Afya Limited (Nasdaq: AFYA) (“Afya” or the

“Company”), the leading medical education group and digital health

service provider in Brazil, reported today financial and operating

results for the three and twelve-month periods ended December 31,

2020 (fourth quarter 2020 and full year 2020, respectively).

Financial results are expressed in Brazilian Reais and are

presented in accordance with International Financial Reporting

Standards (IFRS).

Full Year 2020 Highlights

- FY20 Adjusted

Net Revenue of R$1,207.7 million, up 60.9% YoY. Excluding

acquisitions FY20 Adjusted Net Revenue increased 27.6% YoY reaching

R$957.8 million.

- 2020 Adjusted

EBITDA increased 68.9% YoY reaching R$563.1 million, with an

Adjusted EBITDA Margin of 46.6%, increasing 220 basis points (bps).

Adjusted EBITDA excluding acquisitions increased 40.1% YoY,

reaching R$467.2 million, with Adjusted EBITDA Margin of 48.8%, 440

basis points higher than the same period of 2019.

- FY20 Adjusted

Net Income of R$390.9 million was 72.2% higher than FY19.

- Cash conversion

of 75.7% with a solid cash position of R$1.0 billion at

year-end.

- 2,143 medical

seats, 36.3% increase YoY and 11,030 medical students, which was

67.2% up.

Fourth Quarter 2020

Highlights

- 4Q20 Adjusted

Net Revenue increased 57.5% YoY to R$347.9 million. Adjusted Net

Revenue excluding acquisitions grew 10.7%, reaching R$244.4

million.

- 4Q20 Adjusted

EBITDA increased 51.3% YoY reaching R$155.0 million and Adjusted

EBITDA Margin of 44.6%. Adjusted EBITDA excluding acquisitions grew

8.1% reaching R$ 110.8 million, with Adjusted EBITDA Margin of

45.3%.

- 4Q20 Adjusted

Net Income of R$83.1 million, 14.6% higher than 4Q19.

|

Table 1: Financial

Highlights |

|

|

For the three months period ended December

31, |

|

For the twelve months period ended December

31, |

|

(in thousand of R$) |

2020 |

2020 Ex Acquisitions* |

2019 |

% Chg |

% Chg Ex Acquisitions |

|

2020 |

2020 Ex Acquisitions* |

2019 |

% Chg |

% Chg Ex Acquisitions |

|

(a) Net Revenue |

345,266 |

243,795 |

220,846 |

56.3% |

10.4% |

|

1,201,191 |

954,839 |

750,630 |

60.0% |

27.2% |

|

(b) Adjusted Net Revenue (3) |

347,896 |

244,405 |

220,846 |

57.5% |

10.7% |

|

1,207,735 |

957,790 |

750,630 |

60.9% |

27.6% |

|

(c) Pro forma Adjusted Net Revenue (1) |

347,896 |

244,405 |

220,846 |

57.5% |

10.7% |

|

1,207,735 |

957,790 |

829,731 |

45.6% |

15.4% |

|

(d) Adjusted EBITDA (2) |

155,048 |

110,746 |

102,491 |

51.3% |

8.1% |

|

563,113 |

467,235 |

333,436 |

68.9% |

40.1% |

|

(e) = (d)/(b) Adjusted EBITDA Margin |

44.6% |

45.3% |

46.4% |

-180 bps |

-110 bps |

|

46.6% |

48.8% |

44.4% |

220 bps |

440 bps |

|

(f) Pro forma Adjusted EBITDA (1) |

155,048 |

110,746 |

102,491 |

51.3% |

8.1% |

|

563,113 |

467,235 |

361,622 |

55.7% |

29.2% |

|

(g) = (e)/(c) Pro forma Adjusted EBITDA Margin (1) |

44.6% |

45.3% |

46.4% |

-180 bps |

-110 bps |

|

46.6% |

48.8% |

43.6% |

300 bps |

520 bps |

|

(h) Adjusted Net Income |

83,116 |

49,907 |

72,529 |

14.6% |

-31.2% |

|

390,909 |

322,029 |

226,953 |

72.2% |

41.9% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* Acquisitions includes UniRedentor, UniSL, PEBMED, FCMPB,

MedPhone, FESAR and ITPAC Santa Inês. |

|

1. Includes the pro-forma results of Medcel, IPEMED and FASA, as if

the acquisition had been consummated on January 1, 2019. |

|

2. See more information on "Non-GAAP Financial Measures" (Item

10). |

|

3. Includes mandatory discounts in tuition fees granted by state

decrees and individual and collective legal proceedings due COVID

19 on site classes restriction. |

1. Message from

Management

Virgilio Gibbon, Afya’s CEO,

stated:

I am extremely proud that Afya has

over-delivered outstanding results since the IPO. Our performance

reflects successful execution of our assertive strategy, commitment

of our team members and the resilience of our business model,

particularly during a year of a worldwide pandemic. Since 2017, our

Net Revenue has grown almost 6 times and we are not only growing

fast, our Adjusted Ebitda has grown almost 8 times and increased

1,300 basis points in margin in the same period. And there is more:

Afya generated operating cash of R$391 million in 2020, 9x higher

than 2017’s, reaffirming our tripod of strong growth with high

profitability and cash generation while reinforcing our financial

strength to continue consolidating medical seats, even after we

achieve the 1,000 seats guided in the IPO.

Along with this impressive growth and

profitability figures, we have been creating the largest medical

ecosystem in Brazil, with more than 198 thousand physicians and

medical students using one of our products. We also have more than

430 partnerships with hospitals and clinics in Brazil. Afya’s focus

continues to be providing a lifelong learning experience for

physicians and to help doctors to transform the Brazilian

healthcare environment.

During the year, we successfully executed our

strategy to continue to be the market leader of medical school

seats in Brazil. We have completed 9 acquisitions since we became

public, adding 851 medical seats in less than two years, or

approximately 85% of our three-year target shared during our IPO.

Importantly, we have a solid track record of integrating acquired

companies and delivering cost efficiencies and synergies that can

be seen in the margin expansion we are presenting. These

acquisitions set us up to deliver continued strong results in the

months and years to come. Our medical education business remains,

and will continue to be, the cornerstone of our business in the

short and midterms. We have become extremely efficient at operating

medical schools and we continue to see opportunities in this

area.

In the beginning of the year, due to the

pandemic, we had to adapt with the agility needed to stay focused

on providing the high-quality educational experience that our

students had come to expect from us while at the same time

executing on our long-term strategic plan. We are fortunate that,

as a business, we are able to assist the medical community by using

our campuses as health centers and by providing free courses to

assist hospitals, medical schools, physicians and nurses at this

difficult times.

