Fourth quarter revenue was $113.6 million, up

216% year over year

Net loss was $56.3 million, or $2.70 net loss

per share; adjusted earnings per share of $0.70; Adjusted EBITDA

was $14.7 million, up 59% from the prior year

Announces pricing of $10.8 million Class A

common stock equity offering, including $3.8 million from Chicken

Soup for the Soul Holdings, LLC

Chicken Soup for the Soul Holdings, LLC commits

to future equity investment

Launched Chicken Soup for the Soul AVOD on

Roku, expanding digital distribution footprint

Owned and Operated platforms reach 60 million

monthly active users (MAU)

Company expands ad-rep business to 20 clients

across AVODs and digital-out-of-home (DOOH) networks

Expands international reach through partnership

with KC Global Media for AVOD/FAST in Asia

Management to host a live webcast on March 31,

2023, at 8:45 am ET

Chicken Soup for the Soul Entertainment Inc. (Nasdaq: CSSE) –

one of the largest providers of premium content to value-conscious

consumers, today announced its financial results for the fourth

quarter and full year ended December 31, 2022.

“Our fiscal year was one of significant growth for Chicken Soup

for the Soul Entertainment – especially with the acquisition of

Redbox, which immediately scaled our operations,” said William J.

Rouhana, Jr., chairman and chief executive officer of Chicken Soup

for the Soul Entertainment. “The company is well positioned for the

coming year to take full advantage of the upcoming theatrical slate

and the continued increase in viewers of free ad-supported services

across our FAST and AVOD platforms. Over 40 major film releases are

expected this year – the most since 2019 – with at least one new

movie available every week in our kiosks and digitally. This

increase in movies means more rentals, more revenue, and more cash

flow for the company. We plan to use this cash flow to scale our

operations and help pay down debt.”

Fourth Quarter 2022 Financial Summary

- Net revenue of $113.6 million, compared with $72.4 million in

the third quarter of 2022, and $36.0 million in the year-ago

period

- Net loss of $56.3 million compared with a net loss of $20.1

million in the third quarter of 2022, and a net loss of $22.4

million in the year-ago period; $63.8 million net loss before

income taxes and preferred dividends, compared with $45.1 million

net loss in the third quarter 2022, and $20.2 million net loss in

the year-ago period

- Adjusted EBITDA of $14.7 million, compared with $9.6 million in

the third quarter of 2022, and $9.3 million in the year-ago

period

Full Year 2022 Financial Summary

- Net revenue of $252.8 million, compared with $110.4 million in

2021, an increase of 129% year over year

- Net loss of $111.3 million, compared with $59.4 million in

2021; $139.3 million net loss before income taxes and preferred

dividends, compared with a $50.4 million net loss in the full year

2021

- Adjusted EBITDA of $33.5 million, compared with $21.8 million

in 2021, an increase of 53% year over year

Recent Business Highlights

- On March 31, 2023, priced a $10.8 million Class A common equity

offering, which will provide additional working capital, including

$3.8 million from Chicken Soup for the Soul Holdings, LLC

- Chicken Soup for the Soul Holdings, LLC commits to a future

equity investment of $16.2 million of Class A common equity through

acceptance of Class A common stock in lieu of certain cash fees

under existing management and license agreement

- Grew ad-rep partners to 20 total clients, including AVODs and

digital-out-of-home (DOOH) networks

- Grew MAU reached by our Owned & Operated platforms and

ad-rep partners to 80 million, with 60 million MAU reached by CSSE

Owned & Operated platforms on average during the last three

months

- Launched the Chicken Soup for the Soul app on Roku

- Expanded international footprint by partnering with KC Global

Media, a leading entertainment network and multichannel operator in

Asia, on content licensing and distribution

- Expanded partnership with leading national value retailer to

add 1,000 kiosks nationwide in 2023, and 500 in 2024

- Rana Naidu: Season 1, an Indian-language series produced by

CSSE-owned production company Locomotive Global, was a global top

10 ranked non-English series on Netflix and was ranked number one

in India for two weeks straight

- Expanded FAST channel platform with programming with leading

media outlets, including HSN, QVC, and Allen Media Group

Operating loss for the quarter ended December 31, 2022, was

$47.1 million, compared with an operating loss of $42.0 million in

the third quarter of 2022, and $19.1 million in the year-ago

period.

