Adaptec Reports Better Than Anticipated Second Quarter Results - Q2

Revenues: $109.2 million - Q2 Earnings per Share: $0.00 GAAP; $0.03

Pro Forma - Q2 Operating Cash Flow: $23.2 million MILPITAS, Calif.,

Oct. 27 /PRNewswire-FirstCall/ -- Adaptec, Inc. , a global leader

in storage solutions, today reported its second quarter results for

the period ended September 30, 2003. Net revenues for the second

quarter of fiscal 2004 were $109.2 million, compared with $85.7

million for the second quarter of fiscal 2003 and $107.3 for the

first quarter of fiscal 2004. Net income for the second quarter of

fiscal 2004, on a generally accepted accounting principles (GAAP)

basis, was $0.3 million or $0.00 per share, compared with a net

loss of $10.8 million or $0.10 per share for the second quarter of

fiscal 2003 and net income of $40.8 million or $0.33 per share for

the first quarter of fiscal 2004. Fiscal 2004 first quarter results

include an after tax gain of $49.3 million from the May 2003

settlement with the former president of Distributed Processing

Technology Corp. (DPT), a company Adaptec acquired in 1999. The

first and second quarters of fiscal 2004 include the results from

Eurologic Systems, acquired April 2, 2003, and the second quarter

of fiscal 2004 includes a full quarter of the results of ICP vortex

Computersysteme GmbH (ICP vortex) acquired June 5, 2003. Pro forma

net income for the second quarter of fiscal 2004 was $3.7 million

or $0.03 per share, compared with $0.6 million or $0.01 per share

for the second quarter of fiscal 2003 and $3.6 million or $0.03 per

share for the first quarter of fiscal 2004. Reconciliation between

net income/loss on a GAAP basis and pro forma net income is

provided in the attached tables. "We are pleased with our financial

results and improved efficiency for the second quarter," said

Robert N. Stephens, Adaptec's president and chief executive

officer. "We have made solid progress in Serial ATA, Serial

Attached SCSI, IP storage networking and external storage and are

linking these technologies into a comprehensive spectrum of

scalable product offerings for our customers." Net revenues for the

first six months of fiscal 2004 were $216.5 million, compared with

$193.6 million for the first six months of fiscal 2003. Net income

for the first six months of fiscal 2004, on a GAAP basis, was $41.1

million or $0.35 per share, compared with a net loss of $8.3

million or $0.08 per share for the first six months of fiscal 2003.

Pro forma net income for the first six months of fiscal 2004 was

$7.3 million or $0.07 per share, compared with $9.0 million or

$0.08 per share for the first six months of fiscal 2003. Financial

Highlights -- Operating cash flows for the second quarter of fiscal

2004 were $23.2 million, compared with $11.6 million for the second

quarter of fiscal 2003 and $38.2 million for the first quarter of

fiscal 2004. Operating cash flows for the second quarter of fiscal

2004 included an $11.4 million tax refund and operating cash flows

for the first quarter of fiscal 2004 included $31.0 million

associated with claims settled against the former president of DPT.

-- Cash, cash equivalents and investments as of September 30, 2003,

were $683.4 million, compared with $663.6 million at June 30, 2003

and $742.3 million at March 31, 2003. -- Days sales outstanding

(DSO) in accounts receivable as of September 30, 2003 were 48 days,

compared with 49 days at June 30, 2003, and 45 days at March 31,

2003. -- Annualized inventory turns were 7.0 in the second quarter

of fiscal 2004, compared with 9.1 in the first quarter of fiscal

2004, and 5.3 in the second quarter of fiscal 2003. -- Adaptec

completed the acquisitions of Eurologic Systems and ICP vortex on

April 2 and June 5, respectively. Eurologic contributed $12.6

million of revenue in the second quarter and $13.2 million of

revenue in the first quarter of fiscal 2004, respectively. ICP

vortex contributed $4.9 million of revenue in the second quarter

and $0.9 million of revenue in the first quarter of fiscal 2004,

respectively. -- The Company incurred $1.5 million of restructuring

charges during the second quarter primarily related to reductions

in headcount. Business Highlights -- Adaptec demonstrated the first

prototype Serial Attached SCSI chip at 3-gigabit-per-second

protocol transmission speeds in collaboration with HP, Intel,

Seagate and Maxtor. As this chip is architected to run at

6-gigabits per second, it offers customers investment protection as

faster technologies come to market. The Adaptec chip is a prototype

that supports both Serial Attached SCSI and Serial ATA disk drives.

