UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________________________

FORM 8-K

________________________________________________

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 3, 2014

________________________________________________

Advanced Energy Industries, Inc.

(Exact name of registrant as specified in its charter)

________________________________________________

|

| | | | |

Delaware | | 000-26966 | | 84-0846841 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

|

| | | | | |

1625 Sharp Point Drive, Fort Collins, Colorado | | 80525 | |

(Address of principal executive offices) | | (Zip Code) | |

|

| | | |

(970) 221-4670 |

(Registrant's telephone number, including area code) |

| | | |

Not applicable |

(Former name or former address, if changed since last report) |

________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

| |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02 Results of Operations and Financial Condition.

The information in this Form 8-K that is furnished under “Item 2.02 Results of Operations and Financial Condition” and Exhibit 99.1 attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Act of 1934, nor shall they be deemed incorporated by reference in any filing under the Securities Act of 1933, except as shall be expressly set forth by specific reference in such filing.

On November 3, 2014, Advanced Energy Industries, Inc. announced via press release its financial results for the quarter ended September 30, 2014. A copy of the press release is furnished with this Current Report on Form 8-K as Exhibit 99.1.

Item 9.01 Financial Statements and Exhibits.

|

| | | |

(d) | Exhibits |

| | |

99.1 |

| | Press release dated November 3, 2014 by Advanced Energy Industries, Inc., reporting its financial results for the quarter ended September 30, 2014. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | |

| | | |

| | /s/ Danny C. Herron |

Date: November 3, 2014 | | Danny C. Herron |

| | Executive Vice President and Chief Financial Officer |

EXHIBIT INDEX

|

| | |

Exhibit Number | | Description |

99.1 | | Press release dated November 3, 2014 by Advanced Energy Industries, Inc., reporting its financial results for the quarter ended September 30, 2014. |

Financial News Release

|

| | | |

CONTACTS: | | | |

Danny Herron | | Annie Leschin | |

Advanced Energy Industries, Inc. | | Advanced Energy Industries, Inc. | |

970.407.6570 | | 970.407.6555 | |

danny.herron@aei.com | | ir@aei.com | |

ADVANCED ENERGY ANNOUNCES THIRD QUARTER RESULTS

| |

• | GAAP earnings of $0.30 per diluted share |

| |

• | Non-GAAP earnings of $0.42 per diluted share |

| |

• | Ended quarter with $106 million in cash |

Fort Collins, Colo., November 3, 2014 - Advanced Energy Industries, Inc. (Nasdaq: AEIS) today announced financial results for the third quarter ended September 30, 2014. The company reported third quarter sales of $143.1 million compared with $146.3 million in the second quarter of 2014 and $142.9 million in the third quarter of 2013. Net income was $12.3 million or $0.30 per diluted share. On a non-GAAP basis, net income was $16.9 million or $0.42 per diluted share. A reconciliation of non-GAAP net income and earnings per share is provided in the tables below. The company ended the quarter with $105.8 million in cash and marketable securities, a decrease of $24.4 million over the second quarter of 2014, which included the acquisition of UltraVolt, Inc. in the amount of $30.2 million and the repayment of a credit line in the amount of $4.7 million.

“This quarter’s performance demonstrates the advantages of our diversified model to drive earnings growth even as some markets experience cyclicality and industry-wide challenges,” said Yuval Wasserman, President and CEO of Advanced Energy. “Under our new product line structure, we are now able to respond more quickly and flexibly to changing market dynamics by better leveraging our global resources. While the environment in the solar industry continues to impact our utility scale installations, our focus on the growing demand for 3-phase string inverters and our performance in semiconductor and other precision power applications resulted in better than projected results for the quarter.”

Precision Power Products

Precision Power products sales were $91.2 million in the third quarter of 2014, an 11.4% increase from $81.8 million in the second quarter of 2014 and a 20.9% increase from $75.4 million in the third quarter of 2013. This

quarter, the strength of our sales to semiconductor customers and some of our smaller applications balanced out the sequential decrease in industrial products.

Inverters

Inverter sales were $52.0 million in the third quarter of 2014, down 19.4% from $64.5 million in the second quarter of 2014, and down 23.0% from $67.5 million in the third quarter of 2013. Our mix continues to shift toward 3-phase string inverters from utility scale central inverters.

