0000719135false00007191352023-08-102023-08-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

August 10, 2023

Date of Report (date of earliest event reported)

APYX MEDICAL CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

Delaware | 0-12183 | 11-2644611 |

(State or other jurisdiction of incorporation or organization) | (Commission File Number) | (I.R.S. Employer Identification No.) |

5115 Ulmerton Road, Clearwater, Florida 33760

(Address of principal executive offices, zip code)

(727) 384-2323

(Issuer's telephone number)

_____________________________________________________________

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A common stock | APYX | Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

Item 2.02 - Results of Operations and Financial Condition

On August 10, 2023, Apyx Medical Corporation (the "Company") issued a press release reporting on its results of operations for the second quarter ended June 30, 2023. A copy of that press release is attached hereto as Exhibit 99.1 and incorporated by reference herein. Such information, including the Exhibit 99.1 attached hereto, shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 - Financial Statements and Exhibits

(d)

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 99.1 | | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| Date: August 10, 2023 | Apyx Medical Corporation | |

| | | |

| | | |

| | | |

| | | |

| | | |

| By: | /s/ Tara Semb | |

| | Tara Semb | |

| | Chief Financial Officer, Secretary and Treasurer | |

Apyx Medical Corporation Reports Second Quarter 2023 Financial Results and Reaffirms Full Year 2023 Financial Outlook

Advanced Energy Sales increased 40% year-over-year in Q2

CLEARWATER, FL — August 10, 2023 - Apyx Medical Corporation (NASDAQ:APYX) (the “Company”), the manufacturer of a proprietary helium plasma and radiofrequency technology marketed and sold as Renuvion®, today reported financial results for its second quarter ended June 30, 2023, and reaffirms financial expectations for the full year ending December 31, 2023.

Second Quarter 2023 Financial Summary:

•Total revenue of $13.6 million, up 32% year-over-year.

◦Advanced Energy revenue of $11.7 million, up 40% year-over-year.

◦OEM revenue of $1.8 million, down 4% year-over-year.

•Net loss attributable to stockholders of $1.0 million, down $4.4 million, or 82%, year-over-year.

•Adjusted EBITDA loss of $1.6 million, down $1.8 million, or 52%, year-over-year.

Second Quarter 2023 Operating Summary:

•On April 28, 2023, the Company announced that it received 510(k) clearance from the U.S. Food and Drug Administration (“FDA”) “for the use of it's Renuvion technology for coagulation of subcutaneous soft tissues following liposuction for aesthetic body contouring.”

•On May 8, 2023, the Company closed on a Purchase Agreement and concurrently executed a 10-year agreement to leaseback its underlying real property for its Clearwater, FL facility with VK Acquisitions VI, LLC. The Company received net cash proceeds of approximately $6.6 million, after withholding the security deposit equal to one years rent, taxes, first months rent, expenses, and fees.

•On May 10, 2023, the FDA posted an update to the Medical Device Safety Communication (“Safety Communication”) to inform consumers and healthcare providers about the clearance for the Renuvion APR handpiece for use under the skin in certain procedures intended to improve the appearance of the skin, including for coagulation of subcutaneous soft tissues following liposuction for aesthetic body contouring. The Company believes that the May 10, 2023 FDA update to the Safety Communication addresses the remaining issues set forth in the original Safety Communication from March 14, 2022.

•On June 14, 2023, the Company announced that it received 510(k) clearance from the FDA for the Renuvion Micro Handpiece, a new addition to the Renuvion product family. The Renuvion Micro Handpiece is cleared with an indication “for the delivery of radiofrequency energy and/or helium plasma where coagulation/contraction of soft tissue is needed.” Soft tissue includes subcutaneous tissue.

Management Comments:

“Our total revenue performance in the second quarter was driven by strong sales of our Advanced Energy products, which increased 40% on a year-over-year basis and 21% on a quarter-over-quarter basis,” said Charlie Goodwin, President and Chief Executive Officer. “Our Advanced Energy sales performance in the U.S. was consistent with our expectations, increasing 38% year-over-year and benefiting, in part, from our recently obtained 510(k) clearances for new clinical indications. Meanwhile, sales to our international distributors were softer than expected, which we largely attribute to the timing of orders from certain distributor partners. Importantly, we delivered significant year-over-year reductions in our net loss attributable to stockholders and adjusted EBITDA of 82% and 52%, respectively, while securing additional capital to further strengthen our balance sheet.”

