Amazon's Pitch to Woo Shippers: Fewer Fees Than FedEx, UPS--Update

January 23 2019 - 10:04AM

Dow Jones News

By Paul Ziobro

Amazon.com Inc., which is rolling out its own delivery network,

is trying to poach shippers from FedEx Corp. and United Parcel

Service Inc. by targeting a common complaint: fuel surcharges and

extra fees that drive up the cost of home deliveries.

Amazon recently expanded its nascent home-delivery service,

called Amazon Shipping, beyond test markets in London and Los

Angeles. The online retailer is offering to pick up shipments from

merchants' warehouses and deliver them directly to shoppers, The

Wall Street Journal has previously reported. The end-to-end service

is part of Amazon's quest to built up its own delivery network and

handle more of the millions of items sold through its site.

To woo shippers, the retailer is promising to cut out many fees

that the traditional carriers use to pad their revenues, like extra

charges to deliver packages to homes, during the peak holiday

season or on weekends, according to an email sent last week to

shippers in the New York area and reviewed by the Journal.

"If it's a guaranteed service with none of those surcharges,

they're going to undercut the residential delivery market," said

John Haber, chief executive of the supply-chain consultancy Spend

Management Experts.

An Amazon spokesperson said the company is "always working to

develop new, innovative ways to support the small and medium

businesses who sell on Amazon, including testing shipping programs

that help these businesses get packages to their customers quickly

and reliably."

Such fees can add up. The residential surcharge at FedEx is

$3.60 per parcel and $3.80 at UPS. That alone can account for more

than 40% of the average ground delivery charge, which was $8.81 at

FedEx and $8.71, according to the most recent public data.

The two carriers also impose fuel surcharges, which fluctuate

with market prices. The current weekly surcharge for a domestic

ground delivery is 6.75% at FedEx and 7% at UPS. UPS also imposed

surcharges on deliveries during the peak holiday shopping season

each of the past two years.

Mr. Haber said fees can add up to more than 30% of the shipping

cost in many cases. One merchant who reviewed Amazon's shipping

rates said they were about 10% lower than UPS and FedEx on

average.

Large carriers use the fees to cover the added costs of building

out their networks to handle the surge in e-commerce packages.

Residential delivery, for instance, can have higher costs than

delivering to businesses, where multiple items can be dropped off.

Fuel surcharges also provide transparency into one of the costs

baked into deliveries and can fluctuate.

Since Amazon's service is designed to deliver packages to homes,

not businesses, the costs of residential delivery are factored in,

eliminating the need for a surcharge. The company wants to handle

more of its own deliveries to keep up with its growth and loosen

its reliance on the U.S. Postal Service and other carriers, whose

rates continue to rise. FedEx and UPS typically raise rates an

average of about 5% annually.

Amazon's shipping pact with the Postal Service, which delivers

most of the retailer's packages to homes, also has come under

attack from President Trump for straining the agency's operations

and not generating enough profits.

In addition to leasing airplanes and trucks, Amazon is

recruiting small businesses to carry more of its deliveries during

the last leg of a package's journey to the consumer's door. It has

a program that lets entrepreneurs sign on to lease about 20 to 40

Amazon Prime-branded vans.

FedEx and UPS have in the past played down the ambitions of

Amazon, which is a significant customer to both, in the delivery

field. They have noted that it would take billions of dollars and

years of expertise to build out a full competitor with the breadth

of coverage that either carrier offers globally.

A UPS spokesman declined to comment on Amazon's moves. "UPS has

a healthy and growing small-package business," the spokesman said

"capable of transferring goods competitively from dock to doorstep

anywhere in the world."

A FedEx spokeswoman also declined to comment on Amazon's

strategy. "We are confident in our position as a global

transportation trailblazer, and optimistic about the future," the

spokeswoman said.

Amazon is promising other features that position it as more

user-friendly than traditional carriers. According to its marketing

pitch to shippers, Amazon will offer rates that are easier to

understand than the pricing systems that UPS and FedEx use and any

delivery mistakes won't impact seller ratings.

Write to Paul Ziobro at Paul.Ziobro@wsj.com

(END) Dow Jones Newswires

January 23, 2019 09:49 ET (14:49 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

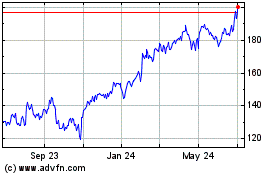

Amazon.com (NASDAQ:AMZN)

Historical Stock Chart

From Mar 2024 to Apr 2024

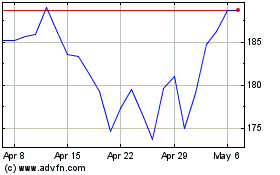

Amazon.com (NASDAQ:AMZN)

Historical Stock Chart

From Apr 2023 to Apr 2024