Casella Waste Systems, Inc. (NASDAQ: CWST), a regional solid waste,

recycling and resource management services company, today reported

its financial results for the three and nine-month periods ended

September 30, 2024.

Key Highlights:

- Revenues

were $411.6 million for the

quarter, up $58.9 million, or

up 16.7%, from the same period

in 2023.

- Solid waste

pricing for the quarter was up 5.5% from the same period in 2023,

driven by 6.1% collection price growth.

- Net income was $5.8 million for the quarter, down

$(12.4) million, or down (68.2)%, as compared to $18.2 million for

the same period in 2023.

- Adjusted

EBITDA, a non-GAAP measure, was $102.9

million for the quarter, up $13.3

million, or up

14.9%, from the same period in

2023.

- Net cash

provided by operating activities was $171.6 million for the

year-to-date period, up $13.8 million, or up 8.7%, as compared to

$157.8 million for the same period in 2023.

- Adjusted

Free Cash Flow, a non-GAAP measure, was $98.8 million for the

year-to-date period, as compared to $94.3 million for the same

period in 2023.

- Acquired six

businesses year-to-date with over $200

million in aggregate annualized revenues, including Royal

Carting and Welsh Sanitation (collectively, “Royal”) on October 1,

2024.

“We posted another solid quarter of execution against our growth

strategies across our business," said John W. Casella, Chairman and

CEO of Casella Waste Systems, Inc. “The success of our operating

plan, combined with our acquisition strategy, has allowed us to

generate over $400 million in revenues and more than $100 million

in Adjusted EBITDA in a quarter for the first time in the company’s

history. Our entire team deserves recognition for their continued

execution and hard work, which puts us on track for another

successful year.”

“While we are executing well against our strategic plan, third

quarter performance was mixed. Insurance expense accruals related

to two discrete events impacted Adjusted EBITDA by over $3 million

in the quarter, and we had a $2 million headwind from continued

lower year-over-year landfill volumes, primarily construction and

demolition materials, which we expect to abate next year. Together,

these two items weighed on overall Adjusted EBITDA margins by 110

basis points,” Casella said.

“Return-driven investments in truck automation and routing

efficiencies across our collection fleet have reduced costs, while

equipment upgrades at our recycling facilities have enhanced our

ability to process more volumes at higher price points

year-over-year,” Casella said. “These operating strategies,

together with our pricing programs, drove higher same store

Adjusted EBITDA margins, up 130 basis points in our collection and

up 90 basis points in our Resource Solutions lines of

business.”

“On October 1, we completed the acquisition of Royal, which is

expected to generate over $90 million in annualized revenues and

provides us entry into adjacent markets of New York’s middle and

lower Hudson Valley region,” Casella said. “We are very excited to

partner with a well-respected and established service provider that

offers us opportunities for new customer growth and landfill volume

internalization over time. As with all of our acquisitions, we

would like to welcome our new team members and look forward to

introducing our services to our new customers and communities.”

“Looking forward, we have set ourselves up to continue capturing

opportunities in our robust acquisition pipeline with our recent

financings, including our equity offering and upsizing and

extending our credit facility,” Casella said. “These transactions

significantly increased our liquidity and financial flexibility,

which will enable us to be both disciplined and nimble as we aim to

add further density to existing markets and chart growth into new

ones.”

For the quarter, revenues were $411.6 million, up $58.9 million,

or up 16.7%, from the same period in 2023, with revenue growth

mainly driven by: newly closed acquisitions along with the rollover

impact from acquisitions closed in prior periods; strong collection

and disposal pricing; and higher recycling commodity volumes and

prices.

Operating income was $24.4 million for the quarter, down $(9.8)

million, or down (28.7)%, from the same period in 2023 as a result

of an $8.5 million charge at the Town of Southbridge, Massachusetts

landfill (“Southbridge Landfill”) to revise accrued post-closure

monitoring costs following receipt of increased requirements

contained in the final closure permit; higher expense from

acquisition activities; and higher depreciation and amortization

expenses related to recently closed acquisitions.

Net income was $5.8 million for the quarter, or $0.10 per

diluted common share, down $(12.4) million, or down (68.2)%, as

compared to net income of $18.2 million, or $0.31 per diluted

common share, for the same period in 2023. Adjusted Net Income, a

non-GAAP measure, was $15.9 million for the quarter, or $0.27

Adjusted Diluted Earnings Per Common Share, a non-GAAP measure, as

compared to Adjusted Net Income of $20.1 million, or $0.35 Adjusted

Diluted Earnings Per Common Share, for the same period in 2023.

Adjusted EBITDA was $102.9 million for the quarter, up $13.3

million, or up 14.9%, from the same period in 2023, driven by

acquisition contribution and 6.0% organic growth.

Please refer to "Non-GAAP Performance Measures" included in

"Unaudited Reconciliation of Certain Non-GAAP Measures" below for

additional information and reconciliations of Adjusted Net Income,

Adjusted Diluted Earnings Per Common Share, Adjusted EBITDA and

other non-GAAP performance measures to their most directly

comparable GAAP measures.

Net cash provided by operating activities was $171.6 million for

the year-to-date period, as compared to $157.8 million for the same

period in 2023, with the year-over-year variance mainly

attributable to growth in the business and unfavorable changes in

working capital. Adjusted Free Cash Flow was $98.8 million for the

year-to-date period, as compared to $94.3 million for the same

period in 2023.

Please refer to "Non-GAAP Liquidity Measures" included in

"Unaudited Reconciliation of Certain Non-GAAP Measures" below for

additional information and reconciliation of Adjusted Free Cash

Flow to its most directly comparable GAAP measure.

