Will Advanced Micro (AMD) Disappoint This Earnings Season? - Analyst Blog

January 17 2014 - 9:50AM

Zacks

Advanced Micro Devices,

Inc. (AMD) is set to report fourth-quarter 2013 results on

Jan 21. Last quarter, it posted a 100% positive surprise. Let us

see how things are shaping up for this announcement.

Growth Factors this

Past Quarter

Advanced Micro’s third-quarter

earnings exceeded the Zacks Consensus Estimate of 2 cents owing to

solid execution and cost control management. Revenues were up 25.8%

sequentially and 15.1% year over year. It is the highest sequential

revenue growth rate in the past five years. The solid growth was

driven by a 109.7% jump in the Graphics and Visual Solutions

segment, primarily from the ramp up of semi-custom

System-on-Chips (SoCs).

However, gross margins of 35.7%

decreased sequentially but were up 480 basis points (bps) from the

year-ago quarter. The sequential decrease was due to unfavorable

mix and higher-than-expected operating expenses.

For the fourth quarter, AMD expects

fourth-quarter 2013 revenues to increase 5.0% (+/- 3.0%)

sequentially. Non-GAAP gross margin is expected to be 35%.

Operating expenses are expected to remain flat sequentially at

approximately $450.0 million.

Earnings

Whispers?

Our proven model does not

conclusively show that AMD will beat earnings this quarter. That is

because a stock needs to have both a positive Earnings ESPand a

Zacks Rank #1, 2 or 3 for this to happen. That is not the case here

as you will see below.

Zacks ESP:

The Most Accurate estimate stands at 5 cents while

the Zacks Consensus Estimate is higher at 6 cents. That is a

difference of -16.67%.

Zacks Rank #4

(Sell): We caution against stocks with Zacks Ranks #4 and

5 (Sell-rated stocks) going into the earnings announcement,

especially when the company is seeing negative estimate revisions

momentum.

Other Stocks to

Consider

You could consider other stocks

with a positive earnings ESP and Zacks Rank #1, 2 or 3 such as:

Bally Technologies,

Inc. (BYI), with Earnings ESP of +3.13% and a Zacks Rank

#1 (Strong Buy).

Western Digital

Corporation (WDC), with Earnings ESP of +0.48% and a Zacks

Rank #1.

Cirrus Logic Inc.

(CRUS), with Earnings ESP of +4.41% and a Zacks Rank #1.

ADV MICRO DEV (AMD): Free Stock Analysis Report

BALLY TECH INC (BYI): Free Stock Analysis Report

CIRRUS LOGIC (CRUS): Free Stock Analysis Report

WESTERN DIGITAL (WDC): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

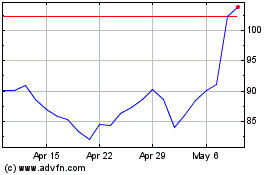

Cirrus Logic (NASDAQ:CRUS)

Historical Stock Chart

From Jun 2024 to Jul 2024

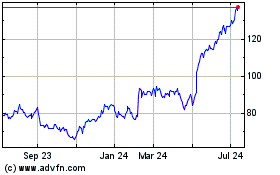

Cirrus Logic (NASDAQ:CRUS)

Historical Stock Chart

From Jul 2023 to Jul 2024