As filed with the Securities and Exchange Commission on September 13, 2023

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

ATHERSYS, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

20-4864095

|

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer

Identification Number)

|

3201 Carnegie Avenue

Cleveland, Ohio 44115-2634

Phone: (216) 431-9900

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Daniel A. Camardo

Chief Executive Officer

Athersys, Inc.

3201 Carnegie Avenue

Cleveland, Ohio 44115-2634

Phone: (216) 431-9900

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies To:

Faith L. Charles

Naveen Pogula

Thompson Hine LLP

300 Madison Avenue, 27th Floor

New York, New York 10017-6232

Phone: (212) 344-5680

Fax: (212) 344-6101

Approximate date of commencement of proposed sale to the public: From time to time after this Registration Statement becomes effective.

If the only securities being registered on this form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, please check the following box. ☒

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this form is a post-effective amendment to a registration statement pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

☐

|

Accelerated filer

|

☐

|

|

Non-accelerated filer

|

☒

|

Smaller reporting company

|

☒

|

| |

|

Emerging growth company

|

☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. □

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. The Selling Stockholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

|

PROSPECTUS

|

SUBJECT TO COMPLETION, DATED SEPTEMBER 13, 2023

|

Up to 15,357,692 Shares

Common Stock

Pursuant to this prospectus, the selling stockholders identified herein (the “Selling Stockholders”) are offering on a resale basis up to 15,357,692 shares of our common stock, par value $0.001 per share, issuable upon conversion of up to $15.0 million of outstanding principal and any accrued and unpaid interest under a convertible promissory note (the “Convertible Note”) that we issued to the Selling Stockholders pursuant to the terms of that certain Forbearance, Restructuring and Settlement agreement (the “Forbearance Agreement”), dated May 17, 2023, between us and the Selling Stockholders. We will not receive any of the proceeds from the sale by the Selling Stockholders of the common stock.

The Selling Stockholders may sell the shares of our common stock covered by this prospectus from time to time through any of the means described in the section of this prospectus entitled “Plan of Distribution.” The prices at which the Selling Stockholders may sell the shares will be determined by the prevailing market price for the shares or in negotiated transactions.

Our common stock is listed on The Nasdaq Capital Market under the symbol “ATHX.” On September 8, 2023, the last reported sale price for our common stock was $0.452 per share.

We may amend or supplement this prospectus from time to time to update the disclosures set forth herein.

Investing in common stock involves risk. Please read carefully the section entitled “Risk Factors” beginning on page 3 of this prospectus and any risk factors described in any applicable prospectus supplement and in the documents we incorporate by reference.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2023.

TABLE OF CONTENTS

Page

|

About This Prospectus

|

i

|

|

Summary

|

1

|

|

Risk Factors

|

3

|

|

Disclosure Regarding Forward-Looking Statements

|

3

|

|

Use of Proceeds

|

5

|

|

Selling Stockholders

|

6

|

|

Plan of Distribution

|

8

|

|

Legal Matters

|

9

|

|

Experts

|

9

|

|

Where You Can Find More Information

|

9

|

|

Information We Incorporate By Reference

|

9

|

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the U.S. Securities and Exchange Commission (the “SEC”) utilizing a “shelf” registration process. Under this shelf registration process, the Selling Stockholders may sell the securities described in this prospectus in one or more offerings. A prospectus supplement may add to, update or change the information contained in this prospectus. You should read this prospectus and any applicable prospectus supplement, together with the information incorporated herein by reference as described under the headings “Where You Can Find More Information” and “Information We Incorporate by Reference.”

You should rely only on the information that we have provided or incorporated by reference in this prospectus and any applicable prospectus supplement. We have not authorized, nor has any Selling Stockholder authorized, any dealer, salesman or other person to give any information or to make any representation other than those contained or incorporated by reference in this prospectus or any applicable prospectus supplement. You should not rely upon any information or representation not contained or incorporated by reference in this prospectus or any accompanying prospectus supplement. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you.

This prospectus and any accompanying prospectus supplement do not constitute an offer to sell or the solicitation of an offer to buy any securities other than the registered securities to which they relate, nor do this prospectus and any accompanying prospectus supplement constitute an offer to sell or the solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction. You should not assume that the information contained in this prospectus or any applicable prospectus supplement is accurate on any date subsequent to the date set forth on the front of the document or that any information we have incorporated by reference is correct on any date subsequent to the date of the document incorporated by reference, even though this prospectus or any applicable prospectus supplement is delivered or securities are sold on a later date.

References in this prospectus to the terms “we,” “us” or “the Company” or other similar terms mean Athersys, Inc. and its consolidated subsidiaries, unless we state otherwise or the context indicates otherwise.

SUMMARY

This summary highlights certain information appearing elsewhere in this prospectus and in the documents we incorporate by reference into this prospectus. The summary is not complete and does not contain all of the information that you should consider before investing in our common stock. After you read this summary, you should read and carefully consider the entire prospectus and any prospectus supplement and the more detailed information and financial statements and related notes that are incorporated by reference into this prospectus. If you invest in our shares, you are assuming a high degree of risk.

The Company

We are a biotechnology company that is focused primarily in the field of regenerative medicine. Our MultiStem® (invimestrocel) cell therapy, a patented and proprietary allogeneic stem cell product candidate, is our lead platform product and is currently in clinical development in several therapeutic and geographic areas. Our most advanced program is an ongoing Phase 3 clinical trial for the treatment of ischemic stroke. Our current clinical development programs are focused on treating neurological conditions, inflammatory and immune disorders, certain pulmonary conditions, cardiovascular disease and other conditions where the current standard of care is limited or inadequate for many patients, particularly in the critical care segment.