Mr. Goodwin continued: “Our team made important progress during the second quarter in addressing the FDA Safety Communication, which was initially posted in March of last year. Specifically, we secured FDA 510(k)

clearance for a new clinical indication related to our Advanced Energy products – our fourth new clinical indication in 12 months. This was followed by a related update to the FDA Safety Communication on May 10th which we believe satisfied all remaining issues in the Agency’s original communication, and we have been pleased to see subsequent improvements in the U.S. sales environment for our Advanced Energy generators. We anticipate continued improvement globally over the balance of the year and remain confident in our ability to achieve Advanced Energy sales growth in excess of 40%, coupled with significant reductions in our net loss.”

The following tables present revenue by reportable segment and geography:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Increase/Decrease | | Six Months Ended

June 30, | | Increase/Decrease |

| (In thousands) | 2023 | | 2022 | | $ Change | | % Change | | 2023 | | 2022 | | $ Change | | % Change |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Advanced Energy | $ | 11,722 | | | $ | 8,364 | | | $ | 3,358 | | | 40.1 | % | | $ | 21,412 | | | $ | 19,178 | | | $ | 2,234 | | | 11.6 | % |

| OEM | 1,847 | | | 1,928 | | | (81) | | | (4.2) | % | | 4,299 | | | 3,607 | | | 692 | | | 19.2 | % |

| Total | $ | 13,569 | | | $ | 10,292 | | | $ | 3,277 | | | 31.8 | % | | $ | 25,711 | | | $ | 22,785 | | | $ | 2,926 | | | 12.8 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Increase/Decrease | | Six Months Ended

June 30, | | Increase/Decrease |

| (In thousands) | 2023 | | 2022 | | $ Change | | % Change | | 2023 | | 2022 | | $ Change | | % Change |

| | | | | | | | | | | | | | | |

| Domestic | $ | 10,137 | | | $ | 7,947 | | | $ | 2,190 | | | 27.6 | % | | $ | 19,008 | | | $ | 15,495 | | | $ | 3,513 | | | 22.7 | % |

| International | 3,432 | | | 2,345 | | | 1,087 | | | 46.4 | % | | 6,703 | | | 7,290 | | | (587) | | | (8.1) | % |

| Total | $ | 13,569 | | | $ | 10,292 | | | $ | 3,277 | | | 31.8 | % | | $ | 25,711 | | | $ | 22,785 | | | $ | 2,926 | | | 12.8 | % |

Second Quarter 2023 Results:

Total revenue for the three months ended June 30, 2023 increased $3.3 million, or 32% year-over-year, to $13.6 million, compared to $10.3 million in the prior year period. Advanced Energy segment sales increased $3.4 million, or 40% year-over-year, to $11.7 million. OEM segment sales decreased $0.1 million, or 4% year-over-year to $1.8 million. The increase in Advanced Energy sales was primarily due to growth in domestic sales, which was driven by sales of the Company's recently launched Apyx One Console to both new and existing customers, along with contributions from increased sales of our handpieces. Advanced Energy sales also benefited from growth in international sales, driven primary by an increase in sales of generators. The decrease in OEM sales was due to decreased sales volume to existing customers. For the second quarter of 2023, revenue in the United States increased $2.2 million, or 28% year-over-year, to $10.1 million, and international revenue increased $1.1 million, or 46% year-over-year, to $3.4 million.

Gross profit for the three months ended June 30, 2023, increased $2.4 million, or 34% year-over-year, to $9.3 million, compared to $6.9 million in the prior year period. Gross margin for the three months ended June 30, 2023, was 68.4%, compared to 67.2% in the prior year period. The increase in gross profit margins for the three months ended June 30, 2023 from the prior year period is primarily attributable to changes in the sales mix between the Company's two segments, with the Advanced Energy segment comprising a higher percentage of total sales. These increases were partially offset by geographic mix within the Advanced Energy segment, with international sales comprising a higher percentage of total sales and product mix.

Operating expenses for the three months ended June 30, 2023 increased $0.3 million, or 2% year-over-year, to $13.2 million, compared to $12.9 million in the prior year period. The year-over-year change in operating expenses was driven by a $0.8 million increase in selling, general and administrative expenses, a $0.1 million increase in salaries and related costs and a $0.1 million increase in research and development expenses. These increases were partially offset by a $0.8 million decrease in professional services.

Income tax expense for the three months ended June 30, 2023 and 2022 was $0.1 million.

Net loss attributable to stockholders for the three months ended June 30, 2023 was $1.0 million, or $0.03 per share, compared to $5.4 million, or $0.16 per share, in the prior year period. Included in net loss for the three months ended June 30, 2023 was a $2.7 million gain on the sale-leaseback of our Clearwater, FL facility.