Net loss was $56.3 million, or $2.70 per share, compared with a

net loss of $20.1 million, or $1.13 per share, in the third quarter

of 2022, and a net loss of $22.4 million, or $1.38 per share in the

prior-year period.

Adjusted EBITDA for the quarter ended December 31, 2022, was

$14.7 million, compared with $9.6 million in the third quarter of

2022, and $9.3 million in the same period last year.

As of December 31, 2022, the company had $18.7 million of cash

and cash equivalents compared with $44.3 million as of December 31,

2021, and net debt of $479.7 million as of December 31, 2022,

compared with $54.9 million as of December 31, 2021.

For a discussion of the financial measures presented herein

which are not calculated or presented in accordance with U.S.

generally accepted accounting principles (“GAAP”), see “Note

Regarding Use of Non-GAAP Financial Measures" below and the

schedules to this press release for additional information and

reconciliations of non-GAAP financial measures.

The company presents non-GAAP measures such as Adjusted EBITDA

to assist in an analysis of its business. These non-GAAP measures

should not be considered an alternative to GAAP measures as an

indicator of the company's operating performance.

Conference Call Information

- Date & Time: Friday, March 31, 2023, 8:45 a.m. ET.

- To access a dial-in number, the company encourages participants

to register in advance by visiting the following pre-registration

link here.

- Please note that a dial-in option is not available without

registering at the provided link.

- A live webcast of the event will also be available in the

“Event Calendar” section under the “News & Events” tab of the

Chicken Soup for the Soul Entertainment investor relations website

at http://ir.cssentertainment.com.

Conference Call Replay Information

- A webcast replay will be made available at

http://ir.cssentertainment.com/ in the “Event Calendar” section

under the “News & Events” tab following the completion of the

call.

About Chicken Soup for the Soul Entertainment

Chicken Soup for the Soul Entertainment (Nasdaq: CSSE) provides

premium content to value-conscious consumers. The company is one of

the largest advertising-supported video-on-demand (AVOD) companies

in the US, with three flagship AVOD streaming services: Redbox,

Crackle, and Chicken Soup for the Soul. In addition, the company

operates Redbox Free Live TV, a free ad-supported streaming

television service (FAST), with over 160 channels as well as a

transaction video on demand (TVOD) service, and a network of

approximately 32,000 kiosks across the US for DVD rentals. To

provide original and exclusive content to its viewers, the company

creates, acquires, and distributes films and TV series through its

Screen Media and Chicken Soup for the Soul TV Group subsidiaries.

Chicken Soup for the Soul Entertainment is a subsidiary of Chicken

Soup for the Soul, LLC, which publishes the famous book series and

produces super-premium pet food under the Chicken Soup for the Soul

brand name.

Note Regarding Use of Non-GAAP Financial Measures

Our consolidated financial statements are prepared in accordance

with generally accepted accounting principles in the United States

(“U.S. GAAP”). We use a non-GAAP financial measure to evaluate our

results of operations and as a supplemental indicator of our

operating performance. The non-GAAP financial measure that we use

is Adjusted EBITDA. Adjusted EBITDA (as defined below) is

considered a non-GAAP financial measure as defined by Regulation G

promulgated by the SEC under the Securities Act of 1933, as

amended. Due to the significance of non-cash and non-recurring

expenses recognized during the years ended December 31, 2022 and

2021, and the likelihood of material non-cash, non-recurring, and

acquisition related expenses to occur in future periods, we believe

that this non-GAAP financial measure enhances the understanding of

our historical and current financial results as well as provides

investors with measures used by management for the planning and

forecasting of future periods, as well as for measuring performance

for compensation of executives and other members of management.