Net Income

Net income for the third quarter of 2014 was $12.3 million or $0.30 per diluted share, compared with net income of $10.6 million or $0.26 per diluted share in the second quarter of 2014, and $0.7 million or $0.02 per diluted share in the third quarter last year. On a non-GAAP basis, adjusted net income this quarter increased to $16.9 million or $0.42 per diluted share from $15.5 million or $0.38 per diluted share in the second quarter of 2014, and decreased from $21.7 million or $0.53 per diluted share in the same period last year.

Fourth Quarter 2014 Guidance

Based on our current view, our guidance is within the following ranges:

| |

• | Sales of $140 million to $150 million |

| |

• | GAAP earnings per share of $0.29 to $0.37, excluding restructuring charges |

| |

• | Non-GAAP earnings per share of $0.37 to $0.45 |

Third Quarter 2014 Conference Call

Management will host a conference call tomorrow, Tuesday, November 4, 2014, at 8:30 a.m. Eastern Time to discuss Advanced Energy's financial results. Domestic callers may access this conference call by dialing 855-232-8958. International callers may access the call by dialing 315-625-6980. Participants will need to provide conference pass code 15550306. For a replay of this teleconference, please call 855-859-2056 or 404-537-3406 and enter pass code 15550306. The replay will be available for one week following the conference call. A webcast will also be available on the Investor Relations web page at http://ir.advanced-energy.com.

About Advanced Energy

Advanced Energy is a global leader in innovative power and control technologies for high-growth, precision power conversion solutions. Advanced Energy is headquartered in Fort Collins, Colorado, with dedicated support and service locations around the world. For more information, go to www.advanced-energy.com.

This release includes GAAP and non-GAAP income and per-share earnings data. Please note that beginning in 2013, Advanced Energy redefined its non-GAAP measures to exclude restructuring charges, acquisition-related

costs, stock based compensation and amortization of intangibles and tax release items. These non-GAAP measures are not in accordance with, or an alternative for, similar measures calculated under generally accepted accounting principles and may be different from non-GAAP measures used by other companies. In addition, these non-GAAP measures are not based on any comprehensive set of accounting rules or principles. Advanced Energy believes that these non-GAAP measures provide useful information to management and investors regarding financial and business trends relating to its financial condition and results of operations. Additionally, the company believes that these non-GAAP measures, in combination with its financial results calculated in accordance with GAAP, provide investors with additional perspective. While some of the excluded items may be incurred and reflected in the company’s GAAP financial results in the foreseeable future, the company believes that the items excluded from certain non-GAAP measures do not accurately reflect the underlying performance of its continuing operations for the period in which they are incurred. The use of non-GAAP measures has limitations in that such measures do not reflect all of the amounts associated with the company’s results of operations as determined in accordance with GAAP, and these measures should only be used to evaluate the company’s results of operations in conjunction with the corresponding GAAP measures.

Please refer to the Form 8-K regarding this release furnished today to the Securities and Exchange Commission.

Forward-Looking Statements

The company’s guidance with respect to anticipated financial results for the fourth quarter ending December 31, 2014 and other statements that are not historical information are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements are subject to known and unknown risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. Such risks and uncertainties include, but are not limited to: (a) the effects of global macroeconomic conditions upon demand for our products; (b) the volatility and cyclicality of the industries the company serves, particularly the semiconductor industry; (c) the volatility and seasonality of renewable energy projects and inverter sales; (d) our ability to integrate successfully the operations of companies we acquire, including the retention of key employees, realization of the benefits of such companies’ products, the total available market and expected sales of such products, and product cost expectations surrounding the fabless manufacturing models for REFUsol and the power control modules product line we acquired from AEG Power Solutions GmbH; (e) with regard to the renewable energy market, tariffs on Chinese & Taiwanese solar panels, the continuation of feed-in-tariffs and other incentives in Europe and elsewhere for inverters, including the RPS (renewable portfolio standards), the timing and availability of grant programs in North America and Europe and the reduction of the investment tax credit for solar facilities in the United States after 2016; (f) renewable energy project delays resulting from solar panel price changes, changes in tariffs and increased competition in the solar inverter equipment market; (g) the timing of orders received from customers; (h) the company’s ability to realize benefits from cost improvement efforts including avoided costs, any restructuring plans and any inorganic growth; (i) the ability to obtain materials and manufacture products; and (j) unanticipated changes to management's

