0001854583

false

0001854583

2023-12-05

2023-12-05

0001854583

CAUD:CommonStockParValue0.0001PerShareMember

2023-12-05

2023-12-05

0001854583

CAUD:WarrantsEachExercisableForOneShareOfCommonStockFor11.50PerShareMember

2023-12-05

2023-12-05

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

8-K

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

December

5, 2023

Date

of Report (Date of earliest event reported)

COLLECTIVE

AUDIENCE, INC.

(Exact

Name of Registrant as Specified in its Charter)

| Delaware |

|

001-40723 |

|

86-2861807 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

85

Broad Street 16-079

New

York, NY 10004

(Address

of Principal Executive Offices and Zip Code)

Registrant’s

telephone number, including area code:

(808)

829-1057

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written communications

pursuant to Rule 425 under the Securities Act |

| ☐ |

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act |

| ☐ |

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act |

| ☐ |

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| |

|

|

|

|

| Common Stock, par value

$0.0001 per share |

|

CAUD |

|

The Nasdaq Stock Market

LLC |

| |

|

|

|

|

| Warrants, each exercisable

for one share of Common Stock for $11.50 per share |

|

CAUDW |

|

The Nasdaq Stock Market

LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 1.01

Entry into a Material Definitive Agreement.

The

information set forth in Item 5.02 of this Current Report on Form 8-K (this “Current Report”) regarding

the Bordes Employment Agreement (as defined in Item 5.02, below) is incorporated by reference into this Item 1.01.

Item 5.02

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain

Officers.

Effective as of December 5, 2023, the Board of Directors (the “Board”)

of Collective Audience, Inc. (the “Company”) accepted the resignation of Brent Suen, the Company’s current Chief Executive

Officer.

Concurrently therewith, effective December 5, 2023, the Board approved

the appointment of Peter Bordes to succeed Mr. Suen as the Company’s Chief Executive Officer.

For

more than 30 years, Mr. Bordes, 61, has been an entrepreneur, CEO, board member, and venture investor focused on disruptive innovation

in artificial intelligence, big data, fintech, cybersecurity, digital media and advertising, and blockchain technology. Since 2012, Mr.

Bordes has been the founder and managing partner of Trajectory Capital, a later-stage investing platform and growth fund, as well as

Trajectory Ventures, a venture capital platform and collective of operators, founders, and entrepreneurs focused on advancing technology

and industry innovation. He is also the CEO and a board member of Trajectory Alpha Acquisition (NYSE: TCOA), a special purpose acquisition

corporation focused on high growth innovative technology. Since 2017, he is also co-founder and managing partner of TruVest, a next generation

impact real estate investment, development, and technology company.

Mr.

Bordes holds a Bachelor’s degree in communication, business and media studies from New England College.

Mr.

Bordes holds the following directorships:

| |

● |

Logiq, Inc. (OTC: LGIQ), a U.S.-based advertising technology

company and significant stockholder of the Company. |

| |

● |

GoLogiq, Inc. (OTC: GOLQ), a U.S.-based global provider

of fintech and consumer data analytics. |

| |

● |

Beasley Broadcast Group

(Nasdaq: BBGI), a public media and digital broadcast company providing music, news, sports information and entertainment to over

19 million listeners from 63 stations across the U.S. |

| |

● |

Kubient (Nasdaq: KBNT),

a cloud advertising platform, where he previously served as its CEO and led the company’s IPO and listing on NASDAQ. |

| |

● |

Fraud.net, a leading AI

powered collective intelligence fraud prevention, risk mitigation cloud infrastructure platform for the real-time economy. |

Mr.

Bordes is not related to any of the Company’s executive officers or directors. There is no arrangement or understanding

between Mr. Bordes and any other person pursuant to which Mr. Bordes was selected as a director of the Board. Mr. Bordes is not a participant

in, nor is she to be a participant in, any related-person transaction or proposed related-person transaction required to be disclosed

by Item 404(a) of Regulation S-K under the Securities Exchange Act of 1934, as amended.

In

connection with his appointment as CEO, the Company and Mr. Bordes entered into an employment agreement, dated as of December 5, 2023

(the “Bordes Agreement”).

The

initial term of the Bordes Agreement is one year from the Effective Date, after which it will automatically renew on an annual basis,

subject to earlier termination in accordance with the terms of the agreement. Pursuant to the terms of the Bordes Agreement, Mr. Bordes

will be entitled to receive:

| |

● |

an

annual base salary of $250,000 per annum (subject to annual review and adjustment) (the “Base Salary”), for the first

three (3) months of employment, the Base Salary shall be reduced to a $10,000 per month gross income rate (the “Initial Pay

Rate”). In the event that, before February 5, 2024, the Company raises an aggregate of $1,500,000 in gross proceeds in one

or more transactions (a “Capital Raise”), the Initial Pay Rate shall increase to the Base Salary gross annual rate, according

to the Company’s standard payroll procedures. In the event that the Capital Raise does not occur before February 5, 2024, then

the Initial Pay Rate shall continue during the Term until the Capital Raise occurs. Notwithstanding the foregoing, the Board can

elect to pay the Base Salary rate earlier than the foregoing in its sole discretion; |

| |

● |

an

annual bonus (paid out annually if targets are met), to be negotiated in January 2024, subject to approval by the Board; |

| |

|

|

| |

● |

Equity

incentive compensation, to be negotiated in 2024, subject to approval by the Board; and |

| |

● |

eligibility

to participate in a number of Company-sponsored benefit plans that may be in effect from time to time. |

The Restricted Stock granted to Mr. Bordes of 71,459 shares of the

Company’s restricted stock as an inducement material to Mr. Bordes entering into employment with the Company in accordance with

Nasdaq Listing Rule 5635(c)(4), which grant was made outside of a writing equity incentive plan.

