UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE

13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For

the month of September 2021

Commission

File Number 001-39025

9F Inc.

(Translation of registrant’s name into English)

Room 1607, Building No. 5, 5 West Laiguangying

Road

Chaoyang District, Beijing 100102

People's Republic of China

(Address of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F. Form 20-F

x Form 40-F ¨

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

9F Inc. Reports First Half 2021 Unaudited Financial

Results

This

current report on Form 6-K was submitted by 9F Inc. (“9F” or the “Company”) in connection with its unaudited

financial results for the first half of fiscal year 2021.

First Half 2021 Financial Highlights

|

|

l

|

Total net revenues were RMB393.0 million (US$60.9 million), representing a decrease of 53.7% from

RMB848.4 million in the first half of 2020.

|

|

|

l

|

Net loss was RMB193.0 million (US$29.9 million), down 74.1% from net loss of RMB744.6 million in

the first half of 2020.

|

|

|

l

|

Adjusted net loss1

was RMB69.8 million (US$10.8 million), down 84.6% from adjusted net loss of RMB454.3 million in the first half of 2020.

|

|

|

l

|

Cash and cash equivalents and term deposits were RMB1,979.6 million (US$306.6 million) as of June 30,

2021, compared with RMB2,860.5 million as of December 31, 2020. The Company believes its cash position to be sufficient to meet its

operational needs and weather the challenges ahead.

|

Recent Developments and Plans for the Company’s Business

9F is currently implementing a series of strategic

adjustments aimed at transforming the Company from a fintech service provider focused on the personal credit sector to a cutting-edge

internet securities service platform and technology company. The Company leverages its ownership of a licensed brokerage firm that has

decades of solid operating experience and more than 100 million registered users the Company has accumulated over time, together with

the extensive Internet operating experience and strong fintech capabilities based on advanced big data, and AI technologies. As a platform

with comprehensive services for individuals and institutional investors, 9F provides securities brokerage services for stocks traded on

the U.S. and Hong Kong exchanges, wealth management services, and investment banking services.

Empowered by big data and AI technologies, the

Company aims to provide users with more convenient, professional and user-friendly securities transaction services, as well as integrated

services to facilitate investment decision making. In the meantime, the Company will continue to help its partners, including public companies

and financial institutions, expand their user base and build user loyalty through its global investment platform.

First Half 2021 Financial Results

Total

net revenues were RMB393.0 million (US$60.9 million), representing a decrease of 53.7% from RMB848.4 million in the first half

of 2020, primarily due to the decrease in net revenues generated from loan facilitation services and post-origination services which resulted

from the termination of online lending information intermediary services in Mainland China in the second half of 2020.

|

|

·

|

Loan facilitation services revenues were nil in the first half of 2021, which resulted from the

termination of online lending information intermediary services in Mainland China.

|

|

|

·

|

Post-origination services revenues were RMB78.0 million (US$12.1 million) in the first half of

2021, representing a decrease of 85.3% from RMB530.2 million in the first half of 2020. Pursuant to industry-wide policy requirement,

we ceased our online lending information intermediary services in Mainland China in 2020 and the remaining post-origination services revenues

were derived from lending information intermediary services rendered in previous years.

|

|

|

·

|

Technical services revenues were RMB164.5 million (US$25.5 million) in the first half of 2021,

representing an increase of 1,534.0% from RMB10.1 million in the first half of 2020, primarily due to our significant progress in fintech

empowerment business.

|

|

|

·

|

Wealth management revenues were RMB61.4 million (US$9.5 million) in the first half of 2021, representing

a decrease of 1.6% from RMB62.4 million in the first half of 2020.

|

1 “Adjusted net income (loss)” is a non-GAAP financial measure. For more information on this non-GAAP financial

measure, please see the section entitled “Use of Non-GAAP Financial Measures” and the table captioned “Reconciliations

of GAAP and Non-GAAP Results” set forth at the end of this Form 6-K. Adjusted net income (loss) excludes the effect of share-based

compensation expenses, impairment loss of investments, impairment of goodwill, impairment loss of intangible asset and tax effect of

adjustments.

|

|

·

|

Other revenues were RMB89.1 million (US$13.8 million) in the first half of 2021, representing an

increase of 395.5% from RMB18.0 million in the first half of 2020.

|

Sales

and marketing expenses were RMB68.8 million (US$10.7 million) in the first half of 2021, representing a decrease of 60.5% from

RMB174.2 million in the first half of 2020. The reason for such decrease was that the Company ceased online lending information intermediary

services in Mainland China, and related marketing promotion and expenses were reduced accordingly.