Adjusted EBITDA loss for the three months ended June 30, 2023 and 2022 was approximately $1.6 million and $3.4 million, respectively.

First Six Months of 2023 Results:

Total revenue for the six months ended June 30, 2023, increased $2.9 million, or 13%, to $25.7 million, compared to $22.8 million in the prior year period. Advanced Energy segment sales increased $2.2 million, or 12% year-over-year, to $21.4 million, compared to $19.2 million in the prior year period. OEM segment sales increased $0.7 million, or 19% year-over-year, to $4.3 million, compared to $3.6 million in the prior year period. For the first six months of 2023, revenue in the United States increased $3.5 million, or 23% year-over-year, to $19.0 million, and international revenue decreased $0.6 million, or 8% year-over-year, to $6.7 million. The increase in Advanced Energy sales was driven by domestic sales of the Company’s recently launched Apyx One Console to both new and existing customers. Growth in domestic sales was partially offset by decreased international sales of generators and handpieces due to continued business disruption related to the FDA Safety Communication. The increase in OEM sales was due to increased sales volume to existing customers, as well as incremental new sales upon the commencement of the supply arrangement related to the completion of the development portion of some of the Company’s OEM development agreements.

Net loss attributable to stockholders for the six months ended June 30, 2023 was $4.5 million, or $0.13 per share, compared to $11.4 million, or $0.33 per share, in the prior year period. Included in net loss for the six months ended June 30, 2023 was a $2.7 million gain on the sale-leaseback of our Clearwater, FL facility.

Full Year 2023 Financial Outlook:

The Company is reaffirming its financial guidance for the year ending December 31, 2023:

•Total revenue in the range of $59.0 million to $62.0 million, representing growth of approximately 33% to 39% year-over-year, compared to total revenue of $44.5 million for the year ended December 31, 2022.

◦Total revenue guidance assumes:

▪Advanced Energy revenue in the range of $51.0 million to $54.0 million, representing growth of approximately 39% to 47% year-over-year, compared to Advanced Energy revenue of $36.8 million for the year ended December 31, 2022.

▪OEM revenue of approximately $8.0 million, representing growth of approximately 4% year-over-year, compared to $7.7 million for the year ended December 31, 2022.

•Net loss attributable to stockholders of approximately $10.5 million, compared to $23.2 million for the year ended December 31, 2022.

Conference Call Details:

Management will host a conference call at 5:00 p.m. Eastern Time on August 10, 2023 to discuss the results of the quarter, and to host a question and answer session. To listen to the call by phone, interested parties may dial 877-407-8289 (or 201-689-8341 for international callers) and provide access code 13739728. Participants should ask for the Apyx Medical Corporation Call. A live webcast of the call will be accessible via the Investor Relations section of the Company’s website and at:

https://event.choruscall.com/mediaframe/webcast.html?webcastid=q73Cu5g0

A telephonic replay will be available approximately three hours after the end of the call through the following two weeks. The replay can be accessed by dialing 877-660-6853 for U.S. callers or 201-612-7415 for international callers and using the replay access code: 13739728. The webcast will be archived on the Investor Relations section of the Company’s website.

Investor Relations Contact:

ICR Westwicke on behalf of Apyx Medical Corporation

Mike Piccinino, CFA

investor.relations@apyxmedical.com

About Apyx Medical Corporation:

Apyx Medical Corporation is an advanced energy technology company with a passion for elevating people’s lives through innovative products, including its Helium Plasma Technology products marketed and sold as Renuvion® in the cosmetic surgery market and J-Plasma® in the hospital surgical market. Renuvion® and J-Plasma® offer surgeons a unique ability to provide controlled heat to tissue to achieve their desired results. The Company also leverages its deep expertise and decades of experience in unique waveforms through OEM agreements with other medical device manufacturers. For further information about the Company and its products, please refer to the Apyx Medical Corporation website at www.ApyxMedical.com.

Cautionary Statement on Forward-Looking Statements:

Certain matters discussed in this release and oral statements made from time to time by representatives of the Company may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and the Federal securities laws. Although the Company believes that the expectations reflected in such forward-looking statements are based upon reasonable assumptions, it can give no assurance that its expectations will be achieved.

All statements other than statements of historical fact are statements that could be deemed forward-looking statements, including but not limited to, any statements regarding the potential impact of the COVID-19 pandemic and the actions by governments, businesses and individuals in response to the situation; projections of net revenue, margins, expenses, net earnings, net earnings per share, or other financial items; projections or assumptions concerning the possible receipt by the Company of any regulatory approvals from any government agency or instrumentality including but not limited to the U.S. Food and Drug Administration (the “FDA”), supply chain disruptions, component shortages, manufacturing disruptions or logistics challenges; or macroeconomic or geopolitical matters and the impact of those matters on the Company’s financial performance.

