Should We Subsidize Nat Gas Engines? - Real Time Insight

March 07 2012 - 9:39AM

Zacks

In early

2010, when I first read of the T. Boone Pickens' plan to subsidize

the conversion of 18-wheelers to run on natural gas I thought it

was a great idea. Clean-burning, abundant, cheap nat gas would be a

triple-crown winner for the environment, the economy, and new

industries, to say nothing of national energy security with less

dependence on the Middle East.

I thought

Boone was one of the more honest types in the energy patch for

having the guts to take this stand for our country when it could

just as easily hurt some of his petroleum investments. But

obviously, lots of other big oil guys would be hurt worse. In fact,

one of his buddies and fellow fossil-fuel billionaire, Charles

Koch, publicly slammed Boone for his plan.

But the

Wall Street Journal ran an editorial piece a couple of weeks

ago that challenged the man's plan as simply more corporate

welfare.

"Proponents

put the cost at about $5 billion over five years, but many energy

experts believe it would be multiples higher. Eight million trucks

are on the road today, and if each got a $15,000 average tax

credit, the price tag grows to over $100 billion.

The history

of energy subsidies is that they become an industrial and political

addiction that is difficult to stop, no matter the results, and may

even inhibit innovation and profitability by providing a

crutch."

My take is

that we've subsidized just about every other industry that needed

it or not. And this one seems like it's worth a try in some way, on

some level. I'm not for wasting money and creating dependent

industries that don't really serve broader objectives. The details

need to get hammered out and compromises will have to be

made.

The Journal

suggests letting free markets work their magic to eventually find

the best solution. I couldn't agree more because while Congress

fiddles and fights about it, American companies (and Norwegian

ones) will probably be busy selling the technology and

infrastructure to China and other markets. Why do you think

Cummins, the biggest maker of nat gas engines, already

does business in 190 countries?

So, should

we subsidize nat gas engines, or not? And why or why

not?

Cooker

CLEAN EGY FUELS (CLNE): Free Stock Analysis Report

CUMMINS INC (CMI): Free Stock Analysis Report

FUEL SYSTEM SOL (FSYS): Free Stock Analysis Report

GOLAR LNG LTD (GLNG): Free Stock Analysis Report

WESTPORT INNOV (WPRT): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

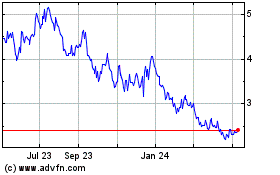

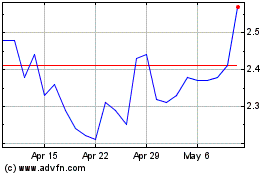

Clean Energy Fuels (NASDAQ:CLNE)

Historical Stock Chart

From Jun 2024 to Jul 2024

Clean Energy Fuels (NASDAQ:CLNE)

Historical Stock Chart

From Jul 2023 to Jul 2024