Cirrus Logic Inc. (Nasdaq:CRUS), a leader in high-precision analog,

mixed-signal and embedded products for audio and industrial

markets, today announced financial results for the third quarter of

Fiscal Year 2006, which ended Dec. 24, 2005. The company reported

third quarter Fiscal Year 2006 revenue of $48.3 million compared

with $44.0 million in the same period one year ago. All revenue

during the third fiscal quarter was analog, mixed-signal and

embedded products related. This represents year-over-year growth of

18 percent when compared to revenue of $40.9 million for the same

period one year ago, which excludes the revenue related to the

digital video-related products of $3.1 million. The second fiscal

quarter revenue related to the analog, mixed-signal and embedded

products was $48.3 million. Third quarter gross margin was 55.1

percent compared with 55.4 percent for the analog, mixed-signal and

embedded products in the second quarter of fiscal year 2006.

Combined research and development (R&D) and selling, general

and administrative (SG&A) expenses for the third fiscal quarter

were $21.2 million, compared with $26.4 million in the prior

quarter. In the second fiscal quarter, R&D and SG&A expense

included digital video-related spending of approximately $1.7

million as well as a $3.3 million contingency charge related to

excess leased office space. Without these items, R&D and

SG&A for the second fiscal quarter was $21.4 million. Net

income for the third fiscal quarter was $12.8 million, or $0.15 per

diluted share. In the second quarter, the company reported a net

loss of $99,000 or ($0.00) per diluted share. Third fiscal quarter

results also included a one-time $5.3 million foreign tax benefit.

The second fiscal quarter results also included a $2.3 million net

restructuring charge primarily related to the sale of the digital

video product line assets and a $207,000 foreign tax benefit. Net

income excluding the foreign tax benefit for the third fiscal

quarter was $7.6 million or $0.09 per diluted share, compared with

net income of $6.8 million or $0.08 per diluted share in the second

fiscal quarter, excluding the digital video related items,

restructuring charges and the foreign tax benefit. Total cash and

marketable securities at the end of the third fiscal quarter was

$233.0 million, compared with $225.1 million at the end of the

prior fiscal quarter. Inventories were $17.0 million, approximately

the same as at the end of the September quarter. "The company has

begun to deliver profitable year-over-year growth in our analog,

mixed-signal and embedded products," said David D. French,

president and chief executive officer, Cirrus Logic. "We achieved

18 percent year-over-year growth in these product categories, we

have a strong cash position, and the underlying fundamentals of the

business are strong." Outlook and Guidance "As we look to our

Fourth Fiscal Quarter, we are forecasting continued strong

year-over-year growth of our analog, mixed-signal and embedded

product revenues between 12 and 22 percent," French continued.

"However, we are cautious as the March quarter is traditionally our

seasonally weakest quarter. Nevertheless, we expect a strong start

to our Fiscal Year 2007 as we begin to build incremental inventory

in preparation for a higher revenue run rate in Q1 FY 07." Fourth

Quarter FY 06 (ending March 25, 2006): -- Revenue is expected to

range between $41 million and $45 million; -- Gross margin is

expected to be between 55 percent and 57 percent; -- Combined

R&D and SG&A expenses are expected to range between $20

million and $22 million; -- Cash is expected to increase between $3

million and $5 million; -- Inventory is anticipated to increase $2

million to $3 million in preparation for growth in the first fiscal

quarter of 2007. Use of Non-GAAP Financial Information Cirrus Logic

reports its financials in accordance with GAAP, which includes

non-recurring items. A reconciliation of GAAP to non-GAAP is

included in the financial statements portion of this release as

well as on our Web site in the Investors section at www.cirrus.com.

