UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): July 30, 2015

AV Homes, Inc.

(Exact

name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-07395 |

|

23-1739078 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

|

|

|

| 8601 N. Scottsdale Rd. Suite 225

Scottsdale, Arizona |

|

85253 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number,

including area code: (480) 214-7400

Not Applicable

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 2.02 |

Results of Operations and Financial Condition. |

On July 30, 2015, AV Homes, Inc. (the

“Company”) issued a press release announcing its results for the quarter ended June 30, 2015. A copy of the press release is furnished herewith as Exhibit 99.1 and is incorporated herein by reference.

The information furnished pursuant to this Item 2.02, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of

the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities under that Section and shall not be deemed to be incorporated by reference into any filing of the Company under the Securities Act of 1933 or

the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

|

|

|

Exhibit

No. |

|

Description |

|

|

| 99.1 |

|

Press Release dated July 30, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

AV Homes, Inc. |

|

|

|

|

| Date: July 30, 2015 |

|

|

|

By: |

|

/s/ Roger A. Cregg |

|

|

|

|

Name: |

|

Roger A. Cregg |

|

|

|

|

Title: |

|

President and Chief Executive Officer |

|

|

|

|

|

|

(Principal Executive Officer) |

Exhibit Index

|

|

|

Exhibit

No. |

|

Description |

|

|

| 99.1 |

|

Press Release dated July 30, 2015. |

Exhibit 99.1

AV Homes Reports Results for Second Quarter 2015

Second Quarter 2015 Highlights - as compared to the prior year second quarter (unless otherwise noted)

| |

• |

|

Total revenue increased 54% to $79.4 million |

| |

• |

|

Homebuilding revenue increased 57% to $75.9 million |

| |

• |

|

Net loss was $4.5 million, or $0.20 per share, compared to a net loss of $2.3 million, or $0.10 per share |

| |

• |

|

Closings increased 52% to 291 units |

| |

• |

|

Net new order value increased 85% to $137.5 million on a 75% increase in units |

| |

• |

|

Backlog value increased 83% to $226.5 million on 803 units |

| |

• |

|

Selling communities increased to 38 from 19 and communities with closings increased to 32 from 14 |

| |

• |

|

Issued $80 million of 6% Senior Convertible Notes due 2020 |

Scottsdale, Ariz. (July 30, 2015) – AV Homes, Inc. (Nasdaq: AVHI), a developer and builder of active adult and primary residential

communities in Florida, Arizona and the Carolinas, today announced results for its second quarter ended June 30, 2015. Total revenue for the second quarter of 2015 increased 54% to $79.4 million from $51.5 million in the second quarter of 2014.

Net loss before interest and taxes in the second quarter of 2015 improved to $2.1 million, compared to $2.3 million in the second quarter of 2014. Net loss attributable to common stockholders was $4.5 million, or $0.20 per share, in the second

quarter of 2015, compared to a net loss of $2.3 million, or $0.10 per share, in the second quarter of 2014, primarily due to the increase in interest expense.

Roger A. Cregg, President and Chief Executive Officer, commented, “We are pleased with our results for the second quarter as we continue

to improve our operating performance highlighted by the 57% growth in homebuilding revenue driven by a 52% increase in homes delivered as we increased our communities with closings to 32 from 14 last year. Net new orders increased 85% on an increase

of 75% in units as the number of selling communities doubled to 38. Our execution supports our long-term growth strategy, while continuing to leverage our overhead structure.”

Mr. Cregg added, “Our second quarter was also highlighted with the announcement of our

agreement to acquire the homebuilding assets of Bonterra Builders, LLC in Charlotte, NC, which subsequently closed on July 1, 2015. The acquisition of Bonterra Builders, will increase our scale and market share in the greater Charlotte area,

improve our geographic and customer segment diversification, and increase our overall company exposure to the primary residential market. With approximately 1,700 lots owned or controlled, the Bonterra acquisition significantly enhances our position

in a key growth market. We remain focused on increasing profitability, growing our market share, and investing in attractive land opportunities.”

