|

Summary Prospectus

|

Ticker Symbols

|

|

Investment Grade Fund

|

February 25, 2013

|

Class A: FIIGX

|

|

|

|

Advisor Class: FIIJX

|

|

|

|

Institutional Class: FIIKX

|

Supplemented as of August 1, 2013

|

Before you invest, you may want to review the Fund’s prospectus, which contains more information about the Fund and its risks. You can find the Fund’s prospectus and other information about the Fund, including the statement of additional information (“SAI”) and most recent reports to shareholders, online at

www.firstinvestors.com/prospectuses

. You can also get this information at no cost by calling 1 (800) 423-4026 or by sending an e-mail request to

admcust@firstinvestors.com

. The Fund’s prospectus and SAI, both dated February 25, 2013, as each may be amended or supplemented, and the financial

statements included in the Fund’s annual report to shareholders, dated September 30, 2012, are all incorporated by reference into this Summary Prospectus.

|

Investment Objective

: The Fund seeks to generate a maximum level of income consistent with investment in investment grade debt securities.

Fees and Expenses

of the Fund

: This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts if you invest, or agree to invest in the future, at least $100,000 in certain classes of shares of First Investors Funds. More information about these and other discounts is available from your financial representative and in “Are sales charge discounts and waivers available” on page 110 of the Fund’s prospectus and in “Additional Information About Sales Charge Discounts and

Waivers” on page II-52 of the Fund’s SAI.

|

Shareholder Fees

(fees paid directly from your investment)

|

Class A

|

Class B

|

Advisor Class

|

Institutional Class

|

|

Maximum sales charge (load) imposed on purchases (as a percentage of offering price)

|

5.75%

|

None

|

None

|

None

|

|

Maximum deferred sales charge (load) (as a percentage of the lower of purchase price or redemption price)

|

1.00%

|

4.00%

|

None

|

None

|

|

|

|

|

|

|

|

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

|

Class A

1

|

Class B

1

|

Advisor Class

2

|

Institutional Class

2

|

|

Management Fees

|

0.66%

|

0.66%

|

0.66%

|

0.66%

|

|

Distribution and Service (12b-1) Fees

|

0.30%

|

1.00%

|

0.00%

|

0.00%

|

|

Other Expenses

|

0.21%

|

0.34%

|

0.23%

3

|

0.09%

3

|

|

Total Annual Fund Operating Expenses

|

1.17%

|

2.00%

|

0.89%

|

0.75%

|

1. The expense information in the table has been restated to reflect a revised allocation of expenses between the Fund’s share classes and that, as of April 1, 2013, the Fund will no longer pay annual custodial fees.

2. Expenses are based on estimated expenses expected to be incurred for the fiscal year ending September 30, 2013.

3. The transfer agent has contractually agreed to limit transfer agency expenses of the Advisor and Institutional Class shares of the Fund until at least April 1, 2014, to the extent that transfer agency expenses exceed 0.20% for Advisor Class shares and 0.05% for Institutional Class shares. The transfer agent can be reimbursed by the Fund within three years after the date the expense limitation has been made, provided that such repayment does not cause the transfer agency expenses of the Fund’s Advisor Class and Institutional Class shares to exceed the foregoing limits. The expense limitation may be terminated or amended prior to April 1, 2014 with the approval of the

Fund’s Board of Trustees.

Example

The Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods and reflects conversion of Class B to Class A after eight years. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

|

1 year

|

3 years

|

5 years

|

10 years

|

|

Class A shares

|

$687

|

$925

|

$1,182

|

$1,914

|

|

Class B shares

|

$603

|

$927

|

$1,278

|

$2,113

|

|

Advisor Class shares

|

$91

|

$284

|

$493

|

$1,096

|

|

Institutional Class shares

|

$77

|

$240

|

$417

|

$930

|

You would pay the following expenses if you did not redeem your shares:

|

|

1 year

|

3 years

|

5 years

|

10 years

|

|

Class A shares

|

$687

|

$925

|

$1,182

|

$1,914

|

|

Class B shares

|

$203

|

$627

|

$1,078

|

$2,113

|

|

Advisor Class shares

|

$91

|

$284

|

$493

|

$1,096

|

|

Institutional Class shares

|

$77

|

$240

|

$417

|

$930

|

Portfolio Turnover

: The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 40% of the average value of its whole portfolio.

