false 0001752036 0001752036 2023-10-26 2023-10-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 26, 2023

CALIFORNIA BANCORP

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| California |

|

001-39242 |

|

82-1751097 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification Number) |

|

|

|

| 1300 Clay Street, Suite 500 |

|

|

| Oakland, California |

|

94612 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

(510) 457-3737

(Registrant’s Telephone Number, Including Area Code)

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Common Stock |

|

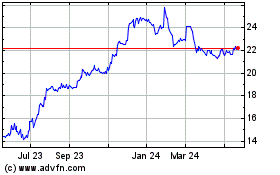

CALB |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 2.02 |

Results of Operations and Financial Condition |

On October 26, 2023, California BanCorp (the “Company”) issued a press release setting forth its unaudited financial results for the quarter and nine months ended September 30, 2023. A copy of the Company’s press release is furnished as Exhibit 99.1 and is hereby incorporated by reference.

| Item 7.01 |

Regulation FD Disclosure. |

Over the upcoming weeks, members of management will be presenting to or conducting one-on-one meetings with investors, analysts or other third parties about the Company and its latest financial results. A copy of the presentation slides, updated with the Company’s financial results for the third quarter and nine months ended September 30, 2023, substantially in the form expected to be used in such presentations and meetings, is attached hereto as Exhibit 99.2 and is incorporated herein by reference.

The information furnished under this Item 2.02 and Item 7.01 and the related Exhibits 99.1 and 99.2 of this Current Report on Form 8-K shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to liabilities under that Section, nor shall it be deemed incorporated by reference in any registration statement or other filings of the Company under the Securities Act of 1933, as amended (the “Securities Act”) or the Exchange Act, except as shall be set forth by specific reference in such filing.

| Item 9.01 |

Financial Statements and Exhibits |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

CALIFORNIA BANCORP |

|

|

|

|

| Date: October 26, 2023 |

|

|

|

By: |

|

/s/ THOMAS A. SA |

|

|

|

|

|

|

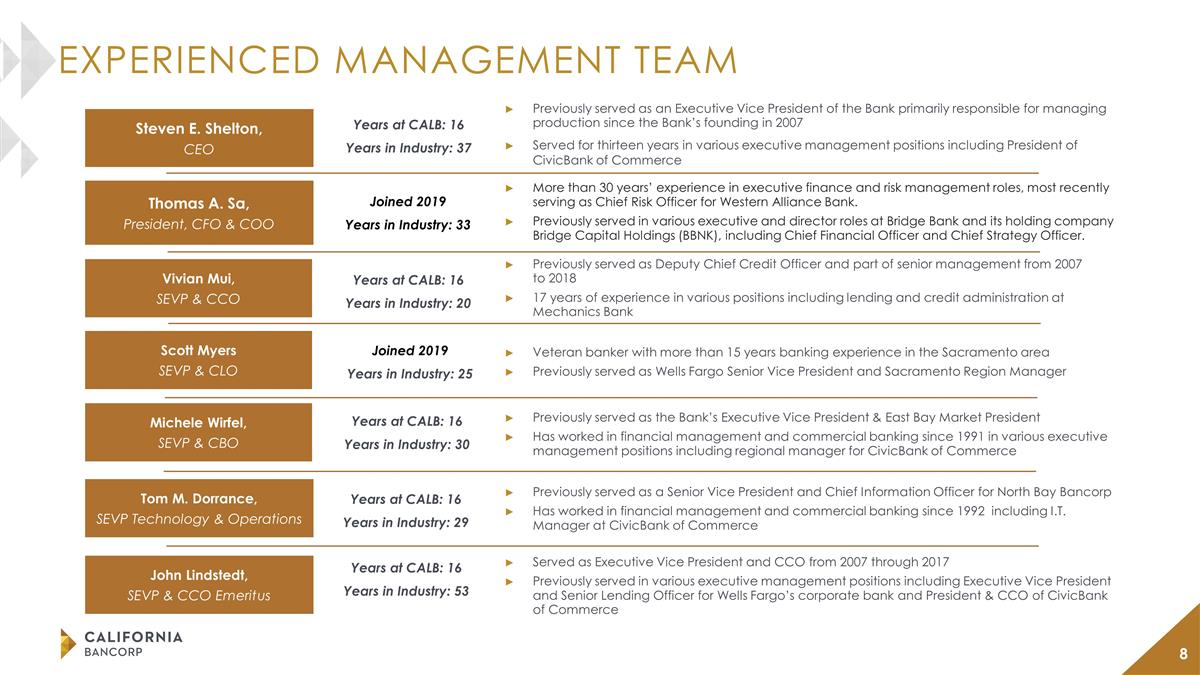

Thomas A. Sa President, Chief Financial Officer and Chief Operating Officer |

Exhibit 99.1

California BanCorp Reports Financial Results for the Third Quarter and Nine Months Ended

September 30, 2023

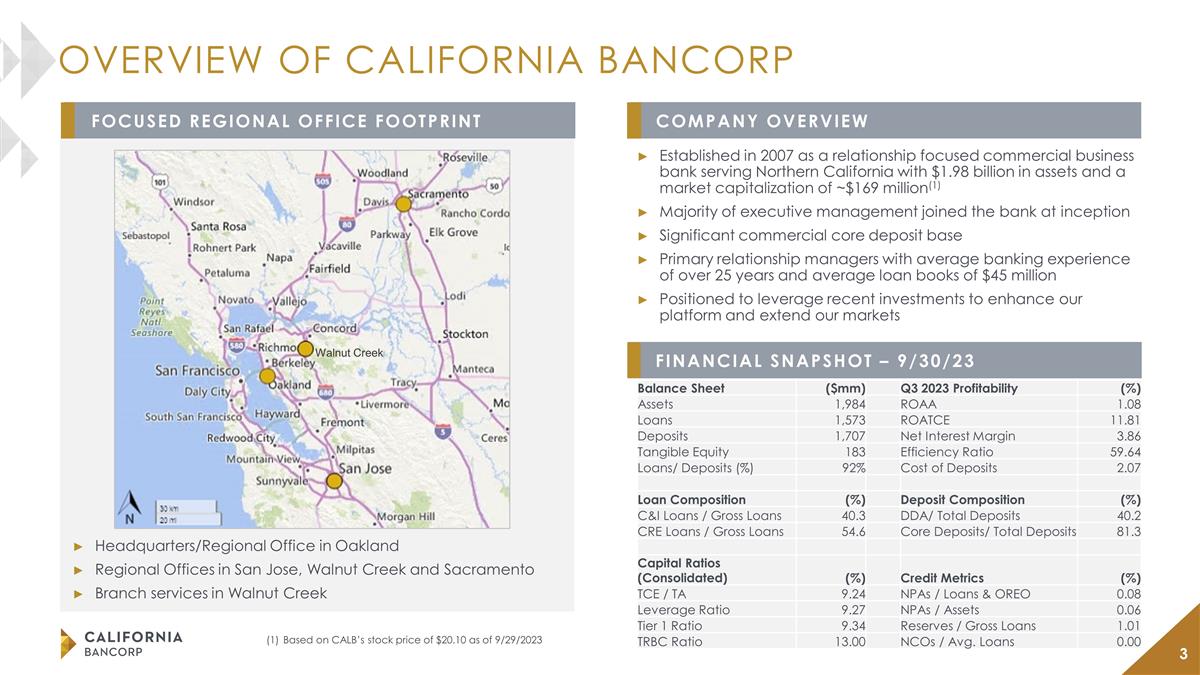

Oakland, CA – October 26, 2023 – California BanCorp (NASDAQ: CALB), whose

subsidiary is California Bank of Commerce, announced today its financial results for the third quarter and nine months ended September 30, 2023.

