0001107421

false

0001107421

2024-01-29

2024-01-29

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report: January 29, 2024

(Date of earliest event reported)

ALAUNOS THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-33038 |

|

84-1475642 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

2617 Bissonnet St

Suite 225

Houston, TX 77005

(Address of principal executive offices, including

zip code)

(346) 355-4099

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material

pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, par value $0.001 per share |

TCRT |

Nasdaq Capital Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| Emerging growth company |

☐ |

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

On January 29, 2024,

the Board of Directors of Alaunos Therapeutics, Inc. (the “Company”) approved the filing with the Secretary of State of the

State of Delaware, to occur on January 31, 2024, of a Second Amended and Restated Certificate of Incorporation (the “Charter Amendment”)

in order to effect a reverse stock split of the Company’s common stock at a ratio of 1-for-15 (the “Reverse Split”).

The Charter Amendment provides

that the Reverse Split will become effective on January 31, 2024 at 5:00 p.m. Eastern Time, at which time every 15 shares of the Company’s

issued and outstanding common stock will automatically be combined and converted into 1 share of common stock. Beginning with the opening

of trading on Thursday, February 1, 2024, the Company’s common stock will continue to trade on The Nasdaq Capital Market under the

symbol “TCRT,” but will trade on a split-adjusted basis under a new CUSIP number, 98973P200.

The Charter Amendment effecting

the Reverse Split was approved by the stockholders of the Company at the Company’s Annual Meeting of Stockholders held on June 6,

2023. In connection with approving the Reverse Split, the Company’s stockholders granted authority to the Board of Directors of

the Company (the “Board”) to determine in its sole discretion the exact ratio within the range of 1-for-5 to 1-for-15 at which

to effectuate the Reverse Split. The Reverse Split was initially approved by the Board on April 14, 2023 and the ratio of 1-for-15 was

approved by the Board on January 12, 2024.

Equiniti Trust Company (“Equiniti”)

is acting as the exchange agent for the Reverse Split. Equiniti will provide instructions to stockholders regarding the process for exchanging

their pre-split shares for post-split shares.

The foregoing description

of the Charter Amendment does not purport to be complete and is qualified in its entirety by reference to the full text of the Charter

Amendment, which is filed as Exhibit 3.1 to this Current Report on Form 8-K and is incorporated by reference herein.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

ALAUNOS THERAPEUTICS, INC. |

| |

|

|

| |

By: |

/s/ Michael Wong |

| |

|

Michael Wong

Vice President, Finance |

Date: January 29, 2024

SECOND AMENDED AND

RESTATED

CERTIFICATE OF INCORPORATION

OF

ALAUNOS THERAPEUTICS,

INC.

___________________________________

Alaunos

Therapeutics, Inc. (the “Corporation”), a corporation organized and existing under and by virtue of the provisions

of the General Corporation Law of the State of Delaware (the “General Corporation Law”),

DOES HEREBY

CERTIFY:

1.

The name of the corporation is: Alaunos Therapeutics, Inc.

2.

The name under which the Corporation originally incorporated was: EasyWeb, Inc. The date of filing of its original

Certificate of Incorporation with the Secretary of State of the State of Delaware was May 16, 2005. The date of filing of its Amended

and Restated Certificate of Incorporation with the Secretary of State of the State of Delaware was April 26, 2006 (as amended, the

“Existing Certificate”).

2.

The Board of Directors of the Corporation duly adopted resolutions proposing to amend and restate the Existing Certificate in its entirety

in the form set forth on Exhibit 1, attached hereto, declaring said amendment and restatement to be advisable and in the best interests

of the Corporation and its stockholders, and authorizing the officers of the Corporation to solicit the approval of the stockholders therefor.

3.

This Second Amended and Restated Certificate of Incorporation, which restates and integrates and further amends the provisions of the

Corporation’s Existing Certificate, was duly adopted in accordance with the provisions of Sections 242 and 245 of the General Corporation

Law.

4.

The Existing Certificate is hereby amended and restated in its entirety, as set forth on Exhibit 1, attached hereto.

5.

This Second Amended and Restated Certificate of Incorporation shall be effective as of 5:00 p.m., Eastern Time, on January 31, 2024.

[Remainder of page intentionally

blank]

IN WITNESS WHEREOF,

this Corporation has caused this Second Amended and Restated Certificate of Incorporation to be signed by its Interim Chief Executive

Officer this 31st day of January, 2024.

| |

ALAUNOS THERAPEUTICS, INC. |

| |

|

| |

By: |

|

| |

Name: |

Dale Curtis Hogue, Jr. |

| |

Title: |

Interim Chief Executive Officer |

| |

|

|

EXHIBIT 1

SECOND AMENDED AND

RESTATED

CERTIFICATE OF INCORPORATION

OF

ALAUNOS THERAPEUTICS,

INC.

