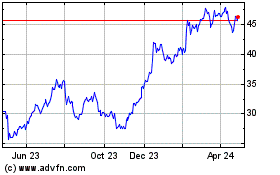

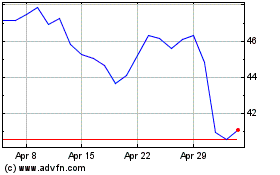

Global alternative asset manager The Carlyle Group L.P. (NASDAQ:

CG) today reported its unaudited results for the first quarter of

2013, which ended on March 31, 2013.

David M. Rubenstein, Co-Chief Executive Officer of Carlyle,

said, “Our first quarter results continue to demonstrate strength

in the Carlyle Engine. Fundraising was particularly strong, with $5

billion in new capital raised, and we generated $4 billion in

realized proceeds. We continue to invest in Carlyle’s growing

operational capabilities, notably the build-out of our

international energy team, the launch of our new business

development corporation, and an expanded retail strategy.”

William E. Conway, Jr., Co-Chief Executive Officer of Carlyle,

said, “Our carry funds had a strong showing, appreciating 7% during

the quarter, and our Global Market Strategies business continued to

grow and perform well across all metrics. Distributable Earnings

were solid and ENI more than doubled quarter over quarter. Our $142

million in realized net performance fees shows how our product

diversity and geographic scope deliver results. We are focused on

the long-term growth and profitability of the firm, which we

believe will benefit our fund and public investors alike.”

U.S. GAAP results for Q1 2013 included income before provision

for income taxes of $452 million and net income attributable to the

common unitholders through The Carlyle Group L.P. of $34 million,

or net income per common unit of $0.66 on a diluted basis. Total

balance sheet assets were $32.7 billion as of March 31, 2013.

First Quarter Distribution

The Board of Directors has declared a quarterly distribution of

$0.16 per common unit to holders of record at the close of business

on May 20, 2013, payable on May 31, 2013.

The Carlyle Group Distribution Policy

As further discussed in its Annual Report on Form 10-K for the

year ended December 31, 2012, Carlyle currently anticipates that it

will cause Carlyle Holdings to make quarterly distributions to its

partners, including The Carlyle Group L.P.’s wholly owned

subsidiaries, that will enable The Carlyle Group L.P. to pay a

quarterly distribution of $0.16 per common unit for each of the

first three quarters of each year, and, for the fourth quarter of

each year, to pay a distribution of at least $0.16 per common unit,

that, taken together with the prior quarterly distributions in

respect of that year, represents its share, net of taxes and

amounts payable under the tax receivable agreement, of Carlyle’s

Distributable Earnings in excess of the amount determined by the

General Partner to be necessary or appropriate to provide for the

conduct of its business, to make appropriate investments in its

business and its funds or to comply with applicable law or any of

its financing agreements. Carlyle anticipates that the aggregate

amount of its distributions for most years will be less than its

Distributable Earnings for that year due to these funding

requirements. The declaration and payment of any distributions is

at the sole discretion of the General Partner, which may change the

distribution policy at any time.

The Carlyle Engine

Carlyle evaluates the underlying performance of its business on

four key metrics known as the Carlyle Engine: funds raised, equity

invested, carry fund returns and realized proceeds for fund

investors. The table below highlights the results of these metrics

for Q1 2013, year-to-date (YTD) and for the last twelve months

(LTM)1.

Funds

Raised Equity Invested Q1 $4.9 billion

Q1

$2.5 billion YTD: $4.9 bn LTM: $16.9 bn YTD: $2.5 bn LTM: $8.8 bn

Realized Proceeds

Carry Fund Returns Q1 $4.1 billion

Q1 7% YTD:

$4.1 bn LTM: $19.1 bn YTD: 7% LTM: 11% Note: Equity Invested

and Realized Proceeds reflect carry funds only.

During Q1 2013, Carlyle generated net realized proceeds of $4.1

billion from 128 different investments across 35 carry funds.

Carlyle deployed $2.5 billion of equity in Q1 2013 in 84 new or

follow-on investments across 19 carry funds. Carlyle realized

proceeds of $19.1 billion and invested $8.8 billion on an LTM

basis.

Segment Realized Proceeds

Equity Invested # of Investments # of Funds $ in millions #

of Investments # of Funds $ in millions

Q1 Corporate

Private Equity 45 19 $2,990 14 7 $1,911 Global Market

Strategies 36 5 $391 5 3 $71 Real Assets 52 11 $741 66 9

$515

Carlyle 128 35 $4,121 84

19 $2,497

Note: The columns may not sum as some

investments cross segment lines, but are only counted one time for

Carlyle results.

1 LTM, or last twelve months, refers to the period Q2 2012

through Q1 2013. Prior LTM, or the prior rolling twelve month

period, refers to the period Q2 2011 through Q1 2012.

Carlyle All Segment Results

- Distributable Earnings (DE): $168

million for Q1 2013 and $678 million on an LTM basis

- Pre-tax Distributable Earnings

were $168 million for Q1 2013, or $0.47 per common unit on a

post-tax basis. Distributable Earnings were $678 million on an LTM

basis, which is 11% lower than the prior rolling twelve month

period. A realized investment loss on a balance sheet investment in

our Real Assets segment had a ($15) million impact on Distributable

Earnings, equivalent to ($0.03) per common unit on a post-tax

basis.

- Fee Related Earnings were $36

million for Q1 2013 and increased by $2 million from $34 million in

Q1 2012 due to an increase in Fee-earning AUM and our acquisition

of an equity interest in NGP Energy Capital Management, offset by

higher fundraising costs and fee and basis step downs of several

funds exiting their investment periods. Fee Related Earnings were

$172 million on an LTM basis, up 49% compared with the prior

rolling twelve month period.

- Realized Net Performance Fees

were $142 million for Q1 2013 compared to $143 million in Q1 2012.

For Q1 2013, Realized Net Performance Fees were positively impacted

by exits in China Pacific Insurance Group, Hertz Global Holdings,

Nielsen Holdings, Cobalt International Energy, Qualicaps and

SS&C Technologies Holding, among others. Realized Net

Performance Fees were $501 million on an LTM basis, which was 17%

lower than the prior rolling twelve month period.

- Realized Investment

Income/(Loss) was ($9) million in Q1 2013, driven by the ($15)

million realized investment loss on a balance sheet investment in

our Real Assets segment.

- Economic Net Income (ENI): $394

million for Q1 2013 and $737 million on an LTM basis

- Economic Net Income was $394

million for Q1 2013 and $737 million on an LTM basis. On a post-tax

basis, Carlyle generated $1.02 in ENI per Adjusted Unit for Q1

2013.

- Q1 2013 ENI was impacted by

appreciation of 7% in Carlyle’s carry fund portfolio, which

excludes structured credit, hedge funds, NGP management fee funds

and fund of funds vehicles. Corporate Private Equity and Global

Market Strategies carry funds were both up 9% while Real Assets

carry funds were up 3% compared to the end of Q4 2012. Carry fund

appreciation was 11% on an LTM basis, compared to 15% in the prior

rolling twelve month period.

- Carlyle’s public carry fund portfolio

increased 13% during Q1 2013 while the private carry fund portfolio

increased 5% during the same period.

The Carlyle Group L.P. - All Segments (Actual Results)

Period LTM % Change $ in millions, except

where noted

Q1 2012 Q2 2012 Q3

2012 Q4 2012 Q1 2013 Q2

12 - Q1 13 QoQ YoY Revenues

894 61 584 505 852 2,003 69% (5%) Expenses 501 119 365 323

458 1,265 42% (9%)

Economic Net Income 392

(57) 219 182

394 737 116% 0% Fee-Related

Earnings 34 36 46 55

36 172 (34%) 6% Net

Performance Fees 335 (107) 165

132 355 545 169%

6% Realized Net Performance Fees 143 76

156 127 142 501

11% (1%) Distributable Earnings 179 115

206 188 168 678

(10%) (6%) Total Assets Under Management ($ in

billions) 159.2 156.2 157.4

170.2 176.3

4% 11% Fee-Earning Assets Under Management ($ in billions)

117.0 112.0 115.1 123.1

122.9 (0%)

5%

Note: Totals may not sum due to

rounding.

Assets Under Management and Remaining

Fair Value of Capital

- Total Assets Under Management:

$176.3 billion as of Q1 2013 (+11% LTM)

- Major drivers of change versus Q4 2012:

Market appreciation (+$6.2 billion), new capital commitments (+$6.0

billion), offset by net distributions (-$4.8 billion) and foreign

exchange impact (-$1.5 billion).

- Total Dry Powder of $46.2 billion as

of Q1 2013, comprised of $17.1 billion in Corporate Private

Equity, $1.8 billion in Global Market Strategies, $9.5 billion in

Real Assets and $17.9 billion in Solutions.

- Fee-earning Assets Under Management:

$122.9 billion as of Q1 2013 (+5% LTM)

- Major drivers of change versus Q4 2012:

Asset inflows (+$2.0 billion), market appreciation (+$745 million),

change in CLO collateral balances (+$296 million), offset by net

distributions and outflows (-$1.8 billion) and foreign exchange

impact (-$1.4 billion).

- As of March 31, 2013, Carlyle had

raised limited partner commitments of $6.1 billion in the aggregate

to several of its latest vintage funds in U.S. Buyout, Asia Buyout

and Financial Services funds, which are not yet included in

Fee-earning Assets Under Management as the predecessor funds have

not yet exited their investment periods.

- Remaining Fair Value of Capital

(carry funds only) as of Q1 2013: $62.2 billion

- Current Multiple of Invested Capital

(MOIC) of remaining fair value of capital: 1.3x.

- Remaining fair value of capital in the

ground in investments made in 2008 or earlier: 44% of total fair

value.

- AUM in-carry ratio as of the end of Q1

2013: 66%.

Non-GAAP Operating Results

Carlyle's non-GAAP results for Q1 2013 are

provided in the table below:

Carlyle Group Summary $ in millions, except unit and

per unit amounts

Economic Net income Q1 2013

Economic Net Income (pre-tax) $ 393.9 Less: Provision for

income taxes (1) 74.3 Economic Net Income, After Taxes $ 319.6

Fully diluted units (in millions) 313.9

Economic

Net Income, After Taxes per Adjusted Unit $ 1.02

Distributable Earnings Distributable Earnings

$ 168.4 Less: Estimated foreign, state, and local taxes (2) 11.0

Distributable Earnings, After Taxes $ 157.4 Allocating

Distributable Earnings for only public unitholders of The Carlyle

Group L.P. Distributable Earnings to The Carlyle Group L.P.