The increase in total revenue for the second quarter of 2015 compared to the prior year period included a 57% increase in homebuilding revenue

to $75.9 million. The increase in homebuilding revenue was driven by volume increases due to a greater number of communities with closings in each of our existing markets. During the second quarter of 2015, the Company closed 291 homes, a 52%

increase from the 191 homes closed during the second quarter of 2014, and the average unit price per closing improved 2.8% to approximately $261,000 from approximately $254,000 in the second quarter of 2014.

Homebuilding gross margin was 16.7% in the second quarter of 2015 compared to 18.2% in the second quarter of 2014. The decline in gross margin

year-over-year was primarily due to a change in the mix of communities as a significant number of new communities in each of our markets came on line within the past year. These newer communities, which typically have lower initial margins than our

well-established communities, were proportionally greater in the current year portfolio.

Homebuilding SG&A expense as a percentage of

homebuilding revenue was 15.3% in the second quarter of 2015 compared to 15.0% in the second quarter of 2014. The slight increase was due to additional costs incurred by new communities that are selling homes but not yet generating significant

revenue from closings. Corporate general and administrative expenses as a percentage of homebuilding revenue improved to 5.6% in the second quarter of 2015 from 8.0% in the same period a year ago driven by the favorable cost leverage the Company is

achieving in effectively managing its costs while growing the revenue of the business.

The number of new housing contracts signed, net of cancellations, during the three months ended

June 30, 2015 increased 75% to 491, compared to 281 units during the same period in 2014. The increase in housing contracts was primarily attributable to the increase in selling communities from 19 to 38. The average sales price on contracts

signed in the second quarter of 2015 increased 6.0% to approximately $280,000 from approximately $264,000 in the second quarter of 2014. The aggregate dollar value of the contracts signed during the second quarter increased 85% to $137.5 million,

compared to $74.3 million during the same period one year ago. The backlog value of homes under contract but not yet closed at June 30, 2015 increased 83% to $226.5 million on 803 units, compared to $123.7 million on 480 units at June 30,

2014.

The Company will hold a conference call and webcast on Friday, July 31, 2015 to discuss its second quarter financial results.

The conference call will begin at 8:30 a.m. EDT. The conference call can be accessed live over the telephone by dialing (877) 643-7158 or for international callers by dialing (914) 495-8565; please dial-in 10 minutes before the start of

the call. A replay will be available on July 31, 2015 beginning at 11:30 a.m. and can be accessed by dialing (855) 859-2056 or for international callers by dialing (404) 537-3406; the conference ID is 88363071. The telephonic replay

will be available until August 7, 2015. The webcast, which can be accessed by going to the Investor Relations section of AV Homes’ website at www.avhomesinc.com, is accompanied by an Investor Presentation. A replay of the original

webcast will be available shortly after the call.

AV Homes, Inc. is engaged in homebuilding and community development in Florida, Arizona

and North Carolina. Its principal operations are conducted in the greater Orlando, Jacksonville, Phoenix, Charlotte and Raleigh markets. The Company builds communities that serve both active adults (55 years and older) as well as people of all ages.

AV Homes common shares trade on NASDAQ under the symbol AVHI. For more information, visit www.avhomesinc.com.

This news release, the conference call, webcast and other related items contain

“forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward looking statements, which may include references to our outlook for 2015, involve known and unknown risks, uncertainties

and other important factors that could cause the actual results, performance or achievements to differ materially from any future results, performance or achievements expressed or implied by such forward-looking statements. Such risks, uncertainties

and other important factors include, among others: the cyclical nature of the homebuilding industry and its dependence on broader economic conditions; competition for home buyers, properties, financing, raw materials and skilled labor; overall

market supply and demand for new homes; our ability to successfully integrate acquired businesses; conflicts of interest involving our largest stockholder; contractual restrictions under a stockholders agreement with our largest stockholder; our

