Filed pursuant to Rule 424(b)(5)

Registration No. 333-275345

PROSPECTUS SUPPLEMENT

(To Prospectus dated November 6, 2023)

$1,700,000,000

American Electric Power Company, Inc.

Common Stock

This prospectus supplement and the accompanying prospectus relate to the offer and sale from time to time of shares of our common stock, having an aggregate offering price of up to $1,700,000,000 through Barclays Capital Inc. (“Barclays”), BofA Securities, Inc. (“BofA Securities”), Citigroup Global Markets Inc. (“Citigroup”), Mizuho Securities USA LLC (“Mizuho”), MUFG Securities Americas Inc. (“MUFG”), Scotia Capital (USA) Inc. (“Scotiabank”) and Wells Fargo Securities, LLC (“Wells Fargo”) as our agents under an at-the-market distribution agreement. We refer to Barclays, BofA Securities, Citigroup, Mizuho, MUFG, Scotiabank and Wells Fargo collectively as the sales agents. The distribution agreement provides that, in addition to the issuance and sale of common stock by us through the sales agents acting as sales agents or directly to the sales agents acting as principals, we also may enter into forward sale agreements, between us and affiliates of each of Barclays, BofA Securities, Citigroup, Mizuho, MUFG, Scotiabank or Wells Fargo. We refer to these affiliated entities, when acting in such capacity, as forward purchasers. In connection with each such forward sale agreement, the relevant forward purchaser will, at our request, borrow from third parties and, through the relevant sales agent, sell a number of shares of our common stock equal to the number of shares of our common stock that will underlie such forward sale agreement to hedge its exposure under such forward sale agreement. We refer to sales agents, when acting as agents for forward purchasers, as forward sellers. In no event will the aggregate number of shares of our common stock sold through the sales agents, each as an agent for us, as principal and as a forward seller, under the distribution agreement have an aggregate sales price in excess of $1,700,000,000. The offering of common stock pursuant to the distribution agreement will terminate upon the earlier of (1) the sale, under the distribution agreement, of shares of our common stock with an aggregate sales price of $1,700,000,000, and (2) the termination of the distribution agreement, pursuant to its terms, by either all of the sales agents or us.

We will not initially receive any proceeds from the sale of borrowed shares of our common stock by a forward seller. In the event of full physical settlement of each forward sale agreement (by delivery of our common stock) with the relevant forward purchaser on one or more dates specified by us on or prior to the maturity date of the relevant forward sale agreement, we expect to receive aggregate cash proceeds equal to the product of the initial forward sale price under such forward sale agreement and the number of shares of our common stock underlying such forward sale agreement, subject to the price adjustment and other provisions of such forward sale agreement. If, however, we elect to cash settle or net share settle a forward sale agreement, we may not receive any proceeds (in the case of cash settlement) or will not receive any proceeds (in the case of net share settlement), and we may owe cash (in the case of cash settlement) or shares of our common stock (in the case of net share settlement) to the relevant forward purchaser.

The shares of our common stock will be offered at market prices prevailing at the time of sale in “at the market offerings,” as defined in Rule 415 of the Securities Act, including sales made directly on the Nasdaq Global Select Market, the existing trading market for shares of our common stock, or sales made to or through a market maker or through an electronic communications network or by such other methods, including privately negotiated transactions (including block transactions), as we and any sales agent agree to in writing. We will pay each sales agent a commission equal to up to 2% of the sales price of all shares of our common stock sold through it as our sales agent under the distribution agreement. In connection with each forward sale agreement, the relevant forward seller will receive, reflected in a reduced initial forward sale price payable by the relevant forward purchaser under its forward sale agreement, a commission equal to up to 2% of the volume weighted average of the sales prices of all borrowed shares of our common stock sold during the applicable period by it as a forward seller.

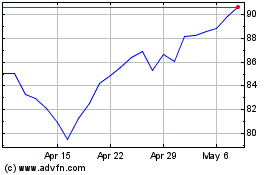

Our common stock is listed on the Nasdaq Global Select Market under the symbol “AEP”. The last reported sale price of our common stock on November 15, 2023 was $76.53 per share.

Investing in our common stock involves certain risks. See the Section entitled “Risk Factors” on page S-3 of this Prospectus Supplement for more information. Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

| | | | | | | | | | | |

| Barclays | BofA Securities | Citigroup | Mizuho |

| MUFG | Scotiabank | Wells Fargo Securities |

The date of this prospectus supplement is November 16, 2023.

We urge you to carefully read this prospectus supplement and the accompanying prospectus, which describe the terms of the offering of the common stock, as well as the information incorporated by reference herein and therein, before you make your investment decision. You should rely only on the information contained in or incorporated by reference in this prospectus supplement, the accompanying prospectus and any related free writing prospectus required to be filed with the Securities and Exchange Commission (“SEC”). We have not, nor have the sales agents, the forward sellers or the forward purchasers, authorized anyone else to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not, and the sales agents are not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information appearing in this prospectus supplement and the accompanying prospectus is accurate as of any date other than the date on the front of those documents or that the information incorporated by reference is accurate as of any date other than the date that the document incorporated by reference was filed with the SEC.

TABLE OF CONTENTS

Prospectus Supplement

| | | | | |

| | Page |

| S-ii |

| S-iii |

| S-1 |

| S-1 |

| S-2 |

| S-3 |

| S-5 |

| S-6 |

| S-9 |

| S-11 |

| S-16 |

| S-16 |

Prospectus

| | | | | |

| | Page |

| 2 |

| 2 |

| 2 |

| 3 |

| 4 |

| 4 |

| 9 |

| 10 |

| 12 |

| 18 |

| 19 |

| 22 |

| 23 |

| 23 |

WHERE YOU CAN FIND MORE INFORMATION

Available Information

This prospectus supplement and the accompanying prospectus are part of a registration statement we filed with the Securities and Exchange Commission (“SEC”). We also file annual, quarterly and special reports and other information with the SEC. You may also examine our SEC filings through the SEC’s website at http://www.sec.gov.

The SEC allows us to “incorporate by reference” the information we file with them, which means that we can disclose important information to you by referring you to those documents. The information incorporated by reference is considered to be part of this prospectus supplement and the accompanying prospectus, and later information that we file with the SEC will automatically update and supersede this information. We incorporate by reference the documents listed below and any future filings made with the SEC under Sections 13(a), 13(c), 14, or 15(d) of the Securities Exchange Act of 1934, as amended (the “1934 Act”) until we sell all the common stock.

•Annual Report on Form 10-K for the year ended December 31, 2022; •Current Reports on Form 8-K filed March 1, 2023, March 13, 2023, April 4, 2023, April 17, 2023 (Item 1.01 and Item 1.02 only), April 28, 2023, May 26, 2023 (Exhibit 99.1 to such report recasts certain financial information contained in the Annual Report and supersedes such disclosure), June 2, 2023, August 21, 2023, September 19, 2023 and October 2, 2023.

You may request a copy of these filings, at no cost, by writing or telephoning us at the following address:

Investor Relations

American Electric Power Service Corporation

1 Riverside Plaza

Columbus, Ohio 43215

Telephone: 614-716-1000

You should rely only on the information incorporated by reference or provided in this prospectus supplement, the accompanying prospectus and in any written communication from us or any sales agent specifying the final terms of the offering. We have not authorized anyone else to provide you with different information. We are not making an offer of the common stock in any state or jurisdiction where the offer is not permitted. You should assume that the information appearing in this prospectus supplement and the accompanying prospectus is accurate as of the date on their respective covers.