$ 23.5 Less: Estimated current corporate income taxes (3) 1.9

Distributable Earnings to The Carlyle Group L.P. net of corporate

income taxes $ 21.6 Units in public float (in millions)(4)

46.1 Distributable Earnings, net, per The Carlyle Group L.P.

common unit outstanding

$ 0.47 (1) Represents

the implied provision for income taxes that was calculated using a

similar methodology applied in calculating the tax provision for

The Carlyle Group L.P., without any reduction for non-controlling

interests. (2) Represents the implied provision for current income

taxes that was calculated using a similar methodology applied in

calculating the current tax provision for The Carlyle Group L.P.,

without any reduction for non-controlling interests. (3) Represents

current corporate income taxes payable upon distributable earnings

allocated to Carlyle Holdings I GP Inc. and estimated current Tax

Receivable Agreement payments owed. (4) Includes 2.9 million common

units issued in May 2013 related to vested DRUs. These units are

included in this calculation because these newly-issued units will

participate in the unitholder distribution that will be paid on May

31, 2013.

Corporate Private Equity (CPE)

Funds Raised Equity Invested Realized

Proceeds Carry Fund Returns Q1 $1.4 bn

Q1

$1.9 bn

Q1 $3.0 bn

Q1 9% YTD: $1.4 bn LTM:

$8.9 bn YTD: $1.9 bn LTM: $5.4 bn YTD: $3.0 bn LTM:

$13.0 bn YTD: 9% LTM: 16%

- Distributable Earnings (DE): $112

million for Q1 2013 and $392 million on an LTM basis. The

following components impacted Distributable Earnings in Q1 2013:

- Fee Related Earnings were $0 in

Q1 2013 ($47 million on an LTM basis), compared to $14 million in

Q1 2012, with the decline driven by higher fundraising costs and

fee and basis step downs in two CPE funds (Carlyle Europe Partners

III and Carlyle Japan Partners II) that exited their original

investment periods during 2012.

- Realized Net Performance Fees

were $111 million for Q1 2013 ($340 million on an LTM basis),

compared to $105 million for Q1 2012.

- Economic Net Income (ENI): $239

million for Q1 2013

- Economic Net Income of $239

million for Q1 2013 ($474 million on an LTM basis) compared to $244

million for Q1 2012.

- CPE carry fund valuations increased 9%

in Q1 2013 (16% on an LTM basis), compared with 8% in Q1 2012.

- Net Performance Fees of $235

million for Q1 2013 ($414 million on an LTM basis), compared to

$215 million for Q1 2012.

- Total Assets Under Management

(AUM): $55.1 billion as of Q1 2013

- Total AUM increased 3% to $55.1

billion from $53.3 billion at Q1 2012.

- Funds Raised of $1.4 billion

were driven by additional closings of our latest vintage U.S. and

Asia buyout funds, closings in our Peru and Sub-Saharan Africa

regional buyout funds, as well as various co-investments.

- Fee-earning Assets Under

Management were $33.2 billion as of Q1 2013, down 12% from

$37.8 billion as of Q1 2012, with the decline driven by $5.5

billion in distributions and basis step-downs, and partially offset

by $1.4 billion in new commitments and inflows.

Corporate Private Equity (Actual Results) Period

LTM % Change $ in millions, except where noted

Q1

2012 Q2 2012 Q3 2012 Q4

2012 Q1 2013 Q2 12 - Q1 13 QoQ

YoY Economic Net Income 244 (65)

177 122 239 474 95% (2%) Fee-Related

Earnings 14 10 19 18 (0) 47

(101%) (101%) Net Performance Fees 215 (80)

159 100 235 414 136% 9% Realized Net

Performance Fees 105 50 126 54 111

340 105% 5% Distributable Earnings 120 61

145 74 112 392 53% (6%)

Total Assets Under Management ($ in billions) 53.3 52.5

53.2 53.3 55.1 3%

3% Fee-Earning Assets Under Management ($ in billions) 37.8

37.1 36.9 33.8 33.2 (2%)

(12%)

Note: Totals may not sum due to

rounding.

Global Market Strategies

Funds Raised Equity Invested

(Carry Fund Only)

Realized Proceeds

(Carry Fund Only)

Carry Fund Returns Q1 $1.3 bn

Q1 $0.1 bn

Q1 $0.4 bn

Q1 9% YTD: $1.3 bn LTM: $5.2 bn YTD: $0.1

bn LTM: $0.5 bn YTD: $0.4 bn LTM: $1.1 bn YTD: 9% LTM: 20%

Note: Funds Raised excludes acquisitions,

but includes hedge funds and CLOs. Equity Invested and Realized

Proceeds are for carry funds only.

- Distributable Earnings (DE): $41

million for Q1 2013 and $178 million on an LTM basis. The

following components impacted Distributable Earnings in Q1 2013:

- Fee Related Earnings were $25

million in Q1 2013 ($98 million on an LTM basis), compared to $16

million in Q1 2012. The increase was driven by a 17% increase in

Fee-earning AUM, net growth in hedge fund assets and pricing of

five new CLOs over the past four quarters.

- Realized Net Performance Fees

were $14 million for Q1 2013 ($66 million on an LTM basis),

compared to $15 million for Q1 2012. Realized Net Performance Fees

in Q1 2013 were largely driven by various carry generating exits in

distressed debt carry funds.

- Economic Net Income (ENI): $104

million for Q1 2013

- Economic Net Income of $104

million for Q1 2013 ($231 million on an LTM basis) compared to $38

million for Q1 2012.

- GMS carry fund valuations increased 9%

in Q1 2013, compared with 12% in Q1 2012.

- Net Performance Fees of $73

million for Q1 2013 ($108 million on an LTM basis), compared to $18

million for Q1 2012.

- Total Assets Under Management

(AUM): $33.1 billion as of Q1 2013

- Total AUM of $33.1 billion as of

Q1 2013 increased 17% versus Q1 2012, while Fee-earning AUM of

$31.4 billion also increased 17% versus Q1 2012.

- Total hedge fund AUM was $12.7 billion

as of Q1 2013.

- Carlyle priced two new CLOs during Q1

2013 totaling $1.2 billion in assets.

- GMS carry fund AUM ended Q1 2013 at

$3.6 billion.

- Total Structured Credit AUM ended Q1

2013 at $16.8 billion.

Global

Markets Strategies (Actual Results) Period LTM

% Change $ in millions, except where noted

Q1

2012 Q2 2012 Q3 2012 Q4

2012 Q1 2013 Q2 12 - Q1 13 QoQ

YoY Economic Net Income 38 32 36

59 104 231 76% 173% Fee-Related

Earnings 16 20 22 31 25 98 (21%)

58% Net Performance Fees 18 4 8 23

73 108 213% 312% Realized Net Performance Fees

15 1 1 50 14 66 (71%)

(1%) Distributable Earnings 31 23 28 86

41 178 (53%) 30% Total Assets Under Management

($ in billions) 28.3 29.0 30.1 32.5

33.1 2% 17% Fee-Earning Assets Under

Management ($ in billions) 26.8 27.7 28.5 31.0

31.4 1% 17%

Funds Raised, excluding hedge funds ($

in billions) 0.7 0.8 0.8 1.2 1.3

4.1 7% 83% Hedge Fund Net Inflows ($ in billions) 0.7

0.7 0.4 0.0 0.0 1.1 N.A.

(100%)

Note: Totals may not sum due to rounding.

Funds Raised excludes the impact of acquisitions.

Real Assets

(RA)

Funds Raised Equity Invested

(Carry Fund Only)

Realized Proceeds

(Carry Fund Only)

Carry Fund Returns Q1 $0.5 bn

Q1 $0.5 bn

Q1 $0.7 bn

Q1 3% YTD: $0.5 bn LTM: $0.7 bn YTD: $0.5

bn LTM: $2.9 bn YTD: $0.7 bn LTM: $5.0 bn YTD: 3% LTM: 1%

Note: Equity Invested and Realized

Proceeds are for carry funds only. Funds Raised excludes

acquisitions.

- Distributable Earnings (DE): $11

million for Q1 2013 and $92 million on an LTM basis. The

following components impacted Distributable Earnings in Q1 2013:

- Fee Related Earnings were $9

million in Q1 2013 ($13 million on an LTM basis), compared to ($1)

million in Q1 2012. The increase was largely driven by the

acquisition of an equity interest in NGP Energy Capital Management,

which closed on December 20, 2012.

- Realized Net Performance Fees

were $16 million for Q1 2013 ($93 million on an LTM basis),

compared to $22 million for Q1 2012.

- Realized Investment

Income/(Loss) of ($13) million was driven by the realization of

a ($15) million investment loss in a real estate investment that

was originally reserved in Q4 2012. This negatively impacted

Distributable Earnings per common unit by ($0.03).

- Economic Net Income (ENI): $42

million for Q1 2013

- Economic Net Income of $42

million for Q1 2013 ($8 million on an LTM basis) compared to $101

million for Q1 2012.

- RA carry fund valuations increased 3%

in Q1 2013, compared with 11% in Q1 2012.

- Net Performance Fees of $42

million for Q1 2013 ($12 million on an LTM basis), compared to $99

million for Q1 2012.

- Total Assets Under Management (AUM):

$40.3 billion as of Q1 2013

- Total AUM increased 25% versus

Q1 2012, driven largely by the acquisition of an equity interest in

NGP Energy Capital Management, partially offset by

distributions.

- Fee-earning AUM of $29.4 billion

was up 29% versus Q1 2012, with the increase driven largely by NGP

Energy Capital Management, partially offset by distributions and

step-downs in basis for funds at the end of their original

investment period.

Real

Assets (Actual Results) Period LTM %

Change $ in millions, except where noted

Q1 2012

Q2 2012 Q3 2012 Q4 2012

Q1 2013 Q2 12 - Q1 13 QoQ YoY

Economic Net Income 101 (29) 2 (7)

42 8 706% (59%) Fee-Related Earnings (1)

3 1 0 9 13 2733% 1163%

Net Performance Fees 99 (33) (4) 6 42

12 574% (58%) Realized Net Performance Fees 22

26 29 22 16 93 (28%) (29%)

Distributable Earnings 22 28 31 22 11

92 (49%) (47%) Total Assets Under Management

($ in billions) 32.2 30.0 29.5 40.2

40.3 0% 25% Fee-Earning Assets Under

Management ($ in billions) 22.8 19.5 19.6 29.3

29.4 0% 29%

Note: Totals may not sum due to

rounding.