The COVID-19 pandemic intensified some behavior

shifts already underway. It has caused the acceleration of our long

term plan as well as the unfolding of our digital services

strategy. As evidenced by the pandemic, the medical community and

patients have embraced a digital component to healthcare. We

discussed in the past that digital assets were appealing to us so

that we can add more services to medical students and

professionals, thus maximizing our product offering and lifetime

customer value. In turn, during the year, we furthered Afya’s

Digital Strategy with the acquisition of PEBMED, iClinic, MedPhone

and Medical Harbour. These acquisitions enable us to deepen our

relationship with our students as well as put our brand in front of

many new doctors, nurses and other medical personnel and students,

enhancing our competitive position and our capabilities.

We continue to have a peer-leading capital

structure, providing us with the ability to adapt to the dynamic

environment and maintain our focus on long-term value generation.

Given our strong free cash flow and liquidity, we remain committed

to our long-term capital priorities, with a balanced approach to

invest in the business and return cash to our shareholders, all

while keeping our students, faculty members and employees safe and

managing through this volatile environment.

Our quality and execution was also acknowledged

and rewarded this year. Afya was the winner of the Education sector

in the Época Negócios 360 survey and also won the Golden Tombstone

in the Equity category. This award is evaluated by the Brazilian

Institute of Finance Executives (IBEF – São Paulo Chapter) and

recognizes Equity Operations in aspects such as complexity of the

transaction, innovation, pricing and others.

Lastly but very important, beginning with this

earnings release we will report key ESG Metrics on an ongoing

basis. Afya’s engagement on these topics is generating a

significant impact on society which makes our team very proud and

even more committed to our values and strategy.

2. Key Events in the

Quarter:

- Authorization to

operate the undergraduate medicine courses in Santa Inês, in the

State of Maranhão, starting October 2, 2020 and in Cruzeiro do Sul,

in the State of Acre, starting December 30, 2020, under the Mais

Médicos II program, adding 100 medical seats.

- Closing of

MedPhone acquisition - MedPhone is a clinical decision software and

medical information guide app in Brazil that helps physicians,

medical students and other healthcare professionals to make faster

and more accurate decisions on a daily basis.

- Closing of FCMPB

acquisition, a medical school in the state of Paraíba, adding 157

medical seats and 861 students to the student base and of FESAR, a

medical school located in the state of Pará, adding 120 medical

seats and 359 students in the beginning of November, 2020.

- Entrance into a

purchase agreement in October, 2020 for the acquisition of

UNIFIPMoc and Fip Guanambi, in the states of Minas

Gerais and Bahia, respectively, adding another 160

medical seats.

- Authorization of

a share buyback program for up to 1,015,844 outstanding Class A

common shares to be purchased in the open market, based on

prevailing market prices, or in privately negotiated transactions,

over a period beginning on December 24, 2020 continuing until the

earlier of the completion of the repurchase or December 31, 2021,

depending upon market conditions.

3. Subsequent Events in

the Quarter

- Closing of the

iClinic acquisition in January, 2021 – a leading practice

management software for physicians in Brazil, expanding Afya’s

end-to-end digital health services.

- Medicinae

acquisition in March 2021 – a unique financial platform that allows

healthcare professionals throughout Brazil to manage receivables in

an efficient and scalable way using FIDC (Receivables Investment

Fund). Medicinae alleviates a number of challenges in the

healthcare payments industry, as it reduces long payment cycles for

professionals and consolidates financial information, improving the

consumer financial experience.

- Medical Harbour

acquisition in April, 2021 – Medical Harbour offers Educational

Health and Medical Imaging Solutions through an interactive

platform for anatomical study, 3D virtual dissection and analysis

of medical images, which allow the exploration, and knowledge of

human anatomy with digital resources.

4. Second Half 2020

Guidance Achievement

Taking into account the challenges brought about

by the Coronavirus outbreak, the Company’s financial results

reaffirmed the resiliency of its business model. Net Revenue of R$

642 million was R$ 2 million above the top end of the guidance

range, while the EBITDA margin was within the guidance range.

| |

|

Guidance for 2H2020 |

Actual 2H2020 |

|

Net Revenue (1) (2) (3) |

|

R$ 600 mn ≤ ∆ ≤ R$ 640 mn |

R$ 641.9 mn |

|

Adjusted EBITDA Margin |

|

45.5% ≤ ∆ ≥ 47.0% |

45.9% |

| |

|

|

|

|

(1) Includes PEBMED starting on July 20, 2020. |

|

(2) Includes R$ 14.4 million of Net Revenue related to the 1H20

that was not recognized due to the postponement of practical

classes during the pandemic. |

|

(3) Excludes any acquisition that may have been concluded after the

issuance of the guidance. Thus, does not include FCMPB, FESAR and

MedPhone |

5. First Half 2021

GuidanceThe Company is introducing guidance for 1H21 which

takes into account the successfully concluded acceptances of new

medicine students, ensuring 100% occupancy for the first half of

2021 in all of its medical schools. Brazil is still facing

uncertain times due COVID-19 which could have some effect on the

business which is unpredictable at this time.

Considering the above factors, the guidance for

1H21 is defined in the following table:

|

Guidance for 1H21 |

Important considerations |

|

Net Revenue is expected to be between R$740 million – R$780

million |

- Includes Mais Médicos schools in Santa Inês and Cruzeiro do Sul

starting on January 1, 2021.

|

- Includes iClinic starting on January 21, 2021.

|

- Excludes any acquisition that may be concluded after the

issuance of the guidance. For example, it does not include

UNIFIPMOC, which 2020 estimated Net Revenue was R$109 million.

|

|

Adjusted EBITDA Margin is expected to be between 46.0%-48.0% |

- Includes Mais Médicos schools in Santa Inês and Cruzeiro do Sul

starting on January 1, 2021.

|

- Includes iClinic starting on January 21, 2021.

|

- Excludes any acquisition that may be concluded after the

issuance of the guidance. For instance does not include

UNIFIPMOC.

|

- Includes the impact of the adoption of IFRS 16.

|

The guidance above represents up to 42.7% YoY

growth in terms of Net Revenue and up to 44.7% YoY growth in terms

of Adjusted EBITDA, both at the high end of the guidance range.

This guidance reflects the embedded growth through the medical

school seats and average tuition maturation, along with a

successful acquisition strategy and the strength of the Company’s

digital platform.

6. Overview of 2020

& 4Q20

Operational Review

Afya is the only company offering technological

solutions to support physicians across every stage of the medical

career, from undergraduate students in its medical school years

through medical residency preparatory courses, medical

specialization programs and continuing medical education. With the

acquisition of PEBMED Afya entered into digital health services,

providing content and clinical decision applications.