Fiscal Year 2024 Outlook

The Company reaffirmed guidance for the fiscal year ending

December 31, 2024 ("fiscal year 2024") by estimating results in the

following ranges:

- Revenues between

$1.520 billion and $1.550 billion;

- Adjusted EBITDA

between $360 million and $370 million;

- Net cash provided by

operating activities between $245 million and $255 million;

and

- Adjusted Free Cash

Flow between $140 million and $150 million.

The Company revised guidance for fiscal year 2024 by estimating

results in the following range:

- Net income between $10 million and $20 million (lowered from a

range of $15 million and $25 million).

The guidance ranges do not include the impact of any

acquisitions that have not been completed. Adjusted EBITDA and

Adjusted Free Cash Flow related to fiscal year 2024 are described

in the Unaudited Reconciliation of Fiscal Year 2024 Outlook

Non-GAAP Measures section of this press release. Net income and Net

cash provided by operating activities are provided as the most

directly comparable GAAP measures to Adjusted EBITDA and Adjusted

Free Cash Flow, respectively, however these forward-looking

estimates for fiscal year 2024 do not contemplate any unanticipated

impacts.

Conference Call to Discuss Quarter

The Company will host a conference call to discuss these results

on Thursday, October 31, 2024 at 10:00 a.m. Eastern Time.

Individuals interested in participating in the call should register

for the call by clicking here to obtain a dial in number and unique

passcode. Alternatively, upon registration, the website linked

above provides an option for the conference provider to call the

registrant's phone line, enabling participation on the call.

The call will also be webcast; to listen, participants should

visit the company’s website at http://ir.casella.com and follow the

appropriate link to the webcast. A replay of the call will be

available on the Company's website and accessible using the same

link.

About Casella Waste Systems, Inc.

Casella Waste Systems, Inc., headquartered in Rutland, Vermont,

provides resource management expertise and services to residential,

commercial, municipal, institutional and industrial customers,

primarily in the areas of solid waste collection and disposal,

transfer, recycling and organics services in the eastern United

States. For further information, investors may contact Charlie

Wohlhuter, Director of Investor Relations at (802) 772-2230; media

may contact Jeff Weld, Vice President of Communications at (802)

772-2234; or visit the Company’s website at

http://www.casella.com.

Safe Harbor Statement

Certain matters discussed in this press release, including, but

not limited to, the statements regarding our intentions, beliefs or

current expectations concerning, among other things, our financial

performance; financial condition; operations and services;

prospects; growth; strategies; anticipated impacts from future or

completed acquisitions; and guidance for fiscal year 2024, are

“forward-looking statements” intended to qualify for the safe

harbors from liability established by the Private Securities

Litigation Reform Act of 1995. These forward-looking statements can

generally be identified as such by the context of the statements,

including words such as “believe,” “expect,” “anticipate,” “plan,”

“may,” “would,” “intend,” “estimate,” "will," “guidance” and other

similar expressions, whether in the negative or affirmative. These

forward-looking statements are based on current expectations,

estimates, forecasts and projections about the industry and markets

in which the Company operates and management’s beliefs and

assumptions. The Company cannot guarantee that it actually will

achieve the financial results, plans, intentions, expectations or

guidance disclosed in the forward-looking statements made. Such

forward-looking statements, and all phases of the Company's

operations, involve a number of risks and uncertainties, any one or

more of which could cause actual results to differ materially from

those described in its forward-looking statements.

Such risks and uncertainties include or relate to, among other

things, the following: the Company may be unable to adequately

increase prices or drive operating efficiencies to adequately

offset increased costs and inflationary pressures, including

increased fuel prices and wages; it is difficult to determine the

timing or future impact of a sustained economic slowdown that could

negatively affect our operations and financial results; the closure

of the Subtitle D landfill located in Southbridge, Massachusetts

(“Southbridge Landfill”) could result in material unexpected costs;

the increasing focus on per - and polyfluoroalkyl substances

(“PFAS”) and other emerging contaminants, including the recent

designation by the U.S. Environmental Protection Agency of two PFAS

chemicals as hazardous substances under the Comprehensive

Environmental Response, Compensation, and Liability Act, will

likely lead to increased compliance and remediation costs and

litigation risks; adverse weather conditions may negatively impact

the Company's revenues and its operating margin; the Company may be

unable to increase volumes at its landfills or improve its route

profitability; the Company may be unable to reduce costs or

increase pricing or volumes sufficiently to achieve estimated

Adjusted EBITDA and other targets; landfill operations and permit

status may be affected by factors outside the Company's control;

the Company may be required to incur capital expenditures in excess

of its estimates; the Company's insurance coverage and

self-insurance reserves may be inadequate to cover all of its risk

exposures; fluctuations in energy pricing or the commodity pricing

of its recyclables may make it more difficult for the Company to

predict its results of operations or meet its estimates;

disruptions or limited access to domestic and global transportation

could impact the Company's ability to sell recyclables into end

markets; the Company may be unable to achieve its acquisition or

development targets on favorable pricing or at all, including due

to the failure to satisfy all closing conditions and to receive

required regulatory approvals that may prevent closing of any

announced transaction; the Company may not be able to successfully

integrate and recognize the expected financial benefits from

acquired businesses; and the Company may incur environmental

charges or asset impairments in the future.

There are a number of other important risks and uncertainties

that could cause the Company's actual results to differ materially

from those indicated by such forward-looking statements. These

additional risks and uncertainties include, without limitation,

those detailed in Item 1A. “Risk Factors” in the Company's most

recently filed Form 10-K, in Item 1A. “Risk Factors” in the

Company’s most recently filed Form 10-Q and in other filings that

the Company may make with the Securities and Exchange Commission in

the future.

The Company undertakes no obligation to update publicly any

forward-looking statements whether as a result of new information,

future events or otherwise, except as required by law.