Solutions

- Distributable Earnings (DE): $4

million for Q1 2013 and $16 million on an LTM basis

- Fee Related Earnings were $3

million for Q1 2013 ($14 million on an LTM basis).

- Realized Net Performance Fees

were $1 million for Q1 2013 and $2 million on an LTM basis.

- Economic Net Income (ENI): $9

million for Q1 2013 and $24 million on an LTM basis, in line with

$9 million in Q1 2012.

- Total Assets Under Management

(AUM): $47.8 billion as of Q1 2013

- Total AUM was up 5% compared to

Q1 2012.

- Fee-earning AUM of $28.9 billion

decreased 2% versus Q1 2012, with the decline driven primarily due

to changes in foreign exchange.

- AlpInvest raised $150 million in new

commitments for a new secondaries fund in Q1 2013.

- On February 24, 2013, Carlyle announced

that Jacques Chappuis will join the firm in May 2013 and become the

Head of the Solutions business segment.

Solutions (Actual Results) Period

LTM % Change $ in millions, except

where noted

Q1 2012 Q2 2012 Q3

2012 Q4 2012 Q1 2013 Q2 12 - Q1

13 QoQ YoY

Economic Net Income 9 4 4

8 9 24 17% (2%)

Fee-Related Earnings 5 3 3

5 3 14 (30%) (39%)

Net Performance Fees 4 1 1

3 6 11 97% 54%

Realized Net Performance Fees 0 0 0

1 1 2 (50%)

25% Distributable Earnings 6 3 3

6 4 16 (33%) (34%)

Total Assets Under Management ($ in billions) 45.4

44.6 44.6 44.1 47.8

8% 5% Fee-Earning Assets

Under Management ($ in billions) 29.5 27.6

30.2 28.9 28.9

(0%) (2%) Note: Totals may not sum due

to rounding.

Balance Sheet Highlights

The amounts presented below exclude the effect of U.S. GAAP

consolidation eliminations on investments and accrued performance

fees, as well as cash and debt associated with Carlyle’s

consolidated funds. All data is as of March 31, 2013.

- Cash and Cash Equivalents of $570

million.

- On-balance sheet investments

attributable to unitholders of $291 million, excluding the equity

investment by Carlyle in NGP Energy Capital Management.

- Net Accrued Performance Fees

attributable to unitholders of $1,437 million. These performance

fees are comprised of Gross Accrued Performance Fees of $2,622

million less $56 million in accrued giveback obligation and $1,129

million in accrued performance fee compensation and non-controlling

interest.

- Loans payable and senior notes totaling

$923 million. During Q1 2013, indirect subsidiaries of The Carlyle

Group L.P. issued $900 million in aggregate principal amount of

10-year and 30-year senior notes. Carlyle used the net proceeds to

repay the outstanding borrowings of $386 million under the

revolving credit facility of its senior credit facility and $475

million of its term loan ($25 million remains outstanding under the

term loan as of March 31, 2013). The senior notes were issued at a

discount of approximately $2 million, which will be recognized and

increase the liability over the term of the notes.

Conference Call

Carlyle will host a conference call on May 9, 2013 at 8:00 a.m.

EDT to discuss Q1 2013 results and industry trends. Immediately

following the prepared remarks, there will be a question and answer

session for analysts and institutional investors.

Analysts and institutional investors may listen to the call by

dialing +1-800-850-2903 (international +1-253-237-1169) and

referencing “The Carlyle Group First Quarter Conference Call.” The

conference call will be webcast simultaneously to the public

through a link on the investor relations section of The Carlyle

Group web site at ir.carlyle.com. An archived replay of the webcast

also will be available on the website shortly after the live

event.

About The Carlyle Group

The Carlyle Group (NASDAQ: CG) is a global alternative asset

manager with $176 billion of assets under management across 114

funds and 76 fund of funds vehicles as of March 31, 2013. Carlyle's

purpose is to invest wisely and create value on behalf of its

investors, many of whom are public pensions. Carlyle invests across

four segments – Corporate Private Equity, Real Assets, Global

Market Strategies and Solutions – in Africa, Asia, Australia,

Europe, the Middle East, North America and South America. Carlyle

has expertise in various industries, including: aerospace, defense

& government services, consumer & retail, energy, financial

services, healthcare, industrial, technology & business

services, telecommunications & media and transportation. The

Carlyle Group employs more than 1,400 people in 34 offices across

six continents.

Web: www.carlyle.com

Videos: www.youtube.com/onecarlyle

Tweets: www.twitter.com/onecarlyle

Podcasts: www.carlyle.com/about-carlyle/market-commentary

Forward Looking Statements

This press release may contain forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934. These

statements include, but are not limited to, statements related to

our expectations regarding the performance of our business, our

financial results, our liquidity and capital resources and other

non-historical statements. You can identify these forward-looking

statements by the use of words such as “outlook,” “believes,”

“expects,” “potential,” “continues,” “may,” “will,” “should,”

“seeks,” “approximately,” “predicts,” “intends,” “plans,”

“estimates,” “anticipates” or the negative version of these words

or other comparable words. These statements are subject to risks,

uncertainties and assumptions, including those described under the

section entitled “Risk Factors” in our Annual Report on Form 10-K

for the year ended December 31, 2012 filed with the SEC on March

14, 2013, as such factors may be updated from time to time in our

periodic filings with the SEC, which are accessible on the SEC’s

website at www.sec.gov. These factors should not be construed as

exhaustive and should be read in conjunction with the other

cautionary statements that are included in this release and in our

filings with the SEC. We undertake no obligation to publicly update

or review any forward-looking statements, whether as a result of

new information, future developments or otherwise, except as

required by applicable law.

This release does not constitute an offer for any Carlyle

fund.

The Carlyle Group L.P.

GAAP Statement of Operations

(Unaudited)

Three Months Ended Mar 31, Mar 31,

2013 2012 (Dollars in millions, except unit and

per unit data) Revenues Fund management fees $ 231.4 $

234.4 Performance fees Realized 252.8 280.6 Unrealized 389.6

360.2 Total performance fees 642.4 640.8

Investment income (loss) Realized (4.2 ) (0.8 ) Unrealized

4.6 22.3 Total investment income (loss) 0.4

21.5 Interest and other income 2.4 2.7 Interest and other income of

Consolidated Funds 268.4 211.5 Total

revenues 1,145.0 1,110.9

Expenses Compensation and

benefits Base compensation 178.5 106.1 Equity-based compensation

52.3 - Performance fee related Realized 108.7 34.3 Unrealized

195.0 54.8 Total compensation and

benefits 534.5 195.2 General, administrative and other expenses

111.4 91.2 Interest 10.5 10.4 Interest and other expenses of

Consolidated Funds 250.1 184.5 Other non-operating income

(2.4 ) (4.1 ) Total expenses 904.1 477.2

Other

income Net investment gains of Consolidated Funds 211.5

872.1 Income before provision for

income taxes 452.4 1,505.8 Provision for income taxes 24.9

11.7 Net income 427.5 1,494.1 Net income

attributable to non-controlling

interests in consolidated entities

168.0 864.9 Net income attributable to

Carlyle Holdings 259.5 $ 629.2 Net income attributable to

non-controlling interests in

Carlyle Holdings

225.7 Net income attributable to The Carlyle Group

L.P. $ 33.8 Net income attributable to The

Carlyle Group L.P. per common unit Basic $ 0.78 Diluted $

0.66 Weighted-average common units Basic

43,343,268 Diluted 51,109,008

Total Segment Information

(Unaudited)

The following table sets forth information in the format used by

management when making resource deployment decisions and in

assessing the performance of our segments. The information below is

the aggregate results of our four segments.

Three Months Ended Twelve Months

Ended Mar 31, Mar 31,

Dec 31, Mar 31, Mar 31,

2013 2012 2012 2013 2012

(Dollars in millions) Segment Revenues Fund level fee

revenues Fund management fees $ 240.1 $ 225.4 $ 248.9 $ 957.9 $

895.3 Portfolio advisory fees, net 4.6 8.0 2.4 18.6 33.2

Transaction fees, net 10.4 2.7 13.9

35.2 22.1 Total fee revenues 255.1

236.1 265.2 1,011.7 950.6 Performance fees Realized 248.9 281.8

200.6 836.2 1,181.4 Unrealized 342.7 349.7

39.3 119.9 (304.6 ) Total performance

fees 591.6 631.5 239.9 956.1 876.8 Investment income (loss)

Realized (9.3 ) 2.1 5.6 4.9 37.9 Unrealized 12.3

21.2 (9.8 ) 16.3 13.8 Total

investment income (loss) 3.0 23.3 (4.2 ) 21.2 51.7 Interest and

other income 2.4 2.6 4.2

13.5 12.2 Total revenues 852.1 893.5 505.1 2,002.5

1,891.3 Segment Expenses Compensation and benefits Direct

base compensation 108.0 101.2 112.5 424.2 406.8 Indirect base

compensation 33.6 33.1 42.3 145.0 136.5 Equity-based compensation

2.6 - 0.6 4.4 - Performance fee related Realized 107.4 139.1 73.2

335.3 575.1 Unrealized 129.5 157.6 34.8

76.3 (223.3 ) Total compensation and benefits

381.1 431.0 263.4 985.2 895.1 General, administrative, and other

indirect

expenses

62.3 55.4 49.5 234.1 230.9 Depreciation and amortization expense

6.3 5.2 6.1 22.6 21.0 Interest expense 8.5 9.8

3.9 23.2 52.5 Total expenses

458.2 501.4 322.9 1,265.1

1,199.5

Economic Net Income $

393.9 $ 392.1 $ 182.2

$ 737.4 $ 691.8 (-) Net

Performance Fees 354.7 334.8 131.9 544.5 525.0 (-) Investment

Income (Loss) 3.0 23.3 (4.2 )

21.2 51.7

(=) Fee Related Earnings $

36.2 $ 34.0 $ 54.5

$ 171.7 $ 115.1 (+) Realized Net

Performance Fees 141.5 142.7 127.4 500.9 606.3 (+) Realized

Investment Income (Loss) (9.3 ) 2.1 5.6

4.9 37.9

(=) Distributable Earnings

$ 168.4 $ 178.8 $

187.5 $ 677.5 $ 759.3

Total Segment Information (Unaudited),

cont

Three Months Ended

Mar 31, 2013 vs.

