Cirrus Logic Inc. (Nasdaq:CRUS) today announced financial results

for the first quarter of fiscal year 2006 which ended June 25,

2005. The company reported first quarter, fiscal year 2006 revenue

of $52.8 million compared with $40.4 million in the prior fiscal

quarter ended March 25, 2005. The revenue for the first fiscal

quarter included $43.7 million related to its core analog,

mixed-signal and embedded product integrated circuits (ICs), an

increase of 19 percent over the $36.8 million in revenue related to

these core products during the prior quarter. First quarter gross

margin was 51.7 percent, compared with 53.1 percent in the prior

quarter. The gross margin for its core products was 56.3 percent.

Combined research and development (R&D) and selling, general

and administrative (SG&A) expenses for the quarter were $28.0

million, compared with $25.2 million in the prior quarter. Combined

R&D and SG&A expense included approximately $5.4 million

for video product line related expenses plus $1.1 million for a

contingency related to excess leased office space. Net income in

the first fiscal quarter was $26.0 million, or $0.30 per diluted

share. In the prior quarter, the company reported a net income of

$2.5 million, or $0.03 per diluted share. The first fiscal quarter

included a $24.8 million net gain related to a legal settlement.

First fiscal quarter net income also included interest income of

$1.1 million, a $388,000 gain on the sale of marketable securities

and a $302,000 foreign tax benefit. Total cash and marketable

securities at the end of the first fiscal quarter were $214.5

million, compared with $179.7 million at the end of the prior

fiscal quarter. Inventories were $19.5 million, down 27 percent, or

$7.1 million, from the end of the March quarter. "We are pleased to

have exceeded our financial expectations for the quarter and to

have successfully reduced our inventory levels," said David D.