Origination

and servicing expenses were RMB87.9 million (US$13.6 million) in the first half of 2021, representing a decrease of 86.1% from

RMB634.5 million in the first half of 2020, which is the result of a decrease in expenses related to lending information intermediary

services.

General

and administrative expenses were RMB279.1 million (US$43.2 million) in the first half of 2021, representing a decrease of 49.3%

from RMB550.7 million in the first half of 2020. With the termination of online lending information intermediary services in Mainland

China, we have implemented staff structure adjustments, including headcount reductions.

Interest

income was RMB39.1 million (US$6.1 million) in the first half of 2021, compared with RMB63.9 million in the first half of 2020.

Income

tax expense was RMB18.0 million (US$2.8 million) in the first half of 2021, compared with RMB17.9 million in the first half

of 2020.

Net

loss was RMB193.0 million (US$29.9 million) in the first half of 2021, compared with net loss of RMB744.6 million in the first

half of 2020.

Adjusted

net loss2 was RMB69.8 million (US$10.8 million), compared with adjusted net loss of RMB454.3 million in the first

half of 2020.

As

of June 30, 2021, the Company had cash and cash equivalents and term deposits of RMB1,979.6 million (US$306.6 million)

About 9F Inc.

9F

Inc. is an internet securities service platform and technology company. It offers securities brokerage services for stocks traded

on the U.S. and Hong Kong exchanges, wealth management services and investment banking services and connects investors with investment

opportunities that come with the vast potential of China's new consumer economy and the appreciation of global assets.

The Company currently

holds Type 1 (dealing in securities), Type 4 (advising on securities), Type 5 (advising on future contract) and Type 9

(asset management) Licenses under the Securities and Futures Ordinance in Hong Kong, and has a veteran team experienced in securities

services. As of December 31, 2020, the Company has accumulated approximately 113 million registered users, and has 65% of its employees

engaged in research, product development and operation functions.

For

more information, please visit http://ir.9fgroup.com/.

Use of Non-GAAP Financial Measures

The Company uses adjusted net income (loss), a

non-GAAP financial measure, in evaluating its operating results and as a supplemental measure to review and assess its financial and operational

performance. The Company believes that adjusted net income (loss) provides useful information about its core operating results, enhances

the overall understanding of its past performance and future prospects and allows for greater visibility with respect to key metrics used

by the Company’s management in its financial and operational decision-making. The Company also believes that adjusted net income

(loss), which excludes the effect of share-based compensation expenses, impairment loss of investments, impairment of goodwill, impairment

loss of intangible asset and tax effect of adjustments, helps identify underlying trends in its business and helps the Company’s

management formulate business plans.

2

“Adjusted net income (loss)” is a non-GAAP financial measure. For more information on this non-GAAP financial

measure, please see the section of “Use of Non-GAAP Financial Measures” and the table captioned “Reconciliations of

GAAP and Non-GAAP Results” set forth at the end of this Form 6-K. Adjusted net income (loss) excludes the effect of share-based

compensation expenses, impairment loss of investments, impairment of goodwill, impairment loss of intangible asset and tax effect of

adjustments.

Adjusted net income (loss) is not defined under

U.S. GAAP and is not presented in accordance with U.S. GAAP. This non-GAAP financial measure has limitations as an analytical tool, and

when assessing the Company’s operating performance, cash flows or liquidity, investors should not consider it in isolation, or as

a substitute for net income (loss), cash flows provided by operating activities or other consolidated statements of operation and cash

flow data prepared in accordance with U.S. GAAP. Other companies, including peer companies in the industry, may calculate this non-GAAP

measure differently, which may reduce its usefulness as a comparative measure. The Company encourages investors and others to review its

financial information in its entirety and not rely on a single financial measure.

