- Prospectus filed pursuant to Rule 424(b)(3) (424B3)

September 07 2010 - 12:47PM

Edgar (US Regulatory)

Use these links to rapidly review the document

TABLE OF CONTENTS_S

TABLE OF CONTENTS_P

Table of Contents

Filed pursuant to Rule 424(b)(3)

Registration No. 333-168433

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class of securities

to be registered

|

|

Amount to be

registered(1)

|

|

Proposed maximum

offering price per

unit(2)

|

|

Aggregate maximum

offering

price

|

|

Amount of

registration fee(3)

|

|

|

|

Common Stock, par value $.0001 per share

|

|

4,017,408

|

|

$14.56

|

|

$58,493,460

|

|

$4,171

|

|

|

-

(1)

-

Pursuant

to Rule 416 of the Securities Act of 1933, as amended (the "Securities Act"), the common stock of the registrant offered hereby shall be

deemed to cover additional securities to be issued as a result of stock splits, stock dividends or similar transactions.

-

(2)

-

Estimated

for purposes of calculating the registration fee in accordance with Rule 457(c) under the Securities Act, based upon the average of the

high and low price of the common stock as provided by the Nasdaq Global Market on August 31, 2010.

-

(3)

-

Payment

of the registration fee is being made in accordance with Rules 456(b) and 457(r). In addition, $4,171 of the registration fee is being

offset, pursuant to Rule 457(p) under the Securities Act, by the registration fees paid in connection with unsold securities registered by the registrant under Registration Statement

No. 333-137124 (initially filed on September 6, 2006).

PROSPECTUS SUPPLEMENT TO PROSPECTUS DATED JULY 30, 2010

Clean Energy Fuels Corp.

4,017,408 Shares of Common Stock

The selling stockholder identified in this prospectus supplement is offering up to 4,017,408 shares of our common stock, par value $0.0001 per

share. We issued the shares of common stock to the selling stockholder in connection with our acquisition of the assets and business of I.M.W. Industries Ltd. We will not receive any proceeds

from the sale of shares being sold by the selling stockholder.

The

selling stockholder may sell the shares of common stock from time to time in the open market, on the Nasdaq Global Market, in privately negotiated transactions or a combination of

these methods, at market prices prevailing at the time of sale, at prices related to the prevailing market prices, at negotiated prices, or otherwise as described under the section of this prospectus

supplement titled "Plan of Distribution."

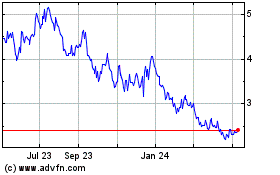

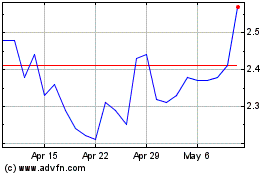

Our

common stock is listed on the Nasdaq Global Market and trades under the symbol "CLNE." On September 3, 2010, the closing sale price of our common stock was $15.48 per share.

Investing in our securities involves a high degree of risk. You should carefully consider the risks described under "Risk Factors" in

Item 1A of our most recent Quarterly Report on Form 10-Q filed on August 9, 2010 (which document is incorporated by reference herein), as well as the other information

contained or incorporated by reference in this prospectus or in any supplement hereto before making a decision to invest in our securities. See "Where You Can Find More Information" below.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these

securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The

date of this prospectus is September 7, 2010.

Table of Contents

Prospectus Supplement Table of Contents

Table of Contents

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement incorporates by reference important business and financial information about us that

is not included in or delivered with this document. This information, other than exhibits to documents that are not specifically incorporated by reference in this prospectus supplement, is available

to you without charge upon written or oral request to Clean Energy Fuels Corp. at the address or telephone number indicated in the section titled "Incorporation of Certain Information by Reference" in

this prospectus supplement.

This

document is in two parts. The first part is this prospectus supplement, which contains specific information about the selling stockholder and the terms on which the selling

stockholder is offering and selling shares of our common stock. The second part is the accompanying prospectus dated July 30, 2010, which contains and incorporates by reference important

business and financial information about us and other information about the offering.

You

should rely only on the information contained or incorporated by reference in this prospectus supplement and the accompanying prospectus or in any free writing prospectus. We have

not, and the

selling stockholder has not, authorized anyone to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not, and

the selling stockholder is not, making an offer to sell the common stock in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this

prospectus supplement, the accompanying prospectus and the documents incorporated by reference in either this prospectus supplement or the accompanying prospectus is accurate only as of their

respective dates. Our business, financial condition, results of operations and prospects may have changed since those dates.

Before

you invest in our common stock, you should carefully read the registration statement (including the exhibits thereto) of which the information in this prospectus supplement is

deemed a part and of which the accompanying prospectus forms a part, this prospectus supplement, the accompanying prospectus and the documents incorporated by reference into this prospectus

supplement and accompanying prospectus. The incorporated documents are described under "Available Information."

SUMMARY

Our Company

We are the leading provider of natural gas as an alternative fuel for vehicle fleets in the United States and Canada, based on the

number of stations operated and the amount of gasoline gallon equivalents of compressed natural gas ("CNG") and liquefied natural gas ("LNG") delivered. We offer a comprehensive solution to enable our

customers to run their fleets on natural gas, often with limited upfront expense to the customer. We design, build, finance and operate fueling stations and supply our customers with CNG and LNG. We

also produce renewable biomethane, which can be used as vehicle fuel, through our landfill gas joint venture, and provide natural gas conversions, alternative fuel systems, application engineering,

service and warranty support and research and development for natural gas vehicles through our wholly owned subsidiary, BAF Technologies, Inc. In addition, we help our customers acquire and

finance natural gas vehicles and obtain local, state and federal clean air rebates and incentives. CNG and LNG are cheaper than gasoline and diesel vehicle fuel, and are well suited for use by vehicle

fleets that consume high volumes of fuel, refuel at centralized locations, and are increasingly required to reduce emissions. According to the U.S. Department of Energy's Energy Information

Administration (EIA), the amount of natural gas consumed in the United States for vehicle use more than doubled between 2000 and 2009. We believe we are positioned to capture a substantial share of

the growth in the use of natural gas as a vehicle fuel in the United States given our leading market share and the comprehensive solutions we offer.

S-1

Table of Contents

Our

principal executive offices are located at 3020 Old Ranch Parkway, Suite 400, Seal Beach, California 90740, and our telephone number at that location is

(562) 493-2804. Our web site is located at www.cleanenergyfuels.com. The reference to our website is intended to be an inactive textual reference and the contents of our website are

not intended to be incorporated into this prospectus supplement.