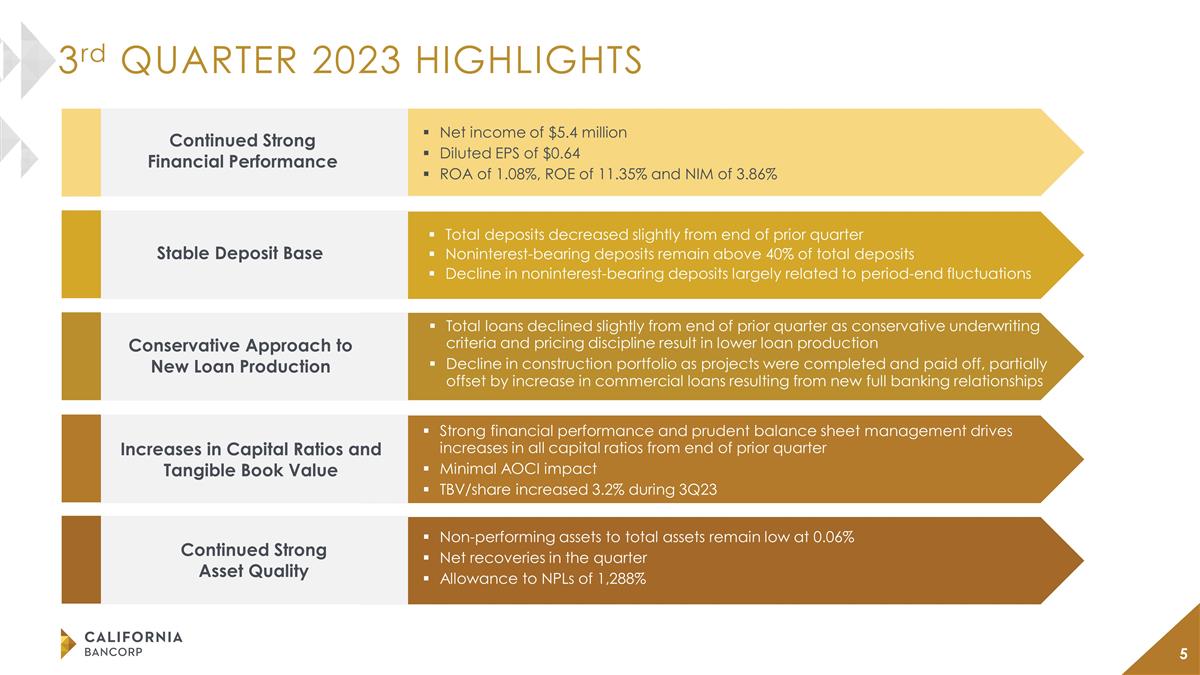

The

Company reported net income of $5.4 million for both the third and second quarters of 2023, compared to $5.5 million for the third quarter of 2022. For the nine months ended September 30, 2023, net income was $16.3 million

representing an increase of $2.9 million, or 21%, compared to $13.4 million for the same period in 2022.

Diluted earnings per share were $0.64

for the third quarter of 2023, compared to $0.65 for the second quarter of 2023 and $0.66 for the third quarter of 2022. For the nine months ended September 30, 2023, diluted earnings per share were $1.93, compared to $1.60 for the same period

in 2022.

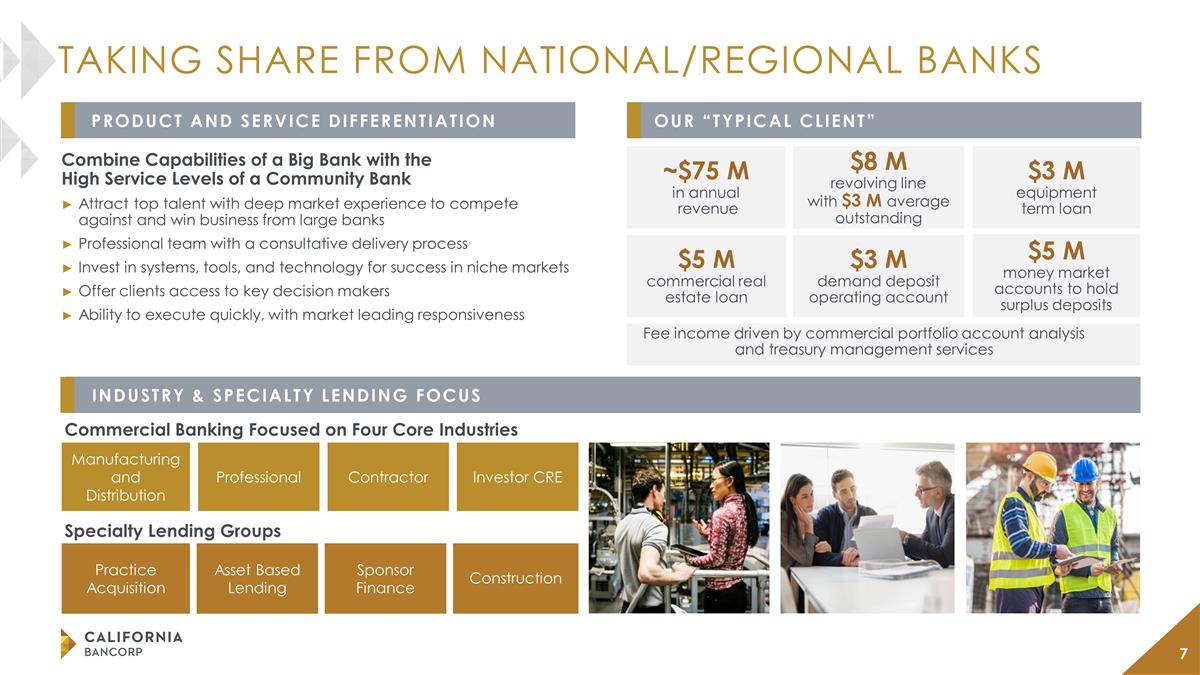

“Our third quarter results reflect the strength of the franchise we have built, as we continued to deliver strong financial performance

with our return on average assets remaining above 1% despite the challenging operating environment,” said Steven Shelton, Chief Executive Officer of California BanCorp. “We saw continued stability in our deposit base, net interest margin,

and asset quality, along with disciplined expense control, which enabled us to generate earnings that were consistent with the prior quarter. As expected, given our conservative approach in the current environment, our balance sheet remained

relatively flat with the prior quarter, although we continued to have success in adding new full banking relationships including operating deposit accounts and high quality commercial lending opportunities.

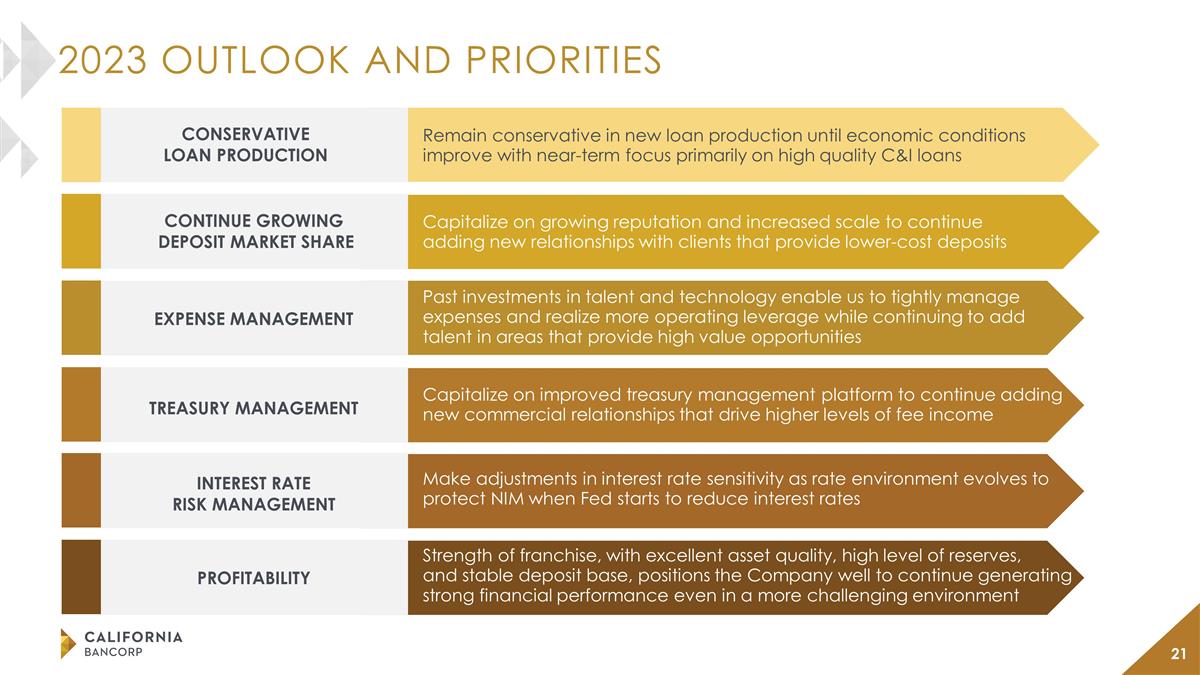

“Given the continued economic uncertainty, we will continue to maintain our conservative approach to new loan production. However, we believe the

competitive environment remains favorable for us to continue adding new commercial deposit relationships and taking market share as we are seeing increasing opportunities to attract clients who are looking for a commercial bank with a strong balance

sheet, robust treasury management solutions, and a superior level of service. Over the near-term, we expect to continue to generate a strong level of profitability while maintaining a high level of capital, liquidity, and reserves, and adding new

full banking relationships that will contribute to our long-term profitable growth and further increasing the value of our franchise,” said Mr. Shelton.

