Current Report Filing (8-k)

May 26 2022 - 5:08PM

Edgar (US Regulatory)

0000887247

false

0000887247

2022-05-24

2022-05-24

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date

of report (Date of earliest event reported): May 24,

2022

ADAMIS PHARMACEUTICALS CORPORATION

(Exact Name of Registrant as Specified in Charter)

| Delaware |

|

0-26372 |

|

82-0429727 |

|

(State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.)

|

11682 El Camino Real, Suite 300

San Diego, CA |

|

92130 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (858) 997-2400

(Former name or Former Address, if Changed Since Last Report.)

___________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Exchange Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on

which registered |

| Common Stock |

|

ADMP |

|

NASDAQ Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| |

Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| |

Item 5.02 |

Departure of Directors of Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

(d) Appointment of Directors

On May 24, 2022, the board of directors (the

“Board”) of Adamis Pharmaceuticals Corporation (the “Company”) approved the appointment of Vickie S. Reed as an

independent director and member of the Board, effective May 24, 2022. Ms. Reed is a healthcare executive with over 25 years of experience

in operating and governance roles. Ms. Reed has served as Senior Vice President, Finance and Chief Accounting Officer at Mirati Therapeutics

since November 2021, and as Chief Accounting Officer since January 2020, Vice President of Finance from December 2016 to January 2020,

and Senior Director and Corporate Controller from October 2013 to December 2016, of Mirati Therapeutics. She is also a member of the board

of directors of Evoke Pharma, a public pharmaceuticals company. Previously, she served as Senior Director, Finance and Controller at Zogenix,

Inc., a public biotechnology company in San Diego and Emeryville, California, and held corporate accounting positions at Amylin Pharmaceuticals,

Inc., a public biotechnology company acquired by Bristol Myers Squibb in 2012. Prior to joining Amylin, Ms. Reed held financial leadership

roles at several biotechnology and telecommunications companies. Ms. Reed began her career with Price Waterhouse, now PricewaterhouseCoopers,

in Denver, Colorado. She is a Certified Public Accountant (inactive) in the State of Colorado and received a B.S. in Accounting from University

of Colorado, Denver.

There is no arrangement

or understanding between Ms. Reed and any other person pursuant to which she was selected as a director of the Company, and there is no

family relationship between Ms. Reed and any of the Company’s other directors or executive officers. Ms. Reed does not have any

direct or indirect material interest in any transaction that is required to be disclosed under Item 404(a) of Regulation S-K.

In connection with her

appointment as a director of the Company, Ms. Reed was granted a cash stock appreciation right (the “SAR”). The SAR provides

for a reference price equal to the fair market value of the common stock of the Company of the date of grant of the SAR, and a reference

number of shares equal to 50,000 shares. The SAR vests with respect to 1/6 of the reference number of shares on the six-month anniversary

of the grant date and vests monthly thereafter in equal installments over a period of three years from the grant date, subject to the

recipient providing continuous service to the Company. The SAR has a term of seven years. The vested portion of the SAR may be settled

only in cash and may be exercised for a period of 12 months after the date of termination of the recipient’s service to the Company.

Upon settlement, the Company will pay to the recipient an amount of cash equal to the difference between the fair market value of the

common stock on the date of termination of service or, if lower, on the date of exercise, and the initial reference price, multiplied

by the number of shares as to which the SAR is being exercised. In the event of a change of control of the Company before the SAR is fully

vested, vesting and exercisability is accelerated.

Pursuant to the Company’s

current policies regarding compensation for non-employee directors, as may be amended from time to time, Ms. Reed will be entitled to

receive an annual cash director fee, currently $64,000 per year paid quarterly in arrears, and is also entitled to reimbursement of reasonable

expenses incurred in connection with Board-related activities. The Company will also enter into its form of indemnity agreement with Ms.

Reed.

| |

Item 7.01 |

Regulation FD Disclosure |

On May 26, 2022, the Company issued

a press release relating to the appointment of Ms. Reed to the Company’s board of directors and the matters described in Item 5.02

above. A copy of the press release, which is attached to this Current Report on Form 8-K as Exhibit

99.1, is furnished pursuant to this Item 7.01. The information in this Item 7.01 and Exhibit 99.1 are furnished and shall not be deemed

“filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or

otherwise subject to the liabilities of that Section, nor shall it be deemed incorporated by reference into any registration statement

or other filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in

such filing, except as shall be expressly incorporated by specific reference in such filing.

| |

Item 9.01 |

Financial Statements and Exhibits |

| Exhibit No. |

Description |

| 99.1 |

Press Release issued May 26, 2022. |

| 104 |

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

ADAMIS

PHARMACEUTICALS CORPORATION |

| |

|

|

| |

|

|

| Dated: May 26, 2022 |

By: |

/s/

David C. Benedicto |

| |

Name: |

David

C. Benedicto |

| |

Title: |

Chief

Financial Officer |

Adamis Pharmaceuticals (NASDAQ:ADMP)

Historical Stock Chart

From Mar 2024 to Apr 2024

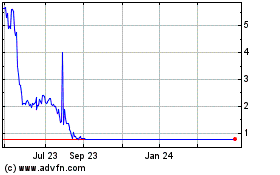

Adamis Pharmaceuticals (NASDAQ:ADMP)

Historical Stock Chart

From Apr 2023 to Apr 2024