Indian Rupee Firms To 6-day High Against U.S. Dollar After RBI Rate Cut

February 06 2019 - 11:04PM

RTTF2

The Indian rupee drifted higher against the U.S. dollar on

Thursday, after the Reserve Bank of India slashed key rates

unexpectedly and flagged a shift in policy to neutral from

calibrated tightening to prop up the economy.

The Indian currency advanced to 71.23 against the greenback, its

strongest since February 1. This marked a 0.7 percent gain from a

2-day low of 71.75 seen in morning deals. The pair closed

Wednesday's trading at 71.60.

Next key resistance for the rupee is seen around the 70.00

region.

The Monetary Policy Committee, led by Governor Shaktikanta Das,

decided to cut the repo rate by 25 basis points to 6.25 percent

from 6.5 percent, the Reserve Bank of India said in a

statement.

The reverse repo rate was trimmed to 6.0 percent from 6.25

percent.

Economists had expected the key rates to remain unchanged.

The MPC also decided to change the monetary policy stance from

calibrated tightening to neutral.

The RBI said that these decisions were aimed to achieve the

medium-term target for inflation goal of 4 percent within a band of

+/- 2 per cent, while supporting growth.

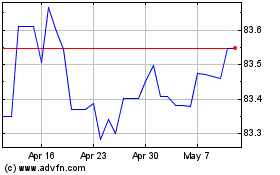

US Dollar vs INR (FX:USDINR)

Forex Chart

From Mar 2024 to Apr 2024

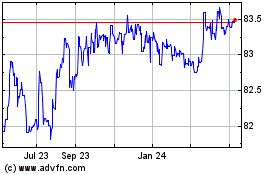

US Dollar vs INR (FX:USDINR)

Forex Chart

From Apr 2023 to Apr 2024