The Company operates two distinct business

units. The first (Business Unit 1 or BU1), is

comprised of Undergraduate – medical schools, other healthcare

programs and ex-health degrees. Revenue is generated from the

monthly tuition fees the Company charges students enrolled in the

undergraduate programs. The Company also offers Residency

Preparatory, Specialization Programs and Digital Health Services

(Business Unit 2 or BU2). Revenue is comprised of

fees from these programs and other revenues from digital services

offered.

| Key Revenue Drivers –

BU1 |

|

|

|

| |

|

|

|

|

Table 2: Key Revenue Drivers |

Twelve months ended December 31, |

|

|

2020 |

2019 |

% Chg |

|

Business Unit 1: Educational Services Segment

(1) |

|

|

|

|

MEDICAL SCHOOL |

|

|

|

|

Approved Seats (2) |

2,143 |

1,572 |

36.3 |

% |

|

Operating Seats |

1,893 |

1,222 |

54.9 |

% |

|

Total Students |

11,030 |

6,597 |

67.2 |

% |

|

Total Students (ex- Acquisitions)* |

7,854 |

5,603 |

40.2 |

% |

|

Tuition Fees (ex- Acquisitions - R$MM) |

751,627 |

491,556 |

52.9 |

% |

|

Tuition Fees (Total - R$MM) |

910,966 |

550,208 |

65.6 |

% |

|

Medical School Avg. Ticket (ex- Acquisitions* -

R$/month) |

7,975 |

7,311 |

9.1 |

% |

|

UNDERGRADUATE HEALTH SCIENCE |

|

|

|

|

Total Students |

10,325 |

6,494 |

59.0 |

% |

|

Total Students (ex- Acquisitions)* |

5,882 |

6,494 |

-9.4 |

% |

|

Tuition Fees (ex- Acquisitions* - R$MM) |

101,558 |

98,488 |

3.1 |

% |

|

Tuition Fees (Total - R$MM) |

152,539 |

98,488 |

54.9 |

% |

|

OTHER UNDERGRADUATE |

|

|

|

|

Total Students |

14,851 |

10,878 |

36.5 |

% |

|

Total Students (ex- Acquisitions)* |

8,603 |

10,878 |

-20.9 |

% |

|

Tuition Fees (ex- Acquisitions* - R$MM) |

110,952 |

145,631 |

-23.8 |

% |

|

Tuition Fees (Total - R$MM) |

172,961 |

145,631 |

18.8 |

% |

|

|

|

|

|

|

* In 2019 acquisitions includes FASA and IPEC. In 2020 acquisitions

includes UniRedentor, UniSL, PEBMED, FCMPB, MedPhone, FESAR and

ITPAC Santa Inês. |

|

1. UniRedentor average tuition fee for medical school in 9M2020 was

R$ 9,625 and for UniSL was R$7,010. |

|

2. This number does not include FCMPB and FESAR that had the

closing of the operations in November, 2020 and contribute 277

seats to Afya. |

|

|

|

|

|

|

|

|

|

|

|

Key Revenue Drivers – BU2 |

|

|

|

|

|

|

|

|

|

Table 2: Key Revenue Drivers |

Twelve months ended December 31, |

|

|

2020 |

2019 |

% Chg |

|

Business Unit 2: Prep Courses & CME, Medical

Specialization and Digital Health Services |

|

|

|

Prep Courses |

|

|

|

|

Active Paying Students |

|

|

|

|

Prep Courses & CME - B2C |

11,316 |

9,577 |

18.2 |

% |

|

Prep Courses & CME - B2B |

1,723 |

1,182 |

45.8 |

% |

|

Medical Specialization & Others |

|

|

|

|

Medical Specialization & Others |

4,181 |

1,588 |

163.3 |

% |

|

Medical Specialization & Others (ex-UniRedentor) |

1,571 |

1,588 |

-1.1 |

% |

|

Digital Health Services - Clinical Decision

Software |

|

|

|

|

WhiteBook Active Subscribers |

106,977 |

81,874 |

30.7 |

% |

|

Revenue from courses (ex- UniRedentor and PEBMED - R$MM)

(3) |

186,642 |

100,750 |

85.3 |

% |

|

Revenue from courses (Total - R$MM) (3) |

200,349 |

100,750 |

98.9 |

% |

|

|

|

|

|

|

* Acquisitions includes UniRedentor, UniSL, PEBMED, FCMPB,

MedPhone, FESAR and ITPAC Santa Inês. |

|

|

3. As Medcel and IPEMED were acquired on March 31, 2019 and on

May 9, 2019 respectively, revenue from courses for BU2 were not

accounted for in 1Q19. The number of students is disclosed to

contribute with investors analysis. |

Key Operational Drivers –

BU2

Monthly Active Users (MaU) represents the number

of unique individuals that consumed Afya’s digital content in the

last 30 days of a specific period. Total monthly active users were

162,512 in WhiteBook, 1.5% lower than 3Q20.

Considering only the MaU of Medcel, the user

base decreased 20.0% due to COVID related courses that were offered

in 2Q20, which temporarily inflated MaU in that quarter. Afya’s

offers to its MaU a significant amount of learning assets,

comprised of e-books, videos, podcasts and question/answer

documents.

|

Table 3: Key Operational Drivers for BU2 |

2020 |

| |

4Q20 |

3Q20 |

% Chg |

|

2Q20 |

1Q20 |

|

Total Monthly Active Users (MaU) - Medcel |

14,658 |

18,322 |

-20.0 |

% |

|

20,420 |

16,008 |

|

Total Monthly Active Users (MaU) - WhiteBook |

162,512 |

165,035 |

-1.5 |

% |

|

- |

- |

Seasonality

Afya’s two businesses are impacted by

seasonality but at different time periods. The first is associated

with the concentration of prep course revenues in the first and

fourth quarters of each year, when new content (books and e-books)

is delivered and the majority of the revenues are recognized. The

second is associated with the maturation of several medical

schools, which leads to a higher enrollment base in the second half

of each year. As a result, in a typical year, the first quarter is

normally the strongest. The fourth quarter is typically the second

strongest, followed by the third and second quarters, respectively.

Finally, the second half of the year is normally stronger than the

first half.

Revenue

Total Net Revenue for fourth quarter 2020 was

R$345.3 million, an increase of 56.3% over the same period of prior

year, due to maturation of medical seats, expansion of Afya Digital

and consolidating acquisitions. Adjusted Net Revenue in 4Q20, which

includes the impact of R$2.6 million due to net temporary discounts

in tuition fees granted by state decrees and individual and

collective legal proceedings related to COVID 19, was R$347.9

million. Excluding acquisitions (UniRedentor, UniSL, PEBMED, FCMPB,

MedPhone, FESAR and ITPAC Santa Inês), Adjusted Net Revenue in the

fourth quarter increased 10.7% YoY to R$244.4 million.

