UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

(Amendment No. 1)

(Rule 13d-101)

INFORMATION TO BE INCLUDED IN STATEMENTS FILED

PURSUANT

TO RULE 13d-1(a) AND AMENDMENTS THERETO FILED

PURSUANT TO RULE 13d-2(a)

Carver Bancorp, Inc.

(Name of Issuer)

Common Stock, par value $0.01 per share

(Title of Class of Securities)

146875604

(CUSIP Number)

Gregory Lewis

Dream Chasers Capital Group LLC

26 Broadway, 8th Floor

New York, New York 10004

917-969-2814

With a copy to:

Drew G.L. Chapman

Hamilton Clarke LLP

48 Wall Street

New York, New York 10005

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

November 4, 2024

(Date of Event Which Requires Filing of This

Statement)

If the filing person has previously filed a statement on Schedule 13G

to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e), 13d-1(f) or

13d-1(g), check the following box. ¨

Note: Schedules filed in paper format shall include a signed

original and five copies of the schedule, including all exhibits. See Rule 13d-7 for other parties to whom copies are to be sent.

| * |

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page. |

The information required on the remainder of this cover page shall

not be deemed to be “filed” for the purpose of section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise

subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

| 1 |

NAME OF REPORTING PERSON

Dream Chasers Capital Group LLC |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) x (b) ¨ |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

WC (See Item 3) |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO

ITEMS 2(d) OR 2(e)

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

New York |

Number of

shares

beneficially

owned by

each

reporting

person

with |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

238,300 |

| 9 |

SOLE DISPOSITIVE POWER

0 |

| 10 |

SHARED DISPOSITIVE POWER

200 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

238,300 |

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

4.6%* |

| 14 |

TYPE OF REPORTING PERSON

CO |

* All percentage calculations set forth herein are based upon the aggregate

of 5,140,872 shares of Common Stock outstanding as of October 15, 2024, as reported in the Issuer’s Definitive Proxy Statement filed

with the SEC on October 31, 2024.

| CUSIP No. 146875604 | Page 2 |

| 1 |

NAME OF REPORTING PERSON

Gregory Antonius Lewis |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) x (b) ¨ |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

OO (See Item 3) |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO

ITEMS 2(d) OR 2(e)

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

United States of America |

Number of

shares

beneficially

owned by

each

reporting

person

with |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

238,300 |

| 9 |

SOLE DISPOSITIVE POWER

0 |

| 10 |

SHARED DISPOSITIVE POWER

200 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

238,300 |

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

4.6%* |

| 14 |

TYPE OF REPORTING PERSON

IN |

* All percentage calculations set forth herein are based upon the aggregate

of 5,140,872 shares of Common Stock outstanding as of October 15, 2024, as reported in the Issuer’s Definitive Proxy Statement filed

with the SEC on October 31, 2024.

| CUSIP No. 146875604 | Page 3 |

| 1 |

NAME OF REPORTING PERSON

Shawn Paul Herrera |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) x (b) ¨ |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

PF (See Item 3) |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO

ITEMS 2(d) OR 2(e)

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

United States of America |

Number of

shares

beneficially

owned by

each

reporting

person

with |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

0 |

| 9 |

SOLE DISPOSITIVE POWER

81,100 |

| 10 |

SHARED DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

81,100 |

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

1.6%* |

| 14 |

TYPE OF REPORTING PERSON

IN |

* All percentage calculations set forth herein are based upon the aggregate

of 5,140,872 shares of Common Stock outstanding as of October 15, 2024, as reported in the Issuer’s Definitive Proxy Statement filed

with the SEC on October 31, 2024.

| CUSIP No. 146875604 | Page 4 |

| 1 |

NAME OF REPORTING PERSON

Kevin Scott Winters |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) x (b) ¨ |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

PF (See Item 3) |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO

ITEMS 2(d) OR 2(e)

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

United States of America |

Number of

shares

beneficially

owned by

each

reporting

person

with |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

0 |

| 9 |

SOLE DISPOSITIVE POWER

157,000 |

| 10 |

SHARED DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

157,000 |

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

3.1%* |

| 14 |

TYPE OF REPORTING PERSON

IN |

* All percentage calculations set forth herein are based upon the aggregate

of 5,140,872 shares of Common Stock outstanding as of October 15, 2024, as reported in the Issuer’s Definitive Proxy Statement filed

with the SEC on October 31, 2024.