Recent Developments

On September 7, 2010, we completed our acquisition of the advanced natural gas fueling compressor and related equipment

manufacturing and servicing business (the "Business") of I.M.W. Industries Ltd. ("IMW"). Pursuant to the Asset Purchase Agreement, the consideration for the Business consists of (i) the

payment at closing of $15.6 million in cash, (ii) the issuance at closing of 4,017,408 shares of our common stock, (iii) the payment on each of January 31, 2011, 2012, 2013

and 2014 of $12.5 million (each payment consisting of $5.0 million in cash plus an additional $7.5 million in cash and/or shares of our common stock, with the exact combination of

cash and/or stock to be determined at our option), (iv) an earn-out arrangement pursuant to which we will, over a four year period, pay the sellers of the Business up to

$40.0 million, based on the Business achieving certain minimum amounts of adjusted gross profit, and (v) our assumption of certain liabilities of IMW.

Founded

in 1912, IMW has manufactured industrial equipment and has been a leading supplier of compressed natural gas equipment for vehicle fueling and industrial applications since 1984.

IMW also manufactures compressor and fueling systems for hydrogen and natural gas to hydrogen reformer systems. IMW is quality certified to the standard of ISO 9001:2008 and carries a full

array of specialized certifications for the precise manufacture of compressor equipment, pressure systems and related components. IMW has an extensive, expanding global customer list that includes

vehicle manufacturers, natural gas companies, vehicle fleet operators, private fueling station owners, and CNG fuel providers. It has service centers in Canada, China, Bangladesh, Colombia and the

U.S., and is opening a second manufacturing facility in Shanghai, China.

The Offering

|

|

|

|

|

Securities offered by the Selling Stockholder

|

|

4,017,408 shares of our common stock.

|

|

Use of Proceeds

|

|

We will not receive any proceeds from the sale of common stock by the selling stockholder.

|

|

Trading

|

|

Our common stock is quoted on the Nasdaq Global Market and trades under the symbol "CLNE."

|

|

Dividend Policy

|

|

We do not intend to declare dividends for the foreseeable future, as we anticipate that we will reinvest any

future earnings in the development and growth of our business.

|

|

Risk Factors

|

|

See "Risk Factors" in Item 1A of our most recent Quarterly Report on Form 10-Q filed on August 9,

2010 and in other documents that we subsequently file with the Securities Exchange Commission, all of which are incorporated by reference to this prospectus supplement and the accompanying prospectus for a discussion of the factors you should

carefully consider before deciding to invest in the shares of our common stock being offered by the selling stockholder.

|

S-2

Table of Contents

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING STATEMENTS

This prospectus supplement, including the documents we incorporate by reference herein, contain forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933, as amended (the "Securities Act"), and Section 21E of the Exchange Act. Such statements include, without limitation, statements

regarding our expectations, hopes or intentions regarding the future. These forward looking statements can often be identified by their use of words such as "expect," "believe," "anticipate,"

"outlook," "could," "target," "project," "intend," "plan," "seek," "estimate," "should," "may" and "assume," as well as variations of such words and similar expressions referring to the future. They

also include statements concerning anticipated revenues, income or loss, capital expenditures, dividends, capital structure or other financial terms. For a non-exhaustive list of certain

forward-looking statements that are incorporated by

reference into or deemed to be a part of this prospectus supplement, please refer to the "Cautionary Note Regarding Forward-Looking Statements" in our Annual Report on Form 10-K for

the year ended December 31, 2009.

Forward-looking

statements involve certain risks and uncertainties, many of which are beyond our control. If any of those risks and uncertainties materialize, actual results could differ

materially from those discussed in any such forward-looking statement. Among the factors that could cause actual results to differ materially from those discussed in forward-looking statements are

those discussed under the heading "Risk Factors" and in other sections of (i) our Annual Report on Form 10-K for the year ended December 31, 2009, (ii) our

Quarterly Reports on Form 10-Q for the quarters ended March 31, 2010 and June 30, 2010, (iii) our other reports filed from time to time with the SEC that are

incorporated by reference into this prospectus supplement, or (iv) this prospectus supplement and accompanying prospectus. See "Incorporation of Certain Information by Reference" and "Available

Information" for information about how to obtain copies of those documents.

All

forward-looking statements in this prospectus supplement and the documents incorporated by reference herein are made only as of the date of the document in which they are contained,

based on information available to us as of the date of that document, and we caution you not to place undue reliance on forward-looking statements in light of the risks and uncertainties associated

with them. Except as required by law, we undertake no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

S-3

Table of Contents

RISK FACTORS

You should carefully consider, among other things, the matters discussed under "Risk Factors" in Item 1A of our most recent

Quarterly Report on Form 10-Q filed on August 9, 2010, and in other documents that we subsequently file with the Securities Exchange Commission, all of which are incorporated

by reference to this prospectus supplement. Each of the referenced risks and uncertainties could adversely affect our business, operating results and financial condition, as well as adversely affect

the value of an investment in our securities. Additional risks not known to us or that we believe are immaterial may also adversely affect our business, operating results and financial condition and

the value of an investment in our securities.

S-4

Table of Contents

USE OF PROCEEDS

Because the selling stockholder will sell the shares of our common stock offered under this prospectus supplement, we will receive no

cash proceeds. All proceeds from the sale of our common stock offered under this prospectus supplement will be for the account of the selling stockholder, as described below. See "Selling Stockholder"

and "Plan of Distribution" described below.

S-5

Table of Contents

SELLING STOCKHOLDER

The following table, which was prepared based on information supplied to us by the selling stockholder, sets forth the name of the

selling stockholder, the number of shares beneficially owned by the selling stockholder and the number of shares to be offered by the selling stockholder pursuant to this prospectus supplement. The

table also provides information regarding the beneficial ownership of our common stock by the selling stockholder as adjusted to reflect the assumed sale of all of the shares of common stock offered

under this prospectus supplement. The ownership percentage indicated in the following table is based on 60,907,389 outstanding shares of common stock of the Company as of September 2, 2010 and

assumes the issuance of 4,017,408 shares of common stock to the selling stockholder.

Beneficial

ownership is determined in accordance with the rules of the SEC. The address of the selling stockholder is: c/o Clean Energy Fuels Corp., 3020 Old Ranch Parkway,

Suite 400, Seal Beach, California 90740.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Beneficial Ownership

Prior to Offering

|

|

|

|

Beneficial Ownership

After Offering

|

|

|

|

Number of

Shares Offered

Hereby

|

|

|

Name of Selling Stockholder

|

|

Number

|

|

Percentage

|

|

Number

|

|

Percentage

|

|

|

B&M Miller Equity Holdings Inc.(1)

|

|

|

4,017,408

|

|

|

6.19

|

%

|

|

4,017,408

|

|

|

—

|

|

|

—

|

%

|

-

(1)

-

Bradley

N. Miller has sole voting and dispositive power over the shares of common stock reported in the table above. Mr. Miller was the President of

I.M.W. Industries Ltd. The shares being registered hereunder are a portion of the consideration received by IMW and its affiliates in connection with our acquisition of the Business. After the

consummation of the acquisition, Mr. Miller will become employed by us as President of Clean Energy Compression Corp.

