Casella Waste Systems Announces Pricing of Public Offering of 4,500,000 Shares of Class A Common Stock

September 18 2024 - 8:00AM

Casella Waste Systems, Inc. (NASDAQ: CWST), a regional solid waste,

recycling and resource management services company, announced today

the pricing of an underwritten public offering of 4,500,000 shares

of its Class A common stock at a public offering price of $100.00

per share, for total gross proceeds of approximately $450.0

million, before deducting underwriting discounts and offering

expenses. Casella also granted the underwriters of the offering an

option for a period of 30 days to purchase up to an additional

675,000 shares of Class A common stock at the public offering

price, less the underwriting discounts. All of the shares in the

offering are to be sold by Casella. The offering is expected to

close on or about September 19, 2024, subject to customary closing

conditions.

Casella intends to use the net proceeds from the offering to

finance its previously announced acquisition of Royal Carting and

Welsh Sanitation, to repay borrowings under its revolving credit

facility and for general corporate purposes.

Raymond James, J.P. Morgan and Stifel are acting as joint

book-running managers for the offering. Goldman Sachs & Co.

LLC and Wolfe | Nomura Alliance are acting as passive

book-runners for the offering.

The shares are being offered by Casella pursuant to an

automatically effective shelf registration statement (including a

prospectus) that was previously filed with the U.S. Securities and

Exchange Commission (“SEC”). The offering is being made only by

means of the written prospectus and prospectus supplement that form

a part of the registration statement. A preliminary prospectus

supplement relating to and describing the terms of the offering was

filed with the SEC on September 17, 2024, and is available on the

SEC’s website at www.sec.gov. A final prospectus supplement

relating to the offering will be filed with the SEC and will form a

part of the registration statement, and will also be available on

the SEC’s website.

Copies of the final prospectus supplement and accompanying

prospectus relating to the offering, when available, may also be

obtained from Raymond James & Associates, Inc., Attention:

Equity Syndicate, 880 Carillon Parkway, St. Petersburg,

Florida 33716, or by telephone at (800) 248-8863, or by e-mail

to prospectus@raymondjames.com; J.P. Morgan Securities LLC,

c/o Broadridge Financial Solutions, 1155 Long Island Avenue,

Edgewood, NY 11717, or by email to prospectus-eq_fi@jpmchase.com

and postsalemanualrequests@broadridge.com; or Stifel, Nicolaus

& Company, Incorporated, Attention: Syndicate Department, One

South Street, 15th Floor, Baltimore, Maryland 21202, or by email to

Syndprospectus@stifel.com.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy, nor shall there be any sale of,

these securities in any state or jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification of these securities under the securities laws of any

such state or jurisdiction.

About Casella Waste Systems, Inc.

Casella Waste Systems, Inc., headquartered in Rutland, Vermont,

provides resource management expertise and services to residential,

commercial, municipal, institutional and industrial customers,

primarily in the areas of solid waste collection and disposal,

transfer, recycling and organics services in the eastern United

States.

Safe Harbor Statement

Certain matters discussed in this press release, including,

among others, our expectations regarding the completion of the

public offering and our intended use of proceeds from the offering,

are “forward-looking statements” intended to qualify for the safe

harbors from liability established by the Private Securities

Litigation Reform Act of 1995. These forward-looking statements can

generally be identified as such by the context of the statements,

including words such as “believe,” “expect,” “anticipate,” “plan,”

“may,” “will,” “would,” “intend,” “estimate,” “guidance” and other

similar expressions, whether in the negative or affirmative. These

forward-looking statements are based on current expectations,

estimates, forecasts and projections about the industry and markets

in which Casella operates and management’s beliefs and assumptions.

Casella cannot guarantee that it actually will achieve the plans,

intentions or expectations disclosed in the forward-looking

statements made. Such forward-looking statements involve a number

of risks and uncertainties, any one or more of which could cause

actual results to differ materially from those described in

Casella’s forward-looking statements. Such risks and uncertainties

include or relate to, among other things: risks and uncertainties

relating to the satisfaction of customary closing conditions

related to the public offering. Additional risks and uncertainties

relating to the proposed offering, Casella and its business are

discussed in the preliminary prospectus supplement related to the

offering filed with the SEC on September 17, 2024 and in other

filings that Casella periodically makes with the SEC. In addition,

the forward-looking statements included in this press release

represent Casella’s views as of the date of this press release.

Casella undertakes no obligation to update publicly any

forward-looking statements, whether as a result of new information,

future events or otherwise, except as required by law. These

forward-looking statements should not be relied upon as

representing Casella’s views as of any date subsequent to the date

of this press release.

Investors:Charlie WohlhuterDirector of Investor

Relations(802) 772-2230

Media:Jeff WeldVice President of

Communications(802) 772-2234

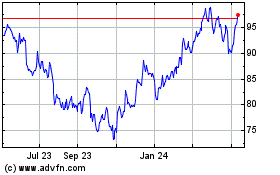

Casella Waste Systems (NASDAQ:CWST)

Historical Stock Chart

From Dec 2024 to Jan 2025

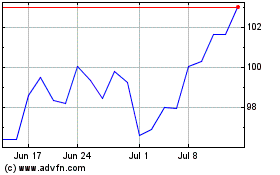

Casella Waste Systems (NASDAQ:CWST)

Historical Stock Chart

From Jan 2024 to Jan 2025