Current Report Filing (8-k)

June 27 2023 - 8:56AM

Edgar (US Regulatory)

0001826397

false

A1

0001826397

2023-06-26

2023-06-26

0001826397

AGRI:CommonSharesMember

2023-06-26

2023-06-26

0001826397

AGRI:SeriesWarrantsMember

2023-06-26

2023-06-26

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): June 26, 2023

AGRIFORCE

GROWING SYSTEMS, LTD.

(Exact

Name of Registrant as Specified in Charter)

| British

Columbia |

|

001-40578 |

|

|

| (State or other jurisdiction |

|

(Commission |

|

(IRS Employer |

| of incorporation) |

|

File Number) |

|

Identification No.) |

| 300 - 2233 Columbia

Street |

|

|

| Vancouver,

BC, |

|

V5Y

0M6 |

| (Address of principal executive

offices) |

|

(Zip Code) |

Registrant’s

telephone number, including area code: (604) 757-0952

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common Shares |

|

AGRI |

|

The Nasdaq Capital Market |

| Series A Warrants |

|

AGRIW |

|

The Nasdaq Capital Market |

FORWARD-LOOKING

STATEMENTS

This

Form 8-K and other reports filed by Registrant from time to time with the Securities and Exchange Commission (collectively, the “Filings”)

contain or may contain forward-looking statements and information that are based upon beliefs of, and information currently available

to, Registrant’s management as well as estimates and assumptions made by Registrant’s management. When used in the Filings

the words “anticipate,” “believe,” “estimate,” “expect,” “future,” “intend,”

“plan” or the negative of these terms and similar expressions as they relate to Registrant or Registrant’s management

identify forward-looking statements. Such statements reflect the current view of Registrant with respect to future events and are subject

to risks, uncertainties, assumptions and other factors relating to Registrant’s industry, Registrant’s operations and results

of operations and any businesses that may be acquired by Registrant. Should one or more of these risks or uncertainties materialize,

or should the underlying assumptions prove incorrect, actual results may differ significantly from those anticipated, believed, estimated,

expected, intended or planned.

Although

Registrant believes that the expectations reflected in the forward-looking statements are reasonable, Registrant cannot guarantee future

results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the

United States, Registrant does not intend to update any of the forward-looking statements to conform these statements to actual results.

Item

1.01 Amendment to a Material Definitive Agreement

See

Item 8.01 below.

Item

8.01 Other Information

On

June 26, 2023, AgriForce Growing Systems, Ltd. (the “Company”) entered into Waiver and Amendment agreements (“Agreements”)

with two institutional investors with respect to those certain Senior Convertible Debentures (“July Notes”) dated July 6,

2022, and Senior Convertible Debentures (“January Notes”, and with the July Notes,

the “Notes”) dated January 17, 2023 issued by the

Company” to those investors (the “Holders”). The Agreements provide as follows:

| 1. | The

Company has notified the Holders of its intention to pay the Monthly Redemption Amount due

on July 1, 2023 in the Notes in Conversion Shares instead of in cash pursuant to Section

6(b) of the Notes, and the Holders have agreed to waive certain requirements under the Notes

in order for the Company to pay the Monthly Redemption Amounts in Conversion Shares. |

| 2. | The

Conversion Price in the Notes has been reduced irrevocably to the Base Conversion Price (which

is currently set at $0.45) based upon subsequent dilutive issuances under the Company’s

ATM program. 100% of ATM proceeds up to $1 million USD have been agreed with the Notes holders

to be kept by Company, while any dollar amount over this threshold is 33% distributed to

the Company and 67% to the Holders , pro-rated based on the outstanding amounts held by the

Holders at such time of determination. |

| 3. | The

minimum tranche for Additional Closings under Section 2.4(a) of the Securities Purchase Agreements

has been reduced from $5 million to $2.5 million. |

| 4. | Upon

the Company’s receipt of a further shareholder approval, the Base Conversion Price

shall be lowered to the lowest price at which the Company has issued a common share or a

right to acquire common shares as described in the first sentence of Section 5(b) of the

Notes (including but not limited to issuances pursuant to the Company’s At Market Issuance

Agreement dated August 18th 2022 with B. Riley Securities, Inc). The Company has

agreed to use best efforts to hold such meeting by August 31, 2023. |

| 5. | The

Holders have each agreed to raise no objection to one or more private placements of securities

by the Company with an aggregate purchase price of up to $1,000,000 at a purchase price of

at least $0.25 per common share and two-year warrant (with a per share exercise price of

$0.50,

and no registration rights). |

| 6. | Section

2(d) of each of the Notes has been restated in full as follows: |

d)

Prepayment. Except as otherwise set forth in this Debenture, the Company may not prepay any portion of the principal amount of

this Debenture without the prior written consent of the Holder. The Company must apply the approved or percentage of approved gross proceeds

from the sale of its Common Stock from an at-the-market offering (as defined in Rule 415 under the Securities Act) to prepay this Debenture

(pro-rated among all Debentures), and shall be permitted to so prepay this Debenture notwithstanding any contrary provision of this Debenture

or the Purchase Agreement. Such prepayments shall be made on a weekly basis (if any sales have been made during such week) on the Wednesday

of the following week. The Company shall give notice to the Holder on the Monday of the following week that a prepayment will be made

on that Wednesday, with the amount of such prepayment.

Item

9.01 Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned thereunto duly authorized.

| Date:

June 27, 2023 |

|

| |

|

| AGRIFORCE

GROWING SYSTEMS, LTD. |

|

| |

|

| By: |

/s/

Richard Wong |

|

| Name: |

Richard

Wong |

|

| Title: |

CFO |

|

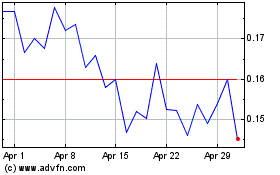

AgriFORCE Growing Systems (NASDAQ:AGRI)

Historical Stock Chart

From Apr 2024 to May 2024

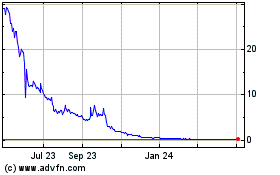

AgriFORCE Growing Systems (NASDAQ:AGRI)

Historical Stock Chart

From May 2023 to May 2024