FORWARD LOOKING INFORMATION

Some of the information contained or incorporated by reference in this prospectus supplement and in the accompanying prospectus are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements may be identified by words such as "expect," "anticipate," "intend," "plan," "believe," "will," "should," "could," "would," "project," "continue" and similar expressions, and include statements reflecting future results or guidance and statements of outlook. These matters are subject to risks and uncertainties that could cause actual results to differ materially from those projected. Forward-looking statements in this document are presented as of the date of this document or the date of the document incorporated by reference, as applicable. Except to the extent required by applicable law, we undertake no obligation to update or revise any forward-looking statement. Among the factors that could cause actual results to differ materially from those in the forward-looking statements are:

•Changes in economic conditions, electric market demand and demographic patterns in AEP service territories.

•The impact of pandemics and any associated disruption of AEP’s business operations due to impacts on economic or market conditions, costs of compliance with potential government regulations, electricity usage, supply chain issues, customers, service providers, vendors and suppliers.

•The economic impact of increased global trade tensions including the conflicts in Ukraine and the Middle East, and the adoption or expansion of economic sanctions or trade restrictions.

•Inflationary or deflationary interest rate trends.

•Volatility and disruptions in financial markets precipitated by any cause, including failure to make progress on federal budget or debt ceiling matters or instability in the banking industry; particularly developments affecting the availability or cost of capital to finance new capital projects and refinance existing debt.

•The availability and cost of funds to finance working capital and capital needs, particularly (i) if expected sources of capital, such as proceeds from the sale of assets, subsidiaries or tax credits, do not materialize or do not materialize at the level anticipated, and (ii) during periods when the time lag between incurring costs and recovery is long and the costs are material.

•Decreased demand for electricity.

•Weather conditions, including storms and drought conditions, and the ability to recover significant storm restoration costs.

•Limitations or restrictions on the amounts and types of insurance available to cover losses that might arise in connection with natural disasters or operations.

•The cost of fuel and its transportation, the creditworthiness and performance of fuel suppliers and transporters and the cost of storing and disposing of used fuel, including coal ash and spent nuclear fuel.

•The availability of fuel and necessary generation capacity, the performance of generation plants.

•The ability to recover fuel and other energy costs through regulated or competitive electric rates.

•The ability to transition from fossil generation and the ability to build or acquire renewable generation, transmission lines and facilities (including the ability to obtain any necessary regulatory approvals and permits) when needed at acceptable prices and terms, including favorable tax treatment, cost caps imposed by regulators and other operational commitments to regulatory commissions and customers for renewable generation projects, and to recover all related costs.

•New legislation, litigation or government regulation, including changes to tax laws and regulations, oversight of nuclear generation, energy commodity trading and new or heightened requirements for reduced emissions of sulfur, nitrogen, mercury, carbon, soot or particulate matter and other substances that could impact the continued operation, cost recovery and/or profitability of generation plants and related assets.

•The impact of federal tax legislation on results of operations, financial condition, cash flows or credit ratings.

•The risks before, during and after generation of electricity associated with the fuels used or the byproducts and wastes of such fuels, including coal ash and spent nuclear fuel.

•Timing and resolution of pending and future rate cases, negotiations and other regulatory decisions, including rate or other recovery of new investments in generation, distribution and transmission service and environmental compliance.

•Resolution of litigation or regulatory proceedings or investigations.

•The ability to constrain operation and maintenance costs.

•Prices and demand for power generated and sold at wholesale.

•Changes in technology, particularly with respect to energy storage and new, developing, alternative or distributed sources of generation.

•The ability to recover through rates any remaining unrecovered investment in generation units that may be retired before the end of their previously projected useful lives.

•Volatility and changes in markets for coal and other energy-related commodities, particularly changes in the price of natural gas.

•The impact of changing expectations and demands of customers, regulators, investors and stakeholders, including heightened emphasis on environmental, social and governance concerns.

•Changes in utility regulation and the allocation of costs within regional transmission organizations, including Electric Reliability Council of Texas regional transmission organization, Pennsylvania – New Jersey – Maryland regional transmission organization and Southwest Power Pool regional transmission organization.

•Changes in the creditworthiness of the counterparties with contractual arrangements, including participants in the energy trading market.

•Actions of rating agencies, including changes in the ratings of debt.

•The impact of volatility in the capital markets on the value of the investments held by the pension, other postretirement benefit plans, captive insurance entity and nuclear decommissioning trust and the impact of such volatility on future funding requirements.

•Accounting standards periodically issued by accounting standard-setting bodies.

•Other risks and unforeseen events, including wars and military conflicts, the effects of terrorism (including increased security costs), embargoes, wildfires, cyber-security threats and other catastrophic events.

•The ability to attract and retain the requisite work force and key personnel.

In light of these risks, uncertainties and assumptions, the forward-looking statements contained or incorporated by reference in this prospectus supplement might not occur. Neither AEP nor the sales agents undertake any obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

ABOUT THIS PROSPECTUS SUPPLEMENT

This document is in two parts. The first part is this prospectus supplement, which describes the specific terms of this offering of common stock and also adds to and updates information contained in the accompanying prospectus and the documents incorporated by reference in this prospectus supplement and the accompanying prospectus. The second part is the accompanying prospectus, which gives more general information, some of which does not apply to the common stock. If the description of the common stock varies between this prospectus supplement and the accompanying prospectus, you should rely on the information in this prospectus supplement.

You should rely only on the information contained or incorporated by reference in this prospectus supplement and in the accompanying prospectus and in any written communication from the Company or the sales agents specifying the final terms of the offering. We have not, and the sales agents have not, authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. You should assume that the information appearing in this prospectus supplement and the accompanying prospectus is accurate as of the date on their respective covers. Our business, financial condition, results of operations and prospects may have changed since those dates.

The following information supplements, and should be read together with, the information contained in the accompanying prospectus. You should carefully read this prospectus supplement and the accompanying prospectus as well as the documents they incorporate by reference, before making an investment decision.

Unless we state otherwise or the context otherwise requires, references appearing in this prospectus supplement to “AEP”, the “Company”, “we”, “us” and “our” should be read to refer to American Electric Power Company, Inc. and its subsidiaries.

AMERICAN ELECTRIC POWER COMPANY, INC.

We are a public utility holding company that owns, directly or indirectly, all of the outstanding common stock of our domestic electric utility subsidiaries and varying percentages of other subsidiaries. Substantially all of our operating revenues derive from the furnishing of electric service. We were incorporated under the laws of New York in 1906 and reorganized in 1925. Our principal executive offices are located at 1 Riverside Plaza, Columbus, Ohio 43215, and our telephone number is (614) 716-1000.

We own, directly or indirectly, all the outstanding common stock of the following operating public utility companies: AEP Texas Inc., Appalachian Power Company, Indiana Michigan Power Company, Kentucky Power Company, Kingsport Power Company, Ohio Power Company, Public Service Company of Oklahoma, Southwestern Electric Power Company and Wheeling Power Company. These operating public utility companies supply electric service in portions of Arkansas, Indiana, Kentucky, Louisiana, Michigan, Ohio, Oklahoma, Tennessee, Texas, Virginia and West Virginia. We also own all of the membership interests of AEP Transmission Holding Company, LLC, a holding company for our transmission operation joint ventures and for seven transmission-only electric utilities, each of which is geographically aligned with our utility operations.

