BT Brands Board of Directors Authorizes Share Repurchase

June 06 2024 - 8:25AM

Business Wire

Company Forecasts Improved Results in Fiscal

2024

BT Brands, Inc. (Nasdaq: BTBD and BTBDW), a growing

multi-concept restaurant operator, today announced that its board

of directors has approved the repurchase of up to 625,000 shares,

representing approximately 10% of its outstanding common shares.

The share purchases may be made from time to time on the open

market at prevailing market prices in compliance with the

established SEC regulations regarding share repurchases. The

company expects open market repurchases under the repurchase

program will be structured to comply with Rule 10b-18 under the

Securities Exchange Act of 1934, as amended, which sets certain

restrictions on the method, timing, price and volume of open market

stock repurchases. The repurchase program does not require the

company to acquire any specific number of shares, and the company

may suspend, modify or discontinue repurchases at any time at

management’s discretion. This decision reflects BT Brands'

confidence in its future, its current cash position and its board’s

recognition of the attractive share value.

BT Brands COO, Kenneth Brimmer, commenting on expected 2024

performance, stated: "Our recent focus has been on improving

profitability at each store across all of our businesses. We

anticipate achieving positive operating cash flow and earnings in

the second half of 2024. We see restaurant operating profit for

2024 improving by approximately $1,000,000 compared to 2023 results

with an expected restaurant-level EBITDA of approximately 14% of

revenue. We also expect that repurposing the six Bagger Dave’s

locations to a different restaurant concept will commence in the

second half of 2024.

Addressing the Company’s investment in Noble Roman’s Inc, BT

Brands, CEO Gary Copperud noted that delays on the part of Noble

Roman’s in completing its required filings with the Securities and

Exchange Commission appear to have delayed the Company’s scheduling

of its annual meeting beyond the deadline set by Indiana law. BT

Brands has previously communicated to Noble Roman’s its intention

to nominate its dissident slate of directors to the Board of Noble

Roman and upon gaining board representation to assist Noble Roman

in refinancing its debt due in the first half of 2025. The goal of

BT Brands is to assist Noble Roman’s in lowering the interest

costs.

About BT Brands Inc.: BT Brands, Inc. (BTBD and BTBDW) manages a

diverse array of restaurants, encompassing Burger Time, Bagger

Dave’s Burger Tavern, Pie In The Sky Coffee and Bakery, Village

Bier Garten, Keegan’s Seafood Grille, and the newly acquired

Schnitzel Haus. The company actively seeks additional acquisitions

within the restaurant industry.

Cautionary Note Regarding Forward-Looking Statements: This press

release contains forward-looking statements within the meaning of

the U.S. Private Securities Litigation Reform Act of 1995. These

statements are based on current information and speak only as of

the date of this release. Actual results may differ materially from

those projected in the forward-looking statements. The company

disclaims any obligation to update these forward-looking

statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240605146471/en/

Kenneth W. Brimmer Chief Financial Officer BT Brands, Inc Phone:

612-229-8811 Email: kbrimmer@itsburgertime.com

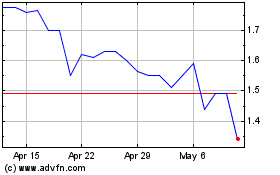

BT Brands (NASDAQ:BTBD)

Historical Stock Chart

From Nov 2024 to Dec 2024

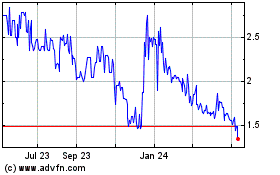

BT Brands (NASDAQ:BTBD)

Historical Stock Chart

From Dec 2023 to Dec 2024