The

Company compensates for these limitations by reconciling the non-GAAP financial measure to the most directly comparable U.S. GAAP financial

measure, which should be considered when evaluating the Company’s performance. For more information on this non-GAAP financial measure,

please see the table captioned “Reconciliations of GAAP and Non-GAAP results” set forth at the end of this Form 6-K.

Exchange Rate Information

This Form 6-K contains translations of certain

RMB amounts into U.S. dollars at a specified rate solely for the convenience of the reader. Unless otherwise noted, all translations from

RMB to U.S. dollars are made at a rate of RMB6.4566 to US$1.00, the rate in effect as of June 30, 2021 as set forth in the H.10 statistical

release of the Federal Reserve Board. The Company makes no representation that the RMB or U.S. dollars amounts referred could be converted

into U.S. dollars or RMB, as the case may be, at any particular rate or at all. The percentages stated are calculated based on RMB amounts.

The

functional currency of certain of our subsidiaries is local currency (such as Hong Kong dollars) other than RMB or U.S. dollars. In preparing

our unaudited financial results contained in this Form 6-K, (i) assets and liabilities are translated from such entity’s

functional currency to RMB using the exchange rates in effect on the balance sheet date, (ii) equity amounts are translated at historical

exchange rates, and (iii) revenues, expenses, gains and losses are translated using the average rates for the six months ended June 30,

2021.

Safe Harbor Statement

This

Form 6-K contains forward-looking statements. These statements constitute “forward-looking” statements within

the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and as defined in the U.S. Private Securities Litigation

Reform Act of 1995. These forward-looking statements can be identified by terminology such as “will,” “expects,”

“anticipates,” “future,” “intends,” “plans,” “believes,” “estimates,”

“target,” “confident” and similar statements. Such statements are based upon management’s current expectations

and current market, regulatory and operating conditions and relate to events that involve known or unknown risks, uncertainties and other

factors, all of which are difficult to predict and many of which are beyond the Company’s control. Forward-looking statements involve

risks, uncertainties and other factors that could cause actual results to differ materially from those contained in any such statements.

Potential risks and uncertainties include, but are not limited to, uncertainties as to the Company’s ability to continue or to complete

its ongoing business transformation, , its ability to attract and retain investors on its platform, its ability to apply for or obtain

any license, its ability to expand into any new market, its ability to compete effectively, its ability to comply with any applicable

laws, regulations and governmental policies in China or elsewhere, general economic conditions in China and elsewhere, and the Company’s

ability to meet the standards necessary to maintain listing of its ADSs on the Nasdaq, including its ability to cure any non-compliance

with the Nasdaq’s continued listing criteria. Further information regarding these and other risks, uncertainties or factors is included

in the Company’s filings with the U.S. Securities and Exchange Commission. Neither track record nor past performance is indicative

of future results. 9F Inc. does not guarantee any specific outcome (including the outcome of its ongoing business transformation) or profit.

All

information provided in this Form 6-K is as of the date of this Form 6-K, and subject to change without notice. 9F Inc.

does not undertake any obligation to update information contained herein as a result of new information, future events or otherwise, except

as required under applicable law.

9F Inc.