1. Name.

The name of the corporation is Alaunos Therapeutics, Inc. (the “Corporation”).

2. Address; Registered

Office and Agent. The address of the Corporation’s registered office is 2711 Centerville Road, Suite 400, Wilmington, Delaware

19808. The Corporation’s registered agent is the Corporation Service Company. The Corporation may from time to time, in the manner

provided by law, change the registered agent and the registered office within the State of Delaware. The Corporation may also maintain

offices for the conduct of its business, either within or without the State of Delaware.

3. Purposes. The

purpose of the Corporation is to engage in any lawful act or activity for which corporations may be organized under the Delaware General

Corporation Law.

4. Number of

Shares. The total number of shares of all classes of stock that the Corporation shall have the authority to issue is 64,666,667

shares, consisting of: 34,666,667 shares of common stock, $0.001 par value per share (the “Common Stock”), and Thirty Million

(30,000,000) shares of preferred stock, $0.001 par value per share (the “Preferred Stock”).

Pursuant to the Delaware

General Corporation Law, upon the filing and effectiveness (the “Effective Time”) of this Second Amended and Restated Certificate

of Incorporation, each fifteen (15), inclusive shares of Common Stock issued and outstanding or held by the Corporation in treasury stock

immediately prior to the Effective Time shall be combined into one validly issued, fully paid and non-assessable share of Common

Stock, without any further action by the Corporation or the holder thereof, subject to the treatment of fractional share interests as

described below (the “Reverse Stock Split”). No fractional shares shall be issued and, in lieu thereof, any holder who otherwise

would be entitled to receive fractional shares of Common Stock shall be entitled to receive cash (without interest) in lieu of such fractional

share interest, upon the submission of a transmission letter by a holder holding the shares in book-entry form and, where shares are held

in certificated form, upon the surrender of the holder’s Old Certificates (as defined below), in an amount equal to such fraction

multiplied by the closing sales price of the Corporation’s Common Stock as reported on the Nasdaq Capital Market on the trading

day immediately preceding the date of the Effective Time. Each certificate that immediately prior to the Effective Time represented shares

of Common Stock (each, an “Old Certificate”) shall thereafter represent that number of shares of Common Stock into which the

shares of Common Stock represented by the Old Certificate shall have been combined, subject to the elimination of fractional share interests

as described above. As soon as practicable following the Effective Time, the Corporation will notify its stockholders holding shares of

Common Stock in certificated form to transmit their Old Certificates to the transfer agent, and the Corporation will cause the transfer

agent to issue new certificates representing the appropriate number of whole shares of Common Stock following the Reverse Stock Split

for every one share of Common Stock transmitted and held of record as of the Effective Time.

The Preferred Stock may

be divided into, and may be issued from time to time in one or more series. The Board of Directors of the Corporation (the “Board”)

is authorized from time to time to establish and designate any such series of Preferred Stock, to fix and determine the variations in

the relative rights, preferences, privileges and restrictions as between and among such series and any other class of capital stock of

the Corporation and any series thereof, and to fix or alter the number of shares comprising any such series and the designation thereof.

The authority of the Board from time to time with respect to each such series shall include, but not be limited to, determination of the

following:

a. The designation of

the series;

b. The number of shares

of the series and (except where otherwise provided in the creation of the series) any subsequent increase or decrease therein;

c. The dividends, if

any, for shares of the series and the rates, conditions, times and relative preferences thereof;

d. The redemption rights,

if any, and price or prices for shares of the series;

e. The terms and amounts

of any sinking fund provided for the purchase or redemption of the series;

f. The relative rights

of shares of the series in the event of any voluntary or involuntary liquidation, dissolution or winding up of the affairs of the Corporation;

g. Whether the shares

of the series shall be convertible into shares of any other class or series of shares of the Corporation, and, if so, the specification

of such other class or series, the conversion prices or rate or rates, any adjustments thereof, the date or dates as of which such shares

shall be convertible and all other terms and conditions upon which such conversion may be made;

h. The voting rights,

if any, of the holders of such series; and

i. Such other designations,

powers, preference and relative, participating, optional or other special rights and qualifications, limitations or restrictions thereof.

5. Election of

Directors. Unless and except to the extent that the by-laws of the Corporation (the “By-laws”) shall

so require, the election of directors of the Corporation need not be by written ballot.

6. Limitation

of Liability. To the fullest extent permitted under the General Corporation Law, as amended from time to time, no director of

the Corporation shall be personally liable to the Corporation or its stockholders for monetary damages for breach of fiduciary duty as

a director. Any amendment, repeal or modification of the foregoing provision shall not adversely affect any right or protection of a director

of the Corporation hereunder in respect of any act or omission occurring prior to the time of such amendment, repeal or modification.