Furthermore,

pursuant to the Bordes Agreement, in the event that the Bordes Agreement is terminated for a reason other than “cause” or

for “good reason,” Mr. Bordes, upon signing and returning an effective waiver and release of claims, shall be entitled to

receive: (i) separation payments in an aggregate amount of 3 months of his then-current base salary; and (ii) continuation of group health

continuation coverage under the Consolidated Omnibus Budget Reconciliation Act of 1986 (“COBRA”) at the Company’s expense

for a period of 3 months following the termination date.

The

foregoing summary of the terms of the Bordes Agreement does not purport to be complete, and is qualified in its entirety by reference

to the complete text of the Bordes Agreement, a copy of which is attached as Exhibit 10.1 to this Current Report and incorporated herein

by reference.

Item 7.01 Regulation FD Disclosure

On

December 11, 2023, the Company issued a press release announcing Mr. Bordes’ appointment as Chief Executive Officer of the

Company. A copy of that press release is furnished as Exhibit 99.1 hereto and incorporated herein by reference.

Exhibit

99.1 contains forward-looking statements. These forward-looking statements are not guarantees of future performance and involve risks,

uncertainties and assumptions that are difficult to predict. Forward-looking statements are based upon assumptions as to future events

that may not prove to be accurate. Actual outcomes and results may differ materially from what is expressed in these forward-looking

statements.

The

information set forth under Item 7.01 of this Current Report, including Exhibit 99.1 attached hereto, is being furnished and shall not

be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of such section.

The information in Item 7.01 of this Current Report, including Exhibit 99.1, shall not be incorporated by reference into any filing under

the Securities Act of 1933, as amended, or the Exchange Act, regardless of any incorporation by reference language in any such filing,

except as expressly set forth by specific reference in such a filing. This Current Report will not be deemed an admission as to the materiality

of any information in this Current Report that is required to be disclosed solely by Regulation FD.

Item 9.01.

Financial Statements and Exhibits.

The following

exhibits are filed herewith:

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

COLLECTIVE AUDIENCE, INC. |

| Dated: December 11, 2023 |

|

| |

|

| |

By: |

/s/

Peter Bordes |

| |

Name: |

Peter Bordes |

| |

Title: |

Chief Executive Officer |

Exhibit 10.1

December

5, 2023

Peter Bordes

_________________

_________________

Dear Peter:

This letter agreement (this “Agreement”)

is entered into between Peter Bordes (“you”) and Collective Audience, Inc., a Delaware corporation (the “Company”).

This Agreement shall be effective December 5, 2023. This Agreement confirms the current terms and conditions of your employment with the

Company. This Agreement supersedes all prior negotiations, representations or agreements between you and the Company, including any prior

consulting agreement, understanding or offer letter between you and the Company.

1. Duties

and Scope of Employment.

(a) Position.

For the term of your employment under this Agreement (your “Employment”), the Company agrees to employ you in the exempt

position of Chief Executive Officer. You will report to the Company’s Board of Directors (the “Board”). You will

be working out of the Company’s principal office, it also being understood that the Company may require you to perform business

travel to other locations from time to time in connection with the Company’s business. You will perform the duties and have the

responsibilities and authority customarily performed and held by an employee in your position or as otherwise may be assigned or delegated

to you by the Company.

(b) Obligations

to the Company. During the term of your Employment, you will devote your full business efforts and time to the Company. During your

Employment, you agree that you will not engage in any other employment, occupation, consulting, advisory or other business activity without

the prior written consent of the Company, nor will you engage in any other activities that conflict with your obligations to the Company,

it being understood that you will be permitted to devote a reasonable amount of time and effort to providing service to, or serving on

governing boards or committees of civic and/or charitable organizations, but only to the extent that such activities, individually or

taken as a whole, do not (A) require or involve your active participation in the management of any corporation, partnership or other entity,

or interfere with the execution of your duties under this Agreement; (B) otherwise violate any provision of this Agreement or the Confidentiality

Agreement (hereinafter defined), or (C) impair your ability to perform your duties to the Company. You shall comply with the Company’s

policies and rules, and the Employee Invention Assignment and Confidentiality Agreement (the “Confidentiality Agreement”),

as they may be in effect from time to time during your Employment.

(c) Term.

Your Employment term will be for a period for one (1) year (the “Initial Term”), subject to termination as set forth

in Section 4 below. Following the Initial Term, your Employment will automatically renew for successive one (1) year terms (the “Renewal

Terms” and, together with the Initial Term, the “Term”). Any contrary representations or prior agreements

that may have been made to you shall be superseded by this Agreement. This Agreement will constitute the full and complete agreement between

you and the Company as to your Employment, which may only be changed in an express written agreement signed by you and a duly authorized

officer of the Company. Except as otherwise herein expressly provided for, upon the termination of your employment, you will only be entitled

to the compensation and benefits earned and the reimbursements described in this Agreement for the period preceding the effective date

of the termination.

(d) Commencement

Date. Assuming your acceptance of this Agreement, as evidenced by your signature below, your full-time Employment will be deemed to

have commenced on December 5, 2023.

2. Compensation;

Business Expenses.