For the twelve-months ended December 31, 2020,

Total Net Revenue was R$1,201.2 million, up 60.0% over the same

period of last year. Full year Adjusted Net Revenue was also

R$1,207.7 million. Excluding acquisitions (UniRedentor, UniSL,

PEBMED, FCMPB, MedPhone, FESAR and ITPAC Santa Inês), Adjusted Net

Revenue in the twelve-months ended December 31, 2020 increased

27.6% YoY, reaching R$957.8 million.

The Company anticipated the enrollment process

to the 1H2020, thus creating a strong base of students. This

strategy ensured a 100% occupancy of medical seats and resulted in

stronger revenue growth in the first semester over the second

semester.

|

Table 4: Revenue & Revenue Mix |

|

(in thousands of R$) |

For the three months period ended December

31, |

|

For the Twelve months period ended December

31, |

|

|

2020 |

2020 Ex Acquisitions* |

2019 |

% Chg |

% Chg Ex Acquisitions |

|

2020 |

2020 Ex Acquisitions* |

2019 |

% Chg |

% Chg Ex Acquisitions |

|

Net Revenue Mix |

|

|

|

|

|

|

|

|

|

|

|

|

Business Unit-1 |

284,193 |

193,722 |

176,129 |

61.4% |

10.0% |

|

1,002,461 |

852,301 |

653,760 |

53.3% |

30.4% |

|

Business Unit-2 |

61,073 |

50,073 |

44,717 |

36.6% |

12.0% |

|

200,349 |

102,538 |

100,750 |

98.9% |

1.8% |

|

Inter-segment transactions |

- |

- |

- |

- |

- |

|

- 1,619 |

|

- 3,880 |

-58.3% |

- |

|

Total Reported Net Revenue |

345,266 |

243,795 |

220,846 |

56.3% |

10.4% |

|

1,201,191 |

954,839 |

750,630 |

60.0% |

27.2% |

|

Total Adjusted Net Revenue ¹ |

347,896 |

244,405 |

220,846 |

57.5% |

10.7% |

|

1,207,735 |

957,790 |

750,630 |

60.9% |

27.6% |

|

Total Pro Forma Adjusted Net Revenue² |

347,896 |

244,405 |

220,846 |

57.5% |

10.7% |

|

1,207,735 |

957,790 |

829,731 |

45.6% |

15.4% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* Acquisitions includes UniRedentor, UniSL, PEBMED, FCMPB,

MedPhone, FESAR and ITPAC Santa Inês. |

|

1. Includes mandatory discounts in tuition fees granted by state

decrees and individual and collective legal proceedings due

COVID-19. |

|

2. Includes the pro forma results of Medcel, IPEMED and FASA, as if

the acquisitions had been consummated on January 1, 2019. |

Adjusted EBITDA

Adjusted EBITDA in the three-months ended

December 31, 2020 increased 51.3% to R$155.0 million, up from

R$102.5 million in the same period of the prior year. Adjusted

EBITDA Margin of 44.6% decreased from 46.4% due to the postponement

of Medcel’s revenue recognition caused by delays in book shipments

and change in the methodology of allowance for doubtful accounts in

4Q19.

Excluding the consolidation of acquisitions

(UniRedentor, UniSL, PEBMED, FCMPB, MedPhone, FESAR and ITPAC Santa

Inês), Adjusted EBITDA in the three-months ended December 31, 2020

increased 8.1% YoY to R$110.8 million from R$102.5 million while

Adjusted EBITDA Margin decreased 110 basis points to 45.3%.

For the twelve-months ended December 31, 2020,

Pro forma Adjusted EBITDA increased 55.7% to R$563.1 million, from

R$361.6 million in the twelve-months ended December 31, 2019.

Adjusted EBITDA Margin of 46.6% was 300 basis points higher than

the same period of the prior year, benefitting from the synergies

extracted from the successful integration of acquisitions and

medical seats and tickets maturation.

For the twelve-months ended December 31, 2020,

Pro forma Adjusted EBITDA excluding acquisitions (UniRedentor,

UniSL, PEBMED, FCMPB, MedPhone, FESAR and ITPAC Santa Inês)

increased 29.2% YoY to R$467.2 million up from R$361.6 million

while Pro forma Adjusted EBITDA Margin increased 520 basis points,

to 48.8% from 43.6%, mainly due to operational leverage and

synergies obtained from recent acquisitions.

|

Table 5: Adjusted EBITDA |

|

(in thousands of R$) |

For the three months period ended December

31, |

|

For the twelve months period ended December

31, |

|

|

2020 |

2020 Ex Acquisitions* |

2019 |

% Chg |

% Chg Ex Acquisitions |

|

2020 |

2020 Ex Acquisitions* |

2019 |

% Chg |

% Chg Ex Acquisitions |

|

Adjusted EBITDA |

155,048 |

110,746 |

102,491 |

51.3% |

8.1% |

|

563,113 |

467,235 |

333,436 |

68.9% |

40.1% |

|

% Margin |

44.6% |

45.3% |

46.4% |

-180 bps |

-110 bps |

|

46.6% |

48.8% |

44.4% |

220 bps |

440 bps |

|

Proforma Adjusted EBITDA¹ |

155,048 |

110,746 |

102,491 |

51.3% |

8.1% |

|

563,113 |

467,235 |

361,622 |

55.7% |

29.2% |

|

% Margin |

44.6% |

45.3% |

46.4% |

-180 bps |

-110 bps |

|

46.6% |

48.8% |

43.6% |

300 bps |

520 bps |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* Acquisitions includes UniRedentor, UniSL, PEBMED, FCMPB,

MedPhone, FESAR and ITPAC Santa Inês. |

|

|

|

|

1. Includes the pro forma results of Medcel, IPEMED and FASA, as if

the acquisitions had been consummated on January 1, 2019. |

Adjusted Net Income

Adjusted Net Income for the fourth quarter of

2020 was R$83.1 million, up 14.6% over the same period of the prior

year and reflects lower financial results, due to the 8.0% exchange

rate depreciation (US Dollar versus Brazilian Real) in the period,

the increase on loan agreements and debts with selling shareholders

and the increase of R$9.0 million in non-recurring expenses.

