held for sale disposal group

|

|

|

25,754 |

|

|

|

- |

|

|

Total current assets

|

|

|

111,232 |

|

|

|

74,559 |

|

| |

|

|

|

|

|

|

|

|

|

Property & equipment, net

|

|

|

8,974 |

|

|

|

9,884 |

|

|

Software development costs, net

|

|

|

39,139 |

|

|

|

27,257 |

|

|

Operating lease assets

|

|

|

5,192 |

|

|

|

7,567 |

|

|

Financing receivables, net of current portion (net of allowance for expected credit losses of $97 and $326, respectively)

|

|

|

1,226 |

|

|

|

3,312 |

|

|

Other assets, net of current portion

|

|

|

7,314 |

|

|

|

8,131 |

|

|

Intangible assets, net

|

|

|

89,213 |

|

|

|

102,000 |

|

|

Goodwill

|

|

|

171,909 |

|

|

|

198,253 |

|

|

Total assets

|

|

$ |

434,199 |

|

|

$ |

430,963 |

|

| |

|

|

|

|

|

|

|

|

|

Liabilities & Stockholders' Equity

|

|

|

|

|

|

|

|

|

|

Current liabilities

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$ |

10,133 |

|

|

$ |

7,035 |

|

|

Current portion of long-term debt

|

|

|

3,141 |

|

|

|

3,141 |

|

|

Deferred revenue

|

|

|

8,677 |

|

|

|

11,590 |

|

|

Accrued vacation

|

|

|

5,410 |

|

|

|

6,214 |

|

|

Liabilities of held for sale disposal group

|

|

|

754 |

|

|

|

- |

|

|

Other accrued liabilities

|

|

|

19,892 |

|

|

|

16,475 |

|

|

Total current liabilities

|

|

|

48,007 |

|

|

|

44,455 |

|

| |

|

|

|

|

|

|

|

|

|

Long-term debt, net of current portion

|

|

|

195,270 |

|

|

|

136,388 |

|

|

Operating lease liabilities, net of current portion

|

|

|

3,074 |

|

|

|

5,651 |

|

|

Deferred tax liabilities

|

|

|

1,230 |

|

|

|

12,758 |

|

|

Total liabilities

|

|

|

247,581 |

|

|

|

199,252 |

|

| |

|

|

|

|

|

|

|

|

|

Stockholders' Equity

|

|

|

|

|

|

|

|

|

|

Common stock, $0.001 par value; 30,000 shares authorized; 15,121 and 14,913 shares issued, respectively

|

|

|

15 |

|

|

|

15 |

|

|

Treasury stock, 572 and 483 shares, respectively

|

|

|

(17,075 |

) |

|

|

(14,500 |

) |

|

Additional paid-in capital

|

|

|

195,546 |

|

|

|

192,275 |

|

|

Retained earnings

|

|

|

8,132 |

|

|

|

53,921 |

|

|

Total stockholders' equity

|

|

|

186,618 |

|

|

|

231,711 |

|

| |

|

|

|

|

|

|

|

|

|

Total liabilities and stockholders' equity

|

|

$ |

434,199 |

|

|

$ |

430,963 |

|

-MORE-

CPSI Announces Fourth Quarter and Full Year 2023 Results

Page 5

February 29, 2024

Computer Programs and Systems, Inc.

Condensed Consolidated Statements of Cash Flows

(In '000s)

(Unaudited)

| |

|

Twelve Months Ended December 31,

|

|

| |

|

2023

|

|

|

2022

|

|

|

Operating activities:

|

|

|

|

|

|

|

|

|

|

Net income (loss)

|

|

$ |

(45,789 |

) |

|

$ |

15,867 |

|

|

Adjustments to net income:

|

|

|

|

|

|

|

|

|

|

Provision for credit losses

|

|

|

1,920 |

|

|

|

992 |

|

|

Deferred taxes

|

|

|

(11,305 |

) |

|

|

(6,688 |

) |

|

Stock-based compensation

|

|

|

3,271 |

|

|

|

5,173 |

|

|

Depreciation

|

|

|

1,946 |

|

|

|

2,443 |

|

|

Loss on extinguishment of debt

|

|

|

- |

|

|

|

125 |

|

|

Amortization of acquisition-related intangibles

|

|

|

16,426 |

|

|

|

17,403 |

|

|

Amortization of software development costs

|

|

|

8,096 |

|

|

|

3,484 |

|

|

Amortization of deferred finance costs

|

|

|

359 |

|

|

|

332 |

|

|

Impairment of goodwill

|

|

|

35,913 |

|

|

|

- |

|

|

Impairment of trademark intangibles

|

|

|

2,342 |

|

|

|

- |

|

|

Gain on contingent consideration

|

|

|

- |

|

|

|

(565 |

) |

|

Non-cash operating lease costs

|

|

|

1,602 |

|

|

|

- |

|

|

Loss on disposal of PP&E

|

|

|

117 |

|

|

|

- |

|

|

Changes in operating assets and liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts receivable

|

|

|

(11,319 |

) |

|

|

(12,428 |

) |

|

Financing receivables

|

|

|

2,659 |

|

|

|

6,144 |

|

|

Inventories

|

|

|

309 |

|

|

|

71 |

|

|

Prepaid expenses and other

|

|

|

(4,554 |

) |

|

|

(2,930 |

) |

|

Accounts payable

|

|

|

3,075 |

|

|

|

(1,429 |

) |

|

Deferred revenue

|

|

|

(2,913 |

) |

|

|

61 |

|

|

Operating lease liabilities

|

|

|

(2,063 |

) |

|

|

- |

|

|

Other liabilities

|

|

|

1,894 |

|

|

|

422 |

|

|

Prepaid income taxes

|

|

|

(927 |

) |

|

|

3,898 |

|

|

Net cash provided by operating activities

|

|

|

1,059 |

|

|

|

32,375 |

|

| |

|

|

|

|

|

|

|

|

|

Investing activities:

|

|

|

|

|

|

|

|

|

|

Purchase of business, net of cash acquired

|

|

|

(36,705 |

) |

|

|

(43,364 |

) |

|

Investment in software development

|

|

|

(23,059 |

) |

|

|

(19,097 |

) |

|

Purchases of property and equipment

|

|

|

(346 |

) |

|

|

(270 |

) |

|

Net cash used in investing activities

|

|

|

(60,110 |

) |

|

|

(62,731 |

) |

| |

|

|

|

|

|

|

|

|

|

Financing activities:

|

|

|

|

|

|

|

|

|

|

Treasury stock purchases

|

|

|

(2,575 |

) |

|

|

(11,924 |

) |

|

Proceeds from long-term debt

|

|

|

- |

|

|

|

575 |

|

|

Payments of long-term debt principal

|

|

|

(3,500 |

) |

|

|

(3,563 |

) |

|

Proceeds from revolving line of credit

|

|

|

67,023 |

|

|

|

48,000 |

|

|

Payments of revolving line of credit

|

|

|

(5,000 |

) |

|

|

(5,300 |

) |

|

Payments of contingent consideration

|

|

|

- |

|

|

|

(1,935 |

) |

|

Proceeds from exercise of stock options

|

|

|

- |

|

|

|

23 |

|

|

Net cash provided by (used in) financing activities

|

|

|

55,948 |

|

|

|

25,876 |

|

| |

|

|

|

|

|

|

|

|

|

Decrease in cash and cash equivalents

|

|

|

(3,103 |

) |

|

|

(4,480 |

) |

| |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents, beginning of period

|

|

|

6,951 |

|

|

|

11,431 |

|

|

Cash and cash equivalents, end of period

|

|

$ |

3,848 |

|

|

$ |

6,951 |

|

-MORE-

CPSI Announces Fourth Quarter and Full Year 2023 Results

Page 6

February 29, 2024

Computer Programs and Systems, Inc.