(a) Base

Wage. In this exempt position, the Company will pay you as compensation for your Employment a base salary at a gross annual rate of

$250,000 “Base Salary”, pro-rated for any partial year. Your annual base salary will be subject to review and adjustment based

upon the Company’s normal performance review practices. Notwithstanding the foregoing, for the first three (3) months of Employment,

the Base Salary shall be reduced to a $10,000 per month gross income rate (the “Initial Pay Rate”). In the event that,

before February 5, 2024, the Company raises an aggregate of $1,500,000 in gross proceeds in one or more transactions (a “Capital

Raise”), the Initial Pay Rate shall increase to the Base Salary gross annual rate, according to the Company’s standard

payroll procedures. In the event that the Capital Raise does not occur before February 5, 2024, then the Initial Pay Rate shall continue

during the Term until the Capital Raise occurs. Notwithstanding the foregoing, the Board can elect to pay the Base Salary rate earlier

than the foregoing in its sole discretion.

(b) Incentive

Compensation. At the discretion of the Board, starting with the 2024 fiscal year, you will be eligible to earn a discretionary, annual

end-of-year incentive bonus in an amount to be determined by the Board and you upon mutual agreement in January 2024. The exact amount

of the incentive bonus you may receive will be dependent on the achievement of Company milestones and profitability, and such other milestones

as the Board deems appropriate. Payment of your incentive bonus, if earned, will be paid to you as soon as practical following the end

of the calendar year, contingent upon final financial results from the prior year and Board approval of meeting performance objectives

whether plan or individual, and in any event, within 60 days therefrom. You will not earn any incentive bonus (including a prorated bonus)

if your employment terminates for any reason before December 31, for the year in question.

(c) Inducement

Grant. As an inducement for your employment, you will be issued 71,429 shares of restricted stock of the Company (the “Shares”).

All of the Shares shall initially be subject to a repurchase option in favor of the Company (the “Repurchase Option”),

which will lapse at the rate of 1/6th per month, commencing December 5, 2023, such that 100% of the shares of restricted stock will be

vested on June 5, 2024, subject to, in each instance, your continued employment with the Company. It is intended that the Shares are an

inducement material to your entry into employment within the meaning of Nasdaq Listing Rule 5635(c)(4).

(d) Equity

Compensation. At the discretion of the Board, starting with the 2024 fiscal year, you will be eligible to receive certain equity compensation

in an amount to be determined by the Board and you upon mutual agreement in 2024. Exact terms, structure are to be negotiated and any

vesting will, of course, depend on your continued employment with the Company.

(e) Business

Expenses. The Company will reimburse you for your necessary and reasonable business expenses incurred in connection with your duties

hereunder upon presentation of an itemized account and appropriate supporting documentation, all in accordance with the Company’s

generally applicable policies currently in effect or to be adopted after the date hereof, as may be amended from time to time.

3. Employee

Benefits. You will be eligible to participate in the employee benefit plans maintained by the Company and generally available to similarly

situated employees of the Company, subject in each case to the generally applicable terms and conditions of the plan in question and to

the determinations of any person or committee administering such plans. You will be eligible for health insurance provided by the Company.

These benefits, as well as all other potential benefit plans maintained by the Company, may change from time to time.

4. Termination

of this Agreement; Separation Benefits.

(a) Termination

of this Agreement. This Agreement and your employment with the Company shall terminate under any of the following conditions: (i)

your death; (ii) your Complete Disability; (iii) upon your receipt of written notice from the Company that your employment is being terminated

for Cause; (iv) upon thirty (30) days’ written notice from the Company that your employment is being terminated other than for Cause;

(v) upon thirty (30) days’ written notice by you that you are resigning from your employment with the Company; (vi) upon thirty

(30) days’ written notice by you that you are resigning from your employment with the Company for Good Reason.

(b) Separation

Benefits. You will be entitled to receive separation benefits upon termination of employment only as set forth in Section 4(b)(iv)

hereof; provided, however, that in the event you are entitled to any severance pay under a Company-sponsored severance pay plan, any such

severance pay to which you are entitled under such severance pay plan will reduce the amount of severance pay to which you are entitled

pursuant to Section 4(b)(iv) hereof. In all cases, upon termination of employment you will receive in a lump sum payment for all salary,

earned bonus (if any), and unused PTO accrued as of the date of your termination of employment.

(i) Voluntary

Resignation. If you voluntarily elect to terminate your employment with the Company (other than in the event of a termination by you

for Good Reason), you will not be entitled to any separation benefits.

(ii) Termination

for Cause. If the Company or any successor in interest terminates your employment for Cause (as defined below), you will not be entitled

to receive any separation benefits.

(iii) Termination

for Death or Complete Disability. If your employment with the Company is terminated as a result of your death or Complete Disability,

you will not be entitled to receive any separation benefits.

(iv) Involuntary

Termination. Subject to the provisions of Section 4(b)(iv) and Section 5 hereof, if there is an Involuntary Termination you will be

entitled to receive the following:

(A) Severance

Payment. The Company will pay you an amount equal to one-twelfth (1/12th) of your Base Salary for three (3) months (the “Severance

Period”), payable in accordance with the Company’s standard payroll procedures over the Severance Period if your then

Base Salary is then being paid in cash or, by issuance of restricted stock in accordance with Section 2 if your then Base Salary is then

being paid in restricted stock.

(B) Health

Insurance. Provided that you timely elect such coverage, the Company shall pay your group health continuation coverage under the Consolidated

Omnibus Budget Reconciliation Act of 1986 (“COBRA”) during the Severance Period; provided, however, that in the event

that you become eligible for group insurance coverage in connection with new employment, such COBRA premium payments by the Company shall

terminate immediately and, in furtherance thereof, you represent, warrant, covenant and agree to promptly, and in any event, within seven

(7) days therefrom, notify the Company of your new employment and eligibility for group insurance coverage related thereto.