For the twelve-months ended December 31, 2020,

the Company reported Adjusted Net Income of R$390.9 million,

compared to an Adjusted Net Income of R$226.9 million in the

twelve-months ended December 31, 2019, an increase of 72.2%, mainly

due to revenue contribution, synergies captured and margin

expansion from the consolidation of acquisitions as well as organic

growth. Earnings per share (EPS) was up 55.2% year over year,

reaching R$ 3.15.

|

(in thousands of R$) |

|

|

|

|

|

|

|

| |

For the three months period ended December

31, |

|

For the twelve months period ended December

31, |

|

|

2020 |

2019 |

% Chg |

|

2020 |

2019 |

% Chg |

|

Net income |

60,856 |

52,976 |

14.9% |

|

307,987 |

172,762 |

78.3% |

|

Amortization of customer relationships and trademark (1) |

14,299 |

11,303 |

26.5% |

|

50,312 |

36,077 |

39.5% |

|

Share-based compensation |

7,961 |

8,250 |

-3.5% |

|

32,610 |

18,114 |

80.0% |

|

Adjusted Net Income |

83,116 |

72,529 |

14.6% |

|

390,909 |

226,953 |

72.2% |

|

|

|

|

|

|

|

|

|

|

Basic earnings per share (R$) |

|

|

|

|

3.15 |

2.03 |

55.2% |

|

|

|

|

|

|

|

|

|

|

(1) Consists of amortization of customer relationships and

trademark recorded under business combinations. |

Cash and Debt Position

Cash and cash equivalents, including restricted

cash, at December 31, 2020 were R$1.0 billion, in line with the

cash position in September 30, 2020.

For the twelve-month period ended December 31,

2020, Afya reported an Adjusted Cash Flow from Operations of

R$390.9 million up from R$307.7 million in same period of previous

year, a 27.0% year-over-year increase.

Operating Cash Conversion Ratio for the

twelve-month period ended December 31, 2020 was 75.7% compared with

99.7% in same period of the previous year. This decrease was mainly

due to: (a) consolidation of Medcel, as its results negatively

affect cash conversion in the first and fourth quarters, because

prep courses revenues are recognized mainly in the first and fourth

quarters of each year; and (b) students renegotiation of overdue

monthly installments due to COVID-19 crisis which increased

accounts receivable in the period.

|

Table 6: Operating Cash Conversion Ratio

Reconciliation |

For the twelve months period ended December

31, |

|

(in thousands of R$) |

Considering the adoption of IFRS 16 |

|

|

2020 |

2019 |

% Chg |

|

(a) Cash flow from operations |

371,507 |

299,216 |

24.2% |

|

(b) Income taxes paid |

19,374 |

8,506 |

127.8% |

|

(c) = (a) + (b) Adjusted cash flow from

operations |

390,881 |

307,722 |

27.0% |

|

|

|

|

|

|

(d) Adjusted EBITDA |

563,113 |

333,436 |

68.9% |

|

(e) Non-recurring expenses: |

|

|

|

|

- Integration of new companies (1) |

9,765 |

6,301 |

55.0% |

|

- M&A advisory and due diligence (2) |

6,161 |

2,752 |

123.9% |

|

- Expansion projects (3) |

18,134 |

3,685 |

392.1% |

|

- Restructuring Expenses (4) |

5,943 |

12,139 |

-51.0% |

|

- Mandatory Discounts in Tuition Fees (5) |

6,544 |

- |

n.a. |

|

(f) = (d) - (e) Adjusted EBITDA ex- non-recurring

expenses |

516,565 |

308,559 |

67.4% |

|

(g) = (a) / (f) Operating cash conversion

ratio |

75.7% |

99.7% |

-2400 bps |

|

(1) Consists of expenses related to the integration of newly

acquired companies. |

|

|

|

(2) Consists of expenses related to professional and consultant

fees in connection with due diligence services for M&A

transactions. |

|

(3) Consists of expenses related to professional and consultant

fees in connection with the opening of new campuses. |

|

(4) Consists of expenses related to the employee redundancies in

connection with the organizational restructuring of acquired

companies. |

|

(5) Consists of mandatory discounts in tuition fees granted by

state decrees and individual and collective legal proceedings due

COVID-19 on site classes restriction. |

On December 31, 2020, net debt totaled R$166.9

million, compared with a net cash position of R$582.6 million on

December 31, 2019, mainly due to acquisitions payments.

|

Table 7: Cash and Debt Position |

For the twelve months period ended December

31, |

|

(in thousands of R$) |

|

|

|

|

|

2020 |

2019 |

% Chg |

|

(+) Cash and Cash Equivalents |

1,045,042 |

943,209 |

10.8% |

|

Cash and Bank Deposits |

57,729 |

13,092 |

340.9% |

|

Cash Equivalents |

987,313 |

930,117 |

6.1% |

|

(-) Loans and Financing |

617,485 |

60,357 |

923.1% |

|

Current |

107,162 |

53,607 |

99.9% |

|

Non-Current |

510,323 |

6,750 |

7460.3% |

|

(-) Accounts Payable to Selling Shareholders |

518,240 |

300,237 |

72.6% |

|

Current |

188,420 |

131,883 |

42.9% |

|

Non-Current |

329,820 |

168,354 |

95.9% |

|

(-) Other Short and Long Term Obligations |

76,181 |

0 |

N/A |

|

(=) Net Debt (Cash) excluding IFRS 16 |

166,864 |

-582,615 |

- |

|

(-) Lease Liabilities |

447,703 |

284,515 |

57.4% |

|

Current |

61,976 |

22,693 |

173.1% |

|

Non-Current |

385,727 |

261,822 |

47.3% |

|

Net Debt (Cash) with IFRS 16 |

614,567 |

-298,100 |

- |

ESG Metrics

Education and health, pillars for Afya's

business, are also crucial issues for individuals’ well-being and

socio-economic development. In turn, Afya, which has schools

distributed nationwide is able to have positive impacts for local

communities.

The Company operates in many regions that do not

have sufficient numbers of physicians to serve the population, the

healthcare system is in need of investments and the population does

not have access to quality health services. With Afya’s regional

presence, the Company is able to attract medical and health

professionals to remote regions, to make investment in the local

healthcare system, along with providing free consultations for low

income populations.

Afya ensures that its human resource policies

encompass social inclusion, employees’ well-being, gender equality

and people development. More than half of Afya’s employees are

female, 55% of the management positions are held by women and there

are two women on the board of directors, accounting for 18% of the

11 total members. Additionally, the Company is committed to

supporting the disabled community and guarantees that 3% of its

hires fall into this category.

With respect to the environment the Company is

undertaking a project to install solar panels in all of its

campuses which will generate all the energy needed by Afya. The

Company currently has 4 campuses operating with solar panels and 8

campuses are in the process of implementation.