Corporate Information

We were incorporated in Delaware and our headquarters are located at 3201 Carnegie Avenue, Cleveland, Ohio 44115. Our telephone number is (216) 431-9900. Our website is http://www.athersys.com. The information accessible on or through our website is not part of this prospectus, other than the documents that we file with the SEC that are specifically incorporated by reference into this prospectus.

Forbearance, Restructuring and Settlement Agreement

On May 17, 2023, we and certain of our subsidiaries as guarantors entered into the Forbearance Agreement, which amends certain supply agreements between the Company and the Selling Stockholders. The Forbearance Agreement, among other things, restructures the Company’s matured and unmatured liabilities owed to the Selling Stockholders under the supply agreements. Pursuant to the terms of the Forbearance Agreement, we issued the Convertible Note to the Selling Stockholders in the principal amount of $15.0 million. The Convertible Note bears interest at a rate of 10.0% per annum, which is capitalized and added to the principal amount semi-annually on January 1 and July 1, commencing on July 1, 2023, and must be repaid in full, including accrued and unpaid interest thereunder, on (or before, subject to certain conditions) May 17, 2026. Subject to a beneficial ownership limitation of 19.99% of the Company’s outstanding common stock and any shareholder approval requirements, the Selling Stockholders may elect, at their sole discretion, to convert any outstanding principal and interest (the “Conversion Amount”) on the Convertible Note into shares of our common stock at a conversion price of $1.30 per share at any time after the 18-month anniversary of the date of issuance of the Convertible Note (or upon an event of default, as defined in the Convertible Note) until the total outstanding balance of the Convertible Note is paid.

We have agreed to file a registration statement on Form S-3 for the resale by the Selling Stockholders of the shares of common stock issuable upon conversion of the Convertible Note.

The Offering

|

Shares of common stock offered by the Selling Stockholders

|

|

Up to 15,357,692 shares of common stock

|

| |

|

|

|

Use of proceeds

|

|

We will not receive any proceeds from the sale of shares of common stock by the Selling Stockholders.

|

| |

|

|

|

Risk factors

|

|

Before investing in our securities, you should carefully read and consider the information set forth in “Risk Factors” on page 3 of this prospectus and under similar headings in any amendments or supplements to this prospectus and the documents incorporated herein by reference.

|

| |

|

|

|

Terms of the offering

|

|

Each of the Selling Stockholders will determine when and how they will sell the common stock offered in this prospectus, as described in “Plan of Distribution.”

|

| |

|

|

|

Nasdaq symbol

|

|

“ATHX”

|

Throughout this prospectus, when we refer to the shares of our common stock being registered on behalf of the Selling Stockholders for offer and sale, we are referring to the shares of our common stock issuable upon the conversion of the Convertible Note as described under the section titled “Forbearance, Restructuring and Settlement Agreement.” When we refer to the Selling Stockholders in this prospectus, we are referring to the Selling Stockholders identified in this prospectus and, as applicable, their donees, pledgees, transferees or other successors-in-interest selling shares of common stock or interests in shares of common stock received after the date of this prospectus from a Selling Stockholder as a gift, pledge, partnership distribution or other transfer.

RISK FACTORS

Investing in our common stock involves risk. Prior to making a decision about investing in our common stock, you should carefully consider the risk factors below as well as those discussed under the heading “Risk Factors” in our most recent annual report on Form 10-K, which is incorporated herein by reference and may be amended, supplemented or superseded from time to time by other reports we have filed with the SEC or will file with the SEC in the future. If any of these risks actually occurs, our business, results of operations and financial condition could suffer. In that case, the trading price of our common stock could decline, and you could lose all or a part of your investment.

Risks Related to this Offering

The sale or availability for sale of shares issuable upon conversion of the Convertible Note may depress the price of our common stock, dilute the interest of our existing stockholders, and encourage short sales by third parties, which could further depress the price of our common stock.

If converted pursuant to its terms, the Convertible Note is and any additional equity or equity-linked financings would be dilutive to our stockholders. To the extent that the Selling Stockholders sell shares of our common stock issued upon conversion of the Convertible Note, the market price of such shares may decrease due to the additional selling pressure in the market. In addition, the dilution from issuances of such shares may cause stockholders to sell their shares of our common stock, which could further contribute to any decline in the price of our common stock. Any downward pressure on the price of our common stock caused by the sale or potential sale of such shares could encourage short sales by third parties. Such sales could place downward pressure on the price of our common stock by increasing the number of shares of our common stock being sold, which could further contribute to any decline in the market price of our common stock.

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus, including the documents incorporated by reference, contains, and any prospectus supplement may contain, “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995 that involve risks and uncertainties. These forward-looking statements relate to, among other things, the timing of initiation of new clinical sites and patient enrollment in our clinical trials, the expected timetable for development of our product candidates, our growth strategy, and our future financial performance, including our operations, economic performance, financial condition, prospects, and other future events. We have attempted to identify forward-looking statements by using such words as “anticipates,” “believes,” “can,” “continue,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “should,” “suggest,” “will,” or other similar expressions. These forward-looking statements are only predictions and are largely based on our current expectations.