(c) Definitions.

(i) “Cause”

means the occurrence of any of the following: (A) your conviction for, or plea of no contest to, a felony or a crime involving moral turpitude;

(B) your commission of an act of personal dishonesty that is intended to result in your personal enrichment (excluding inadvertent acts

that are promptly cured following notice); (C) a continued material failure or failures by you to perform your lawful and reasonable duties

of employment (including, but not limited to, compliance with material written policies of the Company and material written agreements

with the Company) (but only after the Company has delivered a written demand for performance to you that describes the basis for the Company’s

belief that you have committed material violations and you have not cured within a period of 15 days following notice); (D) your willful

failure (other than due to physical incapacity) to reasonably cooperate with any audit or investigation by a governmental authority or

the Company of the Company’s business or financial conditions or practices that continues after written notice from the Board and

at least fifteen (15) days to cure; (E) it is determined that you have conducted yourself in an unprofessional, unethical, illegal or

fraudulent manner, or have acted in a manner detrimental to the reputation, character or standing of the Company, or to the financial

condition of the Company, including, but not limited to theft or misappropriation of Company’s assets, engaging in unlawful discriminatory

or harassing conduct, working while under the influence of alcohol or illegal drugs, or the filing of false expense or related reports;

(F) a material breach of any of your fiduciary duties to the Company; (G) any willful, material violation by you of any law or regulation

applicable to the business of the Company; or (H) a material breach of any of the covenants, representations and warranties contained

herein.

(ii) “Complete

Disability” shall mean your inability to perform your duties under this Agreement, whether with or without reasonable accommodation,

by reason of any incapacity, physical or mental, which the Company, based upon medical advice or an opinion provided by a licensed physician

acceptable to the Company, determines to have incapacitated you from satisfactorily performing all of your usual services for the Company,

with or without reasonable accommodation, for a period of at least one hundred eighty (180) days during any twelve (12) month period (whether

or not consecutive). Based upon such medical advice or opinion, the determination of the Company shall be final and binding and the date

such determination is made shall be the date of such Complete Disability for purposes of this Agreement.

(iii) “Good

Reason” means the occurrence of one or more of the following (through a single action or series of actions) without your written

consent: (A) the assignment to you of any authority, duties or responsibilities or the reduction of your authority, duties or responsibilities,

either of which results in a material diminution in your authority, duties or responsibilities at the Company, unless you are provided

with a comparable position (i.e., a position of equal or greater organizational level, duties, authority and status); or (B) a material

reduction by the Company in your Base Salary, other than a one-time reduction that is applicable to substantially all other similarly-situated

executives.

An event or action will not

constitute Good Reason unless (1) you give the Company written notice within 30 days after you know or should know of the initial existence

of such event or action, (2) such event or action is not reversed, remedied or cured, as the case may be, by the Company as soon as possible

but in no event later than 30 days of receiving such written notice from you, and (3) you terminate employment within 30 days following

the end of the cure period.

(iv) “Involuntary

Termination” means a termination of your employment by the Company without Cause or you terminate your employment with the Company

for Good Reason.

5. Conditions

to Receipt of Severance or other Benefits Pursuant to this Agreement.

(a) Release

of Claims Agreement. Notwithstanding anything herein contained to the contrary, in order for you to receive any severance or other

benefits pursuant to Section 4(b) of this Agreement (the “Severance Benefits”), you will be required to sign and not

revoke a separation and release of claims agreement in a form reasonably satisfactory to the Company (the “Release”).

In all cases, the Release must become effective and irrevocable no later than the 60th day following your Involuntary Termination (the

“Release Deadline Date”). If the Release does not become effective and irrevocable by the Release Deadline Date, you

will forfeit any right to the Severance Benefits. In no event will the Severance Benefits be paid or provided until the Release becomes

effective and irrevocable.

(b) Section

409A.

(i) Notwithstanding

anything to the contrary in this Agreement, no Severance Benefits to be paid or provided to you, if any hereunder that, when considered

together with any other severance payments or separation benefits, are considered deferred compensation under Section 409A of the Internal

Revenue Code of 1986, as amended (the “Code”), and the final regulations and any guidance promulgated thereunder (“Section

409A”) (together, the “Deferred Payments”) will be paid or provided until you have a “separation from

service” within the meaning of Section 409A. Similarly, no Severance Benefits payable to you, if any, under this Agreement that

otherwise would be exempt from Section 409A pursuant to Treasury Regulation Section 1.409A-1(b)(9) will be payable until you have a “separation

from service” within the meaning of Section 409A.

(ii) It

is intended that none of the Severance Benefits will constitute Deferred Payments but rather will be exempt from Section 409A as a payment

that would fall within the “short-term deferral period” as described in Section 5(b)(iii) below or resulting from an involuntary

separation from service as described in Section 5(b)(iv) below. In no event will you have discretion to determine the taxable year of

payment of any Deferred Payment.

(iii) Notwithstanding

anything to the contrary in this Agreement, if you are a “specified employee” within the meaning of Section 409A at the time

of your separation from service (other than due to death), then the Deferred Payments, if any, that are payable within the first 6 months

following your separation from service, will become payable on the date 6 months and 1 day following the date of your separation from

service. All subsequent Deferred Payments, if any, will be payable in accordance with the payment schedule applicable to each payment

or benefit. Notwithstanding anything herein to the contrary, in the event of your death following your separation from service, but before

the 6 month anniversary of the separation from service, then any payments delayed in accordance with this paragraph will be payable in

a lump sum as soon as administratively practicable after the date of your death and all other Deferred Payments will be payable in accordance

with the payment schedule applicable to each payment or benefit. Each payment and benefit payable under this Agreement is intended to

constitute a separate payment under Section 1.409A-2(b)(2) of the Treasury Regulations.