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

(All amounts in thousands, except for number of shares and per share data, or otherwise noted)

|

|

|

December 31,

|

|

|

June 30,

|

|

|

June 30,

|

|

|

|

|

2020

|

|

|

2021

|

|

|

2021

|

|

|

|

|

RMB

|

|

|

RMB

|

|

|

US$

|

|

|

Assets

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

|

2,726,712

|

|

|

|

1,877,191

|

|

|

|

290,740

|

|

|

Restricted cash

|

|

|

390,702

|

|

|

|

376,796

|

|

|

|

58,358

|

|

|

Term deposit*

|

|

|

133,761

|

|

|

|

102,408

|

|

|

|

15,861

|

|

|

Investment in marketable securities

|

|

|

-

|

|

|

|

206,272

|

|

|

|

31,947

|

|

|

Accounts receivable, net

|

|

|

40,862

|

|

|

|

70,130

|

|

|

|

10,862

|

|

|

Other receivables, net

|

|

|

126,745

|

|

|

|

565,904

|

|

|

|

87,647

|

|

|

Loan receivables, net

|

|

|

267,383

|

|

|

|

202,130

|

|

|

|

31,306

|

|

|

Prepaid expenses and other assets

|

|

|

793,092

|

|

|

|

881,771

|

|

|

|

136,569

|

|

|

Contract assets, net

|

|

|

10,374

|

|

|

|

6,494

|

|

|

|

1,006

|

|

|

Long-term investment, net

|

|

|

738,272

|

|

|

|

738,996

|

|

|

|

114,456

|

|

|

Operating lease right-of-use assets, net

|

|

|

28,668

|

|

|

|

25,987

|

|

|

|

4,025

|

|

|

Property, equipment and software, net

|

|

|

63,396

|

|

|

|

52,423

|

|

|

|

8,119

|

|

|

Goodwill, net

|

|

|

22,121

|

|

|

|

22,119

|

|

|

|

3,426

|

|

|

Intangible asset, net

|

|

|

44,413

|

|

|

|

40,345

|

|

|

|

6,249

|

|

|

Total assets

|

|

|

5,386,501

|

|

|

|

5,168,966

|

|

|

|

800,571

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deferred revenue

|

|

|

82,643

|

|

|

|

10,079

|

|

|

|

1,561

|

|

|

Payroll and welfare payable

|

|

|

34,540

|

|

|

|

14,041

|

|

|

|

2,175

|

|

|

Taxes payable

|

|

|

255,244

|

|

|

|

272,896

|

|

|

|

42,266

|

|

|

Accrued expenses and other liabilities

|

|

|

726,686

|

|

|

|

786,213

|

|

|

|

121,769

|

|

|

Operating lease liabilities

|

|

|

29,503

|

|

|

|

25,604

|

|

|

|

3,966

|

|

|

Amounts due to related parties

|

|

|

25,289

|

|

|

|

23,590

|

|

|

|

3,654

|

|

|

Deferred tax liabilities

|

|

|

9,280

|

|

|

|

8,504

|

|

|

|

1,317

|

|

|

Total liabilities

|

|

|

1,163,185

|

|

|

|

1,140,927

|

|

|

|

176,707

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shareholder's equity

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ordinary shares

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

Class A ordinary shares

|

|

|

1

|

|

|

|

1

|

|

|

|

-

|

|

|

Class B ordinary shares

|

|

|

1

|

|

|

|

1

|

|

|

|

-

|

|

|

Additional paid-in capital

|

|

|

5,531,926

|

|

|

|

5,566,840

|

|

|

|

862,194

|

|

|

Statutory reserves

|

|

|

466,352

|

|

|

|

466,468

|

|

|

|

72,247

|

|

|

Retained earnings (deficit)

|

|

|

(1,822,749

|

)

|

|

|

(2,010,642

|

)

|

|

|

(311,409

|

)

|

|

Accumulated other comprehensive income

|

|

|

(6,963

|

)

|

|

|

(49,917

|

)

|

|

|

(7,731

|

)

|

|

Total 9F Inc. shareholders’ equity

|

|

|

4,168,578

|

|

|

|

3,972,751

|

|

|

|

615,301

|

|

|

Non-controlling interest

|

|

|

54,738

|

|

|

|

55,288

|

|

|

|

8,563

|

|

|

Total shareholders’ equity

|

|

|

4,223,316

|

|

|

|

4,028,039

|

|

|

|

623,864

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES AND SHAREHOLDERS’’ EQUITY

|

|

|

5,386,501

|

|

|

|

5,168,966

|

|

|

|

800,571

|

|

*

The term deposit RMB100,000 are from related party.

