Fluor Outperforms Estimate - Analyst Blog

February 21 2013 - 7:40AM

Zacks

Fluor Corporation

(FLR) reported fourth-quarter 2012 earnings per share from

continuing operations of $1.58; well above the Zacks Consensus

Estimate of earnings per share of 68 cents. The results include

after-tax charge of approximately $1.61 per diluted share, relating

to the adverse arbitration ruling on the Greater Gabbard wind farm

project loss per share of 3 cents compared with the earnings per

share of 90 cents in the prior year period.

For 2012, earnings per share from

continuing operations were $4.28, above the Zacks Consensus

Estimate of $3.38. Including a charge of approximately $1.57 per

share relating to the previously announced arbitration ruling on

the Greater Gabbard project, earnings for the quarter were $2.71

compared with $3.40 in 2011. Results for the year were aided by

strong double-digit growth in Oil & Gas and Global Services,

and strength in Industrial & Infrastructure.

Total Revenue

Total revenue was $7.02 billion in

fourth quarter of 2012 compared with $6.25 billion in the fourth

quarter of 2011.

For 2012, total revenue was $27.6

billion, up 18% year over year. The surge was driven by strong

growth in the Industrial & Infrastructure and Oil & Gas

business segments. Consolidated backlog at the end of the year was

$38.2 billion compared with $39.5 million at the end of

2011.

New awards in 2012 were strong at

$27.1 billion, compared with bookings of $26.9 billion a year ago,

including $12.6 billion in Oil & Gas and $9.5 billion in

Industrial & Infrastructure.

Segment

Revenue

Revenue from the Oil & Gas

segment was $9.5 billion in 2012, up 19% year over year, driven by

new awards and good order backlog. New awards won during the year

were approximately $12.6 billion with backlog amounting to $18.2

billion. Petrochemical projects in North America, Europe and Asia

aided backlog of the company.

Industrial & Infrastructure

revenue was $12.2 billion, an increase of 26% year over year. The

rise was due to increased mining and metals business. New awards

won during the year were $9.5 billion with backlog amounting to

$15.5 billion at the end of the year.

Government segment revenue was $3.3

billion compared with $3.4 billion in 2011. New awards won during

the quarter were $3.2 billion with backlog amounting to $978

million at the end of the year.

Global Services segment posted

revenue of $1.7 billion, an increase of 9% year over year, driven

by growth across all business lines. New awards won during the year

were $904 million with backlog amounting to $1.7 billion at the end

of the quarter.

Power segment revenue declined to

$841 million compared with $743 million. New awards won during the

quarter were $884 million with backlog amounting to $1.9 billion at

the end of the quarter. Weak demand for new power generation

projects continues to impact the segment.

Income &

Expenses

Consolidated segment profit for

2012 was $769 million, including the impact of a $416 million

pre-tax charge on Greater Gabbard, which compares with $1.0 billion

in segment profit in 2011.

Loss before taxes was $60 million

during the quarter compared with a profit before taxes of $248.6

million at the end of the prior-year quarter. Total cost and

expenses for the quarter amounted to $7.08 billion compared with

$6.0 billion.

Balance Sheet & Cash

Flow

Cash and marketable securities,

including noncurrent, amounted to $2.61 billion at the end of the

year compared with $2.76 billion at the end of 2011. Long-term debt

was $520.2 million compared with $513.5 million and shareholder’s

equity was $3.34 billion compared with $3.40 billion in the

year-ago quarter.

Outlook

The company maintained its 2013

earnings per share guidance to $3.85 – $4.35. Fluor derives

significant benefits from diverse end-markets.

Acting through its subsidiaries,

Fluor Corporation is one of the largest professional services

firms, providing engineering, procurement, construction and

maintenance as well as project management services on a global

basis. It serves a diverse set of industries worldwide, including

oil and gas, chemical and petrochemicals, transportation, mining

and metals, power, life sciences and manufacturing. It is also a

primary service provider to the U.S. federal government.

Fluor currently has a Zacks Rank #3

(Hold) while some of its competitors such as Quanta

Services Inc. (PWR) has a Zacks Rank #1 (Strong Buy) while

Tyco International Ltd. (TYC), Clean

Energy Fuels Corp. (CLNE) carry a Zacks Rank #2 (Buy).

CLEAN EGY FUELS (CLNE): Free Stock Analysis Report

FLUOR CORP-NEW (FLR): Free Stock Analysis Report

QUANTA SERVICES (PWR): Free Stock Analysis Report

TYCO INTL LTD (TYC): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

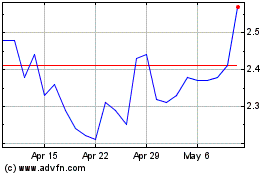

Clean Energy Fuels (NASDAQ:CLNE)

Historical Stock Chart

From Jun 2024 to Jul 2024

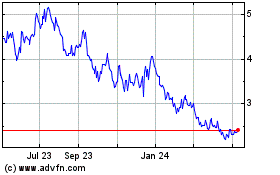

Clean Energy Fuels (NASDAQ:CLNE)

Historical Stock Chart

From Jul 2023 to Jul 2024