(iv) Any

amount paid under this Agreement that satisfies the requirements of the “short-term deferral” rule set forth in Section 1.409A-1(b)(4)

of the Treasury Regulations will not constitute Deferred Payments for purposes of this Section 5.

(v) Any

amount paid under this Agreement that qualifies as a payment made as a result of an involuntary separation from service pursuant to Section

1.409A- 1(b)(9)(iii) of the Treasury Regulations that does not exceed the Section 409A Limit will not constitute Deferred Payments for

purposes of this Section 5.

(vi) The

foregoing provisions are intended to comply with or be exempt from the requirements of Section 409A so that none of the Severance Benefits

will be subject to the additional tax imposed under Section 409A, and any ambiguities herein will be interpreted to so comply or be exempt.

You and the Company agree to work together in good faith to consider amendments to this Agreement and to take such reasonable actions

which are necessary, appropriate or desirable to avoid imposition of any additional tax or income recognition prior to actual payment

to you under Section 409A. In no event will the Company reimburse you for any taxes that may be imposed on you as result of Section 409A.

6. Pre-Employment

Conditions.

(a) Confidentiality

Agreement. Your acceptance of this offer and commencement of employment with the Company is contingent upon the execution, and delivery

to an officer of the Company, of the Confidentiality Agreement, a copy of which is attached hereto as Attachment A for your review

and execution on or before December 5, 2023.

(b) Arbitration

Agreement. In the interest of speedy resolution of disputes, new employees are required to enter into a mutual agreement to arbitrate

claims, a copy of which is attached hereto as Attachment B (the “Arbitration Agreement”) for your review and

execution on or before December 5, 2023. Entering into the Arbitration Agreement is a condition of your employment with the Company. As

set forth in more detail in the Arbitration Agreement, you and the company agree to submit to mandatory binding arbitration for any and

all claims arising out of or related to your employment with the Company and your termination thereof, including but not limited to, claims

for unpaid wages, wrongful termination, torts, stock or stock options or other ownership interest in the Company and/or discrimination

(including harassment) based upon any federal, state or local ordinance, statute, regulation or constitutional provision. THE PARTIES

HEREBY WAIVE ANY RIGHTS THEY MAY HAVE TO TRIAL BY JURY IN REGARD TO SUCH CLAIMS.

(c) Right

to Work. For purposes of federal immigration law, you will be required to provide to the Company documentary evidence of your identity

and eligibility for employment in the United States. Such documentation must be provided to us within three (3) business days of December

5, 2023, or our employment relationship with you may be terminated.

(d) Verification

of Information. This offer of employment is also contingent upon the successful verification of the information you provided to the

Company during your application process, as well as a general background check performed by the Company to confirm your suitability for

employment. By accepting this offer of employment, you warrant that all information provided by you is true and correct to the best of

your knowledge, you agree to execute any and all documentation necessary for the Company to conduct a background check and you expressly

release the Company from any claim or cause of action arising out of the Company’s verification of such information.

7. Successors.

(a) Company’s

Successors. This Agreement shall be binding upon any successor (whether direct or indirect and whether by purchase, lease, merger,

consolidation, liquidation or otherwise) to all or substantially all of the Company’s business and/or assets. For all purposes under

this Agreement, the term “Company” shall include any successor to the Company’s business or assets that becomes

bound by this Agreement.

(b) Your

Successors. This Agreement and all of your rights hereunder shall inure to the benefit of, and be enforceable by, your personal or

legal representatives, executors, administrators, successors, heirs, distributees, devisees and legatees.

8. Miscellaneous.

(a) Notice.

All notices and other communications contemplated under this Agreement shall be in writing and shall be deemed to have been duly given,

made and received (i) when delivered personally; (ii) two (2) days following the day when deposited with a reputable, established overnight

courier service for delivery to the intended addressee, the first of which such delivery shall have been with signature required from

the recipient; (iii) five (5) days following the day when deposited with the United States Postal Service as first class, registered or

certified mail, postage prepaid; and (iv) by confirmed electronic (email) transmission or facsimile. In your case, mailed notices shall

be addressed to you at the home address that you most recently communicated to the Company in writing. In the case of the Company, mailed

notices shall be addressed to its corporate headquarters, and all notices shall be directed to the attention of the Board.

(b) Modifications

and Waivers. No provision of this Agreement shall be modified, waived or discharged unless the modification, waiver or discharge is

agreed to in writing and signed by you and by an authorized officer of the Company (other than you). No waiver by either party of any

breach of, or of compliance with, any condition or provision of this Agreement by the other party shall be considered a waiver of any

other condition or provision or of the same condition or provision at another time.

(c) Whole

Agreement. No other agreements, representations or understandings (whether oral or written and whether express or implied) which are

not expressly set forth in this Agreement have been made or entered into by either party with respect to the subject matter hereof. This

Agreement, the Inventions Agreement and the Arbitration Agreement contain the entire understanding of the parties with respect to the

subject matter hereof.

(d) Withholding

Taxes. All payments made under this Agreement shall be subject to reduction to reflect taxes or other charges required to be withheld

by law.

