Alternative Energy Wars - Investment Ideas

June 09 2011 - 8:00PM

Zacks

When our own Mr. Reitmeister went to Washington DC on Wednesday for

the White House's First Personal Finance Online Summit, he reported

back on the administration's "economic All Stars" team and their

initiatives to attack American challenges. Heather Zichal, Deputy

Assistant to the President for Energy and Climate Change, outlined

the battle plans for energy security.

Zichal noted that China has overtaken the US in

terms of energy consumption and that Obama's goal is to reduce net

oil imports by 1/3rd by 2025 with a simple three-pronged

approach:

- Expand domestic oil and gas production

- Encourage smarter consumption

- Energize the quest for alternative sources

What Are the Investment Opportunities?

The good news is that we are in a global megatrend

for energy that rewards those investors with their fingers on the

pulse of oil and gas companies creating earnings momentum.

Following Zacks #1 and #2 Rank stocks here for the past two years

has been a winning strategy that capitalized on the strong earnings

recovery of many E&P and integrated names.

The bad news is that because of our nation's

dependence on imported oil from unstable areas of the world, and

because $5 a gallon gasoline is a consumer-killer -- not to mention

the omni-present environmental concerns -- it is in every American

investor's best interest for us to find long-term alternative

solutions.

My focus since October has been on the opportunity

that could kill two birds, namely, the Natural Gas Act legislation

that would provide significant tax and investment incentives to

convert America's trucking fleets to run on natural gas engines.

Why is this such a big deal?

Because we have an incredible abundance of domestic

natural gas. And because it is extraordinarily cheap. And because

it has such an extremely low environmental impact compared to oil

and gasoline production processes and emissions. Need I go on?

So I looked at lots of trades in natural gas

E&P firms like Chesapeake (CHK), EOG Resources

(EOG), Cimarex Energy (XEC) and Occidental Petroleum

(OXY), all of which are Zacks #3 Rank (hold) stocks.

And I also looked at the companies involved in

building the engines, conversion kits, and other infrastructure

necessary to use compressed natural gas (CNG) and liquefied natural

gas (LNG) in trucks and cars safely and efficiently:

Westport Innovations (WPRT): specializes in

building natural gas engines and has joint venture with Cummins

(CMI)

Clean Energy Fuels (CLNE): leading provider

of CNG and LNG products for transportation

Fuel Systems Solutions (FSYS): manufactures

products and systems that allow on-highway and off-highway engines

to operate on clean burning, gaseous fuels such as propane and

natural gas

Political Tipping Point

The problem with investing in these early growth

stage companies on the verge of a potentially explosive industry is

that it seems everything hinges on Congress "doing the right

thing." I put that in quotes because there is a big difference of

opinion about what "the right thing" is in Washington.

Initially, I assumed that natural gas economic

incentives were a no-brainer for our economy and environment and

that the only people standing in the way -- the Nat Gas Act

legislation has been pushed to the side at least twice in recent

years -- were big oil companies with a vested interest in the

status quo. Billionaire T. Boone Pickens seemed like the

archetypal, honest, plain-spoken, patriot who just wanted what was

best for his country.

But there is another economic angle on this besides

the vested interests of political lobbyists on either side. Last

month, four Republican lawmakers who had been co-sponsors of the

bill that Pickens helped engineer withdrew their support on mostly

philosophical grounds. In other words, it's not just crude oil vs.

nat gas. It's free market vs. more subsidies and potentially higher

taxes for some, if not all.

As Mr. Reitmeister asked Heather Zichal at the

White House, "How much does the Administration believe in the free

market to help solve our energy dependence issues?" If you had

asked me a few weeks ago, I would have said that we need government

to be the architect of an energy policy that creates good catalysts

and incentives, instead of just letting big oil run the show on de

facto incentives that are leading to higher prices, continued

foreign dependence, and ecological threats.

But Steve's point was simply that higher prices

should be a natural trigger for innovators to create solutions. We

experience this phenomena already as triple digit oil spurs

investment in tar sands exploration and solar alternatives. And

maybe the purest way really is the best way. Goodness knows we

don't need any more complicated tax laws or new subsidies for

industries in an era when the country has a debt and deficit

crisis.

Cummins Wins Either Way

Still, I think that natural economic incentives

that would drive the massive process of converting trucking fleets

to nat gas won't happen fast enough. Oil might have to go to $150 a

barrel to be the "trigger." And that's why I tend to favor

government assistance. But, since this is a debate I need to learn

more about, I will withhold final judgment and close simply with

the best investment idea in this space.

Since all four of the nat gas E&P firms

mentioned are Zacks #3 Rank (hold) stocks, not much stands out

there. If you own one, you might just as well keep it. Regarding

the engine makers and CNG/LNG providers, WPRT and FSYS are both #4

Rank (sell) stocks and should be avoided now, while CLNE is a #3

Rank.

The one company that does stand out is

Cummins (CMI), a Zacks #1 Ranks (strong buy) name. With

strongly profitable conventional engine divisions, it also has

exposure to the nat gas engine industry. If something significant

happens on the legislative front, CMI will likely capitalize since

they are firing on all cylinders anyway. See my article from last

week "Industrial Strength Economics: CAT and CMI" for more on their

earnings drivers in light of emerging markets demand.

When in doubt, don't risk investment capital just

to speculate on future wild cards. Go with the strength of dominant

global companies with the earnings momentum to prove it.

Kevin Cook is a Senior Stock Strategist for

Zacks.com

CLEAN EGY FUELS (CLNE): Free Stock Analysis Report

CUMMINS INC (CMI): Free Stock Analysis Report

FUEL SYSTEM SOL (FSYS): Free Stock Analysis Report

WESTPORT INNOV (WPRT): Free Stock Analysis Report

Zacks Investment Research

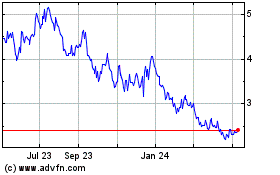

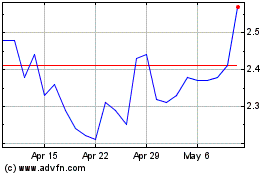

Clean Energy Fuels (NASDAQ:CLNE)

Historical Stock Chart

From Jun 2024 to Jul 2024

Clean Energy Fuels (NASDAQ:CLNE)

Historical Stock Chart

From Jul 2023 to Jul 2024