estimates, reserves or allowances. These and other risks are described in Advanced Energy's Form 10-K, Forms 10-Q and other reports and statements filed with the Securities and Exchange Commission. These reports and statements are available on the SEC's website at www.sec.gov. Copies may also be obtained from Advanced Energy's website at www.advancedenergy.com or by contacting Advanced Energy's investor relations at 970-407-6555. Forward-looking statements are made and based on information available to the company on the date of this press release. Aspirational goals and targets discussed on the conference call or in the presentation materials should not be interpreted in any respect as guidance. The company assumes no obligation to update the information in this press release.

###

ADVANCED ENERGY INDUSTRIES, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED)

(in thousands, except per share data) |

| | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30, | | June 30, | | September 30, |

| 2014 | | 2013 | | 2014 | | 2014 | | 2013 |

| | | | | | | | | |

SALES | $ | 143,147 |

| | $ | 142,899 |

| | $ | 146,285 |

| | $ | 430,380 |

| | $ | 394,424 |

|

COST OF SALES | 95,204 |

| | 86,688 |

| | 93,739 |

| | 277,230 |

| | 243,115 |

|

GROSS PROFIT | 47,943 |

| | 56,211 |

| | 52,546 |

| | 153,150 |

| | 151,309 |

|

| 33.5 | % | | 39.3 | % | | 35.9 | % | | 35.6 | % | | 38.4 | % |

OPERATING EXPENSES: | | | | | | | | | |

Research and development | 15,074 |

| | 15,105 |

| | 15,736 |

| | 44,952 |

| | 45,098 |

|

Selling, general and administrative | 20,223 |

| | 22,138 |

| | 22,828 |

| | 62,782 |

| | 62,702 |

|

Restructuring charges | 1,183 |

| | 19,884 |

| | 244 |

| | 1,427 |

| | 44,090 |

|

Amortization of intangible assets | 2,238 |

| | 626 |

| | 2,226 |

| | 6,339 |

| | 4,814 |

|

Total operating expenses | 38,718 |

| | 57,753 |

| | 41,034 |

| | 115,500 |

| | 156,704 |

|

OPERATING INCOME (LOSS) | 9,225 |

| | (1,542 | ) | | 11,512 |

| | 37,650 |

| | (5,395 | ) |

OTHER INCOME (EXPENSE), NET | (618 | ) | | 164 |

| | 25 |

| | (689 | ) | | (369 | ) |

Income (loss) before income taxes | 8,607 |

| | (1,378 | ) | | 11,537 |

| | 36,961 |

| | (5,764 | ) |

Provision (benefit) for income taxes | (3,695 | ) | | (2,065 | ) | | 891 |

| | (702 | ) | | (3,495 | ) |

NET INCOME (LOSS) | $ | 12,302 |

| | $ | 687 |

| | $ | 10,646 |

| | $ | 37,663 |

| | $ | (2,269 | ) |

| | | | | | | | | |

Basic weighted-average common shares outstanding | 39,998 |

| | 39,878 |

| | 40,540 |

| | 40,450 |

| | 39,365 |

|

Diluted weighted-average common shares outstanding | 40,470 |

| | 40,577 |

| | 41,147 |

| | 41,102 |

| | 40,150 |

|

| | | | | | | | | |

EARNINGS PER SHARE: | | | | | | | | | |

| | | | | | | | | |

BASIC EARNINGS (LOSS) PER SHARE | $ | 0.31 |

| | $ | 0.02 |

| | $ | 0.26 |

| | $ | 0.93 |

| | $ | (0.06 | ) |

DILUTED EARNINGS (LOSS) PER SHARE | $ | 0.30 |

| | $ | 0.02 |

| | $ | 0.26 |

| | $ | 0.92 |

| | $ | (0.06 | ) |

ADVANCED ENERGY INDUSTRIES, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands)

