BlackLine, Inc. (Nasdaq: BL) (“BlackLine” or the “Company”)

today announced that it has entered into a cooperation agreement

(the “agreement”) with Scalar Gauge Fund (“Scalar Gauge”) to

appoint a highly qualified and independent member to the Company’s

Board of Directors (the “Board”). In accordance with the agreement

with Scalar Gauge, the Company will appoint Scott Davidson, no

later than March 14, 2025. He will be a Class I Director with a

term expiring at the Company’s 2026 Annual Meeting.

Davidson has over 25 years of strategy, financial management,

acquisitions, and sales & marketing experience at software

companies. As the former Chief Operating Officer of Alteryx, he led

digital transformation, cloud transition, and M&A strategy.

Davidson also brings to the Board a strong understanding of

operating SaaS companies in the public markets from his tenure at

Hortonworks, where he served as the Chief Financial Officer and

Chief Operating Officer.

Owen Ryan, Chairman of the Board and Co-CEO, commented, “As we

execute on our strategy, we recognize the value of continuing to

add fresh perspectives to the Board. Our Board already has added

five new directors since 2023. The appointment of Scott is an

additional step in the ongoing refreshment of our Board as we

continue to focus on accelerating growth and long-term value

creation.”

Sumit Gautam, Founder and Portfolio Manager of Scalar Gauge,

added, “We are looking forward to the work Scott and Blackline’s

Board will do to drive shareholder value creation. Over the past

few years, the Company has built a strong foundation and is now

solidifying its go-forward priorities. We believe that adding Scott

to the Board of Directors will contribute further to BlackLine’s

strategic position and assist in the creation of value for all

BlackLine stockholders.”

As part of the agreement, Scalar Gauge has agreed to customary

standstill provisions and voting commitments during the term of the

agreement. The complete agreement will be filed by the Company with

the U.S. Securities and Exchange Commission as an exhibit to a

Current Report on Form 8-K.

About Scott DavidsonDavidson has over 25 years

of strategy, financial management, acquisitions, and sales &

marketing experience at software companies. Previously, he was the

Chief Operating Officer at Alteryx and led the company’s digital

transformation of core technologies, cloud transition, and

successful M&A strategy. Prior to this, Davidson served as the

Chief Financial Officer at Hortonworks, a public open-source data

platform company, leading the Company through its successful IPO in

2014 and beyond. As CFO and as Chief Operating Officer, he oversaw

Finance, HR, IT, Corporate Development, Sales, Marketing, and

Professional Services. In 2018, he helped lead Hortonworks’ $5.2

billion merger with Cloudera. Prior to Hortonworks, Davidson was

the CFO of Quest Software, where he drove over 30 separate

acquisitions, and held strategic financial roles at Citrix Systems,

guiding it through robust revenue growth. Davidson earned an M.B.A.

from the University of Miami.

About BlackLine BlackLine

(Nasdaq: BL), the future-ready platform for the Office of the CFO,

drives digital finance transformation by empowering organizations

with accurate, efficient, and intelligent financial operations.

BlackLine’s comprehensive platform addresses mission-critical

processes, including record-to-report and invoice-to-cash, enabling

unified and accurate data, streamlined and optimized processes, and

real-time insight through visibility, automation, and AI.

BlackLine’s proven, collaborative approach ensures continuous

transformation, delivering immediate impact and sustained value.

With a proven track record of innovation, industry-leading R&D

investment, and world-class security practices, more than 4,400

customers across multiple industries partner with BlackLine to lead

their organizations into the future.

For more information, please visit blackline.com.

About Scalar GaugeScalar Gauge is a special

situations investment firm utilizing a private equity approach in

public markets. The fund invests with a long-term view, and often

works with management teams, boards and other strategic investors

to help create shareholder value. For more information, please

visit www.scalargauge.com.

Forward-Looking StatementsThis

release contains forward-looking statements within the meaning of

the Private Securities Litigation Reform Act of 1995. In some

cases, you can identify forward-looking statements by terminology

such as “may,” “will,” “should,” “could,” “expect,” “plan,”

anticipate,” “believe,” “estimate,” “predict,” “intend,”

“potential,” “would,” “continue,” “ongoing” or the negative of

these terms or other comparable terminology. Forward-looking

statements in this release include, but are not limited to,

statements regarding BlackLine’s future financial and operational

performance.