(e) Choice

of Law and Severability. This Agreement shall be interpreted in accordance with the laws of the State of New York without giving effect

to provisions governing the choice of law. If any provision of this Agreement becomes or is deemed invalid, illegal or unenforceable in

any applicable jurisdiction by reason of the scope, extent or duration of its coverage, then such provision shall be deemed amended to

the minimum extent necessary to conform to applicable law so as to be valid and enforceable or, if such provision cannot be so amended

without materially altering the intention of the parties, then such provision shall be stricken and the remainder of this Agreement shall

continue in full force and effect. If any provision of this Agreement is rendered illegal by any present or future statute, law, ordinance

or regulation (collectively, the “Law”) then that provision shall be curtailed or limited only to the minimum extent

necessary to bring the provision into compliance with the Law. All the other terms and provisions of this Agreement shall continue in

full force and effect without impairment or limitation.

(f) No

Assignment. This Agreement and all of your rights and obligations hereunder are personal to you and may not be transferred or assigned

by you at any time.

(g) Interpretation;

Construction. The headings set forth in this Agreement are for convenience of reference only and shall not be used in interpreting

this Agreement. This Agreement has been drafted by legal counsel to the Company, but you acknowledge your understanding that you have

been advised to consult with an attorney prior to executing this Agreement (and by your execution hereof, you acknowledge that you have

so consulted with an attorney of your choice or have knowingly and voluntarily waived such consultation), and the normal rule of construction

to the effect that any ambiguities are to be resolved against the drafting party will not be employed in the interpretation of this Agreement.

(h) Representations

and Warranties. You represent and warrant that you are not restricted or prohibited, contractually or otherwise, from entering into

and performing each of the terms and covenants contained in this Agreement, and that your execution and performance of this Agreement

will not violate or breach any other agreements between you and any other person or entity. You further represent and warrant that you

will not, during the term hereof, enter into any oral or written agreement in conflict with any of the provisions of this Agreement, the

agreements referenced herein and the Company’s policies.

(i) Return

of Company Property. Upon termination of this Agreement or earlier as requested by the Company, you shall deliver to the Company any

and all equipment, and, at the election of the Company, either deliver or destroy, and certify thereto, any and all drawings, notes, memoranda,

specifications, devices, formulas and documents, together with all copies, extracts and summaries thereof, and any other material containing

or disclosing any third-party information or proprietary information.

(j) Counterparts.

This Agreement may be executed in two (2) or more counterparts, each of which shall be deemed an original, but all of which together shall

constitute one and the same instrument. Counterparts may be delivered via facsimile, electronic mail (including pdf or any electronic

signature complying with the U.S. federal ESIGN Act of 2000, e.g., www.docusign.com) or other transmission method and any counterpart

so delivered shall be deemed to have been duly and validly delivered and be valid and effective for all purposes.

We are all delighted to be

able to extend you this offer and look forward to working with you. To indicate your acceptance of the Company’s offer, please sign

and date this letter in the space provided below and return it to me, along with a signed and dated original copy of the Confidentiality

Agreement and Arbitration Agreement, on or before December 5, 2023.

This Agreement, the Confidentiality

Agreement and Arbitration Agreement shall be executed and returned to the Company on or before 11:59 P.M. EST time on December 5, 2023

and, to the extent that the Company has not received the executed counterpart signature pages thereto on or before such date and time,

this offer shall be deemed withdrawn and shall expire.

Very truly yours,

COLLECTIVE AUDIENCE, Inc.

| By: |

/s/ Brent Suen |

|

| Name: |

Brent Suen, Chief Executive Officer |

|

ACCEPTED AND AGREED:

PETER BORDES

| /s/ Peter Bordes |

|

| Signature |

|

| |

|

| Date: |

|

|

9

Exhibit

99.1

Collective

Audience Appoints Technology Visionary, Investor, and Executive Leader, Peter Bordes, as Chief Executive Officer

New

York, NY, December 11, 2023 – Collective Audience, Inc. (Nasdaq: CAUD), a leading innovator of audience based performance advertising

and media solutions, has appointed Peter Bordes as chief executive officer, succeeding Brent Suen who will continue to serve on the board

of directors.

A

lifelong entrepreneur, operator and venture investor, Bordes brings to the company more than 30 years of executive and board experience

leading private and public companies across the AdTech, media, AI, fintech and technology sectors. His career and investing have focused

on innovation and disruptive technologies that drive digital transformation.

“I

have followed Peter’s career since the early 1990s, and over that time I’ve seen the AdTech industry evolved into a multi-billion-dollar

industry thanks to the visionary executive leadership and investments of pioneering individuals like Peter,” commented Suen. “I

have experienced Peter’s guidance and leadership on the executive, operational and board level to be unparalleled. This makes Peter

ideally suited to the new initiatives we are pursuing to build a full stack integrated platform, the acquisition of highly complementary

technologies, and the formation of key new partnerships. We are fortunate to have someone of Peter’s caliber to step into this

important role at this pivotal stage for Collective Audience.”

The

company’s recently appointed director, and noted digital media and technology executive, Elisabeth DeMarse, added: “As an

exceptionally well-known and highly respected leader in the advertising and technology communities, we anticipate Peter’s deep

industry relationships and connections to open doors to new business opportunities that will be transformative for both Collective Audience

and the partners and technology innovators we bring onto our platform.”

Bordes

has been ranked among the nation’s Top 100 most influential angel investors, and has funded and scaled numerous companies from

startup to fully operational, highly-successful organizations. He has also been a noted thought leader across multiple industry sectors,

including for the performance marketing industry as a founding member and former chairman of the Performance Marketing Association.