Financial Highlights:

Profitability - three months

ended September 30, 2023 compared to June 30, 2023

| |

• |

|

Net income of $5.4 million and $0.64 per diluted share, compared to $5.4 million and $0.65 per diluted

share, respectively. |

| |

• |

|

Revenue of $19.8 million increased $91,000, or 0%, compared to $19.8 million for the second quarter of

2023. |

| |

• |

|

Net interest income of $18.6 million decreased $68,000, or 0%, compared to $18.6 million for the second

quarter of 2023. |

| |

• |

|

Provision for credit losses of $314,000 decreased $130,000, or 29%, from $444,000 for the second quarter of 2023.

|

| |

• |

|

Non-interest income of $1.3 million increased $159,000, or 14%,

compared to $1.1 million for the second quarter of 2023. |

| |

• |

|

Non-interest expense, excluding capitalized loan origination costs, of

$12.5 million increased $222,000, or 2%, compared to $12.3 million for the second quarter of 2023. |

Profitability - nine

months ended September 30, 2023 compared to September 30, 2022

| |

• |

|

Net income of $16.3 million and $1.93 per diluted share, compared to $13.4 million and $1.60 per

diluted share, respectively. |

| |

• |

|

Revenue of $59.5 million increased $5.0 million, or 9%, compared to $54.5 million in the prior

year. |

| |

• |

|

Net interest income of $56.0 million increased $6.9 million, or 14%, compared to $49.1 million for

the same period in the prior year. |

| |

• |

|

Provision for credit losses of $1.1 million decreased $1.6 million, or 58%, from $2.7 million for

the nine months ended September 30, 2022. |

| |

• |

|

Non-interest income of $3.5 million decreased $1.9 million, or

35%, from $5.4 million for the same period in the prior year. |

| |

• |

|

Non-interest expense, excluding capitalized loan origination costs, of

$37.3 million decreased $1.2 million, or 3%, compared to $36.1 million for the nine months ended September 30, 2022. |

Financial Position – September 30, 2023 compared to June 30, 2023

| |

• |

|

Total assets decreased by $21.7 million, or 1%, to $1.98 billion; average total assets increased by

$9.3 million to $1.99 billion. |

| |

• |

|

Total gross loans decreased by $10.5 million, or 1%, to $1.57 billion; average total gross loans

decreased by $25.8 million to $1.55 billion. |

| |

• |

|

Total deposits decreased by $31.2 million, or 2%, to $1.71 billion; average total deposits increased by

$35.4 million to $1.72 billion. |

| |

• |

|

Excluding junior subordinated debt securities, the Company had no other borrowings outstanding at

September 30, 2023 and June 30, 2023. |

| |

• |

|

Capital ratios remain healthy with a tier I leverage ratio of 9.27%, tier I capital ratio of 9.34% and total

risk-based capital ratio of 13.00%. |

| |

• |

|

Tangible book value per share of $21.76 increased by $0.67, or 3%. |

Net Interest Income and Margin:

Net interest income for

the quarters ended September 30, 2023 and June 30, 2023 was $18.6 million, compared to $18.4 million for the three months ended September 30, 2022. Net interest income for the nine months ended September 30, 2023 was

$56.0 million, an increase of $6.9 million, or 14% over $49.1 million for the nine months ended September 30, 2022. The increase in net interest income was primarily attributable to an increase in interest income as the result of

a more favorable mix of earning assets combined with higher yields on those assets.

The Company’s net interest margin for the third quarter of 2023 was 3.86%, compared to 3.93% for the

second quarter of 2023 and 3.94% for the same period in 2022. The decrease in margin compared to the prior quarter was primarily due to an unfavorable shift in the mix of average interest earning assets combined with an increase in the cost of

deposits. The decrease in margin from the same period last year was primarily the result of an increase in the cost of deposits, partially offset by a more favorable mix of earning assets with higher yields.

The Company’s net interest margin for the nine months ended September 30, 2023 was 3.94% compared to 3.60% for the same period in 2022. The increase

in margin compared to prior year was primarily due to loan growth and increased yields on earnings assets, partially offset by an increase in the cost of deposits and other borrowings.

Non-Interest Income:

The Company’s non-interest income for the quarters ended September 30, 2023, June 30, 2023, and

September 30, 2022 was $1.3 million, $1.1 million and $1.5 million, respectively. For the nine months ended September 30, 2023, non-interest income of $3.5 million compared to

$5.4 million for the same period of 2022. The decrease in non-interest income from prior year was the result of a decrease in service charges and loan related fees and a gain recognized in the second

quarter of 2022 on the sale of a portion of our solar loan portfolio.

Net interest income and non-interest income

comprised total revenue of $19.9 million, $19.8 million, and $19.8 million for the quarters ended September 30, 2023, June 30, 2023, and September 30, 2022, respectively. Total revenue for the nine months ended

September 30, 2023 and 2022 was $59.5 million and $54.5 million, respectively.

Non-Interest

Expense:

The Company’s non-interest expense for the quarters ended September 30, 2023, June 30,

2023, and September 30, 2022 was $11.9 million, $11.6 million, and $11.2 million, respectively. The increase in non-interest expense from the second quarter of 2023 and third quarter of

2022 was primarily due to an increase in salaries and benefits, partially offset by a reduction in capitalized loan origination costs. Excluding capitalized loan origination costs, non-interest expense for the

third quarter of 2023, the second quarter of 2023 and the third quarter of 2022 was $12.5 million, $12.3 million, and $12.3 million, respectively.

Non-interest expense of $35.3 million for the nine months ended September 30, 2023 increased by

$2.3 million, or 7%, compared to $33.0 million for the same period of 2022. Excluding capitalized loan origination costs, non-interest expense was $37.3 million for the nine months ended

September 30, 2023 and $36.1 million for the same period in 2022 which reflects investment in infrastructure to support the growth of the Company.

The Company’s efficiency ratio, the ratio of non-interest expense to revenues, was 59.64%, 58.66%, and 56.52% for

the quarters ended September 30, 2023, June 30, 2023, and September 30, 2022, respectively. For the nine months ended September 30, 2023 and 2022, the Company’s efficiency ratio was 59.31% and 60.44%, respectively.

Balance Sheet:

Total assets of $1.98 billion as of September 30, 2023, represented a decrease of $21.7 million, or 1%, compared to $2.01 billion at

June 30, 2023 and a decrease of $64.6 million, or 3%, compared to $2.05 billion at September 30, 2022. The decrease in total assets from the prior quarter was primarily the result of conservative new loan production combined with

a modest reduction in deposit balances at the end of the quarter. Compared to the same period in the prior year, total assets decreased primarily due to conservative new loan production during 2023 and decreased liquidity as a result of a reduction

in other borrowings.