Mar 31,2012

Jun 30,2012

Sept 30,2012

Dec 31,2012

Mar 31,2013

Mar 31,2012

Dec 31,2012

Economic Net Income,

(Dollars in millions)

Total Segments Revenues Segment fee revenues Fund management

fees $ 225.4 $ 235.0 $ 233.9 $ 248.9 $ 240.1 $ 14.7 $ (8.8 )

Portfolio advisory fees, net 8.0 7.0 4.6 2.4 4.6 (3.4 ) 2.2

Transaction fees, net 2.7 3.7 7.2

13.9 10.4 7.7 (3.5

) Total fee revenues 236.1 245.7 245.7 265.2 255.1 19.0 (10.1 )

Performance fees Realized 281.8 110.3 276.4 200.6 248.9 (32.9 )

48.3 Unrealized 349.7 (311.1 ) 49.0

39.3 342.7 (7.0 ) 303.4

Total performance fees 631.5 (200.8 ) 325.4 239.9 591.6 (39.9 )

351.7 Investment income Realized 2.1 4.0 4.6 5.6 (9.3 ) (11.4 )

(14.9 ) Unrealized 21.2 10.0 3.8

(9.8 ) 12.3 (8.9 ) 22.1 Total

investment income 23.3 14.0 8.4 (4.2 ) 3.0 (20.3 ) 7.2 Interest and

other income 2.6 2.5 4.4 4.2

2.4 (0.2 ) (1.8 ) Total revenues

893.5 61.4 583.9 505.1 852.1 (41.4 ) 347.0 Expenses

Compensation and benefits Direct base compensation 101.2 105.8 97.9

112.5 108.0 6.8 (4.5 ) Indirect base compensation 33.1 36.2 32.9

42.3 33.6 0.5 (8.7 ) Equity-based compensation - 0.6 0.6 0.6 2.6

2.6 2.0 Performance fee related Realized 139.1 34.5 120.2 73.2

107.4 (31.7 ) 34.2 Unrealized 157.6 (128.6 )

40.6 34.8 129.5 (28.1 )

94.7 Total compensation and benefits 431.0 48.5 292.2 263.4

381.1 (49.9 ) 117.7 General, administrative, and other

indirect expenses

55.4 60.0 62.3 49.5 62.3 6.9 12.8 Depreciation and amortization

expense 5.2 4.0 6.2 6.1 6.3 1.1 0.2 Interest expense 9.8

6.1 4.7 3.9 8.5

(1.3 ) 4.6 Total expenses 501.4

118.6 365.4 322.9 458.2

(43.2 ) 135.3

Economic Net Income

(Loss) $ 392.1 $ (57.2 )

$ 218.5 $ 182.2 $

393.9 $ 1.8 $

211.7 (-) Net Performance Fees 334.8 (106.7 ) 164.6

131.9 354.7 19.9 222.8 (-) Investment Income (Loss) 23.3

14.0 8.4 (4.2 ) 3.0

(20.3 ) 7.2

(=) Fee Related Earnings

$ 34.0 $ 35.5 $

45.5 $ 54.5 $ 36.2

$ 2.2 $ (18.3 ) (+)

Realized Net Performance Fees 142.7 75.8 156.2 127.4 141.5 (1.2 )

14.1 (+) Realized Investment Income (Loss) 2.1 4.0

4.6 5.6 (9.3 ) (11.4 )

(14.9 )

(=) Distributable Earnings $

178.8 $ 115.3 $ 206.3

$ 187.5 $ 168.4 $

(10.4 ) $ (19.1 )

Corporate Private Equity Segment Results

(Unaudited)

Three Months Ended

Mar 31, 2013 vs.

Mar 31,2012

Jun 30,2012

Sept 30,2012

Dec 31,2012

Mar 31,2013

Mar 31,2012

Dec 31,2012

Corporate Private Equity

(Dollars in millions)

Revenues Segment fee revenues Fund management fees $ 123.9 $

124.0 $ 124.8 $ 123.5 $ 108.3 $ (15.6 ) $ (15.2 ) Portfolio

advisory fees, net 7.0 4.9 3.1 2.8 4.1 (2.9 ) 1.3 Transaction fees,

net 1.6 1.6 6.2 9.6

10.4 8.8 0.8 Total fee

revenues 132.5 130.5 134.1 135.9 122.8 (9.7 ) (13.1 ) Performance

fees Realized 223.0 80.6 241.4 94.5 212.3 (10.7 ) 117.8 Unrealized

241.3 (269.7 ) 72.8 86.4

207.6 (33.7 ) 121.2 Total performance

fees 464.3 (189.1 ) 314.2 180.9 419.9 (44.4 ) 239.0 Investment

income (loss) Realized 0.8 1.5 (0.2 ) 1.2 1.8 1.0 0.6 Unrealized

14.5 3.7 (1.0 ) 3.3 2.8

(11.7 ) (0.5 ) Total investment income (loss)

15.3 5.2 (1.2 ) 4.5 4.6 (10.7 ) 0.1 Interest and other income

1.4 1.6 3.4 2.6

1.0 (0.4 ) (1.6 ) Total revenues 613.5 (51.8 )

450.5 323.9 548.3 (65.2 ) 224.4 Expenses Compensation and

benefits Direct base compensation 55.3 54.8 56.2 59.9 55.0 (0.3 )

(4.9 ) Indirect base compensation 20.8 24.1 19.9 27.7 20.0 (0.8 )

(7.7 ) Equity-based compensation - 0.4 0.4 0.4 1.5 1.5 1.1

Performance fee related Realized 117.6 31.0 115.6 40.5 101.6 (16.0

) 61.1 Unrealized 132.0 (140.3 ) 39.2

40.8 83.6 (48.4 ) 42.8

Total compensation and benefits 325.7 (30.0 ) 231.3 169.3 261.7

(64.0 ) 92.4 General, administrative, and other

indirect expenses

34.8 36.9 36.0 26.3 39.0 4.2 12.7 Depreciation and amortization

expense 3.2 2.3 3.5 3.5 3.5 0.3 - Interest expense 5.9

3.5 2.5 2.4 4.9

(1.0 ) 2.5 Total expenses 369.6

12.7 273.3 201.5 309.1

(60.5 ) 107.6

Economic Net Income

(Loss) $ 243.9 $ (64.5 )

$ 177.2 $ 122.4 $

239.2 $ (4.7 ) $

116.8 (-) Net Performance Fees 214.7 (79.8 ) 159.4

99.6 234.7 20.0 135.1 (-) Investment Income (Loss) 15.3

5.2 (1.2 ) 4.5 4.6

(10.7 ) 0.1

(=) Fee Related Earnings $

13.9 $ 10.1 $ 19.0

$ 18.3 $ (0.1 ) $

(14.0 ) $ (18.4 ) (+) Realized

Net Performance Fees 105.4 49.6 125.8 54.0 110.7 5.3 56.7 (+)

Realized Investment Income (Loss) 0.8 1.5

(0.2 ) 1.2 1.8 1.0

0.6

(=) Distributable Earnings $ 120.1

$ 61.2 $ 144.6 $

73.5 $ 112.4 $ (7.7

) $ 38.9

Global Market Strategies Segment Results

(Unaudited)

Three Months Ended

Mar 31, 2013 vs.

Mar 31,2012

Jun 30,2012

Sept 30,2012

Dec 31,2012

Mar 31,2013

Mar 31,2012

Dec 31,2012

Global Market Strategies

(Dollars in millions)

Revenues Segment fee revenues Fund management fees $ 48.6 $

59.5 $ 58.2 $ 70.9 $ 66.3 $ 17.7 $ (4.6 ) Portfolio advisory fees,

net 0.7 0.5 0.8 0.5 0.2 (0.5 ) (0.3 ) Transaction fees, net

- - 0.3 3.2 - -

(3.2 ) Total fee revenues 49.3 60.0 59.3 74.6 66.5

17.2 (8.1 ) Performance fees Realized 32.4 1.3 0.9 77.8 24.1 (8.3 )

(53.7 ) Unrealized 12.7 4.0 5.7

(43.6 ) 64.3 51.6 107.9 Total

performance fees 45.1 5.3 6.6 34.2 88.4 43.3 54.2 Investment income

Realized 1.3 2.8 4.6 4.4 1.9 0.6 (2.5 ) Unrealized 3.7

4.8 0.8 0.3 5.1

1.4 4.8 Total investment income 5.0 7.6 5.4

4.7 7.0 2.0 2.3 Interest and other income 0.6 0.4

0.5 0.8 1.1 0.5

0.3 Total revenues 100.0 73.3 71.8 114.3 163.0 63.0

48.7 Expenses Compensation and benefits Direct base

compensation 19.7 25.2 17.4 24.0 25.7 6.0 1.7 Indirect base

compensation 4.9 4.5 5.9 6.0 4.8 (0.1 ) (1.2 ) Equity-based

compensation - 0.1 - 0.1 0.4 0.4 0.3 Performance fee related

Realized 17.8 0.7 0.2 27.5 9.7 (8.1 ) (17.8 ) Unrealized 9.7

0.2 (1.8 ) (16.5 ) 6.2 (3.5 )

22.7 Total compensation and benefits 52.1 30.7 21.7

41.1 46.8 (5.3 ) 5.7 General, administrative, and other

indirect expenses

7.3 9.1 11.7 12.5 9.5 2.2 (3.0 ) Depreciation and amortization

expense 0.8 0.6 1.1 1.0 1.2 0.4 0.2 Interest expense 1.7

0.9 1.3 0.6 1.5

(0.2 ) 0.9 Total expenses 61.9 41.3

35.8 55.2 59.0 (2.9 )

3.8

Economic Net Income $

38.1 $ 32.0 $ 36.0

$ 59.1 $ 104.0 $

65.9 $ 44.9 (-) Net Performance

Fees 17.6 4.4 8.2 23.2 72.5 54.9 49.3 (-) Investment Income

5.0 7.6 5.4 4.7 7.0

2.0 2.3

(=) Fee Related Earnings

$ 15.5 $ 20.0 $ 22.4

$ 31.2 $ 24.5 $

9.0 $ (6.7 ) (+) Realized Net

Performance Fees 14.6 0.6 0.7 50.3 14.4 (0.2 ) (35.9 ) (+) Realized

Investment Income 1.3 2.8 4.6

4.4 1.9 0.6 (2.5 )

(=)

Distributable Earnings $ 31.4 $

23.4 $ 27.7 $ 85.9

$ 40.8 $ 9.4 $

(45.1 )

Real Assets Segment Results

(Unaudited)

Three Months Ended

Mar 31, 2013 vs.

