Current Report Filing (8-k)

August 17 2020 - 4:16PM

Edgar (US Regulatory)

false 0001701732 0001701732 2020-08-11 2020-08-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 11, 2020

Altair Engineering Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

001-38263

|

|

38-2591828

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

1820 E. Big Beaver Road

Troy, Michigan

|

|

48083

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (248) 614-2400

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of Each Class

|

|

Trading

Symbol(s)

|

|

Name of Each Exchange

on Which Registered

|

|

Class A Common Stock Par value $0.0001 per share

|

|

ALTR

|

|

The Nasdaq Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 5.02.

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

On August 11, 2020, our Board of Directors approved, upon the recommendation of our Compensation Committee, the execution of executive severance agreements with James R. Scapa, our Chief Executive Officer and Chairman, Brett Chouinard, our President and Chief Operating Officer, Amy Messano, our Chief Marketing Officer and Dr. Uwe Schramm, our Chief Technical Officer (collectively, the “Severance Agreements”). The Severance Agreements would each provide for severance protections in the event of a termination by the Company other than for “cause” or in the event of a resignation by Mr. Scapa, Mr. Chouinard, Ms. Messano or Dr. Schramm for “good reason”. Material terms of the Severance Agreements are set forth below:

|

|

•

|

|

The Severance Agreements would automatically terminate if there has not been a termination without “cause” (as defined in the Severance Agreements) or resignation for “good reason” (as defined in the Severance Agreements) on or prior to the one-year anniversary of a “change in control” (as defined in the Severance Agreements).

|

|

|

•

|

|

If, during the period between the execution of the Severance Agreements and the one-year anniversary of a change in control, Mr. Scapa’s, Mr. Chouinard’s, Ms. Messano’s or Dr. Schramm’s employment is terminated by the Company other than for “cause” or by Mr. Scapa, Mr. Chouinard, Ms. Messano or Dr. Schramm, as applicable, for “good reason”, subject to the provisions regarding Sections 280G and 4999 of the Internal Revenue Code of 1986, as amended (the “Code”), summarized below, Mr. Scapa, Mr. Chouinard, Ms. Messano or Dr. Schramm, as applicable, generally would be entitled to the following (in lieu of any other severance payments to which each may be entitled):

|

|

|

•

|

|

an amount equal to his annual rate of base salary for one month for each full year of continuous service (or, for Ms. Messano, (i) an amount equal to her annual rate of base salary for four months if the termination occurs prior to her first anniversary of commencement of employment with the Company, (ii) an amount equal to her annual rate of base salary for three months if the termination occurs between the first and third anniversaries of commencement of her employment with the Company, or (iii) an amount equal to her annual rate of base salary for one month for each full year of continuous service if the termination occurs after the third anniversary of her commencement of employment with the Company), up to a maximum of twelve months (the “Severance Period”), with the Severance Period automatically equal to twelve months if such termination occurs after the Company has entered into a definitive agreement governing a “change in control,” but prior to consummation of such “change in control,” or on or within one year following the occurrence of a “change in control” (or, for Ms. Messano, with the Severance Period automatically equal to twelve months if such termination occurs from and after the “change in control” but prior to the one year anniversary of the occurrence of a “change in control”;

|

-2-

|

|

•

|

|

reimbursement for healthcare continuation payments under the Consolidated Omnibus Budget Reconciliation Act of 1985, as amended (“COBRA”) for the duration of the Severance Period, subject to earlier termination if the applicable individual becomes eligible to obtain alternate healthcare coverage from a new employer or becomes ineligible for COBRA;

|

|

|

•

|

|

a pro-rata bonus, determined based on the executive’s target bonus for the year in which termination occurs (or, following a “change in control”, based on the greater of (i) the amount of the bonus that would have been received for the year in which termination occurs, or (ii) the target amount of the executive’s annual bonus for the calendar year prior to the year in which the “change in control” occurred), less any payment previously received with respect to such target bonus, payable in a cash lump sum;

|

|

|

•

|

|

solely with respect to Ms. Messano, 100% acceleration of any outstanding and unvested restricted stock unit awards in the Company; and

|

|

|

•

|

|

certain compensatory amounts that have accrued prior to termination.

|

|

|

•

|

|

To the extent any amount or benefit to be provided pursuant to the Severance Agreements or otherwise (collectively, the “Payments”) would be treated as an “excess parachute payment,” as that phrase is defined in Section 280G of the Code, then the amounts and benefits Mr. Scapa, Mr. Chouinard, Ms. Messano or Dr. Schramm would otherwise receive would either be (i) paid or allowed in full; or (ii) reduced (but not below zero) to the maximum amount which may be paid without causing any Payment to be nondeductible to the Company under Section 280G of the Code, or subject the executive to an excise tax under Section 4999 of the Code, whichever would result in the executive’s receipt, on an after-tax basis, of the greatest amount of Payments. No “gross-up” or comparable payment would be made with respect to taxes payable by the recipients of the Payments.

|

|

|

•

|

|

Mr. Scapa, Mr. Chouinard, Ms. Messano and Dr. Schramm would each be required to execute a general release in favor of the Company, as a condition to receiving the severance payments contained in the Severance Agreements, and to comply with customary post-employment covenants in favor of the Company, including non-competition, non-solicitation, and cooperation covenants.

|

Contemporaneously with its approval of the above-mentioned agreements, our Board, upon the recommendation of our Compensation Committee, approved substantially similar executive severance agreements with 11 other senior executives (excluding Howard Morof, our Chief Financial Officer, who is entitled to severance pursuant to a previously executed employment agreement).

The foregoing description of the Severance Agreements is intended to be a summary and is qualified in its entirety by references to such documents, which are attached as Exhibits 10.1 through 10.4 and are incorporated by reference herein.

-3-

|

Item 9.01.

|

Financial Statements and Exhibits.

|

-4-

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

ALTAIR ENGINEERING INC.

|

|

|

|

|

By:

|

|

/s/ Howard N. Morof

|

|

Name:

|

|

Howard N. Morof

|

|

Title:

|

|

Chief Financial Officer

|

Date: August 17, 2020

-5-

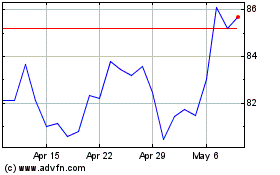

Altair Engineering (NASDAQ:ALTR)

Historical Stock Chart

From Mar 2024 to Apr 2024

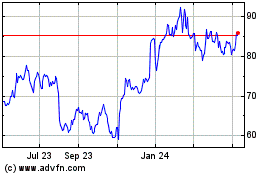

Altair Engineering (NASDAQ:ALTR)

Historical Stock Chart

From Apr 2023 to Apr 2024