Further, we believe that Adjusted EBITDA enables our board of

directors and management to analyze and evaluate financial and

strategic planning decisions that will directly affect operating

decisions and investments. We believe this measure is an important

indicator of our operational strength and performance of our

business because it provides a link between operational performance

and operating income. It is also a primary measure used by

management in evaluating companies as potential acquisition

targets. We believe the presentation of this measure is relevant

and useful for investors because it allows investors to view

performance in a manner similar to the method used by management.

We believe it helps improve investors’ ability to understand our

operating performance and makes it easier to compare our results

with other companies that have different capital structures or tax

rates. In addition, we believe this measure is also among the

primary measures used externally by our investors, analysts and

peers in our industry for purposes of valuation and comparing our

operating performance to other companies in our industry.

The presentation of Adjusted EBITDA should not be construed as

an inference that our future results will be unaffected by unusual,

infrequent or non-recurring items or by non-cash items. This

non-GAAP financial measure should be considered in addition to,

rather than as a substitute for, our actual operating results

included in our condensed consolidated financial statements.

We define Adjusted EBITDA as consolidated operating income

(loss) adjusted to exclude interest, taxes, depreciation,

amortization (including tangible and intangible assets), film

library amortization and related costs (film library amortization,

film library revenue shares and participation costs, theatrical

release costs) as well as amortization for certain program rights,

acquisition-related costs, consulting fees related to acquisitions,

dividend payments, non-cash share-based compensation expense, and

adjustments for other unusual and infrequent in nature identified

charges, including transition related expenses. Adjusted EBITDA is

not an earnings measure recognized by U.S. GAAP and does not have a

standardized meaning prescribed by GAAP; accordingly, Adjusted

EBITDA may not be comparable to similar measures presented by other

companies. We believe Adjusted EBITDA to be a meaningful indicator

of our performance that management uses and believes provides

useful information to investors regarding our financial condition

and results of operations. The most comparable GAAP measure is

operating income (loss).

A reconciliation of net loss to Adjusted EBITDA will be provided

in the company’s Annual Report on Form 10-K for the year ended

December 31, 2022 to be filed on March 31, 2023, under the section

thereof entitled “Management’s Discussion and Analysis of Financial

Condition and Results of Operations – Reconciliation of Unaudited

Historical Results to Adjusted EBITDA.”

