EMDA, a leading Israeli Proxy Advisor, backs Value Base at the Cognyte Software Limited (“Cognyte”) Shareholder Meeting

August 27 2024 - 7:00PM

Business Wire

EMDA Research, an Israeli based proxy advisor has advised their

institutional clients, to vote FOR Tal Yaacobi’s election

and AGAINST Chairman Earl Shanks’ re-election to the Board

at the Cognyte Software Ltd.’s (Nasdaq: CGNT) 2024 Annual Meeting

of Shareholders (the “Annual Meeting”), which is scheduled to be

held on September 4, 2024. EMDA has further recommended

shareholders vote AGAINST the Compensation Plan for the

CEO.

EMDA concluded that Mr. Yaacobi would strengthen the

independence of the company's board. EMDA opposed the re-election

of Chairman Earl Shanks, citing the company’s staggered board as

poor governance practice. EMDA’s emphasis on this point underscores

the importance of removing Chairman Shanks on September 4. Due to

the Cognyte’s staggered board structure, if Mr. Shanks were to be

elected on September 4, shareholders will not have an opportunity

to oppose Chairman Shanks’ re-election until 2027. As such, there

is an urgent need to replace him now before he can oversee any

further destruction in shareholder value.

Tal Yaacobi, Managing Partner of Value Base, was quoted as

saying “we welcome the decision of EMDA to back our voting

recommendations at the Cognyte shareholder Meeting. Change is

needed to stop the 75% decline in the share price that has occurred

during Chairman Shanks’ tenure on the Board and to replace

Cognyte’s CEO Compensation Plan with one that is aligned with

shareholders’ interests. We wish to remind all shareholders that

there is an opportunity only every 3 years to remove Chairman

Shanks, so your vote on this matter is urgently needed.”

Value Base Ltd. and its affiliates (collectively, “Value

Base”), own approximately 9.33% of the ordinary shares and the

largest shareholder of Cognyte urge shareholders to vote:

- FOR the election of Tal

Yaacobi to the Company’s board. - FOR the approval of

indemnification, liability insurance and compensation to Tal

Yaacobi as provided to all other directors. - AGAINST

reelection of Earl Shanks. - AGAINST the approval of

the CEO compensation plan.

Change is urgently needed, so vote today!

About Value Base: Value Base, managed by Victor Shamrich

and Ido Neuberger, is a leading investment banking group in Israel.

It offers a wide range of financial services and strategic

financial consulting under one roof. The group has special

expertise in capital markets with extensive experience in

initiating and managing complex transactions across various

industries. Value Base initiates and manages complex investment

transactions for its clients, oversees public and private

offerings, supports mergers and acquisitions transactions, and

represents leading international investment entities in Israel.

Additionally, the group owns an economic research company that

provides economic analyses to all institutional investors in

Israel.

Value Base Fund is a private investment fund established by the

Value Base group. The fund has already raised approximately $200

million and is expected to make equity investments in companies

amounting to over $250 million. The fund primarily targets

significant positions in publicly traded and private Israeli

companies with proven business models, working alongside their

management to enhance their value and achieve capital

appreciation.

Among the fund’s investors are leading Israeli institutional

investors, including Clal Insurance and Discount Capital, as well

as Value Base shareholders who have committed over $25 million of

their own capital into the fund.

Tal Yaacobi, the Managing Partner of Value Base Fund, has over

twenty years of experience in investment management and strategic

consulting. Tal previously served as a partner at Shamrock Israel

Growth Fund, an affiliate of the private investment company of the

Roy E. Disney family, where he led investments and value creation

in a range of Israeli companies, guiding them to successful exits

for the fund. Prior to that, he worked as a strategic consultant at

McKinsey in New York. Tal is a certified public accountant and

holds an MBA with distinction from Cornell University.

If shareholders have any questions, please contact our Proxy

Solicitor, Alliance Advisors at: Alliance Advisors 200 Broadacres

Drive, 3rd Floor Bloomfield, NJ 07003 Email:

CGNT@allianceadvisors.com

Special note regarding this

communication:

This communication is for informational purposes only and is not

a recommendation, an offer to purchase or a solicitation of an

offer to sell shares. This communication contains our current views

on the value of the Company’s shares and certain actions that the

Board may take to enhance the value of its shares. Our views are

based on our own analysis of publicly available information and

assumptions we believe to be reasonable. There can be no assurance

that the information we considered and analyzed is accurate or

complete. Similarly, there can be no assurance that our assumptions

are correct. The Company’s performance and results may differ

materially from our assumptions and analysis. Our views and our

holdings could change at any time. We may sell any or all of our

holdings or increase our holdings by purchasing additional shares.

We may take any of these or other actions regarding the

company without updating this communication or providing any notice

whatsoever of any such changes (except as otherwise required by

law).

Forward-looking Statements:

Certain statements contained in this communication are

forward-looking statements including, but not limited to,

statements that are predications of or indicate future events,

trends, plans or objectives. Undue reliance should not be placed on

such statements because, by their nature, they are subject to known

and unknown risks and uncertainties. Forward-looking statements are

not guarantees of future performance or activities and are subject

to many risks and uncertainties. Due to such risks and

uncertainties, actual events or results or actual performance may

differ materially from those reflected or contemplated in such

forward-looking statements. Forward-looking statements can be

identified by the use of the future tense or other forward-looking

words such as “believe,” “expect,” “anticipate,” “intend,” “plan,”

“estimate,” “should,” “may,” “will,” “objective,” “projection,”

“forecast,” “continue,” “strategy,” “position” or the negative of

those terms or other variations of them or by comparable

terminology. Important factors that could cause actual results to

differ materially from the expectations set forth in this

communication include, among other things, the factors identified

in the Company’s public filings. Such forward-looking statements

should therefore be construed in light of such factors, and we are

under no obligation, and expressly disclaim any intention or

obligation, to update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise,

except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240827756650/en/

Alliance Advisors 200 Broadacres Drive, 3rd Floor Bloomfield, NJ

07003 Email: CGNT@allianceadvisors.com

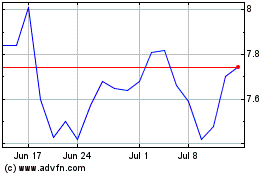

Cognyte Software (NASDAQ:CGNT)

Historical Stock Chart

From Jul 2024 to Aug 2024

Cognyte Software (NASDAQ:CGNT)

Historical Stock Chart

From Aug 2023 to Aug 2024