| CUSIP No. 146875604 | Page 5 |

| 1 |

NAME OF REPORTING PERSON

Jeffrey John Bailey |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) x (b) ¨ |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

PF (See Item 3) |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO

ITEMS 2(d) OR 2(e)

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

United States of America |

Number of

shares

beneficially

owned by

each

reporting

person

with |

7 |

SOLE VOTING POWER

98,274 |

| 8 |

SHARED VOTING POWER

161,2001 |

| 9 |

SOLE DISPOSITIVE POWER

98,274 |

| 10 |

SHARED DISPOSITIVE POWER

161,200 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

259,4742 |

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

5.0%* |

| 14 |

TYPE OF REPORTING PERSON

IN |

* All percentage calculations set forth herein are based upon the aggregate

of 5,140,872 shares of Common Stock outstanding as of October 15, 2024, as reported in the Issuer’s Definitive Proxy Statement filed

with the SEC on October 31, 2024.

1 Jointly owned with

wife, Michelle Bailey.

2 Includes 161,200 shares owned jointly with wife, Michelle

Bailey.

| CUSIP No. 146875604 | Page 6 |

The following constitutes Amendment No. 1 (“Amendment

No. 1”) to the Schedule 13D originally filed by the Reporting Persons on October 22, 2024 (the “Original Schedule 13D”).

Capitalized terms used but not defined herein shall have the meanings ascribed to such terms in the Original Schedule 13D.

ITEM 1. SECURITY AND

ISSUER

Item 1 is hereby amended and

restated to read as follows:

This statement on Schedule

13D (“Schedule 13D”) relates to the common stock, par value $0.01 per share (the “Common Stock”),

of Carver Bancorp, Inc., a Delaware corporation (the “Issuer”). The principal executive offices of the Issuer are located

at 75 West 125th Street, New York, NY 10027. This Schedule 13D amends, supersedes and replaces entirely any and all Schedule

13Ds previously filed by any of the Reporting Persons with respect to the Issuer.

The Reporting Persons (as

defined below) each beneficially owns an aggregate of 497,774 shares of Common Stock. These shares represent approximately 9.7% of the

outstanding shares of Common Stock.

ITEM 5. INTEREST IN SECURITIES OF

THE ISSUER

Item 5 is hereby amended and restated to

read as follows:

The aggregate percentage of

Shares reported as beneficially owned by each person named herein is based upon 5,140,872 Shares issued and outstanding as of October

15, 2024, which is the total number of Shares outstanding as reported in the Issuer’s Definitive Proxy Statement filed with the

Securities and Exchange Commission on October 31, 2024.

| |

(a) |

Dream Chasers beneficially owns 238,300 Shares. |

Percentage: Approximately

4.6%

| |

(b) |

1. |

Sole power to vote or direct vote: 0 |

| |

2. |

Shared power to vote or direct vote: 238,300 |

| |

3. |

Sole power to dispose or direct the disposition: 0 |

| |

4. |

Shared power to dispose or direct the disposition: 200 |

| |

(c) |

Dream Chasers has not entered into any transactions in Shares during the past 60 days. |

Mr. Lewis, as the sole manager of Dream Chasers, may be deemed to have

the shared power to vote or direct the vote of all of the Shares of Dream Chasers, Mr. Herrera and Mr. Winters.

| |

(a) |

Herrera beneficially owns 81,100 Shares. |

Percentage: Approximately

1.6%

| |

(b) |

1. |

Sole power to vote or direct vote: 0 |

| |

2. |

Shared power to vote or direct vote: 0 |

| |

3. |

Sole power to dispose or direct the disposition: 81,100 |

| |

4. |

Shared power to dispose or direct the disposition: 0 |

| CUSIP No. 146875604 | Page 7 |

| |

(c) |

Herrera purchased 4,000 in open market transactions during the past 60 days on September 11, 2024 for an average price per Share of $1.90. |

| |

(a) |

Winters beneficially owns 157,000 Shares. |

Percentage: Approximately

3.1%

| |

(b) |

1. |

Sole power to vote or direct vote: 0 |

| |

2. |

Shared power to vote or direct vote: 0 |

| |

3. |

Sole power to dispose or direct the disposition: 157,000 |

| |

4. |

Shared power to dispose or direct the disposition: 0 |

| |

(c) |

Winters has not entered into any transactions in Shares during the past 60 days. |

| |

(a) |

Bailey beneficially owns 259,474 Shares3, of which 161,200 Shares are jointly owned with his wife. |