PLAN OF DISTRIBUTION

The selling stockholder, and its pledges, assignees, donees, or other successors-in-interest may, from time to

time, sell any or all of his shares of common stock on any stock exchange, market or trading facility on which the shares are traded or in private transactions. If the shares of common stock are sold

through underwriters, broker-dealers or agents, the selling stockholder will be responsible for underwriting discounts or commissions or agent's commissions. These sales may be at fixed prices, at

prevailing market prices at the time of the sale, at varying prices determined at the time of sale, or negotiated prices. The selling stockholder may use any one or more of the following methods when

selling shares:

-

•

-

block transactions (which may involve crosses) and transactions on the Nasdaq Global Market or any other organized market

where the securities may be traded;

-

•

-

purchases by a broker-dealer as principal and resale by the broker-dealer for its own account;

-

•

-

ordinary brokerage transactions and transactions in which a broker-dealer solicits purchasers;

-

•

-

sales "at the market" to or through a market maker or into an existing trading market, on an exchange or otherwise;

-

•

-

sales in other ways not involving market makers or established trading markets, including direct sales to purchasers in

privately negotiated transactions;

-

•

-

a combination of any such methods of sale; and

-

•

-

any other method permitted pursuant to applicable law.

S-6

Table of Contents

The

selling stockholder may also engage in short sales against the box, puts and calls and other transactions in our securities or derivatives of our securities and may sell or deliver

shares in connection with these trades.

Broker-dealers

engaged by the selling stockholder may arrange for other broker-dealers to participate in sales. Broker-dealers may receive commissions or discounts from the selling

stockholder (or, if any broker-dealer acts as agent for the purchaser of shares, from the purchaser) in amounts to be negotiated. The selling stockholder does not expect these commissions and

discounts to exceed what is customary in the types of transactions involved. Any profits on the resale of shares of common stock by a broker-dealer acting as principal might be deemed to be

underwriting discounts or commissions under the Securities Act. Discounts, concessions, commissions and similar selling expenses, if any, attributable to the sale of shares will be borne by the

selling stockholder. The selling stockholder may agree to indemnify any agent, dealer or broker-dealer that participates in transactions involving sales of the shares if liabilities are imposed on

that person under the Securities Act.

In

connection with the sale of the shares of common stock or otherwise, the selling stockholder may enter into hedging transactions with broker-dealers, which may in turn engage in short

sales of the shares of common stock in the course of hedging in positions they assume. The selling stockholder may also sell shares of common stock short and deliver shares of common stock covered by

this prospectus supplement to close out short positions and to return borrowed shares in connection with such short sales. The selling stockholder may also loan or pledge shares of common stock to

broker-dealers that in turn may sell such shares.

The

selling stockholder may from time to time pledge or grant a security interest in some or all of the shares of common stock owned by him and, if he defaults in the performance of his

secured obligations, the pledgees or secured parties may offer and sell the shares of common stock from time to time under this prospectus supplement after we have filed an update to this prospectus

supplement under Rule 424(b) under the Securities Act or other applicable provision of the Securities Act amending the list of selling stockholder to include the pledgee, transferee or other

successors in interest as selling stockholder under this prospectus supplement.

The

selling stockholder also may transfer the shares of common stock in other circumstances, in which case the transferees, pledgees or other successors in interest will be the selling

beneficial owners for purposes of this prospectus supplement and may sell the shares of common stock from time to time under this prospectus supplement after we have filed an update to this prospectus

supplement under Rule 424(b) or other applicable provision of the Securities Act amending the list of selling stockholder to include the pledgee, transferee or other successors in interest as

selling stockholder under this prospectus supplement. The selling stockholder also may transfer and donate the shares of common stock in other circumstances in which case the transferees, donees,

pledgees or other successors in interest will be the selling beneficial owners for purposes of this prospectus supplement.

The

selling stockholder and any broker-dealers or agents that are involved in selling the shares may be deemed to be "underwriters" within the meaning of the Securities Act in connection

with such sales. In such event, any commissions paid, or any discounts or concessions allowed to, such broker-dealers or agents and any profit realized on the resale of the shares purchased by them

may be deemed to be underwriting commissions or discounts under the Securities Act. At the time a particular offering of the shares of common stock is made, a prospectus supplement, if required, will

be filed that will set forth the aggregate amount of shares of common stock being offered and the terms of the offering, including the name or names of any broker-dealers or agents, any discounts,

commissions and other terms constituting compensation from the selling stockholder and any discounts, commissions or concessions allowed or reallowed or paid to broker-dealers. Under the securities

laws of some states, the shares of common stock may be sold in such states only through registered or licensed brokers or dealers. There can be no assurance that the selling stockholder will sell any

or all of the shares of

S-7

Table of Contents

common

stock registered pursuant to the shelf registration statement, of which this prospectus supplement and the accompanying prospectus are deemed a part.

The

anti-manipulation rules of Regulation M under the Exchange Act may apply to sales of our common stock and activities of the selling stockholder, which may limit

the timing of purchases and sales of any of the shares of common stock by the selling stockholder and any other participating person. Regulation M may also restrict the ability of any person

engaged in the distribution of the shares of common stock to engage in passive market-making activities with respect to the shares of common stock. Passive market-making involves transactions in which

a market-maker acts as both our underwriter and as a purchaser of our common stock in the secondary market. All of the foregoing may affect the marketability of the shares of common stock and the

ability of any person or entity to engage in market-making activities with respect to the shares of common stock.

S-8

Table of Contents

LEGAL MATTERS

Morrison & Foerster LLP, San Francisco, California, will pass upon the validity of the securities offered by this

prospectus supplement and the accompanying prospectus.

EXPERTS

The consolidated financial statements and schedule of Clean Energy Fuels Corp. as of December 31, 2008 and 2009 and for each of

the years in the three-year period ended December 31, 2009, and management's assessment of the effectiveness of internal control over financial reporting as of December 31,

2009 have been incorporated by reference herein in reliance upon the report of KPMG LLP, independent registered public accounting firm, incorporated by reference herein and upon the authority

of said firm as experts in auditing and accounting.

The

audit report on the effectiveness of internal control over financial reporting as of December 31, 2009, contains an explanatory paragraph that states that management's

assessment of and conclusion on the effectiveness of internal control over financial reporting did not include the internal controls of BAF Technologies, Inc., which constituted 4% of total

assets as of December 31, 2009 and 5% of revenues for the year then ended. The audit of internal control over financial reporting of Clean Energy Fuels Corp. and subsidiaries also did not

include an evaluation of the internal control over financial reporting of BAF Technologies, Inc.

The

audit report covering the December 31, 2009, consolidated financial statements refers to a change in the method of accounting for business combinations.

S-9

Table of Contents

AVAILABLE INFORMATION

We are required to file annual, quarterly and current reports, proxy statements and other information with the SEC. You may read and

copy any documents filed by us at the SEC's public reference room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for

further information on the public reference room. Our filings with the SEC are also available to the public through the SEC's web site at http://www.sec.gov.