In addition, a number of known and unknown risks, uncertainties, and other factors could affect the accuracy of these statements. Some of the more significant known risks that we face are the risks and uncertainties inherent in the process of discovering, developing, and commercializing products that are safe and effective for use as therapeutics, including the uncertainty regarding market acceptance of our product candidates and our ability to generate revenues. The following risks and uncertainties may cause our actual results, levels of activity, performance, or achievements to differ materially from any future results, levels of activity, performance, or achievements expressed or implied by these forward-looking statements:

| |

●

|

our ability to raise capital to fund our operations in the near term and long term, including our ability to obtain funding through public or private equity offerings, debt financings, collaborations and licensing arrangements or other sources, on terms acceptable to us or at all, and to continue as a going concern;

|

| |

●

|

our collaborators’ ability and willingness to continue to fulfill their obligations under the terms of our collaboration agreements and generate sales related to our technologies;

|

| |

●

|

the possibility of unfavorable results from ongoing and additional clinical trials involving MultiStem;

|

| |

●

|

the risk that positive results in a clinical trial may not be replicated in subsequent or confirmatory trials or success in an early stage clinical trial may not be predictive of results in later stage or large scale clinical trials;

|

| |

●

|

our ability to regain compliance with the requirement to maintain a minimum market value of listed securities of $35 million as set forth in Nasdaq Listing Rule 5550(b)(2);

|

| |

●

|

the timing and nature of results from MultiStem clinical trials, including the MASTERS-2 Phase 3 clinical trial evaluating the administration of MultiStem for the treatment of ischemic stroke;

|

| |

●

|

our ability to meet milestones and earn royalties under our collaboration agreements, including the success of our collaboration with Healios;

|

| |

●

|

the success of our MACOVIA clinical trial evaluating the administration of MultiStem for the treatment of ARDS induced by COVID-19 and other pathogens, and the MATRICS-1 clinical trial being conducted with The University of Texas Health Science Center at Houston evaluating the treatment of patients with serious traumatic injuries;

|

| |

●

|

the availability of product sufficient to meet commercial demand shortly following any approval;

|

| |

●

|

the possibility of delays in, adverse results of, and excessive costs of the development process;

|

| |

●

|

our ability to successfully initiate and complete clinical trials of our product candidates;

|

| |

●

|

the possibility of delays, work stoppages or interruptions in manufacturing by third parties or us, such as due to material supply constraints, contaminations, operational restrictions due to COVID-19 or other public health emergencies, labor constraints, regulatory issues or other factors that could negatively impact our trials and the trials of our collaborators;

|

| |

●

|

uncertainty regarding market acceptance of our product candidates and our ability to generate revenues, including MultiStem cell therapy for neurological, inflammatory and immune, cardiovascular and other critical care indications;

|

| |

●

|

changes in external market factors;

|

| |

●

|

changes in our industry’s overall performance;

|

| |

●

|

changes in our business strategy;

|

| |

●

|

our ability to protect and defend our intellectual property and related business operations, including the successful prosecution of our patent applications and enforcement of our patent rights, and operate our business in an environment of rapid technology and intellectual property development;

|

| |

●

|

our possible inability to realize commercially valuable discoveries in our collaborations with pharmaceutical and other biotechnology companies;

|

| |

●

|

the success of our efforts to enter into new strategic partnerships and advance our programs;

|

| |

●

|

our possible inability to execute our strategy due to changes in our industry or the economy generally;

|

| |

●

|

changes in productivity and reliability of suppliers;

|

| |

●

|

the success of our competitors and the emergence of new competitors;

|

| |

●

|

our ability to maintain our listing on Nasdaq and meet Nasdaq’s listing requirements; and

|

| |

●

|

the risks described in our Annual Report on Form 10-K for the year ended December 31, 2022, under Item 1A, “Risk Factors” and our other filings with the SEC.

|

Any forward-looking statement you read in this prospectus, any prospectus supplement or any document incorporated by reference reflects our current views with respect to future events and is subject to these and other risks, uncertainties and assumptions relating to our operations, operating results, growth strategy and liquidity. Although we currently believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee our future results, levels of activity or performance. You should not place undue reliance on these forward-looking statements because such statements speak only as of the date when made. We undertake no obligation to publicly update forward-looking statements, whether as a result of new information, future events or otherwise, except as otherwise required by law. You are advised, however, to consult any further disclosures we make on related subjects in our reports on Forms 10-Q, 8-K and 10-K furnished to the SEC. You should understand that it is not possible to predict or identify all risk factors. Consequently, you should not consider any such list to be a complete set of all potential risks or uncertainties.

Any document incorporated by reference or any prospectus supplement may also contain statistical data and estimates we obtained from industry publications and reports generated by third parties. Although we believe that the publications and reports are reliable, we have not independently verified their data.

USE OF PROCEEDS

We will not receive any of the proceeds from any sale or other disposition of the common stock covered by this prospectus. All proceeds from the sale of the common stock will be paid directly to the Selling Stockholders. Our obligations to pay amounts otherwise due under the Convertible Note will, however, be reduced as a result of the issuance of our common stock in conversion of the Conversion Amount. The shares offered pursuant to this prospectus are currently not outstanding but are subject to issuance upon conversion of the Convertible Note held by the Selling Stockholders.

We will bear the out-of-pocket costs, expenses and fees incurred in connection with the registration of shares of our common stock to be sold by the Selling Stockholders pursuant to this prospectus including, without limitation, all registration and filing fees, Nasdaq listing fees, and fees and expenses of our counsel and our accountants. The Selling Stockholders will bear underwriting discounts, commissions, placement agent fees or other similar expenses payable with respect to its sales of shares of our common stock.

