King Digital Seeks Cover to Solve Candy Crush Conundum

November 03 2015 - 9:39AM

Dow Jones News

By Jens Hansegard and Anna Molin

STOCKHOLM--King Digital PLC's decision to sell itself to

Activision Blizzard Inc. for $5.9 billion could help the Swedish

studio behind the Candy Crush puzzle game solve the conundrum of

how to keep converting players into paying customers.

King Digital earned its crown as the mobile game industry's

leader by number of users when it launched the Candy Crush Saga

game on mobile phones and tablets in 2012.

The game, in which players have to match candies by colors, has

consistently been a big money spinner and allowed King Digital to

go public in 2014, when it priced its shares at $22.50.

But the company has struggled to duplicate Candy Crush's

success, triggering concerns among analysts and investors about the

strength of its business model. Those doubts were evident even on

King Digital's stock-market debut on March 26 last year when the

stock lost 16%.

"King never really solved the problem of extreme dependence on a

single franchise," mobile games analyst and consultant Tero

Kuittinen said. "A one-horse mobile vendor just isn't a great fit

with the stock market."

Under terms of the agreed offer, King Digital shareholders stand

to receive $18 a share in cash, a 20% premium to King's 4 p.m. ET

price of $14.96 on the New York Stock Exchange on Oct. 30.

King Digital's decision to become part a broader group, though

Activision Blizzard said the business will remain independent under

Chief Executive Ricarrdo Zacconi, highlights how the mobile-game

industry is going through turbulent times. Amid growing competition

from many newcomers, some developers are having difficulties

monetizing pricey game developments.

Disaffection with the stock market has also beset the broader

tech sector.

At the end of last month, French music-streaming service Deezer

postponed its initial public offering citing "market conditions."

In the U.S., only 14% of IPOs this year have been undertaken by

tech companies, the smallest percentage since at least the

mid-1990s, according to Dealogic.

One King Digital shareholder has reasons to celebrate.

Private-equity fund Apax Partners, which plowed EUR29 million

into King Digital in 2005 and holds a 45% interest in the company,

is set to walk away with proceeds of about $2.5 billion, according

to a person familiar with the matter.

Once Activision Blizzard completes its acquisition of King

Digital--just one year after Microsoft Corp. bought Mojang, the

makers of Minecraft--nearly all the large Swedish games studios

will have foreign owners.

Dice, which is making the new "Star Wars Battlefront" game is

owned by Electronic Arts Inc. and Massive Entertainment, which is

developing "Tom Clancy's The Division," is owned by France's

Ubisoft Entertainment SA.

King Digital was set up by Sweden's Sebastian Knutsson in 2003.

He has remained at the company as chief creative officer.

Write to Jens Hansegard at jens.hansegard@wsj.com and Anna Molin

at anna.molin@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 03, 2015 09:24 ET (14:24 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

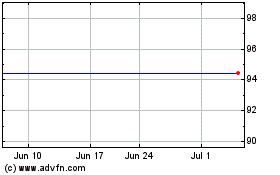

Activision Blizzard (NASDAQ:ATVI)

Historical Stock Chart

From Jun 2024 to Jul 2024

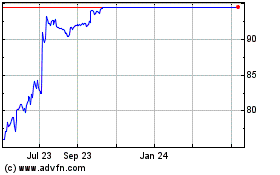

Activision Blizzard (NASDAQ:ATVI)

Historical Stock Chart

From Jul 2023 to Jul 2024