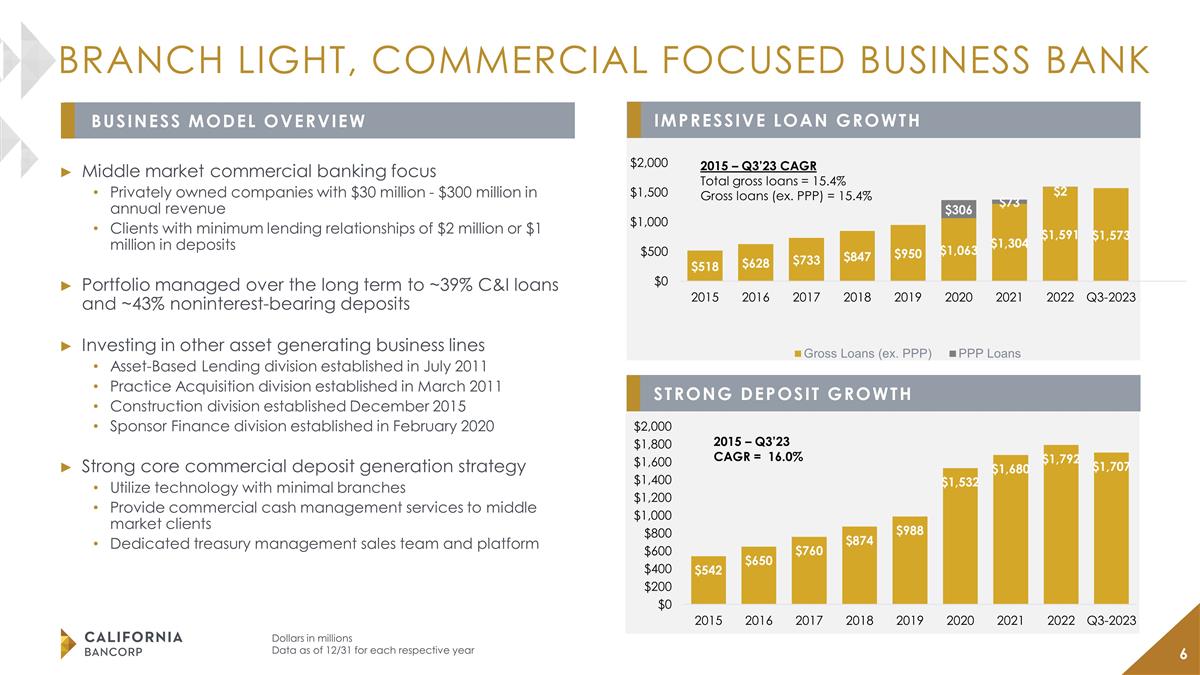

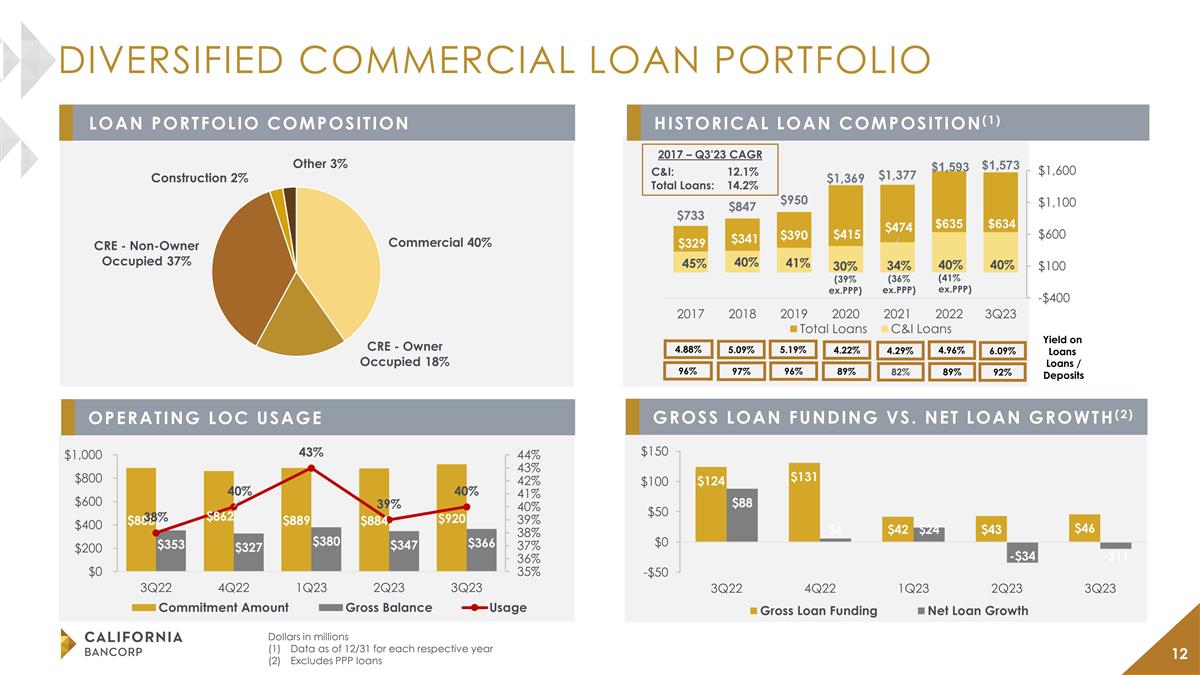

Total gross loans decreased by $10.5 million, or 1%, to $1.57 billion at September 30, 2023, from $1.58 billion

at June 30, 2023 and decreased by $14.8 million, or 1%, compared to $1.59 billion at September 30, 2022. During the third quarter of 2023, the reduction in gross loans was primarily the result of construction and land loans

decreasing by $20.6 million, or 34%, due to the completion of a large construction project, partially offset by an increase in commercial loans of $11.6 million. Compared to the same period in the prior year, real estate other loans

increased by $33.7 million, or 4%, primarily due to organic growth, and commercial, construction and land, and other loans decreased by $9.2 million, $31.5 million, and $7.8 million, respectively.

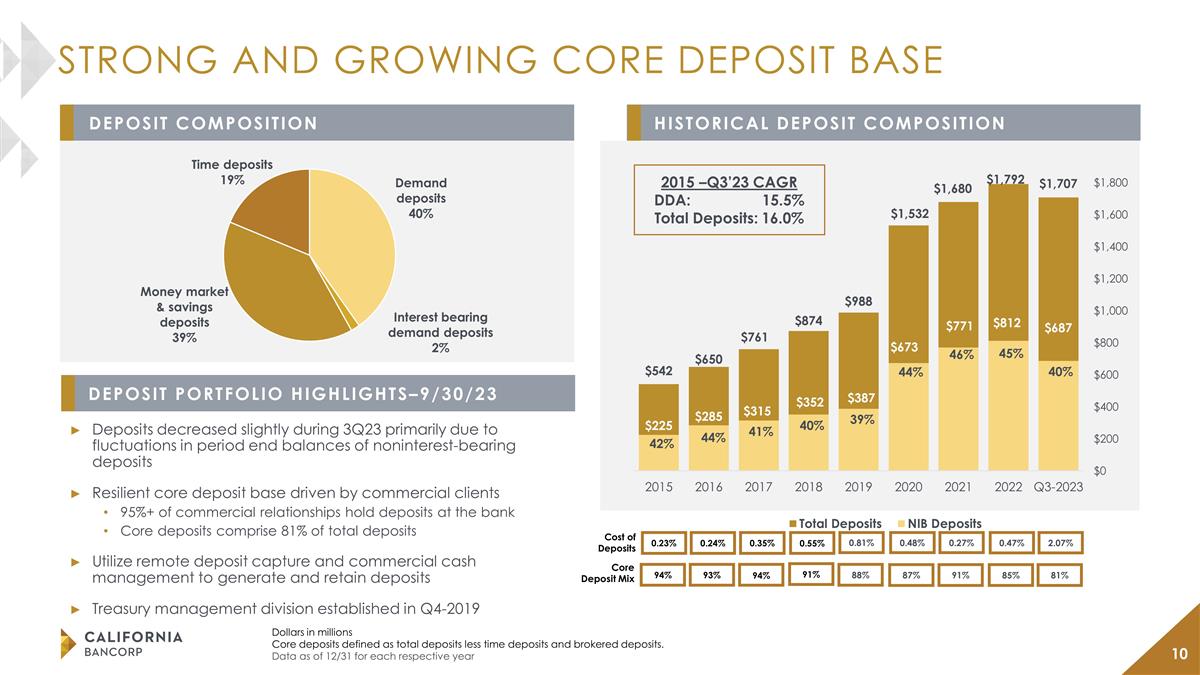

Total deposits decreased by $31.2 million, or 2%, to $1.71 billion at September 30, 2023 from $1.74 billion at June 30, 2023, and

decreased by $2.0 million, or 0%, from $1.71 billion at September 30, 2022. The decrease in total deposits from the end of the second quarter of 2023 was primarily due to a decrease in demand deposits of $56.2 million, or 7%, and

a decrease in time deposits of $13.5 million, or 4%, offset by an increase in money market and savings deposits of $38.5 million, or 6%. Noninterest-bearing deposits, primarily commercial business operating accounts, represented 40.2% of

total deposits at September 30, 2023, compared to 42.7% at June 30, 2023 and 44.4% at September 30, 2022.

At September 30, 2023 and

June 30, 2023, the Company had no outstanding borrowings, excluding junior subordinated debt securities, compared to $100.0 million at September 30, 2022.

