- Q1 revenue of $1.3 million and income from grants of $0.5

million, for a total of $1.8 million.

- Net loss in Q1 of $(4.1) million or $(0.08) per share.

- Company holds cash reserves of $59.3 million as of March 31,

2022.

- Advent’s next-generation MEA has been provided for testing to

select strategic partners.

- New contracts for advanced electrochemistry components with

manufacturers of clean power generation and energy storage

solutions.

Advent Technologies Holdings, Inc. (NASDAQ: ADN) (“Advent” or

the “Company”), an innovation-driven leader in the fuel cell and

hydrogen technology space, today announced consolidated financial

results for the three months ended March 31, 2022. All amounts are

in U.S. dollars unless otherwise noted and have been prepared in

accordance with U.S. generally accepted accounting principles

(“GAAP”).

Q1 2022 Financial Highlights

(all comparisons are to Q1 2021, unless otherwise stated)

- Revenue of $1.3 million and income from grants of $0.5 million

in the first quarter of 2022. The total of revenue and income from

grants of $1.8 million is an increase of 16% from the comparable

total in the prior year first quarter.

- Operating expenses of $12.6 million, a year-over-year increase

of $4.7 million, primarily due to costs related to the accelerated

growth of the Company from the acquired businesses; increased

staffing and costs to operate as a public company; higher R&D

costs; and stock-based compensation expenses.

- Net loss was $(4.1) million, and adjusted net loss was $(12.5)

million. Adjusted net loss excludes a $8.4 million gain from the

change in the fair value of outstanding warrants.

- Net loss per share was $(0.08).

- Cash reserves were $59.3 million as of March 31, 2022, a

decrease of $20.5 million from December 31, 2021, driven by the

increased level of R&D and administrative and selling expenses,

as well as annual insurance renewals and incentive compensation

payouts during the quarter.

“The consolidation of our operations, which will continue

throughout 2022, has accelerated our focus across the value chain

from advanced fuel cell components to fuel cell systems,” said Dr.

Vasilis Gregoriou, Chairman and CEO of Advent Technologies. “We

have seen our pipeline develop this quarter, both in terms of

opportunity size and from the demand for our technology and

products. We remain confident that we are on a firm path for growth

as we deliver efficient solutions for clean energy and

decarbonization to a variety of key markets.”

Q1 2022 Financial Summary

(in Millions of US dollars, except per

share data)

Three Months Ended March

31,

2022

2021

$ Change

Revenue, net

$

1.26

$

1.49

$

(0.23

)

Gross Profit / (Loss)

$

(0.26

)

$

1.14

$

(1.40

)

Gross Margin (%)

(21

)%

77

%

Operating Income/(Loss)

$

(13.10

)

$

(6.96

)

$

(6.14

)

Net Income/(Loss)

$

(4.10

)

$

2.91

$

(7.01

)

Net Income/(Loss) Per Share

(Basic)

$

(0.08

)

$

0.08

$

(0.16

)

Net Income/(Loss) Per Share

(Diluted)

$

(0.08

)

$

0.07

$

(0.15

)

Non-GAAP Financial Measures

Adjusted EBITDA – Excl Warrant

Adjustment and One- Time Transaction Related Expenses

$

(11.99

)

$

(0.89

)

$

(11.10

)

Adjusted Net Income / (Loss) – Excl

Warrant Adjustment and One-Time Transaction Related

Expenses

$

(12.48

)

$

(0.99

)

$

(11.49

)

Cash and Cash Equivalents

$

59.3

For a more detailed discussion of Advent’s first quarter 2022

results, please see the Company’s financial statements and

management’s discussion & analysis, which are available at

ir.advent.energy.

The financial results include non-GAAP financial measures. These

non-GAAP measures are more fully described and are reconciled from

the respective measures determined under GAAP in “Presentation of

Non-GAAP Financial Measures” and the attached appendix tables.