7. Indemnification.

7.1. Right to

Indemnification. The Corporation shall indemnify and hold harmless, to the fullest extent permitted by applicable law as it presently

exists or may hereafter be amended, any person (a “Covered Person”) who was or is made or is threatened to be made a party

or is otherwise involved in any action, suit or proceeding, whether civil, criminal, administrative or investigative (a “Proceeding”),

by reason of the fact that he or she, or a person for whom he or she is the legal representative, is or was a director or officer of the

Corporation or, while a director or officer of the Corporation, is or was serving at the request of the Corporation as a director, officer,

employee or agent of another corporation or of a partnership, joint venture, trust, enterprise or nonprofit entity (an “Other Entity”),

including service with respect to employee benefit plans, against all liability and loss suffered and expenses (including attorneys’

fees) reasonably incurred by such Covered Person. Notwithstanding the preceding sentence, except as otherwise provided in Section 7.3,

the Corporation shall be required to indemnify a Covered Person in connection with a Proceeding (or part thereof) commenced by such Covered

Person only if the commencement of such Proceeding (or part thereof) by the Covered Person was authorized by the Board.

7.2. Prepayment

of Expenses. The Corporation shall pay the expenses (including attorneys’ fees) incurred by a Covered Person in defending

any Proceeding in advance of its final disposition, provided, however, that, to the extent required by applicable law, such payment of

expenses in advance of the final disposition of the Proceeding shall be made only upon receipt of an undertaking by the Covered Person

to repay all amounts advanced if it should be ultimately determined that the Covered Person is not entitled to be indemnified under this

Article 7 or otherwise.

7.3. Claims. If

a claim for indemnification or advancement of expenses under this Article 7 is not paid in full within 30 days after a written claim therefor

by the Covered Person has been received by the Corporation, the Covered Person may file suit to recover the unpaid amount of such claim

and, if successful in whole or in part, shall be entitled to be paid the expense of prosecuting such claim. In any such action the Corporation

shall have the burden of proving that the Covered Person is not entitled to the requested indemnification or advancement of expenses under

applicable law.

7.4. Nonexclusivity

of Rights. The rights conferred on any Covered Person by this Article 7 shall not be exclusive of any other rights that such

Covered Person may have or hereafter acquire under any statute, provision of this Certificate of Incorporation, the By-laws, agreement,

vote of stockholders or disinterested directors or otherwise.

7.5. Other Sources. The

Corporation’s obligation, if any, to indemnify or to advance expenses to any Covered Person who was or is serving at its request

as a director, officer, employee or agent of an Other Entity shall be reduced by any amount such Covered Person may collect as indemnification

or advancement of expenses from such Other Entity.

7.6. Amendment

or Repeal. Any repeal or modification of the foregoing provisions of this Article 7 shall not adversely affect any right or protection

hereunder of any Covered Person in respect of any act or omission occurring prior to the time of such repeal or modification.

7.7. Other Indemnification

and Prepayment of Expenses. This Article 7 shall not limit the right of the Corporation, to the extent and in the manner permitted

by applicable law, to indemnify and to advance expenses to persons other than Covered Persons when and as authorized by appropriate corporate

action.

8. Adoption,

Amendment and/or Repeal of By-Laws. In furtherance and not in limitation of the powers conferred by the laws of the State

of Delaware, the Board is expressly authorized to make, alter and repeal the By-laws, subject to the power of the stockholders

of the Corporation to alter or repeal any By-law whether adopted by them or otherwise.

9. Certificate

Amendments. The Corporation reserves the right at any time, and from time to time, to amend, alter, change or repeal any provision

contained in this Second Amended and Restated Certificate of Incorporation, and other provisions authorized by the laws of the State of

Delaware at the time in force may be added or inserted, in the manner now or hereafter prescribed by applicable law; and all rights, preferences

and privileges of whatsoever nature conferred upon stockholders, directors or any other persons whomsoever by and pursuant to this Second

Amended and Restated Certificate of Incorporation in its present form or as hereafter amended are granted subject to the rights reserved

in this article.

v3.24.0.1

Cover

|

Jan. 29, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 29, 2024

|

| Entity File Number |

001-33038

|

| Entity Registrant Name |

ALAUNOS THERAPEUTICS, INC.

|

| Entity Central Index Key |

0001107421

|

| Entity Tax Identification Number |

84-1475642

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

2617 Bissonnet St

|

| Entity Address, Address Line Two |

Suite 225

|

| Entity Address, City or Town |

Houston

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

77005

|

| City Area Code |

(346)

|

| Local Phone Number |

355-4099

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

TCRT

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

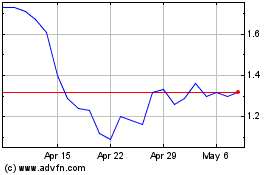

Alaunos Therapeutics (NASDAQ:TCRT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Alaunos Therapeutics (NASDAQ:TCRT)

Historical Stock Chart

From Apr 2023 to Apr 2024