Asset Quality:

The provision for credit losses on loans

decreased to $121,000 for the third quarter of 2023 compared to $340,000 for the second quarter of 2023, and $800,000 for the third quarter of 2022. The Company had loan charge-offs of $156,000 and recoveries of $234,000 during the

third quarter of 2023, no loan charge-offs or recoveries during the second quarter of 2023, and loan charge-offs of $202,000 and no recoveries during the third quarter of 2022.

Non-performing assets (“NPAs”) to total assets were 0.06% at September 30, 2023, 0.01% at June 30,

2023 and 0.02% at September 30, 2022, with non-performing loans of $1.2 million, $181,000 and $343,000, respectively, on those dates. The increase in

non-performing loans during the third quarter of 2023 was due to a loan in our commercial portfolio for which the borrower has entered into a liquidation process; however, this loan has a state guarantee and

no additional loss is expected for the Company as of September 30, 2023.

The allowance for credit losses on loans increased by $199,000 to

$15.9 million, or 1.01% of total loans, at September 30, 2023, compared to $15.7 million, or 0.99% of total loans, at June 30, 2023 and $16.6 million, or 1.04% of total loans, at September 30, 2022. On January 1,

2023, the Company adopted the new current expected credit losses (CECL) standard. The Company’s allowance for credit losses on loans was 0.95% upon adoption on January 1, 2023 compared to 1.07% at December 31, 2022.

The allowance for credit losses on unfunded loan commitments increased by $170,000 to $2.0 million, or

0.32% of total unfunded loan commitments, at September 30, 2023, compared to $1.9 million, or 0.31% of total unfunded loan commitments, at June 30, 2023 and $430,000, or 0.07% of total unfunded loan commitments at September 30,

2022. The Company’s allowance for credit losses on unfunded loan commitments was 0.28% upon the adoption of CECL on January 1, 2023 compared to 0.07% at December 31, 2022.

Capital Adequacy:

At September 30, 2023,

shareholders’ equity totaled $190.1 million compared to $184.2 million at June 30, 2023 and $164.1 million one year ago. As a result, the Company’s total risk-based capital ratio, tier I capital ratio and tier I

leverage ratio of 13.00%, 9.34%, and 9.27%, respectively, were all above the regulatory standards for “well-capitalized” institutions of 10.00%, 8.00% and 5.00% respectively.

“With our strong financial performance and prudent balance sheet management, we continued to increase our capital ratios and tangible book value per

share,” said Thomas A. Sa, President, Chief Financial Officer and Chief Operating Officer of California BanCorp. “We also continue to have exceptional asset quality with a very low level of

non-performing assets and net recoveries in the quarter. With the strong balance sheet we have built, we believe we are well positioned to support the continued growth of our franchise and create additional

long-term value for shareholders.”

About California BanCorp:

California BanCorp, the parent company for California Bank of Commerce, offers a broad range of commercial banking services to closely held businesses and

professionals located throughout Northern California. The Company’s common stock trades on the Nasdaq Global Select marketplace under the symbol CALB. For more information on California BanCorp, please visit our website at

www.californiabankofcommerce.com.

Contacts:

Steven E. Shelton, (510) 457-3751

Chief Executive Officer

seshelton@bankcbc.com

Thomas A. Sa, (510) 457-3775

President, Chief Financial Officer and Chief Operating Officer

tsa@bankcbc.com

Use of Non-GAAP Financial Information:

This press release contains both financial measures based on GAAP and non-GAAP.

Non-GAAP financial measures are used where management believes them to be helpful in understanding the Company’s results of operations or financial position. Where

non-GAAP financial measures are used, the comparable GAAP financial measure, as well as the reconciliation to the comparable GAAP financial measure, can be found in this press release. These disclosures should

not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies.

Forward-Looking Information:

Statements in this news

release regarding expectations and beliefs about future financial performance and financial condition, as well as trends in the Company’s business and markets are “forward-looking statements” as defined in the Private Securities

Litigation Reform Act of 1995. Forward-looking statements often include words such as “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate,” “project,”

“outlook,” or words of similar meaning, or future or conditional verbs such as “will,” “would,” “should,” “could,” or “may.” The forward-looking statements in this news release are based on

current information and on assumptions that the Company makes about future events and circumstances that are subject to a number of risks and uncertainties that are often difficult to predict and beyond the Company’s control. As a result of

those risks and uncertainties, the Company’s actual financial results in the future could differ, possibly materially, from those expressed in or implied by the forward-looking statements contained in this news release and could cause the

Company to make changes to future plans. Those risks and uncertainties include, but are not limited to, the risk of incurring loan losses, which is an inherent risk of the banking business; the risk that the Company will not be able to continue its

internal growth rate; the risk that the United States economy will experience slowed growth or recession or will be adversely affected by domestic or international economic conditions and risks associated with the Federal Reserve Board taking

actions with respect to interest rates, any of which could adversely affect, among other things, the values of real estate collateral supporting many of the Company’s loans, interest income and interest rate margins and, therefore, the

Company’s future operating results; risks associated with changes in income tax laws and regulations; and risks associated with seeking new client relationships and maintaining existing client relationships. Readers of this news release are

encouraged to review the additional information regarding these and other risks and uncertainties to which our business is subject that are contained in our Annual Report on Form 10-K for the year ended

December 31, 2022 which is on file with the Securities and Exchange Commission (the “SEC”). Additional information will be set forth in our Quarterly Report on Form 10-Q for the quarter ended

September 30, 2023, which we expect to file with the SEC during the fourth quarter of 2023, and readers of this release are urged to review the additional information that will be contained in that report.

Due to these and other possible uncertainties and risks, readers are cautioned not to place undue reliance on the forward-looking statements contained in

this news release, which speak only as of today’s date, or to make predictions based solely on historical financial performance. The Company disclaims any obligation to update forward-looking statements contained in this news release, whether

as a result of new information, future events or otherwise, except as may be required by law.

FINANCIAL TABLES FOLLOW

CALIFORNIA BANCORP AND SUBSIDIARY

SELECTED FINANCIAL INFORMATION (UNAUDITED) - PROFITABILITY

(Dollars in Thousands, Except Per Share Data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Change |

|

|

|

|

|

|

|

|

Change |

|

| |

|

Q3 2023 |

|

|

Q2 2023 |

|

|

$ |

|

|

% |

|

|

|

|

|

Q3 2022 |

|

|

$ |

|

|

% |

|

| QUARTERLY HIGHLIGHTS: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest income |

|

$ |

28,094 |

|

|

$ |

27,172 |

|

|

$ |

922 |

|

|

|

3 |

% |

|

|

|

|

|

$ |

21,168 |

|

|

$ |

6,926 |

|

|

|

33 |

% |

| Interest expense |

|

|

9,516 |

|

|

|

8,526 |

|

|

|

990 |

|

|

|

12 |

% |

|

|

|

|

|

|

2,805 |

|

|

|

6,711 |

|

|

|

239 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest income |

|

|

18,578 |

|

|

|

18,646 |

|

|

|

(68 |

) |

|

|

0 |

% |

|

|

|

|

|

|

18,363 |

|

|

|

215 |

|

|

|

1 |

% |

|

|

|

|

|

|

|

|

|

| Provision for credit losses |

|

|

314 |

|

|

|

444 |

|

|

|

(130 |

) |

|

|

-29 |

% |

|

|

|

|

|

|

800 |

|

|

|

(486 |

) |

|

|

-61 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest income after provision for credit losses |

|

|

18,264 |

|

|

|

18,202 |

|

|

|

62 |

|

|

|

0 |

% |

|

|

|

|

|

|

17,563 |

|

|

|

701 |

|

|

|

4 |

% |

|

|

|

|

|

|

|

|

|

| Non-interest income |

|

|

1,294 |

|

|

|

1,135 |

|

|

|

159 |

|

|

|

14 |

% |

|

|

|

|

|

|

1,484 |

|

|

|

(190 |

) |

|

|

-13 |

% |

| Non-interest expense |

|

|

11,851 |

|

|

|

11,603 |

|

|

|

248 |

|

|

|

2 |

% |

|

|

|

|

|

|

11,217 |

|

|

|

634 |

|

|

|

6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income before income taxes |