Mar 31,2012

Jun 30,2012

Sept 30,2012

Dec 31,2012

Mar 31,2013

Mar 31,2012

Dec 31,2012

Real Assets

(Dollars in millions)

Revenues Segment fee revenues Fund management fees $ 36.6 $

34.1 $ 34.4 $ 35.9 $ 47.0 $ 10.4 $ 11.1 Portfolio advisory fees,

net 0.3 1.6 0.7 (0.9 ) 0.3 - 1.2 Transaction fees, net 1.1

2.1 0.7 1.1

- (1.1 ) (1.1 ) Total fee revenues 38.0 37.8

35.8 36.1 47.3 9.3 11.2 Performance fees Realized 23.2 27.0 31.9

24.5 11.0 (12.2 ) (13.5 ) Unrealized 82.4

(56.0 ) (27.7 ) (11.9 ) 49.5

(32.9 ) 61.4 Total performance fees 105.6 (29.0 ) 4.2

12.6 60.5 (45.1 ) 47.9 Investment income (loss) Realized - (0.3 )

0.2 - (13.0 ) (13.0 ) (13.0 ) Unrealized 3.0

1.5 4.0 (13.4 ) 4.5

1.5 17.9 Total investment income (loss)

3.0 1.2 4.2 (13.4 ) (8.5 ) (11.5 ) 4.9 Interest and other income

0.4 0.4 0.4 0.5

0.3 (0.1 ) (0.2 ) Total revenues

147.0 10.4 44.6 35.8 99.6 (47.4 ) 63.8 Expenses Compensation

and benefits Direct base compensation 18.2 16.9 16.1 19.9 17.9 (0.3

) (2.0 ) Indirect base compensation 6.4 5.6 5.7 6.8 7.5 1.1 0.7

Equity-based compensation - 0.1 0.2 0.1 0.6 0.6 0.5 Performance fee

related Realized 0.9 1.5 2.5 2.4 (4.9 ) (5.8 ) (7.3 ) Unrealized

5.9 2.1 5.3 4.0

23.6 17.7 19.6

Total compensation and benefits 31.4 26.2 29.8 33.2 44.7 13.3 11.5

General, administrative, and other

indirect expenses

11.7 11.1 11.4 7.7 10.4 (1.3 ) 2.7 Depreciation and amortization

expense 1.0 0.7 1.1 1.1 1.1 0.1 - Interest expense 1.9

1.1 0.7 0.7

1.6 (0.3 ) 0.9 Total expenses

46.0 39.1 43.0 42.7

57.8 11.8 15.1

Economic Net Income (Loss) $ 101.0

$ (28.7 ) $ 1.6

$ (6.9 ) $ 41.8 $

(59.2 ) $ 48.7 (-) Net

Performance Fees 98.8 (32.6 ) (3.6 ) 6.2 41.8 (57.0 ) 35.6 (-)

Investment Income (Loss) 3.0 1.2

4.2 (13.4 ) (8.5 ) (11.5 ) 4.9

(=) Fee Related Earnings $ (0.8

) $ 2.7 $ 1.0

$ 0.3 $ 8.5 $

9.3 $ 8.2 (+) Realized Net

Performance Fees 22.3 25.5 29.4 22.1 15.9 (6.4 ) (6.2 ) (+)

Realized Investment Income (Loss) - (0.3 )

0.2 - (13.0 ) (13.0 )

(13.0 )

(=) Distributable Earnings $

21.5 $ 27.9 $ 30.6

$ 22.4 $ 11.4

$ (10.1 ) $ (11.0 )

Solutions Segment Results

(Unaudited)

Three Months Ended

Mar 31, 2013 vs.

Mar 31,2012

Jun 30,2012

Sept 30,2012

Dec 31,2012

Mar 31,2013

Mar 31,2012

Dec 31,2012

Solutions

(Dollars in millions)

Revenues Segment fee revenues Fund management fees $ 16.3 $

17.4 $ 16.5 $ 18.6 $ 18.5 $ 2.2 $ (0.1 ) Portfolio advisory fees,

net - - - - - - - Transaction fees, net - - -

- - - -

Total fee revenues 16.3 17.4 16.5 18.6 18.5 2.2 (0.1 ) Performance

fees Realized 3.2 1.4 2.2 3.8 1.5 (1.7 ) (2.3 ) Unrealized

13.3 10.6 (1.8 ) 8.4 21.3

8.0 12.9 Total performance fees 16.5 12.0 0.4

12.2 22.8 6.3 10.6 Investment income Realized - - - - - - -

Unrealized - - - - (0.1 )

(0.1 ) (0.1 ) Total investment income - - - - (0.1 )

(0.1 ) (0.1 ) Interest and other income 0.2 0.1

0.1 0.3 - (0.2 )

(0.3 ) Total revenues 33.0 29.5 17.0 31.1 41.2 8.2 10.1

Expenses Compensation and benefits Direct base compensation 8.0 8.9

8.2 8.7 9.4 1.4 0.7 Indirect base compensation 1.0 2.0 1.4 1.8 1.3

0.3 (0.5 ) Equity-based compensation - - - - 0.1 0.1 0.1

Performance fee related Realized 2.8 1.3 1.9 2.8 1.0 (1.8 ) (1.8 )

Unrealized 10.0 9.4 (2.1 ) 6.5

16.1 6.1 9.6 Total compensation

and benefits 21.8 21.6 9.4 19.8 27.9 6.1 8.1 General,

administrative, and other

indirect expenses

1.6 2.9 3.2 3.0 3.4 1.8 0.4 Depreciation and amortization expense

0.2 0.4 0.5 0.5 0.5 0.3 - Interest expense 0.3 0.6

0.2 0.2 0.5 0.2

0.3 Total expenses 23.9 25.5

13.3 23.5 32.3 8.4

8.8

Economic Net Income $ 9.1

$ 4.0 $ 3.7 $ 7.6

$ 8.9 $ (0.2 ) $

1.3 (-) Net Performance Fees 3.7 1.3 0.6 2.9 5.7 2.0

2.8 (-) Investment Income (Loss) - - -

- (0.1 ) (0.1 ) (0.1 )

(=) Fee

Related Earnings $ 5.4 $ 2.7

$ 3.1 $ 4.7 $ 3.3

$ (2.1 ) $ (1.4 )

(+) Realized Net Performance Fees 0.4 0.1 0.3 1.0 0.5 0.1 (0.5 )

(+) Realized Investment Income - - -

- - - -

(=)

Distributable Earnings $ 5.8 $ 2.8

$ 3.4 $ 5.7 $ 3.8

$ (2.0 ) $ (1.9 )

Total Assets Under Management Roll Forward

(Unaudited)

Corporate Private Equity Global Market Strategies

(8) Real Assets (9) Solutions

(10) Total (USD in millions)

AvailableCapital

Fair Valueof Capital

Total AUM

AvailableCapital

Fair Valueof Capital

Total AUM

AvailableCapital

Fair Valueof Capital

Total AUM

AvailableCapital

Fair Valueof Capital

Total AUM

AvailableCapital

Fair Valueof Capital

Total AUM Balance, As of December 31, 2012 $

17,642 $ 35,696

$ 53,338 $ 1,820

$ 30,722

$ 32,542 $ 9,944 $ 30,250

$ 40,194 $ 14,528 $ 29,554

$ 44,082 $ 43,934 $

126,222 $ 170,156 Commitments (1) 1,430

-

1,430 (12 ) -

(12 ) 419 -

419 4,205 -

4,205 6,042 - 6,042 Capital Called, net

(2) (1,940 ) 1,832

(108 ) (86 ) 75

(11

) (929 ) 874

(55 ) (677 ) 738

61

(3,632 ) 3,519 (113 )

Distributions (3) 18 (2,175 )

(2,157 ) 40 (308 )

(268 ) 103 (1,049 )

(946 ) 89 (1,566 )

(1,477 ) 250 (5,098 )

(4,848 ) Subscriptions, net of Redemptions (4) - -

- - 2

2 - -

- - -

- - 2

2 Changes in CLO collateral balances (5) - -

- - 331

331 - -

- - -

- - 331 331

Market Appreciation/(Depreciation) (6) - 3,073

3,073 - 678

678 - 841

841 - 1,607

1,607 -

6,199 6,199 Foreign exchange (7) (88 )

(369 )

(457 ) -

(174 )

(174 ) (16

) (97 )

(113 )

(292 ) (420 )

(712 )

(396 ) (1,060 )

(1,456 ) Balance, As of March 31,

2013 $ 17,062 $

38,057 $ 55,119 $

1,762 $ 31,326

$ 33,088 $ 9,521

$ 30,819 $ 40,340

$ 17,853 $ 29,913

$ 47,766 $ 46,198

$ 130,115 $

176,313 Corporate Private Equity

Global Market Strategies (8) Real Assets (9)

Solutions (10) Total (USD

in millions)

Available Capital Fair Value of

Capital Total AUM Available Capital

Fair Value of Capital Total AUM Available

Capital Fair Value of Capital Total

AUM Available Capital Fair Value of

Capital Total AUM Available Capital

Fair Value of Capital Total AUM Balance, As

of March 31, 2012 $ 13,362 $ 39,902

$ 53,264 $

1,116 $ 27,176

$ 28,292 $ 7,770 $ 24,472

$

32,242 $ 17,636 $ 27,788

$ 45,424 $

39,884 $ 119,338 $ 159,222

Acquisitions - -

- - 2,275

2,275 4,000 8,106

12,106 - -

- 4,000 10,381 14,381

Commitments (1) 8,676 -

8,676 1,078 -

1,078 323 -

323 4,473 -

4,473 14,550 -

14,550 Capital Called, net (2) (5,769 ) 5,281

(488

) (635 ) 553

(82 ) (3,550 ) 3,374

(176

) (4,279 ) 4,084

(195 ) (14,233

) 13,292 (941 ) Distributions (3) 934

(12,664 )

