July 19, 2024

Biodexa Pharmaceuticals PLC

Announces Pricing of $5.0 Million

Registered Direct Offering and Concurrent Private

Placement

Biodexa Pharmaceuticals PLC (“Biodexa” or the

“Company”) (Nasdaq: BDRX), an acquisition-focused clinical stage

biopharmaceutical company developing a pipeline of innovative

products for the treatment of diseases with unmet medical needs,

today announced that it has entered into definitive agreements with

certain institutional investors to sell an aggregate of (i)

5,050,808 American Depositary Shares (the “Depositary Shares”)

(each Depositary Share representing 400 of the Company’s ordinary

shares, nominal value £0.001 per share) and (ii) 278,975 pre-funded

warrants exercisable for Depositary Shares, at a purchase price of

$0.94 per Depositary Share (or $0.9399 per pre-funded warrant) in a

registered direct offering.

The gross proceeds from the offering are

expected to be approximately $5.0 million, before deducting

placement agent fees and other estimated offering expenses. The

Company anticipates that the proceeds of this offering will be used

to fund its development programs, including to provide the final

match payment with respect to a $17 million grant from the Cancer

Prevention Research Institute of Texas (CPRIT) and initiate the

Phase 3 clinical trial of eRapa in Familial Adenomatous Polyposis

(FAP), for working capital and for general corporate purposes.

In a concurrent private placement, the Company

has also agreed to issue and sell unregistered Series J warrants to

purchase up to an aggregate of 5,329,783 Depositary Shares (the

“Series J Warrants”) and unregistered Series K warrants to purchase

up to an aggregate of 5,329,783 Depositary Shares (the “Series K

Warrants”). The offering is expected to close on or about July 22,

2024, subject to the satisfaction of customary closing

conditions.

The pre-funded warrants have an exercise price

of $0.0001 per Depositary Share, will be immediately exercisable

and will not expire. The Series J Warrants have an exercise price

of $1.00 per Depositary Share, will be immediately exercisable and

will expire on the fifth anniversary of the issuance date. The

Series K Warrants have an exercise price of $1.00 per Depositary

Share, will be immediately exercisable and will expire on the first

anniversary of the issuance date.

Ladenburg Thalmann & Co. Inc. acted as sole

placement agent in connection with the offering.

In connection with the offering, the Company has

also agreed to amend the exercise price of existing Series E

warrants to purchase an aggregate of 978,233 Depositary Shares,

existing Series G warrants to purchase an aggregate of 2,443,995

Depositary Shares and existing Series H warrants to purchase an

aggregate of 3,236,345 Depositary Shares that were previously

issued in December 2023, May 2022 and May 2022, respectively, held

by investors participating in the offering, such that, effective

upon the closing of the offering, the amended warrants will have an

exercise price of $1.00 per share.

The Depositary Shares (or pre-funded warrants in

lieu thereof) are being offered pursuant to a shelf registration

statement on Form F-3 (File No. 333-267932), which was declared

effective by the United States Securities and Exchange Commission

(“SEC”) on October 26, 2022. A prospectus supplement relating to

the Depositary Shares and pre-funded warrants will be filed with

the SEC and will be available on the SEC’s website located at

http://www.sec.gov. Electronic copies of the prospectus supplement

relating to the registered direct offering, together with the

accompanying prospectus, may be obtained, when available, from

Ladenburg Thalmann & Co. Inc., Prospectus Department, 640 Fifth

Avenue, 4th Floor, New York, New York 10019 or by email at

prospectus@ladenburg.com.

The private placement of the Series J Warrants

and Series K Warrants are being made in a transaction not involving

a public offering and the securities to be sold in the private

placement have not been registered under the Securities Act of

1933, as amended (the “Securities Act”), or any state or other

applicable jurisdiction’s securities laws, and may not be offered

or sold in the United States absent registration or an applicable

exemption from the registration requirements of the Securities Act

and applicable state or other jurisdictions’ securities laws.

Pursuant to the securities purchase agreement, the Company has

agreed to file a registration statement with the SEC registering

the resale of the ordinary shares underlying the Depositary Shares

issuable upon the exercise of the Series J Warrants and Series K

Warrants issued in the private placement.

This press release shall not constitute an offer

to sell or the solicitation of an offer to buy these securities,

nor shall there be any offer, solicitation or sale of these

securities in any jurisdiction in which such offer, solicitation or

sale would be unlawful. Any offering of the securities under the

resale registration statement will only be made by means of a

prospectus.