SELLING STOCKHOLDERS

The common stock being offered by the Selling Stockholders consists of up to 15,357,692 shares of our common stock issuable upon conversion of the Conversion Amount under the Convertible Note, see “Summary— Forbearance, Restructuring and Settlement Agreement” above. When we refer to the “Selling Stockholders” in this prospectus, or, if required, a post-effective amendment to the registration statement of which this prospectus is a part, we mean the Selling Stockholders, as well as any of their donees, pledgees, transferees or other successors-in-interest. The Selling Stockholders may sell all, some or none of the shares of common stock subject to this prospectus. See “Plan of Distribution” below as it may be supplemented and amended from time to time.

The number of shares of common stock issuable upon conversion of the Convertible Note represents a good faith estimate of the maximum number of shares of common stock that may be issuable upon conversion of the Convertible Note, based on $15,000,000 aggregate principal amount, plus the amount of accrued and unpaid interest, if any, that may be payable in shares of common stock in connection with the conversion thereof, at the conversion price of $1.30 per share. We assumed, for purposes hereof, that the Convertible Note will accrue interest through their applicable maturity dates at a rate of 10.0% per annum, that the Convertible Note will be fully converted to shares of common stock on its maturity date, and that we will pay applicable interest in shares of common stock upon the date of conversion of the Convertible Note. If the Convertible Note is not converted in full, if the interest on the Convertible Note is paid in cash, or if the conversion price is above $1.30 per share, the actual number of shares issuable to the respective Selling Stockholders upon conversion of the Convertible Note, if any, could be substantially more or less than the number of shares registered. This presentation is not intended to constitute an indication or prediction of the date on which the respective Selling Stockholders will convert the Conversion Amount into common stock, if at all.

Under the terms of the Convertible Note, a Selling Stockholder may not convert the Convertible Note to the extent such conversion would cause such Selling Stockholder, together with its affiliates and attribution parties, to beneficially own a number of shares of common stock which would exceed 19.99% (the “Beneficial Ownership Limitation”) of our then outstanding common stock following such conversion, excluding for purposes of such determination the shares of common stock issuable upon conversion of the Convertible Note which have not been converted. The number of shares of common stock owned prior to the offering in the second column and the number of shares of common stock owned after the offering in the fourth column do not reflect this limitation. The Selling Stockholders may sell all, some or none of their shares in this offering. See “Plan of Distribution.”

| |

|

|

|

|

|

|

|

|

|

Shares of Common Stock

Owned After Offering

|

|

| Name of Selling Stockholder |

|

Number of Shares of Common Stock Owned Prior to Offering |

|

|

Maximum

Number of Shares of Common Stock to be Sold Pursuant to this Prospectus

|

|

|

Number

|

|

|

Percentage of Outstanding Common Stock(1)

|

|

|

Lonza Netherlands B.V.(2)

|

|

|

— |

|

|

|

15,357,692 |

|

|

|

— |

|

|

|

— |

|

(1) Percentages are based on 22,501,410 shares of common stock outstanding on August 9, 2023, and assumes the issuance of all of the shares issuable under the Convertible Note, and the sale by the Selling Stockholder of all of the shares offered for resale hereby, without regard to the Beneficial Ownership Limitation.

(2) Consists of shares of common stock issuable pursuant to the conversion of the Convertible Note, without regard to the Beneficial Ownership Limitation. Lonza Group Ltd. is the ultimate sole owner of all of the outstanding equity interests of Lonza Netherlands B.V. The address of the Selling Stockholder is c/o Lonza Netherlands B.V., Urmonderbaan 20B, 6167 RD Geleen, The Netherlands.

Material Relationships

For a summary of the material relationships between us and the Selling Stockholders, see “Summary—Forbearance, Restructuring and Settlement Agreement” on page 1 of this prospectus.

PLAN OF DISTRIBUTION

Each Selling Stockholder and any of their donees, pledges, assignees and successors-in-interest may from time to time, sell any or all of their shares of common stock covered hereby on The Nasdaq Capital Market or any other stock exchange, market or trading facility on which the common stock is traded or in private transactions. These sales may be at fixed or negotiated prices. A Selling Stockholder may use any one or more of the following methods when selling shares of common stock:

| |

●

|

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

|

| |

●

|

block trades in which the broker-dealer will attempt to sell the shares as agent but may position and resell a portion of the block as principal to facilitate the transaction;

|

| |

●

|

purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

|

| |

●

|

an exchange distribution in accordance with the rules of the applicable exchange;

|

| |

●

|

privately negotiated transactions;

|

| |

●

|

settlement of short sales;

|

| |

●

|

in transactions through broker-dealers that agree with the Selling Stockholders to sell a specified number of shares of common stock at a stipulated price per share;

|

| |

●

|

through the written settlement of options or other hedging transactions, whether through an options exchange or otherwise;

|

| |

●

|

a combination of any such methods of sale; or

|

| |

●

|

any other method permitted pursuant to applicable law.

|

The Selling Stockholders may also sell shares of common stock under Rule 144 or any other exemption from registration under the Securities Act of 1933, as amended (the “Securities Act”), if available, rather than under this prospectus.