ability to access sufficient capital; our ability to generate sufficient cash to service our indebtedness and potential need for additional financing; terms of our financing documents that may restrict our operations and corporate actions;

fluctuations in interest rates; our ability to purchase outstanding notes upon certain fundamental changes; contingent liabilities that may affect our liquidity; development liabilities that may impose payment obligations on us; the availability of

mortgage financing for home buyers; increased regulation of the mortgage industry; changes in federal lending programs and other regulations; cancellations of home sale orders; declines in home prices in our primary regions; inflation affecting

homebuilding costs; the prices and supply of building materials and skilled labor; elimination or reduction of tax benefits associated with home ownership; warrant and construction defect claims; health and safety incidents in homebuilding

activities; availability and suitability of undeveloped land and improved lots; ability to develop communities within expected timeframes; the seasonal nature of our business; impacts of weather conditions and natural disasters; resource shortages

and rate fluctuations; value and costs related to our land and lot inventory; our ability to recover our costs in the event of reduced home sales; dependence on our senior management; effect of our expansion efforts on our cash flows and

profitability; effects of government regulation of development and homebuilding projects; raising healthcare costs; our ability to realize our deferred income tax asset; costs of environmental compliance; impact of environmental changes; dependence

on digital technologies and potential interruptions; and potential dilution related to future financing activities, all as described in “Risk Factors” in our most recent Annual Report on Form 10-K for and our other filings with the

Securities and Exchange Commission, which filings are available on www.sec.gov. Forward-looking statements are based on the expectations, estimates, or projections of management as of the date of this news release, the conference call, the

Investor Presentation and the webcast. AV Homes disclaims any intention or obligation to update or revise any forward-looking statements to reflect subsequent events and circumstances, except to the extent required by applicable law.

AV HOMES, INC. AND SUBSIDIARIES

Consolidated Balance Sheets

(in

thousands, except share data)

|

|

|

|

|

|

|

|

|

| |

|

June 30,

2015 |

|

|

December 31,

2014 |

|

| |

|

(unaudited) |

|

|

|

|

| Assets |

|

|

|

|

| Cash and cash equivalents |

|

$ |

113,274 |

|

|

$ |

180,334 |

|

| Restricted cash |

|

|

25,175 |

|

|

|

16,447 |

|

| Land and other inventories |

|

|

496,910 |

|

|

|

383,184 |

|

| Receivables |

|

|

3,256 |

|

|

|

2,906 |

|

| Property and equipment, net |

|

|

36,140 |

|

|

|

36,922 |

|

| Investments in unconsolidated entities |

|

|

1,179 |

|

|

|

17,991 |

|

| Prepaid expenses and other assets |

|

|

22,547 |

|

|

|

20,980 |

|

| Assets held for sale |

|

|

— |

|

|

|

4,051 |

|

| Goodwill |

|

|

6,071 |

|

|

|

6,071 |

|

|

|

|

|

|

|

|

|

|

| Total Assets |

|

$ |

704,552 |

|

|

$ |

668,886 |

|

|

|

|

|

|

|

|

|

|

| Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

|

|

|

|

|

| Liabilities |

|

|

|

|

|

|

|

|

| Accounts payable |

|

$ |

29,370 |

|

|

$ |

16,087 |

|

| Accrued and other liabilities |

|

|

17,257 |

|

|

|

28,134 |

|

| Customer deposits |

|

|

10,882 |

|

|

|

4,966 |

|

| Estimated development liability |

|

|

32,908 |

|

|

|

33,003 |

|

| Notes payable |

|

|

335,211 |

|

|

|

299,956 |

|

|

|

|

|

|

|

|

|

|

| Total Liabilities |

|

|

425,628 |

|

|

|

382,146 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stockholders’ Equity |

