Cogent Biosciences, Inc. (Nasdaq: COGT), a biotechnology

company focused on developing precision therapies for genetically

defined diseases, today provided a business update and reported

financial results for the fourth quarter and full year of 2024.

“Cogent is preparing to report data from three bezuclastinib

pivotal clinical trials this year,” said Andrew Robbins, the

company’s President and Chief Executive Officer. “Given our strong

cash balance, and emerging pipeline of potential best-in-class

targeted therapies, we are poised for a transformational year

culminating with the planned submission of Cogent’s first NDA for

bezuclastinib by the end of 2025.”

Q4 2024 and Recent Business Highlights

- In December 2024, announced updated clinical results from

SUMMIT, showcasing dramatic symptomatic improvement in nonadvanced

systemic mastocytosis (NonAdvSM) patients and positive updated data

from the APEX trial evaluating bezuclastinib in patients with

advanced systemic mastocytosis (AdvSM) at the American Society of

Hematology (ASH) annual meeting. In both trials, bezuclastinib

continued to demonstrate an encouraging safety and tolerability

profile. Highlights include:

- In SUMMIT, a registration-directed, global, randomized,

placebo-controlled trial in patients with NonAdvSM, treatment with

100 mg bezuclastinib demonstrated:

- 56% mean improvement in Total Symptom Score (TSS) at 24 weeks

with 76% of patients achieving at least a >50% reduction from

baseline in TSS

- 89% of patients had >50% decrease in serum tryptase

levels by four weeks of treatment

- In APEX, a registration-directed, global, open-label trial in

patients with AdvSM, treatment with various doses of bezuclastinib

demonstrated:

- 52% ORR per mIWG criteria, including 83% ORR for patients

receiving 100 mg BID

- 88% ORR per PPR criteria, including 100% ORR for patients

receiving 100 mg BID

- 2.2 months median time-to-response with median

duration-of-response and median PFS not yet reached with at least

20 months follow-up

- In October 2024, announced the addition of a potent and

selective KRAS inhibitor to Cogent’s pipeline at the 2024

EORTC-NCI-AACR International Symposium on Molecular Targets and

Cancer Therapeutics.

- Cogent’s internally-developed pan-KRAS(ON) inhibitor

demonstrated picomolar (pM) activity across KRAS mutations with

selectivity over H/NRAS leading to potential advantages versus

other molecules in the class. Following oral administration,

CGT6737 demonstrated robust PK/PD and tumor growth inhibition with

90% PD inhibition in mouse xenograft models. Lead optimization of

the program is ongoing.

- In October 2024, shared progress on Cogent’s clinical candidate

CGT6297, a potent allosteric inhibitor of PI3Kα, with 25-fold

selectivity over PI3Kα WT. In a poster at the 2024 EORTC-NCI-AACR

International Symposium on Molecular Targets and Cancer

Therapeutics, CGT6297 showed high oral bioavailability and low

clearance across species, providing robust inhibition of downstream

signaling and efficacy in animal models. Importantly, when compared

to a clinically relevant dose of a currently approved therapy in a

mouse tumor model, CGT6297 demonstrated superior efficacy with no

increase in insulin.

Projected Near-Term Milestones

Bezuclastinib – Systemic Mastocytosis (SM)

- Poster presentation focused on symptomatic performance of

patients from SUMMIT Part 1 who have received 100 mg bezuclastinib

for at least 48 weeks at the 2025 American Academy of Allergy

Asthma & Immunology Annual Meeting (AAAAI).

- Report top-line results in July 2025 from the SUMMIT

trial.

- Report top-line results during the second half of 2025 from the

APEX trial.

- Submit the first bezuclastinib New Drug Application (NDA) by

the end of 2025.

Bezuclastinib – Gastrointestinal Stromal Tumors

(GIST)

- Report top-line results by the end of 2025 from the pivotal

Phase 3 PEAK trial. PEAK is a global, blinded, randomized clinical

trial studying the combination of bezuclastinib and sunitinib

versus sunitinib alone in patients with imatinib-resistant

gastrointestinal stromal tumors (GIST).

Bezuclastinib - Expanded Access Program

- In Q1, initiate Expanded Access Programs (EAP) in the U.S. for

SM and GIST patients to receive investigational bezuclastinib after

meeting certain eligibility criteria.

CGT4859 (FGFR2 inhibitor)

- Enroll patients in the ongoing Phase 1 trial with CGT4859, a

reversible, selective FGFR2 inhibitor in patients with documented

FGFR mutations, including advanced cholangiocarcinoma. The trial is

designed to explore the safety, tolerability and clinical activity

of escalating doses of CGT4859 with a goal of selecting an active

and well-tolerated dose for further clinical investigation.

Preclinical Pipeline

- Submit an IND application in 2025 for CGT4255, a potent,

selective ErbB2 inhibitor, highlighted by potential best-in-class

brain-penetrant properties.

