U.S. Dollar Climbs As Fed Meeting In Focus

May 02 2023 - 7:11AM

RTTF2

The U.S. dollar turned higher against its most major

counterparts in the European session on Tuesday, as investors

awaited the monetary policy meeting by the U.S. Federal Reserve for

more clues about the future of monetary policy.

Market participants expect that the Fed will hike interest rates

by 25 basis points to a range of 5.00 - 5.25 percent.

All eyes are on Fed chief Jerome Powell's news conference for

insights about the future path of interest rates.

Key economic data such as ADP private sector employment, ISM

services PMI, jobless claims and nonfarm payrolls are likely to

influence trading during the week.

The currency moved higher on Monday after the release of better

than expected ISM manufacturing data, which dampened hopes for a

rate pause in June.

The greenback was up against the pound, at a 5-day high of

1.2442. The greenback may find resistance around the 1.21

level.

The greenback firmed to near 2-week highs of 1.0948 against the

euro and 0.8994 against the franc, off its early lows of 1.1006 and

0.8942, respectively. The currency is seen finding resistance

around 1.06 against the euro and 0.92 against the franc.

The greenback touched 1.3615 against the loonie, setting a 4-day

high. On the upside, 1.38 is likely seen as its next resistance

level.

In contrast, the greenback eased to 137.24 against the yen, from

an early near 2-month high of 137.77. If the greenback slides

again, it may find support around the 134.00 area.

The greenback fell to 0.6218 against the kiwi, its lowest level

in nearly two weeks. Further fall in the greenback may find support

around the 0.64 mark.

The greenback held steady against the aussie, after hitting near

a 2-week low of 0.6717 in the Asian session. The pair was valued at

0.6630 at yesterday's close.

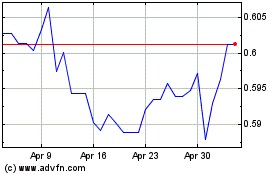

NZD vs US Dollar (FX:NZDUSD)

Forex Chart

From Mar 2024 to Apr 2024

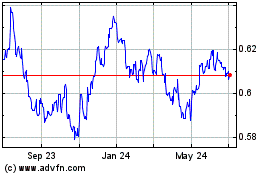

NZD vs US Dollar (FX:NZDUSD)

Forex Chart

From Apr 2023 to Apr 2024