(11,730 ) 203 (949 )

(746 )

1,019 (5,288 )

(4,269 ) 460 (6,861 )

(6,401

) 2,616 (25,762 ) (23,146

) Subscriptions, net of Redemptions (4) - -

- - 1,055

1,055 - -

- - -

- - 1,055

1,055 Changes in CLO collateral balances (5) - -

- -

568

568 - -

- - -

- - 568

568 Market Appreciation/(Depreciation) (6) - 6,084

6,084 - 899

899 - 263

263 - 5,347

5,347

- 12,593 12,593 Foreign exchange (7)

(141 ) (546 )

(687 )

- (251 )

(251

) (41 ) (108 )

(149 ) (437 ) (445 )

(882 ) (619 )

(1,350 ) (1,969 )

Balance, As of March 31, 2013 $ 17,062

$ 38,057 $ 55,119

$ 1,762 $ 31,326

$ 33,088 $ 9,521

$ 30,819 $

40,340 $ 17,853 $

29,913 $ 47,766 $

46,198 $ 130,115

$ 176,313 (1) Represents capital raised

by our carry funds and fund of funds vehicles, net of expired

available capital. (2) Represents capital called by our carry funds

and fund of funds vehicles, net of fund fees and expenses. Equity

Invested amounts may vary from Capital Called due to timing

differences between acquisition and capital call dates. (3)

Represents distributions from our carry funds and fund of funds

vehicles, net of amounts recycled. Distributions are based on when

proceeds are actually distributed to investors, which may differ

from when they are realized. (4) Represents the net result of

subscriptions to and redemptions from our hedge funds and open-end

structured credit funds. (5) Represents the change in the aggregate

collateral balance and principal cash at par of the CLOs. (6)

Market Appreciation/(Depreciation) represents realized and

unrealized gains (losses) on portfolio investments and changes in

the net asset value of our hedge funds. (7) Represents the impact

of foreign exchange rate fluctuations on the translation of our

non-U.S. dollar denominated funds. Activity during the period is

translated at the average rate for the period. Ending balances are

translated at the spot rate as of the period end. (8) Ending

balance is comprised of approximately $16.8 billion from our

structured credit funds (including $0.1 billion of Available

Capital), $12.7 billion in our hedge funds, and $3.6 billion

(including $1.7 billion of Available Capital) in our carry funds.

(9) Amounts related to the NGP Funds are based on the latest

available information (in most cases as of December 31, 2012). (10)

The fair market values for AlpInvest primary fund investments and

secondary investment funds are based on the latest available

valuations of the underlying limited partnership interests (in most

cases as of December 31, 2012) as provided by their general

partners, plus the net cash flows since the latest valuation, up to

March 31, 2013.

Fee-earning AUM Roll Forward

(Unaudited)

For the Three Months Ended March 31, 2013 (USD in

millions)

Corporate Private Equity Global

Market Strategies Real

Assets (7)

Solutions Total

Fee-earning AUM Balance, As of December 31, 2012 $ 33,840 $

31,034 $ 29,305 $ 28,942 $ 123,121 Inflows, including Commitments

(1) 453 54 243 1,244 1,994 Outflows, including Distributions (2)

(797 ) (212 ) (51 ) (739 ) (1,799 ) Subscriptions, net of

Redemptions (3) - (56 ) - - (56 ) Changes in CLO collateral

balances (4) - 296 - - 296 Market Appreciation/(Depreciation) (5) -

489 - 256 745 Foreign exchange and other (6) (301 )

(169 ) (78 )

(849 ) (1,397 )

Balance, As of March

31, 2013 $ 33,195 $

31,436 $ 29,419

$ 28,854 $

122,904 For the Twelve Months Ended

March 31, 2013 (USD in millions)

Corporate Private

Equity Global Market Strategies

Real

Assets (7)

Solutions Total

Fee-earning AUM Balance, As of March 31, 2012 $ 37,833 $

26,803 $ 22,848 $ 29,514 $ 116,998 Acquisitions - 2,260 10,308 -

12,568 Inflows, including Commitments (1) 1,405 1,144 1,412 6,205

10,166 Outflows, including Distributions (2) (5,536 ) (392 ) (5,050

) (6,698 ) (17,676 ) Subscriptions, net of Redemptions (3) - 1,013

- - 1,013 Changes in CLO collateral balances (4) - 373 - - 373

Market Appreciation/(Depreciation) (5) - 479 - 863 1,342 Foreign

exchange and other (6) (507 ) (244 )

(99 ) (1,030 )

(1,880 )

Balance, As of March 31, 2013

$ 33,195 $ 31,436

$ 29,419

$ 28,854 $ 122,904

(1) Inflows represent limited partner capital raised

by our carry funds and fund of funds vehicles and capital invested

by our carry funds and fund of funds vehicles outside the

investment period. (2) Outflows represent limited partner

distributions from our carry funds and fund of funds vehicles and

changes in basis for our carry funds and fund of funds vehicles

where the investment period has expired. (3) Represents the net

result of subscriptions to and redemptions from our hedge funds and

open-end structured credit funds. (4) Represents the change in the

aggregate fee-earning collateral balances at par of our CLOs, as of

the quarterly cut-off dates. (5) Market Appreciation/(Depreciation)

represents changes in the net asset value of our hedge funds and

our fund of fund vehicles based on the lower of cost or fair value.

(6) Represents the impact of foreign exchange rate fluctuations on

the translation of our non-U.S. dollar denominated funds. Activity

during the period is translated at the average rate for the period.

Ending balances are translated at the spot rate as of the period

end. (7) Energy I, Energy II, Energy III, Energy IV, Renew I, and

Renew II (collectively, the “Legacy Energy Funds”), are managed

with Riverstone Holdings LLC and its affiliates. Affiliates of both

Carlyle and Riverstone act as investment advisers to each of the

Legacy Energy Funds. With the exception of Energy IV and Renew II,

where Carlyle has a minority representation on the funds’

management committees, management of each of the Legacy Energy

Funds is vested in committees with equal representation by Carlyle

and Riverstone, and the consent of representatives of both Carlyle

and Riverstone are required for investment decisions. As of March

31, 2013, the Legacy Energy Funds had, in the aggregate,

approximately $14.4 billion in AUM and $9.2 billion in Fee-earning

AUM. NGP VII, NGP VIII, NGP IX, NGP X, or in the case of NGP

M&R, NGP ETP I, NGP ETP II, and NGPC, certain affiliated

entities (collectively, the “NGP management fee funds”), are

managed by NGP Energy Capital Management. As of March 31, 2013, the

NGP management fee funds had, in the aggregate, approximately $12.1

billion in AUM and $10.3 billion in Fee-earning AUM.

Corporate Private Equity and Real Assets

Fund Performance (Unaudited)

The fund return information reflected in this discussion and

analysis is not indicative of the performance of The Carlyle Group

L.P. and is also not necessarily indicative of the future

performance of any particular fund. An investment in The Carlyle

Group L.P. is not an investment in any of our funds. There can be

no assurance that any of our existing or future funds will achieve

similar returns.

TOTAL INVESTMENTS

REALIZED/PARTIALLY REALIZED INVESTMENTS (5) as of March

31, 2013 as of March 31, 2013 Fund Inception Date

(1) Committed Capital Cumulative

Invested Capital (2) Total Fair Value (3)

MOIC (4) Gross IRR (7) Net

IRR (8)

Cumulative Invested Capital (2) Total Fair Value

(3) MOIC (4) Gross IRR (7)

Corporate Private Equity (Reported in Local Currency, in

Millions) (Reported in Local Currency, in Millions)

Fully Invested Funds (6)

CP II 10/1994 $ 1,331.1 $ 1,362.4 $

4,071.5 3.0x 34 % 25 % $ 1,362.4 $ 4,071.5 3.0x 34 % CP III 2/2000

$ 3,912.7 $ 4,031.6 $ 10,145.9 2.5x 27 % 21 % $ 4,031.6 $ 10,145.9

2.5x 27 % CP IV 12/2004 $ 7,850.0 $ 7,612.6 $ 16,237.0 2.1x 16 % 13

% $ 4,394.5 $ 10,581.2 2.4x 20 % CEP I 12/1997

€

1,003.6

€

981.6

€

2,126.5

2.2x 18 % 11 %

€

981.6

€

2,126.5

2.2x 18 % CEP II 9/2003

€

1,805.4

€

2,046.5

€

3,800.9

1.9x 38 % 21 %

€

1,115.8

€

2,797.4

2.5x 67 % CAP I 12/1998 $ 750.0 $ 627.7 $ 2,490.9 4.0x 25 % 18 % $

627.7 $ 2,490.9 4.0x 25 % CAP II 2/2006 $ 1,810.0 $ 1,614.9 $

2,812.0 1.7x 12 % 8 % $ 587.7 $ 1,714.6 2.9x 27 % CJP I 10/2001

¥

50,000.0

¥

47,291.4

¥

133,029.0

2.8x 61 % 37 %

¥

39,756.6

¥

130,139.9

3.3x 65 % All Other Funds (9) Various $ 3,380.3 $ 5,017.2 1.5x 17 %

7 % $ 2,356.2 $ 4,104.6 1.7x 22 % Coinvestments and Other (10)

Various $ 7,238.9 $ 17,607.3

2.4x

36 % 33 % $ 4,648.1 $ 14,350.3 3.1x

36 %

Total Fully Invested Funds $

30,252.5 $ 67,393.2 2.2x

28 % 21 % $

21,119.2 $ 55,153.2 2.6x

30 % Funds in the Investment Period

(6) CP V 5/2007 $ 13,719.7 $ 12,146.1 $ 18,064.7 1.5x 17

% 11 % CEP III 12/2006

€

5,294.9

€

4,461.4

€

5,860.5

1.3x 10 % 7 % CAP III 5/2008 $ 2,551.6

$

1,802.0

$

2,087.8 1.2x 7 % 1 % CJP II 7/2006

¥

165,600.0

¥

135,239.7

¥

137,816.5

1.0x 1 % (4 %) CGFSP I 9/2008 $ 1,100.2 $ 931.3 $ 1,292.9 1.4x 16 %

9 % CAGP IV 6/2008 $ 1,041.4 $ 546.8 $ 666.2 1.2x 11 % 1 % CEOF I

(11) 5/2011 $ 1,017.7 $ 234.6 $ 299.8 1.3x n/m n/m All Other Funds

(12) Various $ 1,232.7 $ 1,510.6 1.2x 11 %

1 %

Total Funds in the Investment Period $

24,048.7 $ 32,898.4 1.4x

13 % 8 % $

4,779.7 $ 9,945.4 2.1x

25 % TOTAL CORPORATE PRIVATE EQUITY

(13) $ 54,301.2 $ 100,291.6

1.8x 26 % 18

% $ 25,898.8 $ 65,098.6

2.5x 30 % TOTAL

INVESTMENTS REALIZED/PARTIALLY REALIZED

INVESTMENTS (5) as of March 31, 2013

as of March 31, 2013 Fund

Inception Date (1) Committed Capital

Cumulative Invested Capital (2)