French, president and chief executive officer, Cirrus Logic. "We

recently introduced our latest low-power stereo codec for

applications such as MP3 players, smart phones and digital

camcorders, which demonstrates our commitment to drive revenue

growth in one of the hottest-growing market segments. We also

anticipate that with the increased focus on our core analog and

mixed-signal products, Cirrus Logic is already well on its way to

achieving consistent revenue growth and profitability." On June 30,

2005, Cirrus Logic announced the completion of the sale of its

digital video product line assets to Magnum Semiconductor in

exchange for a non-controlling interest in that company. First

fiscal quarter revenue and expenses for the digital video product

line were approximately $9.1 million and $11.8 million,

respectively. The sale of the digital video product line assets

excluded related inventories of $1.6 million and receivables of

$5.0 million. "We are encouraged that we have started our fiscal

year with strong momentum," said French. "We have an excellent

balance sheet with roughly $215 million in cash, no debt and our

inventory balances are in line with our expectations. All of these

factors help position Cirrus Logic for profitability and growth

within its broad, expanding customer base for analog, mixed-signal

and embedded products." Outlook and Guidance "After solid growth of

19 percent within our core analog and mixed-signal product lines in

the first fiscal quarter, we are forecasting continued growth in

the second quarter," said French. "Nevertheless, I remain somewhat

cautious in terms of our outlook recognizing that the industry

continues to face challenges." Second Quarter FY 06 (ending

September 24, 2005): -- Sales for our core products are expected to

range between $45 million and $47 million; -- Sales from video

products are estimated at $2 million, as we liquidate the remainder

of the inventory in this product category; -- Gross margin is

anticipated to be between 55 percent and 57 percent for core

products -- Gross margin for the final liquidation of inventory is

expected to be approximately 15 percent; -- Combined R&D and

SG&A expenses are expected to range between $20 million and $22

million; -- The company expects to incur a charge of between $4

million and $5 million as we exit the digital video product line

facility in Fremont, California, partially offset by a gain of $1.5

million on the sale of the digital video assets; -- Cash generated

from core operations is estimated to be $6 million to $8 million

with an additional $6 million to $7 million expected to be

generated from the sale of the remaining video product inventory to

Magnum Semiconductor and the collection of outstanding receivables

associated with the video product line. Conference Call Cirrus

Logic management will hold a conference call to discuss these

results today, July 20, 2005 at 5:00 p.m. EDT. Those wishing to

join should dial 201-689-8044 at approximately 4:50 p.m. EDT. A

replay of the call will be available starting one hour after the

completion of the call, through Aug. 3, 2005. To access the replay,

dial 201-612-7415 (account #: 2445; conference #: 159444). A live

and an archived webcast of the conference call will also be

available via the company's Web site at www.cirrus.com. Upcoming

Conference Cirrus Logic management will be presenting at the

Silicon Valley Bank Tech Investors Forum Sept. 7-8, 2005 in San

Francisco. Those wishing to listen to the presentation can hear a

live and an archived webcast of the event via the company's Web

site at www.cirrus.com. Cirrus Logic, Inc. Cirrus Logic develops

high-precision, analog and mixed-signal integrated circuits for a

broad range of consumer and industrial markets. Building on its

diverse analog mixed-signal patent portfolio, Cirrus Logic delivers

highly optimized products for consumer and commercial audio,

automotive entertainment and industrial applications. The company

operates from headquarters in Austin, Texas, with offices in

Colorado, Europe, Japan and Asia. More information about Cirrus

Logic is available at www.cirrus.com. Safe Harbor Statement Except

for historical information contained herein, the matters set forth

in this news release, including our estimates of second quarter

fiscal year 2006 sales, gross margin, combined research and

development and selling, general and administrative expense levels,

restructuring and other charges, gain on the sale of the video

related assets, and expectations regarding our revenue growth and

increased cash position are forward-looking statements. These

forward-looking statements are based on our current expectations,

estimates and assumptions and are subject to certain risks and

uncertainties that could cause actual results to differ materially

from our current expectations, estimates and assumptions and the

forward-looking statements made in this press release. These risks

and uncertainties include, but are not limited to, the following:

overall conditions in the semiconductor market; our ability to

introduce new products on a timely basis and to deliver products

that perform as anticipated; risks associated with international

sales and international operations; the results of any potential

and pending litigation matters; the level of orders and shipments

during the second quarter of fiscal year 2006, as well as customer

cancellations of orders, or the failure to place orders consistent

with forecasts; pricing pressures; hardware or software

deficiencies; our dependence on subcontractors for assembly,

manufacturing, packaging and testing functions; our ability to make

continued substantial investments in research and development;

foreign currency fluctuations; the retention of key employees; the

impact of restructuring and other costs, such as work force

reductions and facility consolidations; and the risk factors listed

in our Form 10-K for the year ended March 26, 2005, and in other

filings with the Securities and Exchange Commission. Certain income

statement reclassifications have been made to the fiscal year 2005

financial statements to conform to the fiscal year 2006

presentation. These reclassifications had no effect on the results

of operations or stockholders' equity. The foregoing information

concerning our business outlook represents our outlook as of the

date of this news release, and we undertake no obligation to update

or revise any forward-looking statements, whether as a result of

new developments or otherwise. Cirrus Logic and Cirrus are

trademarks of Cirrus Logic Inc. Summary financial data follows: -0-

*T CIRRUS LOGIC, INC. CONSOLIDATED CONDENSED STATEMENT OF

OPERATIONS (unaudited) (in thousands, except per share data)

Quarter Ended ----------------------------- Jun. 25, Mar. 26, Jun.

26, 2005 2005 2004 -------- -------- -------- Net sales $ 52,822 $

40,415 $ 59,117 Cost of sales 25,522 18,955 27,444 --------

-------- -------- Gross Margin 27,300 21,460 31,673 --------

-------- -------- Gross Margin Percentage 51.7% 53.1% 53.6%

Operating expenses: Research and development 13,651 18,270 22,126

Selling, general and administrative 14,301 6,885 12,295

Restructuring and other costs - 485 1,723 Litigation settlement,

net (24,758) 242 199 -------- -------- -------- Total operating

expenses 3,194 25,882 36,343 -------- -------- -------- Total

operating expenses as a percent of revenue 6.0% 64.0% 61.5% Income

(loss) from operations 24,106 (4,422) (4,670) Operating income

(loss) as a percent of revenue 45.6% (10.9%) (7.9%) Realized gain

on marketable equity securities 388 137 669 Interest income, net

1,136 962 696 Other income (expense), net (19) 116 (66) --------

-------- -------- Income (loss) before income taxes 25,611 (3,207)