9F Inc.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Amounts in thousands, except for number of shares and per share data, or otherwise noted)

|

|

|

Six Months

Ended

June 30, 2020

|

|

|

Six Months

Ended

June 30, 2021

|

|

|

Six Months

Ended

June 30, 2021

|

|

|

|

|

RMB

|

|

|

RMB

|

|

|

US$

|

|

|

Net revenue:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loan facilitation services

|

|

|

227,792

|

|

|

|

-

|

|

|

|

-

|

|

|

Post-origination services

|

|

|

530,232

|

|

|

|

78,004

|

|

|

|

12,081

|

|

|

Technical services

|

|

|

10,067

|

|

|

|

164,497

|

|

|

|

25,477

|

|

|

Wealth management

|

|

|

62,360

|

|

|

|

61,362

|

|

|

|

9,504

|

|

|

Others

|

|

|

17,979

|

|

|

|

89,093

|

|

|

|

13,799

|

|

|

Total net revenues

|

|

|

848,430

|

|

|

|

392,956

|

|

|

|

60,861

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating costs and expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales and marketing

|

|

|

(174,243

|

)

|

|

|

(68,826

|

)

|

|

|

(10,660

|

)

|

|

Origination and servicing

|

|

|

(634,521

|

)

|

|

|

(87,911

|

)

|

|

|

(13,616

|

)

|

|

General and administrative

|

|

|

(550,734

|

)

|

|

|

(279,076

|

)

|

|

|

(43,223

|

)

|

|

Provision for doubtful contract assets and receivables

|

|

|

(195,564

|

)

|

|

|

(44,296

|

)

|

|

|

(6,861

|

)

|

|

Total operating costs and expenses

|

|

|

(1,555,062

|

)

|

|

|

(480,109

|

)

|

|

|

(74,359

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income

|

|

|

63,869

|

|

|

|

39,079

|

|

|

|

6,053

|

|

|

Impairment loss of investments

|

|

|

(30,322

|

)

|

|

|

(2,056

|

)

|

|

|

(318

|

)

|

|

Impairment loss of goodwill

|

|

|

(50,291

|

)

|

|

|

-

|

|

|

|

-

|

|

|

Impairment loss of intangible asset

|

|

|

(17,220

|

)

|

|

|

(2,310

|

)

|

|

|

(358

|

)

|

|

Unrealized loss of investment in marketable securities

|

|

|

-

|

|

|

|

(114,211

|

)

|

|

|

(17,689

|

)

|

|

Other income (loss), net

|

|

|

19,612

|

|

|

|

(684

|

)

|

|

|

(106

|

)

|

|

Income before income tax expense and share of profit in

equity method investments

|

|

|

(720,984

|

)

|

|

|

(167,335

|

)

|

|

|

(25,917

|

)

|

|

Income tax expense

|

|

|

(17,874

|

)

|

|

|

(17,998

|

)

|

|

|

(2,788

|

)

|

|

Loss in equity method investments, net

|

|

|

(5,741

|

)

|

|

|

(7,629

|

)

|

|

|

(1,182

|

)

|

|

Net loss

|

|

|

(744,599

|

)

|

|

|

(192,962

|

)

|

|

|

(29,887

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) attributed to the non-controlling interest shareholders

|

|

|

3,586

|

|

|

|

(747

|

)

|

|

|

(116

|

)

|

|

Net loss attributable to 9F Inc.

|

|

|

(741,013

|

)

|

|

|

(193,709

|

)

|

|

|

(30,003

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Change in redemption value of preferred shares

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

Net loss attributable to ordinary shareholders

|

|

|

(741,013

|

)

|

|

|

(193,709

|

)

|

|

|

(30,003

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per ordinary share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

(3.80

|

)

|

|

|

(1.93

|

)

|

|

|

(0.30

|

)

|

|

Diluted

|

|

|

(3.80

|

)

|

|

|

(1.93

|

)

|

|

|

(0.30

|

)

|

|

Weighted average number of ordinary shares used in computing net loss per ordinary share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