Investors:

Charlie WohlhuterDirector of Investor

Relations(802) 772-2230

Media:

Jeff WeldVice President of

Communications(802) 772-2234http://www.casella.com

|

CASELLA WASTE SYSTEMS, INC. AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS(In thousands, except for per share

data) |

| |

| |

Three Months EndedSeptember

30, |

|

Nine Months EndedSeptember

30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Revenues |

$ |

411,627 |

|

|

$ |

352,735 |

|

|

$ |

1,129,797 |

|

|

$ |

904,975 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

Cost of operations |

|

267,117 |

|

|

|

226,303 |

|

|

|

741,695 |

|

|

|

592,865 |

|

|

General and administration |

|

47,030 |

|

|

|

41,177 |

|

|

|

138,547 |

|

|

|

112,721 |

|

|

Depreciation and amortization |

|

59,174 |

|

|

|

47,736 |

|

|

|

168,549 |

|

|

|

116,095 |

|

|

Southbridge Landfill closure charge |

|

8,477 |

|

|

|

70 |

|

|

|

8,477 |

|

|

|

276 |

|

|

Expense from acquisition activities |

|

5,450 |

|

|

|

3,261 |

|

|

|

18,297 |

|

|

|

9,801 |

|

|

Legal settlement |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

6,150 |

|

| |

|

387,248 |

|

|

|

318,547 |

|

|

|

1,075,565 |

|

|

|

837,908 |

|

|

Operating income |

|

24,379 |

|

|

|

34,188 |

|

|

|

54,232 |

|

|

|

67,067 |

|

| Other

expense (income): |

|

|

|

|

|

|

|

|

Interest expense, net |

|

14,368 |

|

|

|

10,223 |

|

|

|

40,134 |

|

|

|

23,888 |

|

|

Loss from termination of bridge financing |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

8,191 |

|

|

Other income |

|

(412 |

) |

|

|

(225 |

) |

|

|

(1,239 |

) |

|

|

(1,019 |

) |

| Other

expense, net |

|

13,956 |

|

|

|

9,998 |

|

|

|

38,895 |

|

|

|

31,060 |

|

|

Income before income taxes |

|

10,423 |

|

|

|

24,190 |

|

|

|

15,337 |

|

|

|

36,007 |

|

|

Provision for income taxes |

|

4,652 |

|

|

|

6,018 |

|

|

|

6,677 |

|

|

|

8,797 |

|

| Net

income |

$ |

5,771 |

|

|

$ |

18,172 |

|

|

$ |

8,660 |

|

|

$ |

27,210 |

|

| Basic

weighted average common shares outstanding |

|

58,808 |

|

|

|

57,962 |

|

|

|

58,318 |

|

|

|

54,228 |

|

| Basic

earnings per common share |

$ |

0.10 |

|

|

$ |

0.31 |

|

|

$ |

0.15 |

|

|

$ |

0.50 |

|

|

Diluted weighted average common shares outstanding |

|

58,921 |

|

|

|

58,062 |

|

|

|

58,415 |

|

|

|

54,325 |

|

|

Diluted earnings per common share |

$ |

0.10 |

|

|

$ |

0.31 |

|

|

$ |

0.15 |

|

|

$ |

0.50 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CASELLA WASTE SYSTEMS, INC. AND

SUBSIDIARIESCONDENSED CONSOLIDATED BALANCE

SHEETS(In thousands) |

| |

| |

September 30,2024 |

|

December 31,2023 |

| |

(Unaudited) |

|

|

|

ASSETS |

|

|

|

|

CURRENT ASSETS: |

|

|

|

|

Cash and cash equivalents |

$ |

518,977 |

|

|

$ |

220,912 |

|

|

Accounts receivable, net of allowance for credit losses |

|

168,088 |

|

|

|

157,324 |

|

|

Other current assets |

|

55,986 |

|

|

|

48,089 |

|

| Total

current assets |

|

743,051 |

|

|

|

426,325 |

|

|

Property and equipment, net of accumulated depreciation and

amortization |

|

1,059,716 |

|

|

|

980,553 |

|

|

Operating lease right-of-use assets |

|

102,445 |

|

|

|

100,844 |

|

|

Goodwill |

|

907,876 |

|

|

|

735,670 |

|

|

Intangible assets, net of accumulated amortization |

|

273,312 |

|

|

|

241,429 |

|

| Other

non-current assets |

|

36,829 |

|

|

|

50,649 |

|

|

Total assets |

$ |

3,123,229 |

|

|

$ |

2,535,470 |

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

CURRENT LIABILITIES: |

|

|

|

|

Current maturities of debt |

$ |

38,368 |

|

|

$ |

35,781 |

|

|

Current operating lease liabilities |

|

10,492 |

|

|

|

9,039 |

|

|

Accounts payable |

|

101,632 |

|

|

|

116,794 |

|

|

Current accrued final capping, closure and post-closure costs |

|

15,991 |

|

|

|

10,773 |

|

|

Other accrued liabilities |

|

124,771 |

|

|

|

106,471 |

|

| Total

current liabilities |

|

291,254 |

|

|

|

278,858 |

|

| Debt,

less current portion |

|

1,045,509 |

|

|

|

1,007,662 |

|

|

Operating lease liabilities, less current portion |

|

68,601 |

|

|

|

66,074 |

|

|

Accrued final capping, closure and post-closure costs, less current

portion |

|

133,644 |

|

|

|

123,131 |

|

| Other

long-term liabilities |

|

52,691 |

|

|

|

37,954 |

|

| Total

stockholders' equity |

|

1,531,530 |

|

|

|

1,021,791 |

|

|

Total liabilities and stockholders' equity |

$ |

3,123,229 |

|

|

$ |

2,535,470 |

|

|

|

|

|

|

|

|

|

|

|

CASELLA WASTE SYSTEMS, INC. AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS(In thousands) |