We

have filed with the SEC an automatic shelf registration statement on Form S-3, of which this prospectus supplement and accompanying prospectus are a part, relating

to the securities covered by this prospectus supplement. This prospectus supplement and accompanying prospectus are a part of the registration statement and do not contain all the information in the

registration statement. Whenever a reference is made in this prospectus supplement and accompanying prospectus to a contract or other document of the company, the reference is only a summary and you

should refer to the exhibits that are a part of the registration statement for a copy of the contract or other document. You may review a copy of the registration statement at the SEC's public

reference room in Washington, D.C., as well as through the SEC's web site.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC and applicable law permits us to "incorporate by reference" into this prospectus supplement and accompanying prospectus

information that we have or may in the future file with or furnish to the SEC. This means that we can disclose important information by referring you to those documents. You should read carefully the

information incorporated herein by reference because it is an important part of this prospectus supplement and accompanying prospectus.

We

incorporate by reference into this prospectus supplement and accompanying prospectus the following documents or information filed with the SEC (other than, in each case, documents or

information deemed to have been furnished and not filed in accordance with SEC rules):

-

•

-

Our Annual Report on Form 10-K for the year ended December 31, 2009;

-

•

-

Our Quarterly Report on Form 10-Q for the period ended March 31, 2010;

-

•

-

Our Quarterly Report on Form 10-Q for the period ended June 30, 2010;

-

•

-

Our Current Reports on Form 8-K filed with the SEC on February 18, 2010, May 28, 2010,

June 30, 2010, and July 6, 2010;

-

•

-

The description of our common stock contained in the Registration Statement on Form S-1, which became

effective on May 24, 2007, including any amendment or report filed for the purposes of updating such description; and

-

•

-

All documents filed by Clean Energy Fuels Corp. under Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange

Act of 1934, as amended (the "Exchange Act"), on or after the date of this prospectus and before the termination of this offering shall be deemed to be incorporated by reference into this prospectus

from the respective dates of filing of such documents.

Any

information that we subsequently file with the SEC that is incorporated by reference as described above will automatically update and supersede any previous information that is part

of this prospectus supplement and accompanying prospectus. Any statement so updated or superseded shall not be deemed, except as so updated or superseded, to constitute a part of this prospectus

supplement or accompanying prospectus.

We

will provide without charge to each person, including any beneficial owner, to whom this prospectus supplement is required to be delivered, upon his or her written or oral request, a

copy of any or all documents referred to above which have been or may be incorporated by reference into this prospectus supplement and accompanying prospectus excluding exhibits to those documents

unless they are specifically incorporated by reference into those documents. Written or telephone requests should be directed to Clean Energy Fuels Corp., Attn: Investor Relations, 3020 Old Ranch

Parkway, Suite 400, Seal Beach, California 90740, (562) 493-2804.

S-10

Table of Contents

PROSPECTUS

Clean Energy Fuels Corp.

Common Stock

Preferred Stock

Debt Securities

Warrants

Rights

Units

We or selling securityholders may from time to time offer to sell common stock, preferred stock, debt securities, depositary shares, warrants, or

units.

Each

time we or a selling securityholder sells securities pursuant to this prospectus, we will provide a supplement to this prospectus. Prospectus supplements will be filed and other

offering material may be provided at later dates that will contain specific information about the offering and specific terms of the securities offered. You should read this prospectus and the

applicable prospectus supplement carefully before you invest in our securities.

Our

common stock is listed on the Nasdaq Global Market and trades under the symbol "CLNE." We or selling securityholders may offer and sell these securities to or through one or more

underwriters, dealers and agents, or directly to purchasers, on a continuous or delayed basis. The applicable prospectus supplement will contain information, where applicable, as to any other listing,

if any, of the securities covered by the applicable prospectus supplement.

Investing in our securities involves a high degree of risk. See the "Risk Factors" section of our filings with the SEC and the applicable

prospectus supplement for certain risks that you should consider before investing in our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these

securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The

date of this prospectus is July 30, 2010.

Table of Contents

TABLE OF CONTENTS

Table of Contents

ABOUT THIS PROSPECTUS

This document is called a prospectus and is part of a registration statement that we have filed with the Securities and Exchange

Commission, or the SEC, using a "shelf" registration process. Under this shelf registration process, we or selling securityholders may, from time to time, sell any combination of the securities

described in this prospectus in one or more offerings in amounts to be determined from time to time.

This

prospectus provides you with a general description of the securities we or selling securityholders may offer. Each time we or selling securityholders offer a type or series of

securities described in this prospectus, we will provide a prospectus supplement, or information that is incorporated by reference into this prospectus, containing more specific information about the

terms of the securities that are being offered. We may also authorize one or more free writing prospectuses to be provided to you that may contain material information relating to these offerings and

securities. We may also add, update or change in the prospectus supplement any of the information contained in this prospectus or in the documents that we have incorporated by reference into this

prospectus, including without limitation, a discussion of any risk factors or other special considerations that apply to these offerings or securities or the specific plan of distribution. If there is

any inconsistency between the information in this prospectus and a prospectus supplement or information incorporated by reference having a later date,

you should rely on the information in that prospectus supplement or incorporated information having a later date. We urge you to read carefully this prospectus, any applicable prospectus supplement

and any related free writing prospectus, together with the information incorporated herein by reference as described under the heading "Where You Can Find More Information," before buying any of the

securities being offered.

You

should rely only on the information we have provided or incorporated by reference in this prospectus, any applicable prospectus supplement and any related free writing prospectus. We

have not authorized anyone to provide you with different information. No dealer, salesperson or other person is authorized to give any information or to represent anything not contained in this

prospectus, any applicable prospectus supplement or any related free writing prospectus.

The

registration statement containing this prospectus, including exhibits to the registration statement, provides additional information about us and the securities offered under this

prospectus and any prospectus supplement. We have filed and plan to continue to file other documents with the SEC that contain information about us and our business. Also, we will file legal documents

that control the terms of the securities offered by this prospectus as exhibits to the reports that we file with the SEC. The registration statement and other reports can be read at the SEC web site

or at the SEC offices mentioned under the heading "Available Information."

1

Table of Contents

AVAILABLE INFORMATION

We are required to file annual, quarterly and current reports, proxy statements and other information with the SEC. You may read and

copy any documents filed by us at the SEC's public reference room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for

further information on the public reference room. Our filings with the SEC are also available to the public through the SEC's web site at http://www.sec.gov.

We

have filed with the SEC a registration statement on Form S-3, of which this prospectus is a part, relating to the securities covered by this prospectus. This

prospectus is a part of the registration statement and does not contain all the information in the registration statement. Whenever a reference is made in this prospectus to a contract or other

document of the Company, the

reference is only a summary and you should refer to the exhibits that are a part of the registration statement for a copy of the contract or other document. You may review a copy of the registration

statement at the SEC's public reference room in Washington, D.C., as well as through the SEC's web site.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC and applicable law permits us to "incorporate by reference" into this prospectus information that we have or may in the future

file with or furnish to the SEC. This means that we can disclose important information by referring you to those documents. You should read carefully the information incorporated herein by reference

because it is an important part of this prospectus.

