FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

REPORT OF FOREIGN ISSUER

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of May 2008

Commission File No. 000-30752

AETERNA ZENTARIS INC.

1405, boul. du Parc-Technologique

Quebec, Quebec

Canada, G1P 4P5

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports

under cover of Form 20-F or Form 40-F.

Form 20-F |X| Form 40-F |_|

Indicate by check mark whether the registrant by furnishing the information

contained in this Form is also thereby furnishing the information to the

Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934

Yes |_| No |X|

If "Yes" is marked, indicate below the file number assigned to the registrant in

connection with Rule 12g3-2(b): 82-___

DOCUMENTS INDEX

Documents Description

1. Press Release dated May 7, 2008: AEterna Zentaris Reports First Quarter

2008 Financial and Operating Results

Aeterna Zentaris [LOGO]

AETERNA ZENTARIS INC. 1405 du Parc-Technologique Blvd.

Quebec (Quebec) Canada G1P 4P5 T 418 652-8525 F 418 652-0881

www.aezsinc.com

PRESS RELEASE

For immediate release

AETERNA ZENTARIS REPORTS FIRST QUARTER 2008 FINANCIAL AND OPERATING RESULTS

ALL AMOUNTS ARE IN U.S. DOLLARS

QUEBEC CITY, CANADA, MAY 7, 2008 - AEterna Zentaris Inc. (NASDAQ: AEZS, TSX:

AEZ), a global biopharmaceutical company focused on endocrinology and oncology,

today reported financial and operating results for the first quarter ended March

31, 2008.

FIRST QUARTER 2008 HIGHLIGHTS

- Cetrorelix: first patients treated in second efficacy trial of the

Phase 3 program in benign prostatic hyperplasia (BPH);

- AEZS-108: first patients treated in Phase 2 trial in ovarian and

endometrial cancers;

- Miltefosine (Impavido(R)): rights sold to Paladin Labs Inc. (TSX:PLB)

for approximately $8.9 million.

SUBSEQUENT TO FIRST QUARTER END

- Cetrorelix: recruitment of 600 patients completed for first efficacy

trial of the Phase 3 program in BPH;

- Juergen Ernst, AEterna Zentaris Chairman, appointed Interim President

and CEO, replacing David J. Mazzo. Departure of Ellen McDonald, Senior

Vice President, Business Operations and Chief Business Officer;

- Board member Jose P. Dorais appointed to the Corporate Governance,

Nominating and Human Resources Committee, replacing Mr. Juergen Ernst,

the Company's Chairman of the Board and Interim President and CEO, who

had previously stepped down from the committee in connection with his

appointment as Interim President and CEO.

Juergen Ernst, Chairman, Interim President and CEO at AEterna Zentaris

commented, "During the quarter, we continued to move forward with our Phase 3

program in BPH with our lead compound cetrorelix, as we completed patient

recruitment for our first efficacy trial in North America and started patient

dosing in our second similar efficacy trial in Europe. We also achieved an

important milestone with our lead oncology compound AEZS-108, as we started

patient dosing for our Phase 2 trial in endometrial and ovarian cancer.

Subsequent to quarter end, we had to make important changes to our management

team in order not to stray from our corporate strategy which is based on the

following priorities: concentrate on the advancement of our lead value-drivers

cetrorelix in BPH and AEZS-108 in oncology, pursue strategic partnership

opportunities for cetrorelix and other compounds from our rich pipeline,

continue monetizing our non-core assets to provide additional sources of

non-dilutive funding and apply strict control of our burn-rate. We believe that

by staying the course with our strategy, we will be able to meet our mid and

long-term goals for the benefit of both patients and shareholders."

CONSOLIDATED RESULTS FOR THE FIRST QUARTER ENDED MARCH 31, 2008

CONSOLIDATED REVENUES were $9.7 million for the three-month period ended March

31, 2008 compared to $9.2 million for the same period in 2007. The increase in

revenues is primarily related to additional sales of Cetrotide(R) to Merck

Sereno, mainly offset by decreased sales activities of Impavido(R) and

Cetrotide(R) in Japan, as well as a reduction in license fees revenues related

to services rendered through our collaborations with Spectrum Pharmaceuticals,

Inc. and Keryx Biopharmaceuticals, Inc.

CONSOLIDATED SELLING, GENERAL AND ADMINISTRATIVE (SG&A) EXPENSES were $4.4

million for the three-month period ended March 31, 2008 compared to $4.9 million

for the same period in 2007. The decrease in SG&A expenses for the three-month

period ended March 31, 2008, compared to the same period in 2007, is primarily

due to non-recurring corporate expenses related to organizational changes that

were implemented in the first quarter of 2007. A decrease in selling expenses

was further impacted by lower royalties and commission expenses related to lower

sales volumes of Cetrotide(R) in Japan and Impavido(R).

CONSOLIDATED R&D COSTS, NET OF TAX CREDITS AND GRANTS were $13.7 million for the

three-month period ended March 31, 2008 compared to $7.9 million for the same

period in 2007. Additional R&D expenses of $5.8 million spent in the first

quarter 2008 compared to the same period in 2007 are mainly related to the

advancement of our lead product cetrorelix in Phase 3 for BPH, as well as

further advancement of targeted, earlier-stage development programs including

AEZS-108 and AEZS-112, our tubulin inhibitor, both of which are in oncology.

CONSOLIDATED NET LOSS for the three-month period ended March 31, 2008 was $10.9

million or $0.20 per basic and diluted share, compared to $5.1 million or $0.10

per basic and diluted share for the same period in 2007. The increase in net

loss is primarily attributable to the increased R&D costs related to the

advancement of cetrorelix in Phase 3 for the treatment of BPH.