Any forward-looking statements contained in this

press release are based upon BlackLine’s historical performance and

its current plans, estimates and expectations and are not a

representation that such plans, estimates, or expectations will be

achieved. Forward-looking statements are based on information

available at the time those statements are made and/or management’s

good faith beliefs and assumptions as of that time with respect to

future events, and are subject to risks and uncertainties. If any

of these risks or uncertainties materialize or if any assumptions

prove incorrect, actual performance or results may differ

materially from those expressed in or suggested by the

forward-looking statements. These risks and uncertainties include,

but are not limited to risks related to the Company’s ability to

attract new customers and expand sales to existing customers; the

extent to which customers renew their subscription agreements or

increase the number of users; the impact of current and future

economic uncertainty and other unfavorable conditions in the

Company's industry or the global economy, the Company’s ability to

manage growth and scale effectively, including entry into new

geographies; the Company’s ability to provide successful

enhancements, new features and modifications to its software

solutions; the Company’s ability to develop new products and

software solutions and the success of any new product and service

introductions; the Company's ability to effectively incorporate

artificial intelligence and machine learning technologies (AI/ML)

into its platform and business and the potential reputational harm

or legal liability that may result from the use of AI/ML solutions

and features; the success of the Company’s strategic relationships

with technology vendors and business process outsourcers, channel

partners and alliance partners; any breaches of the Company’s

security measures; a disruption in the Company’s hosting network

infrastructure; costs and reputational harm that could result from

defects in the Company’s solution; the loss of any key employees;

continued strong demand for the Company’s software in the

United States, Europe, Asia Pacific, and Latin

America; the Company’s ability to compete as the financial close

management provider for organizations of all sizes; the timing and

success of solutions offered by competitors; including competitors'

ability to incorporate AI/ML into products and offerings more

quickly or successfully; changes in the proportion of the Company’s

customer base that is comprised of enterprise or mid-sized

organizations; the Company’s ability to expand and effectively

manage its sales teams and their performance and productivity;

fluctuations in our financial results due to long and increasingly

variable sales cycles, failure to protect the Company’s

intellectual property; the Company’s ability to integrate acquired

businesses and technologies successfully or achieve the expected

benefits of such transactions; unpredictable and uncertain macro

and regional economic conditions; seasonality; changes in current

tax or accounting rules; cyber attacks and the risk that the

Company’s security measures may not be sufficient to secure its

customer or confidential data adequately; acts of terrorism or

other vandalism, war or natural disasters including the effects of

climate change; the impact of any determination of deficiencies or

weaknesses in our internal controls and processes; and other risks

and uncertainties described in the other filings we make with

the Securities and Exchange Commission from time to time,

including the risks described under the heading “Risk Factors” in

our Annual Report on Form 10-K for the year ended December 31,

2024 filed with the Securities and Exchange

Commission on February 21, 2025. Additional information

will also be set forth in our Quarterly Report on Form 10-Q for the

quarter ended March 31, 2025. Forward-looking statements

should not be read as a guarantee of future performance or results,

and you should not place undue reliance on such statements. Except

as required by law, we do not undertake any obligation to publicly

update or revise any forward-looking statement, whether as a result

of new information, future developments or otherwise. All of the

information in this press release is subject to completion of our

quarterly review process.

Investor Relations Contact:Matt Humphries,

CFAmatt.humphries@blackline.com

Media Contact:Samantha

Darileksamantha.darilek@blackline.com

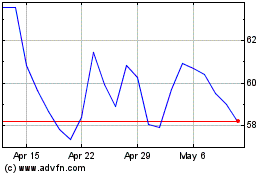

BlackLine (NASDAQ:BL)

Historical Stock Chart

From Feb 2025 to Mar 2025

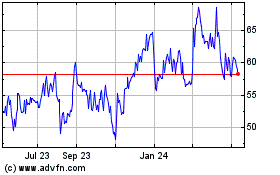

BlackLine (NASDAQ:BL)

Historical Stock Chart

From Mar 2024 to Mar 2025