Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

July 08 2021 - 8:17AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE

13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For

the month of July 2021

Commission

File Number 001-39025

9F Inc.

(Translation of registrant’s name into English)

Room 1607, Building No. 5, 5 West Laiguangying

Road

Chaoyang District, Beijing 100102

People's Republic of China

(Address of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F. Form 20-F

x Form 40-F ¨

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Adjournment of Extraordinary General Meeting

held on July 8, 2021

This

current report on Form 6-K was submitted in connection with the adjournment of the extraordinary general meeting (the “EGM”)

held by 9F Inc. (the “Company”) today. The EGM was convened to consider proposals (the “Proposals”), including

the change of the corporate name of the Company, presented in the Notice of Extraordinary General Meeting dated June 3, 2021. The

Notice of Extraordinary General Meeting is also available on the Company’s website at http://ir.9fgroup.com/.

The EGM was voluntarily adjourned by the Company due to the low voting

rate of the Company’s American depositary shares (“ADSs”). The Company has always attached great importance to the participation

of public shareholders in its corporate governance practice, and wishes to afford sufficient opportunity to the holder of ADSs to cast

their valued votes with respect to the change of the corporate name of the Company they chose to grow with. Therefore, the Company voluntarily

adjourned the EGM to allow Citibank, N.A. to further collect voting instructions from holders of ADSs.

The Company will reconvene the EGM to decide on the Proposals at such

time and place as will be determined by the board of directors of the Company, provided that a notice of a new extraordinary general meeting,

instead of the adjourned EGM, will be disseminated by the Company if the EGM is adjourned for fourteen calendar days. Proxies which have

been received would remain valid for the adjourned EGM. Holders of the Company’s ordinary shares whose names are on the register

of members of the Company at the close of business on June 3, 2021 are entitled to attend the adjourned EGM. Shareholders who wish,

but have not yet, cast their votes may do so by returning the Form of Proxy for Extraordinary General Meeting distributed in connection

with the EGM, according to the instructions and within the deadline as set out therein. Holders of the Company’s ADS who wish to

exercise their voting rights for the underlying shares and who have yet to cast their votes must act through Citibank, N.A.

Safe Harbor Statement

This current report contains forward-looking statements. These statements

constitute “forward-looking” statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as

amended, and as defined in the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified

by terminology such as “will,” “expects,” “anticipates,” “future,” “intends,”

“plans,” “believes,” “estimates,” “target,” “confident” and similar statements.

Such statements are based upon management’s current expectations and current market, regulatory and operating conditions and relate

to events that involve known or unknown risks, uncertainties and other factors, all of which are difficult to predict and many of which

are beyond the Company’s control. Forward-looking statements involve risks, uncertainties and other factors that could cause actual

results to differ materially from those contained in any such statements. Potential risks and uncertainties include, but are not limited

to, uncertainties as to the when and where the EGM will be reconvened and whether the Proposals will be approved. Further information

regarding these and other risks, uncertainties or factors is included in the Company’s filings with the U.S. Securities and Exchange

Commission. All information provided in this press release is as of the date of this press release, and 9F Inc. does not undertake any

obligation to update any forward-looking statement as a result of new information, future events or otherwise, except as required under

applicable law.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

9F Inc.

|

|

|

|

|

|

By:

|

/s/ Lei Liu

|

|

|

Name:

|

Lei Liu

|

|

|

Title:

|

Chief Executive Officer

|

|

|

|

|

Date: July 8, 2021

|

|

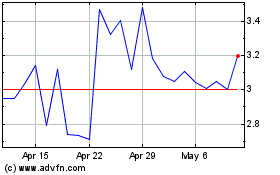

9F (NASDAQ:JFU)

Historical Stock Chart

From May 2024 to Jun 2024

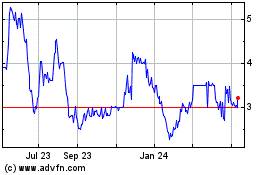

9F (NASDAQ:JFU)

Historical Stock Chart

From Jun 2023 to Jun 2024