As

filed with the Securities and Exchange Commission on July 29, 2020

Registration

No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S-3

REGISTRATION

STATEMENT

UNDER THE SECURITIES ACT OF 1933

|

|

|

|

|

|

|

|

|

|

|

|

CODORUS

VALLEY BANCORP, INC.

(Exact

name of registrant as specified in its charter)

|

Pennsylvania

(State or other jurisdiction of incorporation

or organization)

|

23-2428543

(IRS Employer Identification Number)

|

|

105 Leader

Heights Road

P.O.

Box 2887

York,

PA 17405

(717)

747-1519

|

|

(Address,

including zip code, and telephone number, including area code, of registrant’s principal executive

offices)

|

|

Larry J.

Miller

Chairman,

President and Chief Executive Officer

105 Leader

Heights Road

P.O.

Box 2887

York,

PA 17405

(717)

747-1519

|

With

Copies To:

Charles J.

Ferry, Esq.

Stevens &

Lee, P.C.

17

North Second Street, 16th Floor

Harrisburg,

PA 17101

(717)

255-7380

|

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Approximate

date of commencement of proposed sale to the public: From time to time after the Registration Statement becomes effective.

If

the only securities being registered on this form are being offered pursuant to dividend or interest reinvestment plans, please

check the following box. ☒

If

any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415

under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans,

check the following box. ☐

If

this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please

check the following box and list the Securities Act registration statement number of earlier effective registration statement

for the same offering. ☐

If

this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and

list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become

effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register

additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following

box. ☐

Indicate

by check mark whether the registration is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller

reporting company, or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated

filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange

Act.

|

|

Large

accelerated filer ☐

|

Accelerated

filer ☒

|

|

|

Non-accelerated

filer ☐

|

Smaller

reporting company ☒

|

|

|

|

Emerging growth

company ☐

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities

Act. ☐

CALCULATION

OF REGISTRATION FEE

|

Title

of Each Class of Securities to be Registered

|

Amount

to be

Registered(1)

|

Proposed

Maximum Offering Share Price (2)

|

Proposed

Maximum Aggregate Offering Price (2)

|

Amount

of

Registration Fee

|

|

Common

Stock, $2.50 par value

|

250,000

shares

|

$12.75

|

$3,187,500.00

|

$413.74

|

|

(1) On

July 14, 2020, the board of directors authorized the issuance of an additional 250,000 shares under the Plan. The

shares being registered hereby do not include shares of common stock previously registered on Registration Statement No.

333-179179 on Form S-3.

(2) Estimated

solely for the purpose of determining the registration fee in accordance with Rule 457(c). Based upon

the average of the high and low price, as reported by NASDAQ, as of July 24, 2020.

|

PROSPECTUS

CODORUS

VALLEY BANCORP, INC.

Dividend Reinvestment and Stock Purchase Plan

Cusip

No. 192025 10 4

250,000

Shares of Common Stock

$2.50 Par Value

This

Prospectus relates to 250,000 shares of the $2.50 par value common stock of Codorus Valley Bancorp, Inc. (“Codorus Valley”

or the “Corporation”) which may be issued under the Codorus Valley Bancorp, Inc. Dividend Reinvestment and Stock Purchase

Plan (the “Plan”) which Plan was adopted on February 25, 1992, and amended on December 16, 1994, January 12,

1999, July 23, 2004, January 26, 2012 and July 14, 2020.

The

Plan provides shareholders of the Corporation’s common stock with a simple and convenient method of investing cash dividends

in additional shares of common stock. Shareholders who elect to enroll in the Plan (“participants”) will, if they

so desire, direct any cash dividends paid on their shares of common stock toward automatic investment in additional shares of

common stock. The Plan also provides each participant with a convenient and economical way to voluntarily purchase additional

shares of common stock within the limitations provided in the Plan.

Shares

acquired for the Plan will be purchased in the open market, in negotiated transactions or from the Corporation. The purchase price

of shares purchased from the Corporation will be the fair market value per share, as defined, at the purchase date. As of July 24,

2020, the market price of the Corporation’s common stock was $12.75. The purchase price of shares purchased in the

open market or in negotiated transactions will be the price paid for the shares, excluding all fees, brokerage commissions and

expenses. Shareholders who do not elect to participate in the Plan will receive dividends, as declared and paid, by check.

The

Corporation is listed on the NASDAQ Global Market under the symbol “CVLY.”

Reference

is made to the “Explanation of Dividend Reinvestment and Stock Purchase Plan” section, which is considered part of

this Prospectus, for further information on the Plan.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or

passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

See

“Risk Factors” beginning on page 1 for a discussion of various factors that shareholders should consider about

an investment in our common stock.

The

date of this Prospectus is July 29, 2020.

TABLE

OF CONTENTS

PROSPECTUS

SUMMARY

The

Corporation

Codorus

Valley Bancorp, Inc. (“Codorus Valley” or the “Corporation”), a Pennsylvania business corporation, is

a bank holding company registered with and supervised by the Board of Governors of the Federal Reserve System. The Corporation

was formed in 1986 for the purpose of becoming the parent holding company of PeoplesBank, A Codorus Valley Company, formerly named

Peoples Bank of Glen Rock (“PeoplesBank” or the “Bank”). The formation was effective March 2, 1987.

The Bank, a state-chartered institution, is a full service commercial bank and provides a wide range of services to individuals

and small to medium-sized businesses in its York County, Pennsylvania and northern Maryland market areas.

The

principal executive offices of the Corporation are located at Codorus Valley Corporate Center, 105 Leader Heights Road, P.O.

Box 2887, York, Pennsylvania 17405-2887. The telephone number of the Corporation is (717) 747-1519.

The

Offering; The Plan; Use of Proceeds

The

securities offered hereby are a maximum of 250,000 shares of the Corporation’s common stock, par value $2.50 per share.

The purpose of the offering is to provide holders of the Corporation’s common stock with a simple and convenient method

of investing cash dividends and voluntary cash payments in additional shares of common stock, without incurring brokerage commissions,

through the Corporation's Dividend Reinvestment and Stock Purchase Plan (the “Plan”).

Detailed

information concerning the Plan is provided under “Explanation of the Dividend Reinvestment and Stock Purchase Plan,”

which should be reviewed carefully.

Shares

may be acquired for issuance pursuant to the Plan through open market purchases, through negotiated transactions or from the Corporation.

Open market purchases will be made by an independent purchasing agent retained to act as agent for Plan participants, and the

purchase price to participants will be the actual price paid, excluding brokerage commissions and other expenses, which commissions

and expenses will be paid by the Corporation. The Corporation will receive none of the proceeds from shares acquired for issuance

pursuant to the Plan unless the acquisitions involve the purchase of shares from the Corporation. To the extent any shares are

purchased from the Corporation, the proceeds of such sales will be added to the general funds of the Corporation and will be available

for its general corporate purposes, including working capital requirements and contributions to the Corporation's banking subsidiary

to support its anticipated growth and expansion.