Percentage: Approximately

5.0%

| |

(b) |

1. |

Sole power to vote or direct vote: 98,274 |

| |

2. |

Shared power to vote or direct vote: 161,200 |

| |

3. |

Sole power to dispose or direct the disposition: 98,274 |

| |

4. |

Shared power to dispose or direct the disposition: 161,200 |

| |

(c) |

Bailey has not entered into any transactions in Shares during the past 60 days. |

The

Reporting Persons, as members of a “group” for the purposes of Section 13(d)(3) of the Exchange Act, may be deemed the

beneficial owner of the Shares directly owned by the other Reporting Persons. Each Reporting Person disclaims beneficial ownership of

such Shares except to the extent of his or its pecuniary interest therein.

| |

(d) |

Other than as set forth in Item 3, no person other than the Reporting Persons is known to have the right to receive, or the power to direct the receipt of dividends from, or proceeds from the sale of, Shares. |

Each of the Reporting Persons specifically disclaims beneficial ownership

of the securities reported herein except to the extent of such Reporting Person’s pecuniary interest therein.

3 Bailey has entered into a Proxy and Power of Attorney

that grants full voting and investment discretion over 98,800 Shares to Garrett Kyle Bailey. In total, Bailey owns an aggregate of 358,274

Shares, however beneficially owns for purposes of Section 13(d) 259,474 Shares.

| CUSIP No. 146875604 | Page 8 |

ITEM 6. CONTRACTS, ARRANGEMENTS, UNDERSTANDINGS

OR RELATIONSHIPS WITH RESPECT TO SECURITIES OF THE ISSUER

The third paragraph of Item 6 is hereby amended

and restated to read as follows:

Herrera and Winters have each granted Dream Chasers

a power of attorney to, among other things, vote their Shares pursuant to a Proxy and Power of Attorney, a copy of which is attached hereto

as Exhibit 99.3 and incorporated herein by reference.

ITEM 7. MATERIAL TO BE FILED AS AN

EXHIBIT

Item 7 is hereby amended and restated to read as follows:

| CUSIP No. 146875604 | Page 9 |

SIGNATURES

After reasonable inquiry and to the best of each

of the undersigned’s knowledge and belief, each of the undersigned certify that the information set forth in this statement is true,

complete and correct.

Date: November 4, 2024

| |

DREAM CHASERS CAPITAL GROUP LLC |

| |

|

|

| |

By: |

/s/

Gregory Antonius Lewis |

| |

|

Name: |

Gregory Lewis |

| |

|

Title: |

Managing Member |

| |

|

|

|

| |

GREGORY ANTONIUS LEWIS |

| |

|

| |

By: |

/s/

Gregory Antonius Lewis |

| |

Name: |

Gregory Antonius Lewis |

| |

|

|

| |

SHAWN PAUL HERRERA |

| |

|

| |

By: |

/s/

Shawn Paul Herrera |

| |

Name: |

Shawn Paul Herrera |

| |

|

|

| |

KEVIN SCOTT WINTERS |

| |

|

|

|

| |

By: |

/s/ Kevin Scott Winters |

| |

Name: |

Kevin Scott Winters |

| |

|

|

| |

JEFFREY JOHN BAILEY |

| |

|

| |

By: |

/s/ Jeffrey John Bailey |

| |

Name: |

Jeffrey John Bailey |

| CUSIP No. 146875604 | Page 10 |

| CUSIP No. 146875604 | Page 11 |

Exhibit 99.3

PROXY AND POWER OF ATTORNEY

PROXY

AND POWER OF ATTORNEY (the "Proxy and Power of Attorney"), effective as of November 1, 2024, between each of Shawn Herrera (“Herrera”)

and Kevin Winters (“Winters”; together with Herrera, the “Stockholders” and each, a “Stockholder”),

on the one hand, and Dream Chasers Capital Group LLC (the “Grantee”), on the other hand.

WHEREAS,

Herrera is the owner of 81,100 shares and Winters is the owner of 157,000 (collectively, the “Covered Shares”) of Common Stock,

par value $.01 (the "Common Stock"), of Carver Bancorp, Inc. (the "Company") as of October 15, 2024 and as of the

date of this Proxy and Power of Attorney;

WHEREAS,

the Stockholders desire to enter into this Agreement with the Grantee with respect to the Covered Shares.