Non-GAAP results are not meant as a substitute for GAAP, but are

included solely for informational and comparative purposes. Cirrus

Logic management believes that non-GAAP financial information is

useful to investors because it can enhance the understanding of the

results and trends in our business, and therefore uses non-GAAP

reporting internally to evaluate and manage the company's

operations. The criteria for determining non-GAAP results may

differ from other companies' methods. These non-GAAP measures

should be considered in addition to, and not as a substitute for,

the results prepared in accordance with GAAP. Conference Call

Cirrus Logic management will hold a conference call to discuss

these results today, Jan. 25, 2006 at 5:00 p.m. EST. Those wishing

to join should dial 303-262-2142 (passcode: Cirrus Logic) at

approximately 4:50 p.m. EST. A replay of the call will also be

available, starting one hour after the completion of the call,

until Feb. 8. To access the recording, dial 303-590-3000 (Passcode:

11050686 #). A live and an archived webcast of the conference call

will also be available via the company's Web site at

www.cirrus.com. Upcoming Conferences Cirrus Logic management will

be presenting at the following conferences: -- Thomas Weisel

Partners Technology Conference, Feb. 8 in San Francisco; --

Deutsche Bank Small Cap Growth Conference, Feb. 16 in Miami; --

Roth Capital Growth Conference Feb. 21 in San Diego; -- Piper

Jaffray China Internet & Technology Conference , Feb. 28 in

Beijing; -- Prudential Technology Conference, March 2 in Chicago;

and -- CIBC World Markets 3rd Annual Semiconductor Summit, March 16

in Vail, Colo. Those wishing to listen to these presentations can

hear live and archived webcasts of the events via the company's Web

site at www.cirrus.com. Cirrus Logic, Inc. Cirrus Logic develops

high-precision, analog and mixed-signal integrated circuits for a

broad range of consumer and industrial markets. Building on its

diverse analog mixed-signal patent portfolio, Cirrus Logic delivers

highly optimized products for consumer and commercial audio,

automotive entertainment and industrial applications. The company

operates from headquarters in Austin, Texas, with offices in

Colorado, Europe, Japan and Asia. More information about Cirrus

Logic is available at www.cirrus.com. Safe Harbor Statement Except

for historical information contained herein, the matters set forth

in this news release, including our estimates of fourth quarter

fiscal year 2006 sales, gross margin, combined research and

development and selling, general and administrative expense levels,

and expectations regarding our revenue growth, fiscal year 2007

results, anticipated inventory build and increased cash position

are forward-looking statements. These forward-looking statements

are based on our current expectations, estimates and assumptions

and are subject to certain risks and uncertainties that could cause

actual results to differ materially from our current expectations,

estimates and assumptions and the forward-looking statements made

in this press release. These risks and uncertainties include, but

are not limited to, the following: overall conditions in the

semiconductor market; our ability to introduce new products on a

timely basis and to deliver products that perform as anticipated;

risks associated with international sales and international

operations; the results of any potential and pending litigation

matters; the level of orders and shipments during the fourth

quarter of fiscal year 2006, as well as customer cancellations of

orders, or the failure to place orders consistent with forecasts;

overall economic pressures; pricing pressures; hardware or software

deficiencies; our dependence on subcontractors for assembly,

manufacturing, packaging and testing functions; our ability to make

continued substantial investments in research and development;

foreign currency fluctuations; the retention of key employees; and

the risk factors listed in our Form 10-K for the year ended March

26, 2005, and in other filings with the Securities and Exchange

Commission. The foregoing information concerning our business

outlook represents our outlook as of the date of this news release,

and we undertake no obligation to update or revise any

forward-looking statements, whether as a result of new developments

or otherwise. Cirrus Logic and Cirrus are trademarks of Cirrus

Logic Inc. Summary financial data follows: -0- *T CIRRUS LOGIC,

INC. CONSOLIDATED CONDENSED STATEMENT OF OPERATIONS (unaudited) (in

thousands, except per share data) Quarter Ended

-------------------------- Dec. 24, Sep. 24, Dec. 25, 2005 2005

2004 -------- -------- -------- Net sales $48,253 $50,461 $44,036

Cost of sales 21,686 23,596 26,834 -------- -------- -------- Gross

Margin 26,567 26,865 17,202 -------- -------- -------- Gross Margin

Percentage 55.1% 53.2% 39.1% Operating expenses: Research and

development 10,442 10,630 18,899 Selling, general and

administrative 10,740 15,765 9,611 Restructuring and other costs --

2,311 3,107 Patent agreement, net -- -- (593) -------- --------

-------- Total operating expenses 21,182 28,706 31,024 --------

-------- -------- Total operating expenses as a percent of revenue

43.9% 56.9% 70.5% Income (loss) from operations 5,385 (1,841)