ESG commitment is an important part of Afya’s

strategy and permeates the Company’s core values. Afya has been

advancing year after year on its core pillars and, going forward,

ESG metrics will be disclosed in the Company’s quarterly financial

results.

|

Table 8: ESG Metrics |

2020 |

2019 |

|

# |

Governance and Employee Management |

|

|

| 1 |

Number of employees |

6,100 |

3,369 |

| 2 |

Percentage of female employees |

55.0% |

57.0% |

| 3 |

Percentage of female employees in the board of directors |

18% |

22% |

|

4 |

Percentage of independent member in the board of directors |

36% |

22% |

| |

Environmental |

|

|

| 4 |

Total energy consumption (kWh) |

6,428,382 |

5,928,450 |

| 4.1 |

Consumption per campus |

257,135 |

395,230 |

| 5 |

% supplied by distribution companies |

87.4% |

96.2% |

| 6 |

% supplied by other sources |

12.6% |

3.8% |

|

7 |

Greenhouse gas emissions (tons) |

397 |

445 |

| |

Social |

|

|

| 8 |

Number of free consultations offered by Afya students |

427,184 |

270,000 |

| 9 |

Number of physicians graduated in Afya's campuses |

12,691 |

8,306 |

| 10 |

Number of students with financing programs (FIES and PROUNI) |

4,999 |

2,808 |

| 11 |

% of the undergraduate students |

13.7% |

11.7% |

| 12 |

Hospital and clinics partnership |

432 |

60 |

7. Conference Call and

Webcast Information

When: April 9, 2021 at 11:00

a.m. ET.

|

Who: |

Mr. Virgilio Gibbon, Chief Executive OfficerMr. Luis André Blanco,

Chief Financial OfficerMs. Renata Costa Couto, Head of Investor

Relations |

Dial-in: Brazil: +55 11 4632 2237

or +55 11 4680 6788 or +55 11 4700 9668 or +55 21

3958 7888 or +55 11 4632 2236

United States: +1 929 205 6099 or +1 301 715 8592 or

+1 312 626 6799 or +1 669 900 6833 or +1 253 215 8782

or +1 346 248 7799

ID to webinar: 913 4980 5259

Other Numbers: https://afya.zoom.us/u/aeG5a381E

OR Webcast:

https://afya.zoom.us/j/91349805259 ID to webinar: 913 4980 5259

8. About Afya Limited

(Nasdaq: AFYA)

Afya is the leading medical education group in

Brazil based on number of medical school seats, delivering an

end-to-end physician-centric ecosystem that serves and empowers

students to be lifelong medical learners from the moment they

enroll as medical students through their medical residency

preparation, graduation program, and continuing medical education

activities. Afya also offers content and clinical decision

applications for healthcare professionals, through its products

WhiteBook, Nursebook and Portal PEBMED. For more information,

please visit www.afya.com.br.

9. Forward – Looking

Statements

This press release contains forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995, which statements involve substantial risks and

uncertainties. All statements other than statements of historical

fact, could be deemed forward looking, including risks and

uncertainties related to statements about our competition; our

ability to attract, upsell and retain students; our ability to

increase tuition prices and prep course fees; our ability to

anticipate and meet the evolving needs of student and teachers; our

ability to source and successfully integrate acquisitions; general

market, political, economic, and business conditions; and our

financial targets such as revenue, share count and IFRS and

non-IFRS financial measures including gross margin, operating

margin, net income (loss) per diluted share, and free cash flow.

Forward-looking statements by their nature address matters that

are, to different degrees, uncertain, such as statements about the

potential impacts of the COVID-19 pandemic on our business

operations, financial results and financial position and on the

Brazilian economy.

The Company undertakes no obligation to update

any forward-looking statements made in this press release to

reflect events or circumstances after the date of this press

release or to reflect new information or the occurrence of

unanticipated events, except as required by law. The achievement or

success of the matters covered by such forward-looking statements

involves known and unknown risks, uncertainties and assumptions. If

any such risks or uncertainties materialize or if any of the

assumptions prove incorrect, our results could differ materially

from the results expressed or implied by the forward-looking

statements we make. Readers should not rely upon forward-looking

statements as predictions of future events. Forward-looking

statements represent management’s beliefs and assumptions only as

of the date such statements are made. Further information on these

and other factors that could affect the Company’s financial results

is included in filings made with the United States Securities and

Exchange Commission (SEC) from time to time, including the section

titled “Risk Factors” in the most recent Rule 434(b) prospectus.

These documents are available on the SEC Filings section of the

investor relations section of our website at:

https://ir.afya.com.br/.

10. Non-GAAP Financial

Measures

To supplement the Company's consolidated

financial statements, which are prepared and presented in

accordance with International Financial Reporting Standards as

issued by the International Accounting Standards Board—IASB, Afya

uses Proforma Revenue, Adjusted EBITDA, Pro Forma Adjusted EBITDA,

Pro Forma Adjusted Net Income and Operating Cash Conversion Ratio

information for the convenience of investors, which are non-GAAP

financial measures. A non-GAAP financial measure is generally

defined as one that purpose to measure financial performance but

excludes or includes amounts that would not be so adjusted in the

most comparable GAAP measure.

Afya calculates Adjusted EBITDA as net income

plus/minus net financial result plus income taxes expense plus

depreciation and amortization plus interest received on late

payments of monthly tuition fees, plus share-based compensation

plus/minus income share associate plus/minus non-recurring

expenses. Pro Forma Adjusted EBITDA is calculated as pro forma net

income plus/minus pro forma net financial result plus pro forma

income taxes expense plus pro forma depreciation and amortization

plus pro forma interest received on late payments of monthly

tuition fees, plus pro forma share-based compensation plus/minus

pro forma income share associate plus/minus pro forma non-recurring

expenses. The calculation for Adjusted Net Income is net income

plus amortization of customer relationships and trademark, plus

shared based compensation. We calculate Operating Cash Conversion

Ratio as the cash flows from operations, adjusted with income taxes

paid divided by Adjusted EBITDA plus/minus non-recurring

expenses.

Management presents Adjusted EBITDA, Pro Forma

Adjusted EBITDA and Pro Forma Adjusted Net Income because it

believes these measures provide investors with a supplemental

measure of the financial performance of the core operations that

facilitates period-to-period comparisons on a consistent basis.

Afya also presents Operating Cash Conversion Ratio because it

believes this measure provides investors with a measure of how

efficiently the Company converts EBITDA into cash. The non-GAAP

financial measures described in this prospectus are not a

substitute for the IFRS measures of earnings. Additionally,

calculations of Adjusted EBITDA, Pro Forma Adjusted EBITDA, Pro

Forma Adjusted Net Income and Operating Cash Conversion Ratio may

be different from the calculations used by other companies,

including competitors in the education services industry, and

therefore, Afya’s measures may not be comparable to those of other

companies.

11. Unaudited

Consolidated Financial Information and Pro Forma Condensed

Consolidated Financial Information

These preliminary results are unaudited and are

based on management's initial review of operations for the fourth

quarter and year ended December 31, 2020 and remain subject to the

completion of the Company's customary annual closing and review

procedures by our external auditors as well the completion of the

first year attestation to management’s assessment of the

effectiveness of its internal control over financial reporting

(SOX). Final adjustments and other reclassification may arise

between the date hereof and the filing of the Company's Annual

Report on Form 20-F at the end of April.