About the Cancer Prevention and Research Institute of

Texas

CPRIT was created by the Texas Legislature and

approved by a statewide vote in 2007 to lead the Lone Star State’s

fight against cancer. In 2019, Texas voters again voted

overwhelmingly to continue CPRIT with an additional $3 billion for

a total $6 billion investment in cancer research and prevention. To

date, CPRIT has awarded over $3 billion in grants to Texas research

institutions and organizations through its academic research,

prevention and product development research programs. CPRIT has

also recruited more than 281 distinguished researchers to Texas,

supported the establishment, expansion or relocation of 51

companies to Texas and generated over $7.66 billion in additional

public and private investment. CPRIT funding has advanced

scientific and clinical knowledge and provided over 8.1 million

life-saving cancer prevention and early detection services to

Texans in all 254 counties. Learn more

at https://cprit.texas.gov.

About Biodexa Pharmaceuticals PLC

Biodexa Pharmaceuticals PLC (listed on NASDAQ:

BDRX) is a clinical stage biopharmaceutical company developing a

pipeline of innovative products for the treatment of diseases with

unmet medical needs. The Company’s lead development programs

include eRapa, under development for Familial Adenomatous Polyposis

and Non-Muscle Invasive Blader Cancer: tolimidone, under

development as a for the treatment of type 1 diabetes; and MTX110,

which is being studied in aggressive rare/orphan brain cancer

indications.

eRapa is a proprietary oral tablet formulation

of rapamycin, also known as sirolimus. Rapamycin is an mTOR

(mammalian Target Of Rapamycin) inhibitor. mTOR has been shown to

have a significant role in the signalling pathway that regulates

cellular metabolism, growth and proliferation and is activated

during tumorgenesis.

Tolimidone is an orally delivered, potent and

selective inhibitor of Lyn kinase. Lyn is a member of the Src

family of protein tyrosine kinases, which is mainly expressed in

hematopoietic cells, in neural tissues, liver, and adipose tissue.

Tolimidone demonstrates glycemic control via insulin sensitization

in animal models of diabetes and has the potential to become a

first in class blood glucose modulating agent.

MTX110 is a solubilised formulation of the

histone deacetylase (HDAC) inhibitor, panobinostat. This

proprietary formulation enables delivery of the product via

convection-enhanced delivery (CED) at chemotherapeutic doses

directly to the site of the tumor, by-passing the blood-brain

barrier and potentially avoiding systemic toxicity.

Biodexa is supported by three proprietary drug

delivery technologies focused on improving the bio-delivery and

bio-distribution of medicines. Biodexa’s headquarters and R&D

facility is in Cardiff, UK. For more information visit

www.biodexapharma.com.

Forward-Looking Statements

Certain statements in this announcement may

constitute “forward-looking statements” within the meaning of

legislation in the United Kingdom and/or United States. Such

statements are made pursuant to the safe harbor provisions of the

Private Securities Litigation Reform Act of 1995 and are based on

management’s belief or interpretation. All statements contained in

this announcement that do not relate to matters of historical fact

should be considered forward-looking statements including, but not

limited to, the timing, size and expectation of the closing of the

private placement, the satisfaction of customary closing conditions

related to the private placement and the anticipated use of

proceeds therefrom, and projected cash runway. In certain cases,

forward-looking statements can be identified by the use of words

such as “plans”, “expects” or “does not anticipate”, or “believes”,

or variations of such words and phrases or statements that certain

actions, events or results “may”, “could”, “would”, “might” or

“will be taken”, “occur” or “be achieved.” Forward-looking

statements and information are subject to various known and unknown

risks and uncertainties, many of which are beyond the ability of

the Company to control or predict, that may cause their actual

results, performance or achievements to be materially different

from those expressed or implied thereby, and are developed based on

assumptions about such risks, uncertainties and other factors set

out herein.

Reference should be made to those documents that

Biodexa shall file from time to time or announcements that may be

made by Biodexa in accordance with the rules and regulations

promulgated by the SEC, which contain and identify other important

factors that could cause actual results to differ materially from

those contained in any projections or forward-looking statements.

These forward-looking statements speak only as of the date of this

announcement. All subsequent written and oral forward-looking

statements by or concerning Biodexa are expressly qualified in

their entirety by the cautionary statements above. Except as may be

required under relevant laws in the United States, Biodexa does not

undertake any obligation to publicly update or revise any

forward-looking statements because of new information, future

events or events otherwise arising.

For more information, please contact:

|

Biodexa Pharmaceuticals PLC |

|

Stephen Stamp, CEO, CFOTel: +44 (0)29 20480

180www.biodexapharma.com |

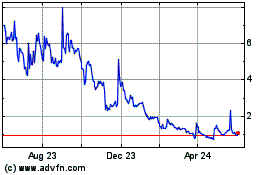

Biodexa Pharmaceuticals (NASDAQ:BDRX)

Historical Stock Chart

From Dec 2024 to Jan 2025

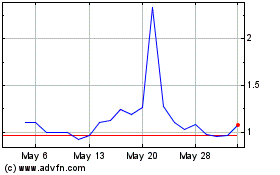

Biodexa Pharmaceuticals (NASDAQ:BDRX)

Historical Stock Chart

From Jan 2024 to Jan 2025