We

incorporate by reference into this prospectus the following documents or information filed with the SEC (other than, in each case, documents or information deemed to have been

furnished and not filed in accordance with SEC rules):

-

•

-

Our Annual Report on Form 10-K for the year ended December 31, 2009;

-

•

-

Our Quarterly Report on Form 10-Q for the period ended March 31, 2010;

-

•

-

Our Current Reports on Form 8-K filed with the SEC on February 18, 2010, May 28, 2010,

June 30, 2010, and July 6, 2010;

-

•

-

The description of our common stock contained in the Registration Statement on Form S-1, which became

effective on May 24, 2007, including any amendment or report filed for the purposes of updating such description; and

-

•

-

All documents filed by Clean Energy Fuels Corp. under Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange

Act of 1934, as amended (the "Exchange Act"), on or after the date of this prospectus and before the termination of this offering shall be deemed to be incorporated by reference into this prospectus

from the respective dates of filing of such documents.

Any

information that we subsequently file with the SEC that is incorporated by reference as described above will automatically update and supersede any previous information that is part

of this prospectus.

We

will provide without charge to each person, including any beneficial owner, to whom this prospectus is delivered, upon his or her written or oral request, a copy of any or all

documents referred to above which have been or may be incorporated by reference into this prospectus excluding exhibits to those documents unless they are specifically incorporated by reference into

those documents. Written or telephone requests should be directed to Clean Energy Fuels Corp., Attn: Investor Relations, 3020 Old Ranch Parkway, Suite 400, Seal Beach, California 90740,

(562) 493-2804.

2

Table of Contents

FORWARD-LOOKING STATEMENTS

This prospectus and any accompanying prospectus supplement, including the documents we incorporate by reference therein or that are

deemed to be a part thereof, contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the "Securities Act"), and Section 21E of the

Exchange Act. Such statements include, without limitation, statements regarding our expectations, hopes or intentions regarding the future. These forward looking statements can often be identified by

their use of words such as "expect," "believe," "anticipate," "outlook," "could," "target," "project," "intend," "plan," "seek," "estimate," "should," "may" and "assume," as well as variations of such

words and similar expressions referring to the future. They also include statements concerning anticipated revenues, income or loss, capital expenditures, dividends, capital structure or other

financial terms. For a non-exhaustive list of certain forward-looking statements that are incorporated by reference into or deemed to be a part of this prospectus and any prospectus

supplement, please refer to the "Cautionary Note Regarding Forward-Looking Statements" in our Annual Report on Form 10-K for the year ended December 31, 2009.

Forward-looking

statements involve certain risks and uncertainties, many of which are beyond our control. If any of those risks and uncertainties materialize, actual results could differ

materially from those discussed in any such forward-looking statement. Among the factors that could cause actual results to differ materially from those discussed in forward-looking statements are

those discussed under the heading "Risk Factors" and in other sections of (i) our Annual Report on Form 10-K for the year ended December 31, 2009, (ii) our

Quarterly Report on Form 10-Q for the quarter ended March 31, 2010, (iii) our other reports filed from time to time with the SEC that are incorporated by reference

into this prospectus and any prospectus supplement, or (iv) any prospectus supplement to this prospectus. See "Available Information" and "Incorporation of Certain Information by Reference" for

information about how to obtain copies of those documents.

All

forward-looking statements in this prospectus, any prospectus supplement and the documents incorporated by reference therein are made only as of the date of the document in which

they are contained, based on information available to us as of the date of that document, and we caution you not to place undue reliance on forward-looking statements in light of the risks and

uncertainties associated with them. Except as required by law, we undertake no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

3

Table of Contents

RISK FACTORS

Investing in our securities involves significant risks. You should review carefully the risks and uncertainties described under the

heading "Risk Factors" contained in, or incorporated by reference into, this prospectus, the applicable prospectus supplement, and any related free writing prospectus. Each of the referenced risks and

uncertainties could adversely affect our business, operating results and financial condition, as well as adversely affect the value of an investment in our securities. Additional risks not known to us

or that we believe are immaterial may also adversely affect our business, operating results and financial condition and the value of an investment in our securities.

DESCRIPTION OF SECURITIES WE MAY OFFER

We may issue, or selling securityholders may offer, from time to time, in one or more offerings the following

securities:

-

•

-

shares of common stock;

-

•

-

shares of preferred stock;

-

•

-

debt securities;

-

•

-

warrants exercisable for debt securities, common stock or preferred stock;

-

•

-

or rights to purchase any of such securities; and

-

•

-

units of debt securities, common stock, preferred stock, rights or warrants, in any combination.

This

prospectus contains a summary of the material general terms of the various securities that we or selling securityholders may offer. The specific terms of the securities will be

described in a prospectus supplement, information incorporated by reference, or free writing prospectus, which may be in addition to or different from the general terms summarized in this prospectus.

Where applicable, the prospectus supplement, information incorporated by reference or free writing prospectus will also describe any material United States federal income tax considerations relating

to the securities offered and indicate whether the securities offered are or will be listed on any securities exchange. The

summaries contained in this prospectus and in any prospectus supplements, information incorporated by reference or free writing prospectus may not contain all of the information that you would find

useful. Accordingly, you should read the actual documents relating to any securities sold pursuant to this prospectus. See "Available Information" and "Incorporation of Certain Information by

Reference" for information about how to obtain copies of those documents.

The

terms of any particular offering, the initial offering price and the net proceeds to us will be contained in the prospectus supplement, information incorporated by reference or free

writing prospectus relating to such offering.

DESCRIPTION OF CAPITAL STOCK

General

The following summary of the material features of our capital stock does not purport to be complete and is subject to, and qualified in

its entirety by, the provisions of our restated certificate of incorporation, our amended and restated bylaws and other applicable law. See "Available Information."

Pursuant

to our restated certificate of incorporation, we are currently authorized to issue 149,000,000 shares of common stock, par value $0.0001 per share, and 1,000,000 shares of

preferred stock, par value $0.0001 per share. The authorized shares of our common stock and preferred stock will be available for issuance without further action by our stockholders, unless such

action is required by applicable law or the rules of any stock exchange or automated quotation system on which our

4

Table of Contents

securities

may be listed or traded. If the approval of our stockholders is not required, our board of directors may determine not to seek stockholder approval.

Common Stock

Subject to provisions of the Delaware General Corporation Law, or the DGCL, and to any future rights which may be granted to the

holders of any series of our preferred stock, dividends are paid on our common stock when and as declared by our board of directors out of funds legally available for dividend payments.

Each holder of shares of our common stock is entitled to one vote per share on all matters submitted to a vote of our common

stockholders. Holders of our common stock are not entitled to cumulative voting rights.

If we are liquidated, holders of our common stock are entitled to receive all remaining assets available for distribution to

stockholders after satisfaction of our liabilities and the preferential rights of any of our preferred stock that may be outstanding at that time.