-- Adaptec announced availability of a new network accelerator card

with enhanced software to increase the performance of servers used

in high-performance computing applications. The Adaptec network

accelerator offloads all TCP/IP processing from the host to make

more CPU processing power available for networked applications and

reduce latency. -- Adaptec certified its iSCSI host bus adapters as

"ca smart" with Computer Associates International, Inc.'s

Brightstor ARCserve Backup, enabling storage area network-based

backup solutions built on low-cost, simple-to-deploy IP storage

networks. -- Adaptec showcased interoperable end-to-end storage

solutions -- from ASICs for direct-attached storage connectivity

and data protection to plug-and-play solutions for storage area

networks -- at the Intel Developer Forum. -- Adaptec and Network

Appliance announced the availability of an IP storage area network

(SAN) solution that enables small and midsize businesses to deploy

cost-effective, easy-to-manage SANs for enterprise-level

applications such as online transaction processing, email and

enterprise resource planning. Conference Call Adaptec's fiscal 2004

second-quarter earnings conference call is scheduled for 1:45 p.m.

PST on October 27, 2003. The dial-in number for the conference call

is 212-346-6401. Individuals may also participate free via Webcast

by visiting http://www.adaptec.com/ 15 minutes prior to the call. A

telephone replay will be made accessible through November 3, 2003,

at 800-633-8284, access code 21096605. A Webcast replay will also

be available via Adaptec's web site. About Adaptec Adaptec Inc.

provides end-to-end storage solutions that reliably move, manage

and protect critical data and digital content. Adaptec provides

software and hardware solutions for storage connectivity and data

protection, storage networking and networked storage subsystems to

leading OEMs and distribution channel partners. Adaptec is an

S&P Small Cap 600 Index member. More information is available

at http://www.adaptec.com/. Safe Harbor Statement This news release

includes forward-looking statements within the meaning of Section

27A of the Securities Act of 1933, as amended, and Section 21E of

the Securities and Exchange Act of 1934, as amended.

Forward-looking statements include statements regarding future

events or the future performance of Adaptec including, but not

limited to, statements regarding our progress with respect to

product development and operating expense reductions, the growth of

our product portfolio, customer acceptance of our products,

improved customer relationships, establishing new partnerships,

stability in the market for our products, continued success with

product design and performance levels, timely introduction of new

technologies, successful business acquisitions and the successful

integration of Eurologic Systems. These forward-looking statements

are based on current expectations, forecasts and assumptions and

involve a number of risks and uncertainties that could cause actual

results to differ materially from those anticipated by these

forward-looking statements. These risks include: difficulty in

forecasting the volume and timing of customer orders, reduced

demand in the server, network storage and desktop computer markets,

our target markets' failure to accept, or delay in accepting,

network storage and other advanced storage solutions, decline in

consumer acceptance of products based on the SCSI standard, the

markets' failure to accept our new products, including our Ultra

320 line of products, the adverse effects of the intense

competition we face in our business, and the continued effects of

the current economic slowdown in the technology sector. For a more

complete discussion of risks related to our business, reference is

made to the section titled "Risk Factors" included in our Form 10-K

for the year ended March 31, 2003, on file with the Securities and

Exchange Commission. Adaptec assumes no obligation to update this

information or the Risk Factors included in its Form 10-K for the

year ended March 31, 2003. Editorial Contact: Investor Contact:

Caroline Yu Marshall Mohr Adaptec, Inc. Adaptec, Inc. 408-957-2324

408-957-6773 Adaptec, Inc. GAAP Condensed Consolidated Statements

of Operations and Reconciliation of GAAP to Pro forma Operating

Results (*) (unaudited) Three-Month Period Ended September 30, 2003

September 30, 2002 Pro Pro GAAP Adjustments forma GAAP Adjustments

forma (in thousands, except per share amounts) Net revenues

$109,192 $-- $109,192 $85,709 $-- $85,709 Cost of revenues 62,746

-- 62,746 39,519 -- 39,519 Gross profit 46,446 -- 46,446 46,190 --

46,190 Operating expenses: Research and development 24,975

(1,116)(a) 23,859 29,403 (2,736)(a) 26,667 Selling, marketing and

administrative 19,223 (36)(a) 19,187 23,238 (1,088)(a) 22,150

Amortization of acquisition -related intangible assets 4,713

(4,713)(b) -- 3,743 (3,743)(b) -- Restructuring and other charges

1,478 (1,478)(c) -- 7,667 (7,667)(d) -- Total operating ' expenses

50,389 (7,343) 43,046 64,051 (15,234) 48,817 Income (loss) from

operations (3,943) 7,343 3,400 (17,861) 15,234 (2,627) Interest and

other income 4,252 -- 4,252 9,633 (2,197)(e) 7,436 Interest expense

(2,490) -- (2,490) (4,011) -- (4,011) Income from operations before

provision for (benefit from) income taxes (2,181) 7,343 5,162

(12,239) 13,037 798 Provision for (benefit from) income taxes

(2,442) 3,887(f) 1,445 (1,419) 1,642(f) 223 Net income (loss) $261

$3,456 $3,717 $(10,820)$11,395 $575 Net income (loss) per share:

Basic $0.00 $0.03 $(0.10) $0.01 Diluted $0.00 $0.03 $(0.10) $0.01

Shares used in computing net income (loss) per share: Basic 108,411

-- 108,411 106,550 -- 106,550 Diluted 110,219 -- 110,219 106,550

1,596(g) 108,146 Adaptec, Inc. GAAP Condensed Consolidated

Statements of Operations and Reconciliation of GAAP to Pro forma

Operating Results (*) (unaudited) Six-Month Period Ended September

30, 2003 September 30, 2002 Pro Pro GAAP Adjustments forma GAAP

Adjustments forma (in thousands, except per share amounts) Net

revenues $216,485 $-- 216,485 $193,555 $-- $193,555 Cost of

revenues 124,177 -- 124,177 86,803 -- 86,803 Gross profit 92,308 --

92,308 106,752 -- 106,752 Operating expenses: Research and

development 50,932 (2,342)(a) 48,590 60,619 (5,522)(a) 55,097

Selling, marketing and administra- tive 39,576 (180)(a) 39,396

47,291 (2,177)(a) 45,114 Amortization of acquisition -related

intangible assets 9,537 (9,537)(b) -- 7,487 (7,487)(b) -- Write-off

of acquired in-process technology 3,649 (3,649)(h) -- -- -- --

Restructuring and other charges 1,826 (1,826)(c) -- 7,667

(7,667)(d) -- Total operating expenses 105,520 (17,534) 87,986

123,064 (22,853) 100,211 Income (loss) from operations (13,212)

17,534 4,322 (16,312) 22,853 6,541 Interest and other income 60,311

(48,790)(i) 11,521 18,468 (3,297)(e) 15,171 Interest expense

(5,688) -- (5,688) (9,185) -- (9,185) Income (loss) from operations

before provision for income taxes 41,411 (31,256) 10,155 (7,029)

19,556 12,527 Provision for income taxes 348 2,495(f) 2,843 1,237

2,270(f) 3,507 Net income (loss) $41,063 $(33,751) $7,312

$(8,266)$17,286 $9,020 Net income (loss) per share: Basic $0.38

$0.07 $(0.08) $0.08 Diluted $0.35 $0.07 $(0.08) $0.08 Shares used

in computing net income (loss) per share: Basic 108,183 -- 108,183

106,264 -- 106,264 Diluted 126,400 (16,328)(j) 110,072 106,264

1,897(g) 108,161 (a) Deferred compensation expense associated with

the Platys acquisition. (b) Amortization of acquisition-related

intangible assets related to the acquisitions of DPT, Platys,

Eurologic and ICP vortex. (c) Restructuring charges. (d)

Restructuring charges of $7.2 million and write-off of a minority

investment of $0.5 million. (e) Gain on early extinguishment of 4

3/4 % Convertible Subordinated Notes. (f) Incremental income taxes

associated with certain pro forma adjustments. (g) Dilutive effect

of employee stock options. (h) Write-off of acquired in-process

technology associated with the Eurologic acquisition. (i) Gain of

$49.3 million related to the settlement with the former president

of DPT, loss of $0.8 million on redemption of 4 3/4% Convertible

Subordinated Notes, and gain distributions of $0.3 million on

investments. (j) Anti-dilutive effect of 3% Convertible

Subordinated Notes. (k) Anti-dilutive effect of 3% and 4 3/4%

Convertible Subordinated Notes. (*) To supplement our consolidated

financial statements presented in accordance with generally

accepted accounting principles (GAAP), we use pro forma measures of

operating results, net income/(loss) and earnings per share, which

are adjusted from results based on GAAP to exclude certain

expenses, gains and losses. These pro forma measures are provided

to enhance the user's overall understanding of our current

financial performance and our prospects for the future.

Specifically, we believe the pro forma results provide useful

information to both management and investors by excluding certain

expenses, gains and losses that we believe are not indicative of

our core operating results. In addition, since we have historically

reported pro forma results to the investment community, we believe

the inclusion of pro forma numbers provides consistency in our

financial reporting. Further, these pro forma results are one of

the primary indicators management uses for planning and forecasting

of future periods. The pro forma information is presented using

consistent methodology from quarter-to-quarter and year-to-year.