Broker‑dealers engaged by the Selling Stockholders may arrange for other brokers‑dealers to participate in sales. Broker‑dealers may receive commissions or discounts from the Selling Stockholders (or, if any broker‑dealer acts as agent for the purchaser of shares of common stock, from the purchaser) in amounts to be negotiated, but, except as set forth in a supplement to this prospectus, in the case of an agency transaction not in excess of a customary brokerage commission in compliance with Rule 2121 of the Financial Industry Regulatory Authority, or FINRA; and in the case of a principal transaction, a markup or markdown in compliance with FINRA Rule 2121.

In connection with the sale of the shares of common stock covered by this prospectus or interests therein, the Selling Stockholders may enter into hedging transactions with broker-dealers or other financial institutions, which may in turn engage in short sales of the shares of common stock in the course of hedging the positions they assume. The Selling Stockholders may also sell shares of common stock short and deliver these shares to close out their short positions, or loan or pledge the shares to broker-dealers that in turn may sell these shares. The Selling Stockholders may also enter into option or other transactions with broker-dealers or other financial institutions or create one or more derivative securities which require the delivery to such broker-dealer or other financial institution of shares of common stock covered by this prospectus, which shares such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The Selling Stockholders and any broker-dealers or agents that are involved in selling the shares of common stock covered hereby may be deemed to be “underwriters” within the meaning of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers or agents and any profit on the resale of the shares purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act. Each Selling Stockholder has informed the Company that it does not have any written or oral agreement or understanding, directly or indirectly, with any person to distribute the shares of common stock.

The Company is required to pay certain fees and expenses incurred by the Company incident to the registration of the shares of common stock covered hereby. The Company has agreed to indemnify the Selling Stockholders against certain losses, claims, damages and liabilities, including liabilities under the Securities Act.

We agreed to keep the registration statement of which this prospectus forms a part effective until no Selling Stockholder owns any common stock registered hereby. The shares of common stock will be sold only through registered or licensed brokers or dealers if required under applicable state securities laws. In addition, in certain states, the shares of common stock covered hereby may not be sold unless they have been registered or qualified for sale in the applicable state or an exemption from the registration or qualification requirement is available and is complied with.

Under applicable rules and regulations under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), any person engaged in the distribution of the shares of common stock covered hereby may not simultaneously engage in market making activities with respect to the common stock for the applicable restricted period, as defined in Regulation M, prior to the commencement of the distribution. In addition, the Selling Stockholders will be subject to applicable provisions of the Exchange Act and the rules and regulations thereunder, including Regulation M, which may limit the timing of purchases and sales of the common stock by the Selling Stockholders or any other person. We will make copies of this prospectus available to the Selling Stockholders and have informed them of the need to deliver a copy of this prospectus to each purchaser at or prior to the time of the sale (including by compliance with Rule 172 under the Securities Act).

LEGAL MATTERS

Thompson Hine LLP, New York, New York, will pass upon the validity of the securities being offered hereby.

EXPERTS

The consolidated financial statements of Athersys, Inc. appearing in Athersys, Inc.’s Annual Report (Form 10-K) for the year ended December 31, 2022 have been audited by Ernst & Young LLP, independent registered public accounting firm, as set forth in their report thereon (which contains an explanatory paragraph describing conditions that raise substantial doubt about the Company's ability to continue as a going concern as described in Note B to the consolidated financial statements) included therein, and incorporated herein by reference. Such financial statements are, and audited financial statements to be included in subsequently filed documents will be, incorporated herein in reliance upon the report of Ernst & Young LLP pertaining to such financial statements (to the extent covered by consents filed with the Securities and Exchange Commission) given on the authority of such firm as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

We are subject to the informational reporting requirements of the Exchange Act. We file reports, proxy statements and other information with the SEC. Our SEC filings are available over the Internet at the SEC’s website at http://www.sec.gov. We make available, free of charge, on our website at http://www.athersys.com, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports and statements as soon as reasonably practicable after they are filed with the SEC. The contents of our website are not part of this prospectus, and the reference to our website does not constitute incorporation by reference into this prospectus of the information contained on or through that site, other than documents we file with the SEC that are specifically incorporated by reference into this prospectus.

INFORMATION WE INCORPORATE BY REFERENCE

The SEC allows us to “incorporate by reference” into this prospectus the information in documents we file with it, which means that we can disclose important information to you by referring you to those documents. The information incorporated by reference is considered to be a part of this prospectus, and information that we file later with the SEC will automatically update and supersede this information. Any statement contained in any document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in or omitted from this prospectus or any accompanying prospectus supplement, or in any other subsequently filed document, which also is or is deemed to be incorporated by reference herein, modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

We incorporate by reference the documents listed below and any future documents that we file with the SEC (excluding any portion of such documents that are furnished and not filed with the SEC) under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act (1) after the date of the initial filing of the registration statement of which this prospectus forms a part prior to the effectiveness of the registration statement and (2) after the date of this prospectus until the offering of the securities is terminated:

| |

●

|

our Annual Report on Form 10-K for the year ended December 31, 2022, as filed with the SEC on April 3, 2023;

|

| |

●

|

our Quarterly Report on Form 10-Q for the quarter ended March 31, 2023, as filed with the SEC on May 15, 2023;

|

| |

●

|

our Quarterly Report on Form 10-Q for the quarter ended June 30, 2023, as filed with the SEC on August 16, 2023

|

| |

●

|

our Current Reports on Form 8-K filed (and/or amendments thereto) on January 5, 2023, January 25, 2023, April 14, 2023, April 18, 2023, May 23, 2023, June 28, 2023, July 5, 2023, July 14, 2023, July 31, 2023, August 8, 2023, August 10, 2023, August 11, 2023, and August 18, 2023; and

|

| |

●

|

the description of our common stock set forth in the registration statement on Form 8-A filed on December 6, 2007, as updated by Exhibit 4.1 to the Company’s Current Report on Form 8-K filed on March 24, 2022, and all amendments and reports filed for the purpose of updating that description.

|

We will not, however, incorporate by reference in this prospectus any documents or portions thereof that are not deemed “filed” with the SEC, including any information furnished pursuant to Item 2.02 or Item 7.01 of our current reports on Form 8-K unless, and except to the extent, specified in such current reports.