The holders of our common stock do not have any preemptive, conversion or redemption rights by virtue of their ownership of the common

stock.

Preferred Stock

Shares of our preferred stock may be issued in one or more series, and our board of directors is authorized to determine the

designation and to fix the number of shares of each series. Our board of directors is further authorized to fix and determine the dividend rate, premium or redemption rates, conversion rights, voting

rights, preferences, privileges, restrictions and other variations granted to or imposed upon any wholly unissued series of our preferred stock.

Prior

to the issuance of shares of a series of preferred stock, our board of directors will adopt resolutions and file a certificate of designation with the SEC. The certificate

of designation will fix for each series the designation and number of shares and the rights, preferences, privileges and restrictions of the shares including, but not limited to, the

following:

-

•

-

the maximum number of shares in the series and the distinctive designation;

-

•

-

voting rights, if any, of the preferred stock;

-

•

-

the dividend rate(s), period(s) and/or payment date(s) or method(s) of calculation applicable to the preferred stock;

-

•

-

whether dividends are cumulative or non-cumulative, and if cumulative, the date from which dividends on the

preferred stock will accumulate;

-

•

-

the relative ranking and preferences of the preferred stock as to dividend rights and rights upon the liquidation,

dissolution or winding up of our affairs;

5

Table of Contents

-

•

-

the terms and conditions, if applicable, upon which the preferred stock will be convertible into common stock, another

series of preferred stock, or any other class of securities being registered hereby, including the conversion price (or manner of calculation) and conversion period;

-

•

-

the provision for redemption, if applicable, of the preferred stock;

-

•

-

the provisions for a sinking fund, if any, for the preferred stock;

-

•

-

liquidation preferences;

-

•

-

any limitations on the issuance of any class or series of preferred stock ranking senior to or on a parity with the class

or series of preferred stock as to dividend rights and rights upon liquidation, dissolution or winding up of our affairs; and

-

•

-

any other specific terms, preferences, rights, limitations or restrictions of the preferred stock.

There

shall be no limitation or restriction on any variation between any of the different series of preferred stock as to the designations, preferences and relative, participating,

optional or other special rights, and the qualifications, limitations or restrictions thereof; and the several series of preferred stock may, except as otherwise expressly provided in any prospectus

supplement, document incorporated by reference or any free writing prospectus, as applicable, vary in any and all respects as fixed and

determined by the resolution or resolutions of our board of directors or any committee thereof, providing for the issuance of the various series;

provided,

however

, that all shares of any one series of preferred stock shall have the same designation, preferences and relative, participating, optional or other special rights and

qualifications, limitations and restrictions.

Except

as otherwise required by law, or as otherwise fixed by resolution or resolutions of our board of directors, each stockholder shall be entitled to one vote for each share of

capital stock held by such stockholder on the record date.

Certain Anti-Takeover Matters

Our restated certificate of incorporation and amended and restated bylaws include a number of provisions that may have the effect of

encouraging persons considering unsolicited tender offers or other unilateral takeover proposals to negotiate with our board of directors rather than pursue non-negotiated takeover

attempts. These provisions include:

Our amended and restated bylaws establish advance notice procedures with regard to stockholder proposals relating to the nomination of

candidates for election as directors or new business to be brought before meetings of our stockholders. These procedures provide that notice of such stockholder proposals must be timely and given in

writing to our Secretary prior to the meeting at which the action is to be taken. Generally, to be timely, notice must be received at our principal executive offices not less than 60 days or

more than 90 days prior to the anniversary date of the annual meeting for the preceding year. The notice must contain certain information specified in the amended and restated bylaws.

Our charter provides for 1,000,000 authorized shares of preferred stock. The existence of authorized but unissued shares of preferred

stock may enable the board of directors to render more difficult or to discourage an attempt to obtain control of us by means of a merger, tender offer, proxy contest or otherwise. For example, if in

the due exercise of its fiduciary obligations, the board of directors were to determine that a takeover proposal is not in our best interests, the board of directors could cause shares of preferred

stock to be issued without stockholder approval in one or more private

6

Table of Contents

offerings

or other transactions that might dilute the voting or other rights of the proposed acquiror or insurgent stockholder or stockholder group. In this regard, the charter grants our board of

directors broad power to establish the rights and preferences of authorized and unissued shares of preferred stock. The issuance of shares of preferred stock could decrease the amount of earnings and

assets available for distribution to holders of shares of common stock. The issuance may also adversely affect the rights and powers, including voting rights, of such holders and may have the effect

of delaying, deterring or preventing a change of control of us.

We are subject to the provisions of Section 203 of the Delaware General Corporation Law regulating corporate takeovers. In

general, Section 203 prohibits a Delaware corporation from engaging in any business combination with any interested stockholder for a period of three years following the date that the

stockholder became an interested stockholder, unless:

-

•

-

the transaction is approved by the board before the date the interested stockholder attained that status;

-

•

-

upon consummation of the transaction that resulted in the stockholder becoming an interested stockholder, the interested

stockholder owned at least 85% of the voting stock of the corporation outstanding at the time the transaction commenced; or

-

•

-

on or after the date the business combination is approved by the board, the business combination is authorized at a

meeting of stockholders by at least two-thirds of the outstanding voting stock that is not owned by the interested stockholder.

Section 203

defines "business combination" to include the following:

-

•

-

any sale, lease, exchange, mortgage, transfer, pledge or other disposition of 10% or more of the assets of the corporation

involving the interested stockholder; a

-

•

-

any merger or consolidation involving the corporation or any majority-owned subsidiary and the interested stockholder;

-

•

-

subject to certain exceptions, any transaction that results in the issuance or transfer by the corporation or by any

majority-owned subsidiary of any stock of the corporation or of such subsidiary to the interested stockholder;

-

•

-

any transaction involving the corporation or any majority-owned subsidiary that has the effect of increasing the

proportionate share of the stock of any class or series of the corporation beneficially owned by the interested stockholder; or

-

•

-

the receipt by the interested stockholder of the benefit of any loans, advances, guarantees, pledges or other financial

benefits provided by or through the corporation or any majority-owned subsidiary.

In

general, Section 203 defines "interested stockholder" to be any entity or person beneficially owning 15% or more of the outstanding voting stock of the corporation and any

entity or person affiliated with or controlling or controlled by any of these entities or persons.

A

Delaware corporation may opt out of this provision either with an express provision in its original Certificate of Incorporation or in an amendment to its Certificate of Incorporation

or Bylaws approved by its stockholders. We have not opted out of this provision. Section 203 could prohibit or delay mergers or other takeover or change in control attempts and, accordingly,

may discourage attempts to acquire us.