Q1 2022 Business Updates

Advent’s Next-Generation MEAs (“Advent MEA”): On March

14, 2022, Advent announced the availability of its next-generation

MEA. These MEAs have already been provided for testing to select

strategic partners. The Advent MEA is currently being developed

within the framework of L’Innovator, Advent’s joint development

program with the U.S. Department of Energy’s Los Alamos National

Laboratory, Brookhaven National Laboratory, and National Renewable

Energy Laboratory. The milestones already achieved include

accelerated stress testing that has confirmed the potential for

significant (>5x) improvement in lifetime versus current HT-PEM

MEAs, and, strong potential for 2x and 3x power density increase

versus current HT-PEM MEAs. Advent is in discussions for various

joint development agreements in the genset, heavy duty automotive,

marine and aviation markets. Advent intends to scale-up the

production capacity of the Advent MEA in the order of 100s of

kilowatts (fuel cell power equivalent) per month in mid-2023 and

megawatts per month by the end of 2023. Advent also intends that

both its own products (SereneU, Honey Badger, MZERØ) and

third-party products will be able to use the new Advent MEAs in

mass-production as soon as 2024. Due to the high-temperature

operation, Advent’s MEAs can work with impure hydrogen that can be

reformed onboard from methanol, natural gas, and other renewable

fuels. The Advent MEA is expected to redefine the MEA market

globally and further validate Advent’s leading position in the

electrochemistry components business.

New Membrane Electrode Assembly (“MEA”) Contracts: On

February 15, 2022, Advent announced the signing of new contracts

with manufacturers of clean power generation and energy storage

solutions for the delivery of advanced electrochemistry components.

The contracts have a combined value of $2.2 million. Advent began

delivering the electrochemistry components in the fourth quarter of

2021 and deliveries are expected to continue to September 2022. The

vast majority of the new business is from customers based in North

America. Advent’s electrochemistry components business includes

electrodes, membranes and MEAs. These components are critical for

fuel cells, electrolysers, and long-duration energy storage such as

flow batteries. The performance of these components defines the

lifetime, efficiency, weight and ultimately, a substantial portion

of the cost of the end electrochemistry products. Advent is

continuously innovating in the area of electrochemical components.

Advent’s electrochemistry materials R&D is based in Boston,

Massachusetts, with synthesis and manufacturing capabilities in

Europe. Advent is expanding its production capabilities through the

development of a new facility at the Hood Park campus in

Charlestown, Massachusetts, which will focus primarily on the

development and production of the next-generation of fuel cell

components.

Distribution and Service Agreement with Calscan Solutions

(“Calscan”): On January 10, 2022, Advent announced that it

signed a distribution and service agreement with Calscan, a

Canadian industrial service company focused in the oil field

industry with a number of products, including methane emissions

mitigation instrumentation and controls, as well as services

including test data processing, rentals, repair, and data

processing. The agreement details Calscan’s plans to market,

resell, install, and service the Advent M-ZERØ™ and SereneU fuel

cell products to address the demand for electric systems in the oil

and gas sector. Current regulatory pressure is focused on targets

which will aggressively reduce oil and gas industry methane

emissions throughout Canada. Advent’s product portfolio, including

the M-ZERØ™ and SereneU fuel cell products, aim to drop wellhead

methane emissions to zero, increase well productivity and safety,

and decrease maintenance costs in North American well sites.

Advent’s products realize a significant carbon advantage over

conventional diesel remote power generation technology and can be

deployed in more extreme environments than solar panels and

electric battery systems. The Advent M-ZERØ™ can also work with

current systems to enhance their reliability and ensure that

systems continue to operate, creating additional value-added

opportunities for customers. The Advent M-ZERØ™ products, designed

specifically to generate power in remote environments, will offer

the ability to drop methane emissions to effectively zero where

they replace methane polluting pneumatic injection technology. The

overall methane emissions related to wellheads approaches 40

million tons of carbon dioxide emissions per year, which is

equivalent to the carbon footprint of more than eight million

passenger cars. M-ZERØ™ will initially be featured mainly in Canada

and the United States with the aim of providing remote power to up

to 185,000 oil and gas wellheads.