Total Fair Value (3) MOIC (4)

Gross IRR (7) Net

IRR (8)

Cumulative Invested Capital (2) Total Fair

Value (3) MOIC (4) Gross IRR

(7) Real Assets (Reported in Local Currency, in

Millions) (Reported in Local Currency, in Millions)

Fully Invested Funds (6) CRP III 11/2000 $

564.1 $ 522.5 $ 1,400.9 2.7x 44 % 30 % $ 522.5 $ 1,400.9 2.7x 44 %

CRP IV 12/2004 $ 950.0 $ 1,186.0 $ 1,210.2 1.0x 1 % (3 %) $ 441.8 $

455.9 1.0x 10 % CRP V 11/2006 $ 3,000.0 $ 3,209.9 $ 4,375.8 1.4x 10

% 7 % $ 1,844.1 $ 2,517.9 1.4x 12 % CEREP I 3/2002

€

426.6

€

517.0

€

741.6

1.4x 13 % 7 %

€

441.2

€

751.8

1.7x 19 % CEREP II 4/2005

€

762.7

€

826.9

€

143.8

0.2x (56 %) (44 %)

€

416.5

€

137.8

0.3x (54 %) CEREP III 5/2007

€

2,229.5

€

1,752.6

€

1,877.9

1.1x 3 % (2 %)

€

-

€

3.5

n/a n/a Energy II 7/2002 $ 1,100.0 $ 1,336.7 $ 3,670.4 2.7x 81 % 54

% $ 827.4 $ 3,410.1 4.1x 105 % Energy III 10/2005 $ 3,800.0 $

3,564.6 $ 6,808.5 1.9x 16 % 12 % $ 1,545.4

$

4,494.2 2.9x 28 % Energy IV 12/2007 $ 5,979.1 $ 5,129.9 $ 8,237.0

1.6x 23 % 15 % $ 1,710.6 $ 3,630.9 2.1x 32 % All Other Funds (14)

Various $ 2,289.4 $ 2,280.5 1.0x 0 % (7 %) $ 1,484.1 $ 1,703.3 1.1x

8 % Coinvestments and Other (10) Various $ 3,962.2 $ 6,706.7

1.7x 20 % 16 % $ 1,727.0 $ 3,850.5

2.2x 29 %

Total Fully Invested Funds $

25,171.1 $ 38,232.7 1.5x

16 % 10 % $

11,202.6 $ 22,608.5 2.0x

28 % Funds in the Investment Period

(6) CRP VI 9/2010 $ 2,340.0 $ 835.8 $ 1,077.5 1.3x 33 %

16 % CIP 9/2006 $ 1,143.7 $ 922.4 $ 948.2 1.0x 1 % (4 %) Renew II

3/2008 $ 3,417.5 $ 2,694.1 $ 3,675.2 1.4x 14 % 8 % All Other Funds

(15) Various $ 201.8 $ 241.2 1.2x 30 %

22 %

Total Funds in the Investment Period $ 4,654.1

$ 5,942.1 1.3x 12

% 6 % $ 833.7

$ 895.4 1.1x 3 %

TOTAL REAL ASSETS (13) $ 29,825.2

$ 44,174.8 1.5x 16

% 10 % $ 12,036.3

$ 23,504.0 2.0x 27

%

Global Markets Strategies Carry Funds and

Solutions (Unaudited)

TOTAL INVESTMENTS

as of March 31, 2013 Fund Inception Date (1)

Fund Size Cumulative

Invested Capital (16)

Total Fair Value (3) MOIC (4)

Gross IRR (7) Net IRR (8) Global Market

Strategies (Reported in Local Currency, in Millions) CSP

II 6/2007 $ 1,352.3 $ 1,352.3 $ 2,353.4 1.7x 18% 13% CEMOF I

(17) 12/2010 $ 1,382.5 $ 274.2 $ 343.8 1.3x n/m n/m

TOTAL INVESTMENTS as of March 31, 2013 Vintage

Year Fund Size Cumulative

Invested Capital (2)(20)

Total Fair Value (3)(20) MOIC (4)

Gross IRR (7) Net IRR (8) Solutions

(18) (Reported in Local Currency, in Millions)

Fully Committed Funds (19) Main Fund I -

Fund Investments 2000

€

5,174.6

€

3,963.3

€

6,337.4

1.6x 12% 12% Main Fund II - Fund Investments 2003

€

4,545.0

€

4,449.5

€

6,362.3

1.4x 10% 9% Main Fund III - Fund Investments 2005

€

11,500.0

€

10,096.9

€

12,158.0

1.2x 6% 6% Main Fund IV - Fund Investments 2009

€

4,880.0

€

1,486.8

€

1,513.3

1.0x 2% (0%) Main Fund I - Secondary Investments 2002

€

519.4

€

464.6

€

875.3

1.9x 55% 52% Main Fund II - Secondary Investments 2003

€

998.4

€

935.2

€

1,659.1

1.8x 28% 26% Main Fund III - Secondary Investments 2006

€

2,250.0

€

2,107.9

€

2,776.0

1.3x 9% 9% Main Fund IV - Secondary Investments 2010

€

1,856.4

€

1,640.3

€

2,139.9

1.3x 20% 19% Main Fund II - Co-Investments 2003

€

1,090.0

€

874.8

€

2,331.6

2.7x 45% 43% Main Fund III - Co-Investments 2006

€

2,760.0

€

2,500.1

€

3,089.5

1.2x 4% 4% Main Fund II - Mezzanine Investments 2004

€

700.0

€

713.6

€

946.4

1.3x 8% 7% Main Fund III - Mezzanine Investments 2006

€

2,000.0

€

1,409.8

€

1,807.7

1.3x 10% 9% All Other Funds (21) Various

€

1,341.4

€

1,972.7

1.5x 18% 14%

Total Fully Committed Funds

€

31,984.1

€

43,969.2

1.4x 11% 10% Funds in the Commitment

Period Main Fund V - Fund Investments (22) 2012

€

4,830.9

€

26.7

€

24.3

0.9x n/m n/m Main Fund V - Secondary Investments 2011

€

2,665.6

€

607.5

€

724.0

1.2x 38% 34% Main Fund IV - Co-Investments 2010

€

1,475.0

€

1,236.3

€

1,654.3

1.3x 19% 16% Main Fund V - Co-Investments (22) 2012

€

1,228.2

€

293.0

€

305.9

1.0x n/m n/m All Other Funds (21) Various

€

119.3

€

126.0

1.1x 21% 14%

Total Funds in the Commitment Period

€

2,282.8

€

2,834.5

1.2x 21% 18% TOTAL SOLUTIONS

€

34,266.9

€

46,803.7

1.4x 11% 10% TOTAL SOLUTIONS (USD) (23)

$ 43,931.9 $ 60,004.7 1.4x

(1) The data presented herein that provides "inception to

date" performance results of our segments relates to the period

following the formation of the first fund within each segment. For

our Corporate Private Equity segment our first fund was formed in

1990. For our Real Assets segment our first fund was formed in

1997. For our Global Market Strategies segment, CSP II and CEMOF I

were formed in June 2007 and December 2010, respectively. (2)

Represents the original cost of all capital called for investments

since inception of the fund. (3) Represents all realized proceeds

combined with remaining fair value, before management fees,

expenses and carried interest. (4) Multiple of invested capital

("MOIC") represents total fair value, before management fees,

expenses and carried interest, divided by cumulative invested

capital. (5) An investment is considered realized when the

investment fund has completely exited, and ceases to own an

interest in, the investment. An investment is considered partially

realized when the total amount of proceeds received in respect of

such investment, including dividends, interest or other

distributions and/or return of capital, represents at least 85% of

invested capital and such investment is not yet fully realized.

Because part of our value creation strategy involves pursuing best

exit alternatives, we believe information regarding

Realized/Partially Realized MOIC and Gross IRR, when considered

together with the other investment performance metrics presented,

provides investors with meaningful information regarding our

investment performance by removing the impact of investments where

significant realization activity has not yet occurred.

Realized/Partially Realized MOIC and Gross IRR have limitations as

measures of investment performance, and should not be considered in

isolation. Such limitations include the fact that these measures do

not include the performance of earlier stage and other investments

that do not satisfy the criteria provided above. The exclusion of

such investments will have a positive impact on Realized/Partially

Realized MOIC and Gross IRR in instances when the MOIC and Gross

IRR in respect of such investments are less than the aggregate MOIC

and Gross IRR. Our measurements of Realized/Partially Realized MOIC

and Gross IRR may not be comparable to those of other companies

that use similarly titled measures. We do not present

Realized/Partially Realized performance information separately for

funds that are still in the investment period because of the

relatively insignificant level of realizations for funds of this

type. However, to the extent such funds have had realizations, they

are included in the Realized/Partially Realized performance

information presented for Total Corporate Private Equity and Total

Real Assets. (6) Fully Invested funds are past the expiration date

of the investment period as defined in the respective limited

partnership agreement. In instances where a successor fund has had

its first capital call, the predecessor fund is categorized as

fully invested. (7) Gross Internal Rate of Return ("Gross IRR")

represents the annualized IRR for the period indicated on Limited

Partner invested capital based on contributions, distributions and

unrealized value before management fees, expenses and carried

interest. (8) Net Internal Rate of Return ("Net IRR") represents

the annualized IRR for the period indicated on Limited Partner

invested capital based on contributions, distributions and

unrealized value after management fees, expenses and carried

interest. (9) Aggregate includes the following funds: CP I, CMG,

CVP I, CVP II, CEVP, CETP I, CAVP I, CAVP II, CAGP III, CUSGF III

and Mexico. (10) Includes co-investments, prefund investments and

certain other stand-alone investments arranged by us. (11) The

Gross IRR and Net IRR for CEOF I are not meaningful as the

investment period commenced May 2011. (12) Aggregate includes the

following funds: MENA, CSABF, CETP II, CBPF, CSSAF and CPF I. (13)