|

|

7,707 |

|

|

|

7,734 |

|

|

|

(27 |

) |

|

|

0 |

% |

|

|

|

|

|

|

7,830 |

|

|

|

(123 |

) |

|

|

-2 |

% |

|

|

|

|

|

|

|

|

|

| Income tax expense |

|

|

2,306 |

|

|

|

2,294 |

|

|

|

12 |

|

|

|

1 |

% |

|

|

|

|

|

|

2,308 |

|

|

|

(2 |

) |

|

|

0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

$ |

5,401 |

|

|

$ |

5,440 |

|

|

$ |

(39 |

) |

|

|

-1 |

% |

|

|

|

|

|

$ |

5,522 |

|

|

$ |

(121 |

) |

|

|

-2 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted earnings per share |

|

$ |

0.64 |

|

|

$ |

0.65 |

|

|

$ |

(0.01 |

) |

|

|

-2 |

% |

|

|

|

|

|

$ |

0.66 |

|

|

$ |

(0.02 |

) |

|

|

-3 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest margin |

|

|

3.86 |

% |

|

|

3.93 |

% |

|

|

-7 Basis Points |

|

|

|

|

|

|

|

3.94 |

% |

|

|

-8 Basis Points |

|

|

|

|

|

|

|

|

| Efficiency ratio |

|

|

59.64 |

% |

|

|

58.66 |

% |

|

|

+98 Basis Points |

|

|

|

|

|

|

|

56.52 |

% |

|

|

+312 Basis Points |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Change |

|

| |

|

Q3 2023 |

|

|

Q3 2022 |

|

|

$ |

|

|

% |

|

|

YEAR-TO-DATE

HIGHLIGHTS: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest income |

|

$ |

80,804 |

|

|

$ |

54,798 |

|

|

$ |

26,006 |

|

|

|

47 |

% |

| Interest expense |

|

|

24,824 |

|

|

|

5,686 |

|

|

|

19,138 |

|

|

|

337 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest income |

|

|

55,980 |

|

|

|

49,112 |

|

|

|

6,868 |

|

|

|

14 |

% |

|

|

|

|

|

| Provision for credit losses |

|

|

1,116 |

|

|

|

2,675 |

|

|

|

(1,559 |

) |

|

|

-58 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest income after provision for credit losses |

|

|

54,864 |

|

|

|

46,437 |

|

|

|

8,427 |

|

|

|

18 |

% |

|

|

|

|

|

| Non-interest income |

|

|

3,536 |

|

|

|

5,412 |

|

|

|

(1,876 |

) |

|

|

-35 |

% |

| Non-interest expense |

|

|

35,297 |

|

|

|

32,952 |

|

|

|

2,345 |

|

|

|

7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income before income taxes |

|

|

23,103 |

|

|

|

18,897 |

|

|

|

4,206 |

|

|

|

22 |

% |

|

|

|

|

|

| Income tax expense |

|

|

6,812 |

|

|

|

5,458 |

|

|

|

1,354 |

|

|

|

25 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

$ |

16,291 |

|

|

$ |

13,439 |

|

|

$ |

2,852 |

|

|

|

21 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted earnings per share |

|

$ |

1.93 |

|

|

$ |

1.60 |

|

|

$ |

0.33 |

|

|

|

21 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest margin |

|

|

3.94 |

% |

|

|

3.60 |

% |

|

|

+34 Basis Points |

|

|

|

|

|

| Efficiency ratio |

|

|

59.31 |

% |

|

|

60.44 |

% |

|

|

-113 Basis Points |

|

CALIFORNIA BANCORP AND SUBSIDIARY

SELECTED FINANCIAL INFORMATION (UNAUDITED) - FINANCIAL POSITION

(Dollars in Thousands, Except Per Share Data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Change |

|

|

|

|

|

|

|

|

Change |

|

| |

|

Q3 2023 |

|

|

Q2 2023 |

|

|

$ |

|

|

% |

|

|

|

|

|

Q3 2022 |

|

|

$ |

|

|

% |

|

| PERIOD-END

HIGHLIGHTS: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

1,983,917 |

|

|

$ |

2,005,646 |

|

|

$ |

(21,729 |

) |

|

|

-1 |

% |

|

|

|

|

|

$ |

2,048,501 |

|

|

$ |

(64,584 |

) |

|

|

-3 |

% |

| Gross loans |

|

|

1,573,115 |

|

|

|

1,583,631 |

|

|

|

(10,516 |

) |

|

|

-1 |

% |

|

|

|

|

|

|

1,587,901 |

|

|

|

(14,786 |

) |

|

|

-1 |

% |

| Deposits |

|

|

1,707,081 |

|

|

|

1,738,296 |

|

|

|

(31,215 |

) |

|

|

-2 |

% |

|

|

|

|

|

|

1,709,078 |

|

|

|

(1,997 |

) |

|

|

0 |

% |

| Tangible equity |

|

|

182,673 |

|

|

|

176,783 |

|

|

|

5,890 |

|

|

|

3 |

% |

|

|

|

|

|

|

156,575 |

|

|

|

26,098 |

|

|

|

17 |

% |

|

|

|

|

|

|

|

|

|

| Tangible book value per share |

|

$ |

21.76 |

|

|

$ |

21.09 |

|

|

$ |

0.67 |

|

|

|

3 |

% |

|

|

|

|

|

$ |

18.80 |

|

|

$ |

2.96 |

|

|

|

16 |

% |

|

|

|

|

|

|

|

| Tangible equity / tangible assets |

|

|

9.24 |

% |

|

|

8.85 |

% |

|

|

+39 Basis Points |

|

|

|

|

|

|

|

7.67 |

% |

|

|

+157 Basis Points |

|

| Gross loans / total deposits |

|

|

92.15 |

% |

|

|

91.10 |

% |

|

|

+105 Basis Points |

|

|

|

|

|

|

|

92.91 |

% |

|

|

-76 Basis Points |

|

| Noninterest-bearing deposits / total deposits |

|

|

40.23 |

% |

|

|

42.69 |

% |

|

|

-246 Basis Points |

|

|

|

|

|

|

|

44.39 |

% |

|

|

-416 Basis Points |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Change |

|

|

|

|

|

|

|

|

Change |

|

| |

|

Q3 2023 |

|

|

Q2 2023 |

|

|

$ |

|

|

% |

|

|

|

|

|

Q3 2022 |

|

|

$ |

|

|

% |

|

| QUARTERLY AVERAGE HIGHLIGHTS: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