Upgrade of Globe Telecom, Inc. (“Globe”) sites: On

January 18, 2022, Advent announced that, within the framework of

its long-lasting collaboration with Globe, it is upgrading various

sites for Globe in the Philippines with 10kW SereneU fuel cell

systems, enabling Globe to reach its ambitious targets for reduced

CO2 emissions. By deploying Advent’s SereneU fuel cells, Globe aims

to reduce carbon emissions across its network, consume cleaner fuel

in smaller quantities, achieve lower emissions, and maintain

energy-efficient heat removal. Advent’s SereneU fuel cells produce

fewer emissions than traditional generator sets, and operate almost

silently, thereby providing a system with a low footprint to

surrounding areas and communities. Depending on the fuels used, the

systems can become close to CO2 neutral, as well as being easier to

store and transport. Advent’s SereneU systems also have higher

temperature and environmental conditions tolerance, ensuring

uninterrupted back-up power and stronger resilience against extreme

environments such as typhoons, monsoon rains, and even long dry

seasons. By using fuel cells in its green transition, Globe

complies not only with regulations and its own ambitions for best

environmental practices but also secures several competitive

advantages. Globe’s commitment to establishing science-based

targets and net-zero emissions by 2050 is in line with the Paris

Agreement and #RacetoZero. The Paris Agreement aims to limit global

warming to 1.5 degrees Celsius compared to pre-industrial levels.

#RacetoZero is the UN-backed global campaign rallying non-state

stakeholders to take rigorous and immediate action to halve global

emissions by 2030 and deliver a net zero-carbon emitting world by

2050. All of Globe’s initiatives in the green transition reflect

its commitment to the UN’s Sustainable Development Goals (SDG),

including SDG 12 “Sustainable Consumption and Production”, which

relates to achieving economic growth and sustainable development by

urgently reducing the ecological footprint.

Memorandum of Understanding (“MoU”) with Electric Ship

Facilities B.V. (“ESF”): On February 23, 2022, Advent announced

the signing of a MoU with ESF, a Dutch based business with over 15

years of experience in electric and hybrid propulsion systems and

energy systems for recreational and commercial purposes. Under the

agreement, ESF commits to becoming a future distributor of Advent’s

SereneU fuel cell products, further strengthening its portfolio of

innovative CO2 reducing technologies. ESF offers demonstrations and

state-of-the-art components, helping its customers significantly

reduce emissions and achieve energy efficiency. This new

collaboration will enable Advent to facilitate trial processes and

fuel cell configurations for both land-based and maritime

applications, with the initial geographic focus being Benelux,

Germany, Switzerland and Austria. Advent’s SereneU fuel cells are

currently being used for demonstrations within the framework of the

Green Shipping Wadden Sea Program, an initiative coordinated by FME

(a Dutch association of enterprises in the industrial sector),

having ESF as one of its founding companies. The Green Shipping

Wadden Sea Program aims to accelerate innovations in the field of

CO2-neutral and fossil-free shipping for the Wadden Sea fleet, as

well as to develop the associated port facilities and

infrastructure, and to secure governmental pathways promoting the

transition towards innovative CO2 reducing technologies.

Preliminary Strategic Agreement with Daiden Equipment Sdn Bhd

(“Daiden”): On March 17, 2022, Advent announced that it entered

into a preliminary strategic agreement with Daiden, a leading power

generation and industrial equipment provider in Malaysia. Daiden

has declared its intention to become a distributor of Advent’s

SereneU fuel cell products. This will enhance the promotion of

Daiden’s clean power generation sources and actively support the

ongoing green energy transition efforts in Malaysia. Advent has

already shipped units of its SereneU fuel cell products to Daiden

for testing and evaluation. Once these tests have been completed,

Daiden and Advent will determine the best strategic approach for

the introduction of Advent’s methanol-based fuel cells to the

Malaysian market.

Dr. Gregoriou concluded, “Advent made significant progress

during 2021, and in this time we strengthened our technology

position and augmented our product offering. This growth strategy

has now started to bear fruit in 2022, reflected by strong customer

interest in our technology and product portfolio, and, a growing

pipeline. We will continue to consolidate our business with a view

to maximizing efficiency and effectiveness throughout our global

operations, and to focus on core markets and significant projects.

The White Dragon and Green HiPo projects are progressing and we

believe that, if approved, each will have a significant impact on

the implementation of green energy in Europe, shifting power

generation and reliability away from traditional fuel sources. I

remain confident in the potential of Advent and our technology, and

I am very optimistic that we will continue to increase market share

as economies embrace clean energy and decarbonization.”

Conference Call

The Company will host a conference call on Thursday, May 12,

2022, at 9:00 AM ET to discuss its results.