The unaudited interim pro forma condensed

consolidated statement of income for the twelve ended December 31,

2019 is based on the historical unaudited interim consolidated

financial statements of each company, and gives effect of the

acquisition of Medcel, IPEMED and FASA by Afya Brazil as if it had

been consummated on January 1, 2019. Pro forma adjustments were

made to reflect the acquisition of Medcel, IPEMED and FASA by Afya

Brazil.

12. Investor Relations

Contact

Renata Couto, Head of Investor RelationsPhone: +55 31

3515.7564 | +55 31

98463.3341E-mail: renata.couto@afya.com.br

13. Financial

Tables

Consolidated statements of

income

For the full year ended December 31, 2020, 2019 and

2018

(In thousands of Brazilian Reais, except earnings per

share)

|

|

2020(Unaudited) |

2019 |

2018 |

| |

|

|

|

| Net revenue |

1,201,191 |

750,630 |

333,935 |

| Cost of services |

(434,654) |

(308,853) |

(168,052) |

| Gross

profit |

766,537 |

441,777 |

165,883 |

| |

|

|

|

|

General and administrative expenses |

(402,855) |

(239,120) |

(70,034) |

|

Other income, net |

(347) |

2,594 |

599 |

| |

|

|

|

| Operating

income |

363,335 |

205,251 |

96,448 |

| |

|

|

|

|

Finance income |

62,290 |

51,689 |

10,428 |

|

Finance expenses |

(98,269) |

(72,365) |

(8,154) |

| Finance result |

(35,979) |

(20,676) |

2,274 |

| |

|

|

|

| Share of income of

associate |

7,698 |

2,362 |

- |

| |

|

|

|

| Income before income

taxes |

335,054 |

186,937 |

98,722 |

| |

|

|

|

|

Income taxes expense |

(27,067) |

(14,175) |

(3,988) |

| |

|

|

|

| Net

income |

307,987 |

172,762 |

94,734 |

| |

|

|

|

|

Other comprehensive income |

- |

- |

- |

| Total comprehensive

income |

307,987 |

172,762 |

94,734 |

| |

|

|

|

| Income attributable to |

|

|

|

|

Equity holders of the parent |

292,075 |

153,916 |

86,353 |

|

Non-controlling interests |

15,912 |

18,846 |

8,381 |

| |

307,987 |

172,762 |

94,734 |

| Basic earnings per

share |

|

|

|

| Per common share |

3.15 |

2.03 |

1.84 |

| Diluted earnings per

share |

|

|

|

| Per common share |

3.12 |

2.02 |

1.81 |

Consolidated balance sheets - For the full year ended

December 31, 2020 and 2019

(In thousands of Brazilian Reais)

|

|

2020(Unaudited) |

2019 |

| Assets |

|

|

| Current

assets |

|

|

|

Cash and cash equivalents |

1,045,042 |

943,209 |

|

Restricted cash |

- |

14,788 |

|

Trade receivables |

302,317 |

125,439 |

|

Inventories |

7,509 |

3,932 |

|

Recoverable taxes |

21,019 |

6,485 |

|

Other assets |

29,614 |

17,912 |

|

Total current assets |

1,405,501 |

1,111,765 |

| |

|

|

| Non-current

assets |

|

|

|

Restricted cash |

2,053 |

2,053 |

|

Trade receivables |

7,627 |

9,801 |

|

Other assets |

74,037 |

17,267 |

|

Property and equipment |

260,381 |

139,320 |

|

Investment in associate |

51,410 |

45,634 |

|

Right-of-use assets |

419,074 |

274,275 |

|

Intangible assets |

2,573,010 |

1,312,338 |

|

Total non-current assets |

3,387,592 |

1,800,688 |

| |

|

|

| Total

assets |

4,793,093 |

2,912,453 |

|

Liabilities |

|

|

| Current

liabilities |

|

|

|

Trade payables |

35,743 |

17,628 |

|

Loans and financing |

107,162 |

53,607 |

|

Derivatives |

- |

757 |

|

Lease liabilities |

61,976 |

22,693 |

|

Accounts payable to selling shareholders |

188,420 |

131,883 |

|

Notes Payable |

10,503 |

- |

|

Advances from customers |

63,839 |

36,860 |

|

Labor and social obligations |

77,855 |

46,770 |

|

Taxes payable |

32,976 |

19,442 |

|

Income taxes payable |

4,574 |

3,213 |

|

Other liabilities |

6,331 |

376 |

|

Total current liabilities |

589,379 |

333,229 |

| |

|

|

| Non-current

liabilities |

|

|

|

Loans and financing |

510,323 |

6,750 |

|

Lease liabilities |

385,727 |

261,822 |

|

Accounts payable to selling shareholders |

329,820 |

168,354 |

|

Notes payable |

65,678 |

- |

|

Taxes payable |

21,425 |

21,304 |

|

Provision for legal proceedings |

53,139 |

5,269 |

|

Other liabilities |

3,822 |

1,999 |

|

Total non-current liabilities |

1,369,934 |

465,498 |

| Total

liabilities |

1,959,313 |

798,727 |

| |

|

|

| Equity |

|

|

|

Share capital |

17 |

17 |

|

Additional paid-in capital |

2,323,488 |

1,931,047 |

|

Share-based compensation reserve |

50,724 |

18,114 |

|

Retained earnings |

407,991 |

115,916 |

| Equity attributable to

equity holders of the parent |

2,782,220 |

2,065,094 |

| Non-controlling interests |

51,560 |

48,632 |

| Total

equity |

2,833,780 |

2,113,726 |

| Total liabilities and

equity |

4,793,093 |

2,912,453 |

Consolidated statements of cash flow - For the full year

ended December 31, 2020, 2019 and 2018

(In thousands of Brazilian Reais)