|

| | | | | | | |

| September 30, | | December 31, |

| 2014 | | 2013* |

ASSETS | UNAUDITED | | |

| | | |

Current assets: | | | |

Cash and cash equivalents | $ | 103,041 |

| | $ | 138,125 |

|

Marketable securities | 2,725 |

| | 11,568 |

|

Accounts receivable, net | 112,785 |

| | 125,782 |

|

Inventories, net | 118,875 |

| | 109,771 |

|

Deferred income tax assets | 10,738 |

| | 10,746 |

|

Income taxes receivable | 13,378 |

| | 10,027 |

|

Other current assets | 11,740 |

| | 10,950 |

|

Total current assets | 373,282 |

| | 416,969 |

|

| | | |

Property and equipment, net | 31,089 |

| | 34,888 |

|

| | | |

Deposits and other | 3,025 |

| | 2,421 |

|

Goodwill and intangibles, net | 268,334 |

| | 177,211 |

|

Deferred income tax assets | 21,660 |

| | 21,488 |

|

Total assets | $ | 697,390 |

| | $ | 652,977 |

|

| | | |

LIABILITIES AND STOCKHOLDERS' EQUITY | | | |

| | | |

Current liabilities: | | | |

Accounts payable | $ | 62,178 |

| | $ | 55,623 |

|

Other accrued expenses | 64,272 |

| | 66,734 |

|

Total current liabilities | 126,450 |

| | 122,357 |

|

| | | |

Long-term liabilities | 104,879 |

| | 66,158 |

|

| | | |

Total liabilities | 231,329 |

| | 188,515 |

|

| | | |

Stockholders' equity | 466,061 |

| | 464,462 |

|

Total liabilities and stockholders' equity | $ | 697,390 |

| | $ | 652,977 |

|

| | | |

* December 31, 2013 amounts are derived from the December 31, 2013 audited Consolidated Financial Statements.

ADVANCED ENERGY INDUSTRIES, INC.

SEGMENT INFORMATION (UNAUDITED)

(in thousands)

|

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30, | | June 30, | | September 30, |

| 2014 | | 2013 | | 2014 | | 2014 | | 2013 |

SALES: | | | | | | | | | |

Precision Power Products | $ | 91,192 |

| | $ | 75,409 |

| | $ | 81,832 |

| | $ | 255,896 |

| | $ | 208,888 |

|

Inverters | 51,955 |

| | 67,490 |

| | 64,453 |

| | 174,484 |

| | 185,536 |

|

Total Sales | $ | 143,147 |

| | $ | 142,899 |

| | $ | 146,285 |

| | $ | 430,380 |

| | $ | 394,424 |

|

| | | | | | | | | |

| | | | | | | | | |

OPERATING INCOME (LOSS): | | | | | | | | | |

Precision Power Products | $ | 22,882 |

| | $ | 18,150 |

| | $ | 18,362 |

| | $ | 64,455 |

| | $ | 40,067 |

|

Inverters | (12,474 | ) | | 192 |

| | (6,606 | ) | | (25,378 | ) | | (1,372 | ) |

Total segment operating income | 10,408 |

| | 18,342 |

| | 11,756 |

| | 39,077 |

| | 38,695 |

|

Restructuring charges and asset impairment | (1,183 | ) | | (19,884 | ) | | (244 | ) | | (1,427 | ) | | (44,090 | ) |

Other income (expense), net | (618 | ) | | 164 |

| | 25 |

| | (689 | ) | | (369 | ) |

Income (loss) before income taxes | $ | 8,607 |

| | $ | (1,378 | ) | | $ | 11,537 |

| | $ | 36,961 |

| | $ | (5,764 | ) |

ADVANCED ENERGY INDUSTRIES, INC.