|

|

|

|

|

|

|

|

| Common stock |

|

|

22,451 |

|

|

|

22,183 |

|

| Additional paid-in capital |

|

|

398,379 |

|

|

|

396,989 |

|

| Accumulated deficit |

|

|

(138,887 |

) |

|

|

(129,413 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

281,943 |

|

|

|

289,759 |

|

| Treasury stock |

|

|

(3,019 |

) |

|

|

(3,019 |

) |

|

|

|

|

|

|

|

|

|

| Total Stockholders’ Equity |

|

|

278,924 |

|

|

|

286,740 |

|

|

|

|

|

|

|

|

|

|

| Total Liabilities and Stockholders’ Equity |

|

$ |

704,552 |

|

|

$ |

668,886 |

|

|

|

|

|

|

|

|

|

|

AV HOMES, INC. AND SUBSIDIARIES

Consolidated Statements of Operations and Comprehensive Income (Loss)

(in thousands, except per share data)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended

June 30, |

|

|

Six Months Ended

June 30, |

|

| |

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

| Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Homebuilding |

|

$ |

75,902 |

|

|

$ |

48,425 |

|

|

$ |

129,251 |

|

|

$ |

74,028 |

|

| Amenity and other |

|

|

2,727 |

|

|

|

2,502 |

|

|

|

5,504 |

|

|

|

5,058 |

|

| Land sales |

|

|

760 |

|

|

|

520 |

|

|

|

3,464 |

|

|

|

16,226 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total revenues |

|

|

79,389 |

|

|

|

51,447 |

|

|

|

138,219 |

|

|

|

95,312 |

|

|

|

|

|

|

| Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Homebuilding |

|

|

74,872 |

|

|

|

46,899 |

|

|

|

129,187 |

|

|

|

73,156 |

|

| Amenity and other |

|

|

2,430 |

|

|

|

2,720 |

|

|

|

4,813 |

|

|

|

5,612 |

|

| Land sales |

|

|

98 |

|

|

|

293 |

|

|

|

383 |

|

|

|

12,238 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total real estate expenses |

|

|

77,400 |

|

|

|

49,912 |

|

|

|

134,383 |

|

|

|

91,006 |

|

| General and administrative expenses |

|

|

4,282 |

|

|

|

3,852 |

|

|

|

7,936 |

|

|

|

8,248 |

|

| Interest income and other |

|

|

(62 |

) |

|

|

(70 |

) |

|

|

(124 |

) |

|

|

(173 |

) |

| Interest expense |

|

|

2,406 |

|

|

|

— |

|

|

|

5,663 |

|

|

|

111 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total expenses |

|

|

84,026 |

|

|

|

53,694 |

|

|

|

147,858 |

|

|

|

99,192 |

|

| Equity in earnings (loss) in unconsolidated entities |

|

|

171 |

|

|

|

(6 |

) |

|

|

165 |

|

|

|

(5 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss before income taxes |

|

|

(4,466 |

) |

|

|

(2,253 |

) |

|

|

(9,474 |

) |

|

|

(3,885 |

) |

| Income tax (expense) benefit |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss and comprehensive loss |

|

|

(4,466 |

) |

|

|

(2,253 |

) |

|

|

(9,474 |

) |

|

|

(3,885 |

) |

| Net income attributable to non-controlling interests in consolidated entities |

|

|

— |

|

|

|

36 |

|

|

|

— |

|

|

|

329 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss and comprehensive loss attributable to AV Homes stockholders |

|

$ |

(4,466 |

) |

|

$ |

(2,289 |

) |

|

$ |

(9,474 |

) |

|

$ |

(4,214 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and Diluted Loss Per Share |

|

$ |

(0.20 |

) |

|

$ |

(0.10 |

) |

|

$ |

(0.43 |

) |

|

$ |

(0.19 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The following table provides a comparison of certain financial data related to our operations for

the three and six months ended June 30, 2015 and 2014 (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months |

|

|

Six Months |

|

| |

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

| Operating income (loss): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Florida |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Homebuilding |