| |

2020(Unaudited) |

2019 |

2018 |

| |

|

|

|

| Operating

activities |

|

|

|

| |

Income before

income taxes |

335,054 |

186,937 |

98,722 |

| |

|

Adjustments to

reconcile income before income taxes |

|

|

|

|

|

|

|

Depreciation and amortization |

108,744 |

73,152 |

9,078 |

| |

|

|

Disposals of property and

equipment |

- |

78 |

- |

| |

|

|

Allowance for doubtful

accounts |

32,081 |

15,040 |

7,714 |

| |

|

|

Share-based compensation

expense |

32,610 |

18,114 |

2,161 |

| |

|

|

Net foreign exchange

differences |

4,613 |

(13,321) |

2,697 |

| |

|

|

Net loss (gain) on

derivatives |

(20,739) |

1,780 |

(1,219) |

| |

|

|

Accrued interest |

25,543 |

24,002 |

1,856 |

| |

|

|

Accrued lease interest |

44,458 |

31,469 |

- |

| |

|

|

Share of income of

associate |

(7,698) |

(2,362) |

- |

| |

|

|

Provision for legal

proceedings |

5,354 |

(2,568) |

(344) |

| |

|

|

Others |

- |

- |

(11) |

| Changes in

assets and liabilities |

|

|

|

| |

Trade

receivables |

(164,286) |

(35,556) |

(28,198) |

| |

Inventories |

(3,110) |

(236) |

(593) |

| |

Recoverable

taxes |

(13,709) |

(3,940) |

(63) |

| |

Other assets |

(23,902) |

(7,403) |

(3,304) |

| |

Trade

payables |

4,475 |

3,029 |

(1,528) |

| |

Taxes

payables |

(552) |

4,940 |

(3,797) |

| |

Advances from

customers |

(1,951) |

19,324 |

2,073 |

| |

Labor and social

obligations |

11,125 |

6,124 |

(3,019) |

| |

Other

liabilities |

22,771 |

(10,881) |

1,990 |

| |

|

390,881 |

307,722 |

84,215 |

| |

Income taxes

paid |

(19,374) |

(8,506) |

(3,897) |

| |

Net cash

flows from operating activities |

371,507 |

299,216 |

80,318 |

| |

|

|

|

|

|

|

| Investing

activities |

|

|

|

| |

Acquisition of

property and equipment |

(89,832) |

(56,964) |

(18,634) |

| |

Acquisition of

intangibles assets |

(47,753) |

(64,745) |

(3,053) |

| |

Restricted

cash |

14,788 |

7,530 |

(18,810) |

| |

Payments of notes

payable |

(5,974) |

- |

- |

| |

Acquisition of

subsidiaries, net of cash acquired |

(913,991) |

(241,568) |

(221,298) |

| |

Loans to related

parties |

- |

1,598 |

(594) |

| |

Net cash

flows used in investing activities |

(1,042,762) |

(354,149) |

(262,389) |

| Financing

activities |

|

|

|

| |

Issuance of loans

and financing |

605,041 |

7,383 |

74,980 |

| |

Payments of loans

and financing |

(155,090) |

(75,093) |

(6,492) |

| |

Payments of lease

liabilities |

(55,455) |

(39,779) |

- |

| |

Related parties

loans |

- |

- |

(106) |

| |

Capital

increase |

5,444 |

167,628 |

156,304 |

| |

Dividends paid to

non-controlling interests |

(12,984) |

(51,812) |

(5,845) |

| |

Proceeds from

initial public offering |

389,170 |

992,778 |

- |

| |

Share issuance

costs |

(19,704) |

(79,670) |

- |

| |

Net cash

flows from (used in) financing activities |

756,422 |

921,435 |

218,841 |

| |

Net foreign

exchange differences |

16,666 |

14,447 |

- |

| |

Net

increase in cash and cash equivalents |

101,833 |

880,949 |

36,770 |

| |

Cash and cash

equivalents at the beginning of the year |

943,209 |

62,260 |

25,490 |

| |

Cash and cash

equivalents at the end of the year |

1,045,042 |

943,209 |

62,260 |

Reconciliation between Net Income and

Adjusted EBITDA, Pro Forma Adjusted EBITDA

|

Reconciliation between Adjusted EBITDA and Net Income;

Proforma Adjusted EBITDA |

|

(in thousands of R$) |

|

|

|

|

|

|

|

| |

For the three months period ended December

31, |

|

For the twelve months period ended December

31, |

|

|

2020 |

2019 |

% Chg |

|

2020 |

2019 |

% Chg |

|

Net income |

60,856 |

52,976 |

14.9% |

|

307,987 |

172,762 |

78.3% |

|

Net financial result |

26,337 |

3,602 |

631.2% |

|

35,979 |

20,676 |

74.0% |

|

Income taxes expense |

9,979 |

4,473 |

123.1% |

|

27,067 |

14,175 |

90.9% |

|

Depreciation and amortization |

31,015 |

22,449 |

38.2% |

|

108,744 |

73,152 |

48.7% |

|

Interest received (1) |

2,407 |

1,952 |

23.3% |

|

11,876 |

9,680 |

22.7% |

|

Income share associate |

-1,305 |

0 |

n.a. |

|

-7,698 |

0 |

n.a. |

|

Share-based compensation |

7,961 |

8,250 |

-3.5% |

|

32,610 |

18,114 |

80.0% |

|

Non-recurring expenses: |

17,798 |

8,789 |

102.5% |

|

46,548 |

24,877 |

87.1% |

|

- Integration of new companies (2) |

1,809 |

1,814 |

-0.3% |

|

9,765 |

6,301 |

55.0% |

|

- M&A advisory and due diligence (3) |

1,205 |

1,226 |

-1.7% |

|

6,161 |

2,752 |

123.9% |

|

- Expansion projects (4) |

10,964 |

2,162 |

407.1% |

|

18,134 |

3,685 |

392.1% |

|

- Restructuring expenses (5) |

1,190 |

3,587 |

-66.8% |

|

5,943 |

12,139 |

-51.0% |

|

- Mandatory Discounts in Tuition Fees (6) |

2,630 |

0 |

n.a. |

|

6,544 |

0 |

n.a. |

|

Adjusted EBITDA |

155,048 |

102,491 |

51.3% |

|

563,113 |

333,436 |

68.9% |

|

Adjusted EBITDA Margin |

44.6% |

46.4% |

-180 bps |

|

46.6% |

44.4% |

220 bps |

|

Pro Forma Adjusted EBITDA |

155,048 |

102,491 |

51.3% |

|

563,113 |

361,622 |

55.7% |

|

Pro Forma Adjusted EBITDA Margin |

44.6% |

46.4% |

-180 bps |

|

46.6% |

43.6% |

300 bps |

|

|

|

|

|

|

|

|

|

|

(1) Represents the interest received on late payments of monthly

tuition fees. |

|

(2) Consists of expenses related to the integration of newly

acquired companies. |

|

(3) Consists of expenses related to professional and consultant

fees in connection with due diligence services for our M&A

transactions. |

|

(4) Consists of expenses related to professional and consultant

fees in connection with the opening of new campuses. |

|

(5) Consists of expenses related to the employee redundancies in

connection with the organizational restructuring of our acquired

companies. |

|

(6) Consists of mandatory discounts in tuition fees granted by

state decrees and individual and collective legal proceedings due

COVID-19 on site classes restriction. |

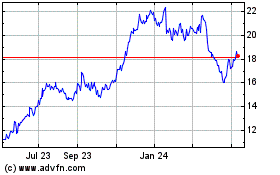

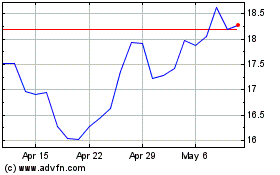

Afya (NASDAQ:AFYA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Afya (NASDAQ:AFYA)

Historical Stock Chart

From Apr 2023 to Apr 2024