(13,822) Operating income (loss) as a percent of revenue 11.2%

(3.6%) (31.4%) Interest income, net 2,131 1,684 946 Other income

(expense), net 53 (109) 272 -------- -------- -------- Income

(loss) before income taxes 7,569 (266) (12,604) Provision (benefit)

for income taxes (5,261) (167) (15,134) -------- -------- --------

Net income (loss) $12,830 $(99) $2,530 ======== ======== ========

Basic and diluted income (loss) per share: $0.15 $-- $0.03 Basic

weighted average common shares outstanding 86,399 85,804 84,773

Diluted weighted average common shares outstanding 88,101 85,804

86,159 See reconciliation of Non-GAAP financial measures Prepared

in accordance with Generally Accepted Accounting Principles Certain

income statement reclassifications have been made to the fiscal

year 2005 financial statements to conform to the fiscal year 2006

presentation. We now report the amortization of acquired

intangibles as a component of our research and development

expenses. These reclassifications had no effect on the results of

operations or stockholders' equity. CIRRUS LOGIC, INC.

RECONCILIATION BETWEEN GAAP AND NON-GAAP FINANCIAL INFORMATION

(unaudited, in thousands, except per share data) (not prepared in

accordance with GAAP) Quarter Ended -------------------------- Dec.

24, Sep. 24, Dec. 25, 2005 2005 2004 -------- -------- --------

GAAP revenue $50,461 $44,036 Non-GAAP adjustments: Video product

line revenue; video assets sold June 30, 2005 (2,152) (3,094)

-------- -------- Non-GAAP revenue $48,309 $40,942 ========

======== GAAP gross margin $26,865 $17,202 Non-GAAP adjustments:

Impact of Video product line inventory reserve, video assets sold

June 30, 2005 (121) 4,621 -------- -------- Non-GAAP gross margin

$26,744 $21,823 ======== ======== 55.4% 53.3% We use these non-GAAP

financial numbers to assist us in the management of the Company

because we believe that this information provides a more consistent

and complete understanding of the underlying results and trends in

our business since we have sold the video product line assets. GAAP

operating expenses $28,706 Non-GAAP adjustments: Video product line

operating expenses; video assets sold June 30, 2005 (1,633)