For purposes of aggregation, funds that report in foreign currency

have been converted to U.S. dollars at the reporting period spot

rate. (14) Aggregate includes the following funds: CRP I, CRP II,

CAREP I, CAREP II, Energy I and Renew I. (15) Aggregate includes

the following fund: CRCP I. (16) Represents the original cost of

investments net of investment level recallable proceeds which is

adjusted to reflect recyclability of invested capital for the

purpose of calculating the fund MOIC. (17) Gross IRR and Net IRR

for CEMOF I are not meaningful as the investment period commenced

in December 2010. (18) Includes private equity and mezzanine

primary fund investments, secondary fund investments and

co-investments originated by the AlpInvest team. Excluded from the

performance information shown are a) investments that were not

originated by AlpInvest and b) Direct Investments, which was spun

off from AlpInvest in 2005. As of March 31, 2013, these excluded

investments represent $0.6 billion of AUM. (19) Fully Committed

funds are past the expiration date of the commitment period as

defined in the respective limited partnership agreement. (20) To

exclude the impact of FX, all foreign currency cash flows have been

converted to Euro at the reporting period spot rate. (21) Aggregate

includes Main Fund I - Co-Investments, Main Fund I - Mezzanine

Investments, AlpInvest CleanTech Funds and funds which are not

included as part of a main fund. (22) Gross IRR and Net IRR are not

meaningful as commitment periods commenced in Q3 2012. (23)

Represents the U.S. dollar equivalent balance translated at the

spot rate as of period end.

Reconciliation for Economic Net Income and

Distributable Earnings (Unaudited)

Three Months Ended

March 31, March 31, 2013

2012 (Dollars in millions) Income

before provision for income taxes $ 452.4 $ 1,505.8

Adjustments: Partner compensation - (271.0 ) Equity-based

compensation issued in conjunction with the IPO and

strategic investments

52.1 - Acquisition related charges and amortization of intangibles

62.5 24.1 Losses associated with debt refinancing activities 1.9 -

Other non-operating (income) expenses (2.4 ) (4.1 ) Net income

attributable to non-controlling interests in consolidated

entities

(168.0 ) (864.9 ) Provision for income taxes attributable to

non-controlling interests

in consolidated entities

(6.0 ) - Severance and lease terminations 0.5 2.4 Other adjustments

0.9 (0.2 )

Economic Net Income $ 393.9

$ 392.1 Net performance fees 354.7 334.8 Investment

income 3.0 23.3

Fee Related

Earnings $ 36.2 $ 34.0 Realized performance fees,

net of related compensation 141.5 142.7 Investment income (loss) -

realized (9.3 ) 2.1

Distributable

Earnings $ 168.4 $ 178.8 Depreciation and

amortization expense 6.3 5.2 Interest expense 8.5

9.8

Adjusted EBITDA $ 183.2 $ 193.8

Reconciliation for Economic Net income and

Distributable Earnings, cont. (Unaudited)

For the Three Months Ended March 31,

2013 (Dollars in millions, except unit and per unit

amounts) Economic Net Income $ 393.9 Less:

Provision for Income Taxes 74.3 Economic Net Income, After

Taxes $ 319.6 Economic Net Income, After Taxes per Adjusted

Unit(1) $ 1.02 Distributable Earnings $ 168.4 Less:

Estimated foreign, state, and local taxes 11.0 Distributable

Earnings, After Taxes $ 157.4 Distributable Earnings to The

Carlyle Group L.P. $ 23.5 Less: Estimated current corporate income

taxes and TRA payments 1.9 Distributable Earnings to The

Carlyle Group L.P. net of corporate income taxes $ 21.6

Distributable Earnings, net, per The Carlyle Group L.P. common unit

outstanding(2) $ 0.47 (1) Adjusted Units were

determined as follows: The Carlyle Group L.P. common units

outstanding 43,244,180 Carlyle Holdings partnership units not held

by The Carlyle Group L.P. 262,873,250 Dilutive effect of unvested

deferred restricted common units 5,393,646 Contingently issuable

Carlyle Holdings partnership units 2,372,094 Total Adjusted

Units 313,883,170 (2)

As of March 31, 2013, there are 43,244,180

outstanding common units of The Carlyle Group L.P. In May 2013, an

additional 2,865,706 common units were issued that relate to vested

deferred restricted common units. For purposes of this calculation,

those common units have been added to the common units outstanding

as of March 31, 2013, resulting in total common units of

46,109,886.

GAAP for 12-Month Rolling Summary

(Unaudited)

Twelve Months Ended March 31,

March 31, 2013

2012 (Dollars in millions) Revenues

Fund management fees $ 974.6 $ 921.9 Performance fees Realized

879.7 1,185.6 Unrealized 163.0 (297.9 ) Total

performance fees 1,042.7 887.7 Investment income Realized 12.9 31.2

Unrealized 2.4 27.3 Total investment income

15.3 58.5 Interest and other income 14.2 12.6 Interest and other

income of Consolidated Funds 960.4 758.2 Total

revenues 3,007.2 2,638.9

Expenses Compensation and

benefits Base compensation 696.9 393.9 Equity-based compensation

254.0 - Performance fee related Realized 359.9 207.0 Unrealized

172.4 (103.0 ) Total compensation and benefits

1,483.2 497.9 General, administrative and other expenses 377.7

348.2 Interest 24.7 54.0 Interest and other expenses of

Consolidated Funds 823.7 551.0 Other non-operating expenses

8.8 12.5 Total expenses 2,718.1 1,463.6

Other income Net investment gains of Consolidated Funds

1,097.4 733.1 Gain on business acquisition - 7.9

Income before provision for income taxes 1,386.5

1,916.3 Provision for income taxes 53.6 34.1

Net income 1,332.9 1,882.2 Net income attributable to

non-controlling

interests in consolidated entities

1,059.8 792.3 Net income attributable to

Carlyle Holdings 273.1 $ 1,089.9 Net income attributable to

non-controlling

interests in Carlyle Holdings

219.0 Net income attributable to The Carlyle Group L.P. $

54.1

Reconciliation of Non-GAAP to GAAP for

12-Month Rolling Summary (Unaudited)

Twelve Months Ended Mar. 31,

Mar. 31, 2013

2012 (Dollars in millions)

Income before provision for income taxes $ 1,386.5 $ 1,916.3

Adjustments: Partner compensation 5.6 (541.4 ) Equity-based

compensation issued in conjunction with the IPO and

strategic investments

252.2 - Acquisition related charges and amortization of intangibles

166.7 101.0 Losses associated with debt refinancing activities 1.9

Gain on business acquisition - (7.9 ) Other non-operating expenses

8.8 12.5 Net income attributable to non-controlling interests

in consolidated entities

(1,059.8 ) (792.3 ) Provision for income taxes attributable to

non-controlling

interests in consolidated entities

(25.5 ) - Severance and lease terminations 4.0 4.9 Other

adjustments (3.0 ) (1.3 )

Economic Net Income

$ 737.4 $ 691.8 Net performance fees 544.5 525.0

Investment income 21.2 51.7

Fee

Related Earnings $ 171.7 $ 115.1 Realized

performance fees, net of related compensation 500.9 606.3

Investment income - realized 4.9 37.9

Distributable Earnings $ 677.5 $ 759.3

Depreciation and amortization expense 22.6 21.0 Interest expense

23.2 52.5

Adjusted EBITDA $

723.3 $ 832.8

The Carlyle Group L.P.

GAAP Balance Sheet (Unaudited)

As of

March 31, 2013

ConsolidatedOperatingEntities

ConsolidatedFunds

Eliminations Consolidated (Dollars in

millions) Assets Cash and cash equivalents $ 570.4 $ - $

- $ 570.4 Cash and cash equivalents held at Consolidated Funds -

2,173.2 - 2,173.2 Restricted cash 43.4 - - 43.4 Restricted cash and

securities of Consolidated Funds - 17.8 - 17.8 Accrued performance

fees 2,622.2 - (24.0 ) 2,598.2 Investments 910.5 - (54.3 ) 856.2

Investments of Consolidated Funds - 25,093.6 - 25,093.6 Due from

affiliates and other receivables, net 159.2 - (12.6 ) 146.6 Due

from affiliates and other receivables of Consolidated

Funds, net

- 320.7 - 320.7 Fixed assets, net 62.2 - - 62.2 Deposits and other

49.8 4.6 - 54.4 Intangible assets, net 650.1 - - 650.1 Deferred tax

assets 64.7 - - 64.7 Total

assets $ 5,132.5 $ 27,609.9 $ (90.9 ) $ 32,651.5

Liabilities and partners' capital Loans payable $ 25.0 $ - $

- $ 25.0 3.875% Senior Notes due 2023 499.8 - - 499.8 5.625% Senior

Notes due 2043 398.4 - - 398.4 Loans payable of Consolidated Funds

- 14,366.6 (53.9 ) 14,312.7 Accounts payable, accrued expenses and

other liabilities 204.9 - - 204.9 Accrued compensation and benefits

1,449.3 - - 1,449.3 Due to affiliates 288.2 44.7 (0.1 ) 332.8

Deferred revenue 184.6 1.5 - 186.1 Deferred tax liabilities 70.0 -

- 70.0 Other liabilities of Consolidated Funds - 1,793.8 (30.1 )

1,763.7 Accrued giveback obligations 55.9 -

(9.6 ) 46.3 Total liabilities 3,176.1 16,206.6 (93.7 )

19,289.0 Redeemable non-controlling interests in

consolidated entities 6.6 3,297.3 - 3,303.9 Total partners'

capital 1,949.8 8,106.0 2.8

10,058.6 Total liabilities and partners' capital $ 5,132.5 $

27,609.9 $ (90.9 ) $ 32,651.5

The Carlyle Group L.P.

Non-GAAP Financial

Information and Other Key Terms

Non-GAAP Financial Information

Carlyle discloses in this press release the following financial

measures that are calculated and presented on the basis of

methodologies other than in accordance with generally accepted

accounting principles in the United States of America:

- Economic net income or “ENI,”

represents segment net income which excludes the impact of income