Principal Investment Strategies

: Under normal circumstances, the Fund will invest at least 80% of its net assets (plus any borrowings for investment purposes) in investment grade debt securities. The Fund defines investment grade debt securities as those that are rated within the four highest ratings categories by Moody’s Investors Service, Inc. (“Moody’s”) or Standard & Poor’s Ratings Services (“S&P”) or that are unrated but determined by the Fund’s Adviser to be of quality equivalent to those within the four highest ratings of Moody’s or S&P.

The Fund may invest in a variety of different types of investment grade securities, including corporate bonds, securities issued or guaranteed by the U.S. Government or U.S. Government-sponsored enterprises (some of which are not backed by the full faith and credit of the U.S. Government), and mortgage-backed and other asset-backed securities. The Fund may also invest in U.S. Treasury futures and options on treasury futures to hedge against changes in interest rates.

In making investment decisions, the Fund considers the outlook for interest rates, economic forecasts and market conditions, credit ratings, and its own analysis of an issuer’s financial condition. The Fund will not necessarily sell an investment if its rating is reduced and it may hold securities that have been downgraded below investment grade (commonly known as “high yield” or “junk” bonds).

Principal Risks

: You can lose money by investing in the Fund. The Fund is intended for investors who:

n

Are seeking an investment which offers current income and a moderate degree of credit risk,

n

Are willing to accept fluctuations in the value of their investment and the income it produces as a result of changes in interest rates, credit ratings and the economy, and

n

Have a long-term investment horizon and are able to ride out market cycles.

Here are the principal risks of investing in the Fund:

Interest Rate Risk

. In general, when interest rates rise, the market value of a debt security declines, and when interest rates decline, the market value of a debt security increases. Securities with longer maturities are generally more sensitive to interest rate changes.

Credit Risk

. This is the risk that an issuer of bonds and other debt securities will be unable to pay interest or principal when due. The

prices of bonds and other debt securities are affected by the credit quality of the issuer and, in the case of asset-backed securities, the credit quality of the underlying loans. Credit risk also applies to securities issued or guaranteed by U.S. Government-sponsored enterprises that are not backed by the full faith and credit of the U.S. Government.

Prepayment and Extension Risk.

The Fund is subject to prepayment and extension risk since it invests in mortgage-backed and other asset-backed securities. When interest rates decline, borrowers tend to refinance their loans. When this occurs, the loans that back these securities suffer a higher rate of prepayment. This could cause a decrease in the Fund’s income and share price. When interest rates rise, the Fund’s average maturity may lengthen due to a drop in prepayments. This will increase both the Fund’s sensitivity to interest rates and its potential for price

declines.

Liquidity Risk

. High yield debt securities tend to be less liquid than higher quality debt securities, meaning that it may be difficult to sell high yield debt securities at reasonable prices.

Derivatives Risk

. Investments in U.S. Treasury futures and options on treasury futures involve risks, such as potential losses if interest rates do not move as expected and the potential for greater losses than if these techniques had not been used. Investments in derivatives can increase the volatility of the Fund’s share price and may expose the Fund to significant additional costs. Derivatives may be difficult to sell, unwind, or value.

Security Selection Risk

. Securities selected by the portfolio manager may perform differently than the overall market or may not meet the portfolio manager’s expectations.

An investment in the Fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

Performance

: The following bar chart and table provide some indication of the risks of investing in the Fund. The bar chart shows changes in the Fund’s performance from year to year for Class A shares. The table shows how the Fund’s average annual returns for 1, 5, and 10 years compare to those of a broad measure of market performance. The Fund’s past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. Updated performance information is available by visiting

www.firstinvestors.com

or by calling

1 (800) 423-4026.