|

$ |

56,686 |

|

|

$ |

39,583 |

|

|

$ |

98,592 |

|

|

$ |

60,932 |

|

| Amenity and other |

|

|

2,727 |

|

|

|

2,502 |

|

|

|

5,504 |

|

|

|

5,058 |

|

| Land sales |

|

|

760 |

|

|

|

520 |

|

|

|

3,464 |

|

|

|

2,358 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Revenues |

|

|

60,173 |

|

|

|

42,605 |

|

|

|

107,560 |

|

|

|

68,348 |

|

|

|

|

|

|

| Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Homebuilding |

|

|

46,023 |

|

|

|

32,196 |

|

|

|

80,624 |

|

|

|

49,227 |

|

| Homebuilding selling, general and administrative |

|

|

8,165 |

|

|

|

5,386 |

|

|

|

14,754 |

|

|

|

9,310 |

|

| Amenity and other |

|

|

2,394 |

|

|

|

2,633 |

|

|

|

4,738 |

|

|

|

5,352 |

|

| Land sales |

|

|

98 |

|

|

|

294 |

|

|

|

383 |

|

|

|

700 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Segment operating income |

|

|

3,493 |

|

|

|

2,096 |

|

|

|

7,061 |

|

|

|

3,759 |

|

|

|

|

|

|

| Arizona |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Homebuilding |

|

$ |

15,277 |

|

|

$ |

8,842 |

|

|

$ |

25,184 |

|

|

$ |

13,097 |

|

| Land sales |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

13,868 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Revenues |

|

|

15,277 |

|

|

|

8,842 |

|

|

|

25,184 |

|

|

|

26,965 |

|

|

|

|

|

|

| Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Homebuilding |

|

|

13,594 |

|

|

|

7,433 |

|

|

|

22,207 |

|

|

|

10,980 |

|

| Homebuilding selling, general and administrative |

|

|

2,515 |

|

|

|

1,483 |

|

|

|

4,837 |

|

|

|

2,940 |

|

| Amenity and other |

|

|

36 |

|

|

|

81 |

|

|

|

74 |

|

|

|

261 |

|

| Land sales |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

11,538 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Segment operating income (loss) |

|

|

(868 |

) |

|

|

(155 |

) |

|

|

(1,934 |

) |

|

|

1,246 |

|

|

|

|

|

|

| Carolinas |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Homebuilding |

|

$ |

3,939 |

|

|

$ |

— |

|

|

$ |

5,475 |

|

|

$ |

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Revenues |

|

|

3,939 |

|

|

|

— |

|

|

|

5,475 |

|

|

|

— |

|

|

|

|

|

|

| Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Homebuilding |

|

|

3,617 |

|

|

|

— |

|

|

|

4,992 |

|

|

|

— |

|

| Homebuilding selling, general and administrative |

|

|

958 |

|

|

|

406 |

|

|

|

1,774 |

|

|

|

699 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Segment operating loss |

|

|

(636 |

) |

|

|

(406 |

) |

|

|

(1,291 |

) |

|

|

(699 |

) |

|

|

|

|

|

| Operating income |

|

$ |

1,989 |

|

|

$ |

1,535 |

|

|

$ |

3,836 |

|

|

$ |

4,306 |

|

| Unallocated income (expenses): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest income and other |

|

|

62 |

|

|

|

70 |

|

|

|

124 |

|

|

|

173 |

|

| Equity in earnings (loss) in unconsolidated entities |

|

|

171 |

|

|

|

(6 |

) |

|

|

165 |

|

|

|

(5 |

) |

| Corporate general and administrative expenses |

|

|

(4,282 |

) |

|

|

(3,852 |

) |

|

|

(7,936 |

) |

|

|

(8,248 |

) |

| Interest expense |

|

|

(2,406 |

) |

|

|

— |

|

|

|

(5,663 |

) |

|

|

(111 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss before income taxes |

|

|

(4,466 |

) |

|

|

(2,253 |

) |

|

|

(9,474 |

) |

|

|

(3,885 |

) |

| Income tax expense |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Net income attributable to non-controlling interests |

|

|

— |

|

|

|

36 |

|

|

|

— |

|

|

|

329 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss attributable to AV Homes |

|

$ |

(4,466 |

) |

|

$ |

(2,289 |

) |

|

$ |

(9,474 |

) |

|

$ |

(4,214 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Data from closings for the Florida, Arizona and the Carolinas segments for the three and six months ended