RISK

FACTORS

The

purpose of the Plan is to provide a simple and convenient method of investing cash dividends in additional shares of common stock.

Nothing in this Prospectus represents a recommendation by the Corporation or anyone else that a person buy or sell the Corporation’s

common stock. We urge you to read this Prospectus thoroughly before you make your investment decision regarding participation

in the plan.

Before

investing in the Corporation’s common stock, you should be aware that an investment in our common stock involves a variety

of risks, including those described below. You should carefully read and consider the risks described below, in addition to the

other information contained in this Prospectus and in our other filings with the SEC, before you decide whether to purchase Codorus

Valley common stock. Unless the context otherwise requires, references to “we,” “us,” “our,”

“Codorus Valley Bancorp, Inc.,” “Codorus Valley” or the “Corporation” refer to Codorus Valley

Bancorp, Inc. and its direct or indirect owned subsidiaries, and references to the “Bank” refer to PeoplesBank, a

Codorus Valley Company, the wholly-owned banking subsidiary of the Corporation.

The

risks and uncertainties described below are not the only ones facing the Corporation. Additional risks and uncertainties that

we are not aware of or focused on, or that we currently deem immaterial, may also impact our business and results of operations.

If any of these known or unknown risks or uncertainties actually occurs, our business, financial condition and results of operations

could be materially and adversely affected. If this were to happen, the market price of our common stock could decline significantly,

and you could lose all or part of your investment.

The

effect of COVID-19 and related events could have a negative effect on the Corporation's business prospects, financial condition

and results of operations.

In

December 2019, a coronavirus (COVID-19) was reported in China, and, in March 2020, the World Health Organization declared

it a pandemic. Since first being reported in China, the coronavirus has spread to additional countries including the United

States.

On March 13, 2020, President Trump declared the ongoing COVID–19 pandemic of sufficient severity and magnitude to warrant

an emergency declaration for all states, territories, and the District of Columbia.

In

response, many state and local governments, including the Commonwealth of Pennsylvania and the State of Maryland, have instituted

emergency restrictions that have substantially limited the operation of non-essential businesses and the activities of individuals.

It has been widely reported that these restrictions have resulted in significant adverse effects for many different types of businesses,

particularly those in the travel, hospitality and food and beverage industries, among many others, and has resulted in a significant

number of layoffs and furloughs of employees nationwide and in the regions in which the Corporation operates. The ultimate effect

of COVID-19 on the local or broader economy is not known nor is the ultimate length of the restrictions described and any accompanying

effects. Moreover, the Federal Reserve has taken action to lower the Federal Funds rate, which may negatively affect interest

income and, therefore, earnings. Given the ongoing and dynamic nature of the circumstances, it is difficult to predict the impact

of the coronavirus outbreak, and there is no guarantee that the Corporation’s efforts to address the adverse impacts of

the coronavirus will be effective. The extent of such impact will depend on future developments, which are highly uncertain and

cannot be predicted, including new information which may emerge concerning the severity of the coronavirus and actions taken to

contain the coronavirus or its impact, among others.

The

effect of COVID-19 and related events, including those described above and those not yet known or knowable, could have a negative

effect on the Corporation's business prospects, financial condition and results of operations, as a result of quarantines; market

volatility; market downturns; changes in consumer behavior; business closures; deterioration in the credit quality of borrowers

or the inability of borrowers to satisfy their obligations (and any related forbearances or restructurings that may be implemented);

changes in the value of collateral securing outstanding loans; changes in the value of the investment securities portfolio; effects

on key employees, including operational management personnel and those charged with preparing, monitoring and evaluating the Corporation's

financial reporting and internal controls; declines in the demand for loans and other banking services and products; declines

in demand resulting from adverse impacts of the disease on businesses deemed to be "non-essential" by governments; and

branch or office closures and business interruptions.

Risks

Related to Our Business and Industry

Weakness

in the economy may materially adversely affect our business and results of operations.

Our

results of operations are materially affected by conditions in the economy generally, which continue to be uncertain and include

uneven economic growth, accompanied by low interest rates. Dramatic declines in the housing market following the 2008 financial

crisis, with falling home prices and increasing foreclosures and unemployment, resulted in significant write-downs of asset values

by financial institutions. While conditions have improved, a return to a recessionary or excessive inflationary economy could

result in financial stress on our borrowers that would adversely affect consumer confidence, a reduction in general business activity

and increased market volatility. The resulting economic pressure on consumers and businesses and the lack of confidence in the

financial markets could adversely affect our business, financial condition, results of operations and stock price. Our ability

to properly assess the creditworthiness of our clients and to estimate the losses inherent in our credit exposure would be made

more complex by these difficult market and economic conditions. Accordingly, if market conditions worsen, we may experience increases

in foreclosures, delinquencies, write-offs and client bankruptcies, as well as more restricted access to funds.

Deterioration

in our local and regional economy or real estate market may adversely affect our business.

Substantially

all of our business is with clients located within South Central Pennsylvania, principally York and Lancaster Counties and North

Central Maryland, principally Harford County, Baltimore County and Baltimore City. As a result of this geographic concentration,

our results depend largely on economic conditions in these and surrounding areas. Deterioration in economic conditions in these

markets could:

|

|

●

|

increase

loan delinquencies;

|

|

|

●

|

increase

problem assets and foreclosures;

|

|

|

●

|

increase

claims and lawsuits;

|

|

|

●

|

decrease

the demand for our products and services; and

|

|

|

●

|

decrease

the value of collateral for loans, especially real estate, in turn reducing clients’

borrowing power, the value of assets associated with nonperforming loans and collateral

coverage.

|

Generally,

we make loans to small and mid-sized businesses whose success depends on the regional economy. These businesses generally have

fewer financial resources in terms of capital or borrowing capacity than larger entities. Adverse economic and business conditions

in our market area could reduce our growth rate, affect our borrowers’ ability to repay their loans and, consequently, adversely

affect our financial condition and performance. For example, we place substantial reliance on real estate as collateral for our

loan portfolio. A sharp downturn in real estate values in our market area could leave many of our loans inadequately collateralized.

If we are required to liquidate the collateral securing a loan to satisfy the debt during a period of reduced real estate values,

our earnings could be adversely affected.

If

our allowance for loan and lease losses is not sufficient to cover actual loan and lease losses, our earnings would decrease.

We

are exposed to the risk that our borrowers may default on their obligations. To absorb probable, incurred loan and lease losses

that we may realize, we recognize an allowance for loan and lease losses based on, among other things, national and regional economic

conditions, historical loss experience, and delinquency trends. However, we cannot estimate loan and lease losses with certainty,

and we cannot assure you that charge-offs in future periods will not exceed the allowance for loan and lease losses. If charge-offs

exceed our allowance, our earnings would decrease. In addition, regulatory agencies, as an integral part of their examination

process, review our allowance for loan and lease losses and may require additions to the allowance based on their judgment about

information available to them at the time of their examination. Factors that require an increase in our allowance for loan and

lease losses, such as a prolonged economic downturn or continued weakening in general economic conditions such as inflation, recession,

unemployment or other factors beyond our control, could reduce our earnings.