Consolidated Bookings

(In '000s)

| |

|

Three Months Ended December 31,

|

|

|

Twelve Months Ended December 31,

|

|

|

In '000s

|

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

|

RCM(1)

|

|

$ |

14,158 |

|

|

$ |

13,373 |

|

|

$ |

48,986 |

|

|

$ |

48,065 |

|

|

EHR(2)

|

|

|

10,888 |

|

|

|

10,678 |

|

|

|

33,143 |

|

|

|

38,152 |

|

|

Patient engagement(1)

|

|

|

969 |

|

|

|

620 |

|

|

|

2,973 |

|

|

|

3,188 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

$ |

26,015 |

|

|

$ |

24,671 |

|

|

$ |

85,102 |

|

|

$ |

89,405 |

|

(1) Generally calculated as the total contract price (for non-recurring, project-related amounts) and annualized contract value (for recurring amounts).

(2) Generally calculated as the total contract price (for system sales) and annualized contract value (for support) for perpetual license system sales and total contract price for SaaS sales.

Computer Programs and Systems, Inc.

Bookings Composition

(In '000s, except per share data)

(Unaudited)

| |

|

Three Months Ended December 31,

|

|

|

Twelve Months Ended December 31,

|

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

|

RCM

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net new(1)

|

|

$ |

7,130 |

|

|

$ |

5,173 |

|

|

$ |

18,237 |

|

|

$ |

14,830 |

|

|

Cross-sell(1)

|

|

|

6,310 |

|

|

|

8,090 |

|

|

|

26,426 |

|

|

|

29,956 |

|

|

TruCode

|

|

|

718 |

|

|

|

110 |

|

|

|

4,323 |

|

|

|

3,273 |

|

|

EHR

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-subscription sales(2)

|

|

|

3,725 |

|

|

|

4,181 |

|

|

|

14,544 |

|

|

|

16,870 |

|

|

Subscription revenue(3)

|

|

|

5,596 |

|

|

|

5,191 |

|

|

|

13,737 |

|

|

|

16,698 |

|

|

Other

|

|

|

1,567 |

|

|

|

1,306 |

|

|

|

4,862 |

|

|

|

4,584 |

|

|

Patient engagement

|

|

|

969 |

|

|

|

620 |

|

|

|

2,973 |

|

|

|

3,194 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

$ |

26,015 |

|

|

$ |

24,671 |

|

|

$ |

85,102 |

|

|

$ |

89,405 |

|

(1) “Net new” represents bookings from outside the Company’s core EHR client base, and “Cross-sell” represents bookings from existing EHR customers. In each case, such bookings are generally comprised of recurring revenues to be recognized ratably over a one-year period and an average timeframe for commencement of bookings-to-revenue conversion of four to six months following contract execution.

(2) Represents nonrecurring revenues that generally exhibit a timeframe for bookings-to-revenue conversion of five to six months following contract execution.

(3) Represents recurring revenues to be recognized on a monthly basis over a weighted-average contract period of five years, with a start date in the next 12 months and an average timeframe for commencement of bookings-to-revenue conversion of five to six months following contract execution.

-MORE-

CPSI Announces Fourth Quarter and Full Year 2023 Results

Page 7

February 29, 2024

Computer Programs and Systems, Inc.

Adjusted EBITDA - by Segment

(In '000s)

| |

|

Three Months Ended December 31,

|

|

|

Twelve Months Ended December 31,

|

|

|

In '000s

|

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

|

RCM

|

|

$ |

6,596 |

|

|

$ |

8,824 |

|

|

$ |

24,800 |

|

|

$ |

35,219 |

|

|

EHR

|

|

|

5,506 |

|

|

|

4,886 |

|

|

|

22,900 |

|

|

|

22,507 |

|

|

Patient engagement

|

|

|

(118 |

) |

|

|

(482 |

) |

|

|

(124 |

) |

|

|

(1,827 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

$ |

11,984 |

|

|

$ |

13,228 |

|

|

$ |

47,576 |

|

|

$ |

55,899 |

|

-MORE-

CPSI Announces Fourth Quarter and Full Year 2023 Results

Page 8

February 29, 2024

Computer Programs and Systems, Inc.