“On

behalf of the board and our shareholders, we would like to express our deepest appreciation for Brent’s unwavering drive and commitment

that successfully completed our business combination with Abri that secured our valuable Nasdaq listing,” stated Bordes. “The

listing has opened the door to a whole new world of exciting opportunities to build, innovate and disrupt.

“This

includes addressing a great unmet need for a next generation fully integrated end to end digital media and advertising platform that

solves the many challenges the industry faces, from the death of the cookie, the fragmentation between buyers, sellers and audience,

and walled gardens, to lack of liquidity, innovation and access to audience data. Our approach will bring together previously disparate

technologies as building blocks with uniquely powerful integrations. The integration and cross pollination has the potential to enable

exponential growth in a way not possible as stand-alone solutions— creating a ‘rising tide’ effect that increases

revenue across our audience-based ecosystem, and drives meaningful, enterprise value.

“Designed

as an open, interconnected, data driven, digital advertising and media ecosystem, it will uniquely eliminate many inefficiencies in the

digital ad buyer and seller process for brands, agencies and publishers. It will deliver long sought-after visibility, complementary

technology, and unique audience data that drives our focus on performance, brand reach, traffic and transactions. For the AdTech providers

and media buyers who come onto our platform, they will be able to leverage audience data as a new asset class, powered by AI as an intelligence

layer to guide decision making.

“As

a next generation audience-based performance advertising and media platform, we expect it to disrupt the traditional digital advertising,

media and consumer data business in ways previously unimagined. It will distinguish Collective Audience as a clear new leader in the

space.”

Peter

Bordes Bio

For

more than 30 years, Bordes has been an entrepreneur, senior executive, board member, and venture investor focused on disruptive innovation

in the areas of artificial intelligence, big data, fintech, cybersecurity, digital media and advertising, and next generation digital

infrastructure technology.

He

is the founder and managing partner of Trajectory Ventures, a venture capital platform comprised of operators, founders, and entrepreneurs

focused on advancing technology and industry innovation with investments in over 100 tech innovators. He is also founder and managing

partner of Trajectory Capital, a later-stage investing platform and private equity fund.

Through

Trajectory Ventures, he helped lead investments and exits for multiple disruptive companies, including:

| ● | TripleLift,

a global Adtech platform. |

| ● | Think-Realtime,

a first machine learning RTB platform for performance advertising that was acquired by Dealer.com. |

| ● | LocalMind,

a location-based information platform providing real-time answers for destination-related

queries that was acquired by AirBNB |

Bordes

is also co-founder and managing partner of TruVest, a next generation impact real estate investment, development, and technology company.

He

also served as CEO and a board member of Trajectory Alpha Acquisition (NYSE: TCOA), a special purpose acquisition corporation focused

on high growth innovative technology.

An

active angel investor and entrepreneur mentor, Bordes has been ranked among the Top 100 Most Influential Angel Investors in the U.S.

and social media.

He

currently serves as vice chairman of Ocearch.org, a non-profit world leader in scientific data related to tracking and biological studies

of keystone marine species, such as great white sharks. He is also chairman of Hoo.be, a leading platform for the creator economy.

His

other board directorships include:

| ● | Beasley

Broadcast Group (Nasdaq: BBGI), a public media and digital broadcast company providing music,

news, sports information and entertainment to over 20 million listeners from 63 stations

across the U.S. |

| ● | Fraud.net,

a leading AI powered collective intelligence fraud prevention, risk mitigation cloud infrastructure

platform for the real-time economy. |

| ● | BeeLine,

a fintech infrastructure platform transforming the mortgage and real estate finance industry

with embedded finance tools for real-time transactions. |

| ● | Fernhill

MainBloq (OTC: FERN), a modular cloud-based infrastructure platform for trading digital assets. |

| ● | GoLogiq,

Inc. (OTC: GOLQ), a U.S.-based global provider of fintech and consumer data analytics. |

| ● | Logiq,

Inc. (OTC: LGIQ), a U.S.-based advertising technology company and significant stockholder

of Collective Audience. |

| ● | MediaJel,

a transformative software platform with proprietary data tools and compliant MarTech solutions,

purpose-built to serve cannabis, CBD, and regulated brands worldwide. |

| ● | Board

of Trustees for New England College. |

Bordes

previously founded and served as founder, CEO and chairman of MediaTrust, the leading real-time performance marketing exchange. He led

the company from startup to being recognized as the 9th fastest growing company in the U.S. in 2009. He also founded and served as member

and chairman of the Performance Marketing Association, a non-profit trade association.

He

has contributed his technology insights to a number of publications, including the CNBC article, “A.I. can ‘Augment Humanity

in a Very Positive Way,’ says Family Office Investor Peter Bordes,” published on May 8.

Bordes

holds a bachelor’s degree in communication, business and media studies from New England College.

Inducement

Grants Under Nasdaq Listing Rule 5635(c)(4)

In

connection with the hiring of Peter Bordes, the compensation committee of Collective Audience’s board of directors issued to him

71,429 shares of restricted common stock of Collective Audience as an inducement material to his entering into employment with Collective

Audience in accordance with Nasdaq Listing Rule 5635(c)(4), which grant shall be made outside of any company equity incentive plan.

The

restricted stock will vest monthly over six months, commencing on the first completed calendar month after the date of issuance and subject

to the terms thereof. The vesting of shares of common stock underlying the restricted stock grant are subject to Bordes’ continuous

service with Collective Audience through each such vesting date.