To access the call please dial (888) 660-6182 from the United

States, or (929) 203-0891 from outside the U.S. The conference call

I.D. number is 3273042. Participants should dial in 5 to 10 minutes

before the scheduled time.

A replay of the call can also be accessed via phone through May

26, 2022, by dialing (800) 770-2030 from the U.S., or (647)

362-9199 from outside the U.S. The conference I.D. number is

3273042.

About Advent Technologies Holdings, Inc.

Advent Technologies Holdings, Inc. is a U.S. corporation that

develops, manufactures, and assembles complete fuel cell systems,

and the critical components for fuel cells in the renewable energy

sector. Advent is headquartered in Boston, Massachusetts, with

offices in California, Greece, Denmark, Germany and the

Philippines. With around 190 patents issued, licensed and pending

for its fuel cell technology, Advent holds the IP for

next-generation HT-PEM that enable various fuels to function at

high temperatures and under extreme conditions – offering a

flexible option for the automotive, aviation, defense, oil and gas,

marine, and power generation sectors. For more information, please

visit www.advent.energy.

Cautionary Note Regarding Forward-Looking Statements

This press release includes forward-looking statements. These

forward-looking statements generally can be identified by the use

of words such as “anticipate,” “expect,” “plan,” “could,” “may,”

“will,” “believe,” “estimate,” “forecast,” “goal,” “project,” and

other words of similar meaning. Each forward-looking statement

contained in this press release is subject to risks and

uncertainties that could cause actual results to differ materially

from those expressed or implied by such statement. Applicable risks

and uncertainties include, among others, the Company’s ability to

maintain the listing of the Company’s common stock on Nasdaq;

future financial performance; public securities’ potential

liquidity and trading; impact from the outcome of any known and

unknown litigation; ability to forecast and maintain an adequate

rate of revenue growth and appropriately plan its expenses;

expectations regarding future expenditures; future mix of revenue

and effect on gross margins; attraction and retention of qualified

directors, officers, employees, and key personnel; ability to

compete effectively in a competitive industry; ability to protect

and enhance our corporate reputation and brand; expectations

concerning our relationships and actions with our technology

partners and other third parties; impact from future regulatory,

judicial and legislative changes to the industry; ability to locate

and acquire complementary technologies or services and integrate

those into the Company’s business; future arrangements with, or

investments in, other entities or associations; and intense

competition and competitive pressure from other companies worldwide

in the industries in which the Company will operate; and the risks

identified under the heading “Risk Factors” in our Annual Report on

Form 10-K filed with the Securities and Exchange Commission on

March 31, 2022, as well as the other information we file with the

SEC. We caution investors not to place considerable reliance on the

forward-looking statements contained in this press release. You are

encouraged to read our filings with the SEC, available at

www.sec.gov, for a discussion of these and other risks and

uncertainties. The forward-looking statements in this press release

speak only as of the date of this document, and we undertake no

obligation to update or revise any of these statements. Our

business is subject to substantial risks and uncertainties,

including those referenced above. Investors, potential investors,

and others should give careful consideration to these risks and

uncertainties.

Presentation of Non-GAAP Financial Measures

In addition to the results provided in accordance with U.S. GAAP

throughout this press release, the Company has provided non-GAAP

financial measures - Adjusted Net Income / (Loss) and Adjusted

EBITDA - which present results on a basis adjusted for certain

items. The Company uses these non-GAAP financial measures for

business planning purposes and in measuring its performance

relative to that of its competitors. The Company believes that

these non-GAAP financial measures are useful financial metrics to

assess its operating performance from period-to-period by excluding

certain items that the Company believes are not representative of

its core business. These non-GAAP financial measures are not

intended to replace, and should not be considered superior to, the

presentation of the Company’s financial results in accordance with

GAAP. The use of the terms Adjusted Net Income / (Loss) and

Adjusted EBITDA may differ from similar measures reported by other

companies and may not be comparable to other similarly titled

measures. These measures are reconciled from the respective

measures under GAAP in the appendix below.