(3,371) Provision (benefit) for income taxes (366) (5,745) 24

-------- -------- -------- Net income (loss) $ 25,977 $ 2,538 $

(3,395) ======== ======== ======== Basic income (loss) per share: $

0.30 $ 0.03 $ (0.04) Diluted income (loss) per share: $ 0.30 $ 0.03

$ (0.04) Basic weighted average common shares outstanding 85,230

85,124 84,419 Diluted weighted average common shares outstanding

86,183 86,151 84,419 Prepared in accordance with Generally Accepted

Accounting Principles CIRRUS LOGIC, INC. NON-GAAP CONSOLIDATED

CONDENSED STATEMENT OF OPERATIONS (unaudited) (in thousands, except

per share data) (not prepared in accordance with GAAP) Quarter

Ended ------------------------------ Jun. 25, Mar. 26, Jun. 26,

2005 2005 2004 -------- --------- -------- Net sales $ 43,693 $

40,415 $ 59,117 Cost of sales 19,089 18,955 27,444 --------

--------- -------- Gross Margin 24,604 21,460 31,673 --------

--------- -------- Gross Margin Percentage 56.3% 53.1% 53.6%

Operating expenses: Research and development 10,667 14,851 18,388

Selling, general and administrative 10,782 9,850 12,267

Restructuring and other costs - - - Litigation settlement, net - -

- -------- --------- -------- Total operating expenses 21,449

24,701 30,655 -------- --------- -------- Total operating expenses

as a percent of revenue 49.1% 61.1% 51.9% Loss from operations

3,155 (3,241) 1,018 Operating income (loss) as a percent of revenue

7.2% (8.0%) 1.7% Realized gain on marketable equity securities - -

- Interest income, net 1,136 962 696 Other income (expense), net

(19) 116 (66) -------- --------- -------- Income (loss) before

income taxes and loss from discontinued operations 4,272 (2,163)

1,648 Provision (benefit) for income taxes (64) 258 24 --------

--------- -------- Net income (loss) $ 4,336 $ (2,421) $ 1,624

======== ========= ======== Basic and diluted income (loss) per

share: $ 0.05 $ (0.03) $ 0.02 Basic and diluted weighted average

common shares outstanding 85,230 85,124 84,419 Diluted weighted

average common shares outstanding 86,183 85,124 86,456 See notes to

Non-GAAP Consolidated Condensed Statement of Operations CIRRUS

LOGIC, INC. RECONCILIATION BETWEEN GAAP AND NON-GAAP FINANCIAL

INFORMATION (unaudited) (in thousands, except per share data) (not

prepared in accordance with GAAP) Quarter Ended

---------------------------- Jun. 25, Mar. 26, Jun. 26, 2005 2005

2004 -------- ------- --------- Net sales (Note 1) $ 9,129 $ - $ -

Cost of sales (Note 2) 6,433 - - -------- ------- --------- Gross

Margin 2,696 - - -------- ------- --------- Operating expenses:

Research and development (Note 3) 2,984 3,419 3,738 Selling,

general and administrative (Note 4) 3,519 (2,965) 28 Restructuring

and other costs (Note 5) - 485 1,723 Litigation settlement, net

(Note 6) (24,758) 242 199 -------- ------- --------- Total

operating expenses (18,255) 1,181 5,688 -------- ------- ---------

Loss from operations 20,951 (1,181) (5,688) Realized gain on

marketable equity securities (Note 7) 388 137 669 Interest income,

net - - - Other income (expense), net - - - -------- -------

--------- Income (loss) before income taxes and loss from

discontinued operations 21,339 (1,044) (5,019) Benefit for income

taxes (Note 8) (302) (6,003) - -------- ------- --------- Net

income (loss) $ 21,641 $ 4,959 $ (5,019) ======== ======= =========

Basic and diluted income (loss) per share: $ 0.25 $ 0.06 $ (0.06)

Basic and diluted weighted average common shares outstanding 85,230

85,124 84,419 Diluted weighted average common shares outstanding

86,183 85,124 86,456 On July 20, 2005 the Company held a conference

call with the public to discuss its first quarter fiscal year 2006

financial results. During that call, the Company made reference to

non-GAAP financial measures. The above schedule is provided to

comply with SEC Regulation G. This table provides the

reconciliation between the Consolidated Condensed Statement of

Operations on a GAAP and non-GAAP reporting basis. We use these

non-GAAP financial numbers to assist us in the management of the

Company because we believe that this information provides a more

consistent and complete understanding of the underlying results and

trends in our business. See notes to Non-GAAP Consolidated

Condensed Statement of Operations Notes to Non-GAAP Consolidated

Condensed Statement of Operations This non-GAAP presentation

reflects the historical financial results adjusted for the

following non-recurring or unusual items: (Note 1) Q1 FY'06 -

Non-GAAP net sales exclude $9.6 million in revenue related to the

video product line, a product line that was sold on June 30, 2005.

(Note 2) Q1 FY'06 - Non-GAAP cost of sales exclude $6.4 million in

product cost related to the video product line, a product line that

was sold on June 30, 2005. (Note 3) Q1 FY'06 - Non-GAAP research

and development excludes $2.3 million in video related expenses and

$0.7 million related to the amortization of acquired intangibles

from our 2002 and 2000 acquisitions. Q4 FY'05 - Non-GAAP research

and development excludes $3.4 million related to the amortization

of acquired intangibles from our 2002 and 2000 acquisitions. Q1

FY'05 - Non-GAAP research and development excludes $3.8 million

related to the amortization of acquisition related intangibles and

compensation from our 2002 and 2000 acquisitions. (Note 4) Q1 FY'06

- Non-GAAP selling, general and administrative expense excludes a

$2.5 million in video related expenses and $1.1 million in facility

related accruals due to losses on new subleases. Q4 FY'05 -

Non-GAAP selling, general and administrative expense excludes a

$3.0 million benefit from the expiration of a use tax contingency.