THE OFFERING

| | | | | |

| Issuer | American Electric Power Company, Inc., a New York corporation |

| | |

| Common stock offered by us | Shares of our common stock, having aggregate sales proceeds of up to $1,700,000,000. |

| | |

| Use of proceeds | We intend to use the net proceeds of this offering for general corporate purposes. |

| | |

| | We will not initially receive any proceeds from the sale of borrowed shares of our common stock by the forward sellers, as agents for the forward purchasers, in connection with any forward sale agreement as a hedge of the relevant forward purchaser’s exposure under such forward sale agreement. See “Use of Proceeds” herein. |

| | |

| Dividend policy | We have historically paid quarterly dividends on our common stock. Future dividends may vary depending upon AEP’s profit levels, operating cash flow levels and capital requirements, as well as financial and other business conditions existing at the time. |

| | |

| Listing | Our common stock is listed on the Nasdaq Global Select Market under the symbol “AEP”. |

| | |

| Accounting treatment | Before any issuance of shares of our common stock upon settlement of any forward sale agreement, we expect that the shares issuable upon settlement of such forward sale agreement will be reflected in our diluted earnings per share calculations using the treasury stock method. Under this method, the number of shares of our common stock used in calculating diluted earnings per share is deemed to be increased by the excess, if any, of the number of shares that would be issued upon full physical settlement of such forward sale agreement over the number of shares that could be purchased by us in the market (based on the average market price of our common stock during the applicable reporting period) using the proceeds receivable upon full physical settlement (based on the adjusted forward sale price at the end of the reporting period). Consequently, we anticipate there will be no dilutive effect on our earnings per share except during periods when the average market price of shares of our common stock is above the applicable adjusted forward sale price subject to increase or decrease based on the overnight bank funding, less a spread, and subject to decrease by amounts related to expected dividends on shares of our common stock during the term of the relevant forward sale agreement. However, if we decide to physically settle or net share settle any forward sale agreement, delivery of our shares to the relevant forward purchaser on the physical settlement or net share settlement of the forward sale agreement would result in dilution to our earnings per share and return on equity. |

| | |

| Risk factors | An investment in our common stock involves various risks, and prospective investors should carefully consider the matters discussed under the caption entitled “Risk Factors” beginning on page S-3 of this prospectus supplement, beginning on page 2 of the accompanying prospectus, in “Item 1A. Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2022 and in our Quarterly Report on Form 10-Q for the quarter ended September 30, 2023. |

RISK FACTORS

Investing in our common stock involves a high degree of risk. You should carefully consider the risks and uncertainties described below as well as any cautionary language or other information contained or incorporated by reference in this prospectus supplement and the accompanying prospectus, including “Item 1A. Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2022 and in our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2023, June 30, 2023 and September 30, 2023 before investing in the common stock, as well as the further risk factors we provide below. Before making an investment decision, you should carefully consider these risks as well as other information contained or incorporated by reference in this prospectus supplement and the accompanying prospectus. The risks and uncertainties described are those presently known to us.

Risk Factors Relating to Our Business

You should carefully consider the risks and uncertainties described below as well as any cautionary language or other information contained or incorporated by reference in this prospectus supplement and the accompanying prospectus, including “Item 1A. Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2022 and in our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2023, June 30, 2023 and September 30, 2023 before investing in the common stock. In addition, we provide the following risk factor.

Risk Factors Relating to Our Common Stock

There may be future sales or other dilution of our equity, which may adversely affect the market price of our common stock.

Except as described under “Plan of Distribution (Conflicts of Interest),” we are not restricted from issuing additional shares of our common stock, including any securities that are convertible into or exchangeable for, or that represent the right to receive, our common stock. The market price of our common stock could decline as a result of sales of shares of our common stock or sales of such other securities made after this offering or the perception that such sales could occur.

The price of our common stock may fluctuate significantly.

The price of our common stock on the Nasdaq constantly changes. We expect that the market price of our common stock will continue to fluctuate.

Our stock price may fluctuate as a result of a variety of factors, many of which are beyond our control. These factors include:

• periodic variations in our operating results or the quality of our assets;

• operating results that vary from the expectations of securities analysts and investors;

• changes in expectations as to our future financial performance;

• announcements of innovations, new products, strategic developments, significant contracts, acquisitions, divestitures and other material events by us or our competitors;

• the operating and securities price performance of other companies that investors believe are comparable to us;

• future sales of our equity or equity-related securities; and

• changes in U.S. and global financial markets and economies and general market conditions, such as interest or foreign exchange rates, stock, commodity or real estate valuations or volatility.

In addition, in recent years, the stock market in general has experienced periods of extreme price and volume fluctuations. This volatility has had a significant effect on the market price of securities issued by many companies, including for reasons unrelated to their operating performance. These broad market fluctuations may adversely affect our stock price regardless of our operating results.

Settlement provisions contained in any forward sale agreement subject us to certain risks.

A forward purchaser will have the right to accelerate a forward sale agreement that it enters into with us and require us to physically settle such forward sale agreement (with respect to all or any portion of the transaction under such forward sale agreement that such forward purchaser determines is affected by such event) on a date specified by such forward purchaser if:

• in such forward purchaser’s commercially reasonable judgment, it or its affiliate is unable to hedge its exposure under such forward sale agreement because (x) insufficient shares of our common stock have been made available for borrowing by securities lenders or (y) the forward purchaser or its affiliate would incur a stock borrowing cost in excess of a specified threshold;

• we declare any dividend, issue or distribution on shares of our common stock

• payable in cash in excess of specified amounts,

• that constitutes an extraordinary dividend under the forward sale agreement,

• payable in securities of another company as a result of a spinoff or similar transaction, or

• of any other type of securities (other than our common stock), rights, warrants or other assets for payment (cash or other consideration) at less than the prevailing market price;

• certain ownership thresholds applicable to such forward purchaser and its affiliates are exceeded;

• an event is announced that if consummated would result in a specified extraordinary event (including certain mergers or tender offers, as well as certain events involving our nationalization, a delisting of our common stock, or change in law); or

• certain other events of default or termination events occur, including, among others, any material misrepresentation made in connection with such forward sale agreement or our insolvency (each as more fully described in each forward sale agreement).

A forward purchaser’s decision to exercise its right to accelerate any forward sale agreement and to require us to settle any such forward sale agreement will be made irrespective of our interests, including our need for capital. In such cases, we could be required to issue and deliver shares of our common stock under the terms of the physical settlement provisions of the applicable forward sale agreement irrespective of our capital needs, which would result in dilution to our earnings per share and return on equity.