Our

exposure to credit risk, which is heightened by our focus on commercial lending, could adversely affect our earnings and financial

condition.

There

are certain risks inherent in making loans. These risks include interest rate changes over the time period in which loans may

be repaid, risks resulting from changes in the economy, risks inherent in dealing with borrowers and, in the case of a loan backed

by collateral, risks resulting from uncertainties about the future value of the collateral if a disposition is necessary.

Commercial

loans, including commercial real estate, are generally viewed as having a higher credit risk than residential real estate or consumer

loans because they usually involve larger loan balances to a single borrower and are more susceptible to a risk of default during

an economic downturn. Our consolidated commercial lending operations include commercial, financial and agricultural lending, real

estate construction lending, and commercial mortgage lending. Construction financing typically involves a higher degree of credit

risk than commercial mortgage lending. Risk of loss on a construction loan depends largely on the accuracy of the initial estimate

of the property’s value at completion of construction compared to the estimated cost (including interest) of construction.

If the estimated property value proves to be inaccurate, the loan may be inadequately collateralized.

Because

our loan portfolio contains a significant number of commercial real estate, commercial and industrial loans, and construction

loans, the deterioration of these loans may cause a significant increase in nonperforming loans. An increase in nonperforming

loans could cause an increase in loan related legal fees and expenses, loan charge-offs and a corresponding increase in the provision

for loan losses, which could adversely impact our financial condition and results of operations.

We

depend primarily on net interest income for our earnings, and changes in interest rates could adversely impact our financial condition

and results of operations.

Our

ability to make a profit, like that of most financial institutions, substantially depends upon our net interest income, which

is the difference between the interest income earned on interest earning assets, such as loans and investment securities, and

the interest expense paid on interest-bearing liabilities, such as deposits and borrowings. Changes in interest rates can increase

or reduce net interest income and net income.

Different

types of assets and liabilities may react differently, and at different times, to changes in market interest rates. When interest-bearing

liabilities mature or reprice more quickly than interest-earning assets in a period, an increase in market rates of interest could

reduce net interest income. When interest-earning assets mature or reprice more quickly than interest-bearing liabilities, falling

interest rates could reduce net interest income. Changes in market interest rates are affected by many factors beyond our control,

including inflation, unemployment, money supply, international events, and events in the United States and other financial markets.

We

attempt to manage risk from changes in market interest rates, in part, by controlling the mix of interest rate sensitive assets

and interest rate sensitive liabilities. However, interest rate risk management techniques are not exact and a rapid increase

or decrease in interest rates could adversely affect our financial performance. In the event that one or more of these factors

were to result

in a decrease in our net interest income, we do not have significant sources of fee income to make up for decreases

in net interest income.

The

planned phasing out of LIBOR as a financial benchmark presents risks to the financial instruments originated or held by the Corporation.

The

London Interbank Offered Rate (“LIBOR”) is the reference rate used for many of the Corporation’s transactions,

including variable and adjustable rate loans and borrowings. However, a reduced volume of interbank unsecured term borrowing,

coupled with recent legal and regulatory proceedings related to rate manipulation by certain financial institutions, has led to

international reconsideration of LIBOR as a financial benchmark. The United Kingdom Financial Conduct Authority (“FCA”),

which regulates the process for establishing LIBOR, announced in July 2017 that the sustainability of LIBOR cannot be guaranteed.

Accordingly, the FCA intends to stop persuading, or compelling, banks to submit rates for the calculation of LIBOR after 2021.

Regulators,

industry groups and certain communities (e.g., the Alternative Reference Rates Committee) have, among other things, published

recommended fallback language LIBOR-linked financial instruments, identified recommended alternatives for certain LIBOR rates

(e.g., the Secured Overnight Financing Rate as the recommended alternative to U.S. Dollar LIBOR), and proposed implementations

of the recommended alternatives in floating rate instruments. At this time, it is not possible to predict whether these recommendations

and proposals will be broadly accepted, whether they will continue to evolve, and what the effect of their implantation may be

on the markets for floating rate financial instruments. The uncertainty surrounding potential reforms, including the use of alternative

reference rates and changes to the methods and processes used to calculate rates, may have an adverse effect on the trading market

for LIBOR-based securities, loan yields, and the amount received and paid on derivative contracts and other financial instruments.

In addition, the implementation of LIBOR reform proposals may result in increased compliance and operational costs.

We

operate in a highly regulated environment and may be adversely affected by changes in laws and regulations.

The

banking industry is heavily regulated, and such regulations are intended primarily for the protection of depositors and the federal

deposit insurance fund, not shareholders. As a bank holding company, we are subject to regulation by the Federal Reserve. Our

bank subsidiary is also regulated by the Federal Deposit Insurance Corporation, or FDIC, and is subject to regulation by the Pennsylvania

Department of Banking and Securities and recently, by regulations promulgated by the Consumer Financial Protection Bureau (CFPB)

as to consumer financial services and products. These regulations affect lending practices, capital structure, investment practices,

dividend policy, and growth. In addition, we have non-bank operating subsidiaries from which we derive income. One of these non-bank

subsidiaries, Codorus Valley Financial Advisors, Inc. d/b/a PeoplesWealth Advisors, engages in providing investment management

and insurance brokerage services, industries that are also heavily regulated on both a state and federal level. In addition, newly

enacted and amended laws, regulations, and regulatory practices affecting the financial service industry may result in higher

capital requirements, higher insurance premiums and limit the manner in which we may conduct our business. Such changes may adversely

affect us, including our ability to offer new products and services, obtain financing, attract deposits, make loans and leases

and achieve satisfactory spreads, and may also result in the imposition of additional costs on us. As a public corporation, we

are also subject to the corporate governance standards set forth in the Sarbanes-Oxley Act of 2002, as well as any applicable

rules or regulations promulgated by the SEC and The NASDAQ Global Market.

Compliance

with such current and potential regulation and scrutiny may significantly increase our costs, impede the efficiency of our internal

business processes, affect retention of key personnel, require us to increase our regulatory capital, require us to invest significant

management attention and resources and limit our ability to pursue business opportunities in an efficient manner.

Additional

requirements imposed by the Dodd-Frank Act could increase our costs of operations.

The

Dodd-Frank Wall Street Reform and Consumer Protection Act, or the Dodd-Frank Act, has significantly changed the current bank regulatory

structure and affected the lending, deposit, investment, trading and operating activities of financial institutions and their

holding companies. The Dodd-Frank Act requires various federal agencies to adopt a broad range of new rules and regulations, and

to prepare numerous studies and reports for Congress. The federal agencies are given significant discretion in drafting the implementing

rules and regulations, and consequently, some of the details and impact of the Dodd-Frank Act may not yet be known. Our operating

and compliance costs have materially increased and it is expected that the legislation and implementing regulations will continue

to increase our operating and compliance costs.