Reconciliation of Non-GAAP Financial Measures

(In '000s)

(Unaudited)

| |

|

Three Months Ended December 31,

|

|

|

Twelve Months Ended December 31,

|

|

|

Adjusted EBITDA:

|

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

|

Net income (loss), as reported

|

|

$ |

(42,474 |

) |

|

$ |

2,517 |

|

|

$ |

(45,789 |

) |

|

$ |

15,867 |

|

|

Net Income Margin

|

|

|

(49.5 |

%) |

|

|

3.0 |

% |

|

|

(13.5 |

%) |

|

|

4.9 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deferred revenue and other purchase accounting-related adjustments

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

109 |

|

|

Depreciation expense

|

|

|

554 |

|

|

|

553 |

|

|

|

1,946 |

|

|

|

2,443 |

|

|

Amortization of software development costs

|

|

|

2,591 |

|

|

|

1,200 |

|

|

|

8,096 |

|

|

|

3,483 |

|

|

Amortization of acquisition-related intangibles

|

|

|

4,383 |

|

|

|

4,486 |

|

|

|

16,426 |

|

|

|

17,403 |

|

|

Impairment of goodwill

|

|

|

35,913 |

|

|

|

- |

|

|

|

35,913 |

|

|

|

- |

|

|

Impairment of trademark intangibles

|

|

|

2,342 |

|

|

|

- |

|

|

|

2,342 |

|

|

|

- |

|

|

Stock-based compensation

|

|

|

1,108 |

|

|

|

(111 |

) |

|

|

3,271 |

|

|

|

5,173 |

|

|

Severance and other nonrecurring charges

|

|

|

6,874 |

|

|

|

2,834 |

|

|

|

22,186 |

|

|

|

4,505 |

|

|

Interest expense and other, net

|

|

|

3,940 |

|

|

|

2,012 |

|

|

|

11,776 |

|

|

|

5,267 |

|

|

Loss (gain) on contingent consideration

|

|

|

- |

|

|

|

427 |

|

|

|

- |

|

|

|

(565 |

) |

|

Provision (benefit) for income taxes

|

|

|

(3,247 |

) |

|

|

(690 |

) |

|

|

(8,591 |

) |

|

|

2,214 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Adjusted EBITDA

|

|

$ |

11,984 |

|

|

$ |

13,228 |

|

|

$ |

47,576 |

|

|

$ |

55,899 |

|

|

Adjusted EBITDA Margin

|

|

|

14.0 |

% |

|

|

15.9 |

% |

|

|

14.0 |

% |

|

|

17.1 |

% |

Computer Programs and Systems, Inc.

Reconciliation of Non-GAAP Financial Measures

(In '000s, except per share data)

(Unaudited)

| |

|

Three Months Ended December 31,

|

|

|

Twelve Months Ended December 31,

|

|

|

Non-GAAP Net Income and Non-GAAP EPS:

|

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

|

Net income (loss), as reported

|

|

$ |

(42,474 |

) |

|

$ |

2,517 |

|

|

$ |

(45,789 |

) |

|

$ |

15,867 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pre-tax adjustments for Non-GAAP EPS:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deferred revenue and other purchase accounting-related adjustments

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

109 |

|

|

Amortization of acquisition-related intangible assets

|

|

|

4,383 |

|

|

|

4,486 |

|

|

|

16,426 |

|

|

|

17,403 |

|

|

Stock-based compensation

|

|

|

1,108 |

|

|

|

(111 |

) |

|

|

3,271 |

|

|

|

5,173 |

|

|

Severance and other nonrecurring charges

|

|

|

6,874 |

|

|

|

2,834 |

|

|

|

22,186 |

|

|

|

4,505 |

|

|

Non-cash interest expense

|

|

|

90 |

|

|

|

90 |

|

|

|

359 |

|

|

|

332 |

|

|

Loss on extinguishment of debt

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

125 |

|

|

Impairment of trademark intangibles

|

|

|

2,342 |

|

|

|

- |

|

|

|

2,342 |

|

|

|

- |

|

|

Impairment of goodwill

|

|

|

35,913 |

|

|

|

- |

|

|

|

35,913 |

|

|

|

- |

|

|

After-tax adjustments for Non-GAAP EPS:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tax-effect of pre-tax adjustments, at 21%