We expect that settlement of any forward sale agreement will generally occur no later than the date specified in such forward sale agreement. However, any forward sale agreement may be settled earlier than such specified date in whole or in part at our option. Except under the circumstances described above, we generally have the right to elect physical, cash or net share settlement under each forward sale agreement. Delivery of our common stock upon physical settlement of any forward sale agreement (or, if we elect net share settlement of any forward sale agreement, upon such settlement to the extent we are obligated to deliver our common stock) will result in dilution to our earnings per share and return on equity. If we elect to cash or net share settle all or a portion of the shares of our common stock underlying any forward sale agreement, we would expect the relevant forward purchaser or one of its affiliates to purchase shares of our common stock in secondary market transactions over an unwind period to:

• return shares of our common stock to securities lenders in order to unwind such forward purchaser’s hedge (after taking into consideration any shares of our common stock to be delivered by us to such forward purchaser, in the case of net share settlement); and,

• if applicable, in the case of net share settlement, deliver shares of our common stock to us to the extent required in settlement of such forward sale agreement.

The forward sale price that we expect to receive upon physical settlement of any forward sale agreement will be subject to adjustment on a daily basis based on a floating interest rate factor equal to the overnight bank funding rate less a spread and will be subject to decrease on certain dates specified in the relevant forward sale agreement by the amount per share of quarterly dividends we currently expect to declare during the term of such forward sale agreement. If the overnight bank funding rate is less than the spread on any day, the interest rate factor will result in a daily reduction of the forward sale price. If the volume-weighted average price at which the relevant forward purchaser (or its affiliate) purchases shares during the applicable unwind period under a forward sale agreement is above the relevant forward sale price, in the case of cash settlement, we would pay the relevant forward purchaser under such forward sale agreement an amount in cash equal to the difference or, in the case of net share settlement, we would deliver to such forward purchaser a number of shares of our common stock having a value equal to the difference. Thus, we could be responsible for a potentially substantial cash payment in the case of cash settlement. If the volume-weighted average price at which the relevant forward purchaser (or its affiliate) purchases shares during the applicable unwind period under a forward sale agreement is below the relevant forward sale price, in the case of cash settlement, we would be paid the difference in cash by the relevant forward purchaser under such forward sale agreement or, in the case of net share settlement, we would receive from such forward purchaser a number of shares of our common stock having a value equal to the difference. Any such difference could be significant. See “Plan of Distribution (Conflicts of Interest)—Sales Through Forward Sellers.”

In addition, the purchase of our common stock by a forward purchaser or its affiliate to unwind the forward purchaser’s hedge position could cause the price of our common stock to increase over time (or prevent a decrease over time), thereby increasing the amount of cash (in the case of cash settlement), or the number of shares (in the case of net share settlement), that we would owe such forward purchaser upon settlement of the applicable forward sale agreement or decreasing the amount of cash (in the case of cash settlement), or the number of shares (in the case of net share settlement), that such forward purchaser would owe us upon settlement of the applicable forward sale agreement, as the case may be.

In case of our bankruptcy or insolvency, any forward sale agreement that is in effect will automatically terminate, and we would not receive the expected proceeds from any forward sales of our common stock.

If we or a regulatory authority with jurisdiction over us institutes, or we consent to, a proceeding seeking a judgment in bankruptcy or insolvency or any other relief under any bankruptcy or insolvency law or other similar law affecting creditors’ rights, or we or a regulatory authority with jurisdiction over us presents a petition for our winding-up or liquidation, or we consent to such a petition, any forward sale agreement that is then in effect will automatically terminate. If any such forward sale agreement so terminates under these circumstances, we would not be obligated to deliver to the relevant forward purchaser any common stock not previously delivered, and the relevant forward purchaser would be discharged from its obligation to pay the applicable forward sale price per share in respect of any shares of common stock not previously settled under the applicable forward sale agreement. Therefore, to the extent that there are any shares of common stock with respect to which any forward sale agreement has not been

settled at the time of the commencement of any such bankruptcy or insolvency proceedings, we would not receive the relevant forward sale price per share in respect of those shares.

USE OF PROCEEDS

We intend to use the net proceeds that we receive upon the issuance or sale of shares of our common stock by us through the sales agents for general corporate purposes.

We will not initially receive any proceeds from the sale of borrowed shares of our common stock by the forward sellers, as agents for the forward purchasers, in connection with any forward sale agreement as a hedge of the relevant forward purchaser’s exposure under such forward sale agreement. In the event of full physical settlement of a forward sale agreement (by delivery of our common stock), which we expect to occur on or prior to the maturity date of such forward sale agreement, we expect to receive aggregate cash proceeds equal to the product of the initial forward sale price under such forward sale agreement and the number of shares of our common stock underlying such forward sale agreement, subject to the price adjustment and other provisions of such forward sale agreement. We intend to use any cash proceeds that we receive upon physical settlement of any forward sale agreement, if physical settlement applies, or upon cash settlement of any forward sale agreement, if we elect cash settlement, for the purposes provided in the immediately preceding paragraph. If, however, we elect to cash settle or net share settle any forward sale agreement, we would expect to receive an amount of proceeds that is significantly lower than the product set forth in the second preceding sentence (in the case of any cash settlement) or will not receive any proceeds (in the case of any net share settlement), and we may owe cash (in the case of any cash settlement) or shares of our common stock (in the case of any net share settlement) to the applicable forward purchaser.

U.S. FEDERAL INCOME TAX CONSEQUENCES TO NON-U.S. HOLDERS

The following is a summary of the material U.S. federal income tax consequences of the ownership and disposition of our common stock. This summary deals only with common stock that is held as a capital asset (generally, property held for investment) by a non-U.S. holder.

As used herein, a “non-U.S. holder” means a beneficial owner of our common stock (other than a partnership or other entity or arrangement treated as a partnership for U.S. federal income tax purposes) that is not for U.S. federal income tax purposes any of the following:

• an individual who is a citizen or resident of the United States;

• a corporation (or any other entity treated as a corporation for U.S. federal income tax purposes) created or organized in or under the laws of the United States, any state thereof or the District of Columbia;

• an estate the income of which is subject to U.S. federal income taxation regardless of its source; or

• a trust if it (1) is subject to the primary supervision of a court within the United States and one or more U.S. persons have the authority to control all substantial decisions of the trust or (2) has a valid election in effect under applicable U.S. Treasury regulations to be treated as a U.S. person.

This summary is based upon provisions of the Internal Revenue Code of 1986, as amended (the “Code”), and regulations, rulings and judicial decisions as of the date hereof. Those authorities may be changed, perhaps retroactively, so as to result in U.S. federal income tax consequences different from those summarized below. This summary does not address all of the U.S. federal income tax consequences that may be relevant to you in light of your particular circumstances, nor does it address the Medicare tax on net investment income, U.S. federal estate and gift taxes or the effects of any state, local or foreign tax laws. In addition, it does not represent a detailed description of the U.S. federal income tax consequences applicable to you if you are subject to special treatment under the U.S. federal income tax laws (including if you are a U.S. expatriate, foreign pension fund, “controlled foreign corporation,” “passive foreign investment company” or a partnership or other pass-through entity for U.S. federal income tax purposes). We cannot assure you that a change in law will not alter significantly the tax considerations that we describe in this summary.

If a partnership (or other entity or arrangement treated as a partnership for U.S. federal income tax purposes) holds our common stock, the tax treatment of a partner will generally depend upon the status of the partner and the activities of the partnership. If you are a partner of a partnership holding our common stock, you should consult your tax advisors.

If you are considering the purchase of our common stock, you should consult your own tax advisors concerning the particular U.S. federal income tax consequences to you of the ownership and disposition of our common stock, as well as the consequences to you arising under other U.S. federal tax laws and the laws of any other taxing jurisdiction.