We will provide you with a copy of any of these filings (other than an exhibit to these filings, unless the exhibit is specifically incorporated by reference into the filing requested) at no cost, if you submit a request to us by writing or telephoning us at the following address and telephone number:

Athersys, Inc.

3201 Carnegie Avenue

Cleveland, Ohio 44115-2634

(216) 431-9900

Attn: Secretary

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution.

The following are the estimated expenses of the issuance and distribution of the securities being registered, all of which are payable by us. All of the items below, except for the registration fee, are estimates.

|

Securities and Exchange Commission (“SEC” or “Commission”) registration fee

|

|

$ |

726.89 |

|

|

Legal Fees and Expenses

|

|

|

* |

|

|

Accountant’s fees and expenses

|

|

$ |

10,000 |

|

|

Printing and Miscellaneous fees

|

|

$ |

1,000 |

|

|

Total

|

|

$ |

11,726.89 |

|

Item 15. Indemnification of Directors and Officers.

Delaware law provides that directors of a company will not be personally liable for monetary damages for breach of their fiduciary duty as directors, except for liabilities:

| |

●

|

for any breach of their duty of loyalty to the company or its stockholders;

|

| |

●

|

for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law;

|

| |

●

|

for unlawful payment of dividend or unlawful stock repurchase or redemption, as provided under Section 174 of the General Corporation Law of the State of Delaware (the “DGCL”); or

|

| |

●

|

for any transaction from which the director derived an improper personal benefit.

|

The provisions of Delaware law that relate to indemnification expressly state that the rights provided by the statute are not exclusive and are in addition to any rights provided in bylaws, by agreement, or otherwise. Our certificate of incorporation also provides that if Delaware law is amended to further eliminate or limit the liability of directors, then the liability of our directors shall be eliminated or limited, without further stockholder action, to the fullest extent permissible under Delaware law as so amended.

Our certificate of incorporation requires us to indemnify, to the fullest extent permitted by the DGCL, any and all persons we have the power to indemnify under the DGCL from and against any and all expenses, liabilities or other matters covered by the DGCL. Additionally, our certificate of incorporation requires us to indemnify each of our directors and officers in each and every situation where the DGCL permits or empowers us (but does not obligate us) to provide such indemnification, subject to the provisions of our bylaws. Our bylaws requires us to indemnify our directors to the fullest extent permitted by the DGCL, and permits us, to the extent authorized by the board of directors, to indemnify our officers and any other person we have the power to indemnify against liability, reasonable expense or other matters.

Under our certificate of incorporation, indemnification may be provided to directors and officers acting in their official capacity, as well as in other capacities. Indemnification will continue for persons who have ceased to be directors, officers, employees or agents, and will inure to the benefit of their heirs, executors and administrators. Additionally, under our certificate of incorporation, except under certain circumstances, our directors are not personally liable to us or our stockholders for monetary damages for breach of fiduciary duty as a director. At present, there is no pending litigation or proceeding involving any of our directors, officers, or employees in which indemnification is sought, nor are we aware of any threatened litigation that may result in claims for indemnification.

Our bylaws also permit us to secure insurance on behalf of any officer, director, employee, or agent for any liability arising out of actions in his or her capacity as an officer, director, employee, or agent. We have obtained an insurance policy that insures our directors and officers against losses, above a deductible amount, from specified types of claims. Finally, we have entered into indemnification agreements with most of our directors and executive officers, which agreements, among other things, require us to indemnify them and advance expenses to them relating to indemnification suits to the fullest extent permitted by law.

Item 16. Exhibits.

The following documents are exhibits to the registration statement:

|

Exhibit Number

|

|

Description

|

|

4.1

|

|

Certificate of Incorporation of Athersys, Inc., as amended as of June 20, 2013 (incorporated by reference to Exhibit 3.1 to our Quarterly Report on Form 10-Q (Commission No. 001-33876) filed with the SEC on August 13, 2013).

|

|

4.2

|

|

Certificate of Amendment to Certificate of Incorporation of Athersys, Inc., as amended as of June 7, 2017 (incorporated by reference to Exhibit 3.1 to our Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2017 (Commission No. 001-33876) filed with the SEC on August 9, 2017).

|

|

4.3

|

|

Bylaws of Athersys, Inc., as amended and restated as of March 13, 2019 (incorporated by reference to Exhibit 3.1 to our Current Report on Form 8-K (Commission No. 001-33876) filed with the Commission on March 14, 2019).

|

|

4.4

|

|

Certificate of Amendment to Certificate of Incorporation of Athersys, Inc., as amended, effective as of June 16, 2021 (incorporated by reference to Exhibit 3.3 to our Registration Statement on Form S-3 (Commission No. 333-257409) filed with the Commission on June 25, 2021).

|

|

4.5

|

|

Certificate of Amendment to Certificate of Incorporation of Athersys, Inc., as amended as of August 26, 2022 (incorporated by reference to Exhibit 3.1 to our Current Report on Form 8-K (Commission No. 001-33876) filed with the Commission on August 29, 2022).

|

|

5.1

|

|

Opinion of Thompson Hine LLP.

|

|

23.1

|

|

Consent of Thompson Hine LLP (included in Exhibit 5.1 to this Registration Statement).

|

|

23.2

|

|

Consent of Independent Registered Public Accounting Firm.

|

|

24.1

|

|

Power of Attorney (included on signature page).

|

|

107

|

|

Filing Fee Table.

|

Item 17. Undertakings.