The

Dodd-Frank Act created the Consumer Financial Protection Bureau, or CFPB, as an independent bureau of the Federal Reserve with

broad powers to supervise and enforce consumer protection laws. In addition, the CFPB has rule-making authority for a wide range

of consumer protection laws that apply to all banks and savings institutions, including the authority to prohibit “unfair,

deceptive or abusive” acts and practices. The CFPB’s qualified mortgage rule, or “QM Rule,” became effective

on January 10, 2014. The QM Rule is designed to clarify how lenders can manage the potential legal liability under the Dodd-Frank

Act, which would hold lenders accountable for insuring a borrower’s ability to repay a mortgage. Loans that meet the definition

of “qualified mortgage” will be presumed to have complied with the new ability-to-repay standard. The QM Rule and

similar rules could limit the Bank’s ability to make certain types of loans or loans to certain borrowers, or could make

it more expensive and time-consuming to make these loans, which could limit the Bank’s growth or profitability.

The

Dodd-Frank Act requires publicly traded companies to give stockholders a non-binding vote on executive compensation and so-called

“golden parachute” payments. It also provides that the listing standards of the national securities exchanges shall

require listed companies to implement and disclose “clawback” policies mandating the recovery of incentive compensation

paid to executive officers in connection with accounting restatements. The Dodd-Frank Act also directs the Federal Reserve to

promulgate rules prohibiting excessive compensation paid to bank holding company executives. Compliance with these rules will

likely increase our overall regulatory compliance costs and may have an adverse effect on our ability to recruit and retain executive

officers for the Corporation and the Bank.

We

recently became subject to more stringent capital requirements.

The

Dodd-Frank Act required the federal banking agencies to establish minimum leverage and risk-based capital requirements for insured

banks and their holding companies. The federal banking agencies issued a joint final rule, or the Final Capital Rule, that implements

the Basel III capital standards and establishes the minimum capital levels required under the Dodd-Frank Act. Certain capital

requirements mandated by the Final Capital Rule became effective January 1, 2015. The Final Capital Rule establishes a minimum

common equity Tier I capital ratio of 6.5 percent of risk-weighted assets for a “well capitalized” institution

and increases the minimum Tier I capital ratio for a “well capitalized” institution from 6 percent to 8 percent.

Additionally, the Final Capital Rule requires an institution to maintain a 2.5 percent common equity Tier I capital

conservation buffer over the 6.5 percent minimum risk-based capital requirement for “adequately capitalized”

institutions, or face restrictions on the ability to pay dividends, discretionary bonuses, and engage in share repurchases. For

bank holding companies under $15 billion in assets as of December 31, 2009, the Final Capital Rule permanently grandfathers

trust preferred securities issued before May 19, 2010, subject to a limit of 25 percent of Tier I capital. The

Final Capital Rule increases the required capital for certain categories of assets, including high-volatility construction real

estate loans and certain exposures related to securitizations; however, the Final Capital Rule retains the current capital treatment

of residential mortgages. Implementation of these standards, or any other new regulations, may adversely affect our ability to

pay dividends, or require us to reduce business levels or raise capital, including in ways that may adversely affect our results

of operations or financial condition.

The

soundness of other financial services institutions may adversely affect our credit risk.

Our

ability to engage in funding transactions could be adversely affected by the actions and failure of other financial institutions.

Financial services institutions are interrelated as a result of trading, clearing, counterparty, or other relationships. We have

exposure to many different industries and counterparties, and we routinely execute transactions with counterparties in the financial

services industry, including brokers and dealers, commercial banks, investment banks, mutual funds, and other institutional clients.

As a result, defaults by, or even questions or rumors about, one or more financial services institutions, or the financial services

industry generally, have led to market-wide liquidity problems and could lead to losses or defaults by us or other institutions.

Many of these transactions expose us to operational and credit risk in the event of default of our counterparty or client. In

addition, our credit risk may be exacerbated when the collateral held by us cannot be realized upon or is liquidated at prices

not sufficient to recover the full amount of the loan or derivative exposure due us. Losses related to these credit risks could

materially and adversely affect our results of operations or earnings.

We

are required to make a number of judgments in applying accounting policies and different estimates and assumptions in the application

of these policies could result in a decrease in capital and/or other material changes to our reports of financial condition and

results of operations.

Material

estimates that are particularly susceptible to significant change relate to the determination of the allowance for loan losses

and reserve for unfunded lending commitments, the effectiveness of derivatives and other hedging activities, and the fair value

of certain financial instruments (securities, derivatives, and privately held investments), income tax assets or liabilities (including

deferred tax assets and any related valuation allowance), and share-based compensation. While we have identified those accounting

policies that are considered critical and have procedures in place to facilitate the associated judgments, different assumptions

in the application of these policies could result in a decrease to net income and, possibly, capital and may have a material adverse

effect on our financial condition and results of operations.

From

time to time, the Financial Accounting Standards Board, or FASB, and the SEC change the financial accounting and reporting guidance

that governs the preparation of our financial statements. These changes are beyond our control, can be difficult to predict, and

could materially impact how we report our financial condition and results of operations. We could be required to apply new or

revised guidance retrospectively, which may result in the revision of prior financial statements by material amounts. The implementation

of new or revised guidance could result in material adverse effects to our reported capital.

We

may elect or need to seek additional capital in the future, but that capital may not be available when needed.

We

are required by federal and state regulatory authorities to maintain adequate levels of capital to support our operations. In

the future, we may elect or need to raise additional capital. Our ability to raise additional capital, if needed, will depend

on conditions in the capital markets at that time, which are outside our control, and on our financial performance. Accordingly,

we cannot assure you of our ability to raise additional capital if needed on acceptable terms. If we cannot raise additional capital

when needed, our ability to expand our operations through internal growth or acquisitions could be materially impaired.

Risks

associated with system failures, interruptions, or breaches of security could negatively affect our earnings. Information technology

systems are critical to our business.

We

use various technology systems to manage our client relationships, general ledger, securities investments, deposits, and loans.

Business disruptions can occur due to forces beyond our control such as severe weather, power or telecommunications loss, accidents,

cyberattacks, terrorism, health emergencies, the spread of infectious diseases or pandemics. We have established policies and

procedures to prevent or limit the impact of system failures, interruptions, and security breaches (including privacy breaches

and cyber-attacks), but such events may still occur or may not be adequately addressed if they do occur. In addition, any compromise

of our systems could deter clients from using our products and services. Although we take protective measures, the security of

our computer systems, software, and networks may be vulnerable to breaches, unauthorized access, misuse, computer viruses, or

other malicious code and cyber-attacks that could have an impact on information security.