Sales charges are not reflected in the bar chart, and if those charges were included, returns would be less than those shown.

Total Annual Returns For Calendar Years Ended December 31

|

|

During the periods shown, the highest quarterly return was 10.39% (for the quarter ended June 30, 2009) and the lowest quarterly return was -9.53% (for the quarter ended September 30, 2008).

|

Average Annual Total Returns For Periods Ended December 31, 2012*

|

|

1 Year

|

5 Years

|

10 Years

|

|

Class A Shares

|

|

|

|

|

(Return Before Taxes)

|

4.54%

|

5.26%

|

4.78%

|

|

(Return After Taxes on Distributions)

|

3.10%

|

3.54%

|

3.00%

|

|

(Return After Taxes on Distributions and Sales of Fund Shares)

|

2.91%

|

3.37%

|

2.95%

|

|

Class B Shares

|

|

|

|

|

(Return Before Taxes)

|

6.02%

|

5.45%

|

4.80%

|

|

BofA Merrill Lynch U.S. Corporate Master Index

(reflects no deduction for fees, expenses or taxes)

|

10.37%

|

7.71%

|

6.31%

|

* No performance information is presented for Advisor Class and Institutional Class shares because these share classes have not been in existence for a full calendar year.

The after-tax returns are shown only for Class A shares and are calculated using the highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts.

Investment Adviser

: First Investors Management Company, Inc. is the Fund’s investment adviser.

Portfolio Manager

: Clark D. Wagner, Director of Fixed Income, serves as Co-Portfolio Manager of the Fund and has served as Portfolio Manager or Co-Portfolio Manager of the Fund since 2007.

Rajeev Sharma has served as Co-Portfolio Manager of the Fund since 2009.

Purchase and Sale of Fund Shares

: You may purchase or redeem shares of the Fund on any business day by: contacting your financial intermediary in accordance with its policies; writing to the Fund’s transfer agent at the following address: Administrative Data Management Corp., Raritan Plaza I, Edison, NJ 08837; or calling the Fund’s transfer agent at

1 (800) 423-4026. The minimum initial purchase for Class A shares, Class B shares and Advisor Class shares is $1,000. The minimum initial purchase for Institutional Class shares is

$2,000,000. The minimum initial purchase is reduced for certain types of accounts and also for accounts that are eligible to be opened under a systematic investment plan. Subsequent investments can be made in any U.S. dollar amount.

Tax Information

: The Fund’s distributions are taxable, and will be taxed as ordinary income or capital gains, unless you are investing through a tax-deferred arrangement, such as a 401(k) plan or individual retirement account, in which case the withdrawal of your investment from a tax-deferred account may be taxable.

Payments to Broker-Dealers and Other Financial Intermediaries:

The Fund is primarily sold to retail investors through its principal underwriter, First Investors Corporation (

“

FIC

”

), which is an affiliate of the Fund’s adviser, and both are subsidiaries of the same holding company. FIC pays its representatives a higher level of compensation for selling First Investors Funds than for selling other funds. The Fund also may be sold through unaffiliated broker-dealers and other

financial intermediaries, which receive compensation for selling First Investors Funds. These payments may create a conflict of interest by influencing representatives, broker-dealers or other financial intermediaries to recommend First Investors Funds over other funds. For more information ask your representative or your financial intermediary, see the Fund’s Statement of Additional Information or visit First Investors’ or your financial intermediary’s website.

4

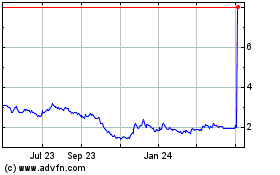

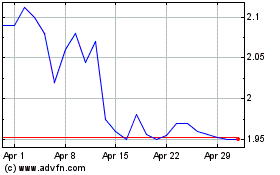

Aeterna Zentaris (NASDAQ:AEZS)

Historical Stock Chart

From Jun 2024 to Jul 2024

Aeterna Zentaris (NASDAQ:AEZS)

Historical Stock Chart

From Jul 2023 to Jul 2024