| |

| |

Nine Months EndedSeptember

30, |

|

|

|

2024 |

|

|

|

2023 |

|

| Cash

Flows from Operating Activities: |

|

|

|

| Net

income |

$ |

8,660 |

|

|

$ |

27,210 |

|

|

Adjustments to reconcile net income to net cash provided by

operating activities: |

|

|

|

|

Depreciation and amortization |

|

168,549 |

|

|

|

116,095 |

|

|

Interest accretion on landfill and environmental remediation

liabilities |

|

8,758 |

|

|

|

7,470 |

|

|

Amortization of debt issuance costs |

|

2,224 |

|

|

|

2,221 |

|

|

Stock-based compensation |

|

7,433 |

|

|

|

6,699 |

|

|

Operating lease right-of-use assets expense |

|

13,119 |

|

|

|

10,956 |

|

|

Disposition of assets, other items and charges, net |

|

12,459 |

|

|

|

279 |

|

|

Loss from termination of bridge financing |

|

— |

|

|

|

8,191 |

|

|

Deferred income taxes |

|

3,424 |

|

|

|

5,233 |

|

|

Changes in assets and liabilities, net of effects of acquisitions

and divestitures |

|

(53,032 |

) |

|

|

(26,529 |

) |

|

Net cash provided by operating activities |

|

171,594 |

|

|

|

157,825 |

|

| Cash

Flows from Investing Activities: |

|

|

|

|

Acquisitions, net of cash acquired |

|

(259,196 |

) |

|

|

(847,763 |

) |

|

Additions to intangible assets |

|

(265 |

) |

|

|

— |

|

|

Additions to property and equipment |

|

(126,361 |

) |

|

|

(90,364 |

) |

|

Proceeds from sale of property and equipment |

|

1,047 |

|

|

|

971 |

|

|

Proceeds from property insurance settlement |

|

146 |

|

|

|

— |

|

|

Net cash used in investing activities |

|

(384,629 |

) |

|

|

(937,156 |

) |

| Cash

Flows from Financing Activities: |

|

|

|

|

Proceeds from debt borrowings |

|

801,750 |

|

|

|

465,000 |

|

|

Principal payments on debt |

|

(780,771 |

) |

|

|

(18,563 |

) |

|

Payments of debt issuance costs |

|

(6,448 |

) |

|

|

(12,759 |

) |

|

Proceeds from the exercise of share based awards |

|

— |

|

|

|

89 |

|

|

Proceeds from the public offering of Class A common stock |

|

496,569 |

|

|

|

496,231 |

|

|

Net cash provided by financing activities |

|

511,100 |

|

|

|

929,998 |

|

| Net

increase in cash, cash equivalents and restricted cash |

|

298,065 |

|

|

|

150,667 |

|

| Cash,

cash equivalents and restricted cash, beginning of period |

|

220,912 |

|

|

|

71,152 |

|

| Cash,

cash equivalents and restricted cash, end of period |

$ |

518,977 |

|

|

$ |

221,819 |

|

|

Supplemental Disclosure of Cash Flow Information: |

|

|

|

|

Cash interest payments |

$ |

45,685 |

|

|

$ |

28,626 |

|

|

Cash income tax payments |

$ |

5,135 |

|

|

$ |

9,689 |

|

|

Non-current assets obtained through long-term financing

obligations |

$ |

23,679 |

|

|

$ |

8,053 |

|

|

Right-of-use assets obtained in exchange for operating lease

obligations |

$ |

10,776 |

|

|

$ |

18,558 |

|

| |

|

|

|

|

CASELLA WASTE SYSTEMS, INC. AND

SUBSIDIARIESUNAUDITED RECONCILIATION OF CERTAIN

NON-GAAP MEASURES(In thousands) |

| |

|

|

|

Non-GAAP Performance Measures

In addition to disclosing financial results prepared in

accordance with generally accepted accounting principles in the

United States ("GAAP"), the Company also presents non-GAAP

performance measures such as Adjusted EBITDA, Adjusted EBITDA as a

percentage of revenues, Adjusted Operating Income, Adjusted

Operating Income as a percentage of revenues, Adjusted Net Income

and Adjusted Diluted Earnings Per Common Share that provide an

understanding of operational performance because it considers them

important supplemental measures of the Company's performance that

are frequently used by securities analysts, investors and other

interested parties in the evaluation of the Company's results. The

Company also believes that identifying the impact of certain items

as adjustments provides more transparency and comparability across

periods. Management uses these non-GAAP performance measures to

further understand its “core operating performance” and believes

its “core operating performance” is helpful in understanding its

ongoing performance in the ordinary course of operations. The

Company believes that providing such non-GAAP performance measures

to investors, in addition to corresponding income statement

measures, affords investors the benefit of viewing the Company’s

performance using the same financial metrics that the management

team uses in making many key decisions and understanding how the

core business and its results of operations has performed. The

tables below set forth such performance measures on an adjusted

basis to exclude such items:

| |

Three Months EndedSeptember

30, |

|

Nine Months EndedSeptember

30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Net income |

$ |

5,771 |

|

|

$ |

18,172 |

|

|

$ |

8,660 |

|

|

$ |

27,210 |

|

|

Net income as a percentage of revenues |

|

1.4 |

% |

|

|

5.2 |

% |

|

|

0.8 |

% |

|

|

3.0 |

% |

|

Provision for income taxes |

|

4,652 |

|

|

|

6,018 |

|

|

|

6,677 |

|

|

|

8,797 |

|

|

Other income |

|

(412 |

) |

|

|

(225 |

) |

|

|

(1,239 |

) |

|

|

(1,019 |

) |

|

Loss from termination of bridge financing (i) |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