195,191,000

|

|

|

|

100,361,432

|

|

|

|

100,361,432

|

|

|

Diluted

|

|

|

195,191,000

|

|

|

|

100,361,432

|

|

|

|

100,361,432

|

|

|

9F Inc.

|

|

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS

|

|

(Amounts in thousands, except for number of shares and per share data, or otherwise noted)

|

|

|

|

|

|

|

|

|

Six Months

Ended

June 30, 2020

|

|

|

Six Months

Ended

June 30, 2021

|

|

|

Six Months

Ended

June 30, 2021

|

|

|

|

|

RMB

|

|

|

RMB

|

|

|

USD

|

|

|

Net loss

|

|

|

(744,599

|

)

|

|

|

(192,962

|

)

|

|

|

(29,887

|

)

|

|

Other comprehensive income (loss):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustment, net of tax of nil

|

|

|

24,021

|

|

|

|

(44,892

|

)

|

|

|

(6,953

|

)

|

|

Unrealized loss on available for sale investments, net of tax of nil

|

|

|

(100

|

)

|

|

|

-

|

|

|

|

-

|

|

|

Total comprehensive loss

|

|

|

(720,678

|

)

|

|

|

(237,854

|

)

|

|

|

(36,840

|

)

|

|

Total comprehensive income (loss) attributable to the non-controlling interest shareholders

|

|

|

3,586

|

|

|

|

(747

|

)

|

|

|

(116

|

)

|

|

Total comprehensive loss attributable to 9F Inc

|

|

|

(717,092

|

)

|

|

|

(238,601

|

)

|

|

|

(36,956

|

)

|

|

9F Inc.

|

|

Reconciliations of GAAP And Non-GAAP Results

|

|

(Amounts in thousands, except for number of shares and per share data, or otherwise noted)

|

|

|

|

|

|

|

|

|

Six Months

Ended

June 30, 2020

|

|

|

Six Months

Ended

June 30, 2021

|

|

|

Six Months

Ended

June 30, 2021

|

|

|

|

|

RMB

|

|

|

RMB

|

|

|

USD

|

|

|

Net loss

|

|

|

(744,599

|

)

|

|

|

(192,962

|

)

|

|

|

(29,886

|

)

|

|

Add:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Share-based compensation

|

|

|

207,008

|

|

|

|

34,842

|

|

|

|

5,396

|

|

|

Impairment loss of investments

|

|

|

30,322

|

|

|

|

2,056

|

|

|

|

318

|

|

|

Impairment of goodwill

|

|

|

50,291

|

|

|

|

-

|

|

|

|

-

|

|

|

Impairment loss of intangible asset

|

|

|

17,220

|

|

|

|

2,310

|

|

|

|

358

|

|

|

Unrealized loss of investment in marketable securities

|

|

|

|

|

|

|

114,211

|

|

|

|

17,689

|

|

|

Less:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tax effect of adjustments

|

|

|

14,546

|

|

|

|

30,300

|

|

|

|

4,693

|

|

|

Adjusted net loss

|

|

|

(454,304

|

)

|

|

|

(69,843

|

)

|

|

|

(10,817

|

)

|

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

9F Inc.

|

|

|

|

|

|

By:

|

/s/ Lei Liu

|

|

|

Name:

|

Lei Liu

|

|

|

Title:

|

Chief Executive Officer

|

|

|

|

|

Date: September 30, 2021

|

|

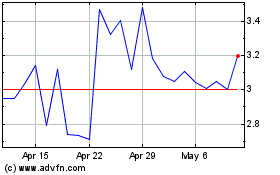

9F (NASDAQ:JFU)

Historical Stock Chart

From May 2024 to Jun 2024

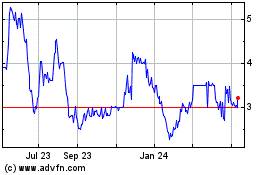

9F (NASDAQ:JFU)

Historical Stock Chart

From Jun 2023 to Jun 2024