1,993,147 |

|

|

$ |

1,983,877 |

|

|

$ |

9,270 |

|

|

|

0 |

% |

|

|

|

|

|

$ |

1,930,227 |

|

|

$ |

62,920 |

|

|

|

3 |

% |

| Total earning assets |

|

|

1,910,755 |

|

|

|

1,900,918 |

|

|

|

9,837 |

|

|

|

1 |

% |

|

|

|

|

|

|

1,849,242 |

|

|

|

61,513 |

|

|

|

3 |

% |

| Gross loans |

|

|

1,551,708 |

|

|

|

1,577,529 |

|

|

|

(25,821 |

) |

|

|

-2 |

% |

|

|

|

|

|

|

1,523,442 |

|

|

|

28,266 |

|

|

|

2 |

% |

| Deposits |

|

|

1,719,416 |

|

|

|

1,684,008 |

|

|

|

35,408 |

|

|

|

2 |

% |

|

|

|

|

|

|

1,592,096 |

|

|

|

127,320 |

|

|

|

8 |

% |

| Tangible equity |

|

|

181,384 |

|

|

|

175,752 |

|

|

|

5,632 |

|

|

|

3 |

% |

|

|

|

|

|

|

155,448 |

|

|

|

25,936 |

|

|

|

17 |

% |

|

|

|

|

|

|

|

| Tangible equity / tangible assets |

|

|

9.13 |

% |

|

|

8.89 |

% |

|

|

+24 Basis Points |

|

|

|

|

|

|

|

8.08 |

% |

|

|

+105 Basis Points |

|

| Gross loans / total deposits |

|

|

90.25 |

% |

|

|

93.68 |

% |

|

|

-343 Basis Points |

|

|

|

|

|

|

|

95.69 |

% |

|

|

-544 Basis Points |

|

| Noninterest-bearing deposits / total deposits |

|

|

41.59 |

% |

|

|

42.65 |

% |

|

|

-106 Basis Points |

|

|

|

|

|

|

|

46.41 |

% |

|

|

-482 Basis Points |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Change |

|

|

|

|

Q3 2023 |

|

|

|

Q3 2022 |

|

|

|

$ |

|

|

|

% |

|

| YEAR-TO-DATE

AVERAGE HIGHLIGHTS: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

1,983,839 |

|

|

$ |

1,907,661 |

|

|

$ |

76,178 |

|

|

|

4 |

% |

| Total earning assets |

|

|

1,901,933 |

|

|

|

1,826,172 |

|

|

|

75,761 |

|

|

|

4 |

% |

| Gross loans |

|

|

1,570,411 |

|

|

|

1,453,741 |

|

|

|

116,670 |

|

|

|

8 |

% |

| Deposits |

|

|

1,701,189 |

|

|

|

1,603,620 |

|

|

|

97,569 |

|

|

|

6 |

% |

| Tangible equity |

|

|

175,584 |

|

|

|

150,587 |

|

|

|

24,997 |

|

|

|

17 |

% |

|

|

|

|

| Tangible equity / tangible assets |

|

|

8.88 |

% |

|

|

7.92 |

% |

|

|

+96 Basis Points |

|

| Gross loans / total deposits |

|

|

92.31 |

% |

|

|

90.65 |

% |

|

|

+166 Basis Points |

|

| Noninterest-bearing deposits / total deposits |

|

|

42.36 |

% |

|

|

46.04 |

% |

|

|

-368 Basis Points |

|

CALIFORNIA BANCORP AND SUBSIDIARY

SELECTED INTERIM FINANCIAL INFORMATION (UNAUDITED) - ASSET QUALITY

(Dollars in Thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

09/30/23 |

|

|

06/30/23 |

|

|

03/31/23 |

|

|

12/31/22 |

|

|

09/30/22 |

|

| ALLOWANCE FOR CREDIT LOSSES (LOANS): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance, beginning of period |

|

$ |

15,722 |

|

|

$ |

15,382 |

|

|

$ |

17,005 |

|

|

$ |

16,555 |

|

|

$ |

15,957 |

|

| CECL adjustment |

|

|

— |

|

|

|

— |

|

|

|

(1,840 |

) |

|

|

— |

|

|

|

— |

|

| Provision for credit losses, quarterly |

|

|

121 |

|

|

|

340 |

|

|

|

464 |

|

|

|

1,100 |

|

|

|

800 |

|

| Charge-offs, quarterly |

|

|

(156 |

) |

|

|

— |

|

|

|

(247 |

) |

|

|

(650 |

) |

|

|

(202 |

) |

| Recoveries, quarterly |

|

|

234 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance, end of period |

|

$ |

15,921 |

|

|

$ |

15,722 |

|

|

$ |

15,382 |

|

|

$ |

17,005 |

|

|

$ |

16,555 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

09/30/23 |

|

|

06/30/23 |

|

|

03/31/23 |

|

|

12/31/22 |

|

|

09/30/22 |

|

| NONPERFORMING ASSETS: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loans accounted for on a non-accrual basis |

|

$ |

1,236 |

|

|

$ |

181 |

|

|

$ |

222 |

|

|

$ |

1,250 |

|

|

$ |

182 |

|

| Loans with principal or interest contractually past due 90 days or more and still accruing

interest |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

161 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Nonperforming loans |

|

$ |

1,236 |

|

|

$ |

181 |

|

|

$ |

222 |

|

|

$ |

1,250 |

|

|

$ |

343 |

|

| Other real estate owned |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Nonperforming assets |

|

$ |

1,236 |

|

|

$ |

181 |

|

|

$ |

222 |

|

|

$ |

1,250 |

|

|

$ |

343 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Nonperforming loans by asset type: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Commercial |

|

$ |

1,183 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

1,028 |

|

|

$ |

161 |

|

| Real estate other |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Real estate construction and land |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| SBA |

|

|

53 |

|

|

|

181 |

|

|

|

222 |

|

|

|

222 |

|

|

|

182 |

|

| Other |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Nonperforming loans |

|

$ |

1,236 |

|

|

$ |

181 |

|

|

$ |

222 |

|

|

$ |

1,250 |

|

|

$ |

343 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

09/30/23 |

|

|

06/30/23 |

|

|

03/31/23 |

|

|

12/31/22 |

|

|

09/30/22 |

|

| ASSET QUALITY: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Allowance for credit losses (loans) / gross loans |

|

|

1.01 |

% |

|

|

0.99 |

% |

|

|

0.95 |

% |

|

|

1.07 |

% |

|

|

1.04 |

% |

| Allowance for credit losses (loans) / nonperforming loans |

|

|

1288.11 |

% |

|

|

8686.19 |

% |

|

|

6928.83 |

% |

|

|

1360.40 |

% |

|

|

4826.53 |

% |

| Nonperforming assets / total assets |

|

|

0.06 |

% |

|

|

0.01 |

% |

|

|

0.01 |

% |

|

|

0.06 |

% |

|

|

0.02 |

% |

| Nonperforming loans / gross loans |

|

|

0.08 |

% |

|

|

0.01 |

% |

|

|

0.01 |

% |

|

|

0.08 |

% |

|

|

0.02 |

% |

| Net quarterly charge-offs / gross loans |

|

|

0.00 |

% |

|

|

0.00 |

% |

|

|

0.02 |

% |

|

|

0.04 |

% |

|

|

0.01 |

% |

CALIFORNIA BANCORP AND SUBSIDIARY

INTERIM CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED)

(Dollars in Thousands, Except Per Share Data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended |

|

|

Nine months ended |

|

| |

|

09/30/23 |

|

|

06/30/23 |

|

|

09/30/22 |

|

|

09/30/23 |

|

|

09/30/22 |

|

| INTEREST INCOME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loans |

|

$ |

23,804 |

|

|

$ |

23,476 |

|

|

$ |

19,084 |

|

|

$ |

69,752 |

|

|

$ |

50,268 |

|

| Federal funds sold |

|

|

2,814 |

|

|

|

2,238 |

|

|

|

867 |

|

|

|

6,811 |

|

|

|

1,283 |

|

| Investment securities |

|

|

1,476 |

|

|

|

1,458 |

|

|

|

1,217 |

|

|

|

4,241 |

|

|

|

3,247 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total interest income |

|

|

28,094 |

|

|

|

27,172 |

|

|

|

21,168 |

|

|

|

80,804 |

|

|

|

54,798 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| INTEREST EXPENSE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Deposits |

|

|

8,961 |

|

|

|

7,493 |

|

|

|

1,672 |

|

|

|

22,476 |

|

|

|

3,274 |

|

| Other |

|

|

555 |

|

|

|

1,033 |

|

|

|

1,133 |

|

|

|

2,348 |

|

|

|

2,412 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total interest expense |

|

|

9,516 |

|

|

|

8,526 |

|

|

|

2,805 |

|

|

|

24,824 |

|

|

|

5,686 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest income |

|

|

18,578 |

|

|

|

18,646 |

|

|

|

18,363 |

|

|

|

55,980 |

|

|

|

49,112 |

|

| Provision for credit losses |

|

|

314 |

|

|

|

444 |

|

|

|

800 |

|

|

|

1,116 |

|

|

|

2,675 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest income after provision for credit losses |

|

|

18,264 |

|

|

|

18,202 |

|

|

|

17,563 |

|

|

|

54,864 |

|

|

|

46,437 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NON-INTEREST INCOME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Service charges and other fees |

|

|

1,003 |

|

|

|

867 |

|

|

|

1,237 |

|

|

|

2,733 |

|

|

|

3,260 |

|

| Gain on sale of loans |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,393 |

|

| Other non-interest income |

|

|

291 |

|

|

|

268 |

|

|

|

247 |

|

|

|

803 |

|

|

|

759 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total non-interest income |

|

|

1,294 |

|

|

|

1,135 |

|

|

|

1,484 |

|

|

|

3,536 |

|

|

|

5,412 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NON-INTEREST EXPENSE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Salaries and benefits |

|

|

8,238 |

|

|

|

7,831 |

|

|

|

7,415 |

|

|

|

23,945 |

|

|

|

21,654 |

|

| Premises and equipment |

|

|

1,155 |

|

|

|

1,168 |

|

|

|

1,275 |

|

|

|

3,503 |

|

|

|

3,844 |

|

| Other |

|

|

2,458 |

|

|

|

2,604 |

|

|

|

2,527 |

|

|

|

7,849 |

|

|

|

7,454 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total non-interest expense |

|

|

11,851 |

|

|

|

11,603 |

|

|

|

11,217 |

|

|

|

35,297 |

|

|

|

32,952 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income before income taxes |