About

Collective Audience

Collective

Audience is a U.S.-based provider of e-commerce and digital customer acquisition solutions that simplifies digital advertising. It provides

data-driven, end-to-end marketing through its results solutions or access to data for activating campaigns across multiple channels.

The

company’s digital marketing business includes a holistic, self-serve AdTech platform, a proprietary data-driven, AI-powered system

that enables brands and agencies to advertise across thousands of the world’s leading digital media and connected TV platforms.

To

learn more, visit collectiveaudience.co.

Important

Cautions Regarding Forward-Looking Statements

This

press release includes certain statements that are not historical facts but are forward-looking statements for purposes of the safe harbor

provisions under the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements generally are accompanied

by words such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,”

“intend,” “expect,” “should,” “would,” “plan,” “predict,” “potential,”

“seem,” “seek,” “future,” “outlook” and similar expressions that predict or indicate

future events or trends or that are not statements of historical matters. All statements, other than statements of present or historical

fact included in this press release, regarding the company’s future financial performance, as well as the company’s strategy,

future operations, estimated financial position, estimated revenues and losses, projected costs, prospects, plans and objectives of management

are forward-looking statements. These statements are based on various assumptions, whether or not identified in this press release, and

on the current expectations of the management of Collective Audience and are not predictions of actual performance. These forward-looking

statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on as, a guarantee, an

assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible

to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of Collective Audience. Potential

risks and uncertainties that could cause the actual results to differ materially from those expressed or implied by forward-looking statements

include, but are not limited to, changes in domestic and foreign business, market, financial, political and legal conditions; unanticipated

conditions that could adversely affect the company; the overall level of consumer demand for Collective Audience’s products/services;

general economic conditions and other factors affecting consumer confidence, preferences, and behavior; disruption and volatility in

the global currency, capital, and credit markets; the financial strength of Collective Audience’s customers; Collective Audience’s

ability to implement its business strategy; changes in governmental regulation, Collective Audience’s exposure to litigation claims

and other loss contingencies; disruptions and other impacts to Collective Audience’s business, as a result of the COVID-19 pandemic

and government actions and restrictive measures implemented in response; stability of Collective Audience’s suppliers, as well

as consumer demand for its products, in light of disease epidemics and health-related concerns such as the COVID-19 pandemic; the impact

that global climate change trends may have on Collective Audience and its suppliers and customers; Collective Audience’s ability

to protect patents, trademarks and other intellectual property rights; any breaches of, or interruptions in, Collective Audience’s

information systems; changes in tax laws and liabilities, legal, regulatory, political and economic risks. More information on potential

factors that could affect Collective Audience’s financial results is included from time to time in Collective Audience’s

public reports filed with the SEC. If any of these risks materialize or Collective Audience’s assumptions prove incorrect, actual

results could differ materially from the results implied by these forward-looking statements. There may be additional risks that Collective

Audience presently knows, or that Collective Audience currently believes are immaterial, that could also cause actual results to differ

from those contained in the forward-looking statements. In addition, forward-looking statements reflect Collective Audience’s expectations,

plans or forecasts of future events and views as of the date of this press release. Nothing in this press release should be regarded

as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated

results of such forward-looking statements will be achieved. Collective Audience anticipates that subsequent events and developments

will cause their assessments to change. However, while Collective Audience may elect to update these forward-looking statements at some

point in the future, Collective Audience specifically disclaims any obligation to do so, except as required by law. These forward-looking

statements should not be relied upon as representing Collective Audience’s assessments as of any date subsequent to the date of

this press release. Accordingly, undue reliance should not be placed upon the forward-looking statements.

Company

Contact:

Peter

Bordes, CEO

Collective Audience, Inc.

Email contact

Investor

Contact:

Ron Both or Grant Stude

CMA

Investor Relations

Tel (949) 432-7566

Email contact

Media

Contact:

Tim Randall

CMA

Media Relations

Tel (949) 432-7572

Email contact

v3.23.3

Cover

|

Dec. 05, 2023 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 05, 2023

|

| Entity File Number |

001-40723

|

| Entity Registrant Name |

COLLECTIVE

AUDIENCE, INC.

|

| Entity Central Index Key |

0001854583

|

| Entity Tax Identification Number |

86-2861807

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

85

Broad Street 16-079

|

| Entity Address, City or Town |

New

York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10004

|

| City Area Code |

808

|

| Local Phone Number |

829-1057

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Common Stock, par value $0.0001 per share |

|

| Title of 12(b) Security |

Common Stock, par value

$0.0001 per share

|

| Trading Symbol |

CAUD

|

| Security Exchange Name |

NASDAQ

|

| Warrants, each exercisable for one share of Common Stock for $11.50 per share |

|

| Title of 12(b) Security |

Warrants, each exercisable

for one share of Common Stock for $11.50 per share

|

| Trading Symbol |

CAUDW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=CAUD_CommonStockParValue0.0001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=CAUD_WarrantsEachExercisableForOneShareOfCommonStockFor11.50PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

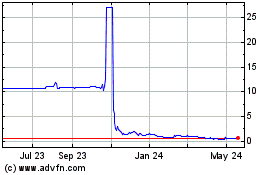

Collective Audience (NASDAQ:CAUD)

Historical Stock Chart

From Feb 2025 to Mar 2025

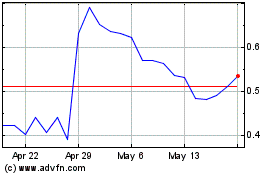

Collective Audience (NASDAQ:CAUD)

Historical Stock Chart

From Mar 2024 to Mar 2025