- Submit an IND application in 2025 for CGT6297, a potent

allosteric inhibitor of PI3Kα, with 25-fold selectivity over PI3Kα

WT.

Upcoming Investor Conference

- Leerink Healthcare Conference on Wednesday, March 12 at 10:00

a.m. ET.

- A live webcast can be accessed on the Investors & Media

page of Cogent’s website at investors.cogentbio.com/events. A

replay will be available approximately two hours after completion

of the event and will be archived for up to 30 days.

Fourth Quarter and Full Year 2024 Financial

Results

Cash and Cash Equivalents: As of December

31, 2024, Cogent had cash, cash equivalents and marketable

securities of $287.1 million. Cogent believes this year-end

balance, together with the $25.0 million gross proceeds from shares

sold under the Company’s at-the-market (ATM) stock offering in

February 2025, will be sufficient to fund its operating expenses

and capital expenditure requirements into late 2026, including

through clinical readouts from the ongoing SUMMIT, PEAK and APEX

registration-directed trials.

R&D Expenses: Research and development

expenses were $62.0 million for the fourth quarter of 2024 and

$232.7 million for the year ended December 31, 2024, as compared to

$48.7 million for the fourth quarter of 2023 and $173.8 million for

the year ended December 31, 2023. The increase was driven by

the development of bezuclastinib, including costs associated with

the accelerated completion of enrollment of the SUMMIT and PEAK

trials and ongoing cost of the APEX trial, and the continued

progression of our research pipeline. R&D expenses

include non-cash stock compensation expense of $5.0 million for the

fourth quarter of 2024 and $19.0 million for the year ended

December 31, 2024, as compared to $4.1 million for the fourth

quarter of 2023 and $14.6 million for the year ended December 31,

2023.

G&A Expenses: General and

administrative expenses were $11.7 million for the fourth quarter

of 2024 and $43.3 million for the year ended December 31, 2024, as

compared to $9.5 million for the fourth quarter of 2023 and $34.4

million for the year ended December 31, 2023. The increase was

primarily due to the growth of the organization. G&A expenses

include non-cash stock compensation expense of $5.0 million for the

fourth quarter of 2024 and $20.8 million for the year ended

December 31, 2024, as compared to $4.8 million for the fourth

quarter of 2023 and $16.0 million for the year ended December 31,

2023.

Net Loss: Net loss was $67.9 million for

the fourth quarter of 2024 and $255.9 million for the year ended

December 31, 2024, as compared to a net loss of $54.4 million for

the fourth quarter of 2023 and $192.4 million for the year ended

December 31, 2023.

Inducement Grants Under Nasdaq Listing Rule

5635(c)(4) Cogent also announced today that, on

February 12, 2025 and February 24, 2025, the Compensation Committee

of Cogent’s Board of Directors, made up entirely of independent

directors, approved the grants of “inducement” equity awards to

five new employees under the company’s 2020 Inducement Plan with

grant dates of February 12, 2025, February 19, 2025 and February

24, 2025. The awards were approved in accordance with Listing Rule

5635(c)(4) of the corporate governance rules of the Nasdaq Stock

Market. The employees received, in the aggregate, nonqualified

options to purchase 78,500 shares of Cogent common stock. Each

option has a 10-year term, an exercise price equal to the closing

price of Cogent’s common stock on the grant date, and a 4-year

vesting schedule with 25% vesting on the 1-year anniversary of the

grant date and the remainder vesting in equal monthly installments

over the subsequent 36 months, provided such employee remains

employed through each such vesting date.

About Cogent Biosciences, Inc. Cogent

Biosciences is a biotechnology company focused on developing

precision therapies for genetically defined diseases. The most

advanced clinical program, bezuclastinib, is a selective tyrosine

kinase inhibitor that is designed to potently inhibit the KIT D816V

mutation as well as other mutations in KIT exon 17. KIT D816V is

responsible for driving systemic mastocytosis, a serious disease

caused by unchecked proliferation of mast cells. Exon 17 mutations

are also found in patients with advanced gastrointestinal stromal

tumors (GIST), a type of cancer with strong dependence on oncogenic

KIT signaling. The company also has an ongoing Phase 1 study of its

novel internally discovered FGFR2 inhibitor. In addition, the

Cogent Research Team is developing a portfolio of novel targeted

therapies to help patients fighting serious, genetically driven

diseases targeting mutations in ErbB2, PI3Kα and KRAS. Cogent

Biosciences is based in Waltham, MA and Boulder, CO. Visit our

website for more information at www.cogentbio.com. Follow Cogent

Biosciences on social media: X (formerly known as

Twitter) and LinkedIn. Information that may be important

to investors will be routinely posted on our website and X.