SELECTED OTHER DATA (UNAUDITED)

(in thousands)

|

| | | | | | | | | | | | | | | | | | | |

Reconciliation of Non-GAAP measure - operating expenses and operating income, excluding certain items | Three Months Ended | | Nine Months Ended |

| September 30, | | June 30, | | September 30, |

| 2014 | | 2013 | | 2014 | | 2014 | | 2013 |

| | | | | | | | | |

Gross Profit, as reported | $ | 47,943 |

| | $ | 56,211 |

| | $ | 52,546 |

| | $ | 153,150 |

| | $ | 151,309 |

|

Operating expenses, as reported | 38,718 |

| | 57,753 |

| | 41,034 |

| | 115,500 |

| | 156,704 |

|

Adjustments: | | | | | | | | | |

Restructuring charges | (1,183 | ) | | (19,884 | ) | | (244 | ) | | (1,427 | ) | | (44,090 | ) |

Acquisition-related costs | (60 | ) | | — |

| | (470 | ) | | (790 | ) | | (1,093 | ) |

Stock-based compensation | (1,488 | ) | | (4,106 | ) | | (1,495 | ) | | (4,747 | ) | | (9,310 | ) |

Amortization of intangible assets | (2,238 | ) | | (626 | ) | | (2,226 | ) | | (6,339 | ) | | (4,814 | ) |

Nonrecurring executive severance | — |

| | — |

| | (867 | ) | | (867 | ) | | — |

|

Non-GAAP operating expenses | $ | 33,749 |

| | $ | 33,137 |

| | $ | 35,732 |

| | $ | 101,330 |

| | $ | 97,397 |

|

Non-GAAP operating income | $ | 14,194 |

| | $ | 23,074 |

| | $ | 16,814 |

| | $ | 51,820 |

| | $ | 53,912 |

|

|

| | | | | | | | | | | | | | | | | | | |

Reconciliation of Non-GAAP measure - income excluding certain items | Three Months Ended | | Nine Months Ended |

| September 30, | | June 30, | | September 30, |

| 2014 | | 2013 | | 2014 | | 2014 | | 2013 |

| | | | | | | | | |

Income (loss), net of tax, as reported | $ | 12,302 |

| | $ | 687 |

| | $ | 10,646 |

| | $ | 37,663 |

| | $ | (2,269 | ) |

Adjustments, net of tax | | | | | | | | | |

Restructuring charges | 1,102 |

| | 22,441 |

| | 225 |

| | 1,327 |

| | 42,020 |

|

Acquisition-related costs | 56 |

| | — |

| | 434 |

| | 718 |

| | 993 |

|

Stock-based compensation | 1,385 |

| | 3,601 |

| | 1,380 |

| | 4,309 |

| | 7,972 |

|

Amortization of intangible assets | 2,084 |

| | 549 |

| | 2,052 |

| | 5,778 |

| | 4,132 |

|

Nonrecurring executive severance | — |

| | — |

| | 800 |

| | 800 |

| | — |

|

Nonrecurring tax release items | — |

| | (5,608 | ) | | — |

| | — |

| | (5,608 | ) |

Non-GAAP income, net of tax | $ | 16,929 |

| | $ | 21,670 |

| | $ | 15,537 |

| | $ | 50,595 |

| | $ | 47,240 |

|

|

| | | | | | | | | | | | | | | | | | | |

Reconciliation of Non-GAAP measure - per share earnings excluding certain items | Three Months Ended | | Nine Months Ended |

| September 30, | | June 30, | | September 30, |

| 2014 | | 2013 | | 2014 | | 2014 | | 2013 |

| | | | | | | | | |

Diluted earnings per share, as reported | $ | 0.30 |

| | $ | 0.02 |

| | $ | 0.26 |

| | $ | 0.92 |

| | $ | (0.06 | ) |

Add back: | | | | | | | | | |

per share impact of Non-GAAP adjustments, net of tax | 0.12 |

| | 0.51 |

| | 0.12 |

| | 0.31 |

| | 1.24 |

|

Non-GAAP per share earnings | $ | 0.42 |

| | $ | 0.53 |

| | $ | 0.38 |

| | $ | 1.23 |

| | $ | 1.18 |

|

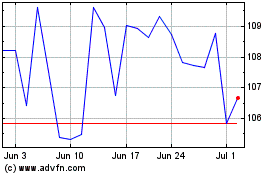

Advanced Energy Industries (NASDAQ:AEIS)

Historical Stock Chart

From Jun 2024 to Jul 2024

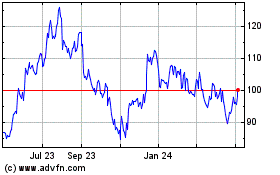

Advanced Energy Industries (NASDAQ:AEIS)

Historical Stock Chart

From Jul 2023 to Jul 2024