|

|

7,707 |

|

|

|

7,734 |

|

|

|

7,830 |

|

|

|

23,103 |

|

|

|

18,897 |

|

| Income taxes |

|

|

2,306 |

|

|

|

2,294 |

|

|

|

2,308 |

|

|

|

6,812 |

|

|

|

5,458 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET INCOME |

|

$ |

5,401 |

|

|

$ |

5,440 |

|

|

$ |

5,522 |

|

|

$ |

16,291 |

|

|

$ |

13,439 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EARNINGS PER SHARE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic earnings per share |

|

$ |

0.64 |

|

|

$ |

0.65 |

|

|

$ |

0.66 |

|

|

$ |

1.95 |

|

|

$ |

1.62 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted earnings per share |

|

$ |

0.64 |

|

|

$ |

0.65 |

|

|

$ |

0.66 |

|

|

$ |

1.93 |

|

|

$ |

1.60 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average common shares outstanding |

|

|

8,390,138 |

|

|

|

8,369,907 |

|

|

|

8,322,529 |

|

|

|

8,366,584 |

|

|

|

8,298,269 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average common and equivalent shares outstanding |

|

|

8,455,917 |

|

|

|

8,414,213 |

|

|

|

8,405,669 |

|

|

|

8,438,444 |

|

|

|

8,394,439 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| PERFORMANCE MEASURES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Return on average assets |

|

|

1.08 |

% |

|

|

1.10 |

% |

|

|

1.13 |

% |

|

|

1.10 |

% |

|

|

0.94 |

% |

| Return on average equity |

|

|

11.35 |

% |

|

|

11.91 |

% |

|

|

13.45 |

% |

|

|

11.90 |

% |

|

|

11.37 |

% |

| Return on average tangible equity |

|

|

11.81 |

% |

|

|

12.41 |

% |

|

|

14.09 |

% |

|

|

12.40 |

% |

|

|

11.93 |

% |

| Efficiency ratio |

|

|

59.64 |

% |

|

|

58.66 |

% |

|

|

56.52 |

% |

|

|

59.31 |

% |

|

|

60.44 |

% |

CALIFORNIA BANCORP AND SUBSIDIARY

INTERIM CONSOLIDATED BALANCE SHEETS (UNAUDITED)

(Dollars in Thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

09/30/23 |

|

|

06/30/23 |

|

|

03/31/23 |

|

|

12/31/22 |

|

|

09/30/22 |

|

| ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash and due from banks |

|

$ |

17,128 |

|

|

$ |

19,763 |

|

|

$ |

15,121 |

|

|

$ |

16,686 |

|

|

$ |

24,709 |

|

| Federal funds sold |

|

|

181,854 |

|

|

|

187,904 |

|

|

|

198,804 |

|

|

|

215,696 |

|

|

|

216,345 |

|

| Investment securities |

|

|

149,244 |

|

|

|

151,129 |

|

|

|

153,769 |

|

|

|

155,878 |

|

|

|

157,531 |

|

| Loans: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Commercial |

|

|

633,902 |

|

|

|

622,270 |

|

|

|

656,519 |

|

|

|

634,535 |

|

|

|

643,131 |

|

| Real estate other |

|

|

858,611 |

|

|

|

856,344 |

|

|

|

853,431 |

|

|

|

848,241 |

|

|

|

824,867 |

|

| Real estate construction and land |

|

|

40,003 |

|

|

|

60,595 |

|

|

|

63,928 |

|

|

|

63,730 |

|

|

|

71,523 |

|

| SBA |

|

|

4,415 |

|

|

|

4,936 |

|

|

|

5,610 |

|

|

|

7,220 |

|

|

|

8,565 |

|

| Other |

|

|

36,184 |

|

|

|

39,486 |

|

|

|

37,775 |

|

|

|

39,695 |

|

|

|

39,815 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loans, gross |

|

|

1,573,115 |

|

|

|

1,583,631 |

|

|

|

1,617,263 |

|

|

|

1,593,421 |

|

|

|

1,587,901 |

|

| Unamortized net deferred loan costs (fees) |

|

|

1,312 |

|

|

|

1,637 |

|

|

|

1,765 |

|

|

|

2,040 |

|

|

|

1,902 |

|

| Allowance for credit losses |

|

|

(15,921 |

) |

|

|

(15,722 |

) |

|

|

(15,382 |

) |

|

|

(17,005 |

) |

|

|

(16,555 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loans, net |

|

|

1,558,506 |

|

|

|

1,569,546 |

|

|

|

1,603,646 |

|

|

|

1,578,456 |

|

|

|

1,573,248 |

|

| Premises and equipment, net |

|

|

2,432 |

|

|

|

2,625 |

|

|

|

2,848 |

|

|

|

3,072 |

|

|

|

3,382 |

|

| Bank owned life insurance |

|

|

25,697 |

|

|

|

25,519 |

|

|

|

25,334 |

|

|

|

25,127 |

|

|

|

24,955 |

|

| Goodwill and core deposit intangible |

|

|

7,442 |

|

|

|

7,452 |

|

|

|

7,462 |

|

|

|

7,472 |

|

|

|

7,483 |

|

| Accrued interest receivable and other assets |

|

|

41,614 |

|

|

|

41,708 |

|

|

|

43,790 |

|

|

|

39,828 |

|

|

|

40,848 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

1,983,917 |

|

|

$ |

2,005,646 |

|

|

$ |

2,050,774 |

|

|

$ |

2,042,215 |

|

|

$ |

2,048,501 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| LIABILITIES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Deposits: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Demand noninterest-bearing |

|

$ |

686,723 |

|

|

$ |

742,160 |

|

|

$ |

740,650 |

|

|

$ |

811,671 |

|

|

$ |

758,716 |

|

| Demand interest-bearing |

|

|

28,533 |

|

|

|

29,324 |

|

|

|

30,798 |

|

|

|

37,815 |

|

|

|

35,183 |

|

| Money market and savings |

|

|

672,119 |

|

|

|

633,620 |

|

|

|

616,864 |

|

|

|

671,016 |

|

|

|

597,244 |

|

| Time |

|

|

319,706 |

|

|

|

333,192 |

|

|

|

329,298 |

|

|

|

271,238 |

|

|

|

317,935 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total deposits |

|

|

1,707,081 |

|

|

|

1,738,296 |

|

|

|

1,717,610 |

|

|

|

1,791,740 |

|

|

|

1,709,078 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Junior subordinated debt securities |

|

|

54,256 |

|

|

|

54,221 |

|

|

|

54,186 |

|

|

|

54,152 |

|

|

|

54,117 |

|

| Other borrowings |

|

|

— |

|

|

|

— |

|

|

|

75,000 |

|

|

|

— |

|

|

|

100,000 |

|

| Accrued interest payable and other liabilities |

|

|

32,465 |

|

|

|

28,894 |

|

|

|

25,417 |

|

|

|

24,069 |

|

|

|

21,248 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total liabilities |

|

|

1,793,802 |

|

|

|

1,821,411 |

|

|

|

1,872,213 |

|

|

|

1,869,961 |

|

|

|

1,884,443 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Common stock |

|

|

112,656 |

|

|

|

112,167 |

|

|

|

111,609 |

|

|

|

111,257 |

|

|

|

110,786 |

|

| Retained earnings |

|

|

78,824 |

|

|

|

73,423 |

|

|

|

68,082 |

|

|

|

62,297 |

|

|

|

54,628 |

|

| Accumulated other comprehensive loss |

|

|

(1,365 |

) |

|

|

(1,355 |

) |

|

|

(1,130 |

) |

|

|

(1,300 |

) |

|

|

(1,356 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total shareholders’ equity |

|

|

190,115 |

|

|

|

184,235 |

|

|

|

178,561 |

|

|

|

172,254 |

|

|

|

164,058 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total liabilities and shareholders’ equity |

|

$ |

1,983,917 |

|

|

$ |

2,005,646 |

|

|

$ |

2,050,774 |

|

|

$ |

2,042,215 |

|

|

$ |

2,048,501 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CAPITAL ADEQUACY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Tier I leverage ratio |

|

|

9.27 |

% |

|

|

9.01 |

% |

|

|

8.76 |

% |

|

|

7.98 |

% |

|

|

8.21 |

% |

| Tier I risk-based capital ratio |

|

|

9.34 |

% |

|

|

9.07 |

% |

|

|

8.54 |

% |

|

|

8.23 |

% |

|

|

7.98 |

% |

| Total risk-based capital ratio |

|

|

13.00 |

% |

|

|

12.73 |

% |

|

|

12.08 |

% |

|

|