These measures should be considered in addition to results prepared

in accordance with GAAP, but should not be considered a substitute

for or superior to GAAP results. Adaptec, Inc. Summary Balance

Sheet and Cash Flow Data (unaudited) (in thousands) Balance Sheet

Data As of Sept. 30, March 31, Sept. 30, 2003 2003 2002 Cash, cash

equivalents and marketable securities $683,425 $742,302 $707,149

Accounts receivable, net 57,369 50,137 47,474 Inventories 40,738

23,496 32,419 Goodwill and other intangible assets 110,540 101,249

110,601 Other assets 157,518 185,795 185,335 Total assets

$1,049,590 $1,102,979 $1,082,978 Current liabilities $142,637

$247,606 $145,828 Convertible subordinated notes and other

long-term obligations 255,888 252,596 335,200 Stockholders' equity

651,065 602,777 601,950 Total liabilities and stockholders' equity

$1,049,590 $1,102,979 $1,082,978 Cash Flow Data Three-Month Period

Ended Sept. 30, June 30, Sept. 30, 2003 2003 2002 Net income (loss)

$261 $40,802 $(10,820) Adjustments to reconcile net income (loss)

to net cash provided by operations: Non-cash P&L items:

Non-cash restructuring charges 66 -- 1,851 Write-off of acquired

in-process technology -- 3,649 -- Stock-based compensation related

to Platys 1,081 1,271 2,775 Loss (gain) on extinguishment of debt

-- 790 (2,197) Non-cash portion of DPT settlement gain -- (18,256)

-- Depreciation and amortization 14,184 12,665 11,645 Deferred

income taxes (3,100) (2,435) (455) Other items 156 89 1,000 Changes

in assets and liabilities 10,516 (408) 7,833 Net cash provided by

operating activities $23,164 $38,167 $11,632 Other significant cash

flow activities: Payments for business acquisitions, net of cash

acquired (61) 29,945 -- Payment of general holdback in connection

with acquisition of Platys 159 -- 10,640 Repurchase of 4 3/4%

convertible notes -- 83,010 70,374 Adaptec, Inc. GAAP Condensed

Consolidated Statements of Operations and Reconciliation of GAAP to

Pro forma Operating Results (*) (unaudited) Three-Month Period

Ended June 30, 2003 GAAP Adjustments Pro forma (in thousands,

except per share amounts) Net revenues $107,293 $-- $107,293 Cost

of revenues 61,431 -- 61,431 Gross profit 45,862 -- 45,862

Operating expenses: Research and development 25,957 (1,226)(a)

24,731 Selling, marketing and administrative 20,353 (144)(a) 20,209

Amortization of acquisition -related intangible assets 4,824

(4,824)(b) -- Write-off of acquired in-process technology 3,649

(3,649)(h) -- Restructuring charges 348 (348) -- Total operating

expenses 55,131 (10,191) 44,940 Income (loss) from operations

(9,269) 10,191 922 Interest and other income 56,059 (48,790)(i)

7,269 Interest expense (3,198) -- (3,198) Income from operations

before provision for income taxes 43,592 (38,599) 4,993 Provision

for income taxes 2,790 (1,392)(e) 1,398 Net income $40,802

$(37,207) $3,595 Net income per share: Basic $0.38 $0.03 Diluted

$0.33 $0.03 Shares used in computing net income per share: Basic

107,956 -- 107,956 Diluted 127,901 (17,975)(k) 109,926 Please see

the footnotes accompanying the Condensed Consolidated Statement of

Operations for the three- and six- month periods ended September

30, 2003 and 2002 for an explanation of the footnotes referred to

in the table above. DATASOURCE: Adaptec, Inc. CONTACT: media,

Caroline Yu, +1-408-957-2324, or , or investors, Marshall Mohr,

+1-408-957-6773, or , both of Adaptec, Inc. Web site:

http://www.adaptec.com/

Copyright

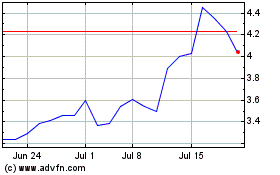

Adaptive Biotechnologies (NASDAQ:ADPT)

Historical Stock Chart

From Jun 2024 to Jul 2024

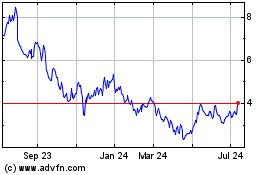

Adaptive Biotechnologies (NASDAQ:ADPT)

Historical Stock Chart

From Jul 2023 to Jul 2024