June 30, 2015 and 2014 is summarized as follows (dollars in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Number of

Units |

|

|

Revenues |

|

|

Average

Price Per

Unit |

|

| For the three months ended June 30, |

|

|

|

|

| 2015 |

|

|

|

|

| Florida |

|

|

218 |

|

|

$ |

56,686 |

|

|

$ |

260 |

|

| Arizona |

|

|

60 |

|

|

|

15,277 |

|

|

|

255 |

|

| Carolinas |

|

|

13 |

|

|

|

3,939 |

|

|

|

303 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

|

|

291 |

|

|

$ |

75,902 |

|

|

$ |

261 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 2014 |

|

|

|

|

| Florida |

|

|

155 |

|

|

$ |

39,583 |

|

|

$ |

255 |

|

| Arizona |

|

|

36 |

|

|

|

8,842 |

|

|

|

246 |

|

| Carolinas |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

|

|

191 |

|

|

$ |

48,425 |

|

|

$ |

254 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Number of

Units |

|

|

Revenues |

|

|

Average

Price Per

Unit |

|

| For the six months ended June 30, |

|

|

|

|

| 2015 |

|

|

|

|

| Florida |

|

|

387 |

|

|

$ |

98,592 |

|

|

$ |

255 |

|

| Arizona |

|

|

99 |

|

|

|

25,184 |

|

|

|

254 |

|

| Carolinas |

|

|

18 |

|

|

|

5,475 |

|

|

|

304 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

|

|

504 |

|

|

$ |

129,251 |

|

|

$ |

256 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 2014 |

|

|

|

|

| Florida |

|

|

239 |

|

|

$ |

60,932 |

|

|

$ |

255 |

|

| Arizona |

|

|

52 |

|

|

|

13,097 |

|

|

|

252 |

|

| Carolinas |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

|

|

291 |

|

|

$ |

74,029 |

|

|

$ |

254 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Data from contracts signed for the Florida, Arizona and the Carolinas segments for the three and

six months ended June 30, 2015 and 2014 is summarized as follows (dollars in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| For the three months ended June 30, |

|

Gross

Number

of Contracts

Signed |

|

|

Cancellations |

|

|

Contracts

Signed,

Net of

Cancellations |

|

|

Dollar

Value |

|

|

Average

Price Per

Unit |

|

| 2015 |

|

|

|

|

|

|

|

|

|

|

|

|

| Florida |

|

|

385 |

|

|

|

(59 |

) |

|

|

326 |

|

|

$ |

88,143 |

|

|

$ |

270 |

|

| Arizona |

|

|

167 |

|

|

|

(36 |

) |

|

|

131 |

|

|

|

38,481 |

|

|

|

294 |

|

| Carolinas |

|

|

38 |

|

|

|

(4 |

) |

|

|

34 |

|

|

|

10,880 |

|

|

|

320 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

|

|

590 |

|

|

|

(99 |

) |

|

|

491 |

|

|

$ |

137,504 |

|

|

$ |

280 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 2014 |

|

|

|

|

|

|

|

|

|

|

|

|

| Florida |

|

|

250 |

|

|

|

(17 |

) |

|

|

233 |

|

|

$ |

61,312 |

|

|

$ |

263 |

|

| Arizona |

|

|

59 |

|

|

|

(11 |

) |

|

|

48 |

|

|

|

12,942 |

|

|

|

270 |

|

| Carolinas |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

|

|

309 |

|

|

|

(28 |

) |

|

|

281 |

|

|

$ |

74,254 |

|

|

$ |

264 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| For the six months ended June 30, |