7

Table of Contents

Limitation of Liability and Indemnification Matters

Our restated certificate of incorporation provides that a director of ours will not be liable to us or our stockholders for monetary

damages for breach of fiduciary duty as a director, except in certain cases where liability is mandated by the Delaware General Corporation Law. Our amended and restated bylaws also provide for

indemnification, to the fullest extent permitted by law, by us of any person made or threatened to be made a party to, or who is involved in, any threatened, pending or completed action, suit or

proceeding, whether civil, criminal, administrative or investigative, by reason of the fact that such person is or was our director or officer, or at our request, serves or served as a director or

officer of any other enterprise, against all expenses, liabilities, losses and claims actually incurred or suffered by such person in connection with the action, suit or proceeding. Our amended and

restated bylaws also provide that, to the extent authorized from time to time by our board of directors, we may provide indemnification to any one or more employees and other agents of ours to the

extent and effect determined by the board of directors to be appropriate and authorized by the Delaware General Corporation Law. Our amended and restated bylaws also permit us to purchase and maintain

insurance for the foregoing and we expect to maintain such insurance.

Listing

Our common stock is listed on the Nasdaq Global Market and trades under the symbol "CLNE."

Transfer Agent and Registrar

The Transfer Agent and Registrar for our common stock is Computershare Trust Company, N.A.

DESCRIPTION OF DEBT SECURITIES

The following sets forth certain general terms and provisions of the base indenture to be entered into between us and an entity

identified in the applicable prospectus supplement, as trustee, under which the debt securities are to be issued from time to time. We have filed a form of the base indenture as an exhibit to the

registration statement of which this prospectus is a part. When the debt securities are offered in the future, the applicable offering material will explain the particular terms of those securities

and the extent to which the general provisions may apply. The base indenture, as it may be supplemented, amended or modified from time to time, is referred to in this prospectus as the "indenture."

Wherever particular sections or defined terms of the indenture are referred to, it is intended that such sections or defined terms shall be incorporated herein by reference. In this section of the

prospectus, the term "the Company" refers only to Clean Energy Fuels Corp. and not to any of its subsidiaries.

This

summary and any description of the indenture and any debt securities in the applicable prospectus supplement, information incorporated by reference or free writing prospectus is

subject to and is qualified in its entirety by reference to all the provisions of the indenture, any indenture supplement and the terms of the debt securities, including, in each case, the definitions

therein of certain terms. We will file each of these documents, as applicable, with the SEC and incorporate them by reference as an exhibit to the registration statement of which this prospectus is a

part on or before the time we issue a series of debt securities. See "Available Information" and "Incorporation of Certain Information by Reference" for information on how to obtain a copy of a

document when it is filed. The specific terms of the debt securities as described in a prospectus supplement, information incorporated by reference, or free writing prospectus will supplement and, if

applicable, may modify or replace the general terms described in this section.

The

debt securities will represent unsecured general obligations of the Company, unless otherwise provided in the applicable offering material. As indicated in the applicable offering

material, the debt securities will be either senior debt or subordinated debt.

8

Table of Contents

General

The indenture does not limit the amount of debt securities that may be issued thereunder. The applicable prospectus supplement,

documents incorporated by reference, or free writing prospectus with respect to any debt securities will set forth the following terms of the debt securities offered pursuant

thereto:

-

•

-

the title and series of such debt securities;

-

•

-

any limit upon the aggregate principal amount of such debt securities of such series;

-

•

-

whether such debt securities will be in global or other form;

-

•

-

the date or dates and method or methods by which principal and any premium on such debt securities is payable;

-

•

-

the interest rate or rates (or method by which such rate will be determined), if any;

-

•

-

the dates on which any such interest will be payable and the method of payment;

-

•

-

whether and under what circumstances any additional amounts are payable with respect to such debt securities;

-

•

-

the notice, if any, to holders of such debt securities regarding the determination of interest on a floating rate debt

security;

-

•

-

the basis upon which interest on such debt securities shall be calculated, if other than that of a 360 day year of

twelve 30-day months;

-

•

-

the place or places where the principal of and interest or additional amounts, if any, on such debt securities will be

payable;

-

•

-

any redemption or sinking fund provisions, or the terms of any repurchase at the option of the holder of the debt

securities;

-

•

-

the denominations of such debt securities, if other than $1,000 and integral multiples thereof;

-

•

-

any rights of the holders of such debt securities to convert the debt securities into, or exchange the debt securities

for, other securities or property;

-

•

-

the terms, if any, on which payment of principal or any premium, interest or additional amounts on such debt securities

will be payable in a currency other than U.S. dollars;

-

•

-

the terms, if any, by which the amount of payments of principal or any premium, interest or additional amounts on such

debt securities may be determined by reference to an index, formula, financial or economic measure or other methods;

-

•

-

if other than the principal amount hereof, the portion of the principal amount of such debt securities that will be

payable upon declaration of acceleration of the maturity thereof or provable in bankruptcy;

-

•

-

any events of default or covenants in addition to or in lieu of those described herein and remedies therefor;

-

•

-

whether such debt securities will be subject to defeasance or covenant defeasance;

-

•

-

the terms, if any, upon which such debt securities are to be issuable upon the exercise of warrants, units or rights;

-

•

-

any trustees and any authenticating or paying agents, transfer agents or registrars or any other agents with respect to

such debt securities;

9

Table of Contents

-

•

-

the terms, if any, on which such debt securities will be subordinate to other debt of the Company;

-

•

-

whether such debt securities will be guaranteed and the terms thereof;

-

•

-

whether such debt securities will be secured by collateral and the terms of such security; and

-

•

-

any other specific terms of such debt securities and any other deletions from or additions to or modifications of the

indenture with respect to such debt securities.

Debt

securities may be presented for exchange, conversion or transfer in the manner, at the places and subject to the restrictions set forth in the debt securities and the applicable

offering material. Such services will be provided without charge, other than any tax or other governmental charge payable in connection therewith, but subject to the limitations provided in the

indenture.

The

indenture does not contain any covenant or other specific provision affording protection to holders of the debt securities in the event of a highly leveraged transaction or a change

in control of the Company, except to the limited extent described below under "—Consolidation, Merger and Sale of Assets."

Modification and Waiver

The indenture provides that supplements to the indenture and the applicable supplemental indentures may be made by the Company and the

trustee for the purpose of adding any provisions to or changing in any manner or eliminating any of the provisions of the indenture or of modifying in any manner the rights of the holders of debt

securities of a series under the indenture or the debt securities of such series, with the consent of the holders of a majority (or such greater amount as is provided for a particular series of debt

securities) in principal amount of the outstanding debt securities issued under such indenture that are affected by the supplemental indenture, voting as a single class; provided that no such

supplemental indenture may, without the consent of the holder of each such debt security affected thereby, among other things:

(a) change

the stated maturity of the principal of, or any premium, interest or additional amounts on, such debt securities, or reduce the principal amount thereof, or

reduce the rate or extend the time of payment of interest or any additional amounts thereon, or reduce any premium payable on redemption thereof or otherwise, or reduce the amount of the principal of

debt securities issued with original issue discount that would be due and payable upon an acceleration of the maturity thereof or the amount thereof provable in bankruptcy, or change the redemption

provisions or adversely affect the right of repayment at the option of the holder, or change the place of payment or currency in which the principal of, or any premium, interest or additional amounts

with respect to any debt security is payable, or impair or affect the right of any holder of debt securities to institute suit for the payment after such payment is due (except a rescission and

annulment of acceleration with respect to a series of debt securities by the holders of at least a majority in aggregate principal amount of the then outstanding debt securities of such series and a

waiver of the payment default that resulted from such acceleration);

(b) reduce

the percentage of outstanding debt securities of any series, the consent of the holders of which is required for any such supplemental indenture, or the consent

of whose holders is required for any waiver or reduce the quorum required for voting;

(c) modify

any of the provisions of the sections of such indenture relating to supplemental indentures with the consent of the holders, waivers of past defaults or

securities redeemed in part, except to increase any such percentage or to provide that certain other provisions of such indenture cannot be modified or waived without the consent of each holder

affected thereby; or

10

Table of Contents

(d) make

any change that adversely affects the right to convert or exchange any security into or for common stock or other securities, cash or other property in accordance

with the terms of the applicable debt security.