In

addition, we outsource a significant amount of our data processing to certain third-party providers. If these third-party providers

encounter difficulties, or if we have difficulty communicating with them, our ability to adequately process and account for transactions

could be affected, and our business operations could be adversely affected. While we have selected these third party vendors carefully,

we do not control their actions. Any problems caused by these third parties, including as a result of their not providing us their

services for any reason or their performing their services poorly, could adversely affect our ability to deliver products and

services to our clients or otherwise conduct our business efficiently and effectively. Replacing these third party vendors could

also entail significant delay and expense. Threats to information security also exist in the processing of client information

through various other vendors and their personnel.

There

have been increasing efforts on the part of third parties, including through cyber-attacks, to breach data security at financial

institutions or with respect to financial transactions. There have been several recent instances involving financial services

and consumer-based companies reporting the unauthorized disclosure of client or customer information or the destruction or theft

of corporate data. In addition, because the techniques used to cause such security breaches change frequently, often are not recognized

until launched against a target and may originate from less regulated and remote areas around the world, we may be unable to proactively

address these techniques or to implement adequate preventative measures. The ability of our clients to bank remotely, including

online and through mobile devices, requires secure transmission of confidential information and increases the risk of data security

breaches.

The

occurrence of any system failures, interruption, or breach of security could damage our reputation and result in a loss of clients

and business thereby subjecting us to additional regulatory scrutiny, or could expose us to litigation and possible financial

liability. Any of these events could have a material adverse effect on our financial condition and results of operations.

Our

controls and procedures may fail or could be circumvented.

Management

regularly reviews and updates our internal controls, disclosure controls and procedures, and corporate governance policies and

procedures in order to ensure accurate financial control and reporting. Any system of controls, no matter how well designed and

operated, can only provide reasonable, not absolute assurance that the objectives of the system are met. Any failure or circumvention

of our controls and/or procedures could have a material adverse effect on our business and results of operation and financial

condition.

We

may incur fines, penalties and other negative consequences from regulatory violations, possibly even inadvertent or unintentional

violations.

We

maintain systems and procedures designed to ensure that we comply with applicable laws and regulations. However, some legal/regulatory

frameworks provide for the imposition of fines or penalties for noncompliance even though the noncompliance was inadvertent or

unintentional and even though there was in place at the time systems and procedures designed to ensure compliance. For example,

we are subject to regulations issued by the Office of Foreign Assets Control, or OFAC, that prohibit financial institutions from

participating in the transfer of property belonging to the governments of certain foreign countries and designated nationals of

those countries. OFAC may impose penalties for inadvertent or unintentional violations even if reasonable processes are in place

to prevent the violations. There may be other negative consequences resulting from a finding of noncompliance, including restrictions

on certain activities. Such a finding may also damage our reputation as described below and could restrict the ability of institutional

investment managers to invest in our securities.

The

inability to hire or retain key personnel could adversely affect our business.

Our

success is dependent upon our ability to attract and retain highly skilled individuals. We face intense competition from various

other financial institutions, as well as from non-bank providers of financial services, such as credit unions, brokerage firms,

insurance agencies, consumer finance companies and government organizations, for the attraction and retention of key personnel,

specifically those who generate and maintain our client relationships and serve in other key operation positions in the areas

of finance, credit oversight and administration, and wealth management. These competitors may offer greater compensation and benefits,

which could result in the loss of potential and/or existing substantial client relationships and may adversely affect our ability

to compete effectively. The unexpected loss of services of one or more of these or other key personnel could have a material adverse

impact on our business because of their skills, knowledge of the markets in which we operate, years of industry experience and

the difficulty of promptly finding qualified replacement personnel.

Damage

to our reputation could significantly harm our business, including our competitive position and business prospects.

We

are dependent on our reputation within our market area, as a trusted and responsible financial corporation, for all aspects of

our relationships with clients, employees, vendors, third-party service providers, and others, with whom we conduct business or

potential future business. Our ability to attract and retain clients and employees could be adversely affected if our reputation

is damaged. Our actual or perceived failure to address various issues could give rise to reputational risk that could cause harm

to us and our business prospects. These issues also include, but are not limited to, legal and regulatory requirements; properly

maintaining client and employee personal information; record keeping; money-laundering; sales and trading practices; ethical issues;

appropriately addressing potential conflicts of interest; and the proper identification of the legal, reputational, credit, liquidity

and market risks inherent in our products. Failure to appropriately address any of these issues could also give rise to additional

regulatory restrictions and legal risks, which could, among other consequences, increase the size and number of litigation claims

and damages asserted or subject us to enforcement actions, fines and penalties and incur related costs and expenses.

We

continually encounter technological change, and we may have fewer resources than our competitors to continue to invest in technological

improvements, which could reduce our ability to effectively compete.

Our

future success depends, in part, on our ability to effectively embrace technological efficiencies to better serve clients and

reduce costs. Many of our competitors have substantially greater resources to invest in technological improvements. There can

be no assurance that we will be able to effectively implement new technology-driven products and services, which could reduce

our ability to effectively compete. Failure to keep pace with technological change could potentially have an adverse effect on

our business operations and financial condition.

Competition

from other financial institutions in originating loans, attracting deposits and providing various financial services may adversely

affect our profitability.

Our

banking subsidiary faces substantial competition in originating loans, both commercial and consumer. This competition comes principally

from other banks, savings institutions, mortgage banking companies, and other lenders. Many of our competitors enjoy advantages

over us, including greater financial resources and higher lending limits, a wider geographic presence, more accessible branch

office locations, the ability to offer a wider array of services or more favorable pricing alternatives, as well as lower origination

and operating costs. This competition could reduce our net income by decreasing the number and size of loans that our banking

subsidiary originates and the interest rates it may charge on these loans.

In

attracting business and consumer deposits, our bank subsidiary faces substantial competition from other insured depository institutions

such as banks, savings institutions and credit unions, as well as institutions offering uninsured investment alternatives, including

money market funds. Many of our competitors enjoy advantages over us, including greater financial resources, more aggressive marketing

campaigns and better brand recognition and more branch locations. These competitors may offer higher interest rates than we do,

which could decrease the deposits that we attract or require us to increase our rates to retain existing deposits or attract new

deposits. Increased deposit competition could adversely affect our ability to generate the funds necessary for lending operations.

As a result, we may need to seek other sources of funds that may be more expensive to obtain and could increase our cost of funds.

Our

banking and non-banking subsidiaries also compete with non-bank providers of financial services, such as brokerage firms, consumer

finance companies, credit unions, insurance companies and governmental organizations which may offer more favorable terms. Some

of our non-bank competitors are not subject to the same extensive regulations that govern our banking operations. As a result,

such non-bank competitors may have advantages over our banking and non-banking subsidiaries in providing certain products and

services. This competition may reduce or limit our margins on banking and non-banking services, reduce our market share, and adversely

affect our earnings and financial condition.