|

Gross

Number

of Contracts

Signed |

|

|

Cancellations |

|

|

Contracts

Signed,

Net of

Cancellations |

|

|

Dollar

Value |

|

|

Average

Price Per

Unit |

|

| 2015 |

|

|

|

|

|

|

|

|

|

|

|

|

| Florida |

|

|

808 |

|

|

|

(119 |

) |

|

|

689 |

|

|

$ |

183,738 |

|

|

$ |

267 |

|

| Arizona |

|

|

287 |

|

|

|

(48 |

) |

|

|

239 |

|

|

|

69,069 |

|

|

|

289 |

|

| Carolinas |

|

|

57 |

|

|

|

(9 |

) |

|

|

48 |

|

|

|

15,236 |

|

|

|

317 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

|

|

1,152 |

|

|

|

(176 |

) |

|

|

976 |

|

|

$ |

268,043 |

|

|

$ |

275 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 2014 |

|

|

|

|

|

|

|

|

|

|

|

|

| Florida |

|

|

412 |

|

|

|

(34 |

) |

|

|

378 |

|

|

$ |

97,420 |

|

|

$ |

258 |

|

| Arizona |

|

|

120 |

|

|

|

(17 |

) |

|

|

103 |

|

|

|

26,733 |

|

|

|

260 |

|

| Carolinas |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

|

|

532 |

|

|

|

(51 |

) |

|

|

481 |

|

|

$ |

124,153 |

|

|

$ |

258 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Backlog for the Florida, Arizona and the Carolinas segments as of June 30, 2015 and 2014 is

summarized as follows (dollars in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Number of

Backlog

Units |

|

|

Dollar

Volume |

|

|

Average

Price

Per Unit |

|

| As of June 30, |

|

|

|

|

| 2015 |

|

|

|

|

| Florida |

|

|

575 |

|

|

$ |

157,137 |

|

|

$ |

273 |

|

| Arizona |

|

|

192 |

|

|

|

57,666 |

|

|

|

300 |

|

| Carolinas |

|

|

36 |

|

|

|

11,705 |

|

|

|

325 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

|

|

803 |

|

|

$ |

226,508 |

|

|

$ |

282 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 2014 |

|

|

|

|

| Florida |

|

|

359 |

|

|

$ |

92,762 |

|

|

$ |

258 |

|

| Arizona |

|

|

121 |

|

|

|

30,888 |

|

|

|

255 |

|

| Carolinas |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

|

|

480 |

|

|

$ |

123,650 |

|

|

$ |

258 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of net loss to net loss before interest and taxes (in thousands):

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended June 30, |

|

| |

|

2015 |

|

|

2014 |

|

| Net loss |

|

$ |

(4,466 |

) |

|

$ |

(2,253 |

) |

| Adjusted for: |

|

|

|

|

|

|

|

|

| Taxes |

|

|

— |

|

|

|

— |

|

| Interest expense |

|

|

2,406 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

| Net loss before interest and taxes |

|

$ |

(2,060 |

) |

|

$ |

(2,253 |

) |

Non-GAAP net loss before interest and taxes

Net loss before interest and taxes is a non-GAAP financial measure defined as net loss plus taxes and interest expense. We believe net loss before interest and

taxes is a relevant and a useful financial measure to investors in understanding the results of our core homebuilding operations. However, because net loss before interest and taxes is not calculated in accordance with GAAP, this financial measure

should not be considered in isolation or as an alternative to financial measures prescribed by GAAP. Rather, this non-GAAP financial measure should be used to supplement our GAAP results.

Investor Contact:

Mike Burnett

EVP, Chief Financial Officer

480-214-7408

m.burnett@avhomesinc.com

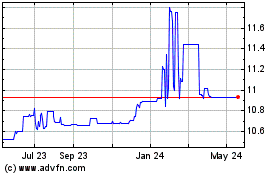

Achari Ventures Holdings... (NASDAQ:AVHI)

Historical Stock Chart

From Jul 2024 to Aug 2024

Achari Ventures Holdings... (NASDAQ:AVHI)

Historical Stock Chart

From Aug 2023 to Aug 2024