Current Report Filing (8-k)

December 28 2021 - 4:16PM

Edgar (US Regulatory)

0001825249

false

0001825249

2021-12-28

2021-12-28

0001825249

CFIV:UnitsEachConsistingOfOneShareOfClassCommonStockAndOnethirdOfOneRedeemableWarrantMember

2021-12-28

2021-12-28

0001825249

CFIV:ClassCommonStockParValue0.0001PerShareMember

2021-12-28

2021-12-28

0001825249

CFIV:RedeemableWarrantsExercisableForClassCommonStockAtExercisePriceOf11.50PerShareMember

2021-12-28

2021-12-28

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT

REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): December

28, 2021

CF ACQUISITION CORP. IV

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

001-39824

|

|

85-1042073

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer

Identification Number)

|

110

East 59th Street, New

York, NY

10022

(Address of principal executive offices, including

zip code)

Registrant’s telephone number, including

area code: (212) 938-5000

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b)

of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Units, each consisting of one share of Class A common stock and one-third of one redeemable warrant

|

|

CFIVU

|

|

The Nasdaq Stock Market LLC

|

|

Class A common stock, par value $0.0001 per share

|

|

CFIV

|

|

The Nasdaq Stock Market LLC

|

|

Redeemable warrants, exercisable for Class A common stock at an exercise price of $11.50 per share

|

|

CFIVW

|

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act.

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

(d) Appointment of

Directors.

Effective December 28, 2021, the board of directors

(the “Board”) of CF Acquisition Corp. IV (the “Company”) appointed Mark Kaplan and Robert Hochberg

as members of the Board. Mr. Kaplan will serve as a Class I director and Mr. Hochberg as a Class II director. Additionally, effective

December 28, 2021, the Board appointed Mr. Hochberg as a member of the audit committee (the “Audit Committee”) and

the compensation committee (the “Compensation Committee”) of the Board. Mr. Hochberg replaces Mr. Steven Bisgay as

a member of the Audit Committee. As a result of these appointments, the Company believes that it is in compliance with the corporate governance

requirements of the Nasdaq Stock Market to have all members of the Audit Committee being independent within one year of the consummation

of the Company’s initial public offering.

Mr. Kaplan, age 61, is currently the Global

Chief Operating Officer of Cantor Fitzgerald & Co., the Investment Banking, Asset Management arm of Cantor Fitzgerald

(“Cantor”), a position he has held since February 2018. In that role, Mr. Kaplan oversees the businesses and

operations of Cantor’s primary business divisions, both domestically and internationally. From 2007 to 2017, Mr. Kaplan was

Chief Operating Officer for Société Générale in the Americas (“Société

Générale”) where he was responsible for managing its regional operations, including the IT, Operations, Finance,

Product Control, Operational Risk, IT Security, BCP, Sourcing and Real Estate departments. As part of that role, Mr. Kaplan

helped develop and build many of the firm’s business initiatives, as well as several significant mergers and acquisitions.

Prior to that position, Mr. Kaplan spent six years as the General Counsel for Société Générale, and for its

investment banking subsidiary, Cowen & Co., leading their Legal and Compliance departments. Before joining Société

Générale, Mr. Kaplan was the U.S. General Counsel of CBIC. And prior to that position was a Managing Director and Director

of Litigation at Oppenheimer & Co., Inc. Mr. Kaplan has a B.A. from Bucknell University and a Juris Doctor from Columbia Law

School.

Mr. Hochberg, age 59, is

currently President and Chief Executive Officer of Numeric Computer Systems, Inc. (“Numeric”). Mr. Hochberg has served

at Numeric as President since June 1984 and as Chief Executive Officer since November 1994. Numeric is a global software company with

offices in New York, San Juan, Auckland, Jakarta and Sydney. Mr. Hochberg has also served as a director of CF Acquisition Corp. VIII

since March 2021. Mr. Hochberg previously served as a director of CF Finance Acquisition Corp. from January 2020 until the consummation

of its business combination with GCM Grosvenor, Inc. in November 2020, a director of CF Finance Acquisition Corp. II from August 2020

until consummation of its business combination with View, Inc. in March 2021 and CF Finance Acquisition Corp. III from November 2020 until

consummation of its business combination with AEye, Inc. in August 2021. Mr. Hochberg is a graduate of Vassar College, where he received

a Bachelor of Arts in Economics.

In connection with the appointment of Mr. Hochberg,

the Board and the Compensation Committee approved a one-time payment of $25,000 to him, payable at the earlier of the Company’s

initial business combination and March 31, 2022. In addition, the Company’s sponsor, CFAC

Holdings IV, LLC will transfer an aggregate of 2,500 shares of the Company’s Class A common stock to Mr. Hochberg in connection

with his appointment.

There are no family relationships between Mr.

Kaplan or Mr. Hochberg and any director, executive officer, or person nominated or chosen by the Company to become an executive officer

of the Company.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

CF ACQUISITION CORP. IV

|

|

|

|

|

|

By:

|

/s/ Howard W. Lutnick

|

|

|

|

Name:

|

Howard W. Lutnick

|

|

|

|

Title:

|

Chief Executive Officer

|

Dated: December 28, 2021

2

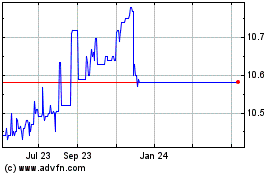

CF Acquisition Corporati... (NASDAQ:CFIV)

Historical Stock Chart

From Nov 2024 to Dec 2024

CF Acquisition Corporati... (NASDAQ:CFIV)

Historical Stock Chart

From Dec 2023 to Dec 2024