We

may not be able to successfully maintain and manage our growth.

We

continue to execute on our acquisition and organic branching initiatives, which are intended to develop our branch infrastructure

in a manner more consistent with the expansion of lending markets and to fill in and grow our branch footprint. As we continue

to grow through our acquisitions, branching and other strategic initiatives, we cannot be certain as to our ability to manage

increased levels of assets and liabilities. We may be required to make additional investments in equipment and personnel to manage

higher asset levels and loans balances, which may adversely impact our efficiency ratio, earnings and shareholder returns.

The

financial impact and difficulties in integrating future acquisitions could adversely affect our business.

The

efficient and effective integration of any businesses we acquire into our organization is critical to the financial success of

an acquisition transaction. Any future acquisitions involve numerous risks, including difficulties in integrating the culture,

operations, technologies and personnel of the acquired companies, the diversion of management’s attention from other business

concerns and the potential loss of clients. Failure to successfully integrate the operations of any future acquisitions could

also harm our business, results of operations and cash flows.

Risks

Related to Our Common Stock

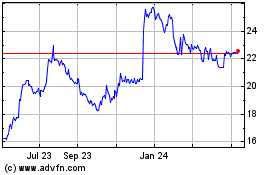

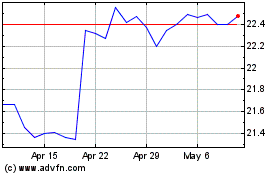

The

market price of our common stock may fluctuate significantly, and this may make it difficult for you to resell shares of common

stock owned by you at times or at prices you find attractive.

The

market price of our common stock on the NASDAQ Global Market constantly changes. We expect that the market price of our common

stock will continue to fluctuate and there can be no assurance about the market prices for our common stock.

Stock

price volatility may make it difficult for you to resell your common stock when you want and at prices you find attractive. Our

stock price may fluctuate significantly as a result of a variety of factors, many of which are beyond our control. These factors

include, among others:

|

|

●

|

actual

or anticipated variations in quarterly results of operations or quality of our assets;

|

|

|

●

|

recommendations

by securities analysts;

|

|

|

●

|

operating

and stock price performance of other companies that investors deem comparable to us;

|

|

|

●

|

any

failure to pay dividends on our common stock or a reduction in cash dividends;

|

|

|

●

|

continued

levels of loan quality and volume origination;

|

|

|

●

|

the

adequacy of loan loss reserves;

|

|

|

●

|

the

willingness of clients to substitute competitors’ products and services for our

products and services and vice versa, based on price, quality, relationship or otherwise;

|

|

|

●

|

interest

rate, market and monetary fluctuations;

|

|

|

●

|

declines

in the fair value of our available-for-sale securities that are deemed to be other-than-temporarily

impaired;

|

|

|

●

|

the

timely development of competitive new products and services by us and the acceptance

of such products and services by clients;

|

|

|

●

|

changes

in consumer spending and saving habits relative to the financial services we provide;

|

|

|

●

|

relationships

with major clients;

|

|

|

●

|

our

ability to continue to grow our business internally and through acquisition and successful

integration of new or acquired entities while controlling costs;

|

|

|

●

|

news

reports relating to trends, concerns and other issues in the financial services industry,

including the failures of other financial institutions in the current economic downturn;

|

|

|

●

|

perceptions

in the marketplace regarding us and/or our competitors;

|

|

|

●

|

rapidly

changing technology, or new technology used, or services offered, by competitors;

|

|

|

●

|

changes

in accounting principles, policies and guidelines;

|

|

|

●

|

significant

acquisitions or business combinations, strategic partnerships, joint ventures or capital

commitments by or involving us or our competitors;

|

|

|

●

|

failure

to integrate acquisitions or realize anticipated benefits from acquisitions;

|

|

|

●

|

changes

in and compliance with laws and government regulations of federal, state and local agencies;

|

|

|

●

|

effects

of climate change;

|

|

|

●

|

geopolitical

conditions such as acts or threats of terrorism or military conflicts;

|

|

|

●

|

natural

disasters or severe weather conditions;

|

|

|

●

|

health

emergencies, the spread of infectious diseases or pandemics;

|

|

|

●

|

cyber

breaches or breaches of physical premises, including data centers;

|

|

|

●

|

failure

to retain or attract key personnel;

|

|

|

●

|

operating

results that vary from the expectations of management, analysts and investors;

|

|

|

●

|

future

sales of our equity or equity-related securities;

|

|

|

●

|

the

credit, mortgage and housing markets, the markets for securities relating to mortgages

or housing, and developments with respect to financial institutions generally; and

|

|

|

●

|

the

relatively low trading volume of our common stock.

|

General

market fluctuations, industry factors and general economic and political conditions and events, such as economic slowdowns or

recessions, interest rate changes or credit loss trends, could also cause our stock price to decrease regardless of operating

results as evidenced by the current volatility and disruption of capital and credit markets.

The

trading volume of our common stock may not provide adequate liquidity for investors and is less than that of other financial services

companies.

Our

common stock is listed under the symbol “CVLY” on the NASDAQ Global Market. The average daily trading volume for shares

of our common stock is less than larger financial institutions. As a result, sales of our common stock may place significant downward

pressure on the market price of our common stock. Furthermore, it may be difficult for holders to resell their shares at prices

they find attractive, or at all.

We

may issue additional common stock or other equity securities in the future which could dilute the ownership interest of existing

shareholders.

In

order to maintain our capital at desired or regulatory-required levels or to replace existing capital, we may be required to issue

additional shares of common stock, or securities convertible into, exchangeable for or representing rights to acquire shares of

common stock. Generally, we are not restricted from issuing such additional shares. We may sell any shares that we issue at prices

below the current market price of our common stock, and the sale of these shares may significantly dilute shareholder ownership.

We could also issue additional shares in connection with acquisitions of other financial institutions or in connection with our

equity compensation plans. Additional equity offerings may dilute the holdings of our existing shareholders or reduce the market

price of our common stock, or both.

Offerings

of debt and/or preferred equity securities may adversely affect the market price of our common stock.

We

may attempt to increase our capital resources or, if our or our subsidiary bank’s capital ratios fall below the required

minimums, we could be forced to raise additional capital by making additional offerings of debt or preferred equity securities,

including medium-term notes, trust preferred securities, senior or subordinated notes and preferred stock. Upon liquidation, holders

of our debt securities and shares of preferred stock and lenders with respect to other borrowings are likely to receive distributions

of our available assets prior to the holders of our common stock. Additional equity offerings may dilute the holdings of our existing

shareholders or reduce the market price of our common stock, or both. Holders of our common stock are not entitled to preemptive

rights or other protections against dilution.