NOW,

THEREFORE, in consideration of the foregoing and the mutual covenants and agreements contained herein, and intending to be legally bound

hereby, the parties agree as follows:

1.

Each Stockholder hereby constitutes, appoints, authorizes and empowers the Grantee, during the term of this Proxy and Power of Attorney,

as its sole and exclusive true and lawful proxy and attorney-in-fact, with full power of substitution, to vote and exercise all voting

and related rights with respect to all of the Covered Shares (and any and all securities issued or issuable in respect thereof), for and

in the name, place and stead of such Stockholder, at any annual, special or other meeting of the stockholders of the Company, including

the 2024 Annual Meeting of the Company, and at any adjournment or adjournments thereof, or pursuant to any consent in lieu of a meeting

or otherwise, with respect to any matter that may be submitted for a vote of stockholders of the Company.

2. Each Stockholder, as to himself

and not any other person, represents and warrants to the Grantee that, as of the date hereof, the Stockholder (i) owns all of the Covered

Shares, and (ii) except for that certain Voting Agreement dated as of December 12, 2022 (the “Prior Voting Agreement”), has

not granted any proxy to any Person (other than the Grantee) with respect to any Covered Shares or deposited such Covered Shares into

a voting trust.

3. Any securities of the Company

to be issued or issuable to the Stockholder in respect of Covered Shares during the term of this Proxy and Power of Attorney shall be

deemed Covered Shares for purposes of this Proxy and Power of Attorney.

4. The term of this Proxy and Power

of Attorney shall continue until terminated in accordance with Section 7 below.

5. This Proxy and Power of Attorney

shall be governed by and construed in accordance with the laws of the State of Delaware.

6. This Proxy and Power of Attorney

shall be binding upon, inure to the benefit of, and be enforceable by the successors and permitted assigns of the parties hereto.

7. This Proxy and Power of

Attorney shall terminate as to each Stockholder upon written notice to the Grantee. In the event a Stockholder terminates this Proxy and

Power of Attorney, such termination shall only be effective as to himself and not with respect to the other Stockholder, and this Proxy

and Power of Attorney will remain in full force and effect with respect to the non-terminating Stockholder.

8. The Stockholder will, upon request,

execute and deliver any additional documents and take such actions as may reasonably be deemed by the Grantee to be necessary or desirable

to complete the Proxy and Power of Attorney granted herein or to carry out the provisions hereof.

9. If any term, provision, covenant,

or restriction of this Proxy and Power of Attorney is held by a court of competent jurisdiction to be invalid, void or unenforceable,

the remainder of the terms, provisions, covenants and restrictions of this Proxy and Power of Attorney shall remain in full force and

effect and shall not in any way be affected, impaired or invalidated.

10. This Proxy and Power of

Attorney supersedes, replaces, repeals and terminates any and all agreements with respect to the Covered Shares that were previously entered

into by each of the Stockholders, including but not limited to the Prior Voting Agreement.

11. This Proxy and Power of Attorney

may be executed in any number of counterparts, each of which shall be deemed to be an original but both of which together shall constitute

one and the same instrument.

IN

WITNESS WHEREOF, the parties have caused this Proxy and Power of Attorney to be duly executed on the date first above written.

| |

/s/

Shawn Herrera |

| |

Shawn

Herrera |

| |

|

| |

/s/

Kevin Winters |

| |

Kevin

Winters |

| |

|

| |

DREAM

CHASERS CAPITAL GROUP LLC |

| |

|

| |

|

| |

By: |

/s/

Gregory Lewis |

| |

Name: |

Gregory Lewis |

| |

Title: |

Manager |

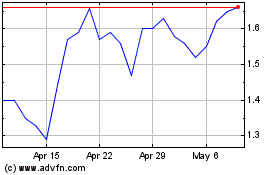

Carver Bancorp (NASDAQ:CARV)

Historical Stock Chart

From Oct 2024 to Nov 2024

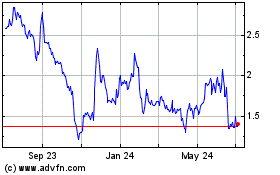

Carver Bancorp (NASDAQ:CARV)

Historical Stock Chart

From Nov 2023 to Nov 2024