The undersigned registrant hereby undertakes:

1. To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i) To include any prospectus required by Section 10(a)(3) of the Securities Act;

(ii) To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Filing Fee Tables” filed as an exhibit to the effective registration statement; and

(iii) To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

provided, however, that the undertakings set forth in paragraphs (1)(i), (1)(ii) and (1)(iii) do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the registrant pursuant to Section 13 or Section 15(d) of the Exchange Act that are incorporated by reference in this registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of this registration statement.

2. That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

3. To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

4. That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser:

(A) Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

(B) Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information required by Section 10(a) of the Securities Act of 1933 shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is a part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date.

The undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act of 1933, each filing of the registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in this registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-3 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Cleveland, State of Ohio, on September 13, 2023.

| |

ATHERSYS, INC.

By: /s/ Daniel A. Camardo

Daniel A. Camardo

Chief Executive Officer

|

POWER OF ATTORNEY AND SIGNATURES

Each individual whose signature appears below hereby constitutes and appoints Daniel A. Camardo as such person’s true and lawful attorney-in-fact and agent, with full power of substitution and revocation, for such person in such person’s name, place and stead, in any and all capacities, to sign any and all amendments (including post-effective amendments) to this Registration Statement (or any Registration Statement for the same offering that is to be effective upon filing pursuant to Rule 462(b) under the Securities Act of 1933), and to file the same, with all exhibits thereto, and all documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorney-in-fact and agent, and any substitute or substitutes, full power and authority to do and perform each and every act and thing requisite, necessary and/or advisable to be done in connection therewith, as fully to all intents and purposes as such person might or could do in person, hereby ratifying and confirming all that any said attorney-in-fact and agent, or any substitute or substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, this registration statement on Form S-3 has been signed below by the following persons in the capacities indicated as of September 13, 2023:

|

Signatures

|

|

Title

|

|

/s/ Daniel A. Camardo

|

|

Chief Executive Officer and Director

(Principal Executive Officer)

|

|

Daniel A. Camardo

|

|

| |

|

|

|

/s/ Kasey Rosado

|

|

Interim Chief Financial Officer

|

|

Kasey Rosado

|

|

(Principal Financial and Accounting Officer)

|

| |

|

|

|

/s/ Ismail Kola

|

|

|

|

Ismail Kola

|

|

Chairman of the Board of Directors

|

| |

|

|

|

/s/ Joseph Nolan

|

|

|

|

Joseph Nolan

|

|

Director

|

| |

|

|

|

/s/ Jane Wasman

|

|

|

|

Jane Wasman

|

|

Director

|

| |

|

|

|

/s/ Jack L. Wyszomierski

|

|

|

|

Jack L. Wyszomierski

|

|

Director

|

| |

|

|

|

/s/ Neema Mayhugh

|

|

|

|

Neema Mayhugh

|

|

Director

|

Exhibit 5.1

September 13, 2023

Athersys, Inc.

3201 Carnegie Avenue

Cleveland, Ohio 44115-2634

|

Re:

|

Registration Statement on Form S-3

|

Ladies and Gentlemen:

We have acted as counsel to Athersys, Inc., a Delaware corporation (the “Company”), in connection with the preparation and filing by the Company of its registration statement on Form S-3 (the “Registration Statement”) with the U.S. Securities and Exchange Commission (the “Commission”) under the Securities Act of 1933, as amended (the “Securities Act”), with respect to the resale by the selling stockholder named in the Registration Statement under the caption “Selling Stockholders” (the “Selling Stockholder”) of up to 15,357,692 shares (the “Shares”) of the Company’s common stock, par value $0.001 per share (the “Common Stock”), issuable upon conversion of the outstanding principal and any accrued and unpaid interest under a convertible promissory note (the “Convertible Note”) that the Company issued to the Selling Stockholder pursuant to the terms of that certain forbearance, restructuring and settlement agreement, dated May 17, 2023 (the “Forbearance Agreement”), between the Company and the Selling Stockholder.

In connection with this opinion, we have examined and relied upon the Registration Statement, the Convertible Note, the Forbearance Agreement, the Company’s certificate of incorporation, as amended, and the Company’s bylaws, each as currently in effect, a certificate of good standing, issued by the Delaware Secretary of State on September 12, 2023, and the originals or copies certified to our satisfaction of such records, documents, certificates, memoranda, and other instruments as in our judgment are necessary or appropriate to enable us to render the opinion expressed below.