Our

board of directors is authorized to issue one or more classes or series of preferred stock from time to time without any action

on the part of the shareholders. Our board of directors also has the power, without shareholder approval, to set the terms of

any such classes or series of preferred stock that may be issued, including voting rights, dividend rights, and preferences over

our common stock with respect to dividends or upon our dissolution, winding up and liquidation and other terms. If we issue preferred

stock in the future that has a preference over our common stock with respect to the payment of dividends or upon our liquidation,

dissolution or winding up, or if we issue preferred stock with voting rights that dilute the voting power of our common stock,

the rights of holders of our common stock or the market price of our common stock could be adversely affected.

Our

common stock is subordinate to our existing and future indebtedness and preferred stock, and effectively subordinated to all the

indebtedness and other non-common equity claims against our subsidiaries.

Shares

of our common stock are equity interests in us and do not constitute indebtedness. As such, shares of our common stock rank junior

to all of our indebtedness and to other non-equity claims against us and our assets available to satisfy claims against us, including

in our liquidation. Additionally, holders of our common stock could be subject to the prior dividend and liquidation rights of

holders of our preferred stock. Furthermore, our right to participate in a distribution of assets upon any of our subsidiaries’

liquidation or reorganization is subject to the prior claims of that subsidiary’s creditors.

We

may attempt to increase our capital resources or, if our or the Bank’s capital ratios fall below the required minimums,

we could be forced to raise additional capital by making additional offerings of debt or preferred equity securities, including

medium-term notes, trust-preferred securities, senior or subordinated notes and preferred stock. Upon liquidation, holders of

our debt securities and shares of preferred stock and lenders with respect to other borrowings are likely to receive distributions

of our available assets prior to the holders of our common stock.

We

are currently authorized to issue up to 30,000,000 shares of common stock of which 9,763,713 shares were outstanding

as of April 24, 2020, and up to 1,000,000 shares of preferred stock, none of which were outstanding as of April 24,

2020. Our board of directors has authority, without action or vote of the shareholders of common stock, to issue all or part of

the authorized but unissued shares. Authorized but unissued shares of our common stock or preferred stock could be issued on terms

or in circumstances that could dilute the interests of other shareholders.

Regulatory

and contractual restrictions may limit or prevent us from paying dividends or repurchasing, or we may choose not to pay dividends

on or repurchase, our common stock.

The

Corporation is an entity separate and distinct from its principal subsidiary, PeoplesBank, and we derive substantially all of

our revenue in the form of dividends from that subsidiary. Accordingly, we are and will be dependent upon dividends from PeoplesBank

to pay the principal of and interest on our indebtedness, to satisfy our other cash needs and to pay dividends on our common and

preferred stock. The Bank’s ability to pay dividends is subject to its ability to earn net income and to meet certain regulatory

requirements. In the event PeoplesBank is unable to pay dividends to us, we may not be able to pay dividends on our common or

preferred stock. Also, our right to participate in a distribution of assets upon a subsidiary’s liquidation or reorganization

is subject to the prior claims of the subsidiary’s creditors, including those of its depositors.

As

described below in the next risk factor, the terms of our outstanding junior subordinated debt securities prohibit us from paying

dividends on or repurchasing our common stock at any time when we have elected to defer the payment of interest on such debt securities

or certain events of default under the terms of those debt securities have occurred and are continuing. These restrictions could

have a negative effect on the value of our common stock. Moreover, holders of our common stock are entitled to receive dividends

only when, as and if declared by our board of directors.

Although

we have historically paid cash dividends on our common stock, we are not required to do so and our board of directors could reduce,

suspend or eliminate our common stock cash dividend in the future. No determination has been made by our board of directors regarding

whether or what amount of dividends will be paid in future quarters. Additionally, there can be no assurance that regulatory approval

will be granted by the Federal Reserve Board to pay dividends. Future payment of cash dividends, if any, will be at the discretion

of our board of directors and will be dependent upon our financial condition, results of operations, capital requirements and

such other factors as the board may deem relevant and will be subject to applicable federal and state laws that impose restrictions

on our and our bank subsidiary’s ability to pay dividends, as well as guidance issued from time to time by regulatory authorities.

Under

guidance issued by the Federal Reserve, as a bank holding company we are to consult the Federal Reserve before declaring dividends

and are to strongly consider eliminating, deferring, or reducing dividends we pay to our shareholders if (1) our net income

available to shareholders for the past four quarters, net of dividends previously paid during that period, is not sufficient to

fully fund the dividends, (2) our prospective rate of earnings retention is not consistent with our capital needs and overall

current and prospective financial condition, or (3) we will not meet, or are in danger of not meeting, our minimum regulatory

capital adequacy ratios.

Under

additional supervisory guidance issued by the Federal Reserve in June, 2020, in response to the ongoing COVID-19 pandemic, the

Federal Reserve is requiring large banks ($100 billion or more in assets) for the third quarter of 2020 to preserve capital by

suspending share repurchases, capping dividend payments to the amount paid in the second quarter and is further limiting dividends

to an amount based on recent earnings. While the Corporation and PeoplesBank are not subject to this supervisory guidance, we

cannot predict whether guidance of this type will become applicable to the Corporation and PeoplesBank in the future.

If

we defer payments of interest on our outstanding junior subordinated debt securities or if certain defaults relating to those

debt securities occur, we will be prohibited from declaring or paying dividends or distributions on, and from making liquidation

payments with respect to, our common stock.

As

of March 31, 2020, we had $10,310,000 outstanding aggregate principal amount of junior subordinated debt securities issued

in connection with the sale of trust preferred securities by certain of our subsidiaries that are statutory business trusts. We

have also guaranteed those trust preferred securities. There are currently two separate series of these junior subordinated debt

securities outstanding, each series having been issued under a separate indenture and with a separate guarantee. Each of these

indentures, together with the related guarantee, prohibits us, subject to limited exceptions, from declaring or paying any dividends

or distributions on, or redeeming, repurchasing, acquiring or making any liquidation payments with respect to, any of our capital

stock at any time when (i) there shall have occurred and be continuing an event of default under the indenture or any event,

act or condition that with notice or lapse of time or both would constitute an event of default under the indenture; or (ii) we

are in default with respect to payment of any obligations under the related guarantee; or (iii) we have deferred payment

of interest on the junior subordinated debt securities outstanding under that indenture. In that regard, we are entitled, at our

option but subject to certain conditions, to defer payments of interest on the junior subordinated debt securities of each series

from time to time for up to five years.

Events

of default under each indenture generally consist of our failure to pay interest on the junior subordinated debt securities outstanding

under that indenture under certain circumstances, our failure to pay any principal of or premium on such junior

subordinated debt

securities when due, our failure to comply with certain covenants under the indenture, and certain events of bankruptcy, insolvency

or liquidation relating to us or the Bank.