(Note 5) Q4 FY'05 - Non-GAAP restructuring and other costs excludes

a $0.5 million expense related to our announced workforce

reduction. Q1 FY'05 - Non-GAAP restructuring and other costs

excludes a $1.7 million expense related to facilities consolidation

charges. (Note 6) Q1 FY'06 - Non-GAAP litigation settlement, net

excludes a $25.0 million benefit from a litigation settlement

finalized during the quarter related to Fujitsu, LTD partially

offset by $0.2 million in litigation fees related to this

settlement. Q4 FY'05 - Non-GAAP litigation settlement, net excludes

$0.2 million in legal costs associated with a lawsuit related to a

previously exited product line. Q1 FY'05 - Non-GAAP litigation

settlement, net excludes $0.2 million in legal costs associated

with a lawsuit related to a previously exited product line. (Note

7) Q1 FY'06 - Non-GAAP realized gain on marketable equity

securities excludes a $0.4 million benefit from the proceeds

related to the sale of an investment in another publicly traded

company. Q4 FY'05 - Non-GAAP realized gain on marketable equity

securities excludes a $0.1 million benefit from the proceeds

related to the sale of an investment in another publicly traded

company. Q1 FY'05 - Non-GAAP realized gain on marketable equity

securities excludes a $0.7 million benefit from the net proceeds

related to the sale of an investment in another publicly traded

company. (Note 8) Q1 FY'06 - Non-GAAP benefit for income taxes

excludes a $0.3 million income tax benefit resulting from the

expiration of foreign statute of limitations for the years in which

we had previously recorded potential tax liabilities. Q4 FY'05 -

Non-GAAP benefit for income taxes excludes a $6.0 million income

tax benefit resulting from the expiration of foreign statute of

limitations for the years in which we had previously recorded

potential tax liabilities. CIRRUS LOGIC, INC. CONSOLIDATED

CONDENSED BALANCE SHEET (in thousands) Jun. 25, Mar. 26, Jun. 26,

2005 2005 2004 --------- --------- --------- ASSETS (unaudited)

(unaudited) Current assets Cash and cash equivalents $ 89,938 $

79,235 $ 168,976 Restricted investments 7,987 7,898 8,159

Marketable securities 100,311 91,559 18,438 Accounts receivable,

net 23,457 18,593 27,927 Inventories 19,544 26,649 40,988 Other

current assets 11,769 6,600 8,597 --------- --------- ---------

Total Current Assets 253,006 230,534 273,085 Long-term marketable

securities 16,311 1,021 2,112 Property and equipment, net 15,707

17,572 22,982 Intangibles, net 4,689 10,786 24,929 Other assets

3,210 2,897 2,912 --------- --------- --------- Total Assets $

292,923 $ 262,810 $ 326,020 ========= ========= =========

LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities Accounts

payable $ 14,542 $ 10,546 $ 32,347 Accrued salaries and benefits

8,350 8,164 10,027 Other accrued liabilities 10,824 10,799 18,389

Deferred income on shipments to distributors 7,435 7,935 5,962

Income taxes payable 8,788 9,276 30,124 --------- ---------

--------- Total Current Liabilities 49,939 46,720 96,849 Long-term

restructuring accrual 3,526 3,678 7,610 Other long-term obligations

8,541 8,675 9,915 Stockholders' equity: Capital stock 876,763

875,687 873,319 Accumulated deficit (644,820) (670,797) (660,804)

Accumulated other comprehensive loss (1,026) (1,153) (869)

--------- --------- --------- Total Stockholders' Equity 230,917

203,737 211,646 --------- --------- --------- Total Liabilities and

Stockholders' Equity $ 292,923 $ 262,810 $ 326,020 =========

========= ========= Prepared in accordance with Generally Accepted

Accounting Principles *T

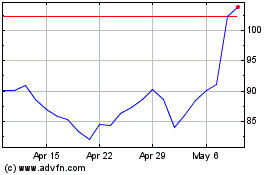

Cirrus Logic (NASDAQ:CRUS)

Historical Stock Chart

From Jun 2024 to Jul 2024

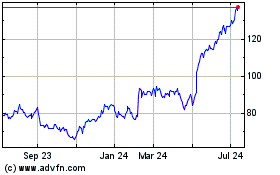

Cirrus Logic (NASDAQ:CRUS)

Historical Stock Chart

From Jul 2023 to Jul 2024