Forward-looking statements and information are subject to certain risks, trends and uncertainties that could cause actual results to differ materially from those projected. Many of these factors are beyond the Company’s ability to control or predict. Important factors that may cause the Company’s actual results to differ materially and that could impact the Company and the statements contained in this release include but are not limited to risks, uncertainties and assumptions relating to the regulatory environment in which the Company is subject to, including the Company’s ability to gain requisite approvals for its products from the FDA and other governmental and regulatory bodies, both domestically and internationally; the impact of the recent FDA Safety Communication on our business and operations; factors relating to the effects of the COVID-19 pandemic; sudden or extreme volatility in commodity prices and availability, including supply chain disruptions; changes in general economic, business or demographic conditions or trends; changes in and effects of the geopolitical environment; liabilities and costs which the Company may incur from pending or threatened litigations, claims, disputes or investigations; and other risks that are described in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022 and the Company’s other filings with the Securities and Exchange Commission. For forward-looking statements in this release, the Company claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. The Company assumes no obligation to update or supplement any forward-looking statements whether as a result of new information, future events or otherwise.

| | | | | | | | |

| | |

APYX MEDICAL CORPORATION CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (In thousands, except per share data) (Unaudited) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2023 | | 2022 | | 2023 | | 2022 | | |

| Sales | $ | 13,569 | | | $ | 10,292 | | | $ | 25,711 | | | $ | 22,785 | | | |

| Cost of sales | 4,290 | | | 3,378 | | | 8,859 | | | 7,652 | | | |

| Gross profit | 9,279 | | | 6,914 | | | 16,852 | | | 15,133 | | | |

| Other costs and expenses: | | | | | | | | | |

| Research and development | 1,199 | | | 1,070 | | | 2,320 | | | 2,228 | | | |

| Professional services | 1,594 | | | 2,389 | | | 3,334 | | | 4,675 | | | |

| Salaries and related costs | 5,035 | | | 4,892 | | | 10,103 | | | 10,073 | | | |

| Selling, general and administrative | 5,378 | | | 4,539 | | | 10,633 | | | 10,004 | | | |

| | | | | | | | | |

| | | | | | | | | |

| Total other costs and expenses | 13,206 | | | 12,890 | | | 26,390 | | | 26,980 | | | |

| Gain on sale-leaseback | 2,692 | | | — | | | 2,692 | | | — | | | |

| Loss from operations | (1,235) | | | (5,976) | | | (6,846) | | | (11,847) | | | |

| Interest income | 179 | | | 18 | | | 230 | | | 20 | | | |

| | | | | | | | | |

| | | | | | | | | |

| Interest expense | (543) | | | (3) | | | (777) | | | (11) | | | |

| Other income, net | 646 | | | 607 | | | 641 | | | 586 | | | |

| Total other income, net | 282 | | | 622 | | | 94 | | | 595 | | | |

| Loss before income taxes | (953) | | | (5,354) | | | (6,752) | | | (11,252) | | | |

| Income tax expense (benefit) | 66 | | | 96 | | | (2,201) | | | 166 | | | |

| Net loss | (1,019) | | | (5,450) | | | (4,551) | | | (11,418) | | | |

| Net loss attributable to non-controlling interest | (25) | | | (24) | | | (74) | | | (47) | | | |

| Net loss attributable to stockholders | $ | (994) | | | $ | (5,426) | | | $ | (4,477) | | | $ | (11,371) | | | |

| | | | | | | | | |

| Loss per share | | | | | | | | | |

| Basic and Diluted | $ | (0.03) | | | $ | (0.16) | | | $ | (0.13) | | | $ | (0.33) | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Weighted average number of shares outstanding - basic and diluted | 34,603 | | 34,464 | | 34,600 | | 34,447 | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | |

| | |

APYX MEDICAL CORPORATION

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except share and per share data)

|

| | | | | | | | | | | |

| June 30, 2023

(Unaudited) | | December 31,

2022 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 18,479 | | | $ | 10,192 | |

| | | |

| | | |

| Trade accounts receivable, net of allowance of $555 and $668 | 12,072 | | | 10,602 | |

| Income tax receivables | 7,752 | | | 7,545 | |

| Other receivables | 315 | | | 99 | |

| Inventories, net of provision for obsolescence of $579 and $457 | 11,167 | | | 11,797 | |