As

a result of these provisions, if we were to elect to defer payments of interest on any series of junior subordinated debt securities,

or if any of the other events described in clause (i) or (ii) of the first paragraph of this risk factor were to occur, we

would be prohibited from declaring or paying any dividends on our common stock, from redeeming, repurchasing or otherwise acquiring

any of our common stock, and from making any payments to holders of our common stock in the event of our liquidation, which would

likely have a material adverse effect on the market value of our common stock. Moreover, without notice to or consent from the

holders of our common stock, we may issue additional series of junior subordinated debt securities in the future with terms similar

to those of our existing junior subordinated debt securities or enter into other financing agreements that limit our ability to

purchase or to pay dividends or distributions on our capital stock, including our common stock.

Our

common stock is not insured by any governmental entity.

Our

common stock is not a deposit account or other obligation of any bank and, therefore, is not insured against loss by the FDIC,

any other deposit insurance fund, any other governmental entity or by any other public or private entity. Investment in our common

stock is inherently risky for the reasons described in this “Risk Factors” section and elsewhere in this document

and our other filings with the SEC, and is subject to the same market forces that affect the price of common stock in any company.

As a result, if you acquire our common stock, you may lose some or all of your investment.

Anti-takeover

provisions and restrictions on ownership could negatively impact our shareholders.

Provisions

of federal and Pennsylvania law and our amended and restated articles of incorporation and bylaws could make it more difficult

for a third party to acquire control of us or have the effect of discouraging a third party from attempting to acquire control

of us. These provisions could make it more difficult for a third party to acquire us even if an acquisition might be in the best

interest of our shareholders. In addition, the Bank Holding Company Act of 1956, as amended, or the BHCA, requires any bank holding

company to obtain the approval of the Federal Reserve prior to acquiring more than 5 percent of our outstanding common stock.

Any person other than a bank holding company is required to obtain prior approval of the Federal Reserve to acquire 10 percent

or more of our outstanding common stock under the Change in Bank Control Act. Any holder of 25 percent or more of our outstanding

common stock, other than an individual, is subject to regulation as a bank holding company under the BHCA.

Our

articles of incorporation and bylaws contain certain provisions that may have the effect of deterring or discouraging an attempt

to take control of the Corporation. Among other things, these provisions:

|

|

●

|

empower

our board of directors, without shareholder approval, to issue shares of our preferred

stock the terms of which, including voting power, are set by our board;

|

|

|

●

|

divide

our board of directors into three classes serving staggered three year terms;

|

|

|

●

|

authorize

our board of directors to oppose a tender or other offer for the Corporation’s

securities if the board determines that such an offer should be rejected;

|

|

|

●

|

require

the affirmative vote of holders of at least 75 percent of the outstanding shares

of our common stock to approve a merger, consolidation, liquidation or dissolution of

the Corporation, or any sale or other disposition of all or substantially all of the

assets of the Corporation, excepting transactions described above that are approved by

at least 80 percent of the members of the Board of Directors, where such transactions

shall require only such shareholder approval, if any, as may be required pursuant to

the Pennsylvania Business Corporation Law as in effect from time to time.

|

|

|

●

|

eliminate

cumulative voting in the election of directors; and

|

|

|

●

|

require

advance notice of nominations for the election of directors and the presentation of shareholder

proposals at meetings of shareholders.

|

Risks

Related to the Offering

You

will have a minimal influence on shareholder decisions.

Together,

our directors and executive officers beneficially hold 493,602 shares, representing 5.00% of the total number of shares outstanding

as of February 26, 2020. Further, this percentage of ownership could increase if our directors and officers participate in

the Plan. Our directors and officers are able to significantly influence our management policies and decisions as well as issues

that require a shareholder vote. If our directors and executive officers vote together, they could influence the outcome of certain

corporate actions requiring shareholder approval, including the election of directors and the approval or non-approval of significant

corporate transactions, such as the merger or sale of all of substantially all of our assets. Their interests may differ from

the interests of other shareholders with respect to management issues.

Possible

future sales of our common stock by our directors and executive officers could cause the market value of our common stock to decline.

Sales

of additional shares of our stock, or the perception that shares may be sold by directors and executive officers of the Corporation,

could negatively affect the market price of our stock.

Our

issuance of additional shares of common stock could dilute or depress the value of your shares.

The

Corporation’s Articles of Incorporation authorize the issuance of up to 30,000,000 shares of common stock and up to

1,000,000 shares of preferred stock. The issuance of additional stock within these limits will not require prior shareholder

approval. Sales of additional shares of stock, or the perception that shares may be sold, could negatively affect the market price

of the Corporation’s stock. The issuance of additional shares could also dilute the percentage ownership interest and corresponding

voting power of the prior shareholders.

The

price of common stock may fluctuate.

You

do not have control or authority to direct the price or time at which common stock is purchased or sold for Plan accounts. Therefore,

you bear the market risk associated with fluctuations in the price of common stock. The Plan Administrator will allocate shares

purchased to 3 decimal places; thus, there will likely always be a partial share in your plan account. This practice allows

maximum investment of your dividends.

EXPLANATION

OF THE DIVIDEND REINVESTMENT

AND STOCK PURCHASE PLAN

An

explanation of the Plan follows. The Plan is contained in a written Plan instrument, a copy of which is maintained at the offices

of the Corporation, as well as at the offices of the Plan Administrator. In the event of any inconsistency between that Plan instrument

and this explanation, the Plan instrument will control. The Plan does not represent a change in our dividend policy, which will

continue to depend upon earnings, financial and regulatory requirements and other factors, and which will be determined by our

Board of Directors from time to time. Shareholders who do not wish to participate in this Plan will continue to receive cash dividends

when and as declared. We cannot provide any assurance whether, or at what rate, we will continue to pay dividends.

Purpose

|

|

1.

|

What

is the purpose of the Plan?

|

The

purpose of the Plan is to provide holders of the Corporation’s common stock with a convenient and economical method of investing

cash dividends payable upon their common stock and voluntary cash payments in additional shares of common stock. To the extent

that the additional shares are purchased directly from the Corporation under the Plan, the Corporation will receive additional

funds for its general corporate purposes.

Advantages

|

|

2.

|

What

are the advantages of the Plan?

|

Participation

in the Plan offers a number of advantages:

|

|

●

|

The

Plan enables the shareholders to acquire additional shares of common stock without the

payment of brokerage commissions.

|

|

|

●

|

The

Plan provides shareholders of the Corporation with the opportunity to reinvest their

dividends automatically in additional shares of common stock. The Plan also provides

shareholders with the opportunity to make additional voluntary cash payments, within

specified limits, to purchase additional shares of common stock without the payment of

any service charges or brokerage commissions.

|

|

|

●

|

Participants

may deposit their physically held common stock certificate(s), at no cost, with the Plan

Administrator.

|

|

|

●

|

Participants’

funds will be fully utilized through the crediting of fractional shares of stock to their

accounts under the Plan. Because the shares of stock are held in their Plan account,

participants avoid cumbersome safekeeping and record keeping costs through the free custodial

and reporting services furnished under the Plan.

|

|

|

●

|

Participants