The

indenture provides that a supplemental indenture that changes or eliminates any covenant or other provision of the indenture that has expressly been included solely for the benefit

of one or more particular series of debt securities, or that modifies the rights of the holders of such series with respect to such covenant or other provision, shall be deemed not to affect the

rights under the indenture of the holders of debt securities of any other series.

The

indenture provides that the Company and the trustee may, without the consent of the holders of any series of debt securities issued thereunder, enter into additional supplemental

indentures for one of the following purposes:

(a) to

evidence the succession of another corporation to the Company and the assumption by any such successor of the covenants of the Company in such indenture and in the

debt securities issued thereunder;

(b) to

add to the covenants of the Company or to surrender any right or power conferred on the Company pursuant to the indenture;

(c) to

establish the form and terms of debt securities issued thereunder;

(d) to

evidence and provide for a successor trustee under such indenture with respect to one or more series of debt securities issued thereunder or to provide for or

facilitate the administration of the trusts under such indenture by more than one trustee;

(e) to

cure any ambiguity, to correct or supplement any provision in the indenture that may be defective or inconsistent with any other provision of the indenture or to make

any other provisions with respect to matters or questions arising under such indenture; provided that no such action pursuant to this clause (e) shall adversely affect the interests of the

holders of any series of debt securities issued thereunder in any material respect;

(f) to

add to, delete from or revise the conditions, limitations and restrictions on the authorized amount, terms or purposes of issue, authentication and delivery of

securities under the indenture;

(g) to

add any additional events of default with respect to all or any series of debt securities;

(h) to

supplement any of the provisions of the indenture as may be necessary to permit or facilitate the defeasance and discharge of any series of debt securities, provided

that such action does not adversely affect the interests of any holder of an outstanding debt security of such series or any other security in any material respect;

(i) to

make provisions with respect to the conversion or exchange rights of holders of debt securities of any series;

(j) to

pledge to the trustee as security for the debt securities of any series any property or assets;

(k) to

add guarantees in respect of the debt securities of one or more series;

(l) to

change or eliminate any of the provisions of the indenture, provided that any such change or elimination become effective only when there is no security of any series

outstanding created prior to the execution of such supplemental indenture which is entitled to the benefit of such provision;

(m) to

provide for certificated securities in addition to or in place of global securities;

11

Table of Contents

(n) to

qualify such indenture under the Trust Indenture Act of 1939, as amended;

(o) with

respect to the debt securities of any series, to conform the text of the indenture or the debt securities of such series to any provision of the description thereof

in the Company's offering memorandum or prospectus relating to the initial offering of such debt securities, to the extent that such provision, in the good faith judgment of the Company, was intended

to be a verbatim recitation of a provision of the indenture or such securities; or

(p) to

make any other change that does not adversely affect the rights of holders of any series of debt securities issued thereunder in any material respect.

Events of Default

Unless otherwise provided in any applicable prospectus supplement, documents incorporated by reference or free writing prospectus, the

following will be events of default under the indenture with respect to each series of debt securities issued thereunder:

(a) default

for 30 days in the payment when due of interest on, or any additional amount in respect of, any series of debt securities;

(b) default

in the payment of principal or any premium on any series of the debt securities outstanding under the indenture when due;

(c) default

in the payment, if any, of any sinking fund installment when and as due by the terms of any debt security of such series, subject to any cure period that may be

specified in any debt security of such series;

(d) failure

by the Company for 60 days after receipt by registered or certified mail of written notice from the trustee upon instruction from holders of at least 25%

in principal amount of the then outstanding debt securities of such series to comply with any of the other agreements in the indenture and stating that such notice is a "Notice of Default" under the

indenture; provided, that if such failure cannot be remedied within such 60-day period, such period shall be automatically extended by another 60 days so long as (i) such

failure is subject to cure and (ii) the Company is using commercially reasonable efforts to cure such failure; and provided, further, that a failure to comply with any such other agreement in

the indenture that results from a change in generally accepted accounting principles shall not be deemed to be an event of default;

(e) certain

events of bankruptcy, insolvency or reorganization of the Company; and

(f) any

other event of default provided in a supplemental indenture with respect to a particular series of debt securities, provided that any event of default that results

from a change in generally accepted accounting principles shall not be deemed to be an event of default.

In

case an event of default specified in clause (a) or (b) above shall occur and be continuing with respect to any series of debt securities, holders of at least 25%, and

in case an event of default specified in any clause other than clause (a), (b) or (e) above shall occur and be continuing with respect to any series of debt securities, holders of

at least a majority, in aggregate principal amount of the debt securities of such series then outstanding may declare the principal (or, in the case of discounted debt securities, the amount specified

in the terms thereof) of such series to be due and payable. If an event of default described in (e) above shall occur and be continuing then the principal amount (or, in the case of discounted

debt securities, the amount specified in the terms thereof) of all the debt securities outstanding shall be and become due and payable immediately, without notice or other action by any holder or the

trustee, to the full extent permitted by law. Any past or existing default or event of default with respect to particular series of debt securities under such indenture may be waived by the holders of

a majority in aggregate principal amount of the outstanding debt securities of such series, except in each case a continuing default (1) in the payment of the principal of, any

12

Table of Contents

premium

or interest on, or any additional amounts with respect to, any debt security of such series, or (2) in respect of a covenant or provision which cannot be modified or amended without the

consent of each holder affected thereby.

The

indenture provides that the trustee may withhold notice to the holders of any default with respect to any series of debt securities (except in payment of principal of or interest or

premium on, or sinking fund payment in respect of, the debt securities) if the trustee considers it in the interest of holders to do so.

The

indenture contains a provision entitling the trustee to be indemnified by the holders before proceeding to exercise any trust or power under the indenture at the request of such

holders. The indenture provides that the holders of a majority in aggregate principal amount of the then outstanding debt securities of any series may direct the time, method and place of conducting

any proceedings for any remedy available to the trustee or of exercising any trust or power conferred upon the trustee with respect to the debt securities of such series; provided, however, that the