8,191 |

|

|

Interest expense, net |

|

14,368 |

|

|

|

10,223 |

|

|

|

40,134 |

|

|

|

23,888 |

|

|

Southbridge Landfill closure charge (ii) |

|

8,477 |

|

|

|

70 |

|

|

|

8,477 |

|

|

|

276 |

|

|

Legal settlement (iii) |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

6,150 |

|

|

Expense from acquisition activities (iv) |

|

5,450 |

|

|

|

3,261 |

|

|

|

18,297 |

|

|

|

9,801 |

|

|

Gain on resolution of acquisition related contingent consideration

(v) |

|

— |

|

|

|

(376 |

) |

|

|

— |

|

|

|

(965 |

) |

|

Depreciation and amortization |

|

59,174 |

|

|

|

47,736 |

|

|

|

168,549 |

|

|

|

116,095 |

|

|

Depletion of landfill operating lease obligations |

|

2,552 |

|

|

|

2,255 |

|

|

|

7,247 |

|

|

|

6,558 |

|

|

Interest accretion on landfill and environmental remediation

liabilities |

|

2,896 |

|

|

|

2,469 |

|

|

|

8,758 |

|

|

|

7,470 |

|

|

Adjusted EBITDA |

$ |

102,928 |

|

|

$ |

89,603 |

|

|

$ |

265,560 |

|

|

$ |

212,452 |

|

|

Adjusted EBITDA as a percentage of revenues |

|

25.0 |

% |

|

|

25.4 |

% |

|

|

23.5 |

% |

|

|

23.5 |

% |

|

Depreciation and amortization |

|

(59,174 |

) |

|

|

(47,736 |

) |

|

|

(168,549 |

) |

|

|

(116,095 |

) |

|

Depletion of landfill operating lease obligations |

|

(2,552 |

) |

|

|

(2,255 |

) |

|

|

(7,247 |

) |

|

|

(6,558 |

) |

|

Interest accretion on landfill and environmental remediation

liabilities |

|

(2,896 |

) |

|

|

(2,469 |

) |

|

|

(8,758 |

) |

|

|

(7,470 |

) |

|

Adjusted Operating Income |

$ |

38,306 |

|

|

$ |

37,143 |

|

|

$ |

81,006 |

|

|

$ |

82,329 |

|

|

Adjusted Operating Income as a percentage of

revenues |

|

9.3 |

% |

|

|

10.5 |

% |

|

|

7.2 |

% |

|

|

9.1 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months EndedSeptember

30, |

|

Nine Months EndedSeptember

30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Net income |

$ |

5,771 |

|

|

$ |

18,172 |

|

|

$ |

8,660 |

|

|

$ |

27,210 |

|

|

Loss from termination of bridge financing (i) |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

8,191 |

|

|

Southbridge Landfill closure charge (ii) |

|

8,477 |

|

|

|

70 |

|

|

|

8,477 |

|

|

|

276 |

|

|

Legal settlement (iii) |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

6,150 |

|

|

Expense from acquisition activities (iv) |

|

5,450 |

|

|

|

3,261 |

|

|

|

18,297 |

|

|

|

9,801 |

|

|

Gain on resolution of acquisition related contingent consideration

(v) |

|

— |

|

|

|

(376 |

) |

|

|

— |

|

|

|

(965 |

) |

|

Interest expense from acquisition activities (vi) |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

496 |

|

|

Tax effect (vii) |

|

(3,797 |

) |

|

|

(987 |

) |

|

|

(7,805 |

) |

|

|

(6,920 |

) |

|

Adjusted Net Income |

$ |

15,901 |

|

|

$ |

20,140 |

|

|

$ |

27,629 |

|

|

$ |

44,239 |

|

| |

|

|

|

|

|

|

|

|

Diluted weighted average common shares

outstanding |

|

58,921 |

|

|

|

58,062 |

|

|

|

58,415 |

|

|

|

54,325 |

|

| |

|

|

|

|

|

|

|

|

Diluted earnings per common share |

$ |

0.10 |

|

|

$ |

0.31 |

|

|

$ |

0.15 |

|

|

$ |

0.50 |

|

|

Loss from termination of bridge financing (i) |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

0.15 |

|

|

Southbridge Landfill closure charge (ii) |

|

0.14 |

|

|

|

— |

|

|

|

0.15 |

|

|

|

0.01 |

|

|

Legal settlement (iii) |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

0.11 |

|

|

Expense from acquisition activities (iv) |

|

0.09 |

|

|

|

0.07 |

|

|

|

0.31 |

|

|

|

0.18 |

|

|

Gain on resolution of acquisition related contingent consideration

(v) |

|

— |

|

|

|

(0.01 |

) |

|

|

— |

|

|

|

(0.02 |

) |

|

Interest expense from acquisition activities (vi) |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

0.01 |

|

|

Tax effect (vii) |

|

(0.06 |

) |

|

|

(0.02 |

) |

|

|

(0.14 |

) |

|

|

(0.13 |

) |

|

Adjusted Diluted Earnings Per Common Share |

$ |

0.27 |

|

|

$ |

0.35 |

|

|

$ |

0.47 |

|

|

$ |

0.81 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(i) Loss from termination of bridge financing is related to

the write-off of the remaining unamortized debt issuance costs

associated with the extinguishment of bridge financing agreements

associated with acquisitions.

(ii) Southbridge Landfill closure charge are expenses

related to the unplanned early closure of the Southbridge Landfill

along with associated legal activities. The Company initiated the

unplanned, premature closure of the Southbridge Landfill in the

fiscal year ended December 31, 2017 due to the significant capital

investment required to obtain expansion permits and for future

development coupled with an uncertain regulatory environment. The

unplanned closure of the Southbridge Landfill reduced the economic

useful life of the assets from prior estimates by approximately ten

years. In August 2024, the Company received the final closure

permit related to Southbridge Landfill and entered into

post-closure.

(iii) Legal settlement is related to reaching an agreement

in June 2023 with the collective class members of a class action

lawsuit relating to certain Fair Labor Standards Act of 1938

("FLSA") claims as well as state wage and hours laws.