Restructuring and other charges, net (2,311) Patent agreement legal

expense savings -- Loss contingencies on subleased facilities

(3,319) Goods and Sales tax refund -- Litigation expenses related

to the magnetic storage product line -- Impairment of Computer

Aided Design tools -- -------- Non-GAAP operating expenses $21,443

======== We use these non-GAAP financial numbers to assist us in

the management of the Company because we believe that this

information provides a more consistent and complete understanding

of the underlying results and trends of the ongoing business due to

the uniqueness of these charges as the Company was refocused on our

core technology. GAAP net income (loss) $12,830 $(99) Non-GAAP

adjustments: Subtract tax benefit due to expiration of statutue of

limitations in foreign jurisdictions (5,271) (207) Add non-GAAP

operating expenses listed above -- 7,263 Adjust for non-GAAP gross

margin impact -- (121) Subtract bankruptcy proceeds impact -- --

-------- -------- Non-GAAP net income $7,559 $6,836 ========

======== Non-GAAP diluted earnings per share: $0.09 $0.08 We use

these non-GAAP financial numbers to assist us in the management of

the Company because we believe that this information provides a

more consistent and complete understanding of the underlying

results and trends in our business. CIRRUS LOGIC, INC. CONSOLIDATED

CONDENSED STATEMENT OF OPERATIONS (unaudited) (in thousands, except

per share data) Nine Months Ended -------------------- Dec. 24,

Dec. 25, 2005 2004 --------- --------- Net sales $151,536 $154,485

Cost of sales 70,804 82,682 --------- --------- Gross Margin 80,732

71,803 --------- --------- Gross Margin Percentage 53.3% 46.5%

Operating expenses: Research and development 34,723 62,237 Selling,

general and administrative 40,806 35,267 Restructuring and other

costs 2,311 8,978 Litigation settlement, net (24,758) -- Patent

agreement, net -- (593) --------- --------- Total operating

expenses 53,082 105,889 --------- --------- Total operating

expenses as a percent of revenue 35.0% 68.5% Income (loss) from

operations 27,650 (34,086) Operating income (loss) as a percent of

revenue 18.2% (22.1%) Realized gain on marketable equity securities

388 669 Interest income, net 4,951 2,246 Other income (expense),

net (75) 201 --------- --------- Income (loss) before income taxes

and loss from discontinued operations 32,914 (30,970) Benefit for

income taxes (5,794) (15,044) --------- --------- Net income (loss)

$38,708 $(15,926) ========= ========= Basic income (loss) per

share: $0.45 $(0.19) Diluted income (loss) per share: $0.44 $(0.19)

Basic weighted average common shares outstanding 85,811 84,621

Diluted weighted average common shares outstanding 87,436 84,621

Prepared in accordance with Generally Accepted Accounting

Principles Certain income statement reclassifications have been

made to the fiscal year 2005 financial statements to conform to the

fiscal year 2006 presentation. We now report the amortization of

acquired intangibles as a component of our research and development

expenses. These reclassifications had no effect on the results of

operations or stockholders' equity. CIRRUS LOGIC, INC. CONSOLIDATED

CONDENSED BALANCE SHEET (unaudited) (in thousands) Dec. 24, Sep.

24, Dec. 25, 2005 2005 2004 --------- --------- --------- ASSETS

Current assets Cash and cash equivalents $114,947 $112,347 $93,432

Restricted investments 5,755 5,755 7,784 Marketable securities

107,330 92,163 61,893 Accounts receivable, net 21,442 21,579 21,050

Inventories 17,049 17,014 32,330 Other current assets 6,978 6,287

7,249 --------- --------- --------- Total Current Assets 273,501

255,145 223,738 Long-term marketable securities 4,935 14,869 15,319

Property and equipment, net 14,012 14,329 19,934 Intangibles, net

3,441 4,090 14,807 Other assets 10,837 11,372 2,907 ---------

--------- --------- Total Assets $306,726 $299,805 $276,705

========= ========= ========= LIABILITIES AND STOCKHOLDERS' EQUITY

Current liabilities Accounts payable $17,149 $15,181 $14,914

Accrued salaries and benefits 6,329 6,756 8,974 Other accrued

liabilities 12,223 14,072 15,809 Deferred income on shipments to

distributors 6,108 6,807 7,877 Income taxes payable 3,145 8,526

15,075 --------- --------- --------- Total Current Liabilities

44,954 51,342 62,649 Long-term restructuring accrual 4,545 4,807

3,411 Other long-term obligations 9,428 10,062 9,848 Stockholders'

equity: Capital stock 880,930 879,560 875,216 Accumulated deficit

(632,089) (644,919) (673,335) Accumulated other comprehensive loss

(1,042) (1,047) (1,084) --------- --------- --------- Total

Stockholders' Equity 247,799 233,594 200,797 --------- ---------

--------- Total Liabilities and Stockholders' Equity $306,726

$299,805 $276,705 ========= ========= ========= *T

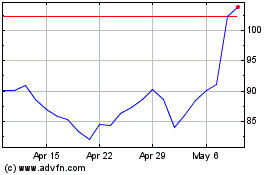

Cirrus Logic (NASDAQ:CRUS)

Historical Stock Chart

From Jun 2024 to Jul 2024

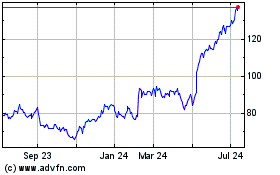

Cirrus Logic (NASDAQ:CRUS)

Historical Stock Chart

From Jul 2023 to Jul 2024