ADVENT TECHNOLOGIES HOLDINGS,

INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Amounts in thousands, except

share and per share amounts)

As of

ASSETS

March 31, 2022

(Unaudited)

December 31, 2021

Current assets:

Cash and cash equivalents

$

59,282

$

79,764

Accounts receivable

2,806

3,139

Contract assets

1,090

1,617

Inventories

9,211

6,958

Prepaid expenses and Other current

assets

10,235

5,873

Total current assets

82,624

97,351

Non-current assets:

Goodwill

30,030

30,030

Intangibles, net

22,657

23,344

Property and equipment, net

8,964

8,585

Other non-current assets

2,523

2,475

Deferred tax assets

1,374

1,246

Total non-current assets

65,548

65,680

Total assets

$

148,172

$

163,031

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities:

Trade and other payables

$

5,474

$

4,837

Deferred income from grants, current

192

205

Contract liabilities

558

1,118

Other current liabilities

7,963

12,515

Income tax payable

192

196

Total current liabilities

14,379

18,871

Non-current liabilities:

Warrant liability

1,997

10,373

Deferred tax liabilities

2,197

2,500

Defined benefit obligation

95

90

Other long-term liabilities

956

996

Total non-current liabilities

5,245

13,959

Total liabilities

19,624

32,830

Commitments and contingent

liabilities

Stockholders’ equity

Common stock ($0.0001 par value per share;

Shares authorized: 110,000,000 at March 31, 2022 and December 31,

2021; Issued and outstanding: 51,253,591 and 51,253,591 at March

31, 2022 and December 31, 2021, respectively)

5

5

Preferred stock ($0.0001 par value per

share; Shares authorized: 1,000,000 at March 31, 2022 and December

31, 2021; nil issued and outstanding at March 31, 2022 and December

31, 2021)

-

-

Additional paid-in capital

167,755

164,894

Accumulated other comprehensive loss

(1,691)

(1,273)

Accumulated deficit

(37,521)

(33,425)

Total stockholders’ equity

128,548

130,201

Total liabilities and stockholders’

equity

$

148,172

$

163,031

ADVENT TECHNOLOGIES HOLDINGS,

INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(Amounts in thousands, except

share and per share amounts)

Three months ended March

31,

(Unaudited)

2022

2021

Revenue, net

$

1,256

$

1,489

Cost of revenues

(1,517)

(347)

Gross profit / (loss)

(261)

1,142

Income from grants

508

38

Research and development expenses

(2,149)

(29)

Administrative and selling expenses

(10,498)

(7,922)

Amortization of intangibles

(699)

(187)

Operating loss

(13,099)

(6,958)

Fair value change of warrant liability

8,376

9,766

Finance expenses, net

(10)

(10)

Foreign exchange (losses) / gains, net

(17)

24

Other (expenses) / income, net

(3)

84

Income / (loss) before income

tax

(4,753)

2,906

Income taxes

657

-

Net income / (loss)

$

(4,096)

$

2,906

Net income / (loss) per share

Basic income / (loss) per share

(0.08)

0.08

Basic weighted average number of

shares

51,253,591

37,769,554

Diluted income / (loss) per

share

(0.08)

0.07

Diluted weighted average number of

shares

51,253,591

40,987,346

ADVENT TECHNOLOGIES HOLDINGS,

INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(Amounts in thousands)

Three months ended March

31, (Unaudited)

2022

2021

Net Cash used in Operating

Activities

$

(19,311)

$

(12,196)

Cash Flows from Investing

Activities:

Proceeds from sale of property and

equipment

0

-

Purchases of property and equipment

(950)

(77)

Purchases of intangible assets

(13)

-

Advances for the acquisition of property

and equipment

(50)

-

Acquisition of subsidiaries, net of cash

acquired

-

(3,976)

Receipt of government grants

3

-

Net Cash used in Investing

Activities

$

(1,010)

$

(4,053)

Cash Flows from Financing

Activities:

Business Combination and PIPE financing,

net of issuance costs paid

-

140,693

Net Cash provided by Financing

Activities

$

-

$

140,693

Net increase / (decrease) in cash and

cash equivalents

$

(20,321)

$

124,444

Effect of exchange rate changes on cash

and cash equivalents

(161)

15

Cash and cash equivalents at the beginning

of the period

79,764

516

Cash and cash equivalents at the end of

the period

$

59,282

$

124,975

Supplemental Cash Flow

Information

Cash activities

Interest paid

$

6

$

-

Non-cash Investing and Financing

Activities:

Stock-based compensation

$

2,861

$

-

Supplemental Non-GAAP Measures and Reconciliations

In addition to providing measures prepared in accordance with

GAAP, we present certain supplemental non-GAAP measures. These

measures are EBITDA, Adjusted EBITDA and Adjusted Net Income /

(Loss), which we use to evaluate our operating performance, for

business planning purposes and to measure our performance relative

to that of our peers. These non-GAAP measures do not have any

standardized meaning prescribed by GAAP and therefore may differ

from similar measures presented by other companies and may not be

comparable to other similarly titled measures. We believe these

measures are useful in evaluating the operating performance of the

Company’s ongoing business. These measures should be considered in

addition to, and not as a substitute for net income, operating

expense and income, cash flows and other measures of financial

performance and liquidity reported in accordance with GAAP. The

calculation of these non-GAAP measures has been made on a

consistent basis for all periods presented.

EBITDA and Adjusted EBITDA

These supplemental non-GAAP measures are provided to assist

readers in determining our operating performance. We believe this

measure is useful in assessing performance and highlighting trends

on an overall basis. We also believe EBITDA and Adjusted EBITDA are

frequently used by securities analysts and investors when comparing

our results with those of other companies. EBITDA differs from the

most comparable GAAP measure, net income / (loss), primarily

because it does not include interest, income taxes, depreciation of

property, plant and equipment, and amortization of intangible

assets. Adjusted EBITDA adjusts EBITDA for transactional gains and

losses, asset impairment charges, finance and other income and

acquisition costs.

The following tables show a reconciliation of net income /

(loss) to EBITDA and Adjusted EBITDA for the three months ended

March 31, 2022 and 2021.

EBITDA and Adjusted EBITDA

Three months ended March

31, (Unaudited)

(in Millions of US dollars)

2022

2021

$ change

Net income / (loss)

$

(4.10)

$

2.91

(7.01)

Depreciation of property and equipment

$

0.42

$

0.00

0.42

Amortization of intangibles

$

0.70

$

0.19

0.51

Finance costs, net

$

0.01

$

0.01

-

Other (income) / expenses, net

$

-

$

(0.08)

0.08

Foreign exchange differences, net

$

0.02

$

(0.02)

0.04

Income tax

$

(0.66)

$

0.00

(0.66)

EBITDA

$

(3.61)

$

3.01

(6.62)

Net change in warrant liability

$

(8.38)

$

(9.77)

1.39

One-Time Transaction Related Expenses

(1)

$

0.00

$

5.87

(5.87)

Adjusted EBITDA

$

(11.99)

$

(0.89)

(11.10)

(1) Bonus awarded after consummation of the Business Combination

effective February 4, 2021.

Adjusted Net Income / (Loss)

This supplemental non-GAAP measure is provided to assist readers

in determining our financial performance. We believe this measure

is useful in assessing our actual performance by adjusting our

results from continuing operations for changes in warrant liability

and one-time transaction costs. Adjusted Net Loss differs from the

most comparable GAAP measure, net income / (loss), primarily

because it does not include one-time transaction costs and warrant

liability changes. The following table shows a reconciliation of

net income / (loss) for the three months ended March 31, 2022 and

2021.

Adjusted Net Loss

Three months ended March

31,

(Unaudited)

(in Millions of US dollars)

2022

2021

$ change

Net income / (loss)

$

(4.10)

$

2.91

(7.01)

Net change in warrant liability

$

(8.38)

$

(9.77)

1.39

One-Time Transaction Related Expenses

(1)

$

0.00

$

5.87

(5.87)

Adjusted Net Loss

$

(12.48)

$

(0.99)

(11.49)

(1) Bonus awarded after consummation of the Business Combination

effective February 4, 2021.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220512005453/en/

Naiem Hussain nhussain@advent.energy

Chris Kaskavelis press@advent.energy

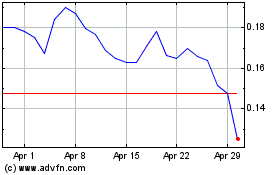

Advent Technologies (NASDAQ:ADN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Advent Technologies (NASDAQ:ADN)

Historical Stock Chart

From Jul 2023 to Jul 2024