(iv) Expense from acquisition activities is comprised

primarily of legal, consulting, rebranding and other costs

associated with the due diligence, acquisition and integration of

acquired businesses. The nine months ended September 30, 2024

included a charge for an increase in the reserve against accounts

receivable of the businesses acquired in the acquisition of four

wholly owned subsidiaries of GFL Environmental Inc., as a result of

our inability to pursue collections during the transition services

period with the seller, resulting in accounts receivable aged

beyond what is typical in our business.

(v) Gain on resolution of acquisition related contingent

consideration is associated with the reversal of a contingency for

a transfer station permit expansion that is no longer deemed

viable.

(vi) Interest expense from acquisition activities is the

amortization of debt issuance costs comprised of transaction,

legal, and other similar costs associated with bridge financing

activities related to acquisitions.

(vii) Tax effect of the adjustments is an aggregate of the

current and deferred tax impact of each adjustment, including the

impact to the effective tax rate, current provision and deferred

provision. The computation considers all relevant impacts of the

adjustments, including available net operating loss carryforwards

and the impact on the remaining valuation allowance.

Non-GAAP Liquidity Measures

In addition to disclosing financial results prepared in

accordance with GAAP, the Company also presents non-GAAP liquidity

measures such as Adjusted Free Cash Flow that provide an

understanding of the Company's liquidity because it considers them

important supplemental measures of its liquidity that are

frequently used by securities analysts, investors and other

interested parties in the evaluation of the Company's cash flow

generation from its core operations that are then available to be

deployed for strategic acquisitions, growth investments,

development projects, unusual landfill closures, site improvement

and remediation, and strengthening the Company’s balance sheet

through paying down debt. The Company also believes that showing

the impact of certain items as adjustments provides more

transparency and comparability across periods. Management uses

non-GAAP liquidity measures to understand the Company’s cash flow

provided by operating activities after certain expenditures along

with its consolidated net leverage and believes that these measures

demonstrate the Company’s ability to execute on its strategic

initiatives. The Company believes that providing such non-GAAP

liquidity measures to investors, in addition to corresponding cash

flow statement measures, affords investors the benefit of viewing

the Company’s liquidity using the same financial metrics that the

management team uses in making many key decisions and understanding

how the core business and cash flow generation has performed. The

table below, on an adjusted basis to exclude certain items, sets

forth such liquidity measures:

| |

Three Months EndedSeptember

30, |

|

Nine Months EndedSeptember

30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Net cash provided by operating activities |

$ |

91,813 |

|

|

$ |

74,629 |

|

|

$ |

171,594 |

|

|

$ |

157,825 |

|

|

Capital expenditures |

|

(51,461 |

) |

|

|

(39,949 |

) |

|

|

(126,361 |

) |

|

|

(90,364 |

) |

|

Proceeds from sale of property and equipment |

|

220 |

|

|

|

195 |

|

|

|

1,047 |

|

|

|

971 |

|

|

Proceeds from property insurance settlement |

|

146 |

|

|

|

— |

|

|

|

146 |

|

|

|

— |

|

|

Southbridge Landfill closure (i) |

|

799 |

|

|

|

887 |

|

|

|

2,281 |

|

|

|

3,224 |

|

|

Cash outlays from acquisition activities (ii) |

|

4,580 |

|

|

|

2,233 |

|

|

|

14,015 |

|

|

|

8,292 |

|

|

Acquisition capital expenditures (iii) |

|

12,830 |

|

|

|

6,041 |

|

|

|

25,489 |

|

|

|

11,053 |

|

|

McKean Landfill rail capital expenditures (iv) |

|

318 |

|

|

|

2,403 |

|

|

|

3,543 |

|

|

|

3,306 |

|

|

FLSA legal settlement payment (v) |

|

— |

|

|

|

— |

|

|

|

6,150 |

|

|

|

— |

|

|

Landfill capping charge - veneer failure payment (vi) |

|

— |

|

|

|

— |

|

|

|

850 |

|

|

|

— |

|

|

Adjusted Free Cash Flow |

$ |

59,245 |

|

|

$ |

46,439 |

|

|

$ |

98,754 |

|

|

$ |

94,307 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(i) Southbridge Landfill closure are cash outlays

associated with the unplanned, early closure of the Southbridge

Landfill. The Company initiated the unplanned, premature closure of

the Southbridge Landfill in the fiscal year ended December 31,

2017, and expects to incur cash outlays through satisfaction of the

closure requirements and the environmental remediation process. In

August 2024, the Company received the final closure permit related

to Southbridge Landfill and entered into post-closure.

(ii) Cash outlays from acquisition activities are cash

outlays for transaction and integration costs relating to specific

acquisition transactions and include legal, consulting, rebranding

and other costs as part of the Company’s strategic growth

initiative.

(iii) Acquisition capital expenditures are acquisition

related capital expenditures that are necessary to optimize

strategic synergies associated with integrating newly acquired

operations as contemplated by the discounted cash flow return

analysis conducted by management as part of the acquisition

investment decision. Acquisition related capital expenditures

include costs required to achieve initial operating synergies and

integrate operations.

(iv) McKean Landfill rail capital expenditures are

long-term infrastructure capital expenditures related to rail side

development at the Company's landfill in Mount Jewett, PA ("McKean

Landfill"), which is different from the landfill construction

investments in the normal course of operations.

(v) FLSA legal settlement payment is the cash outlay of a

legal settlement related to reaching an agreement in June 2023 with

the collective class members of a class action lawsuit relating to

certain claims under the FLSA as well as state wage and hours

laws.

(vi) Landfill capping charge - veneer failure payment is

the cash outlay associated with operating expenses incurred to

clean up the affected capping material at the Company's landfill in

Seneca, New York. Engineering analysis is currently underway to

determine root causes and responsibility for the event.