Dividends

Any distribution of cash or other property in respect of our common stock (other than certain pro rata distributions of our stock) generally will be treated as a dividend for U.S. federal income tax purposes to the extent it is paid from our current or accumulated earnings and profits, as determined under U.S. federal income tax principles. Any portion of a distribution that exceeds our current and accumulated earnings and profits generally will be treated first as a tax-free return of capital, causing a reduction in the adjusted tax basis of a non-U.S. holder’s common stock, and to the extent the amount of the distribution exceeds a non-U.S. holder’s adjusted tax basis in our common stock, the excess will be treated as gain from the disposition of our common stock (the tax treatment of which is discussed below under “—Gain on Disposition of Common Stock”).

Dividends paid to a non-U.S. holder generally will be subject to withholding of U.S. federal income tax at a 30% rate or such lower rate as may be specified by an applicable income tax treaty. However, dividends that are effectively connected with the conduct of a trade or business by the non-U.S. holder within the United States (and, if required by an applicable income tax treaty, are attributable to a U.S. permanent establishment) are not subject to the withholding tax, provided certain certification and disclosure requirements are satisfied. Instead, such dividends are subject to U.S. federal income tax on a net income basis generally in the same manner as if the non-U.S. holder were a United States person as defined under the Code. Any such effectively connected dividends received by a foreign corporation may be subject to an additional “branch profits tax” at a 30% rate or such lower rate as may be specified by an applicable income tax treaty.

A non-U.S. holder who wishes to claim the benefit of an applicable treaty rate and avoid backup withholding, as discussed below, for dividends will be required (a) to provide the applicable withholding agent with a properly executed Internal Revenue Service (“IRS”) Form W-8BEN or W-8BEN-E (or other applicable form) certifying under penalty of perjury that such holder is not a United States person as defined under the Code and is eligible for treaty benefits or (b) if our common stock is held through certain foreign intermediaries, to satisfy the relevant certification requirements of applicable U.S. Treasury regulations.

A non-U.S. holder eligible for a reduced rate of U.S. withholding tax pursuant to an income tax treaty may obtain a refund of any excess amounts withheld by timely filing an appropriate claim for refund with the IRS.

Gain on Disposition of Common Stock

Subject to the discussion of backup withholding below, any gain realized by a non-U.S. holder on the sale or other disposition of our common stock generally will not be subject to U.S. federal income tax unless:

• the gain is effectively connected with a trade or business of the non-U.S. holder in the United States (and, if required by an applicable income tax treaty, is attributable to a U.S. permanent establishment of the non-U.S. holder);

• the non-U.S. holder is an individual who is present in the United States for 183 days or more in the taxable year of that disposition, and certain other conditions are met; or

• we are or have been a “United States real property holding corporation” for U.S. federal income tax purposes at any time during the shorter of the five-year period preceding the disposition or the non-U.S. holder’s holding period, and either our common stock has ceased to be traded on an established securities market prior to the beginning of the calendar year in which the disposition occurs or the non-U.S. holder owns or has owned a threshold amount of our common stock, as described below.

A non-U.S. holder described in the first bullet point immediately above will be subject to tax on the net gain derived from the sale or other disposition under the regular graduated U.S. federal income tax rates applicable to U.S. persons. A non-U.S. holder that is a corporation also may be subject to a branch profits tax equal to 30% (or such lower rate as may be specified by an applicable income tax treaty) on any such effectively contained gains, as adjusted for certain items. An individual non-U.S. holder described in the second bullet point immediately above will be subject to a flat 30% (or such lower rate as may be specified by an applicable income tax treaty) tax on the gain derived from the sale or other disposition, which may be offset by U.S. source capital losses, even though the individual is not considered a resident of the United States.

Generally, a corporation is a “United States real property holding corporation” if the fair market value of its U.S. real property interests equals or exceeds 50% of the sum of the fair market value of its worldwide real property interests and its other assets used or held for use in a trade or business (all as determined for U.S. federal income tax purposes). We have not determined whether we are a “United States real property holding corporation” for U.S. federal income tax purposes. If we are or become a “United States real property holding corporation,” so long as our common stock continues to be regularly traded on an established securities market, only a non-U.S. holder who actually or constructively holds or held (at any time during the shorter of the five-year period preceding the date of disposition or the holder’s holding period) more than 5% of our common stock will be subject to U.S. federal income tax on the disposition of our common stock.

Information Reporting and Backup Withholding

Payors must report annually to the IRS and to each non-U.S. holder the amount of distributions paid to such holder and the tax withheld with respect to such distributions, regardless of whether withholding was required. Copies of the information returns reporting such distributions and any withholding may also be made available to the tax authorities in the country in which the non-U.S. holder resides under the provisions of an applicable income tax treaty.

A non-U.S. holder will generally be subject to backup withholding on dividends paid to such holder unless such holder certifies under penalty of perjury that it is not a United States person as defined under the Code (and the payor does not have actual knowledge or reason to know that such holder is a United States person as defined under the Code), or such holder otherwise establishes an exemption.

Information reporting and, depending on the circumstances, backup withholding will apply to the proceeds of a sale or other disposition of our common stock made within the United States or conducted through certain United States-related financial intermediaries, unless the beneficial owner certifies under penalty of perjury that it is not a United States person as defined under the Code (and the payor does not have actual knowledge or reason to know that the beneficial owner is a United States person as defined under the Code), or such owner otherwise establishes an exemption.

Backup withholding is not an additional tax and any amounts withheld under the backup withholding rules may be allowed as a refund or a credit against a non-U.S. holder’s U.S. federal income tax liability, provided the required information is timely furnished to the IRS.

Additional Withholding Requirements

Under Sections 1471 through 1474 of the Code (such Sections commonly referred to as “FATCA”), a 30% U.S. federal withholding tax may apply to any dividends paid on our common stock to (i) a “foreign financial institution” (as specifically defined in the Code and whether such foreign financial institution is the beneficial owner or an intermediary) that does not provide sufficient documentation, typically on IRS Form W-8BEN-E, evidencing either (x) an exemption from FATCA, or (y) its compliance (or deemed compliance) with FATCA (which may alternatively be in the form of compliance with an intergovernmental agreement with the United States) in a manner that avoids withholding, or (ii) a “non-financial foreign entity” (as specifically defined in the Code and whether such non-financial foreign entity is the beneficial owner or an intermediary) that does not provide sufficient documentation, typically on IRS Form W-8BEN-E, evidencing either (x) an exemption from FATCA, or (y) adequate information regarding certain substantial U.S. beneficial owners of such entity (if any). If a dividend payment is both subject to withholding under FATCA and subject to the withholding tax discussed above under “—Dividends,” an applicable withholding agent may credit the withholding under FATCA against, and therefore reduce, such other withholding tax. Payments of dividends that you receive in respect of our

common stock could be affected by this withholding if you are subject to the FATCA information reporting requirements and fail to comply with them or if you hold common stock through a non-U.S. person (e.g., a foreign bank or broker) that fails to comply with these requirements (even if payments to you would not otherwise have been subject to FATCA withholding). While withholding under FATCA would also have applied to payments of gross proceeds from the sale or other disposition of our common stock, proposed U.S. Treasury regulations (upon which taxpayers may rely until final regulations are issued) eliminate FATCA withholding on payments of gross proceeds entirely. You should consult your own tax advisor regarding these requirements and whether they may be relevant to your ownership and disposition of our common stock.

