U.S. Natural Gas Market Evolves - Clean Energy Fuels and Cheniere Energy Poised to Benefit

February 23 2012 - 8:20AM

Marketwired

An abundance of available natural gas combined with muted domestic

demand has sent prices for the fuel down to record lows this year.

The U.S. Energy Information Administration projects shale gas

production to increase from 5.0 trillion cubic feet in 2010 to 13.6

trillion cubic feet in 2035. With prices near historic levels, U.S.

producers have started either idling wells or looking outward for

other sources of demand. Five Star Equities examines investing

opportunities in the natural gas market and provides equity

research on Clean Energy Fuels Corporation (NASDAQ: CLNE) and

Cheniere Energy, Inc. (NYSE Amex: LNG). Access to the full company

reports can be found at:

www.fivestarequities.com/CLNE

www.fivestarequities.com/LNG

According to an energy sector report from EIC Consult, the rise

in shale gas development has led to a number of Liquefied Natural

Gas (LNG) terminals being converted from import to export terminals

and LNG exports doubling between 2009 and 2011. By July 2011,

imports were down 44 percent year-on-year, according to Reuters,

with imports at the lowest monthly level since December 2002. At

the same time exports almost doubled from 33.355 Bcf (billion cubic

feet) in 2009 to 64.793 Bcf in 2010 -- a result of the

re-exportation of LNG imports.

EIC Consult argues that natural gas storage capacity is

increasing to accommodate shale output with many new storage

facilities entering construction, with resulting opportunities for

the supply chain.

Five Star Equities releases regular market updates on the

Natural Gas market so investors can stay ahead of the crowd and

make the best investment decisions to maximize their returns. Take

a few minutes to register with us free at www.fivestarequities.com

and get exclusive access to our numerous stock reports and industry

newsletters.

EIC Consult warns, however, that the future of LNG remains

uncertain as "the market for US exports is far from secure" as

proposed export terminals are located on the East Coast lacking a

direct route to the more profitable Asian markets.

Earlier this month Fitch Ratings issued a report arguing that

the measured conversion of some U.S. liquefied natural gas (LNG)

terminals to allow the export of liquid natural gas as positive.

"However, currently favorable margins for U.S. LNG exports may not

be sustainable and could set up long-term risks for these

infrastructure projects," Fitch says.

Five Star Equities provides Market Research focused on equities

that offer growth opportunities, value, and strong potential

return. We strive to provide the most up-to-date market activities.

We constantly create research reports and newsletters for our

members. Five Star Equities has not been compensated by any of the

above-mentioned Companies. We act as an independent research portal

and are aware that all investment entails inherent risks. Please

view the full disclaimer at:

www.fivestarequities.com/disclaimer

Add to Digg Bookmark with del.icio.us Add to Newsvine

Contact: Five Star Equities Email Contact

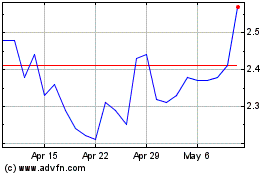

Clean Energy Fuels (NASDAQ:CLNE)

Historical Stock Chart

From Jun 2024 to Jul 2024

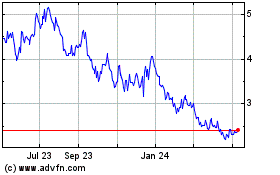

Clean Energy Fuels (NASDAQ:CLNE)

Historical Stock Chart

From Jul 2023 to Jul 2024