Will WESCO (WCC) Miss Earnings Estimates? - Analyst Blog

April 21 2014 - 6:00PM

Zacks

WESCO International Inc. (WCC) is set to report

first-quarter fiscal 2014 results on Apr 24. Last quarter, it

posted a 4.6% negative surprise. Let’s see how things are shaping

up for this announcement.

Growth Factors This Past Quarter

WESCO posted dismal fourth quarter 2013 results with both the

top and bottom lines missing the Zacks Consensus Estimate. The

sequential revenue decline of 2.7% was attributable to reduction in

organic sales and unfavorable currency movements (weaker Canadian

to U.S. dollar conversion). Despite the dismal earnings report,

WESCO’s business is being driven by strengthening end markets and

an integrated supply model, which increase efficiencies for its

customers.

Moreover, WESCO recently acquired Hazmasters, Inc., a Canadian

company that distributes safety products in the industrial,

construction, commercial, institution and government markets. The

acquisition will enhance WESCO’s safety business and customer base,

which in turn will strengthen its Canadian footprint. Also, the

acquisition is expected to be accretive to WESCO’s earnings and

will likely add 5 cents per share to the company’s profit in the

first year of operation.

For the first quarter, WESCO expects year-over-year revenue

increase of at least 0-3%. Gross margin is expected to be in the

range of 20.8-21% while operating margin is expected to be in the

range of 5.3-5.5%. The tax rate is expected to be in the 26-28%

range.

Earnings Whispers?

Our proven model does not conclusively show that WESCO

International will beat estimates this quarter. That is because a

stock needs to have both a positive Earnings ESP and a Zacks Rank

#1, 2 or 3 for this to happen. That is not the case here as you

will see below.

Negative Zacks ESP: That is because the

Most Accurate estimate stands at $1.06 while the Zacks Consensus

Estimate is higher at $1.08. That is a difference of –1.85%.

Zacks Rank: WESCO International’s Zacks Rank #3

(Hold) when combined with a negative ESP makes surprise prediction

difficult.

We caution against stocks with Zacks Ranks #4 and 5 (Sell-rated

stocks) going into the earnings announcement, especially when the

company is seeing negative estimate revisions momentum.

Other Stocks to Consider

Here are some other companies, which you may want to consider as

our model shows that they have the right combination of elements to

post an earnings beat this quarter:

Advanced Energy Industries, Inc. (AEIS), with

Earnings ESP of +10.00% and a Zacks Rank #1 (Strong Buy).

E-Commerce China Dangdang Inc. (DANG),

with Earnings ESP of +33.33% and a Zacks Rank #1.

ON Semiconductor Corp. (ONNN), with

Earnings ESP of +6.67% and a Zacks Rank #1.

ADV ENERGY INDS (AEIS): Free Stock Analysis Report

E-COMMRC CH-ADR (DANG): Free Stock Analysis Report

ON SEMICON CORP (ONNN): Free Stock Analysis Report

WESCO INTL INC (WCC): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

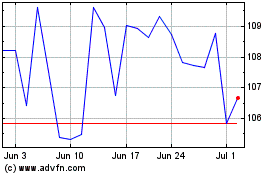

Advanced Energy Industries (NASDAQ:AEIS)

Historical Stock Chart

From Jun 2024 to Jul 2024

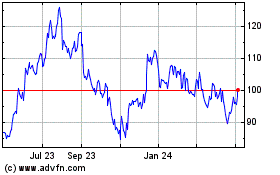

Advanced Energy Industries (NASDAQ:AEIS)

Historical Stock Chart

From Jul 2023 to Jul 2024