CERTAIN ERISA CONSIDERATIONS

The following is a summary of certain considerations associated with the purchase of shares of our common stock by (i) “employee benefit plans” within the meaning of Section 3(3)of the U.S. Employee Retirement Income Security Act of 1974, as amended (“ERISA”) that are subject to Title I of ERISA, (ii) plans, individual retirement accounts (“IRAs” each, an “IRA”) and other arrangements that are subject to Section 4975 of the Code or provisions under any other federal, state, local, non-U.S. or other laws or regulations that are similar to such provisions of the Code or ERISA (collectively, “Similar Laws”), and (iii) entities whose underlying assets are considered to include the assets of any of the foregoing described in clauses (i) and (ii) pursuant to ERISA or otherwise (each of the foregoing described in clauses (i), (ii) and (iii) referred to herein as a “Plan”).

General Fiduciary Matters

ERISA and the Code impose certain duties on persons who are fiduciaries of a Plan subject to Title I of ERISA or Section 4975 of the Code (a “Covered Plan”) and prohibit certain transactions involving the assets of a Covered Plan and its fiduciaries or other interested parties. Under ERISA and the Code, any person who exercises any discretionary authority or control over the administration of such a Covered Plan or the management or disposition of the assets of such Covered Plan, or who renders investment advice for a fee or other compensation to such a Covered Plan, is generally considered to be a fiduciary of the Covered Plan.

In considering an investment in shares of our common stock of a portion of the assets of any Plan, a fiduciary should determine whether the investment is in accordance with the documents and instruments governing the Plan and the applicable provisions of ERISA, the Code or any Similar Law relating to a fiduciary’s duties to the Plan including, without limitation, the prudence, diversification and delegation of control requirements of ERISA, the prohibited transaction provisions of ERISA or the Code and any applicable Similar Laws.

Prohibited Transaction Issues

Section 406 of ERISA and Section 4975 of the Code prohibit Covered Plans from engaging in specified transactions involving plan assets with persons or entities who are “parties in interest,” within the meaning of ERISA, or “disqualified persons,” within the meaning of Section 4975 of the Code, unless an exemption is available. A party in interest or disqualified person who engaged in a non-exempt prohibited transaction may be subject to excise taxes and other penalties and liabilities under ERISA and the Code. In addition, the fiduciary of the Covered Plan that engaged in such a non-exempt prohibited transaction may be subject to penalties and liabilities under ERISA and the Code.

The acquisition of the shares of our common stock by a Covered Plan with respect to which AEP, the sales agents or their respective affiliates (collectively, the “Transaction Parties”) is considered a party in interest or a disqualified person may constitute or result in a direct or indirect prohibited transaction under Section 406 of ERISA and/or Section 4975 of the Code, unless the investment is acquired and is held in accordance with an applicable statutory, class or individual prohibited transaction exemption. In this regard, the U.S. Department of Labor has issued prohibited transaction class exemptions, or “PTCEs,” that may apply to the acquisition and holding of shares of our common stock. These class exemptions include, without limitation, PTCE 84-14 respecting transactions determined by independent qualified professional asset managers, PTCE 90-1 respecting insurance company pooled separate accounts, PTCE 91-38 respecting bank collective investment funds, PT CE 95-60 respecting life insurance company general accounts and PTCE 96-23 respecting transactions determined by in-house asset managers. In addition, Section 408(b)(17) of ERISA and Section 4975(d)(20) of the Code provide relief from the prohibited transaction provisions of ERISA and Section 4975 of the Code for certain transactions, provided that neither the issuer of the securities nor any of its affiliates (directly or indirectly) have or exercise any discretionary authority or control or render any investment advice with respect to the assets of any Covered Plan involved in the transaction and provided further that the Covered Plan pays no more than adequate consideration in connection with the transaction. Each of the above-noted exemptions contain conditions and limitations on its application. Fiduciaries of Covered Plans considering acquiring shares of our common stock in reliance on these or any other exemption should carefully review the exemption in consultation with its own advisors to assure that it is applicable. There can be no assurance that all of the conditions of any such exemptions will be available with respect to an otherwise prohibited transaction arising in connection with an investment in our shares of common stock or that all of the conditions of any such exemptions will be satisfied or that any exemption would cover all potential transactions that may arise in connection with such an investment.

Certain Plans that are governmental plans (as defined in Section 3(32) of ERISA), church plans (as defined in Section 3(33) of ERISA) and non-U.S. plans (as described in Section 4(b)(4) of ERISA) may not subject to these “prohibited transaction” rules of ERISA or Section 4975 of the Code, but may be subject to similar restrictions under applicable Similar Laws.

Accordingly, our shares of common stock (including any interests therein) may not be acquired by any person investing “plan assets” of any Plan, unless such acquisition will not constitute or result in a non-exempt prohibited transaction under ERISA or the Code or a violation of any applicable Similar Laws.

Representation

By acceptance of shares of our common stock, each purchaser and subsequent transferee of shares of our common stock will be deemed to have represented, warranted and acknowledged that either (i) no portion of the assets used by such investor to invest in our shares of common stock constitutes assets of any Plan or (ii) the purchase, holding and disposition of shares of our common stock by

such purchaser or transferee will not constitute a non-exempt prohibited transaction under Section 406 of ERISA or Section 4975 of the Code or violation under any applicable Similar Laws.

The foregoing discussion is general in nature and is not intended to be all-inclusive. Due to the complexity of these rules and the penalties that may be imposed upon persons involved in non-exempt prohibited transactions, it is particularly important that fiduciaries, or other persons considering purchasing shares of our common stock on behalf of, or with the assets of, any Plan, consult with their counsel regarding the potential applicability of ERISA, Section 4975 of the Code and any Similar Laws to such investment and whether, the case of a Covered Plan, one or more exemptions would be applicable to the purchase, holding and disposition of shares of our common stock. Each purchaser has exclusive responsibility for ensuring that its purchase, holding and disposition of our shares of common stock will not result in a violation of the fiduciary responsibility or prohibited transaction rules of ERISA or the Code, or the provisions of applicable Similar Laws.

This prospectus supplement and sale of our shares of common stock to a Plan is in no respect a representation or recommendation by any of the Transaction Parties that such an investment meets all relevant legal requirements with respect to investments by Plans generally or any particular Plan or that such an investment is appropriate or advisable for Plans generally or any particular Plan. The decision to invest in common shares must be made solely by each prospective Plan on an arm’s length transaction.

PLAN OF DISTRIBUTION (CONFLICTS OF INTEREST)

We have entered into a distribution agreement, dated November 16, 2023, with each of the sales agents, forward sellers and forward purchasers under which we may issue and sell up to $1,700,000,000 in the aggregate of shares of our common stock from time to time through the sales agents acting as sales agents or directly to the sales agents acting as principals for the offer and sale of shares of our common stock. Further, the distribution agreement provides that, in addition to the issuance and sale of shares of our common stock by us through the sales agents, we also may deliver from time to time instructions to any sales agent specifying that such sales agent, as a forward seller, use commercially reasonable efforts to sell shares of our common stock borrowed by the applicable forward purchaser in connection with one or more forward sale agreements, as described below. In no event will the aggregate number of shares of our common stock sold through the sales agents, each as an agent for us, as principal and as a forward seller, under the distribution agreement have an aggregate sales price in excess of $1,700,000,000.