Non-GAAP financial measures are not in accordance with or an

alternative for GAAP. Adjusted EBITDA, Adjusted EBITDA as a

percentage of revenues, Adjusted Operating Income, Adjusted

Operating Income as a percentage of revenues, Adjusted Net Income,

Adjusted Diluted Earnings Per Common Share, and Adjusted Free Cash

Flow should not be considered in isolation from or as a substitute

for financial information presented in accordance with GAAP, and

may be different from Adjusted EBITDA, Adjusted EBITDA as a

percentage of revenues, Adjusted Operating Income, Adjusted

Operating Income as a percentage of revenues, Adjusted Net Income,

Adjusted Diluted Earnings Per Common Share, and Adjusted Free Cash

Flow presented by other companies.

|

CASELLA WASTE SYSTEMS, INC. AND

SUBSIDIARIESUNAUDITED RECONCILIATION OF FISCAL

YEAR 2024 OUTLOOK NON-GAAP MEASURES(In

thousands) |

| |

Following is a reconciliation of the

Company's estimated Adjusted

EBITDA(i)

from estimated Net income for fiscal year

2024:

|

|

(Estimated) Twelve Months Ending December 31,

2024 |

| Net

income |

$10,000 - $20,000 |

|

Provision for income taxes |

11,000 |

|

Other income |

(1,500) |

|

Interest expense, net |

52,000 |

|

Southbridge Landfill closure charge |

8,500 |

|

Expense from acquisition activities |

23,000 |

|

Depreciation and amortization |

235,000 |

|

Depletion of landfill operating lease obligations |

10,500 |

|

Interest accretion on landfill and environmental remediation

liabilities |

11,500 |

| Adjusted

EBITDA |

$360,000 - $370,000 |

| |

|

Following is a reconciliation of the Company's estimated

Adjusted Free Cash

Flow(i)

from estimated Net cash provided by operating activities

for fiscal year 2024:

|

|

(Estimated) Twelve Months Ending December 31,

2024 |

| Net cash provided by

operating activities |

$245,000 - $255,000 |

|

Capital expenditures |

(196,000) |

|

Proceeds from sale of property and equipment |

1,350 |

|

Proceeds from property insurance settlement |

150 |

|

FLSA legal settlement payment |

6,150 |

|

Southbridge Landfill closure |

2,500 |

|

Acquisition capital expenditures |

55,000 |

|

Cash outlays from acquisition activities |

20,000 |

|

McKean Landfill rail capital expenditures |

5,000 |

|

Landfill capping charge - veneer failure payment |

850 |

| Adjusted Free Cash

Flow |

$140,000 - $150,000 |

| |

|

(i) See footnotes for Non-GAAP Performance Measures and Non-GAAP

Liquidity Measures included in the Unaudited Reconciliation of

Certain Non-GAAP Measures for further disclosure over the nature of

the various adjustments to estimated Adjusted EBITDA and estimated

Adjusted Free Cash Flow.

|

CASELLA WASTE SYSTEMS, INC. AND

SUBSIDIARIESUNAUDITED SUPPLEMENTAL DATA

TABLES(In thousands) |

| |

Amounts of total revenues attributable to

services provided for the three and nine

months ended September 30, 2024

and 2023 are as

follows:

| |

Three Months Ended September 30, |

| |

|

2024 |

|

|

% of TotalRevenues |

|

|

2023 |

|

|

% of TotalRevenues |

|

Collection |

$ |

252,579 |

|

|

|

61.4 |

% |

|

$ |

206,093 |

|

|

|

58.4 |

% |

|

Disposal |

|

67,453 |

|

|

|

16.4 |

% |

|

|

66,337 |

|

|

|

18.8 |

% |

|

Landfill gas-to-energy |

|

1,651 |

|

|

|

0.4 |

% |

|

|

1,797 |

|

|

|

0.5 |

% |

|

Processing |

|

3,482 |

|

|

|

0.8 |

% |

|

|

3,021 |

|

|

|

0.9 |

% |

|

Solid waste operations |

|

325,165 |

|

|

|

79.0 |

% |

|

|

277,248 |

|

|

|

78.6 |

% |

|

Processing |

|

34,954 |

|

|

|

8.5 |

% |

|

|

27,782 |

|

|

|

7.9 |

% |

| National

Accounts |

|

51,508 |

|

|

|

12.5 |

% |

|

|

47,705 |

|

|

|

13.5 |

% |

|

Resource Solutions operations |

|

86,462 |

|

|

|

21.0 |

% |

|

|

75,487 |

|

|

|

21.4 |

% |

|

Total revenues |

$ |

411,627 |

|

|

|

100.0 |

% |

|

$ |

352,735 |

|

|

|

100.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Nine Months Ended September 30, |

| |

|

2024 |

|

|

% of TotalRevenues |

|

|

2023 |

|

|

% of TotalRevenues |

|

Collection |

$ |

687,896 |

|

|

|

60.9 |

% |

|

$ |

495,917 |

|

|

|

54.8 |

% |

|

Disposal |

|

182,716 |

|

|

|

16.2 |

% |

|

|

181,433 |

|

|

|

20.0 |

% |

| Power

generation |

|

6,144 |

|

|

|

0.5 |

% |

|

|

5,042 |

|

|

|

0.6 |

% |

|

Processing |

|

8,290 |

|

|

|

0.7 |

% |

|

|

7,351 |

|

|

|

0.8 |

% |

|

Solid waste operations |

|

885,046 |

|

|

|

78.3 |

% |

|

|

689,743 |

|

|

|

76.2 |

% |

|

Processing |

|

97,992 |

|

|

|

8.7 |

% |

|

|

75,970 |

|

|

|

8.4 |

% |

| National

Accounts |

|

146,759 |

|

|

|

13.0 |

% |

|

|

139,262 |

|

|

|

15.4 |

% |

|

Resource Solutions operations |

|

244,751 |

|

|

|

21.7 |

% |

|

|

215,232 |

|

|

|

23.8 |

% |

|

Total revenues |

$ |

1,129,797 |

|

|

|

100.0 |

% |

|

$ |

904,975 |

|

|

|

100.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Components of revenue growth for the three months