Forward Looking StatementsThis press release

contains forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995, including, but

not limited to, statements regarding: the expectation to report

SUMMIT top-line results in July 2025; the expectation to report

APEX top-line results in the second half of 2025; the expectation

to report PEAK top-line results by the end of 2025; ; the company’s

anticipated cash runway into late 2026; the planned submission of

Cogent’s first NDA for bezuclastinib by the end of 2025; the

potential best-in-class attributes of the company’s pipeline

programs; plans to initiate Expanded Access Programs in the first

quarter of 2025 in the United States for SM and GIST patients to

receive investigational bezuclastinib after meeting certain

eligibility criteria; and plans to submit INDs in 2025 for the

company’s ErbB2 and PI3Kα programs. The use of words such as, but

not limited to, “anticipate,” “believe,” “continue,” “could,”

“estimate,” “expect,” “intend,” “may,” “might,” “plan,”

“potential,” “predict,” “project,” “should,” “target,” “will,” or

“would” and similar words or expressions are intended to identify

forward-looking statements. Forward-looking statements are neither

historical facts nor assurances of future performance. Instead,

they are based on our current beliefs, expectations and assumptions

regarding the future of our business, future plans and strategies,

our clinical results, the rate of enrollment in our clinical trials

and other future conditions. New risks and uncertainties may emerge

from time to time, and it is not possible to predict all risks and

uncertainties. No representations or warranties (expressed or

implied) are made about the accuracy of any such forward-looking

statements. We may not actually achieve the forecasts or milestones

disclosed in our forward-looking statements, and you should not

place undue reliance on our forward-looking statements. Such

forward-looking statements are subject to a number of material

risks and uncertainties including but not limited to those set

forth under the caption “Risk Factors” in Cogent’s most recent

Quarterly Report on Form 10-Q filed with the SEC. Any

forward-looking statement speaks only as of the date on which it

was made. Neither we, nor our affiliates, advisors or

representatives, undertake any obligation to publicly update or

revise any forward-looking statement, whether as result of new

information, future events or otherwise, except as required by law.

These forward-looking statements should not be relied upon as

representing our views as of any date the date hereof.

|

COGENT BIOSCIENCES, INC.CONSOLIDATED

STATEMENTS OF OPERATIONS(in thousands)(unaudited) |

|

|

|

|

Three Months Ended December 31, |

|

|

Year Ended December 31, |

|

|

|

2024 |

|

|

2023 |

|

|

|

2024 |

|

|

2023 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

$ |

62,045 |

|

|

$ |

48,719 |

|

|

|

$ |

232,658 |

|

|

$ |

173,755 |

|

|

General and administrative |

|

11,689 |

|

|

|

9,509 |

|

|

|

|

43,281 |

|

|

|

34,375 |

|

|

Total operating expenses |

|

73,734 |

|

|

|

58,228 |

|

|

|

|

275,939 |

|

|

|

208,130 |

|

| Loss from operations |

|

(73,734 |

) |

|

|

(58,228 |

) |

|

|

|

(275,939 |

) |

|

|

(208,130 |

) |

| Other income: |

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

3,859 |

|

|

|

3,870 |

|

|

|

|

18,088 |

|

|

|

13,077 |

|

|

Other income, net |

|

1,948 |

|

|

|

(7 |

) |

|

|

|

1,992 |

|

|

|

943 |

|

|

Change in fair value of CVR liability |

|

-- |

|

|

|

-- |

|

|

|

|

-- |

|

|

|

1,700 |

|

|

Total other income, net |

|

5,807 |

|

|

|

3,863 |

|

|

|

|

20,080 |

|

|

|

15,720 |

|

| Net loss |

$ |

(67,927 |

) |

|

$ |

(54,365 |

) |

|

|

$ |

(255,859 |

) |

|

$ |

(192,410 |

) |

| |

|

COGENT BIOSCIENCES, INC.SELECTED

CONSOLIDATED BALANCE SHEET DATA(in

thousands)(unaudited) |

| |

|

December 31, |

|

|

December 31, |

|

| |

|

2024 |

|

|

2023 |

|

|

Cash, cash equivalents and marketable securities |

|

$ |

287,077 |

|

|

$ |

273,170 |

|

| Working capital |

|

$ |

240,762 |

|

|

$ |

232,603 |

|

| Total assets |

|

$ |

327,898 |

|

|

$ |

313,437 |

|

| Total liabilities |

|

$ |

71,612 |

|

|

$ |

55,635 |

|

| Total stockholders’

equity |

|

$ |

256,286 |

|

|

$ |

257,802 |

|

| |

Contact: Christi Waarich Senior Director,

Investor Relationschristi.waarich@cogentbio.com617-830-1653

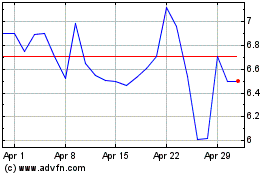

Cogent Biosciences (NASDAQ:COGT)

Historical Stock Chart

From Feb 2025 to Mar 2025

Cogent Biosciences (NASDAQ:COGT)

Historical Stock Chart

From Mar 2024 to Mar 2025