The sales, if any, of shares of our common stock under the distribution agreement will be made in “at the market offerings” as defined in Rule 415 of the Securities Act, including sales made directly on the Nasdaq Global Select Market, the existing trading market for shares of our common stock, or sales made to or through a market maker or through an electronic communications network. In addition, shares of our common stock may be offered and sold by such other methods, including privately negotiated transactions (including block transactions), as we and any sales agent agree to in writing.

We have also agreed to reimburse the sales agents, the forward sellers and the forward purchasers for their reasonable and documented out-of-pocket expenses, including substantially all fees and expenses of counsel in connection with the at-the-market program. These reimbursed fees and expenses are deemed to be underwriting compensation to the sales agents under Financial Industry Regulatory Authority, Inc. (“FINRA”) Rule 5110.

In connection with the sale of our common stock as contemplated in this prospectus supplement, the sales agents and the forward purchasers may be deemed to be “underwriters” within the meaning of the Securities Act, and the compensation paid to the sales agents and the forward purchasers may be deemed to be underwriting commissions or discounts. We have agreed to indemnify the sales agents and the forward purchasers against certain liabilities, including liabilities under the Securities Act.

If a sales agent or we have reason to believe that the exemptive provisions set forth in Rule 101(c)(1) of Regulation M under the Exchange Act are not satisfied, that party will promptly notify the other and sales of common stock under the distribution agreement will be suspended until that or other exemptive provisions have been satisfied in the judgment of the sales agents and us.

We estimate that the total expenses from this offering payable by us, excluding compensation payable to the sales agents under the distribution agreement, will be approximately $560,000.

We intend to report to the SEC at least quarterly (1) the number of shares of our common stock sold through the sales agents in connection with at-the-market sales as described below under “—Sales Through Sales Agents,” (2) the number of borrowed shares of our common stock sold by the forward sellers, as agents for the forward purchasers, in connection with the forward sale agreements as described below under “—Sales Through Forward Sellers” and (3) the net proceeds received by us and the compensation paid by us to the sales agents in connection with transactions described in clauses (1) and (2).

Sales of our common stock as contemplated in this prospectus supplement will be settled through the facilities of The Depository Trust Company or by such other means as we and the sales agents may agree upon. The offering of common stock pursuant to the distribution agreement will terminate upon the earlier of (1) the sale, under the distribution agreement, of shares of our common stock with an aggregate sales price of $1,700,000,000, and (2) the termination of the distribution agreement, pursuant to its terms, by either all of the sales agents or us.

In the ordinary course of their business, certain of the sales agents and/or their affiliates have in the past performed, and may continue to perform, investment banking, broker dealer, lending, financial advisory or other services for us for which they have received, or may receive, separate fees.

The sales agents and their affiliates are full service financial institutions engaged in various activities, which may include securities trading, commercial and investment banking, financial advisory, investment management, investment research, principal investment, hedging, financing and brokerage activities. In the ordinary course of their business, the sales agents and their affiliates may make or hold a broad array of investments and actively trade debt and equity securities (or related derivative securities) and financial instruments (including bank loans) for their own account and for the accounts of their customers and such investment and securities activities may involve securities and/or instruments of the Company. The sales agents and their affiliates may also make investment recommendations and/or publish or express independent research views in respect of such securities or instruments and may at any time hold, or recommend to clients that they acquire, long and/or short positions in such securities and instruments.

Sales Through Sales Agents

From time to time during the term of the distribution agreement, and subject to the terms and conditions set forth therein, we may deliver instructions to any of the sales agents. Upon receipt of such instructions from us, and subject to the terms and conditions of the distribution agreement, each sales agent has agreed to use its commercially reasonable efforts consistent with its normal trading and sales practices to sell the amount of shares of our common stock specified in our instructions. We or the relevant sales agent may

suspend the offering of shares of our common stock at any time upon proper notice to the other, upon which the selling period will immediately terminate. Settlement for sales of shares of our common stock will occur on the second trading day following the date on which the sales were made (or such earlier day as in industry practice for regular-way trading) unless another date shall be agreed to in writing by us and the relevant sales agent. The obligation of any sales agent under the distribution agreement to sell shares of our common stock pursuant to our instructions is subject to a number of conditions, which such sales agent reserves the right to waive in its sole discretion.

We will pay each sales agent a commission equal to up to 2% of the sales price of all shares of our common stock sold through it as our agent under the distribution agreement.

Sales Through Forward Sellers

From time to time during the term of the distribution agreement, and subject to the terms and conditions set forth therein, we may enter into one or more forward sale agreements with a forward purchaser and deliver instructions to its sales agent, requesting that the sales agent execute sales of borrowed shares of our common stock as a forward seller in connection with the applicable forward sale agreement, and subject to the terms and conditions of the distribution agreement, the relevant forward purchaser will attempt to borrow, and such forward seller will use its commercially reasonable efforts consistent with its normal trading and sales practices to sell, such shares of our common stock on such terms to hedge such forward purchaser’s exposure under such forward sale agreement. We or the relevant forward seller may immediately suspend the offering of shares of our common stock at any time upon proper notice to the other. We expect settlement between a forward purchaser and the relevant forward seller of sales of borrowed shares of our common stock, as well as the settlement between the relevant forward seller and buyers of such shares in the market, to occur on the second trading day following each date on which the sales are made unless another date shall be agreed to in writing by us and the relevant sales agent. The obligation of each forward seller under the distribution agreement to execute such sales of shares of our common stock is subject to a number of conditions, which each forward seller reserves the right to waive in its sole discretion.

In connection with each forward sale agreement, the relevant forward seller will receive, reflected in a reduced initial forward sale price payable by the relevant forward purchaser under its forward sale agreement, a commission equal to up to 2% of the volume weighted average of the sales prices of all borrowed shares of our common stock sold during the applicable period by it as a forward seller. We refer to this commission rate as the forward selling commission.

The initial forward sale price per share under each forward sale agreement will equal the product of (1) an amount equal to one minus the applicable forward selling commission and (2) the volume weighted average price per share at which the borrowed shares of our common stock were sold pursuant to the distribution agreement by the relevant forward seller to hedge the relevant forward purchaser’s exposure under such forward sale agreement. Thereafter, the initial forward sale price will be subject to price adjustment as described below. If we elect to physically settle any forward sale agreement by delivering shares of our common stock, we will receive an amount of cash from the relevant forward purchaser equal to the product of the initial forward sale price per share under such forward sale agreement and the number of shares of our common stock underlying such forward sale agreement, subject to the price adjustment and other provisions of such forward sale agreement. Each forward sale agreement will provide that the initial forward sale price, as well as the sales prices used to calculate the initial forward sale price, will be subject to adjustment based on a floating interest rate factor equal to the overnight bank funding rate less a spread. In addition, the initial forward sale price will be subject to decrease on certain dates specified in the relevant forward sale agreement by the amount per share of quarterly dividends we currently expect to declare during the term of such forward sale agreement. If the overnight bank funding rate is less than the spread on any day, the interest rate factor will result in a daily reduction of the forward sale price.