ended September 30, 2024 compared

to the three months ended September 30,

2023 are as follows:

| |

Amount |

|

%

ofRelatedBusiness |

|

% of TotalCompany |

| Solid waste

operations: |

|

|

|

|

|

|

Collection |

$ |

12,639 |

|

|

|

6.1 |

% |

|

|

3.6 |

% |

|

Disposal |

|

2,542 |

|

|

|

3.8 |

% |

|

|

0.7 |

% |

|

Solid waste price |

|

15,181 |

|

|

|

5.5 |

% |

|

|

4.3 |

% |

|

Collection |

|

(1,445 |

) |

|

|

(0.7 |

)% |

|

|

(0.4 |

)% |

|

Disposal |

|

(1,311 |

) |

|

|

(2.0 |

)% |

|

|

(0.4 |

)% |

|

Processing |

|

(71 |

) |

|

|

(2.4 |

)% |

|

|

— |

% |

|

Solid waste volume |

|

(2,827 |

) |

|

|

(1.0 |

)% |

|

|

(0.8 |

)% |

|

Surcharges and other fees |

|

(539 |

) |

|

|

|

|

(0.1 |

)% |

|

Commodity price and volume |

|

19 |

|

|

|

|

|

— |

% |

|

Acquisitions |

|

36,083 |

|

|

|

13.0 |

% |

|

|

10.2 |

% |

| Total solid waste

operations |

|

47,917 |

|

|

|

17.3 |

% |

|

|

13.6 |

% |

| Resource Solutions

operations: |

|

|

|

|

|

|

Price |

|

2,452 |

|

|

|

3.2 |

% |

|

|

0.7 |

% |

|

Volume |

|

7,312 |

|

|

|

9.7 |

% |

|

|

2.0 |

% |

|

Surcharges and other fees |

|

(160 |

) |

|

|

|

|

— |

% |

|

Acquisitions |

|

1,371 |

|

|

|

1.8 |

% |

|

|

0.4 |

% |

| Total Resource

Solutions operations |

|

10,975 |

|

|

|

14.5 |

% |

|

|

3.1 |

% |

| Total

Company |

$ |

58,892 |

|

|

|

|

|

16.7 |

% |

| |

|

|

|

|

|

|

|

|

|

Components of capital

expenditures(i)

for the three and nine

months ended September 30, 2024

and 2023 are as

follows:

| |

Three Months EndedSeptember

30, |

|

Nine Months EndedSeptember

30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Growth capital expenditures: |

|

|

|

|

|

|

|

|

Acquisition capital expenditures |

$ |

12,830 |

|

|

$ |

6,041 |

|

|

$ |

25,489 |

|

|

$ |

11,053 |

|

|

McKean Landfill rail capital expenditures |

|

318 |

|

|

|

2,403 |

|

|

|

3,543 |

|

|

|

3,306 |

|

|

Other |

|

4,644 |

|

|

|

2,217 |

|

|

|

9,636 |

|

|

|

6,115 |

|

|

Growth capital expenditures |

|

17,792 |

|

|

|

10,661 |

|

|

|

38,668 |

|

|

|

20,474 |

|

|

Replacement capital expenditures: |

|

|

|

|

|

|

|

|

Landfill development |

|

14,728 |

|

|

|

16,155 |

|

|

|

32,536 |

|

|

|

27,353 |

|

|

Vehicles, machinery, equipment and containers |

|

13,103 |

|

|

|

11,125 |

|

|

|

41,348 |

|

|

|

30,897 |

|

|

Facilities |

|

4,527 |

|

|

|

2,008 |

|

|

|

10,536 |

|

|

|

8,578 |

|

|

Other |

|

1,311 |

|

|

|

— |

|

|

|

3,273 |

|

|

|

3,062 |

|

|

Replacement capital expenditures |

|

33,669 |

|

|

|

29,288 |

|

|

|

87,693 |

|

|

|

69,890 |

|

|

Capital expenditures |

$ |

51,461 |

|

|

$ |

39,949 |

|

|

$ |

126,361 |

|

|

$ |

90,364 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(i) The Company's capital expenditures are broadly defined as

pertaining to either growth or replacement activities. Growth

capital expenditures are defined as costs related to development

projects, organic business growth, and the integration of newly

acquired operations. Growth capital expenditures include costs

related to the following: 1) acquisition capital expenditures that

are necessary to optimize strategic synergies associated with

integrating newly acquired operations as contemplated by the

discounted cash flow return analysis conducted by management as

part of the acquisition investment decision and includes the

capital expenditures required to achieve initial operating

synergies and integrate operations; 2) McKean Landfill rail capital

expenditures, which is unique and different from landfill

construction investments in the normal course of operations because

the Company is investing in long-term infrastructure; and 3)

development of new airspace, permit expansions, and new recycling

contracts, equipment added directly as a result of organic business

growth and infrastructure added to increase throughput at transfer

stations and recycling facilities. Replacement capital expenditures

are defined as landfill cell construction costs not related to

expansion airspace, costs for normal permit renewals, replacement

costs for equipment and other capital expenditures due to age or

obsolescence, and capital items not defined as growth capital

expenditures.

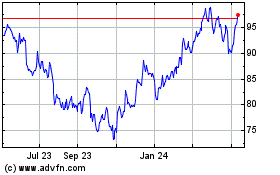

Casella Waste Systems (NASDAQ:CWST)

Historical Stock Chart

From Dec 2024 to Jan 2025

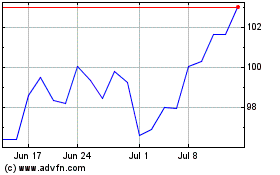

Casella Waste Systems (NASDAQ:CWST)

Historical Stock Chart

From Jan 2024 to Jan 2025