In such examination and in rendering the opinion expressed below, we have assumed, without independent investigation or verification: (i) the genuineness of all signatures on all agreements, instruments, corporate records, certificates, and other documents submitted to us; (ii) the legal capacity, competency, and authority of all individuals executing documents submitted to us; (iii) the authenticity and completeness of all agreements, instruments, corporate records, certificates, and other documents submitted to us as originals; (iv) that all agreements, instruments, corporate records, certificates and other documents submitted to us as certified, electronic, facsimile, conformed, photostatic, or other copies conform to the originals thereof, and that such originals are authentic and complete; (v) the due authorization, execution, and delivery of all agreements, instruments, corporate records, certificates and other documents by all parties thereto (other than the Company); (vi) that no documents submitted to us have been amended or terminated orally or in writing, except as has been disclosed to us in writing; (vii) that the Purchase Agreement is the valid and binding obligation of each of the parties thereto, enforceable against such parties in accordance with its terms and that it has not been amended or terminated orally or in writing; and (viii) that the statements contained in the certificates and comparable documents of public officials, officers, and representatives of the Company and other persons on which we have relied for the purposes of this opinion letter are true and correct on and as of the date hereof.

Our opinion is limited to the matters stated herein and no opinion is implied or may be inferred beyond the matters expressly stated. Our opinion herein is expressed solely with respect to the federal laws of the United States and the General Corporation Law of the State of Delaware as in effect on the date hereof. We are not rendering any opinion as to compliance with any federal or state antifraud law, rule, or regulation relating to securities, or to the sale or issuance thereof. Our opinion is based on these laws as in effect on the date hereof, and we disclaim any obligation to advise you of facts, circumstances, events, or developments which hereafter may be brought to our attention and which may alter, affect, or modify the opinion expressed herein. We express no opinion as to whether the laws of any particular jurisdiction other than those identified above are applicable to the subject matter hereof.

On the basis of the foregoing, and in reliance thereon, the Shares issuable upon conversion of the Convertible Note have been duly authorized for issuance by all necessary corporate action on the part of the Company and, when issued and delivered against payment therefor upon conversion of the Convertible Note, will be validly issued, fully paid and non-assessable.

We hereby consent to the filing of this opinion as an exhibit to the Registration Statement, and to being named under the caption “Legal Matters” contained therein. In giving this consent, we do not hereby admit that we are within the category of persons whose consent is required under Section 7 of the Securities Act or the rules and regulations of the Commission promulgated thereunder.

| |

Very truly yours,

|

| |

|

| |

/s/ Thompson Hine LLP

|

| |

Thompson Hine LLP

|

Exhibit 23.2

Consent of Independent Registered Public Accounting Firm

We consent to the reference to our firm under the caption "Experts" in this Registration Statement on Form S-3 and related Prospectus of Athersys, Inc. for the registration of 15,357,692 shares of its common stock and to the incorporation by reference therein of our report dated March 31, 2023, with respect to the consolidated financial statements of Athersys, Inc. included in its Annual Report (Form 10-K) for the year ended December 31, 2022, filed with the Securities and Exchange Commission.

Cleveland, Ohio

September 13, 2023

Exhibit 107

Calculation of Filing Fee Tables

Form S-3

(Form Type)

Athersys, Inc.

(Exact Name of Registrant as Specified in its Charter)

Table 1: Newly Registered and Carry Forward Securities

| |

Security

Type

|

|

Security

Class

Title

|

|

Fee

Calculation

or Carry

Forward

Rule

|

|

Amount

Registered(2)

|

|

|

Proposed

Maximum

Offering

Price

Per

Unit

|

|

|

Maximum

Aggregate

Offering

Price

|

|

|

Fee Rate

|

|

|

Amount of

Registration

Fee

|

|

Carry

Forward

Form

Type

|

|

Carry

Forward

File

Number

|

|

Carry

Forward

Initial

effective

date

|

|

Filing Fee

Previously

Paid In

Connection

with

Unsold

Securities

to

be

Carried

Forward

|

|

Newly Registered Securities

|

|

Fees to Be Paid

|

Equity

|

|

Common stock, par value $0.001 per share

|

|

Other

|

|

|

15,357,692 |

(1) |

|

$ |

0.43 |

(3) |

|

$ |

6,596,128.71 |

|

|

|

0.00011020 |

|

|

$ |

726.89 |

|

|

|

|

|

|

|

|

| |

Total Offering Amounts

|

|

|

|

|

|

|

|

|

|

$ |

6,596,128.71 |

|

|

|

|

|

|

$ |

726.89 |

|

|

|

|

|

|

|

|

| |

Total Fees Previously Paid

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

|

| |

Total Fee Offsets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

|

| |

Net Fee Due

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

726.89 |

|

|

|

|

|

|

|

|

| |

(1)

|

Represents the maximum number of shares that may be issued upon conversion of the Convertible Note at the conversion price of $1.30 per share, without regard to the Beneficial Ownership Limitation.

|

| |

(2)

|

Pursuant to Rule 416 under the Securities Act, this registration statement shall also cover any additional shares of the registrant’s securities that become issuable by reason of any share splits, share dividends or similar transactions.

|

| |

(3)

|

Calculated solely for the purpose of determining the registration fee pursuant to Rule 457(c) and 457(g) of the Securities Act, based on the average of the high and low prices of the registrant's common stock as reported in the consolidated reporting system by the Nasdaq Capital Market on September 8, 2023.

|

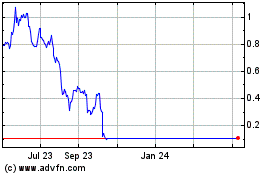

Athersys (NASDAQ:ATHX)

Historical Stock Chart

From Apr 2024 to May 2024

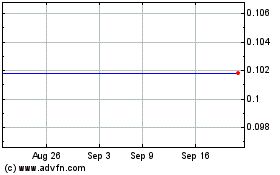

Athersys (NASDAQ:ATHX)

Historical Stock Chart

From May 2023 to May 2024