Before any issuance of shares of our common stock upon settlement of any forward sale agreement, we expect that the shares issuable upon settlement of such forward sale agreement will be reflected in our diluted earnings per share calculations using the treasury stock method. Under this method, the number of shares of our common stock used in calculating diluted earnings per share is deemed to be increased by the excess, if any, of the number of shares that would be issued upon full physical settlement of such forward sale agreement over the number of shares that could be purchased by us in the market (based on the average market price of our common stock during the applicable reporting period) using the proceeds receivable upon full physical settlement (based on the adjusted forward sale price at the end of the reporting period). Consequently, we anticipate there will be no dilutive effect on our earnings per share except during periods when the average market price of shares of our common stock is above the applicable adjusted forward sale price subject to increase or decrease as described in the immediately preceding paragraph. However, if we decide to physically settle or net share settle any forward sale agreement, delivery of our shares to the relevant forward purchaser on the physical settlement or net share settlement of the forward sale agreement would result in dilution to our earnings per share and return on equity.

We expect that settlement of any forward sale agreement will generally occur no later than the date specified in such forward sale agreement. However, any forward sale agreement may be settled earlier than that specified date in whole or in part at our option. Except under the circumstances described below, we have the right, in lieu of physical settlement of any forward sale agreement, to elect cash or net share settlement of such forward sale agreement. If we elect cash or net share settlement of any forward sale agreement, we would expect the relevant forward purchaser or one of its affiliates to purchase shares of our common stock in secondary market transactions over an unwind period to:

• return shares of our common stock to securities lenders in order to unwind such forward purchaser’s hedge (after taking into consideration any shares of our common stock to be delivered by us to such forward purchaser, in the case of net share settlement); and,

• if applicable, in the case of net share settlement, deliver shares of our common stock to us to the extent required in settlement of such forward sale agreement.

If the volume-weighted average price at which the relevant forward purchaser (or its affiliate) purchases shares during the applicable unwind period under a forward sale agreement is above the relevant forward sale price, in the case of cash settlement, we would pay the relevant forward purchaser under such forward sale agreement an amount in cash equal to the difference or, in the case of net share settlement, we would deliver to such forward purchaser a number of shares of our common stock having a value equal to the difference. Thus, we could be responsible for a potentially substantial cash payment in the case of cash settlement. If the volume-weighted average price at which the relevant forward purchaser (or its affiliate) purchases shares during the applicable unwind period under a forward sale agreement is below the relevant forward sale price, in the case of cash settlement, we would be paid the difference in cash by the relevant forward purchaser under such forward sale agreement or, in the case of net share settlement, we would receive from such forward purchaser a number of shares of our common stock having a value equal to the difference.

In addition, the purchase of our common stock by a forward purchaser or its affiliate to unwind the forward purchaser’s hedge position could cause the price of our common stock to increase over time (or prevent a decrease over time), thereby increasing the amount of cash (in the case of cash settlement), or the number of shares (in the case of net share settlement), that we would owe such forward purchaser upon settlement of the applicable forward sale agreement or decreasing the amount of cash (in the case of cash settlement), or the number of shares (in the case of net share settlement), that such forward purchaser would owe us upon settlement of the applicable forward sale agreement, as the case may be.

A forward purchaser will have the right to accelerate the forward sale agreement that it enters into with us and require us to physically settle such forward sale agreement (with respect to all or any portion of the transaction under such forward sale agreement that such forward purchaser determines is affected by such event) on a date specified by such forward purchaser if:

• in such forward purchaser’s commercially reasonable judgment, it or its affiliate is unable to hedge its exposure under such forward sale agreement because (x) insufficient shares of our common stock have been made available for borrowing by securities lenders or (y) the forward purchaser or its affiliate would incur a stock borrowing cost in excess of a specified threshold;

• we declare any dividend, issue or distribution on shares of our common stock

• payable in cash in excess of specified amounts,

• that constitutes an extraordinary dividend under the forward sale agreement,

• payable in securities of another company as a result of a spinoff or similar transaction, or

• of any other type of securities (other than our common stock), rights, warrants or other assets for payment (cash or other consideration) at less than the prevailing market price;

• certain ownership thresholds applicable to such forward purchaser and its affiliates are exceeded;

• an event is announced that if consummated would result in a specified extraordinary event (including certain mergers or tender offers, as well as certain events involving our nationalization, a delisting of our common stock, or change in law); or

• certain other events of default or termination events occur, including, among others, any material misrepresentation made in connection with such forward sale agreement or our insolvency (each as more fully described in each forward sale agreement).

A forward purchaser’s decision to exercise its right to accelerate any forward sale agreement and to require us to settle any such forward sale agreement will be made irrespective of our interests, including our need for capital. In such cases, we could be required to issue and deliver shares of our common stock under the terms of the physical settlement provisions of the applicable forward sale agreement irrespective of our capital needs, which would result in dilution to our earnings per share and return on equity. In addition, upon certain events of bankruptcy, insolvency or reorganization relating to us, the forward sale agreement will terminate without further liability of either party. Following any such termination, we would not issue any shares and we would not receive any proceeds pursuant to the forward sale agreement.

Restrictions on Sales of Similar Securities

During any period beginning on the date we deliver instructions to any of the sales agents and ending on the settlement date with respect to the sale of such shares, we have agreed not to, unless we give the sales agents prior written notice, (i) directly or indirectly offer, pledge, announce the intention to sell, sell, contract to sell, sell any option or contract to purchase, purchase any option or contract to sell, grant any option, right or warrant to purchase or otherwise transfer or dispose of any shares of our common stock or any equity securities or securities convertible into or exercisable, redeemable or exchangeable for shares of our common stock or file any registration statement under the Securities Act with respect to any of the foregoing or (ii) enter into any swap or any other agreement that transfers, in whole or in part, directly or indirectly, the economic consequence of ownership of our common stock,

whether any such transaction described in clause (i) or (ii) above is to be settled by delivery of our common stock, in cash or otherwise. The restriction described in this paragraph does not apply to:

• sales of shares of our common stock we offer or sell pursuant to the distribution agreement (including sales of borrowed shares of our common stock by the forward sellers in connection with any forward sale agreement);

• the issuance by us of shares of our common stock pursuant to, or the grant of options under our stock option, employee benefit or dividend reinvestment plans (as described in this prospectus supplement, the accompanying prospectus and any free writing prospectus), or the filing of a registration statement with the Commission relating to the offering of any shares of our common stock issued or reserved for issuance under such plans; or

• the establishment of a trading plan pursuant to Rule 10b5-1 under the Exchange Act for the repurchase of shares of our common stock, provided that such plan does not provide for the repurchase of our common stock during the Delivery Period.

No Public Offering Outside of the United States

No action has been or will be taken in any jurisdiction (except in the United States) that would permit a public offering of the shares of our common stock, or the possession, circulation, or distribution of this prospectus supplement or the accompanying prospectus or any other material relating to us or the shares of our common stock in any jurisdiction where action for that purpose is required. Accordingly, the shares of our common stock offered by this prospectus supplement and the accompanying prospectus may not be offered or sold, directly or indirectly, and this prospectus supplement, the accompanying prospectus and any other offering material or advertisements in connection with the shares of our common stock may not be distributed or published, in or from any country or jurisdiction except in compliance with any applicable rules and regulations of any such country or jurisdiction.

European Economic Area (“EEA”)