The consolidated cash and short-term investments were $38.7 million as of March

31, 2008.

2

CONFERENCE CALL

Management will be hosting a conference call for the investment community

beginning at 4:00 p.m. Eastern Time today, Wednesday, May 7, to discuss first

quarter 2008 results.

To participate in the live conference call by telephone, please dial

416-644-3425, 514-807-8791 or 800-796-7558. Individuals interested in listening

to the conference call on the Internet may do so by visiting www.aezsinc.com. A

replay will be available on the Company's Web site for 30 days.

ABOUT AETERNA ZENTARIS INC.

AEterna Zentaris Inc. is a global biopharmaceutical company focused on endocrine

therapy and oncology with proven expertise in drug discovery, development and

commercialization.

News releases and additional information are available at www.aezsinc.com.

FORWARD-LOOKING STATEMENTS

This press release contains forward-looking statements made pursuant to the safe

harbor provisions of the U.S. Securities Litigation Reform Act of 1995.

Forward-looking statements involve known and unknown risks and uncertainties,

which could cause the Company's actual results to differ materially from those

in the forward-looking statements. Such risks and uncertainties include, among

others, the availability of funds and resources to pursue R&D projects, the

successful and timely completion of clinical studies, the ability of the Company

to take advantage of business opportunities in the pharmaceutical industry,

uncertainties related to the regulatory process and general changes in economic

conditions. Investors should consult the Company's quarterly and annual filings

with the Canadian and U.S. securities commissions for additional information on

risks and uncertainties relating to the forward-looking statements. Investors

are cautioned not to rely on these forward-looking statements. The Company does

not undertake to update these forward-looking statements. We disclaim any

obligation to update any such factors or to publicly announce the result of any

revisions to any of the forward-looking statements contained herein to reflect

future results, events or developments except if we are requested by a

governmental authority or applicable law.

-30-

CONTACTS

INVESTOR RELATIONS

Dennis Turpin, CA

Senior Vice President and Chief Financial Officer

(908) 330-5188

dturpin@aezsinc.com

MEDIA RELATIONS

Paul Burroughs

Director of Communications

(418) 575-8982

pburroughs@aezsinc.com

ATTACHMENT: Financial summary

3

(IN THOUSANDS OF US DOLLARS, EXCEPT SHARE

AND PER SHARE DATA)

THREE MONTHS ENDED

CONSOLIDATED RESULTS MARCH 31,

UNAUDITED 2008 2007

-----------------------------------------------------------------------------

REVENUES

Sales and royalties $ 7,942 $ 7,204

License fees 1,806 2,029

------------------------

9,748 9,233

------------------------

OPERATING EXPENSES

Cost of sales 4,604 3,310

Selling, general and administrative 4,404 4,892

R&D costs, net of tax credits 13,689 7,907

Depreciation and amortization 1,209 1,427

------------------------

23,906 17,536

------------------------

LOSS FROM OPERATIONS (14,158) (8,303)

------------------------

OTHER REVENUES NET OF EXPENSES 3,292 616

INCOME TAX RECOVERY -- 2,544

------------------------

NET LOSS FROM CONTINUING OPERATIONS (10,866) (5,143)

NET EARNINGS FROM DISCONTINUED OPERATIONS -- 33

------------------------

NET LOSS (10,866) (5,110)

========================

NET LOSS PER SHARE FROM CONTINUING OPERATIONS

Basic and diluted (0.20) (0.10)

NET EARNINGS PER SHARE FROM DISCONTINUED OPERATIONS

Basic and diluted -- --

NET LOSS PER SHARE

Basic and diluted (0.20) (0.10)

WEIGHTED AVERAGE NUMBER OF SHARES

Basic and diluted 53,187,470 53,179,470

(IN THOUSANDS OF US DOLLARS, EXCEPT SHARE

AND PER SHARE DATA)

CONSOLIDATED BALANCE SHEETS MARCH 31, December 31,

UNAUDITED 2008 2007

-------------------------------------------------------------------------------

CASH AND SHORT-TERM INVESTMENTS $ 38,714 $ 41,387

OTHER CURRENT ASSETS 18,527 18,193

----------------------

57,241 59,580

LONG-TERM ASSETS 60,281 63,783

----------------------

TOTAL ASSETS 117,522 123,363

======================

CURRENT LIABILITIES 26,135 22,255

OTHER LONG-TERM LIABILITIES 13,354 12,517

----------------------

39,489 34,772

SHAREHOLDERS' EQUITY 78,033 88,591

----------------------

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY 117,522 123,363

======================

|

4

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the

undersigned, thereunto duly authorized.

AETERNA ZENTARIS INC.

Date: May 8, 2008 By: /s/ Dennis Turpin

------------------------------------

Dennis Turpin

Senior Vice President,

Chief Financial Officer

|

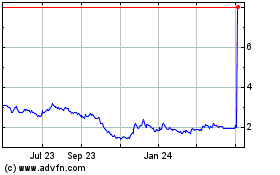

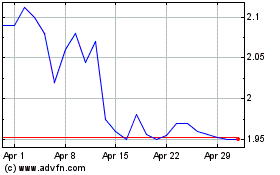

Aeterna Zentaris (NASDAQ:AEZS)

Historical Stock Chart

From Jun 2024 to Jul 2024

Aeterna Zentaris (NASDAQ:AEZS)

Historical Stock Chart

From Jul 2023 to Jul 2024