Forward-Looking Statements and Available Information

This press release includes forward-looking statements within

the meaning of the federal securities laws. Forward-looking

statements are statements that are not historical facts. These

statements are based on various assumptions, whether or not

identified in this press release, and on the current expectations

of management and are not predictions of actual performance. Such

assumptions involve a number of known and unknown risks and

uncertainties, including but not limited to risks relating to our

core strategy, operating income and margin, seasonality, liquidity,

including cash flows from operations, available funds, and access

to financing sources, free cash flows, revenues, net income,

profitability, stock price volatility, future regulatory changes,

price changes, ability to achieve and sustain market acceptance of

our content streaming services and other content offerings, ability

to recruit and retain officers, key employees, or directors,

ability to protect our intellectual property, ability to complete

and integrate into our existing operations future strategic

acquisitions, ability to manage growth, ability to pay dividends

and our debt obligations, as well as evolving regulatory or other

operational risks, and risks presented by changing general market

conditions impacting demand for our services. For a more complete

description of these and other risks and uncertainties, please

refer to Item 1A (Risk Factors) in the Company’s Annual Report on

Form 10-K for the year ended December 31, 2022 to be filed with the

SEC on March 31, 2023. If any of these risks materialize or our

assumptions prove incorrect, actual results could differ materially

from the results implied by the forward-looking statements

contained in this press release. Information regarding the

acquisition of Redbox and related transactions is qualified by

reference to the Company’s Current Reports on Form 8-K filed with

the SEC on May 11, 2022 as amended May 12, 2022, June 6, 2022,

August 12, 2022, November 14, 2022 and thereafter from time to

time, and all exhibits filed with respect to such reports. The

forward-looking statements contained in this press release speak

only as of the date hereof and the Company expressly disclaims any

obligation or undertaking to release publicly any updates or

revisions to any forward-looking statements contained herein to

reflect any change in the Company’s expectations with respect

thereto or any change in events, conditions or circumstances on

which any statement is based.

Chicken Soup for the Soul Entertainment, Inc. Condensed

Consolidated Balance Sheets

December 31,

December 31,

2022

2021

(unaudited) ASSETS Cash, cash equivalents and

restricted cash $

18,738,395

$

44,286,105

Accounts receivable, net of allowance for doubtful accounts of

$1,277,597 and $786,830, respectively

113,963,425

60,213,807

Prepaid expenses and other current assets

13,196,180

1,904,273

Operating lease right-of-use assets

16,315,342

—

Content assets, net

126,090,508

63,645,396

Intangible assets, net

305,425,709

30,199,034

Goodwill

260,748,057

39,986,530

Other assets, net

29,401,793

4,774,925

Total assets $

883,879,409

$

245,010,070

LIABILITIES AND EQUITY Accounts payable $

50,960,682

$

12,547,652

Accrued expenses

87,817,015

22,094,505

Due to affiliated companies

3,778,936

489,959

Programming obligations

55,883,788

1,641,250

Film library acquisition obligations

39,750,121

24,673,866

Accrued participation costs

28,695,713

12,323,329

Debt, net

479,653,611

54,859,599

Contingent consideration

7,311,949

9,764,256

Put option obligation

11,400,000

11,400,000

Operating lease liabilities

18,079,469

—

Other liabilities

20,800,186

3,616,501

Total liabilities

804,131,470

153,410,917

Equity Stockholders' Equity: Series A cumulative redeemable

perpetual preferred stock, $.0001 par value, liquidation preference

of $25.00 per share, 10,000,000 shares authorized; 4,496,345 and

3,698,318 shares issued and outstanding, respectively; redemption

value of $112,408,625 and $92,457,950, respectively

450

370

Class A common stock, $.0001 par value,

140,000,000 shares authorized; 15,621,562 and 8,964,330 shares

issued, 13,198,720 and 8,019,828 shares outstanding,

respectively

1,559

899

Class B common stock, $.0001 par value,

20,000,000 shares authorized; 7,654,506 shares issued and

outstanding, respectively

766

766

Additional paid-in capital

355,185,280

240,609,345

Deficit

(247,752,446

)

(136,462,244

)

Accumulated other comprehensive income

47,528

571

Class A common stock held in treasury, at cost (2,422,842 and

944,502 shares, respectively)

(28,165,913

)

(13,202,407

)

Total stockholders’ equity

79,317,224

90,947,300

Noncontrolling interests

430,715

651,853

Total equity

79,747,939

91,599,153

Total liabilities and equity $

883,879,409

$

245,010,070

Chicken Soup for the Soul Entertainment, Inc. Condensed

Consolidated Statements of Operations (unaudited)

Year Ended December 31, Three Months Ended December

31,

2022

2021

2022

2021

Net revenues $

252,810,110

$

110,395,466

$

113,574,703

$

35,966,835

Costs and expenses Operating

215,820,880

88,933,738

101,493,042

34,400,711

Selling, general and administrative

93,537,386

47,874,241

37,742,322

13,373,621

Amortization and depreciation

20,716,325

5,728,051

11,038,598

1,613,696

Management and license fees

18,400,648

11,039,547

6,941,575

3,596,684

Merger, transaction, and other costs

21,003,791

2,781,507

3,500,000

2,044,647

Total costs and expenses

369,479,030

156,357,084

160,715,537

55,029,359

Operating loss

(116,668,920

)