| | | |

| | | |

| Prepaid expenses and other current assets | 3,100 | | | 2,737 | |

| | | |

| Total current assets | 52,885 | | | 42,972 | |

| Property and equipment, net | 2,118 | | | 6,761 | |

| Operating lease right-of-use assets | 5,421 | | | 710 | |

| Finance lease right-of-use assets | 97 | | | 115 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Other assets | 1,908 | | | 1,217 | |

| | | |

| Total assets | $ | 62,429 | | | $ | 51,775 | |

| | | |

| LIABILITIES AND EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 2,658 | | | $ | 2,669 | |

| | | |

| Accrued expenses and other liabilities | 7,114 | | | 8,928 | |

| Current portion of operating lease liabilities | 337 | | | 216 | |

| Current portion of finance lease liabilities | 28 | | | 37 | |

| Term loan, net | 8,892 | | | — | |

| Total current liabilities | 19,029 | | | 11,850 | |

| Long-term operating lease liabilities | 5,093 | | | 470 | |

| Long-term finance lease liabilities | 63 | | | 73 | |

| Long-term contract liabilities | 1,326 | | | 1,408 | |

| Other liabilities | 185 | | | 181 | |

| Total liabilities | 25,696 | | | 13,982 | |

| EQUITY | | | |

| | | |

| | | |

| | | |

| Preferred Stock, $0.001 par value; 10,000,000 shares authorized; 0 issued and outstanding as of June 30, 2023 and December 31, 2022 | — | | | — | |

| Common stock, $0.001 par value; 75,000,000 shares authorized; 34,628,517 issued and outstanding as of June 30, 2023 and 34,597,822 issued and outstanding as of December 31, 2022 | 35 | | | 35 | |

| Additional paid-in capital | 76,773 | | | 73,282 | |

| Accumulated deficit | (40,212) | | | (35,735) | |

| Total stockholders' equity | 36,596 | | | 37,582 | |

| Non-controlling interest | 137 | | | 211 | |

| Total equity | 36,733 | | | 37,793 | |

| Total liabilities and equity | $ | 62,429 | | | $ | 51,775 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | | | | | | |

| | |

APYX MEDICAL CORPORATION

RECONCILIATION OF GAAP NET LOSS RESULTS TO NON-GAAP ADJUSTED EBITDA

(Unaudited)

|

Use of Non-GAAP Financial Measure

We present the following non-GAAP measure because we believe such measure is a useful indicator of our operating performance. Our management uses this non-GAAP measure principally as a measure of our operating performance and believes that this measure is useful to investors because it is frequently used by analysts, investors and other interested parties to evaluate companies in our industry. We also believe that this measure is useful to our management and investors as a measure of comparative operating performance from period to period. The non-GAAP financial measure presented in this release should not be considered as a substitute for, or preferable to, the measures of financial performance prepared in accordance with GAAP.

The Company has presented the following non-GAAP financial measure in this press release: adjusted EBITDA. The Company defines adjusted EBITDA as its reported net income (loss) attributable to stockholders (GAAP) plus income tax expense (benefit), interest, depreciation and amortization, stock-based compensation expense and other significant non-recurring items.

| | | | | | | | | | | | | | | | | | | | | | | |

| (In thousands) | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Net loss attributable to stockholders | $ | (994) | | | $ | (5,426) | | | $ | (4,477) | | | $ | (11,371) | |

| Interest income | (179) | | | (18) | | | (230) | | | (20) | |

| Interest expense | 543 | | | 3 | | | 777 | | | 11 | |

| Income tax expense (benefit) | 66 | | | 96 | | | (2,201) | | | 166 | |

| Depreciation and amortization | 151 | | | 247 | | | 354 | | | 472 | |

| Stock based compensation | 1,482 | | | 1,714 | | | 2,849 | | | 3,364 | |

| Gain on sale-leaseback | (2,692) | | | — | | | (2,692) | | | — | |

| Adjusted EBITDA | $ | (1,623) | | | $ | (3,384) | | | $ | (5,620) | | | $ | (7,378) | |

| | | | | | | |

| | | | | | | |

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

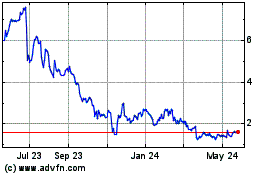

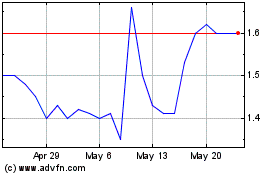

Apyx Medical (NASDAQ:APYX)

Historical Stock Chart

From Apr 2024 to May 2024

Apyx Medical (NASDAQ:APYX)

Historical Stock Chart

From May 2023 to May 2024