|

|

|

(3,107 |

) |

|

|

(1,533 |

) |

|

|

(9,363 |

) |

|

|

(5,806 |

) |

|

Tax shortfall (windfall) from stock-based compensation

|

|

|

- |

|

|

|

- |

|

|

|

65 |

|

|

|

(112 |

) |

|

Loss (gain) on contingent consideration

|

|

|

- |

|

|

|

427 |

|

|

|

- |

|

|

|

(565 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP net income

|

|

$ |

5,129 |

|

|

$ |

8,710 |

|

|

$ |

25,410 |

|

|

$ |

37,031 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding, diluted

|

|

|

14,205 |

|

|

|

14,210 |

|

|

|

14,187 |

|

|

|

14,356 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP EPS

|

|

$ |

0.36 |

|

|

$ |

0.61 |

|

|

$ |

1.79 |

|

|

$ |

2.58 |

|

Explanation of Non-GAAP Financial Measures

We report our financial results in accordance with accounting principles generally accepted in the United States of America, or “GAAP.” However, management believes that, in order to properly understand our short-term and long-term financial and operational trends, investors may wish to consider the impact of certain non-cash or non-recurring items, when used as a supplement to financial performance measures that are prepared in accordance with GAAP. These items result from facts and circumstances that vary in frequency and impact on continuing operations. Management uses these non-GAAP financial measures in order to evaluate the operating performance of the Company and compare it against past periods, make operating decisions, and serve as a basis for strategic planning. These non-GAAP financial measures provide management with additional means to understand and evaluate the operating results and trends in our ongoing business by eliminating certain non-cash expenses and other items that management believes might otherwise make comparisons of our ongoing business with prior periods more difficult, obscure trends in ongoing operations, or reduce management’s ability to make useful forecasts. In addition, management understands that some investors and financial analysts find these non-GAAP financial measures helpful in analyzing our financial and operational performance and comparing this performance to our peers and competitors.

-MORE-

CPSI Announces Fourth Quarter and Full Year 2023 Results

Page 9

February 29, 2024

As such, to supplement the GAAP information provided, we present in this press release and during the live webcast discussing our financial results the following non‑GAAP financial measures: Adjusted EBITDA, Adjusted EBITDA Margin, Non-GAAP net income, and Non-GAAP earnings per share (“EPS”).

We calculate each of these non-GAAP financial measures as follows:

| |

●

|

Adjusted EBITDA – Adjusted EBITDA consists of GAAP net income as reported and adjusts for (i) deferred revenue purchase and other accounting adjustments arising from purchase allocation adjustments related to business acquisitions; (ii) depreciation expense; (iii) amortization of software development costs; (iv) amortization of acquisition-related intangibles; (v) impairment of goodwill; (vi) impairment of trademark intangibles; (vii) stock-based compensation; (viii) severance and other non‑recurring charges; (ix) interest expense and other, net; (x) gain on contingent consideration; and (xi) the provision for income taxes.

|

| |

●

|

Adjusted EBITDA Margin – Adjusted EBITDA Margin is calculated as Adjusted EBITDA, as defined above, divided by total revenue.

|

| |

●

|

Non-GAAP net income – Non-GAAP net income consists of GAAP net income as reported and adjusts for (i) deferred revenue and other purchase accounting adjustments arising from purchase allocation adjustments related to business acquisitions; (ii) amortization of acquisition-related intangible assets; (iii) stock-based compensation; (iv) severance and other non-recurring charges; (v) non-cash interest expense; (vi) loss on extinguishment of debt; (vii) impairment of trademark intangible assets; (viii) impairment of goodwill; and (ix) the total tax effect of items (i) through (vi). Adjustments to Non-GAAP net income also include the after-tax effect of the shortfall (windfall) from stock-based compensation and gain on contingent consideration.

|

| |

●

|

Non-GAAP EPS – Non-GAAP EPS consists of Non-GAAP net income, as defined above, divided by weighted average shares outstanding (diluted) in the applicable period.

|

Certain of the items excluded or adjusted to arrive at these non-GAAP financial measures are described below:

| |

●

|