(45,961,618

)

(47,140,834

)

(19,062,524

)

Interest expense

27,840,340

4,831,175

16,848,446

1,297,235

Other non-operating income, net

(5,259,102

)

(379,151

)

(226,901

)

(132,114

)

Loss before income taxes and preferred dividends

(139,250,158

)

(50,413,642

)

(63,762,379

)

(20,227,645

)

Income tax (benefit) provision

(37,301,242

)

66,000

(10,014,403

)

7,000

Net loss before noncontrolling interests and preferred

dividends

(101,948,916

)

(50,479,642

)

(53,747,976

)

(20,234,645

)

Net loss attributable to noncontrolling interests

(404,664

)

(73,458

)

(56,640

)

(82,543

)

Net loss attributable to Chicken Soup for the Soul

Entertainment, Inc.

(101,544,252

)

(50,406,184

)

(53,691,336

)

(20,152,102

)

Less: preferred dividends

9,745,950

9,013,540

2,628,469

2,253,385

Net loss available to common stockholders $

(111,290,202

)

$

(59,419,724

)

$

(56,319,805

)

$

(22,405,487

)

Net loss per common share: Basic and diluted $

(6.45

)

$

(3.96

)

$

(2.70

)

$

(1.38

)

Weighted-average common shares outstanding: Basic and

diluted

17,261,460

15,018,421

20,885,719

16,192,422

Adjusted EBITDA (unaudited)

Three Months Ended December

31, Year Ended December 31,

2022

2021

2022

2021

Reported loss per share (GAAP) $

(56,319,805

)

$

(22,405,487

)

$

(111,290,202

)

$

(59,419,724

)

Preferred dividends

2,628,469

2,253,385

9,745,950

9,013,540

Net (loss) income attributable to noncontrolling interests

(56,640

)

(82,543

)

(404,664

)

(73,458

)

Provision for income taxes

(10,014,403

)

7,000

(37,301,242

)

66,000

Other Taxes

87,106

58,094

408,309

308,720

Interest Expense

16,848,446

1,297,235

27,840,340

4,831,175

Film Library & Program Amortization

23,962,043

11,748,690

66,538,476

35,630,591

Stock-based Compensation

820,523

1,309,888

5,869,711

5,247,807

Reserve for bad debt and video returns

1,262,476

366,321

3,316,112

2,522,629

Amortization and depreciation

12,537,994

2,143,802

23,565,986

7,408,155

Other non-operating income

(226,901

)

(132,114

)

(4,259,122

)

(379,151

)

Impairment of assets

12,652,452

11,839,501

12,652,452

11,839,501

Transitional expenses

3,870,493

155,115

7,175,963

560,982

All other nonrecurring costs

6,613,760

693,680

29,610,957

4,267,725

Adjusted EBITDA $

14,666,013

$

9,252,567

$

33,469,026

$

21,824,492

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230331005121/en/

(INVESTOR RELATIONS) Zaia Lawandow Chicken Soup for the Soul

Entertainment zlawandow@chickensoupforthesoul.com

(PRESS) Peter Binazeski Chicken Soup for the Soul Entertainment

pbinazeski@chickensoupforthesoul.com

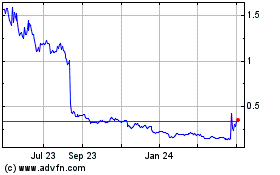

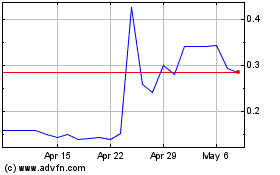

Chicken Soup for the Sou... (NASDAQ:CSSE)

Historical Stock Chart

From Apr 2024 to May 2024

Chicken Soup for the Sou... (NASDAQ:CSSE)

Historical Stock Chart

From May 2023 to May 2024